Cloud Storage Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Region, 2025-2033

Cloud Storage Market Size and Share:

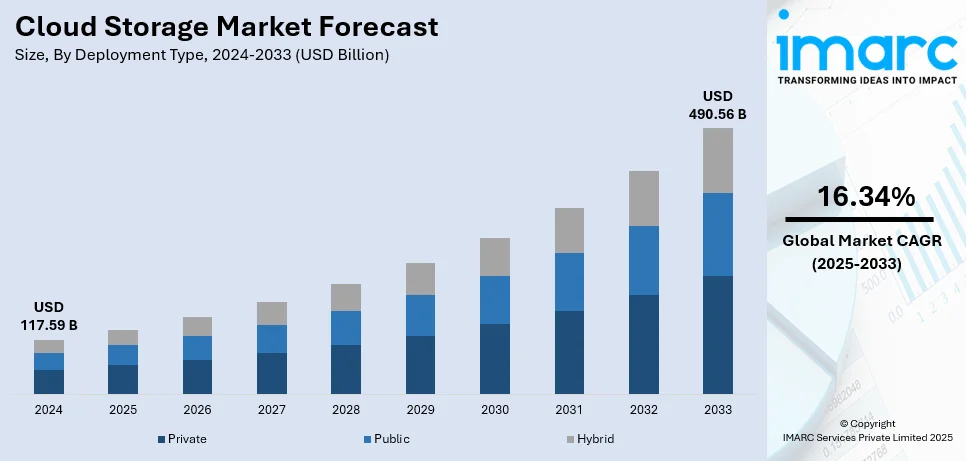

The global cloud storage market size was valued at USD 117.59 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 490.56 Billion by 2033, exhibiting a CAGR of 16.34% during 2025-2033. North America currently dominates the market, holding a significant market share of over 47.5% in 2024. The market is growing rapidly mainly driven by increasing data generation, the rising demand for cost-effective storage solutions and the widespread adoption of remote work culture. Businesses and individuals are adopting cloud storage for its scalability, accessibility, and security features, which is contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 117.59 Billion |

|

Market Forecast in 2033

|

USD 490.56 Billion |

| Market Growth Rate 2025-2033 | 16.34% |

The global cloud storage market is primarily influenced by amplifying data generation across crucial sectors, along with the heightening requirement need for cost-effective and flexible storage services. The increase in digital transformation ventures and rapid inclination towards in remote work has bolstered cloud adoption, allowing various firms to significantly improve both collaboration and availability. Innovations in technologies, typically including machine learning (ML) and artificial intelligence (AI), are further advancing cloud storage systems and improving the cloud storage market value. In addition to this, requirement for disaster recovery systems and regulatory needs for safe data storage also facilitate the market expansion substantially. Furthermore, the proliferation of 5G networks implementation aids uninterrupted incorporation of cloud solution, encouraging further adoption across key industries.

To get more information on this market, Request Sample

The United States is a crucial player in the global cloud storage market, generally impacted by magnified shift towards digital transformation, cutting-edge technology infrastructure, and resilient presence of key cloud service providers. For instance, according to industry reports, as of 2024, the leading three cloud service providers, all based in the United States, are Amazon Web Services (AWS) with a 31% market share, Microsoft Azure holding 25%, and Google Cloud accounting for 11% of the market. Moreover, the nation’s leading-edge ecosystem, combined with heavy investments in research and development initiatives, facilitates constant innovations in cloud computing technologies. In addition, the escalating requirement for comprehensive storage solutions across wide range of industries, such as e-commerce, healthcare, and finance, boosts market growth. Regulatory policies aiding both data privacy and security further improve the U.S.'s stance as a major contributor to the global market.

Cloud Storage Market Trends:

Hybrid and Multi-Cloud Strategies

Hybrid and multi-cloud strategies are gaining traction as businesses seek to optimize their IT resources and enhance operational flexibility. By combining private and public cloud services, organizations can tailor their infrastructure to meet specific workloads and compliance requirements. This approach allows for better resource allocation, enabling companies to scale their storage and computing power as needed. Additionally, utilizing multiple cloud providers helps avoid vendor lock-in, giving businesses the freedom to choose the best services and pricing options available. As organizations increasingly adopt these strategies, they benefit from improved resilience, enhanced disaster recovery capabilities, and the ability to innovate more rapidly. For instance, in May 2024, Hewlett Packard Enterprise (HPE) announced a significant lead in the hybrid cloud storage race with the release of HPE GreenLake for Block Storage, according to industry partners.

Enhanced Security Measures

Enhanced security measures are contributing to cloud storage market growth as organizations prioritize data protection and compliance. According to IBM's Cost of a Data Breach Report 2022, 45% of data breaches were cloud-based. Organizations are investing heavily in advanced security features to protect sensitive information stored in the cloud. Encryption techniques safeguard data both at rest and in transit, ensuring that unauthorized access is minimized. Multi-factor authentication provides enhanced security measures by demanding customers to verify their identity via several methods. Furthermore, compliance with regulatory standards, such as GDPR and HIPAA, is crucial for businesses to avoid penalties and maintain consumer trust. As a result, robust security measures are essential for organizations to safeguard their data assets effectively.

Integration of AI and Machine Learning

The rapid incorporation of ML and AI in cloud storage substantially improves data analytics as well as management abilities, thereby cloud storage industry value. According to Ministry of Electronics & Information Technology, Government of India, 92% of Indian workers using AI compared to the global average of 75%, accelerates cloud storage market. Such technologies aid in automation of routine tasks, such as significantly lowering manual errors, data retrieval or organization, and advancing operational efficacy. AI algorithms evaluate utilization patterns, facilitating predictive maintenance that can pinpoint potential risks and challenges before they adversely impact service, consequently lowering downtime. In addition, ML improves customer experience by offering customized recommendations and insights, making it convenient for users to manage their data efficiently. As various companies are rapidly depending on data-based decision-making, the role of both automation and AI in upgrading cloud storage solutions continues to proliferate, fueling customer satisfaction as well as innovation.

Cloud Storage Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cloud storage market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment type, user type, and industry vertical.

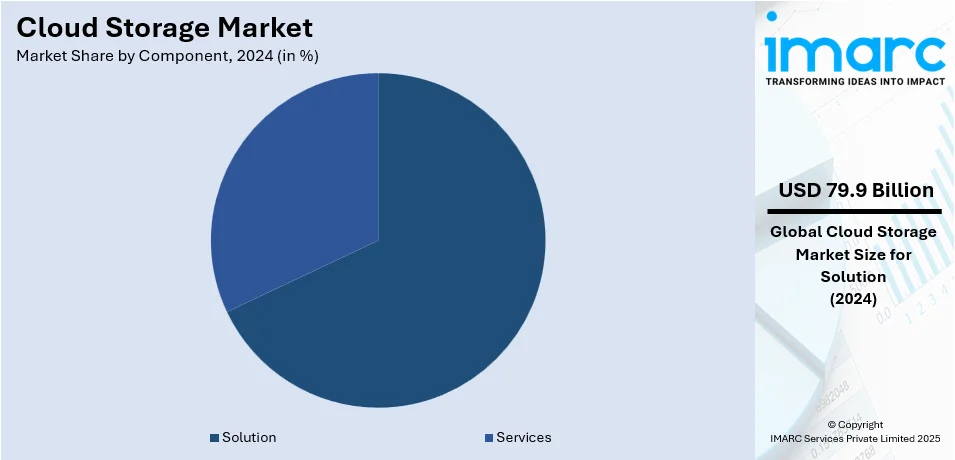

Analysis by Component:

- Solution

- Services

Solution stand as the largest component in 2024, holding around 67.9% of the market. These solutions encompass various services, including data storage, backup, and recovery, tailored to meet diverse organizational needs. As companies increasingly shift toward digital transformation, the demand for scalable and flexible cloud storage solutions has surged. This allows businesses to efficiently manage growing data volumes while ensuring security and accessibility. Additionally, the rise of hybrid and multi-cloud strategies has further solidified the position of solution-based offerings, enabling organizations to optimize their storage infrastructure while maintaining control over their data assets. For instance, in June 2024, ZNet Technologies, a leading cloud distributor in India, partnered with Wasabi Technologies to offer cost-effective and high-speed cloud storage solutions in the country. Wasabi's hot cloud storage provides fast write and read speeds, instant availability, and robust data protection. The collaboration aims to transform the way businesses handle their data storage needs in India. These advancements and strategic partnerships are creating a positive cloud storage market outlook by driving innovations and expanding access to effective solutions.

Analysis by Deployment Type:

- Private

- Public

- Hybrid

Private cloud storage is typically developed for a single organization, offering improved control for managing data as well as security. This deployment type facilitates businesses to customize storage services as per their specific requirements, guaranteeing adherence with data protection policies and industry norms. Private cloud solutions can be implemented by a third-party service provider or on-premises, providing exceptional adaptability for infrastructure management. Furthermore, organizations with critical data, including healthcare providers and financial institutions, often incline toward private cloud storage for its excellent security attributes. In addition, private clouds allow for superior reliability and performance, positing them as an ideal option for businesses with substantial data storage and processing needs.

Public cloud storage is a highly cost-saving solution where data is basically stored on shared infrastructure offered by third-party service providers. This deployment type enables organizations to avail expanded storage resources without any requirement for substantial upfront investments in both maintenance and hardware. Public cloud storage provides better flexibility, as firms can easily adjust their storage capacity on the basis of their fluctuating needs. It is especially profitable for small to medium-sized enterprises navigating ways to lower costs while benefiting from enhanced services and technology. However, organizations are preferred to acknowledge data adherence and security risks, as their information is stored on a shared platform with other customers.

Hybrid cloud storage blends the advantages of public as well as private cloud solutions, fostering organizations to sustain control and flexibility over their data. This deployment type allows businesses to store critical data on private clouds while harnessing public clouds to manage heavy workloads or for storing generic information . Hybrid cloud storage also aids uninterrupted data transfer between different ecosystems, improving resource allocation and adaptability. This approach is increasingly popular among organizations seeking to optimize costs while ensuring compliance and security. As businesses embrace digital transformation, hybrid cloud storage offers a balanced solution that adapts to evolving data management needs.

Analysis by User Type:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises lead the market by user type. This is due to their substantial data storage requirements and complex IT infrastructures. These organizations leverage cloud storage solutions to manage vast volumes of data generated from various operations, including customer interactions, transactions, and analytics. The scalability and flexibility of cloud solutions allow large enterprises to efficiently allocate resources and optimize costs. Additionally, the need for enhanced security, compliance, and disaster recovery capabilities drives large organizations to adopt robust cloud storage systems. As digital transformation accelerates, the demand for integrated and reliable cloud storage solutions in large enterprises continues to grow, which, in turn, is driving the cloud storage demand in large enterprises.

Analysis by Industry Vertical:

- BFSI

- Government and Public Sector

- Healthcare

- IT and Telecom

- Retail

- Manufacturing

- Media and Entertainment

- Others

The BFSI sector relies heavily on cloud storage to manage vast amounts of sensitive data, including customer information and transaction records. Cloud solutions enable financial institutions to ensure data security, compliance with regulations, and efficient disaster recovery. With the growing demand for digital banking and financial services, cloud storage provides the scalability needed to accommodate fluctuating workloads and enhance customer experiences. Additionally, BFSI organizations utilize cloud analytics to gain insights from their data, improving decision-making and operational efficiency. As the industry evolves, cloud storage is becoming essential for innovation and competitiveness in the BFSI landscape.

The government and public sector are increasingly adopting cloud storage solutions to enhance data management and service delivery. Cloud technology enables agencies to store and analyze vast amounts of public data while ensuring compliance with stringent security and privacy regulations. By utilizing cloud storage, government organizations can improve operational efficiency, streamline workflows, and enhance citizen engagement through accessible online services. Additionally, cloud solutions facilitate collaboration between various departments and agencies, enabling data sharing and improving response times in public services. As governments continue to embrace digital transformation, cloud storage is integral to modernizing operations and enhancing public service delivery.

In the healthcare sector, cloud storage plays a crucial role in managing patient records, clinical data, and administrative information. The ability to securely store and share large volumes of data facilitates better patient care, collaboration among healthcare providers, and compliance with regulations such as HIPAA. Cloud storage solutions enable healthcare organizations to implement electronic health records (EHR) systems, enhancing accessibility and improving patient outcomes. Additionally, cloud technology supports telehealth services and data analytics, allowing for personalized treatment plans and predictive health insights. As the demand for efficient healthcare services grows, cloud storage is becoming essential for innovation and operational efficiency in the industry.

The IT and telecom industries are at the forefront of cloud storage adoption, which they are utilizing to manage vast amounts of data generated from networks, applications, and customer interactions. Cloud storage enables IT companies to scale their resources quickly, optimize infrastructure, and reduce operational costs. Telecom providers leverage cloud solutions to enhance service delivery, improve data backup and recovery, and support the growing demand for mobile applications and services. Additionally, cloud storage facilitates seamless collaboration and communication among teams, driving innovation and agility in a rapidly evolving digital landscape. As competition intensifies, cloud storage remains a vital component for IT and telecom firms.

In the retail sector, cloud storage is increasingly vital for managing inventory, customer data, and sales transactions. Retailers leverage cloud solutions to gain real-time insights into consumer behavior, enabling personalized marketing strategies and improving customer engagement. The scalability of cloud storage allows retailers to accommodate fluctuating demands during peak seasons, such as holidays or sales events. Additionally, cloud technology supports e-commerce platforms, ensuring seamless transactions and data security. As retailers continue to embrace omnichannel strategies, cloud storage is essential for integrating online and offline operations, enhancing supply chain management, and improving overall operational efficiency.

The manufacturing industry is adopting cloud storage to enhance production processes, supply chain management, and data analytics. By utilizing cloud solutions, manufacturers can securely store and access large volumes of data generated from machinery, sensors, and production lines. This data-driven approach enables real-time monitoring, predictive maintenance, and improved decision-making. Cloud storage also facilitates collaboration among teams, suppliers, and partners, streamlining communication and enhancing operational efficiency. As manufacturers increasingly embrace Industry 4.0 technologies, cloud storage plays a crucial role in supporting smart manufacturing initiatives, optimizing resource allocation, and driving innovation in the industry.

In the media and entertainment sector, cloud storage is transforming content creation, distribution, and archiving processes. With the increasing demand for high-quality digital content, cloud solutions enable studios and production companies to store and access large files, such as videos, audio, and graphics, efficiently. Cloud storage supports collaboration among creative teams, allowing for seamless sharing and editing of content from various locations. Additionally, cloud technology facilitates the delivery of streaming services, ensuring that users can access content anytime, anywhere. As the industry continues to evolve with new distribution models, cloud storage remains essential for innovation and operational efficiency in media and entertainment.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 47.5%. This is due to its advanced technological infrastructure and early adoption of cloud solutions by businesses. The region is home to major cloud service providers and innovative startups, driving continuous advancements in cloud technology. High demand for scalable storage solutions from various industries, including BFSI, healthcare, and IT, further supports market growth. Additionally, regulatory frameworks and government initiatives promoting digital transformation contribute to the increasing adoption of cloud storage services. As organizations prioritize data security, compliance, and efficient data management, North America's cloud storage market remains robust and poised for further expansion. According to the cloud storage market forecast, North America is expected to maintain its dominant position in the market, driven by ongoing innovations and an increasing shift towards hybrid and multi-cloud strategies. For instance, in April 2024, Coca-Cola and Microsoft announced a five-year strategic partnership to accelerate cloud and generative AI initiatives. As part of the partnership, Coca-Cola has committed $1.1 billion to the Microsoft Cloud and its generative AI capabilities. The collaboration aims to foster innovation and productivity globally, with a focus on AI transformation and adoption of cutting-edge technology. This partnership reflects Coca-Cola's commitment to ongoing digital transformation and leveraging emerging technologies to create incremental enterprise value.

Key Regional Takeaways:

United States Cloud Storage Market Analysis

In 2024, United States accounted for the 85% of the market share in North America. The cloud storage market in the United States is experiencing significant growth as businesses are increasingly adopting hybrid and multi-cloud solutions for enhanced flexibility and scalability. Moreover, companies are prioritizing data security and compliance, driving the demand for advanced cloud storage solutions with robust encryption and backup features. Additionally, enterprises are shifting towards automated data management systems that streamline operations and reduce overhead costs. With a growing focus on remote work, organizations are expanding their use of cloud-based collaboration tools, further propelling the need for secure, easily accessible storage. According to a survey conducted by the Bureau of Labor Statistics, in May 2020, approximately 40% of the workforce was engaged in remote work due to the impact of the pandemic. Furthermore, innovations in artificial intelligence and machine learning are enabling smarter cloud storage solutions, improving data retrieval and management processes. Moreover, tech giants are continuously investing in expanding their cloud infrastructure, making advanced storage solutions more accessible to a wider range of customers.

Asia Pacific Cloud Storage Market Analysis

The cloud storage market in Asia Pacific is rapidly expanding as businesses are increasingly migrating workloads to the cloud for improved operational efficiency and scalability. Moreover, governments across this region are investing heavily in digital infrastructure, which is encouraging enterprises to adopt cloud storage solutions for better data accessibility and security. Additionally, companies in industries such as manufacturing, retail, and finance are leveraging cloud storage for enhanced data analytics capabilities, enabling real-time decision-making. Furthermore, the rise of e-commerce platforms is also contributing to the increased storage demand as businesses require scalable solutions to handle large volumes of customer data. According to the India Brand Equity Foundation (IBEF), in FY23, the Gross Merchandise Value (GMV) of the e-commerce sector surged to USD 60 Billion, reflecting a 22% year-over-year growth from USD 49 Billion in FY22.

Europe Cloud Storage Market Analysis

The cloud storage market in Europe is witnessing strong growth as organizations are shifting to the cloud to optimize their IT infrastructures and reduce operational costs. According to a survey, in 2021, 41% of enterprises across the European Union adopted cloud computing solutions. Moreover, businesses are prioritizing data sovereignty and compliance with regional regulations, such as GDPR, which is driving demand for cloud storage solutions that ensure privacy and data protection. Additionally, European companies are increasingly embracing hybrid cloud strategies to maintain control over sensitive data while leveraging the flexibility of public cloud services. Furthermore, the expansion of cloud-based digital transformation initiatives is also fueling the adoption of cloud storage for better data sharing and collaboration across industries. Moreover, enterprises are investing in cloud storage for disaster recovery and business continuity, as the need for data availability and uptime becomes more critical. With the growth of cloud-native applications, European organizations are continuously optimizing their cloud storage environments to support modern digital ecosystems.

Latin America Cloud Storage Market Analysis

The cloud storage market in Latin America is growing rapidly as businesses are increasingly migrating to the cloud to support digital transformation efforts and improve data management. Moreover, the rapid expansion of internet access and mobile connectivity is also fueling the growth of the cloud storage market in Latin America. According to the government of Brazil, in 2023, 92.5% of households in Brazil, equivalent to 72.5 Million homes, had internet access, reflecting a 1.0 percentage point increase compared to 2022.

Middle East and Africa Cloud Storage Market Analysis

The cloud storage market in the Middle East and Africa is expanding as businesses are increasingly adopting cloud storage solutions to address challenges related to data storage, security, and disaster recovery. In addition to this, the rise of mobile penetration and the growing digital economy are encouraging businesses across this region to migrate to the cloud to meet the demands of a rapidly changing market. According to World Bank, in 2019, the UAE achieved an impressive internet penetration rate of 99.15%.

Competitive Landscape:

The market is represented by vigorous competition among leading players striving to proliferate their market share through tactical collaboration and advancements. Key companies sustain their dominance by utilizing their wide range of service offerings, comprehensive infrastructure, and innovative technologies. Moreover, niche providers and emerging firms are actively focusing on advanced solutions, targeting particular use cases or sectors. Furthermore, competitive differentiation is mainly propelled by factors including incorporation abilities, pricing models, security attributes, and flexibility. Magnifying utilization of hybrid cloud environments, rapid innovations in technology, and elevating need for data storage due to digital transformation are magnifying market dynamics, making customer-centric tactics and advancements crucial to gain a competitive lead. For instance, according to industry reports, as of 2024, among organizations generating over USD 500 million in revenue, 56% adopt a hybrid cloud model. Additionally, 70% of IT executives consider a strong hybrid cloud strategy essential for achieving effective digital transformation.

The report provides a comprehensive analysis of the competitive landscape in the cloud storage market with detailed profiles of all major companies, including:

- Alibaba Cloud

- Amazon Web Services Inc.

- Box Inc.

- Dell Inc.

- Dropbox, Inc.

- Google LLC

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Microsoft Corporation

- NetApp

- Oracle Corporation

- Wasabi Technologies

Latest News and Developments:

- February 2024: Rakuten Symphony, Inc. unveiled the full-scale commercial launch of Rakuten Drive, a cloud-based file storage service in Japan. Rakuten Drive offers secure, user-friendly file storage and sharing solutions for both individual and enterprise clients, enabling fast transfer of large files with enhanced security features.

- August 2024: Cloudian, a global leader in secure S3-compatible AI data lake platforms, has partnered with Fastweb, a leading telecommunications provider in Italy, to strengthen Fastweb’s secure cloud storage offerings.

- August 2024: At its 47th Annual General Meeting, Reliance Industries revealed that Jio will offer as much as 100GB of free cloud storage under the Jio AI-Cloud Welcome Offer. This cloud space will be accessible for users to utilize Jio Phonecall AI services.

- November 2024: The Reserve Bank of India (RBI) announced plans to introduce a pilot programme in 2025 focused on delivering cost-effective local cloud storage solutions designed for financial institutions. This project intends to create competition for indicating international cloud service suppliers like Amazon Web Services, Microsoft Azure, Google Cloud, and IBM Cloud.

- January 2025: QNAP® Systems, Inc. launched myQNAPcloud Storage to fulfil the requirements of data sstorage and disaster-proof data protection for people and businesses. The platform provides seamless, effective, and secured cloud storage along with various other advantages like free data transmission.

Cloud Storage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Types Covered | Private, Public, Hybrid |

| User Types Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, Government and Public Sector, Healthcare, IT and Telecom, Retail, Manufacturing, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Alibaba Cloud, Amazon Web Services Inc., Box Inc., Dell Inc., Dropbox, Inc., Google LLC, Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Microsoft Corporation, NetApp, Oracle Corporation, Wasabi Technologies, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cloud storage market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cloud storage market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cloud storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global cloud storage market was valued at USD 117.59 Billion in 2024.

IMARC estimates the global cloud storage market to exhibit a CAGR of 16.34% during 2025-2033.

Key factors driving the market include increasing adoption of hybrid cloud solutions, surging demand for scalable data storage, rising digital transformation initiatives, advancements in cloud security, and the growing need for cost-efficient, flexible storage solutions across diverse industries and enterprise sizes.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global cloud storage market include Alibaba Cloud, Amazon Web Services Inc., Box Inc., Dell Inc., Dropbox, Inc., Google LLC, Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Microsoft Corporation, NetApp, Oracle Corporation, Wasabi Technologies, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)