Co-Packaged Optics Market Size, Share, Trends, and Forecast by Data Rates, Application, and Region, 2025-2033

Co-Packaged Optics Market Size and Share:

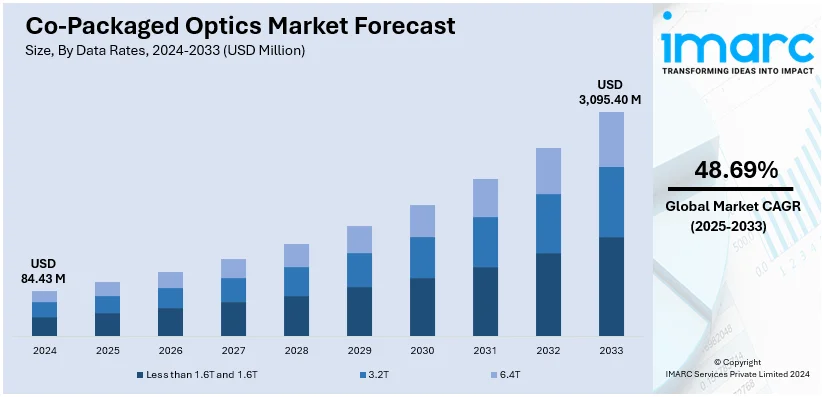

The global co-packaged optics market size was valued at USD 84.43 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,095.40 Million by 2033, exhibiting a CAGR of 48.69% during 2025-2033. North America currently dominates the market, holding a significant market share of 35.9% in 2024. The growing increasing reliance dependence on cloud computing, 5G networks, streaming services, 5G networks and Internet of Things (IoT) applications, increasing utilization of edge computing devices, and rising integration of optical components with semiconductor chips with semiconductor chips providing energy-efficiency are some of the major factors boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 84.43 Million |

| Market Forecast in 2033 | USD 3,095.40 Million |

| Market Growth Rate (2025-2033) | 48.69% |

The rapid growth of cloud computing, e-commerce, video streaming, and the Internet of Things (IoT) has led to a sharp increase in data center construction worldwide. As of December 2024, there are 1,692 active data centers in the U.S., with an additional 332 under construction and 691 announced, reflecting ongoing investment to meet digital demand. These facilities act as the backbone for storing and processing data. With increasing pressure to manage high volumes of traffic and reduce latency, data centers are turning to co-packaged optics. Energy efficiency has also become a top priority across industries, particularly in IT and telecommunications. Data centers are highly energy-intensive, and their electricity consumption is projected to increase from 4% to 6% of the U.S.'s total consumption by 2026, equating to the output of 43 nuclear reactors. Co-packaged optics significantly reduce the power needed for data transmission compared to traditional setups, making them a viable solution for greener operations.

The United States is a major market disruptor with a share of 76.80% in North America. The rollout of 5G is transforming industries and enhancing connectivity in the country. 5G connections have reached 68.4 connections per 100 inhabitants. The infrastructure supporting 5G requires robust technologies to handle increased data traffic efficiently. Co-packaged optics (CPOs) provide the speed and efficiency needed for 5G networks to function at their peak, reducing latency and improving bandwidth. This alignment with 5G development has positioned CPO as a vital component in modern telecommunications, driving its market growth. Moreover, major tech companies and governments are investing significantly in optical interconnect technology. As per industry reports, in 2024, cloud service providers are expected to invest a record $227 billion in capital expenditures, marking a 39% increase from the year 2023, with a substantial portion directed towards data center infrastructure. These investments fund R&D and enable large-scale deployments of CPO solutions, accelerating innovation, reducing costs, and making the technology more accessible, ensuring consistent market growth in the country.

Co-Packaged Optics Market Trends:

Rising demand for data

The market is expanding because of the rising demand for data driven by cloud computing, streaming services, 5G networks, and Internet of Things (IoT) applications. In 2021, 95% of U.S. homes had a computer and 90% had a broadband internet connection, according to the Census Bureau. This is an increase from 2018, when 92% of households owned a computer and 85% had a broadband internet subscription. Co-packaged optics are useful in this context as they reduce signal travel distance by directly integrating optical components with semiconductor chips. This drastically lowers latency, which makes it ideal for applications like online gaming, video conferencing, and driverless cars where real-time data processing and quick reaction times are essential. Higher bandwidths of data transmission are made possible by the integration of optical components with semiconductor processors. This is necessary to handle the growing amount of data produced by global developing technologies.

Technological advancements in co-packaged optics

The leading manufacturers in this industry are concentrating on expanding co-packaged optics' bandwidth. In order to fulfill the needs of high-speed networks and applications, it involves the development of novel optical components and materials that can enable higher data transfer rates. Furthermore, heat control is essential for co-packaged optics to avoid overheating and preserve dependable performance. More efficient heat dissipation is made possible by innovations in thermal management technologies, such as sophisticated heat sinks and materials, which provide steady performance in demanding settings. The co-packaged optics market price is influenced by advancements in optical interconnect technology, increasing demand for high-speed data centers, and the adoption of efficient thermal management solutions to enhance performance and reliability.

Growing demand for edge computing

By processing data closer to where it is generatedits generation, edge computing eliminates surpasses the need for data to travel great distances to centralized data centers. For real-time applications like augmented reality (AR), industrial automation, and driverless cars, this method requires incredibly low latency. For these latency-sensitive edge computing applications, co-packaged optics is the ideal option since it drastically lowers latency. Additionally, the high bandwidth capabilities of co-packaged optics allow for the smooth movement of massive amounts of data to and from edge devices.

Co-Packaged Optics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global co-packaged optics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on data rates and application.

Analysis by Data Rates:

- Less than 1.6T and 1.6T

- 3.2T

- 6.4T

Less than 1.6T and 1.6T segment hold the largest co-packaged optics market share in 2024. In compact data centers and networking equipment wherein less than 1.6T data rate is utilized, co-packaged optics can help save space. It enables the integration of optical transceivers and electronic components within the same package, reducing the footprint of the equipment. It can lead to power savings as it optimizes the electrical and optical connections, reducing energy consumption in the system.

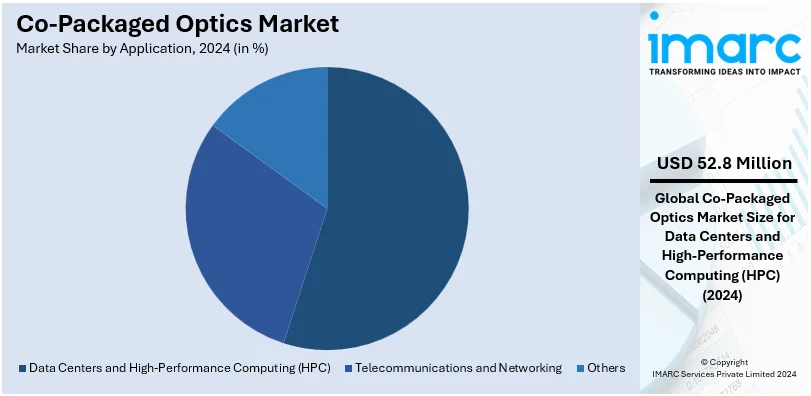

Analysis by Application:

- Data Centers and High-Performance Computing (HPC)

- Telecommunications and Networking

- Others

In 2024, data centers and high-performance computing (HPC) held a dominant market share of 62.5%. In data centers and HPC clusters, co-packaged optics presents a small and integrated way to link switches, routers, and computation nodes. They provide high-speed data transfer, which is necessary to manage the enormous amounts of data produced by contemporary applications. Moreover, co-packaged optics aids in lowering signal propagation delays in data centers and HPC where low latency is essential. Its proximity to processing units minimizes latency, ensuring rapid data exchange for time-sensitive tasks. Co-packaged optics can also be designed for energy efficiency, helping data centers reduce their power consumption.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America held the largest co-packaged optics market share of 35.9% in 2024. Because of the growing demand for cloud services, digital transformation, and the spread of data-intensive applications, North America accounted for the largest portion of the market. Co-packaged optics are a vital part of the digital ecosystem in the region as they enable high-speed data transfer within these data centers. Furthermore, the need for high-speed optical communication technologies like co-packaged optics is being driven by the rollout of 5G networks, the growth of broadband services, and the rise in mobile connectivity.

Key Regional Takeaways:

United States Co-Packaged Optics Market Analysis

With a 76.80% market share in North America, the United States is dominating the industry in 2024. Massive data center installations across the US and the expansion of cloud computing services are driving up the demand for high bandwidth, which co-packaged optics are effectively supplying. Over 5000 data centers are located in the United States, according to the National Telecommunications and Information Administration (NTIA). Accordingly, the region's adoption of co-packaged optical technology for long-distance communication and data transmission is being supported by the quick development of 5G networks and the growing need for high-speed internet. Over 330 million Americans had access to one or more 5G networks by the end of 2023, with 40% of cellular connections using 5G technology, according to a survey. The National Telecommunications and Information Administration (NTIA) also found that, in 2023, there were 13 million more internet users in the US than there were two years earlier.

Asia Pacific Co-Packaged Optics Market Analysis

Leading semiconductor manufacturers are relocating to Asia-Pacific nations, which is propelling the advancement and use of co-packaged optics technology. The India Brand Equity Foundation (IBEF) estimates that the country's semiconductor sector was worth USD 26.3 billion in 2022. Additionally, cloud computing and e-commerce development have caused the fast proliferation of data centers throughout this area, which is driving the market for co-packaged optics. The top seven cities in India now have a combined data center capacity of 977 MW, according to the India Brand Equity Foundation (IBEF). Accordingly, the Asia-Pacific area is spearheading the worldwide implementation of 5G, prompting a notable need for co-packaged optical technology to provide quicker and more effective communication networks.

Europe Co-Packaged Optics Market Analysis

The European automobile sector is presently offering co-packaged optics with the potential to provide low-latency data transfer, especially with the move towards autonomous cars. Over 169,000 people were employed by motor vehicle manufacturing businesses in the United Kingdom in 2018, making up 0.5% of the workforce, according to the Office for National Statistics. Furthermore, the growing requirement for effective, fast data transport in massive data centers is fueling the market for co-packaged optics in Europe. There are reportedly 1,200 specialized data center locations in Europe presently. Furthermore, co-packaged optics has a chance to significantly improve network performance as a result of Europe's growing 5G networks and fiber optic infrastructure. According to the government of the United Kingdom, 5G became available in over 100 towns and cities across the United Kingdom, including London, Edinburgh, Cardiff, and Belfast.

Latin America Co-Packaged Optics Market Analysis

The growing interest in establishing data centers to meet local and regional cloud computing is fueling the need for co-packed optics market. According to the United States International Trade Commission, both Mexico and Brazil contributed 2% to the total global data center capacity. In line with this, investing in 5G and improving internet infrastructure across the region is creating new opportunities for the co-packaged optics market. According to a survey, 55% of operators across the Latin American region with live 5G networks have announced plans to upgrade to 5G SA – in line with the global average.

Middle East and Africa Co-Packaged Optics Market Analysis

The need for data centers is rising in the Middle Est and Africa region due to the expansion of cloud computing, which is supporting the need for a co-packaged optics that operates efficiently. Accordingly, a lot of Middle Eastern nations are making significant investments in fiber optics and 5G communication infrastructure, which is driving up the demand for co-packaged optics. In the second quarter of 2023, the UAE reportedly had the world's fastest 5G market. Additionally, 557.63 Mbps was the median download speed.

Competitive Landscape:

In order to satisfy the growing need for energy-efficient solutions and high-speed data transmission, major competitors in the industry are aggressively advancing the technology. Businesses are making significant investments in R&D to improve the integration of co-packaged optics. To enhance data center performance, they are concentrating on creating semiconductor solutions that use co-packaged optics. Others are developing novel designs to enable the smooth integration of electrical and optical components with the goal of lowering power consumption and delay. In order to meet the increasing data rates needed by contemporary applications, certain firms are also looking into cutting-edge semiconductor technologies. Next-generation optical interconnects that solve the bandwidth limits of traditional copper interconnects are also being explored. These strategic initiatives are crucial in driving the adoption of co-packaged optics, positioning key companies as leaders in the evolving landscape of data center and high-performance computing infrastructure.

The report provides a comprehensive analysis of the competitive landscape in the co-packaged optics market with detailed profiles of all major companies, including:

- Broadcom Inc.

- Lumentum Operations LLC

- Ranovus

Latest News and Developments:

- January 2025: Marvell Technology announced the launch of a new AI accelerator integrated with co-packaged optics technology to enhance server performance. The architecture allows for AI server scalability, improves data transfer rates, and reduces power usage.

- June 2024: Samsung showcased its advanced semiconductor innovations at the Samsung Foundry Forum (SFF) in San Jose, unveiling cutting-edge 2nm (SF2Z) and 4nm (SF4U) process nodes. The event highlighted Samsung's commitment to AI-era solutions and introduced plans for future CPO-integrated AI offerings.

- June 2024: Intel demonstrated the world's first fully integrated optical compute interconnect (OCI) chiplet, co-packaged with an Intel CPU, at the Optical Fiber Communication Conference (OFC). This co-packaged OCI chiplet enabled high-bandwidth optical I/O, reducing power usage and increasing reach, which is crucial for scaling AI workloads and high-performance computing. It addressed the increasing demands of AI infrastructure with enhanced efficiency and connectivity.

- March 2024: MediaTek reportedly ventured into the rapidly growing field of Heterogeneous Integration Co-Packaged Optics (CPO) through a strategic partnership with optical communications firm Ranovus. Together, they introduced a customized Application-Specific Integrated Circuit (ASIC) design platform tailored for CPO applications.

- March 2024: Broadcom (AVGO) launched Bailly, which is the world's first 51.2 Terabits per second (Tbps) co-packaged optics (CPO) Ethernet switch. This innovative product combined advanced silicon photonics technology with Broadcom's industry-leading StrataXGS Tomahawk 5 switch chip, establishing a new benchmark for efficiency and performance in AI infrastructure.

- August 2022: Broadcom announced its collaboration with Tencent to advance the adoption of high-bandwidth co-packaged optics switches. The company had deployed its first switch integrated with optics, named Humboldt, in the cloud giant's data centers.

Co-Packaged Optics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Rates Covered | Less than 1.6T and 1.6T, 3.2T, 6.4T |

| Applications Covered | Data Centers and High-Performance Computing (HPC), Telecommunications and Networking, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Broadcom Inc., Lumentum Operations LLC, Ranovus, etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the co-packaged optics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global co-packaged optics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the co-packaged optics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Co-packaged optics (CPO) is a technology that integrates optical and electronic components within the same package, minimizing signal loss and power consumption. It is designed for high-speed data transfer and is widely used in data centers and telecommunications to enhance efficiency and meet increasing bandwidth demands.

The global co-packaged optics market was valued at USD 84.43 Million in 2024.

IMARC estimates the global co-packaged optics market to exhibit a CAGR of 48.69% during 2025-2033.

The global co-packaged optics market is driven by the rising demand for high-speed data transfer, increasing energy efficiency requirements, rapid 5G deployment, growing data center investments, advancements in artificial intelligence (AI) and machine learning (ML), and the miniaturization of electronic devices, all fueling the adoption of this technology.

According to the report, less than 1.6T and 1.6T represented the largest segment by data rates, as the majority of current data center and networking infrastructures operate within the 1.6T data rate range.

Data centers and high-performance computing (HPC) leads the market by application as they demand high-speed, low-latency solutions to handle massive data volumes and complex computations.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global co-packaged optics market include Broadcom Inc., Lumentum Operations LLC, and Ranovus, etcamong others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)