Coal Bed Methane (CBM) Market Report by Type (CBM Wells, Coal Mines), Technology (Horizontal Drilling, Hydraulic Fracturing, CO2 Sequestration), Application (Power Generation, Residential, Commercial, Industrial, Transportation), and Region 2025-2033

Coal Bed Methane (CBM) Market Size:

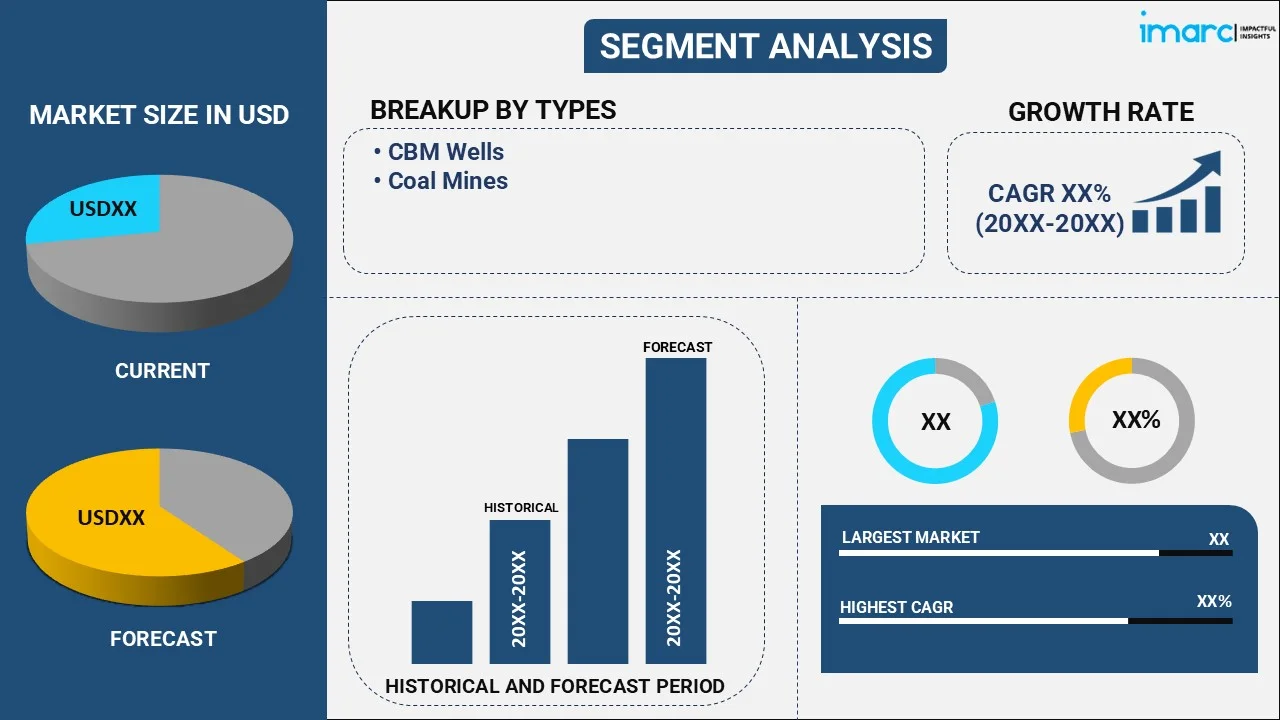

The global coal bed methane (CBM) market size reached USD 20.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 29.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033. The market is expanding rapidly mainly due to the escalating demand for clean energy alternatives. Increasing natural gas prices and innovations in extraction methodologies are also driving market growth. Additionally, CBM’s role in minimizing greenhouse gas emissions further reinforces its adoption across numerous energy industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 20.7 Billion |

|

Market Forecast in 2033

|

USD 29.8 Billion |

| Market Growth Rate 2025-2033 | 4.1% |

Coal Bed Methane (CBM) Market Analysis:

- Major Market Drivers: The market is majorly driven by heightening demand for clean energy solutions. With rising concerns about lowering carbon emissions, coal bed methane (CBM) provides a feasible solution as it is a cleaner-burning fuel in comparison to conventionally used coal. Moreover, technological advancements in extraction techniques, encompassing hydraulic fracturing and horizontal drilling, have also substantially improved CBM production efficacy, further fueling market expansion. In addition, increasing prices of natural gas are establishing CBM as a preferable option for sectors seeking cost-efficient energy solutions, propelling its adoption across numerous industries.

- Key Market Trends: Numerous key trends are steering the global coal bed methane (CBM) market dynamics, including the inclination towards cleaner and renewable energy solutions that has prompted interest in CBM as a transitional fuel, especially in regions with abundant coal supply. Innovations in technology like improved reservoir management and enhanced drilling methods are reducing costs, driving production efficacy, and enhancing yield. In addition, tactical collaborations between private businesses and governmental bodies to upgrade CBM infrastructure are rapidly becoming prevalent, reflecting a synergistic approach towards sustainability targets and energy differentiation.

- Geographical Trends: Asia Pacific is the leading regional market for CBM, primarily driven by its ample coal reserves, especially in countries such as Australia, India, and China. Government campaigns encouraging adoption of cleaner energy resources and lowering the dependency on conventional coal are supporting the CBM development in the region. India and China, particularly, are witnessing growing investments in CGM extraction ventures to address their increasing energy requirements while limiting emissions. In addition, Australia’s robust regulatory aid and leading-edge CBM infrastructure position it as a major player in the Asia Pacific’s market growth.

- Competitive Landscape: Some of the major market players in the coal bed methane (CBM) industry include Arrow Energy Holdings Pty Ltd., Baker Hughes Company, BP PLC, Essar Group, G3 Exploration, Halliburton Company, Petroliam Nasional Berhad (PETRONAS), Reliance Industries Limited, Royal Dutch Shell plc, Santos Limited, The ConocoPhillips Company, among many others.

- Challenges and Opportunities: The market experiences challenges like technical complications pertaining to extraction technologies, increasing environmental concerns, and elevated costs of initial investment. However, such challenges offer opportunities for innovations, especially in formulating more effective extraction techniques and eco-friendly practices. Moreover, government initiatives endorsing cleaner energy solutions, coupled with increasing energy demands in emerging economies, create prospects for market growth. The rapid development of infrastructure and collaborations with technology providers will further boost the CBM market expansion globally.

Coal Bed Methane (CBM) Market Trends:

Magnifying Emphasis on Clean Energy Transition

According to the coal bed methane (CBM) market report, an increasing inclination towards cleaner energy sources is currently being witnessed in the global marker. Numerous sectors and governments are focusing on low-emission substitutes to lower their carbon footprints, establishing CBM as a critical transitional fuel. Its reduced carbon emissions in comparison to coal position it as an ideal choice for economies aiming to address the international climate targets. According to the World Nuclear Association, global annual carbon emissions from the combustion of fossil fuel are around 34 billion tons, with coal accounting for approximately 45% of these emissions. In addition, with accelerating demand for natural gas, CBM is notably playing a significant role in the global energy blend, facilitating the decarbonization of power generation as well as major sectors.

Advancements in CBM Extraction Technologies

As per the coal bed methane (CBM) market overview, technological advancements are substantially improving the efficacy of CBM extraction, facilitating the market expansion. Technologies like horizontal drilling and hydraulic fracturing have enhanced cost-efficiency as well as yield of CBM production. Such innovations elevate the overall productivity of CBM extraction processes and allow better access to deep coal seams. In addition, reservoir refinement and advancements in water management are mitigating the environmental concerns, making CBM extraction more convenient and sustainable to both energy producers and investors. For instance, in December 2023, Essar Oil and Gas Exploration and Production Ltd. (EOGEPL) signed a MoU with Indian Institute of Technology Bombay to collaboratively execute research and development initiatives focused on indigenous innovations in numerous leading-edge CBM technologies, particularly in CO2 sequestration, an extraction technology, and enhanced CBM recovery techniques.

Rising Interest in CBM for Power Generation

The utilization of CBM for power production is rapidly gaining momentum as numerous countries are seeking ways to expand their energy sources. CBM provides a cleaner and dependable alternative to conventional coal-fired power plants, aiding the reduction of greenhouse gas emissions. Moreover, several countries are increasingly incorporating CBM into their energy portfolios to address the growing electricity requirements while complying with the environmental standards. This trend is also bolstered by increasing emissions during power generation processes. According to the International Energy Agency, global energy-related carbon emissions elevated by 410 million tons in 2023, with U.S., China, and other key countries significantly contributing to over 40% of this elevation. In addition, investments in CBM-based power generation ventures are amplifying, especially in regions with ample coal reserves, further improving the global market’s expansion potential.

Coal Bed Methane (CBM) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, technology, and application.

Breakup by Type:

- CBM Wells

- Coal Mines

CBM wells account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes CBM wells and coal mines. According to the report, CBM wells represented the largest segment.

CBM wells play a critical role in the global CBM market, driving its growth as the leading type segment. These wells are developed particularly for retrieving methane gas confined in coal seams. The escalating demand for cleaner energy solutions has resulted in heightened investment in developing as well as discovering CBM wells, especially in regions with surplus of coal reserves. Moreover, advanced well designs and improved extraction technologies are enhancing rates of gas recovery, reinforcing the segment’s dominance in global market share. CBM wells remain crucial for addressing the global energy requirements and lowering dependency on traditional fossil fuels.

Breakup by Technology:

- Horizontal Drilling

- Hydraulic Fracturing

- CO2 Sequestration

Horizontal drilling holds the largest share of the industry

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes horizontal drilling, hydraulic fracturing, and CO2 sequestration. According to the report, horizontal drilling accounted for the largest market share.

Horizontal drilling as emerged as the dominant technology in the global CBM market. This technology significantly enhances gas extraction efficacy by facilitating the access to several coal seams from a single wellbore. Horizontal drilling magnifies resource recovery while reducing environmental impact, positioning it as an ideal method for extraction procedure. In addition, the capability of this technology to bolster production rates and lower operational costs has fortified its position as the extensively leveraged technology in the market, boosting investments and prompting advancements in CBM development globally.

Breakup by Application:

- Power Generation

- Residential

- Commercial

- Industrial

- Transportation

Power generation represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes power generation, residential, commercial, industrial, and transportation. According to the report, power generation represented the largest segment.

Power generation accounts for the largest market share as CBM is rapidly being utilized as a cleaner substitute of coal in power plants, assisting the reduction of greenhouse gas emissions and fostering the shift towards lower-carbon energy solutions. Furthermore, its role in producing electricity has proliferated, especially in regions with accelerating energy demands and expansive coal reserves. In addition, the capability of CBM to provide constant, dependable power generation while complying to environmental regulations establishes it as a major energy source in power generation industry.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest coal bed methane (CBM) market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for coal bed methane (CBM).

Asia Pacific has established itself as the dominant regional market in the global CBM market, principally driven by accelerating energy requirement in numerous countries, particularly Australia, China, and India, and abundant reserves for coal. Government projects supporting the adoption of clean energy sources and minimizing the dependency on conventional sources like coal are further fueling CBM development in Asia Pacific. In addition, major companies are heavily investing in the CBM plants of key countries like India and China to address the magnifying energy needs. For instance, in February 2024, Essar Oil and Gas Exploration and Production (EOGEPL), a subsidiary of Essar Group, a major conglomerate company, announced a significant investment of INR 3 crore to improve gas production at its CBM block in West Bengal, India. This investment aims to elevate production to five million standard cubic meters per day by FY2029. Moreover, resilient CBM infrastructure and rapid development of cutting-edge extraction method also reinforces Asia Pacific’s dominance in the global market.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the coal bed methane (CBM) industry include Arrow Energy Holdings Pty Ltd., Baker Hughes Company, BP PLC, Essar Group, G3 Exploration, Halliburton Company, Petroliam Nasional Berhad (PETRONAS), Reliance Industries Limited, Royal Dutch Shell plc, Santos Limited, and The ConocoPhillips Company.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The market is represented by fierce competition among major industry players focused on technological advancements and expansion. Key companies are heavily investing in cutting-edge extraction technologies to enhance efficacy and lower their operational costs. Moreover, strategic joint projects and partnerships are highly prevalent, as various businesses seek to expand their market presence in emerging economies. For instance, in April 2024, Deep Energy Resources Ltd's subsidiary, Ultra Gas Trading Limited, announced that it has secured an order to supply Coal Bed Methane (CBM) gas, allocated at 0.05 MMSCMD, through collaboration between Oil and Natural Gas Corporation Limited (ONGC), Indian Oil Corporation Ltd (IOCL), and Prabha Energy Private Limited (PEPL). In addition, competitive dynamics are shaped by the pursuit of sustainability targets, with companies rapidly aligning their operations with environmental frameworks and clean energy ventures.

Coal Bed Methane (CBM) Market News:

- In November 2023, Sekaname Energy, a CBM power production company, signed an agreement with Botswana Power Corporation to develop a CBM power plant to supply cleaner energy to Botswana.

- In August 2024, Reliance Industries (RIL) announced an investment of INR 1 crore to boost production at CBM blocks in Madhya Pradesh, India. RIL has planned to increase production to 1 million standard cubic meters per days within 3 years through new well drilling.

Coal Bed Methane (CBM) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | CBM Wells, Coal Mines |

| Technologies Covered | Horizontal Drilling, Hydraulic Fracturing, CO2 Sequestration |

| Applications Covered | Power Generation, Residential, Commercial, Industrial, Transportation |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arrow Energy Holdings Pty Ltd., Baker Hughes Company, BP PLC, Essar Group, G3 Exploration, Halliburton Company, Petroliam Nasional Berhad (PETRONAS), Reliance Industries Limited, Royal Dutch Shell plc, Santos Limited, The ConocoPhillips Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the coal bed methane (CBM) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global coal bed methane (CBM) market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the coal bed methane (CBM) industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Coal Bed Methane (CBM) market was valued at USD 20.7 Billion in 2024.

We expect the global Coal Bed Methane (CBM) market to exhibit a CAGR of 4.1% during 2025-2033.

The rising demand for clean-burning fuels like Coal Bed Methane (CBM) in various industrial applications, such as cement production, rolling mills, and steel plants, is primarily driving the global Coal Bed Methane (CBM) market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for coal bed methane.

Based on the type, the global Coal Bed Methane (CBM) market can be segmented into CBM wells and coal mines. Currently, CBM wells hold the majority of the total market share.

Based on the technology, the global Coal Bed Methane (CBM) market has been divided into horizontal drilling, hydraulic fracturing, and CO2 sequestration. Among these, horizontal drilling currently exhibits a clear dominance in the market.

Based on the application, the global Coal Bed Methane (CBM) market can be categorized into power generation, residential, commercial, industrial, and transportation. Currently, power generation accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global Coal Bed Methane (CBM) market include Arrow Energy Holdings Pty Ltd., Baker Hughes Company, BP PLC, Essar Group, G3 Exploration, Halliburton Company, Petroliam Nasional Berhad (PETRONAS), Reliance Industries Limited, Royal Dutch Shell plc, Santos Limited, and The ConocoPhillips Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)