Cloud Migration Services Market Size, Share, Trends and Forecast by Service Type, Enterprise Size, Deployment Mode, Application, Industry Vertical, and Region, 2025-2033

Cloud Migration Services Market 2024, Size and Overview:

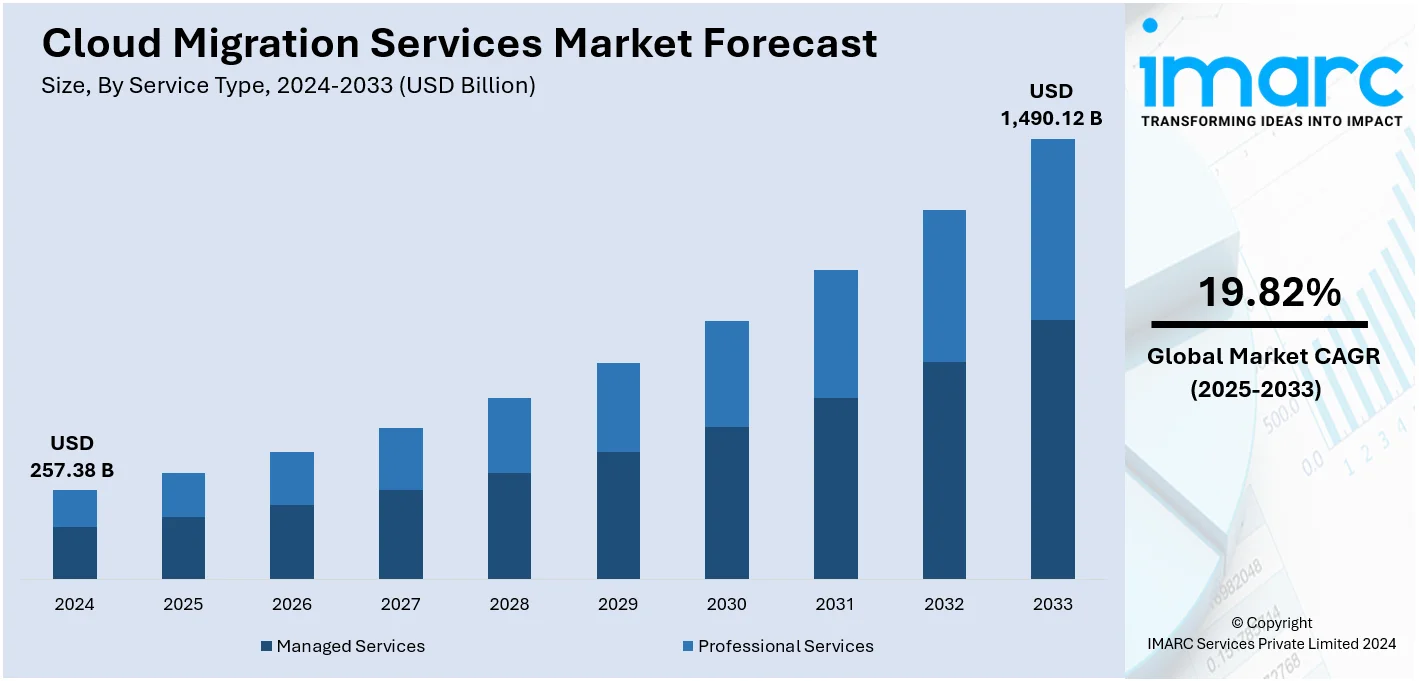

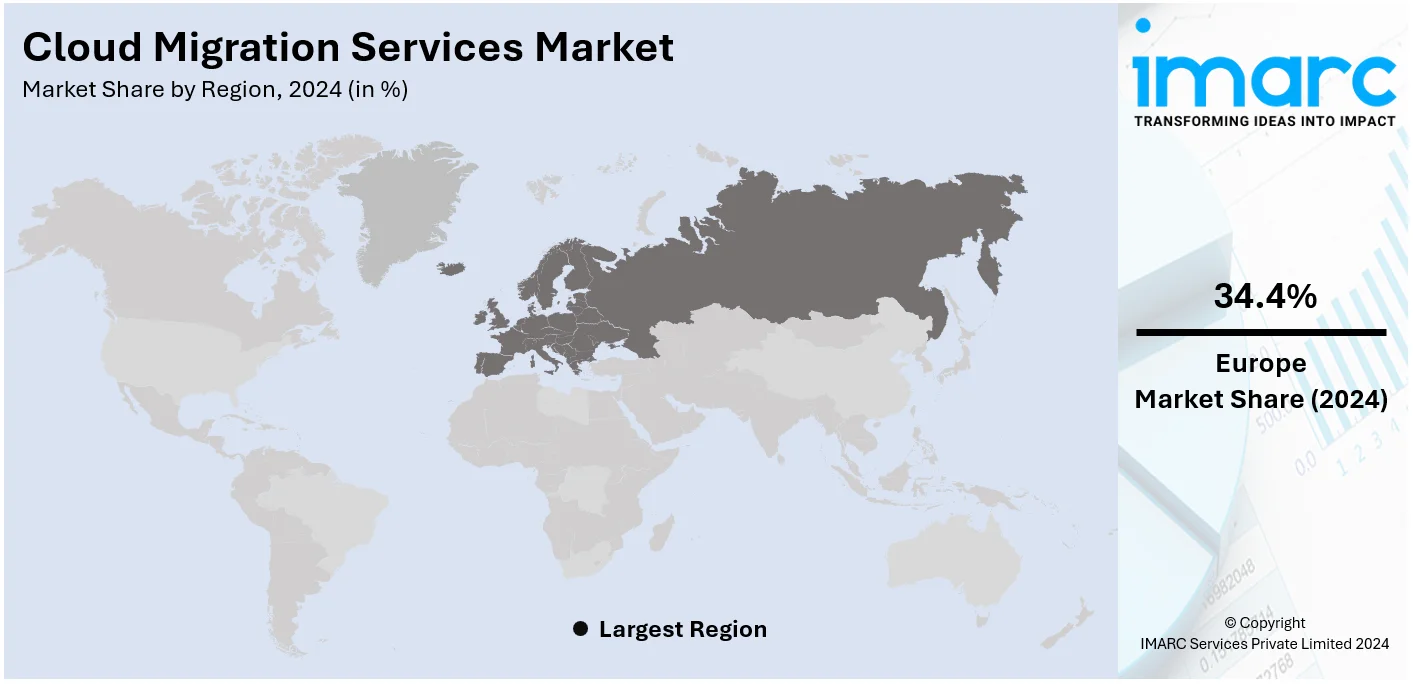

The global cloud migration services market size was valued at USD 257.38 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,490.12 Billion by 2033, exhibiting a CAGR of 19.82% during 2025-2033. Europe currently dominates the market. The increasing multi-cloud adoption, the need for business agility and scalability, enhanced security and compliance requirements, the increasing demand for cost optimization, rapid digital transformation, and the rising demand for advanced information technology (IT) infrastructure are strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 257.38 Billion |

|

Market Forecast in 2033

|

USD 1,490.12 Billion |

| Market Growth Rate (2025-2033) | 19.82% |

The global market is primarily driven by increasing demand for scalable and cost-effective IT solutions across industries. The rise in data volumes, coupled with the need for improved data security and compliance, is further accelerating this transition. Along with this, rapid advancements in cloud platforms, including hybrid and multi-cloud solutions, are fostering adoption by offering greater flexibility and integration capabilities. On 1st July 2024, Nashik-based ESDS Software Solutions planned a transformation in the cloud infrastructure through an AI-powered autonomous cloud platform which will help with automated deployment, scaling, and management. To enhance its AI capabilities, ESDS has planned to recruit 300 AI and ML engineers within the next six months. With more than 1,000 employees on board and its clientele list having banks and large enterprises, the company continues to focus on India while going international in the Middle East and the UK. Additionally, the rise in digital transformation initiatives, supported by government policies promoting cloud adoption, is propelling market growth, making cloud migration an essential strategy for enterprises.

The United States stands out as a key regional market, primarily driven by the rising need for businesses to enhance flexibility and optimize costs. Companies are prioritizing cloud adoption to manage increasing data loads, improve collaboration, and support innovation. The proliferation of advanced technologies such as artificial intelligence and big data analytics is increasing the demand for robust cloud platforms. Furthermore, the shift to hybrid and multi-cloud environments aligns with enterprises' goals to maintain operational resilience. On 7th November 2024, Upbound announced major enhancements to its universal cloud platforms, aimed at enterprises that build self-service cloud environments for developers and machine learning teams. The platform, built on Crossplane and Kubernetes, makes it easier to customize the cloud, reduces configuration drift, and enhances efficiency. Concurrently, the growing dependence on remote work solutions and the rising pressure to modernize legacy systems also contribute to the widespread adoption of cloud migration services nationwide.

Cloud Migration Services Market Trends:

Increasing adoption of multi-cloud strategies

Organizations are increasingly leveraging multiple cloud services to optimize performance, cost, and redundancy. According to the IMARC Group, the global multi-cloud management market reached USD 13.1 Billion in 2024. This multi-cloud approach allows businesses to avoid vendor lock-in, ensuring they can choose the best services from different providers based on their specific needs. It also enhances disaster recovery and business continuity capabilities, as data and applications can be distributed across various platforms. The complexity of managing multiple cloud environments necessitates comprehensive migration services that can seamlessly integrate and manage diverse cloud infrastructures. As companies strive to harness the benefits of multi-cloud environments, the demand for cloud migration services that offer expertise in orchestrating and optimizing multi-cloud strategies is contributing to the market expansion.

Growing need for business agility and scalability

In a fast-paced business environment, organizations must be able to quickly adapt to changing market conditions and customer demands. Cloud computing provides the flexibility and scalability needed to support rapid growth and innovation. According to reports, around 59 % of medium-sized enterprises purchased cloud computing services in 2023. By migrating to cloud services, businesses can scale their information technology (IT) resources up or down based on demand, enabling them to respond swiftly to new opportunities and challenges. Cloud migration services play a critical role in facilitating this transition, ensuring that the migration process is smooth and that the cloud infrastructure is optimized for performance and cost-efficiency. The escalating need to enhance agility and scalability in companies is bolstering the Cloud Migration Services market share.

Rising focus on security and compliance

With data breaches and cyber threats becoming increasingly sophisticated, organizations are prioritizing the security of their IT environments. According to reports, 50% of UK businesses experienced some form of cyber attack in 2023. Cloud service providers offer advanced security features and compliance certifications that can help organizations meet regulatory requirements and protect sensitive data. However, migrating to the cloud involves significant risks if not managed properly. Cloud migration services provide the necessary expertise to ensure that security and compliance are maintained throughout the migration process. These services include risk assessments, security architecture design, and compliance audits to safeguard data and applications. As regulatory requirements become more stringent and cyber threats continue to change, the demand for secure and compliant cloud migration services is rising, thus creating a positive outlook for market expansion.

Cloud Migration Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cloud migration services market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on service type, enterprise size, deployment mode, application, and industry vertical.

Analysis by Service Type:

- Managed Services

- Professional Services

Managed services stand as the largest component in 2024 due to their comprehensive approach to cloud management and migration. These services provide end-to-end solutions, including planning, implementation, and ongoing management of cloud infrastructure, ensuring a seamless transition and optimal performance. Moreover, businesses are increasingly preferring managed services for their expertise, reliability, and ability to handle complex migration processes, reducing the risk of downtime and data loss. Additionally, managed services offer continuous monitoring, security, and compliance management, which is aiding in market expansion.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises lead the market in 2024. The widespread product adoption across large enterprises due to their substantial IT infrastructure and complex operational needs, which necessitate expert migration strategies and robust cloud solutions is bolstering cloud migration services market size. These organizations often seek to modernize their legacy systems, improve scalability, and enhance operational efficiency, making cloud migration essential. The significant data volumes and critical applications involved require sophisticated migration services that can ensure seamless transitions with minimal disruptions. Large enterprises’ financial resources allow them to invest in comprehensive managed services, leveraging advanced cloud technologies and maintaining competitive advantages, thus impelling the cloud migration services market growth.

Analysis by Deployment Mode:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Public cloud leads the market in 2024. The demand for public cloud services as businesses seek scalability and flexibility is propelling the cloud migration services market size, as it allows them to quickly adjust resources to meet changing needs without large capital investments. Cost efficiency is another major driver, as public cloud services reduce the need for maintaining expensive on-premises infrastructure. Cloud adoption is further increased with the growing significance of remote work and digital transformation initiatives. In addition, features including enhanced security and compliance with regulatory standards as well as access to advanced technologies, such as artificial intelligence (AI) and machine learning (ML), further enhance the growth in demand for public cloud solutions.

Analysis by Application:

- Project Management

- Infrastructure Management

- Security and Compliance Management

- Others

Infrastructure management leads the market in 2024. The expanding product utilization in infrastructure management applications due to its critical role in ensuring seamless and efficient cloud transitions is impelling the market growth. It involves comprehensive planning, execution, and maintenance of cloud infrastructure as the key to successful application, data, and workload migration. Effective management of infrastructure avoids downtime, loss of data, and security breach risks during migration. It further ensures that performance and cost are optimum after migration and monitored for improvements in resource consumption. Organizations, especially those with complex and large-scale IT environments, rely heavily on these services to handle the intricacies of cloud infrastructure, driving the demand and dominance of infrastructure management in the cloud migration services market.

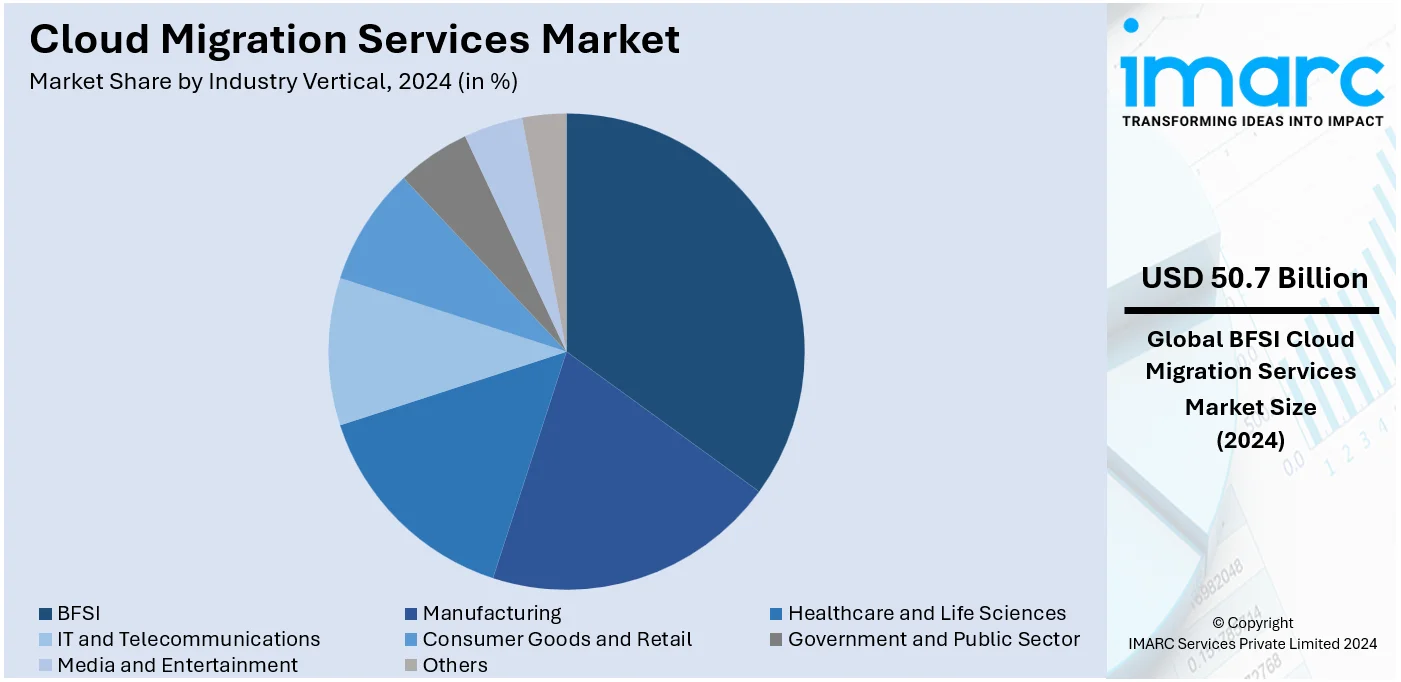

Analysis by Industry Vertical:

- BFSI

- Manufacturing

- Healthcare and Life Sciences

- IT and Telecommunications

- Consumer Goods and Retail

- Government and Public Sector

- Media and Entertainment

- Others

BFSI leads the market in 2024 due to its extensive need for secure, scalable, and compliant IT solutions which is presenting lucrative opportunities for market expansion. Cloud technologies are being increasingly used by financial institutions to enhance the efficiency of operations, improve customer experiences, and facilitate digital transformation. The nature of the sector, therefore, requires much more compliance and strict standards, thus demanding specialist cloud migration services in securing as well as ensuring compliance. Along with this, the competitive scenario in BFSI drives companies to innovate and implement agile cloud solutions to ensure better service delivery and cost management, thereby facilitating market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share. The robust digital infrastructure and strict regulatory framework of Europe create an auspicious setting for the growth of the market. Strict regulations related to data protection, including GDPR, compel organizations in Europe to move towards compliant cloud migration services with safety. Apart from this, the European market has a high level of concentration by multinational corporations and technologically advanced enterprises, who invest significantly in cloud solutions for better operational efficiency and competitiveness. Besides this, favorable government initiatives toward digital transformation and significant investments in cloud computing further support the cloud migration services market share.

Key Regional Takeaways:

United States Cloud Migration Services Market Analysis

The increasing need for businesses to update their IT infrastructures to ensure efficiency in operation is the first driver. Most organizations look forward to saving on costs, scaling up or down, and creating space for innovation through cloud solutions rather than on-premises solutions. The use of cloud migration services enables businesses to outsource the complexities of in-house data centers and instead avail themselves of the automatic update capabilities, better security, and high performance delivered by cloud platforms. The growing need for data security and disaster recovery is another primary driver. With the increasing level of sophistication in cyber threats and data breaches becoming more common, businesses are looking for robust cloud-based solutions that offer security features such as encryption, multi-factor authentication, and real-time backups. In 2023, ransomware reportedly had a direct impact on 2,207 hospitals, schools, and governments in the United States. Cloud providers are increasingly investing in advanced security protocols, making cloud environments safer for businesses to store and process sensitive information. Additionally, the rise of big data analytics, artificial intelligence (AI), and Internet of Things (IoT) technologies is pushing companies to migrate their workloads to the cloud. These technologies require massive computational power and storage, which cloud platforms can easily accommodate. The ability to scale resources on demand without hefty capital expenditures is a significant attraction for businesses, especially startups and small and medium enterprises (SMEs). Lastly, government policies and initiatives supporting digital transformation are also driving the cloud migration trend.

Asia Pacific Cloud Migration Services Market Analysis

The rapid digital change occurring in many different businesses is one of the main factors. The Ministry of External Affairs Government of India reports that the digital transformation in India is expected to create a USD 1 Trillion economy by 2028. As businesses in the region seek to modernize their IT infrastructure, cloud migration offers an efficient way to reduce operational costs, improve flexibility, and scale resources according to demand. The shift towards cloud solutions is particularly beneficial in this region, where companies are looking to optimize their operations, reduce capital expenditures, and streamline workflows. Another major driver is the growing adoption of digital technologies, such as Artificial Intelligence (AI), Big Data, and the Internet of Things (IoT). These technologies require vast amounts of data storage and processing power, which cloud platforms can provide more cost-effectively and flexibly than traditional on-premises infrastructure. The advantage of cloud migration is that organizations can scale their resources rapidly, analyze large datasets, and deploy innovative technologies to create more customer experience and business agility. As a result, the region has seen a growth in cloud services due to increasing interest in data security and compliance. As concerns over cyber threats and data privacy regulations increase, many businesses are migrating to cloud environments, offering an array of enhanced security features such as encryption, multi-factor authentication, and ongoing compliance updates. Therefore, to address these concerns, cloud providers are heavily investing in robust data-protection mechanisms, thus making cloud migration even more attractive.

Europe Cloud Migration Services Market Analysis

The Europe cloud migration services market is growing rapidly, driven by several key factors that reflect the region's increasing emphasis on digital transformation and technological innovation. One of the primary drivers is the push for businesses to enhance operational efficiency, reduce IT infrastructure costs, and improve scalability. As organizations face rising pressure to innovate and remain competitive, migrating to the cloud enables them to optimize their IT resources, enhance performance, and minimize capital expenditure on on-premises hardware. Cloud solutions provide flexible pay-as-you-go models that allow businesses to scale resources as needed, contributing to cost savings and improved business agility. Another major factor driving cloud migration in Europe is the increasing importance of data security and compliance with stringent regulatory frameworks, such as the General Data Protection Regulation (GDPR). Businesses are turning to cloud platforms that offer robust security features, such as encryption, multi-factor authentication, and regular compliance updates with heightened concerns around data privacy. Cloud providers are also investing in data sovereignty solutions, allowing businesses to comply with local regulations while leveraging global cloud infrastructure. In line with this, advanced technologies require vast amounts of computational power and storage, which the cloud can easily accommodate. Finally, government initiatives across Europe, aimed at fostering digital transformation and supporting Industry 4.0, are also accelerating cloud adoption. Policies encouraging digitalization in sectors, such as healthcare, manufacturing, and public services are making cloud migration an essential strategy for organizations in these industries. According to the reports, in 2023, 59% of all EU businesses reached a basic level of digital intensity.

Latin America Cloud Migration Services Market Analysis

The region's firms are looking for solutions that can be achieved at relatively low cost by modernizing IT, reducing capital expenditures, and improving scalability. Cloud migration allows organizations to access flexible and on-demand resources with reduced overhead related to physical servers. The growth in the number of digital transformation initiatives across the industry has driven the adoption of cloud solutions for various industries involved - banking and healthcare, retail, and manufacturing. Brazil invested USD 30.1 Billion in digital transformation, as stated by the Brazilian NR. Cloud platforms support the ongoing realization of emerging technologies such as big data analytics and artificial intelligence (AI) applications, which come with high demand for computations and storage as well as the Internet of Things (IoT). The other drivers are data security and regulatory compliance. Since governments in Brazil and Mexico have increasingly placed strict data protection laws, businesses have migrated to cloud services that have devised better security features as well as local regulation compliance.

Middle East and Africa Cloud Migration Services Market Analysis

A major growth driver in this region is digital transformation in the way businesses are modernizing their IT infrastructure to reduce costs and obtain operational efficiency. Cloud migration allows an organization to scale resources more flexibly; hence, without significant investments compared to traditional on-premises systems. The rapid adoption of emerging technologies such as AI, big data analytics, and IoT further fuels cloud adoption. These technologies require enormous computational power and huge storage capacity, which cloud platforms provide very easily. Furthermore, favorable government initiatives, especially in countries such as the UAE, Saudi Arabia, and South Africa, are promoting the digitalization of public services and industries. As per the IMARC Group, Saudi Arabia's cybersecurity market is projected to exhibit a CAGR of 12.78% during 2024-2032.

Competitive Landscape:

The global market has a competitive landscape dominated by the manufacturers, with a comprehensive portfolio of services and a wide presence across the world. Manufacturers have been innovating constantly to come up with sophisticated migration tools, automation, and AI-driven solutions for attracting and retaining clients. Apart from this, many specialized service providers and consulting firms are engaged in the market, offering migration strategies and industry-specific expertise tailored to the client's needs. The strategic partnerships, mergers, and acquisitions also take place very frequently in light of companies attempting to increase capabilities and market shares. This healthy competition fosters constant improvements within service quality, pricing, and customer support towards organizations interested in cloud migration but at the same time develops an ever-changing, dynamic market landscape.

The report provides a comprehensive analysis of the competitive landscape in the cloud migration services market with detailed profiles of all major companies, including:

- Accenture plc

- Amazon Web Services Inc. (Amazon.com Inc)

- Cisco Systems Inc.

- DXC Technology Company

- Flexera

- Google LLC (Alphabet Inc.)

- International Business Machines Corporation

- Microsoft Corporation

- Nippon Telegraph and Telephone Corporation

- Oracle Corporation

- Rackspace Technology Inc.

- VMware Inc. (Dell Technologies Inc.)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- December 2024: AWS launched a preview of Amazon Elastic VMware Service (Amazon EVS), a new, native AWS service for customers to run VMware Cloud Foundation (VCF) within their Amazon Virtual Private Cloud (Amazon VPC). The service, which uses the same VCF software as on-premises, streamlines deployment and facilitates a speedy transfer of virtual machines based on VMware to AWS, according to the firm.

- September 2024: AWS partner ClearScale launched ‘Powerful’ cloud migration platform. ClearScale One offers clients a comprehensive cloud modernization and migration plan without the usual operational and financial strains that come with major migrations.

- September 2024: Pythian Services Inc, one of the premier providers of data, analytics, AI, and cloud services, has unveiled its new Oracle migration services towards helping organizations take advantage of the strategic partnership announced by Oracle and Google Cloud (Oracle Database@Google Cloud).

- February 2024: Data Intensity, the Oracle-managed Cloud Services and Solutions Company broadens its ability to support cloud migrations in a landmark agreement with industry-leader Matilda Cloud to exclusively deliver first-of-its-kind innovative IT landscape discovery services. Applications, services, databases, networks, operating systems, and virtualization are all part of a client's IT ecosystem, which Data Intensity thoroughly examines as part of its cloud migration services.

Cloud Migration Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Managed Services, Professional Services |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Deployment Modes Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Applications Covered | Project Management, Infrastructure Management, Security and Compliance Management, Others |

| Industry Verticals Covered | BFSI, Manufacturing, Healthcare and Life Sciences, IT and Telecommunications, Consumer Goods and Retail, Government and Public Sector, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Amazon Web Services Inc. (Amazon.com Inc), Cisco Systems Inc., DXC Technology Company, Flexera, Google LLC (Alphabet Inc.), International Business Machines Corporation, Microsoft Corporation, Nippon Telegraph and Telephone Corporation, Oracle Corporation, Rackspace Technology Inc., VMware Inc. (Dell Technologies Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cloud migration services market from 2019-2033.

- The cloud migration services market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cloud migration services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cloud migration services involve the process of moving an organization's data, applications, and workloads from on-premises systems or other cloud environments to a cloud platform. These services ensure seamless migration while optimizing performance, scalability, security, and cost-efficiency.

The cloud migration services market was valued at USD 257.38 Billion in 2024.

IMARC estimates the global cloud migration services market to exhibit a CAGR of 19.82% during 2025-2033.

The market is driven by rising multi-cloud adoption, the need for scalability, cost optimization, digital transformation, enhanced security and compliance requirements, and advanced IT infrastructure demands.

Managed services represented the largest segment by service type, driven by their end-to-end cloud management capabilities and reliability.

Large enterprises lead the market by enterprise size due to their complex IT needs and financial resources for comprehensive cloud migration solutions.

The public cloud is the leading segment by deployment mode, driven by its scalability, cost-efficiency, and ability to support remote work and digital initiatives.

Infrastructure management represented the largest segment by application, driven by its critical role in efficient cloud transitions and post-migration optimization.

BFSI leads the market by industry vertical due to its need for secure, scalable, and compliant IT solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Europe currently dominates the market.

Some of the major players in the global cloud migration services market include Accenture plc, Amazon Web Services Inc. (Amazon.com Inc), Cisco Systems Inc., DXC Technology Company, Flexera, Google LLC (Alphabet Inc.), International Business Machines Corporation, Microsoft Corporation, Nippon Telegraph and Telephone Corporation, Oracle Corporation, Rackspace Technology Inc., and VMware Inc. (Dell Technologies Inc.), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)