CNG and LPG Vehicle Market Size, Share, Trends and Forecast by Fuel Type, Vehicle Type, Sales Channel, and Region, 2025-2033

CNG and LPG Vehicle Market 2024, Size and Share:

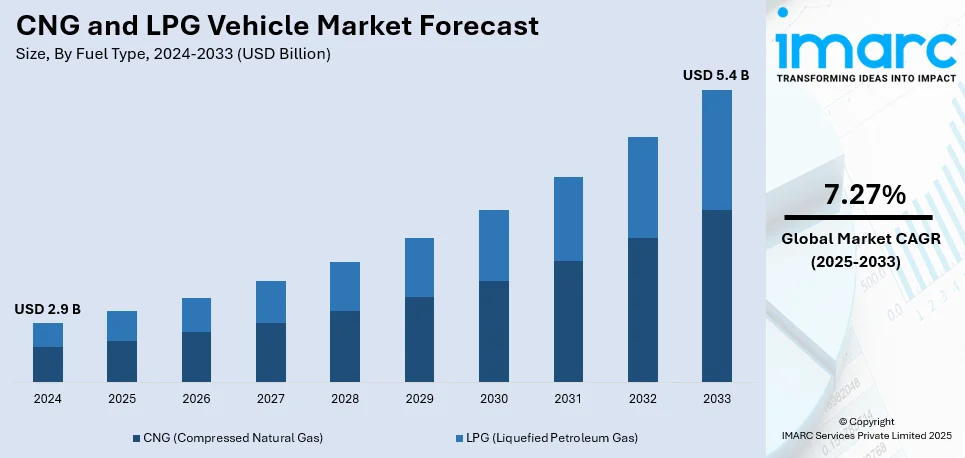

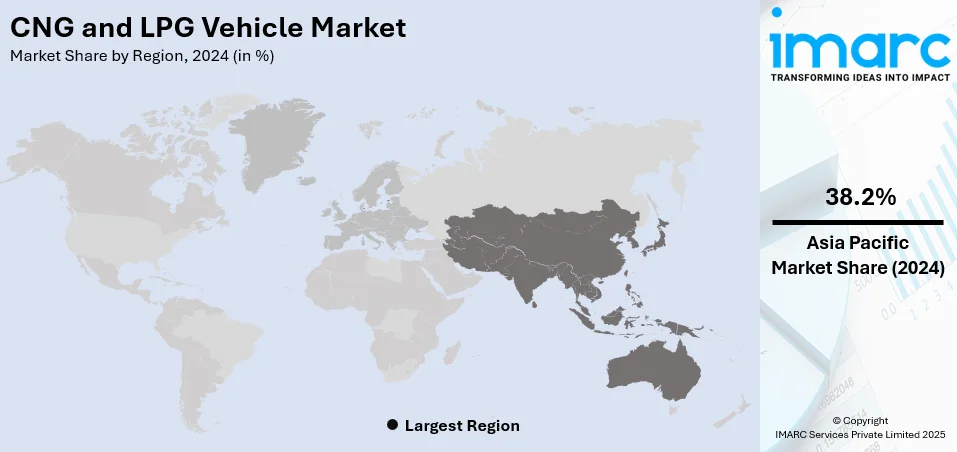

The global CNG and LPG vehicle market size was valued at USD 2.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.4 Billion by 2033, exhibiting a CAGR of 7.27% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 38.2% in 2024. The burgeoning automobile industry, rising fuel prices, and the growing demand for original equipment manufacturer (OEM)-fitted vehicles represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.9 Billion |

|

Market Forecast in 2033

|

USD 5.4 Billion |

| Market Growth Rate (2025-2033) | 7.27% |

The CNG and LPG vehicle market is growing due to rising concerns about environmental pollution and stringent emissions regulations. These vehicles offer lower carbon emissions compared to conventional gasoline or diesel-powered vehicles, making them a preferred choice for eco-conscious consumers and governments promoting green alternatives. For instance, in September 2024, the Indian Auto LPG Coalition urged the government to recognize Auto LPG as a clean fuel alternative highlighting its environmental and economic advantages. The coalition emphasized that Auto LPG produces lower emissions compared to petrol and diesel. They called for tax incentives and policy support to promote its integration into India's sustainable development strategies. Increasing fuel cost savings associated with CNG and LPG further drives adoption among cost-sensitive customers. The CNG and LPG vehicle market forecast indicate that supportive government policies, tax incentives and subsidies to encourage the use of alternative fuels are also significant contributors. Additionally, advancements in engine technologies and the expansion of refueling infrastructure are enhancing vehicle performance and accessibility boosting market demand globally.

The United States CNG and LPG vehicle market is driven by growing environmental awareness and stringent federal and state-level emissions regulations aimed at reducing greenhouse gases. Rising fuel cost sensitivity has increased the adoption of alternative fuels like CNG and LPG which offer significant cost advantages over gasoline and diesel. Government incentives including tax benefits and grants for alternative fuel vehicles and infrastructure development are further supporting the CNG and LPG vehicle market growth in the country. The increasing presence of refueling stations and advancements in bi-fuel and dedicated engine technologies are enhancing convenience and efficiency encouraging consumers and fleet operators to transition to CNG and LPG-powered vehicles. According to industry reports, there are over 700 public compressed natural gas (CNG) fueling stations in the United States. There are around 50 liquefied natural gas (LNG) fueling stations primarily located in regions that cater to the long-haul trucking sector.

CNG and LPG Vehicle Market Trends:

Rising Focus on Low-Emission Vehicles

Governments globally are prioritizing low-emission vehicles to combat environmental challenges like air pollution and climate change. Policies and regulations including emission standards and green certifications are encouraging the shift from traditional fuel options to cleaner alternatives such as CNG and LPG. Incentives like tax benefits, subsidies and relaxed regulations further support the adoption of these vehicles. CNG and LPG emit significantly fewer greenhouse gases and harmful pollutants making them a viable solution for reducing the transportation sector’s environmental impact. This focus is reshaping the automotive market prompting manufacturers to innovate and expand their low emission vehicle portfolios to meet rising demand. For instance, in September 2024, Tata Motors launched the Nexon iCNG adding a CNG variant to its popular Nexon lineup which now includes petrol, diesel and electric options. The new model features two 30-litre cylinders and aims to boost CNG sales.

Emergence of Aftermarket Conversion Kits

The rise of aftermarket conversion kits is significantly boosting the adoption of CNG and LPG vehicles market share, especially in emerging regions. These kits provide a cost-effective way for vehicle owners to transition from conventional fuels to cleaner alternatives without purchasing new vehicles. Modern kits include advanced components like fuel injectors, regulators and lightweight storage tanks ensuring safety and efficiency. Their affordability and ease of installation make them appealing to consumers in regions with limited disposable income. For instance, in June 2024, KR Fuels became the first company in India to receive approval for LPG retrofit kits for BS4 two-wheelers with an initial production of 8,000 tanks. The company aims to expand to BS6 vehicles promoting a cleaner fuel solution that could significantly reduce vehicular emissions across the country. Additionally, the growing support from governments and manufacturers for certified conversion solutions enhances trust and accelerates market penetration making cleaner mobility more accessible and widespread.

Government Subsidies and Incentives

Governments across the globe are actively encouraging the adoption of CNG and LPG vehicles through financial incentives and policy support. These measures include subsidies on vehicle purchases, reduced registration fees, and tax rebates to lower the upfront costs for consumers. In some regions, governments offer grants to support the development of refueling infrastructure further promoting accessibility. These incentives align with environmental goals by reducing carbon emissions and air pollution. For instance, in October 2024, Mahanagar Gas Limited launched a new incentive scheme for CNG commercial vehicle owners in Mumbai, Thane and Raigad. Buyers can receive up to Rs 4.5 lakhs via CNG fuel cards aimed at promoting cleaner fuel adoption and sustainability in urban transportation. As per the CNG and LPG vehicle market outlook, by fostering a favorable economic environment for alternative fuels these policies not only benefit consumers but also drive the growth of the CNG and LPG vehicle market supporting a sustainable transportation future.

CNG and LPG Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global CNG and LPG vehicle market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on fuel type, vehicle type, and sales channel.

Analysis by Fuel Type:

- CNG (Compressed Natural Gas)

- LPG (Liquefied Petroleum Gas)

CNG (compressed natural gas) filters stand as the largest fuel type in 2024, holding around 95.4% of the market. CNG (Compressed Natural Gas) dominates the CNG and LPG vehicle market as the largest segment due to its widespread adoption and economic benefits. Known for its lower cost compared to traditional fuels, CNG offers significant savings, making it a preferred choice for both individual and fleet operators. Its cleaner combustion process results in reduced greenhouse gas emissions, aligning with global environmental goals. The robust infrastructure development, including CNG refueling stations in urban and rural areas, further supports its growth. Additionally, advancements in CNG engine technology and storage systems enhance vehicle efficiency and performance, solidifying its position as the leading fuel type.

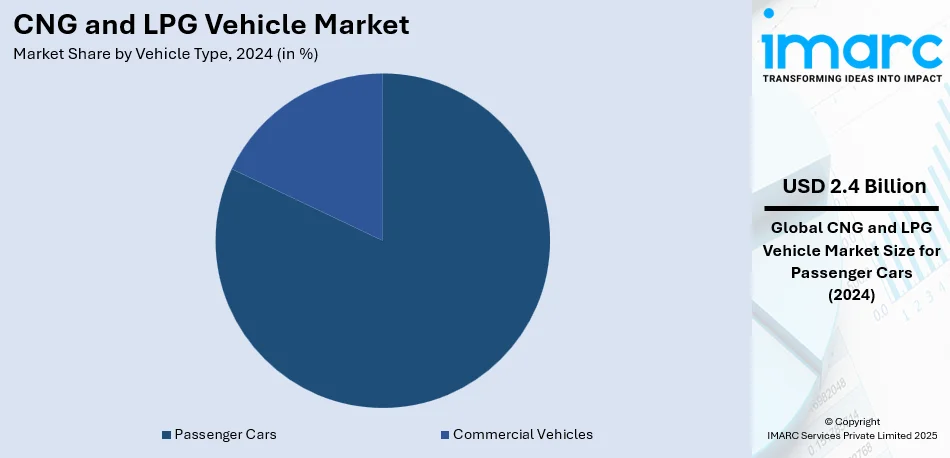

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars leads the market with around 82.3% of market share in 2024. Passenger cars hold the largest market share in the CNG and LPG vehicle market due to their widespread use and increasing demand for cost-efficient and environmentally friendly transportation. Rising fuel prices and growing urbanization have encouraged consumers to adopt CNG and LPG passenger cars, which offer lower running costs and reduced emissions. Automakers are introducing a wide range of CNG and LPG car models with enhanced performance and safety features, appealing to eco-conscious buyers. Moreover, government incentives and expanding refueling infrastructure for alternative fuels further boost their popularity, solidifying passenger cars as the dominant segment in this market.

Analysis by Sales Channel:

- OEM (Original Equipment Manufacturer)

- Retrofitting

Retrofitting holds the largest market share in the CNG and LPG vehicle market share, driven by its cost-effective solution for converting existing vehicles to alternative fuels. This option appeals to a broad consumer base, particularly in regions where the upfront cost of new OEM models is prohibitive. Retrofitting kits are increasingly advanced, offering improved safety, efficiency, and compatibility with diverse vehicle types. The flexibility to convert conventional vehicles into CNG or LPG variants without requiring a new purchase has made retrofitting popular. Growing availability, combined with supportive government policies and lower installation costs, has solidified its position as the leading sales channel.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 38.2%. Asia Pacific leads the CNG and LPG vehicle market, driven by high demand in countries like China, India, and Indonesia. The region’s rapid urbanization, coupled with rising fuel prices, has pushed consumers toward cost-efficient and eco-friendly alternatives. Governments are actively promoting CNG and LPG adoption through subsidies and infrastructure development, including refueling stations. Additionally, abundant natural gas reserves in the region ensure a stable supply, further supporting CNG and LPG vehicle market growth in this region. Automakers are launching affordable models tailored to local needs, bolstering adoption. These factors, combined with increasing environmental awareness, have established Asia Pacific as the largest market for CNG and LPG vehicles.

Key Regional Takeaways:

North America CNG and LPG Vehicle Market Analysis

In North America, the CNG and LPG vehicle market is experiencing steady growth, fueled by environmental concerns and economic benefits. The United States leads the region, accounting for a significant share of the market, as consumers and businesses increasingly shift toward cleaner alternatives. Rising awareness about air pollution and greenhouse gas emissions has propelled the adoption of low-emission vehicles. Lower costs of natural gas compared to gasoline and diesel enhance the feasibility of these vehicles, particularly for fleets seeking operational savings. Government support, including tax credits, rebates, and infrastructure expansion, further incentivizes adoption. As per the CNG and LPG vehicle market forecast, Canada is also contributing to the market's growth through similar measures and a focus on sustainable transportation. With over 135,000 natural gas vehicles already on U.S. roads, North America’s CNG and LPG vehicle market is set to expand further, driven by innovation and supportive policies.

United States CNG and LPG Vehicle Market Analysis

In 2024, the United States accounted for a share of 81.90% of the North American market. CNG and LPG fuelled vehicles are gaining popularity in the United States because of environmental issues and economic benefits. Over the last few years, there has been an alarming rise in air pollution, and the greenhouse effect has led to the advocacy for environmentally friendly energy. While CNG/LPG vehicles for their capabilities of emissions of much lesser magnitude as compared to traditional gasoline/diesel finishing vehicles set well with the country’s goals towards emissions control. Furthermore, due to the lower commodity price of natural gas in comparison to gasoline and diesel the feasibility of these AFVs increases. At the federal and state levels, incentives such as tax credits and rebates apply toward the purchase of CNG and LPG vehicles to motivate their use. According to recent statistics, NGVs are already on American roads more than 135,000 which proves the tendency of increasing interest in such automobiles. Infrastructures like CNG & LPG Refueling Stations also evolve to make these vehicles available to astound the populace or the fleets that buy them. CNG & LPG vehicles will continue to witness a gradual market growth in the U.S., backed by specific key drivers such as sustainability & Energy Security Technology and Government support.

Asia Pacific CNG and LPG Vehicle Market Analysis

In the APAC region, the major driving force behind the demand for CNG and LPG vehicles has been the environmental policy and the relative availability of cheaper substitutes for conventional fuels. India and China, for instance, have set higher emission norms that force society as well as local and imported vehicle manufacturers to embrace cleaner vehicles. According to an article published in the Economic Times in India, there are ambiguous estimates of 100 trillion cubic feet of remaining unexplored natural gas resources which will suffice India’s requirement of gas till 2050. This abundance helps increase the use of CNG vehicles which supply a cheap and reliable fuel. Furthermore, the CNG and LPG vehicle market outlook highlights that the exploration of subsidies and tax credit policies, sponsored by governments, enhance the development of these vehicles. The availability of affordable credit, the rising middle class and the firm’s focus on decreasing in use of imported oil add fuel to this transition towards these cleaner fuels. With shifting focus towards environment friendly products, the use of CNG and LPG vehicles has been predicted to go up shortly in APAC.

Europe CNG and LPG Vehicle Market Analysis

The main demand of the European market for CNG and LPG vehicles can be explained by such factors as strict environmental standards and policies specifying a reduction of greenhouse potentials, demand for clean technologies or alternation of traditional automotive fuels. Following climate objectives, the European Union passed its First Climate Law in 2021, making an emission reduction target of 40% by 2030 and an aim to become a climate-neutral economy by 2050. Following the measures of the law, in February 2024, the European Commission also suggested achieving the intermediate goal of reducing greenhouse gas emissions by 90% by 2040, which would deepen the region’s transition to sustainable transport. These are very ambitious policies that have boosted the demand for low-emitting vehicles such as CNG and LPG-run automobiles. Market inducements in the form of taxation privileges, subsidized fuels, as well as government grants for improvements in the spectrum of infrastructural facilities have also been instrumental in determining the CNG and LPG vehicle market growth. Additionally, escalating fuel costs of petrol and diesel along with the socio-economic advantages connected with natural gas have made the value shift to CNG and LPG vehicles which in turn have stimulated the demand for vehicles conversion to natural gas. With expanding refueling infrastructure and growing environmental awareness, CNG and LPG vehicles will continue their capture of the markets in Europe.

Latin America CNG and LPG Vehicle Market Analysis

CNG and LPG vehicle usage in Latin America is motivated by cost and incentives from governments. When the prices of fuel are high, the natural gas is the better option because it is cheaper given the opportunity of saving a lot of money. For example, findings indicated that Brazil has 15 Tcf of natural gas proved reserves as of 2017 and ranks 33rd in the world and a minimal portion of the global natural gas proved reserves. This sufficiency helps the growth of the CNG vehicle market as several countries in the region such as Brazil and Argentina increased the refueling stations. The applicants’ incentives like tax rebates and subsidies given to the government promoting the use of other market fuels equally expand the market.

Middle East and Africa CNG and LPG Vehicle Market Analysis

In the MEA region, the market is being primarily driven by economic and environmental concerns. The Middle East, which has the largest natural gas reserves, has increased its proved reserves to 75.5 Trillion Cubic Meters (tcm) by 2018 from 73.7 tcm in 2008 as per BP's 2019 Statistical Review of World Energy. This abundance of natural gas supports the adoption of CNG vehicles, offering an affordable and sustainable fuel alternative. Governments in the region have introduced policies and incentives to encourage cleaner transportation, further driving market growth.

Competitive Landscape:

The CNG and LPG vehicle market is highly competitive, driven by advancements in technology, government incentives, and a growing focus on environmental sustainability. Market participants are focusing on innovation in engine efficiency, lightweight storage systems, and dual-fuel technologies to enhance performance and appeal. Companies are also competing by offering cost-effective retrofitting solutions, making the transition to alternative fuels accessible to a broader audience. Expansion of refueling infrastructure and strategic collaborations with energy providers further intensify competition. For instance, in November 2024, Hyundai Motor India is focusing on CNG vehicles due to the rising demand in both urban and rural areas. Models such as the Grand i10 NIOS and EXTER have contributed to an increase in CNG sales which now account for 12.8% of the company's overall sales. To support further growth, Hyundai aims to expand its CNG infrastructure targeting the establishment of 17,500 CNG stations by 2030. In emerging markets, affordability and local manufacturing capabilities are key competitive factors, while in developed regions, stringent emission norms and advanced technology adoption dominate. The market’s dynamic nature fosters continuous improvement, creating opportunities for growth across multiple regions.

The report has also analysed the competitive landscape of the market with some of the key players being:

- AB Volvo

- Hyundai Motor Company

- IVECO S.p.A

- Suzuki Motor Corporation

- Tata Motors Limited (Tata Group)

Latest News and Developments:

- October 2024: Toyota Motor Corporation has introduced the “JPN Taxi,” a hybrid vehicle powered by a newly developed LPG hybrid system (THS II), combining an LPG engine with an electric motor. It delivers a fuel economy of 19.4 km/L with significantly reduced CO2 emissions. It is manufactured at the Higashi-Fuji Plant and has several features such as enhanced safety systems, including the Toyota Safety Sense C package and six SRS airbags.

- October 2024: Tata Motors has revealed that it has launched the supply of its Tata Prima 5530 S LNG trucks to key green fuel supply and Clean Green Fuel and Logistics Pvt. Ltd. This is the initial part of the 150 LNG-powered trucks order; the initial set has been turned over at the turning over ceremony. Subsequent releases will take place over time progressively.

- September 2024: Maruti Suzuki has launched the Swift CNG in India, its 14th CNG model. Powered by a 1.2-litre engine with 69.75PS and 101.8Nm, it offers 32.85 km/kg fuel efficiency, a 6% improvement over the previous model.

- September 2024: The company Tata Motors has unveiled the iCNG version of the Nexon. This addition fills up the Nexon dominance which was already having petrol, Diesel and electric options beforehand. The CNG variant is aimed as a high performance, environment friendly vehicle in the sub-compact SUV segment.

- September 2024: Dacia, Renault's Romanian subsidiary, has achieved a milestone with over 1 Million LPG vehicle sales since launching LPG-powered cars in 2010. The business unveiled the ECO-G100 dual-fuel system in 2020 which provides 170 Nm torque at 2,000 RPM; more torque than petrol-based engines with better efficiency. Equipped with twin-tank technology, LPG cars give a driving efficiency of up to 1,500 km Theirs comes with a 3-year/1,00,000 km manufacturer warranty.

CNG and LPG Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | CNG (Compressed Natural Gas), LPG (Liquefied Petroleum Gas) |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Sales Channels Covered | OEM (Original Equipment Manufacturer), Retrofitting |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, Hyundai Motor Company, IVECO S.p.A, Suzuki Motor Corporation, Tata Motors Limited (Tata Group), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the CNG and LPG vehicle market from 2019-2033.

- The CNG and LPG vehicle market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the CNG and LPG vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

CNG (Compressed Natural Gas) and LPG (Liquefied Petroleum Gas) vehicles utilize alternative fuels that produce significantly fewer emissions compared to traditional gasoline or diesel-powered vehicles. These vehicles are cost-effective and environmentally friendly, making them popular for reducing air pollution and greenhouse gas emissions.

The CNG and LPG vehicle market was valued at USD 2.9 Billion in 2024.

IMARC estimates the global CNG and LPG vehicle market to exhibit a CAGR of 7.27% during 2025-2033.

The market is driven by rising environmental concerns, stringent emissions regulations, cost advantages of CNG and LPG over conventional fuels, supportive government policies, and expanding refueling infrastructure globally.

In 2024, CNG represented the largest segment by fuel type, driven by its affordability and lower carbon emissions.

Passenger cars lead the market by vehicle type owing to their widespread use and increasing demand for cost-efficient transportation.

The retrofitting segment is the leading segment by sales channel, driven by its affordability and ease of installation.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global CNG and LPG vehicle market include AB Volvo, Hyundai Motor Company, IVECO S.p.A, Suzuki Motor Corporation, Tata Motors Limited (Tata Group), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)