Coating Equipment Market Size, Share, Trends and Forecast by Product, Distribution Channel, Application, and Region, 2025-2033

Coating Equipment Market Size and Share:

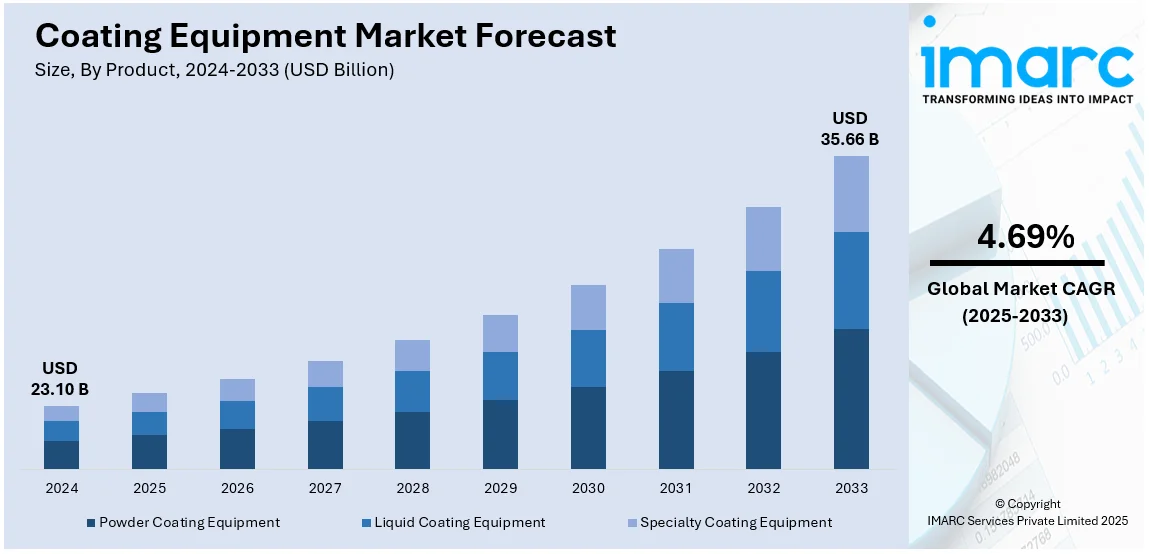

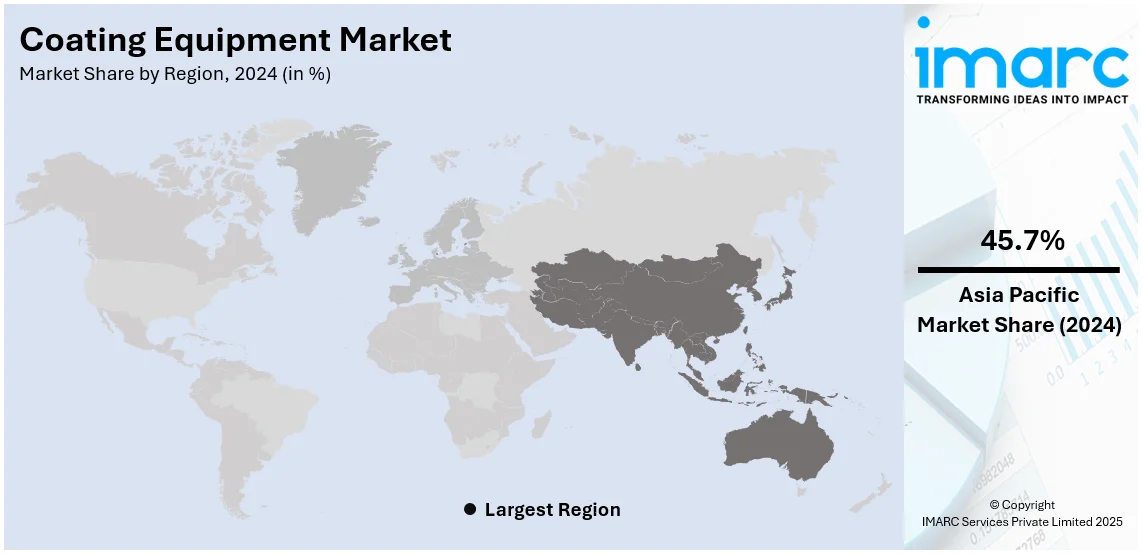

The global coating equipment market size was valued at USD 23.10 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.66 Billion by 2033, exhibiting a CAGR of 4.69% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 45.7% in 2024. The market is primarily driven by growing demand for industry-specific customization, significant advancements in automation and robotics for precision, and rise in eco-friendly technologies prioritizing low emissions and energy efficiency, reflecting industries' heightened focus on innovation, sustainability, and operational optimization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 23.10 Billion |

|

Market Forecast in 2033

|

USD 35.66 Billion |

| Market Growth Rate (2025-2033) | 4.69% |

The global market is experiencing growth due to the rising demand for advanced surface treatments across automotive, aerospace, and electronics industries to enhance durability, aesthetics, and performance. In line with this, increasing adoption of automated and robotic coating systems driving precision and efficiency improvements, is impelling the market. For instance, on 16 February 2024, Qlayers signed an MoU with PVMR to introduce robotic coating solutions to Vietnam, leveraging Qlayers’ 10Q coating robot to enhance efficiency, safety, and sustainability in maintenance operations. PVMR, a PetroVietnam subsidiary, specializes in engineering and asset management, integrating innovative technology into Vietnam’s oil, gas, and industrial sectors. Additionally, expanding applications in renewable energy, medical devices, and consumer goods further boost the coating equipment market growth. Besides this, increasing investments in infrastructure and construction are increasing demand for protective coatings and strengthening the market demand.

The United States is a key regional market and is witnessing considerable growth propelled by the rising automotive and aerospace industries, requiring advanced coatings to enhance performance and protection. Similarly, increasing adoption of automated and robotic coating technologies augmenting operational efficiency and precision is propelling the market expansion. Additionally rising investments in renewable energy projects, particularly wind turbines and solar panels, are generating demand for specialized coating solutions. For example, on December 20, 2024, the Biden-Harris administration approved the SouthCoast Wind Project, the 11th U.S. commercial-scale offshore wind project, generating up to 2.4 GW to power 840,000 homes. Covering 127,388 acres near Massachusetts and Rhode Island, the project supports clean energy goals, job creation, and environmental sustainability. Moreover, rapid urbanization and infrastructure upgrades are driving the coating equipment market share. Eco-friendly, low-emission technologies aligned with regulations and expanding electronics and medical applications are stimulating the market appeal.

Coating Equipment Market Trends:

Customization and Industry-Specific Solutions

The growing demand for customized coating equipment tailored to industry-specific requirements highlights the diverse applications of advanced coatings. Sectors such as electronics, medical devices, and renewable energy increasingly require specialized technologies to meet precise functional and aesthetic standards. Notably, on November 13, 2024, Lead Intelligent Equipment (LEAD) delivered solid-state dry electrode coating equipment to a leading South Korean battery manufacturer. This innovative solution enhances production efficiency, reduces costs, and supports high-quality all-solid-state battery production. LEAD’s globally recognized technologies also optimize energy density and safety, advancing battery manufacturing and enabling new energy vehicle development. Similarly, the renewable energy sector benefits from coating equipment designed to apply durable coatings to wind turbines and solar panels, ensuring long-term performance under harsh conditions. Investments in research and development (R&D) continue to drive innovation, fostering growth in the coating equipment market demand through industry-specific advancements.

Continual Automation and Robotic Advancements

The market is shifting toward automation and robotics, driven by demand for precision, efficiency, and cost savings. Advanced robotics are extensively used in automotive, aerospace, and industrial sectors for consistent, waste-minimizing coating applications. These systems utilize artificial intelligence (AI) and machine learning (ML) technologies for real-time process optimization, allowing precise adjustments to coating parameters. Coating equipment market trends highlight the increasing adoption of automated solutions in industries with high production volumes and strict quality requirements. For instance, on September 19, 2024, Comau and Prima Additive introduced a robotic brake disc coating system presented at Stellantis Factory Booster Day in Turin. This innovation enhances brake durability, reduces emissions by 80%, and complies with Euro 7 standards, with deployment at Stellantis’ Sept-Fons plant in France by year-end. Supported by advancements in sensor technology and user-friendly programmable systems, automation in coating applications is driving market growth and innovation.

Eco-Friendly and Sustainable Coating Solutions

The emphasis on environmental sustainability is augmenting the adoption of eco-friendly coating equipment, with manufacturers focusing on low-emission technologies like water-based and powder coatings to meet stringent environmental regulations. To illustrate, on November 18, 2024, PPG had a strategic alliance with SARO/Siccardi, Italy's leading powder coatings distributor, to strengthen its distribution network and enhance customer access to sustainable coating solutions. This collaboration leverages PPG’s advanced technologies and SARO/Siccardi’s extensive market presence to deliver tailored solutions, improved service, and support for sustainable manufacturing initiatives. Equipment for these coatings reduces volatile organic compound (VOC) emissions, promoting cleaner production processes and aligning with the positive coating equipment market outlook. Energy-efficient systems, such as ultraviolet (UV) and infrared (IR) curing, are increasingly popular for reducing energy use and costs, reflecting the industry's focus on combining efficiency with environmental responsibility.

Coating Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global coating equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, distribution channel, and application.

Analysis by Product:

- Powder Coating Equipment

- Liquid Coating Equipment

- Specialty Coating Equipment

Powder coating equipment stand as the largest segment in 2024, holding around 43.6% of the market due to its cost-efficiency, superior finish quality, and environmental advantages. Powder coatings, formulated without solvents, significantly reduce volatile organic compound (VOC) emissions, supporting stringent environmental regulations and growing sustainability goals. The technology’s ability to minimize material wastage through overspray reclamation enhances resource efficiency, making it highly attractive across automotive, industrial, and consumer goods sectors. Its versatility, supporting applications from decorative finishes to protective coatings, further drives adoption. Additionally, advancements in equipment, such as automated systems and energy-efficient curing technologies, bolster demand, as industries prioritize precision, reduced operational costs, and compliance with eco-friendly manufacturing practices.

Analysis by Distribution Channel:

- Wholesale Distributor

- Retail Distributor

Wholesale distributors play a crucial role in the coating equipment market by streamlining the supply chain and ensuring bulk availability of products to meet growing industrial demand. Their ability to source equipment directly from manufacturers allows them to offer competitive pricing, which is critical for large-scale buyers in automotive, aerospace, and industrial sectors. The increasing adoption of automated and eco-friendly coating technologies is driving the need for wholesale distributors to maintain extensive inventories of advanced equipment. Additionally, their robust distribution networks enable efficient delivery to diverse regions, supporting market growth. By collaborating with manufacturers to understand emerging technologies, wholesale distributors drive innovation and facilitate the adoption of cutting-edge coating solutions.

Retail distributors significantly contribute to the market by providing access to specialized products for small and medium-sized enterprises (SMEs) and individual customers. They cater to the growing demand for compact, user-friendly coating systems suitable for personalized or small-scale applications, particularly in sectors like electronics, consumer goods, and construction. The rising trend of DIY projects and customization is further augmenting retail sales of coating equipment. Retail distributors also play a key role in educating customers on advanced technologies, offering tailored solutions, and providing after-sales support. Their localized presence ensures quick access to products, promoting adoption among smaller businesses and end-users, thereby driving market expansion.

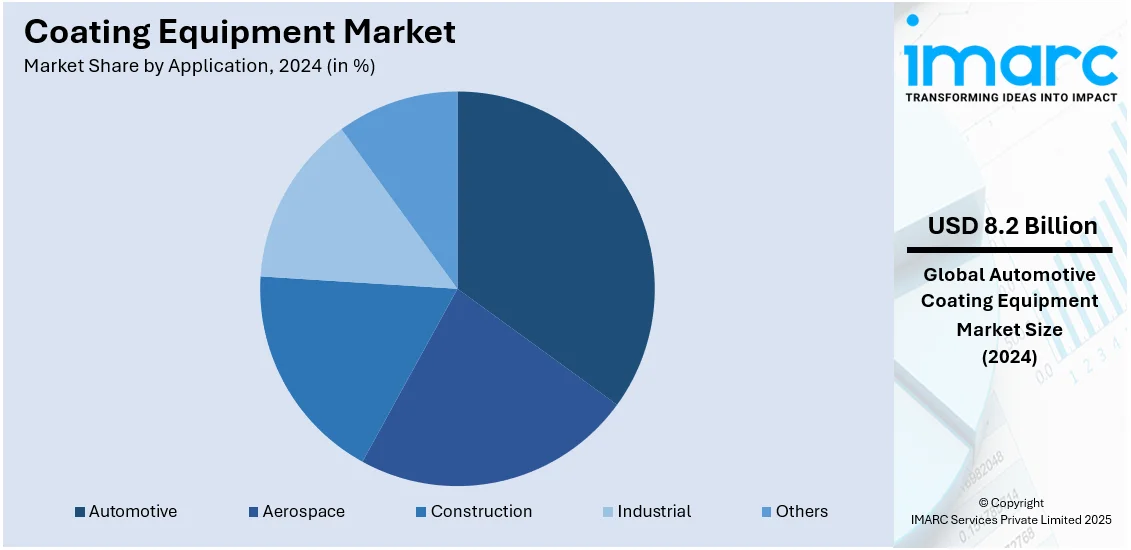

Analysis by Application:

- Automotive

- Aerospace

- Construction

- Industrial

- Others

Automotive leads the market with around 35.4% of the market share in 2024 driven by its high demand for advanced surface treatments to enhance durability, aesthetics, and performance. Automotive manufacturers rely on specialized coating equipment for corrosion resistance, UV protection, and custom finishes that meet stringent quality and environmental standards. The rising production of electric vehicles (EVs) further boosts demand for precision coating technologies to protect battery components and lightweight materials. Innovations in automated and robotic coating systems ensure consistent application, reduced material wastage, and cost efficiency, making them indispensable in high-volume automotive manufacturing. This combination of innovation, customization, and efficiency solidifies automotive’s dominance in the coating equipment market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 45.7% attributed to rapid industrialization, urbanization, and infrastructure growth in economies like China, India, and Southeast Asia. The region’s strong automotive and aerospace manufacturing base fuels demand for advanced coating technologies to enhance durability and performance. For instance, on July 22, 2024, BASF Coatings renewed its agreement to power its automotive OEM coatings operations in Shanghai with 100% renewable electricity, supporting net-zero targets and reducing product carbon footprints. Funding for renewable energy initiatives, such as solar panels and wind turbines, further boost demand for specialized coating solutions. Additionally, growth in electronics and consumer goods production, coupled with eco-friendly initiatives and automation advancements, solidifies Asia-Pacific’s dominance in the market.

Key Regional Takeaways:

United States Coating Equipment Market Analysis

In 2024, the United States held 76.80% of the North America coating equipment market and is witnessing significant growth, driven by robust demand in sectors such as automotive, aerospace, construction, and construction equipment. The U.S. construction equipment market alone reached a size of USD 43.53 Billion in 2023, highlighting the need for durable and high-performance coatings to protect machinery and infrastructure. With increasing focus on corrosion resistance, longevity, and aesthetic finishes, there is a growing demand for advanced coating solutions. Additionally, the rising regulatory pressure for environmentally friendly products is prompting a shift toward water-based and low-VOC coatings. Automation in manufacturing processes is also driving the adoption of cutting-edge coating equipment, enhancing efficiency, and reducing labor costs. Technological innovations, such as artificial intelligence and IoT, are further improving precision in coating applications. The strong growth in infrastructure development, supported by government incentives for energy-efficient construction, is augmenting demand for coating solutions across the construction sector. The market is also benefiting from trends in customized coatings for consumer goods, electronics, and medical devices, positioning the U.S. market for long-term growth.

Europe Coating Equipment Market Analysis

The market in Europe is being significantly influenced by various drivers, including the growing demand for environmentally friendly coatings, stringent regulations on VOC emissions, and the rising focus on sustainable manufacturing practices. The automotive sector, a major consumer of coating equipment, is undergoing a transformation, driven by the rise in electric vehicle (EV) production. According to reports, new electric car registrations in Europe reached nearly 3.2 million in 2023, marking an almost 20% increase from 2022. This growth in the EV market is fueling demand for lightweight, corrosion-resistant coatings and innovative finishes. Additionally, the construction sector's augmenting demand for protective and decorative coatings is contributing to market expansion. As the European Union continues to enforce stringent environmental policies, the market is witnessing a shift toward waterborne and UV-curable coatings to meet regulatory standards. Moreover, the emphasis on automation and digitalization in manufacturing is impelling the adoption of advanced coating technologies, improving production efficiency, and reducing labor costs. With the growing demand for high-performance coatings across diverse industries, including aerospace and marine, the European coating equipment market is poised for sustained growth.

Asia Pacific Coating Equipment Market Analysis

The coating equipment market in Asia-Pacific is experiencing significant growth, driven by rapid industrialization and urbanization, especially in countries like China and India. According to the World Bank, East Asia and the Pacific is the most swiftly urbanizing region, with an average annual urbanization rate of 3%. This urbanization is fueling demand for advanced coatings in infrastructure projects, automotive, and construction sectors. The inflating disposable incomes and the growing middle class are contributing to the demand for premium consumer goods with durable, high-quality finishes. Additionally, as the region faces stricter environmental regulations, there is a notable shift towards eco-friendly, waterborne, and low-VOC coatings. The push for smarter cities and sustainable construction is further driving innovation in coating technologies, especially in terms of durability and functionality, such as anti-corrosion and anti-abrasion properties. With continuous investments in research and development (R&D) and a strong focus on sustainability, the APAC market is expected to maintain strong growth.

Latin America Coating Equipment Market Analysis

In Latin America, the market is driven by increasing industrial activities, especially in the automotive, construction, and manufacturing sectors. The region's urbanization rate, now around 80% according to industry reports, is higher than most other regions, increasing infrastructure growth and growing demand for high-performance coatings. The growing middle class and rising disposable incomes are also adding to the higher demand for consumer goods with premium finishes. In line with this, the shift towards environmentally friendly products on account of the stricter regulations is accelerating the adoption of eco-friendly coating solutions, positioning the market for continued growth.

Middle East and Africa Coating Equipment Market Analysis

The coating equipment market in the Middle East and Africa is benefiting from strong growth in construction, automotive, and oil and gas industries. As the region focuses on infrastructure development, the demand for protective coatings to ensure longevity and aesthetic appeal is rising. The Saudi Arabia steel market, valued at USD 8.7 Billion in 2024, highlights the expanding need for high-performance coatings in industrial applications. In line with this, the region’s emphasis on sustainability and environmental responsibility is bolstering the adoption of eco-friendly coatings. These trends, combined with increasing investments in infrastructure, augment the market’s expansion in this region.

Competitive Landscape:

The market's competitive landscape is defined by global players prioritizing innovation, sustainability, and automation to retain market leadership. Investments in research and development (R&D) drive the introduction of advanced technologies, including automated and robotic coating systems, ensuring precision and efficiency. Partnerships and acquisitions are key strategies for expanding networks and capabilities. For example, on November 5, 2024, Medeologix partnered with Biocoat to integrate hydrophilic coating services into its catheter solutions, enhancing efficiency, quality, and cost-effectiveness while accelerating production and time-to-market. Eco-friendly technologies, powder, and water-based coatings are emerging, meeting tough environmental regulations, whereas regional players are gaining an upper hand attributed to rapid industrialization and rising demands for specialized equipment in a technologically advancing dynamic market and fluctuating customer demand.

The report provides a comprehensive analysis of the competitive landscape in the coating equipment market with detailed profiles of all major companies, including:

- Anest Iwata Corporation

- Asahi Sunac Corporation

- Castolin Eutectic

- Graco Inc.

- Hydromer

- IHI Corporation

- J. Wagner GmbH

- Larius S.r.l

- Nordson Corporation

- OC Oerlikon

- Praxair Surface Technologies Inc. (Linde plc)

- Samvardhana Motherson Group

Latest News and Developments:

- January 2025: Valmet announced it will supply a high-speed off-machine coater with curtain coating technology to an APAC customer for coated special paper grades. The delivery includes coating, drying, automation, and Valmet Industrial Internet solutions, supported by pilot tests conducted at Valmet’s Paper Technology Center in Finland.

- September 2024: Oerlikon Balzers launched INVENTA, its latest Physical Vapor Deposition (PVD) system featuring Advanced Arc Technology (AAT). This innovation enhances coating efficiency, reduces per-piece costs, and enables seamless integration with existing BALINIT® coatings.

- July 2024: AkzoNobel introduced the Selva Pro range of 2K polyurethane and acrylic coatings designed for professional and industrial woodworking. Featuring Italian-inspired formulations, the range offers durability, design versatility, and eco-friendly solutions with streamlined inventory and application processes. Available via Chemcraft's network, it caters to diverse uses, including kitchens, bathrooms, yacht interiors, and musical instruments.

- March 2024: Mitsui Chemicals announced that its subsidiary, COTEC GmbH, partnered with CADIS Engineering GmbH to develop a digital printer for hydrophobic-coated automotive displays. Combining COTEC’s ultra hydrophobic coating technology and CADIS’s inkjet expertise, the printer enables precise, eco-friendly coatings under normal pressure. The innovation improves productivity, reduces environmental impacts, and enhances automotive display design flexibility.

- March 2024: Hardide Coatings launched a new range of pre-coated components, beginning with a JP-5000 4" copper nozzle for High-Velocity Oxy Fuel (HVOF) thermal spray coating. Equipped with a tungsten/tungsten carbide-based chemical vapor deposition (CVD) coating, these nozzles can extend operational life by up to 40 times when spraying metallic or carbide powders.

- February 2024: Covestro introduced a new range of waterborne and waterborne UV resins for industrial coatings, targeting wood furniture, cabinetry, and building products. These resins address growing regulatory demands for water-based solutions, offering reduced volatile organic compounds (VOCs), improved energy efficiency, and a more sustainable, circular solution.

Coating Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Powder Coating Equipment, Liquid Coating Equipment, Specialty Coating Equipment |

| Distribution Channels Covered | Wholesale Distributor, Retail Distributor |

| Applications Covered | Automotive, Aerospace, Construction, Industrial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anest Iwata Corporation, Asahi Sunac Corporation, Castolin Eutectic, Graco Inc., Hydromer, IHI Corporation, J. Wagner GmbH, Larius S.r.l, Nordson Corporation, OC Oerlikon, Praxair Surface Technologies Inc. (Linde plc) and Samvardhana Motherson Group., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the coating equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global coating equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the coating equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The coating equipment market was valued at USD 23.10 Billion in 2024.

The coating equipment market is projected to exhibit a CAGR of 4.69% during 2025-2033, reaching a value of USD 35.66 Billion by 2033.

The market is majorly driven by growing demand for industry-specific customization, ongoing advancements in automation and robotics, eco-friendly low-emission technologies, increasing infrastructure investments, rising automotive and aerospace production, and expanding applications in renewable energy, consumer goods, and medical devices.

Asia Pacific currently dominates the coating equipment market, accounting for a share exceeding 45.7%. This dominance is fueled by rapid industrialization, urbanization, strong automotive and aerospace manufacturing, and investments in renewable energy projects.

Some of the major players in the coating equipment market include Anest Iwata Corporation, Asahi Sunac Corporation, Castolin Eutectic, Graco Inc., Hydromer, IHI Corporation, J. Wagner GmbH, Larius S.r.l, Nordson Corporation, OC Oerlikon, Praxair Surface Technologies Inc. (Linde plc) and Samvardhana Motherson Group, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)