Cloud Point of Sale (POS) Market Size, Share, Trends and Forecast by Component, Type, Organization Size, Application, and Region, 2025-2033

Cloud POS Market Size and Share:

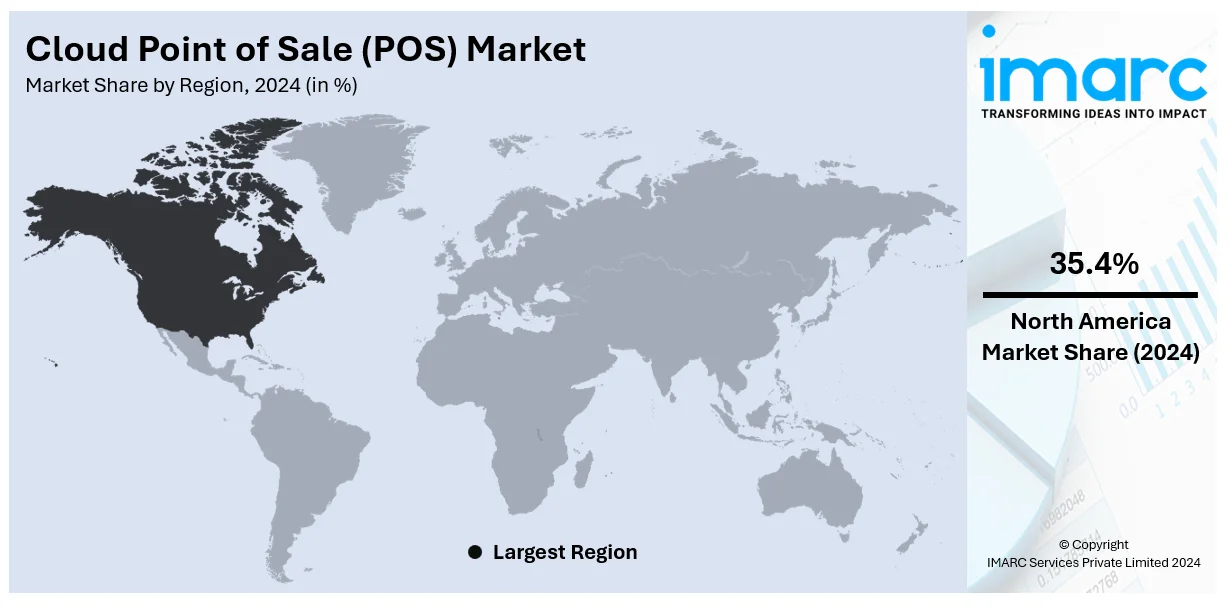

The global cloud POS market size was valued at USD 5.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.21 Billion by 2033, exhibiting a CAGR of 18.43% during 2025-2033. North America currently dominates the market due to rapid adoption of digital payment services and increasing emphasis on data security, coupled with robust technological infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.11 Billion |

|

Market Forecast in 2033

|

USD 25.21 Billion |

| Market Growth Rate 2025-2033 | 18.43% |

The global cloud POS market is driven by several key factors. The increasing adoption of digital payment methods and the growing preference for contactless transactions are significant contributors. Additionally, the demand for real-time data analytics allows businesses to make informed decisions and enhance customer experiences. The scalability of cloud solutions enables businesses of all sizes to adapt to changing market conditions efficiently. Furthermore, the rise of e-commerce and mobile shopping necessitates integrated systems that provide seamless transaction capabilities across various platforms. Besides, the need for remote access and management tools has accelerated the shift towards cloud-based POS systems.

-market.webp)

The United States plays a pivotal role in the global cloud POS market, driven by its advanced technological infrastructure and high adoption rates of digital payment solutions. A diverse range of industries, including retail, hospitality, and e-commerce, leverage cloud POS systems to enhance operational efficiency and customer engagement. The increasing demand for real-time analytics and inventory management further propels market growth. Additionally, the U.S. market benefits from a strong emphasis on innovation, with numerous startups and established companies developing cutting-edge cloud POS solutions. Regulatory support and a competitive landscape also contribute to the expansion of this market segment in the region. For instance, in June 2024, Torchy's Tacos, a prominent restaurant chain, announced the deployment of Oracle Simphony POS to enhance its operations with real-time analytics and data and automation, along effectively unifying its digital channels.

Cloud POS Market Trends:

Cloud POS Adoption in Retail and Hospitality Sectors

Cloud-based Point-of-Sale (POS) systems in retail and hospitality continue to grow at a significant rate. For instance, alone, the retail sector has seen an increase of 15% over 2020 and 2023, as per reports, with most businesses shifting from traditional POS due to the flexibility and cost-effectiveness of cloud solutions. Cloud POS adoption in the hospitality industry jumped 20% in 2022 because restaurants and hotels in huge numbers began adopting cloud POS systems. This is the reason that revenue for cloud POS providers also went up as companies like Square reported their POS solutions revenue to have gone up by 25% compared to last year. This growing demand for integrated solutions that support frictionless customer interaction, and efficient back-end operations has made it mandatory for most organizations to opt for cloud-based systems due to their scalability and ease of use.

Integration of AI and Machine Learning in Cloud POS Systems

Integration of AI and machine learning in cloud POS systems is increasingly important for the improvement of operational efficiencies, especially in the restaurant industry. As per a 2024 Restaurant Industry Trends report, 76% of restaurants used cloud-based POS systems in 2023, indicating a strong shift towards AI-enhanced solutions. AI functionalities, such as customer behavior analysis and inventory forecasting, are enabling businesses to make data-driven decisions. For instance, AI-based restaurant systems have contributed to the optimizing of labor and minimizing food wastes, which helped restaurants save much money and boost their operations. Cloud POS, as AI moves forward, should improve decision making. More emphasis on these systems is further emphasized by the development of mobile POS, which will have a transaction value CAGR of 14% from 2023 when it stood at USD 3.3 trillion to reach USD 5.58 trillion in 2027. These improvements are expected to bring higher efficiency and profitability into cloud POS adoption.

Shift Towards Subscription-Based Cloud POS Models

The trend toward subscription-based cloud POS is being pushed more by mobile POS (mPOS) and other more flexible, more acceptable methods of payments in the current modern market. However, according to an industrial report, in 2023, only 28% of the retailers adopted their POS software during the last two years, whereas about 32% adopted new hardware for the point-of-sale systems during the last two years as well, pointing more to upgrading into newer, possibly cloud-based point of sale system solutions. The global mobile POS (mPOS) terminal market is valued at over USD 36 Billion in 2022 and is expected to grow to USD 40.8 Billion in 2023 and reach USD 85.1 billion by 2030. The transaction value for mPOS payments is expected to reach USD 3.3 trillion globally in 2023, with a 14% CAGR, bringing it to USD 5.58 trillion by 2027. Furthermore, 40% of restaurant businesses prioritized the implementation of mPOS in 2023. With digital and mobile wallet payments making up 43% of global payments by 2026, businesses are realizing the importance of integrating cloud POS solutions to adapt to changing customer preferences.

Cloud POS Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cloud point of sale (POS) market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, type, organization size, and application.

Analysis by Component:

- Solutions

- Services

Solutions lead the market with around 68.9% of market share in 2024, driven by the increasing demand for integrated systems that streamline business operations. These solutions encompass a range of functionalities, including sales processing, inventory management, and customer relationship management, all accessible via cloud technology. Businesses are increasingly recognizing the advantages of cloud-based solutions, such as real-time data access, scalability, and reduced IT infrastructure costs. Moreover, the ability to integrate with other software applications enhances operational efficiency and provides valuable insights into consumer behavior. As companies seek to improve their overall performance and adapt to changing market dynamics, the demand for comprehensive cloud POS solutions is expected to continue growing, solidifying their position as a dominant force in the market.

Analysis by Type:

- Fixed Point of Sale

- Mobile Point of Sale

Fixed point of sale leads the market with around 57.8% of market share in 2024. This is primarily due to its established presence in traditional retail environments. Fixed POS systems offer reliability and stability, making them a preferred choice for businesses that require consistent performance in high-traffic settings. These systems are designed to handle various transactions efficiently, providing essential features such as barcode scanning, receipt printing, and payment processing. Furthermore, as retailers increasingly adopt cloud technology, fixed POS systems are evolving to incorporate advanced functionalities, including real-time inventory tracking and customer analytics. This evolution enhances the overall customer experience and operational efficiency. Additionally, the continued reliance on fixed point of sale systems in brick-and-mortar establishments ensures their prominence in the cloud POS market, catering to the needs of diverse industries.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises lead the market with around 59.0% of market share in 2024, driven by their substantial budgets and complex operational requirements. These organizations often seek advanced POS solutions that can handle high transaction volumes and integrate seamlessly with existing systems. The scalability of cloud-based POS systems allows large enterprises to expand their operations without significant infrastructure investments. Additionally, the need for real-time data analytics and reporting capabilities is paramount for these organizations, enabling them to make informed decisions and optimize their business strategies. As large enterprises increasingly prioritize digital transformation and customer engagement, the demand for sophisticated cloud POS solutions tailored to their specific needs continues to rise, reinforcing their dominant position in the market.

Analysis by Application:

-market1.webp)

- Retail and Consumer Goods

- Travel and Hospitality

- Media and Entertainment

- Transport and Logistics

- Healthcare

Retail and consumer goods lead the market with around 37.6% of market share in 2024. This reflects the industry's rapid adoption of technology to enhance customer experiences. As e-commerce and omnichannel retailing gain traction, businesses in this sector require robust POS systems that can seamlessly integrate online and offline sales channels. Cloud POS solutions provide retailers with real-time inventory management, sales tracking, and customer insights, enabling them to respond swiftly to market trends and consumer preferences. Furthermore, the ability to analyze customer data helps retailers personalize marketing efforts and improve service delivery. As competition intensifies in the retail landscape, the demand for innovative cloud POS applications tailored to the unique needs of the consumer goods sector is expected to grow, solidifying its position as a key driver of market expansion.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America has emerged as the leading regional market for the global cloud POS industry, principally because of magnified penetration of digital payment solutions and its well-established technological infrastructure. The region's varied range of industries, such as healthcare, retail, and hospitality, are actively opting for cloud POS systems to improve their user engagement as well as operational efficacy. Furthermore, the emergence of numerous major players facilitates a competitive ecosystem that boosts advancements and the development of high-end features, encompassing mobile accessibility and real-time analytics. The escalating focus on adherence with regulatory policies and data security also fuels market expansion. In addition, the elevating trend towards both omnichannel retailing and e-commerce further fortifies North America's position as a dominating force in the cloud POS sector. For instance, according to the International Trade Administration, by 2025, e-commerce sales in Canada are projected to reach around USD 40.3 billion.

Key Regional Takeaways:

United States Cloud Point of Sale (POS) Market Analysis

In 2024, United States accounted for 87.70 of the market share in North America. The U.S. cloud POS market has grown significantly, with 51% of businesses using cloud services, as reported by a recent Public First survey. U.S. adoption of cloud-based POS systems will continue as the business need for remote access, automated updates, enhanced data security, and scalability grow. The cloud POS solutions are very efficient in managing operations across multiple locations. They provide real-time updates, and integrations are smoother when dealing with other business tools, such as accounting and inventory management systems. At scale, cloud POS systems are flexible because they can adapt to growing transaction volumes and ever-changing needs without requiring huge investments in new hardware. With that, the aspect of data security is also seeing growth, coupled with the increasing importance of being able to operate with robust encryption, secure access controls, and regular data backup. The adoption of cloud for the U.S. market remains significant, which boosts innovation in these retail and hospitality industries, demanding efficient, solution-based approaches if they are going to be operationally successful and get ahead of others.

Europe Cloud Point of Sale (POS) Market Analysis

The European cloud POS market is growing, due to the increase in digital solution adoption and the need for compliance with regulations. Eurostat reveals that 45.2% of enterprises within the European Union reported buying cloud computing services in 2023, which depicts a strong trend toward cloud-based operations. With remote accessibility, real-time management across multiple locations is possible, a critical requirement for SMEs and large enterprises. Automatic software updates save IT expenses, thereby reducing maintenance costs by 15%. Advanced data security ensures GDPR compliance and encrypts sensitive information through off-site backup and storage. Scalability also ensures the growth of a business through integration with accounting and inventory systems, making processes efficient. Majorly, such companies as Lightspeed and SumUp continue to innovate with flexible payment models and easy interfaces. This energetic market will make Europe integral in advancing the use of cloud-based POS systems.

Asia Pacific Cloud Point of Sale (POS) Market Analysis

Asia Pacific cloud POS market is booming because of digital transformation and support from the government. IDC said that 67% of companies in the region heavily rely on cloud-based solutions in 2023, taking advantage of remote access to efficiently operate. The Government of India has set aside about USD 580 million (Rs 4,795.24 crore) for the Digital India Programme in the 2023-24 budget to strengthen digital infrastructure and embrace newer technologies. Automated updates lower operational costs by 18%, hence improving system reliability. Also, effective data security through encryptions and off-site backups decrease cybersecurity risks, which is particularly important for populous markets like China and India. Scalability enables businesses to expand seamlessly, and about 40% of retailers are integrating cloud POS features for improved operation; thereby firms partner with Alibaba Cloud, for instance, to adopt the technology among SMEs. Flexible pricing models and user-friendly systems position Asia Pacific as the hub for innovation and growth of cloud POS.

Latin America Cloud Point of Sale (POS) Market Analysis

Latin America cloud POS market is growing at a steady rate, driven by increasing digital adoption and operational efficiency needs. As per industry insights, cloud spending grew 85% in Latin America, showing the region is accelerating its shift toward cloud-based solutions. Access from anywhere facilitates real-time management across multiple locations, which is critical for an expanding business. Automatic updates save IT costs and reduce expenses by 12%, as noted in a survey. Data protection measures such as encryption and off-site backup cater to increasing cybersecurity. Scalability allows business houses to adapt seamlessly while 50% of SMEs plan on increasing its locations or features by 2025. Integrating it with Mercado Libre enhances operational efficiency, and flexible pricing models cater to various business sizes. This position makes Latin America an emerging market for cloud POS solutions which are bound to gain wide acceptance within their respective industries.

Middle East and Africa Cloud Point of Sale (POS) Market Analysis

Adoption of cloud services in the Middle East and Africa is moving forward, as accelerated by incremental migration strategies and transformation goals on enterprise-wide scale. According to a survey 2023 report showed that 54% of the companies have already adopted the cloud in all or most parts of their business and that 73% of the non-adopters planned for full integration with cloud within the next two years. Moreover, 74% of companies are increasing cloud spend in 2023, which reflects confidence in cloud-enabled operational efficiency and innovation. Step-by-step migrations are common, starting with non-critical functions like presentation layers before moving to core business systems such as CRM and finance. Companies in the region are also prioritizing compliance workstreams, particularly in industries managing sensitive data, aligning with global privacy regulations. The structured migration strategy further emphasizes the commitment of the region to utilize cloud technology to ensure increased productivity, better customer experience, and more data-driven decision-making.

Competitive Landscape:

The competitive landscape is represented by a wide array of industry players, ranging from advanced startups to established technology companies. Key firms are currently emphasizing on improving their services through innovative features, including exceptional mobile compatibility, real-time analytics, and uninterrupted incorporation with various other business systems. Moreover, tactical acquisitions and collaborations are prevalent as companies are actively striving to augment their market reach and improve product attributes. For instance, in October 2024, TRAY, a prominent cloud POS systems company, announced the expansion of its partnership with Alraedah Finance. Moreover, Alraedah made heavy investment in TRAY to strengthen the cloud company to efficiently develop its leading-edge POS services. In addition, the resilient focus on user experience bolsters competition, encouraging providers to design rigid support solutions and user-friendly interfaces. This dynamic ecosystem facilitates constant advancements and adaptation to address the transforming industry trends as well as customer needs.

The report provides a comprehensive analysis of the competitive landscape in the cloud POS market with detailed profiles of all major companies, including:

- B2B Soft

- Cegid Group

- Fiserv Inc.

- Intuit Inc.

- Lightspeed Commerce Inc.

- NEC Corporation (AT&T Inc.)

- Oracle Corporation, Panasonic Corporation

- PAR Technology Corporation

- Samsung Electronics Co. Ltd.

- Shopify Inc.

- Square Inc.

Latest News and Developments:

- October 2024: Clover by Fiserv is a line of software and hardware solutions that help small businesses to tailor the services to their restaurant, retail, and service needs. Enhancements include the resolution of increasing cost and labor pressures, including real-time reporting, appointment booking, omnichannel integration, and financial flexibility. The new suite supports operational efficiency and growth through vertical-specific capabilities.

- October 2024: Intuit showed its new AI-driven innovations at the Intuit Connect conference, where it focuses on supporting accounting professionals and business customers. Among them are accounting automation, payroll solutions, and marketing capabilities designed to drive business growth and improve profitability through predictive analytics and insights.

- September 2024: NEC Corporation announced plans to transfer the POS-related business segment of NEC Platforms, Ltd. to a specialized unit funded by Nippon Mirai Capital Co., Ltd. The transfer is set for August 2025. NEC Platforms develops the TWINPOS series and supports digital transformation in retail.

- June 2024: Oracle has reported over 275,000 restaurant clients worldwide who use Oracle Simphony Cloud POS to help drive efficiency and revenue. The platform manages a whopping 24 million daily transactions and monthly payments of $180 million. New features include channel management, frontline management, and integrated payment solutions, optimizing operations, sales, and customer experiences.

- January 2024: Samsung Electronics officially launched its cloud-native Visual eXperience Transformation (VXT) platform on January 15, 2024. This single CMS always helps businesses to create and manage their digital displays using seamless and accessible tools that scale. VXT helps streamline operations toward remote signage management for various sectors; its sectors include retail and hospitality.

Cloud POS Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Types Covered | Fixed Point of Sale, Mobile Point of Sale |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Applications Covered | Retail and Consumer Goods, Travel and Hospitality, Media and Entertainment, Transport and Logistics, Healthcare |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B2B Soft, Cegid Group, Fiserv Inc., Intuit Inc., Lightspeed Commerce Inc., NEC Corporation (AT&T Inc.), Oracle Corporation, Panasonic Corporation, PAR Technology Corporation, Samsung Electronics Co. Ltd., Shopify Inc., Square Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cloud POS market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cloud POS market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cloud POS industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global cloud POS market was valued at USD 5.11 Billion in 2024.

The market is estimated to reach USD 25.21 Billion by 2033, exhibiting a CAGR of 18.43% during 2025-2033.

Key factors driving the market include the increasing adoption of digital payment solutions, the demand for real-time data analytics, and the need for enhanced customer experiences. Additionally, the growing trend of e-commerce and mobile transactions further propels the shift towards cloud-based POS systems across various industries.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global cloud POS market include B2B Soft, Cegid Group, Fiserv Inc., Intuit Inc., Lightspeed Commerce Inc., NEC Corporation (AT&T Inc.), Oracle Corporation, Panasonic Corporation, PAR Technology Corporation, Samsung Electronics Co. Ltd., Shopify Inc. and Square Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)