Cloud Music Services Market Size, Share, Trends and Forecast by Type, Application, End Use, and Region, 2025-2033

Cloud Music Services Market Size and Share:

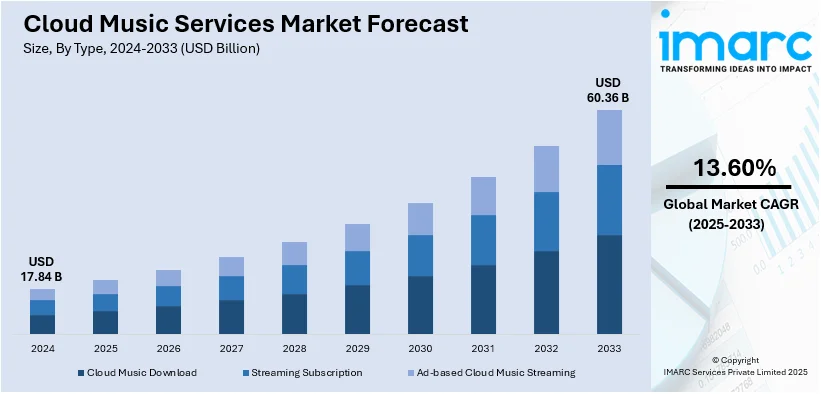

The global cloud music services market size was valued at USD 17.84 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 60.36 Billion by 2033, exhibiting a CAGR of 13.60% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.8% in 2024. The market is expanding due to rising demand for subscription-based streaming, AI-driven personalization and high-resolution audio. Smart device integration, regional content localization and blockchain adoption further drive growth. Increasing competition among platforms enhances user experience and monetization strategies, influencing market dynamics and profitability. Key players focus on strategic partnerships, exclusive content and advanced features to strengthen their cloud music services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.84 Billion |

| Market Forecast in 2033 | USD 60.36 Billion |

| Market Growth Rate (2025-2033) | 13.60% |

The cloud music services market is driven by increasing smartphone and internet penetration, growing demand for on-the-go music streaming and rising adoption of subscription-based models. According to industry reports, in 2024, 5.35 billion people globally use the internet, marking 66.2% of the population with an annual growth of 1.8% and 97 million new users in 2023. Thirteen countries report over 99% penetration. Advancements in cloud storage, AI-driven recommendations and high-resolution audio streaming enhance user experience. The expansion of 5G networks supports seamless streaming while collaborations between music labels and streaming platforms boost content availability. Smart speaker integration and personalized playlists further fuel market growth catering to evolving consumer preferences for convenience and accessibility. These factors are collectively creating a positive cloud music services market outlook across the world.

The U.S. cloud music services market is driven by widespread smartphone usage, high-speed internet availability and strong consumer demand for streaming platforms. The National Telecommunications and Information Administration's Internet Use Survey reports 13 million more U.S. internet users in 2023, with 83% of those 3 and older online, up from 80% in 2021. Internet access increased in lower-income households (69% to 73%) and 72% of households had both fixed and mobile connections up from 69%. The rise of subscription-based models, AI-powered recommendations and exclusive content offerings enhance user engagement. Integration with smart speakers, wearables and connected devices boosts accessibility. Expanding 5G networks support seamless high-quality audio streaming. Strategic partnerships between music labels and streaming platforms increase content diversity while growing preference for personalized playlists and offline listening options further propel market growth.

Cloud Music Services Market Trends:

Growing Popularity of Subscription-Based Models

The growing popularity of subscription-based models in cloud music services is driven by tiered pricing structures offering ad-free listening, offline access and high-quality audio. Premium subscriptions provide exclusive content, early releases and personalized playlists attracting users seeking enhanced experiences. Family and student plans make services more accessible while regional pricing strategies expand market reach. Bundling with telecom providers and smart devices further boosts adoption. Subscription models ensure steady revenue for platforms while benefiting artists through improved royalty distribution and monetization. For instance, in February 2025, Spotify announced its plans to launch a premium subscription tier Music Pro in 2025 offering lossless audio streaming and AI tools for remixing songs. It aims to attract dedicated music fans with exclusive concert perks and high-quality audio.

AI-Powered Personalization

AI-powered personalization in cloud music services enhances user experience by analyzing listening habits, mood, and preferences to generate curated playlists and recommendations. For instance, in February 2023, Spotify introduced a new AI-powered feature called 'DJ' which curates personalized music playlists and provides commentary on tracks. Currently in beta it learns users' preferences to enhance music recommendations blending their favorite songs with new discoveries. Machine learning models process vast datasets, identifying patterns in song selection, genre affinity, and playback history. Advanced AI enables contextual recommendations based on time of day, location, or activity. Features like dynamic playlists, smart radio stations, and real-time trend analysis improve engagement. Voice assistants and predictive algorithms further refine personalization, ensuring a tailored and immersive listening experience.

Expansion of High-Resolution Audio Streaming

The demand for high-resolution audio streaming is rising as listeners seek superior sound quality with lossless formats like FLAC, ALAC, and immersive experiences such as Dolby Atmos and Sony 360 Reality Audio. Audiophiles and premium subscribers are driving adoption, valuing better clarity, depth, and dynamic range. Streaming platforms are integrating high-fidelity tiers, partnering with hardware brands for optimized playback. Faster internet speeds and advanced compression technology enable seamless high-quality streaming, making studio-quality sound more accessible to mainstream users.

Cloud Music Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cloud music services market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end use.

Analysis by Type:

- Cloud Music Download

- Streaming Subscription

- Ad-based Cloud Music Streaming

Cloud music download stands as the largest type in 2024, holding around 65.2% of the market. Cloud music download is the largest segment in the cloud music services market due to its convenience, offline accessibility, and high-quality audio storage. Users prefer downloadable music for uninterrupted playback without internet dependency. Streaming platforms offering download options have boosted this segment’s popularity, catering to both casual listeners and audiophiles. Advancements in cloud storage technology enhance accessibility across devices, ensuring seamless user experience. Growing demand for on-the-go music consumption and increasing smartphone penetration further solidify cloud music download as the dominant type.

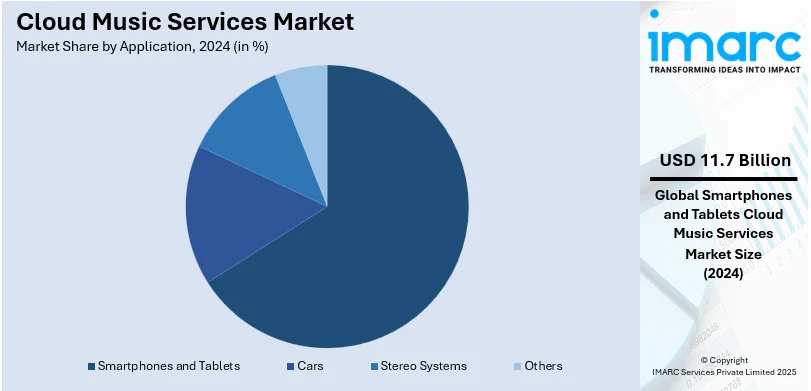

Analysis by Application:

- Smartphones and Tablets

- Cars

- Stereo Systems

- Others

Smart phones and tablets lead the market with around 65.4% of market share in 2024. Smartphones and tablets lead the cloud music services market due to their widespread adoption, portability, and seamless integration with streaming platforms. Users prefer these devices for music consumption, benefiting from high-speed internet, app-based access, and cloud storage options. Enhanced mobile connectivity, 5G adoption, and expanding music libraries drive market growth. Subscription-based and ad-supported streaming services further boost engagement. The convenience of cross-device synchronization and offline playback features solidifies smartphones and tablets as the primary choice for cloud music services.

Analysis by End Use:

- Individual Use

- Commercial Use

Commercial use dominates the cloud music services market as businesses increasingly integrate music into retail, hospitality, fitness, and corporate environments. Cloud-based solutions provide seamless access to licensed tracks, ensuring legal compliance while enhancing customer experiences. Retail stores, restaurants, and gyms leverage curated playlists to influence ambiance and engagement. Subscription-based commercial music services offer customization, remote management, and analytics for better audience targeting. The growing emphasis on brand identity through music-driven environments continues to drive cloud music services market demand in the commercial segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.8%. North America holds the largest share in the cloud music services market due to high consumer adoption of streaming platforms, strong internet infrastructure, and widespread use of smartphones and smart devices. The region's advanced digital ecosystem, coupled with high disposable income, supports subscription-based services. Major music labels and tech companies drive innovation, offering diverse music libraries and seamless integration across platforms. Increasing demand for on-the-go music consumption and rising commercial applications further strengthen North America's dominance in the market.

Key Regional Takeaways:

United States Cloud Music Services Market Analysis

The U.S. cloud music services market is driven by the widespread adoption of smartphones, high-speed internet, and a growing demand for personalized music experiences. A recent study indicates that 93% of individuals in the U.S. engage with music, spending over 25 hours each week enjoying their preferred songs. Furthermore, 75% of Americans actively opt to listen to music, slightly exceeding the 73% who prefer watching television. As consumers increasingly turn to streaming services over traditional music formats, platforms like Spotify, Apple Music, and Amazon Music dominate the market. The growing interest in high-definition audio, coupled with advancements in AI-driven recommendations, enhances user engagement. Partnerships with artists and content creators, along with exclusive releases, further stimulate market growth. The rise of smart home devices, including voice-activated speakers, also fuels cloud music consumption. Flexible subscription models, such as freemium services, appeal to a wide range of consumer preferences. As disposable income rises, more consumers are willing to pay for premium services, further accelerating market expansion. Moreover, the U.S. is a leader in technological innovation, driving new features like podcast integration and live streaming events, all of which contribute to the sector’s continued growth.

Asia Pacific Cloud Music Services Market Analysis

The cloud music services market in the Asia-Pacific (APAC) region is largely fueled by the increase in smartphone usage, which accounted for 53.4% of the 3 billion global smartphone users in 2018, translating to roughly 1.6 billion users. This large mobile user base accelerates the adoption of digital content, including music streaming services. As mobile data consumption rises, particularly in emerging markets, affordable internet access and increased urbanization play a significant role in expanding market reach. Growing disposable incomes in countries like India and China further contribute to the adoption of premium music services. Major players such as Tencent Music, YouTube Music, and JioSaavn are expanding their offerings with region-specific content to cater to local preferences. Additionally, affordable and localized subscription models, such as freemium services, are encouraging a wide consumer base, making cloud music services increasingly accessible and driving market growth across APAC.

Europe Cloud Music Services Market Analysis

Europe's cloud music services market is driven by widespread internet connectivity, growing smartphone adoption, and shifting consumer preferences toward digital content. Streaming platforms like Spotify, Deezer, and Apple Music, popular among younger demographics, are further accelerating this trend. The growth of high-speed internet, along with a predicted 80% coverage of 5G among the population by the end of 2024, as anticipated by Ericsson, has greatly improved the streaming experience, allowing for quicker access to music with enhanced quality. Integration of artificial intelligence is also driving innovation in user experience, allowing for more personalized playlists and seamless interfaces. The growing popularity of podcasts, alongside exclusive content collaborations with artists, has strengthened the market. Moreover, European regulatory policies focused on consumer protection and data privacy ensure a secure environment for users, boosting confidence in music streaming platforms. Additionally, the increasing adoption of smart speakers and wearable devices for music consumption, as well as the growing appeal of family and bundled subscription models, further fuel market growth. Tailored, localized content addressing diverse cultural preferences across European countries contributes to deeper market penetration and engagement.

Latin America Cloud Music Services Market Analysis

The Latin American cloud music services market is benefiting from growing smartphone adoption, improved internet infrastructure, and increasing disposable incomes. Urbanization in the region has reached approximately 80%, surpassing several other areas, according to the reports. This urban shift supports the expansion of digital services, including music streaming. Major platforms like Spotify, YouTube Music, and Amazon Music are strengthening their presence by offering region-specific content and subscription models. The rise of mobile-first consumers further drives cloud music adoption, making services more accessible to a larger audience across Latin America.

Middle East and Africa Cloud Music Services Market Analysis

The cloud music services market in the Middle East and Africa is being fueled by smartphone growth, expanding internet access, and rising disposable incomes. With urbanization at 64%, according to the World Bank, a growing number of consumers are leaning towards digital services such as music streaming. Reports suggest that Spotify users in this region spend an average of 124 minutes daily on the platform, indicating a high level of engagement with digital music content. Services like Anghami and Spotify cater to local cultural preferences, while younger demographics further boost market development. The widespread use of mobile devices and smart speakers encourages increased music consumption, driving further market growth.

Competitive Landscape:

The cloud music services market is highly competitive, with numerous players offering diverse streaming options, including subscription-based, ad-supported, and high-resolution audio services. Companies focus on AI-driven personalization, exclusive content, and seamless integration with smart devices to enhance user engagement. Strategic partnerships with telecom providers, device manufacturers, and social media platforms help expand reach. Pricing strategies, regional content localization, and differentiated user experiences drive competition. Innovations in immersive audio formats and blockchain-based music rights management are shaping the market. The growing demand for lossless audio and customized playlists further intensifies competition, pushing platforms to innovate and refine monetization models.

The report provides a comprehensive analysis of the competitive landscape in the cloud music services market with detailed profiles of all major companies, including:

- Amazon.com Inc.

- Apple Inc.

- Deezer

- Gamma Gaana Ltd. (Times Internet)

- NetEase Inc.

- Pandora Media LLC (Sirius XM Holdings)

- Rhapsody International Inc. (RealNetworks Inc.)

- Saavn Media Pvt Ltd

- Spotify AB

- YouTube Music (Google LLC)

Latest News and Developments:

- October 2024: Apple Music formed a partnership with China Mobile, allowing subscribers to access the streaming service through China Mobile’s app and retail locations. As the largest mobile network operator in the world, boasting over one billion subscribers, China Mobile significantly boosts Apple Music’s presence within China, where the market is largely controlled by local competitors such as Tencent Music and NetEase Cloud Music.

- July 2024: Cloud Music Inc. announced a collaboration with Timbaland's Beatclub™ to enhance the music landscape in China. This partnership will see the integration of Beatclub’s premium beats into NetEase Cloud Music’s Beatsoul, the leading platform for beat transactions in China. The initiative focuses on supporting independent artists, aligning with Beatclub’s mission to empower music creators.

- April 2024: Cloud Music Inc. established a licensing agreement with JYP Entertainment for the digital distribution of music in China. This partnership allows NetEase Cloud Music to access JYP’s catalog, broadening its K-Pop offerings, which include popular artists like TWICE, Stray Kids, ITZY, and NMIXX. The collaboration aims to improve music accessibility, user engagement, and commercial opportunities.

- April 2024: BEAT Music Fund, part of Armada Music's investment initiative in dance music, acquired Cloud 9 Music, based in Amsterdam, thereby enhancing its publishing arm. The merging of Armada Publishing B.V. and Cloud 9 Music will lead to the formation of Armada Music Publishing. This strategic move supports Armada’s ambition to expand its presence in the global electronic dance music sector, which is expected to grow to USD 20.9 billion by 2033.

- November 2023: Google Cloud and Spotify deepened their collaboration to improve infrastructure, data analysis, and AI/ML applications. Having utilized Google Cloud since 2016, Spotify is set to explore AI tools for content discovery, personalized suggestions, and safe listening experiences. The company aims to harness large language models to enhance metadata, optimize spoken content recommendations, and identify harmful content. This collaboration builds on Spotify’s previous investments in AI, fostering innovation and improvements in user experience.

Cloud Music Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cloud Music Download, Streaming Subscription, Ad-based Cloud Music Streaming |

| Applications Covered | Smartphones and Tablets, Cars, Stereo Systems, Others |

| End Uses Covered | Individual Use, Commercial Use |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon.com Inc., Apple Inc., Deezer, Gamma Gaana Ltd. (Times Internet), NetEase Inc., Pandora Media LLC (Sirius XM Holdings), Rhapsody International Inc. (RealNetworks Inc.), Saavn Media Pvt Ltd, Spotify AB, YouTube Music (Google LLC)., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cloud music services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cloud music services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cloud music services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cloud music services market was valued at USD 17.84 Billion in 2024.

IMARC estimates the cloud music services market to reach USD 60.36 Billion by 2033, exhibiting a CAGR of 13.60% during 2025-2033.

Key drivers of the cloud music services market include rising demand for subscription-based streaming, AI-driven personalization, increasing smartphone penetration, high-resolution audio adoption, smart device integration, regional content localization, and growing internet connectivity. Advancements in 5G and cloud storage enhance accessibility, while monetization through ads and premium plans boosts market expansion.

North America accounted for the largest cloud music services market share, driven by high smartphone penetration, strong consumer spending on subscription-based streaming, widespread adoption of smart devices, and presence of major industry players. Advanced internet infrastructure and demand for high-resolution audio further contribute to market dominance in the region.

Some of the major players in the cloud music services market include Amazon.com Inc., Apple Inc., Deezer, Gamma Gaana Ltd. (Times Internet), NetEase Inc., Pandora Media LLC (Sirius XM Holdings), Rhapsody International Inc. (RealNetworks Inc.), Saavn Media Pvt Ltd, Spotify AB and YouTube Music (Google LLC)., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)