Cloud Kitchen Market Size, Share, Trends and Forecast by Type, Product Type, Nature, and Region, 2026-2034

Cloud Kitchen Market Size and Share:

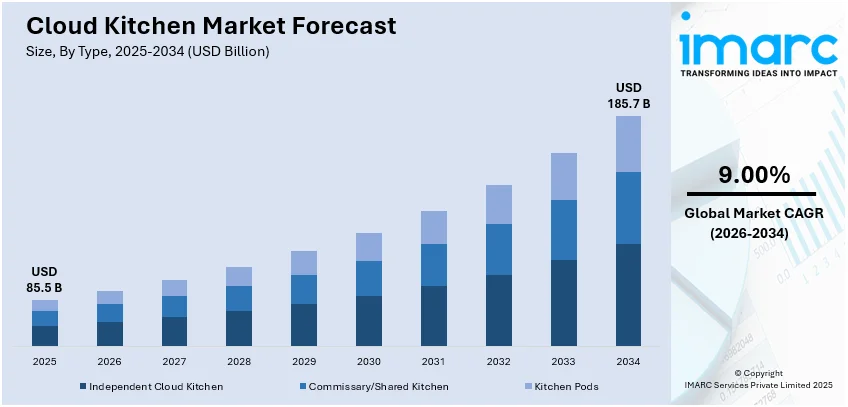

The global cloud kitchen market size was valued at USD 85.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 185.7 Billion by 2034, exhibiting a CAGR of 9.00% from 2026-2034. Asia Pacific currently dominates the market owing to the emerging trend of co-working kitchen spaces, the development of subscription models, and the integration of robotics and artificial intelligence (AI) for various tasks, such as cooking, cleaning, and packing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 85.5 Billion |

| Market Forecast in 2034 | USD 185.7 Billion |

| Market Growth Rate 2026-2034 | 9.00% |

A key driver of the global cloud kitchen market outlook is the growing consumer preference for convenience in meal consumption. As daily routines become more hectic due to fast-paced urban lifestyles, people increasingly turn to food delivery services that save time and effort. Cloud kitchens meet this need by providing delivery-only food options without dine-in spaces, streamlining operations and reducing wait times. This model supports access to diverse cuisines through digital platforms, aligning with modern expectations for fast and flexible dining. The widespread shift toward online ordering has reinforced this trend, making cloud kitchens an attractive solution for both consumers and food entrepreneurs.

To get more information on this market Request Sample

In the U.S., a key driver of the cloud kitchen market is the growing preference for digital food ordering along with a significant share of 88.43%. With 70% of consumers reporting they ordered delivery in the past month, the shift toward app-based and online platforms is clear. Consumers value the speed, customization, and convenience these platforms offer, aligning with a culture that prioritizes time efficiency and tech-enabled services. The rise of third-party delivery apps has also lowered the barriers to entry for virtual restaurant brands, eliminating the need for physical storefronts. As digital adoption increases across various age groups and regions, cloud kitchens capitalize on this trend, providing fast, flexible, and contactless dining experiences directly from mobile devices.

Cloud Kitchen Market Trends:

The Increasing Penetration of Online Food Delivery Platforms

The growing popularity of online food delivery platforms across the globe to provide consumers with innovative cuisines and eateries through their smartphones is positively influencing the cloud kitchen industry. Moreover, the emerging trend of customization in menus and the introduction of seasonal specials to cater to diverse individual tastes and preferences are also catalyzing the market growth. For instance, as per the report published by Zomato, the Indian food delivery platforms had over 80 million monthly active users and have set targets of reaching 200 million over the next few years. Additionally, the increasing internet penetration and the development of simplified e-banking systems are anticipated to propel the cloud kitchen market outlook significantly. In 2024, 68% of the global population had access to the internet, equating to 5.5 billion individuals and recording a significant increase from 2023 at 65%, as per the International Telecommunication Union (ITU).

Rapid Urbanization and Lifestyle Changes

The emerging trend of urbanization, the increasing working population, and the hectic schedules of individuals are propelling the demand for ready-to-eat (RTE) food options, which is primarily driving the market growth. According to the United Nations, 68% of the global population is expected to live in urban cities by 2050. In addition to this, the development of advanced cloud kitchens that offer a convenient dining experience to consumers is positively influencing the global market. For instance, Arabic REEF Technologies, a United States-based operator of delivery kitchens, logistics, and proximity hubs, announced plans to launch cloud kitchens for its network of restaurants and brands in the Middle East and North Africa. Additionally, the convenience of having meals delivered in a record time and at an affordable cost has increased the number of online orders, further fueling the cloud kitchen market growth.

Advancements in Technology and Data Analytics

As per the cloud kitchen market overview, the continuous advancements in technology and data analytics to optimize operations, improve delivery services, and personalize customer experience are significantly driving the market growth. As such, the global data analytics market reached USD 74.26 Billion in 2024 and is forecasted to grow at a CAGR of 23.12% during 2025-2033. Besides this, the integration of advanced technologies, such as artificial intelligence (AI) with food delivery apps and online ordering platforms for real-time tracking to improve efficiency and enhance individual experience is also stimulating the cloud kitchen market demand. For instance, Swiggy entered into a partnership with Garuda Aerospace to deliver groceries with the help of drones in the city of Bengaluru in the Indian state of Karnataka and the Delhi-NCR region.

Cloud Kitchen Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cloud kitchen market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, product type, and nature.

Analysis by Type:

- Independent Cloud Kitchen

- Commissary/Shared Kitchen

- Kitchen Pods

Independent cloud kitchens dominate the cloud kitchen market share with 64.2% due to their cost-effectiveness and operational flexibility. These kitchens operate without a physical storefront, focusing solely on food delivery through online platforms. By eliminating overhead costs like rent, utilities, and front-of-house staff, they can offer competitive pricing and streamline operations. Additionally, independent cloud kitchens benefit from quick scalability, allowing operators to expand rapidly across multiple locations. They also have the flexibility to experiment with different cuisines and menu items without significant financial risk. The growing demand for food delivery services and the shift toward digital ordering further fuel the success of independent cloud kitchens.

Analysis by Product Type:

- Burger and Sandwich

- Pizza and Pasta

- Chicken

- Seafood

- Mexican and Asian Food

- Others

Based on the cloud kitchen market forecast, the burgers and sandwiches drive market growth with 23.8% due to their versatility, convenience, and widespread consumer preference. These items are easily customizable, catering to various dietary needs and tastes, which enhances their appeal across diverse demographics. Additionally, the increasing demand for quick and affordable meal options boosts their popularity, particularly in fast-food and delivery services. The rise of food delivery platforms and cloud kitchens has further supported their growth by making these items more accessible. As consumers seek comfort food with minimal preparation time, burgers and sandwiches remain popular choices, contributing significantly to the expansion of the market.

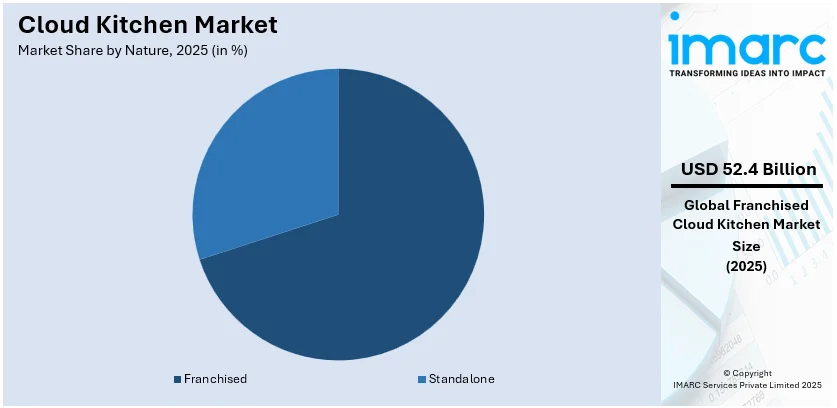

Analysis by Nature:

Access the comprehensive market breakdown Request Sample

- Franchised

- Standalone

Franchised operations hold the majority of market share with 67.1% due to their ability to scale rapidly with a proven business model. Franchising allows for efficient expansion with reduced financial risk, as the franchisee provides the capital while benefiting from an established brand and operational support. This model ensures consistent product quality, streamlined processes, and effective marketing, which are crucial for maintaining brand reputation across multiple locations. Additionally, franchisors offer ongoing training, supply chain management, and support, which helps franchisees succeed. The reduced complexity for franchisees, coupled with the established brand value, makes franchising a highly attractive option for business growth and market dominance.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The Asia-Pacific (APAC) region dominates various industries due to its rapid economic growth, large population, and expanding middle class. This demographic shift has fueled increased consumer spending, particularly in sectors like food and beverages, technology, and manufacturing. The region is a hub for innovation, with countries like China, Japan, and South Korea leading advancements in technology and digital transformation. Additionally, APAC's diverse consumer preferences create a dynamic market, driving demand for both global and local products. The region's robust supply chains, cost-effective production capabilities, and increasing investment in infrastructure further enhance its economic dominance. Governments across APAC are also supportive of business growth through favorable policies, making it an attractive destination for investment and market expansion, thereby solidifying its leading role in the global economy.

Key Regional Takeaways:

North America Cloud Kitchen Market Analysis

The North American cloud kitchen market is experiencing significant growth, driven by a shift in consumer preferences toward convenience, time-saving, and digital dining experiences. As busy urban lifestyles become more common, consumers are increasingly opting for food delivery services that save time and effort. Cloud kitchens, which operate solely on a delivery-only model, cater to this demand by eliminating the need for dine-in spaces, reducing operational costs, and improving service efficiency. This model enables faster order fulfillment and the ability to offer diverse menus through digital platforms. Moreover, the rise of third-party food delivery apps has enhanced accessibility, allowing cloud kitchen operators to reach a broader audience without the need for traditional brick-and-mortar establishments. As technology continues to evolve, cloud kitchens are benefiting from innovations in logistics, order management, and customer engagement, which further streamline operations and enhance customer satisfaction. With a growing consumer base seeking flexible and contactless dining options, the cloud kitchen model is well-positioned to thrive, especially in regions where convenience and digital access are key drivers of the foodservice industry.

United States Cloud Kitchen Market Analysis

The United States cloud kitchen market is primarily driven by the increasing demand for online food delivery services. According to a report by the IMARC Group, the United States online food delivery market reached USD 31.9 Billion in 2024 and is expected to grow at a CAGR of 9.31% during 2025-2033. This has led to a rise in cloud kitchen adoption, offering consumers convenience and a diverse range of culinary options. Technological advancements in kitchen automation, data analytics, and delivery logistics have also enhanced operational efficiency, enabling cloud kitchens to scale effectively. Additionally, the shift in consumer behavior toward fast-casual dining and delivery services has further bolstered the market. Moreover, the emergence of ghost kitchens, which are facilities dedicated solely to fulfilling online orders, has allowed restaurants to expand their reach without the overhead costs associated with traditional dine-in establishments. Other than this, the market is also supported by advancements in kitchen technologies, which allow for improved food preparation, inventory management, and delivery logistics. With the expansion of virtual brands and multi-brand kitchens, cloud kitchens are creating a more competitive landscape that meets diverse consumer needs while reducing the risks associated with traditional restaurant models.

Asia Pacific Cloud Kitchen Market Analysis

The Asia Pacific cloud kitchen market is expanding due to rapid urbanization across countries such as China and India, which has led to increased demand for convenient food delivery options, aligning with the cloud kitchen model. The proliferation of internet access and smartphone usage in the region has also facilitated the widespread adoption of online food delivery services, further boosting the cloud kitchen market. For instance, in India, the number of internet subscribers reached 954.4 Million in 2024. Of these, 82.7% were 4G connections, and 16.9% were 5G. In addition to this, the fast-paced lifestyles of consumers have heightened the preference for ready-to-eat meals, making cloud kitchens an attractive solution. Entrepreneurship opportunities within the cloud kitchen model have also contributed substantially to industry expansion, as it allows new entrants to establish food businesses with relatively lower upfront costs compared to traditional restaurants.

Europe Cloud Kitchen Market Analysis

A number of interrelated factors that are in line with changing customer preferences and market situations are driving the cloud kitchen industry in Europe. One significant driver is the growing preference for convenience and time-saving solutions, particularly in urban areas, where consumers increasingly seek quick and accessible food delivery options. This has heightened the demand for online food delivery services, which cloud kitchens are optimized to fulfill. Furthermore, the demand for meals delivered straight to homes and workplaces has increased due to the growth of the gig economy and flexible work arrangements including remote, work-from-home, and hybrid settings. Cloud kitchens, which operate on a delivery-only model, can meet the demand for home delivered meals without the overhead costs of traditional restaurants. Besides this, the strong digital infrastructure in Europe and the rapid proliferation of delivery platforms in the region further contribute to the expansion of the cloud kitchen model.

Latin America Cloud Kitchen Market Analysis

The Latin American cloud kitchen market is fueled by the region's growing interest in digital food services and low-investment restaurant models. As urbanization continues to expand, there is an increasing demand for food delivery services, which cloud kitchens are perfectly positioned to meet. As to predictions by Worldometers, in 2025, 88.4% of the population of Latin America lives in urban areas, equal to 387,287,563 inhabitants. The rise of social media and online platforms has also enabled businesses to reach a wider audience without the need for traditional marketing or physical presence. Additionally, cloud kitchens offer an efficient way to experiment with new culinary concepts and quickly scale operations, which attracts both new entrepreneurs and established food brands. Favorable government regulations around food delivery and online businesses in several countries also support market growth, making it easier for cloud kitchens to operate and expand their reach.

Middle East and Africa Cloud Kitchen Market Analysis

The Middle East and Africa cloud kitchen market is significantly influenced by the increasing focus on food innovation and customization in the region. With rising demand for niche food options, such as plant-based and halal diets, cloud kitchens offer the flexibility to adapt quickly and cater to these trends. The region's high mobile penetration and growing reliance on e-commerce have also made it easier for consumers to access delivery-only food services. Additionally, the scalability of cloud kitchens, allowing operators to manage multiple virtual brands from a single location, is also attracting investment. The region’s growing hospitality and tourism sectors are further contributing to industry expansion, driving demand for consistent, high-quality food delivery.

Competitive Landscape:

The competitive landscape is characterized by intense rivalry among a growing number of players adopting innovative business models. Entrants range from food delivery startups to established restaurant operators, all leveraging the low overhead and scalability of virtual kitchens. The market is segmented by cuisine types, service models, and regional preferences, driving competition on menu variety, pricing, delivery speed, and customer experience. Technological integration plays a critical role, with data analytics and automation enhancing operational efficiency. Strategic partnerships with logistics providers and use of shared kitchen spaces are common tactics. As consumer demand for online food delivery continues to rise, market participants are focused on differentiation, geographic expansion, and seamless digital integration to gain competitive advantage.

The report provides a comprehensive analysis of the competitive landscape in the cloud kitchen market with detailed profiles of all major companies, including:

- CloudKitchens

- DoorDash Inc.

- Kitchen United

- Kitopi Catering Services LLC

- Lightspeed Commerce Inc.

- PAR Technology Corporation

- POSist Technologies Private Limited

- Rebel Foods

- Starbucks Coffee Company

- Swiggy Platform

- Toast Inc.

Latest News and Developments:

- February 2025: In Mumbai, India, cloud kitchen brand Rebel Foods introduced QuickIES, a 15-minute meal delivery service. The company uses its full-stack software platform and AI-powered forecasting to develop QuickiES.

- November 2024: Pomodoro Pizza Co. established a vegetarian cloud kitchen in Bengaluru, offering Neapolitan-style pizzas.

- October 2024: Karigari established its first cloud kitchen service in Noida, India. This will be the eleventh Karigari outlet.

- June 2024: London-based private equity firm Finnest acquired a majority stake in Kitchens@, an Indian cloud kitchen startup that offers cloud kitchen logistics and recruitment support, as well as pre-made kitchen sets. With a capital commitment of INR 1,335 crore, Finnest has become the largest shareholder in the company.

- April 2024: The cloud kitchen firm Shy Tiger, situated in Gujarat, India, was fully acquired by the food-tech platform Ghost Kitchens.

Cloud Kitchen Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Independent Cloud Kitchen, Commissary/Shared Kitchen, Kitchen Pods |

| Product Types Covered | Burger and Sandwich, Pizza and Pasta, Chicken, Seafood, Mexican and Asian Food, Others |

| Natures Covered | Franchised, Standalone |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CloudKitchens, DoorDash Inc., Kitchen United, Kitopi Catering Services LLC, Lightspeed Commerce Inc., PAR Technology Corporation, POSist Technologies Private Limited, Rebel Foods, Starbucks Coffee Company, Swiggy Platform, Toast Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cloud kitchen market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cloud kitchen market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cloud kitchen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cloud kitchen market was valued at USD 85.5 Billion in 2025.

The cloud kitchen market was valued at USD 185.7 Billion in 2034 exhibiting a CAGR of 9.00% during 2026-2034.

Key factors driving the cloud kitchen market include rising demand for food delivery, increasing urbanization, and changing consumer preferences toward convenience and digital ordering. Low operational costs, technological advancements, and the growth of third-party delivery platforms also contribute to the market's rapid expansion and appeal among food entrepreneurs.

Asia Pacific dominates the cloud kitchen market due to rapid urbanization, increasing internet penetration, and growing consumer demand for food delivery services. The region’s diverse culinary preferences and a tech-savvy population, along with the rise of food delivery platforms, make cloud kitchens a popular and efficient dining solution.

Some of the major players in the cloud kitchen market include CloudKitchens, DoorDash Inc., Kitchen United, Kitopi Catering Services LLC, Lightspeed Commerce Inc., PAR Technology Corporation, POSist Technologies Private Limited, Rebel Foods, Starbucks Coffee Company, Swiggy Platform, Toast Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)