Cloud Gaming Market Size, Share, Trends and Forecast by Type, Genre, Technology, Gamers, and Region 2025-2033

Cloud Gaming Market Analysis 2025-2033:

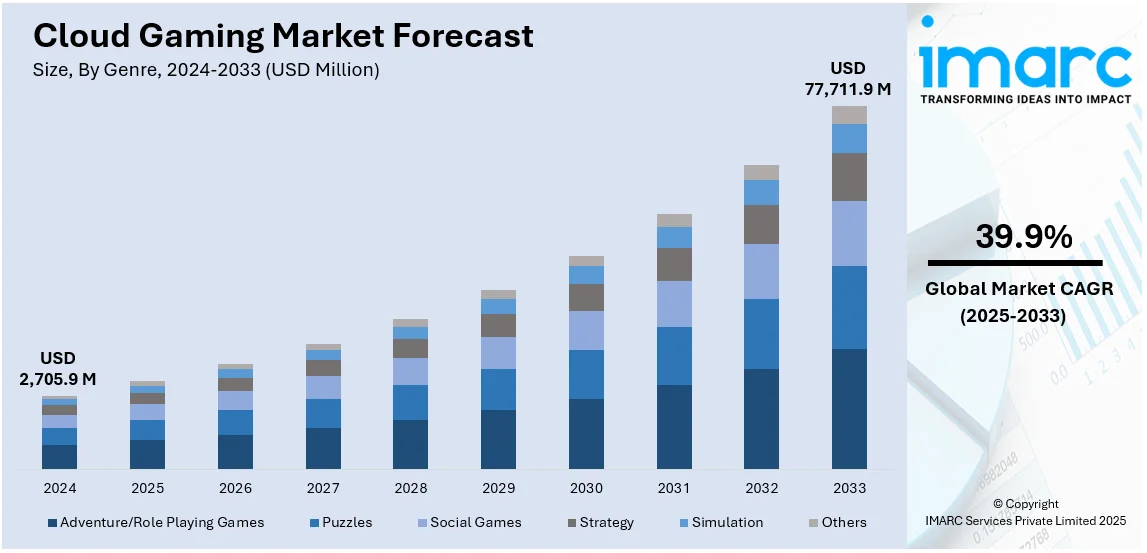

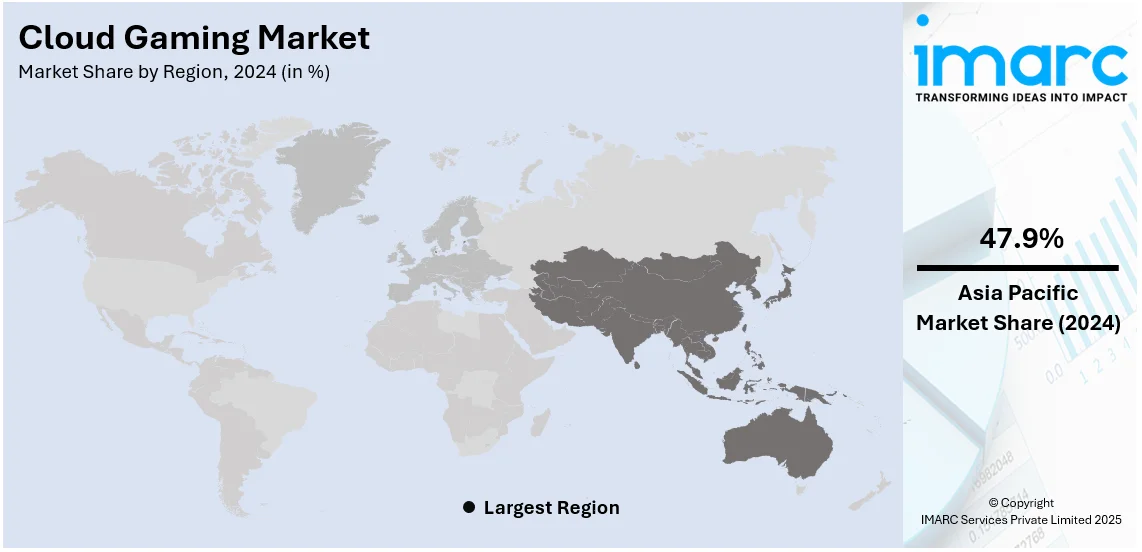

The global cloud gaming market size was valued at USD 2,705.9 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 77,711.9 Million by 2033, exhibiting a CAGR of 39.9% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant cloud gaming market share of over 47.9% in 2024. The increasing demand for online video games, rising number of startups offering realistic games, and the growing adoption of cloud gaming services that rely on gaming analytics to monitor player behaviour are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,705.9 Million |

|

Market Forecast in 2033

|

USD 77,711.9 Million |

| Market Growth Rate 2025-2033 | 39.9% |

The global cloud gaming industry is fueled by the technological innovations, changes in consumer behavior, and strategic collaborations.. Expansion of high-speed internet network such as 5G has expanded exponentially, thus enhancing the delivery of seamless, and low latency gaming experiences, that users could increasingly avail and enjoy without possessing costly hardware. More accessible availability due to greater penetration of smart devices like smartphones, tablets and, especially smart TVs also make cloud games more accessible. It is estimated that by 2024, the smartphone market has reached 1,517.0 Million Units. Another factor driving cloud-based solutions adoption is the high demand for cross-platform games and multiplayer experience, granting consumers the freedom to play them when and where they want. Subscription-based business models and the convergence of cloud gaming with popular streaming services have also fueled market growth, offering users extensive libraries of games at competitive prices.

The United States has emerged as a key regional market for cloud gaming. Several factors driving the United States cloud gaming market include a high penetration rate of fast internet, upsurging 5G network deployment, and an evolving demand for accessible and on-demand gaming experience. More consumers seek seamless, multi-device gaming without buying expensive hardware, which clouds offer a cost-effective route by unloading processing tasks off to servers in the clouds. Further driving scalability and performance is the rapid cloud infrastructure development of giants in tech such as Microsoft, Google, and Amazon. Similarly, subscription models like Netflix have appealed to a larger audience interested in accessing hundreds of games for a flat, predictable monthly fee. Most of these users prefer engaging social and multiplayer gaming experiences, which find an ideal space in cloud-based environments.

Cloud Gaming Market Trends:

Increase in accessibility and device flexibility

One of the primary factors driving the demand for cloud gaming is its enhanced accessibility and device flexibility. Traditional gaming requires expensive gaming hardware, which can be a barrier for many potential gamers. Cloud gaming eliminates this constraint by allowing users to play high-quality games on various devices, from low-end smartphones to smart TVs, with minimal hardware requirements. This democratization of gaming experiences attracts a broader audience, including casual gamers who may not have invested in specialized gaming equipment before. For instance, Cloud gaming benefits significantly from the robust smart TV trade, supported by its market size reaching USUSD 274.1 Billion in 2023, according to the IMARC Group. Moreover, cloud gaming enables seamless gaming sessions across devices, allowing players to start a game on one device and continue another, further enhancing convenience and enticing gamers with a more flexible and accessible gaming experience.

Rise in improved gaming performance and graphics

Cloud gaming leverages powerful data centres with advanced hardware configurations, which surpass the capabilities of most individual gaming devices. According to IEA, in 2023, overall capital investment by Google, Microsoft and Amazon, which are industry leaders in AI adoption and data centre installation, was higher than that of the entire US oil and gas industry – totaling around 0.5% of US GDP, cloud gaming benefits from enhanced global infrastructure and scalability, ensuring seamless, low-latency gaming experiences. This results in enhanced gaming performance and graphics quality, which provides players with a seamless and immersive experience. The processing and rendering of games in the cloud enables support for higher resolutions, smoother frame rates, and more realistic visual effects. As a result, gamers can enjoy visually stunning and lag-free gameplay, even on modest devices, encouraging them to use cloud gaming for accessing premium gaming experiences without the need to invest heavily in top-tier gaming hardware.

Growing inclination toward subscription model

The cost-effectiveness of cloud gaming is another crucial factor driving its demand. Traditional gaming often involves significant upfront expenses on gaming consoles or high-end personal computers (PCs), followed by additional costs for individual game purchases. For instance, Cloud gaming is gaining traction, with Netflix testing cloud-streamed games in 2023 and Microsoft aiming for 110 Million Game Pass subscribers by 2030 according to Xbox maker, signaling a shift to subscription models that enhance accessibility and monetize older titles. Cloud gaming mitigates these financial burdens by offering subscription-based models, which allow users to access a library of games for a fixed monthly fee. This approach provides access to a vast catalog of games without the need for individual purchases, which makes gaming more affordable and accessible for a wider audience. Additionally, its pay-as-you-go models enable players to try out games before committing to a purchase, which ensure cost-conscious decisions. The prospect of cost savings and flexibility in game selection contributes to the rising demand for cloud gaming services.

Cloud Gaming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cloud gaming market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on devices type, genre, technology, and gamers.

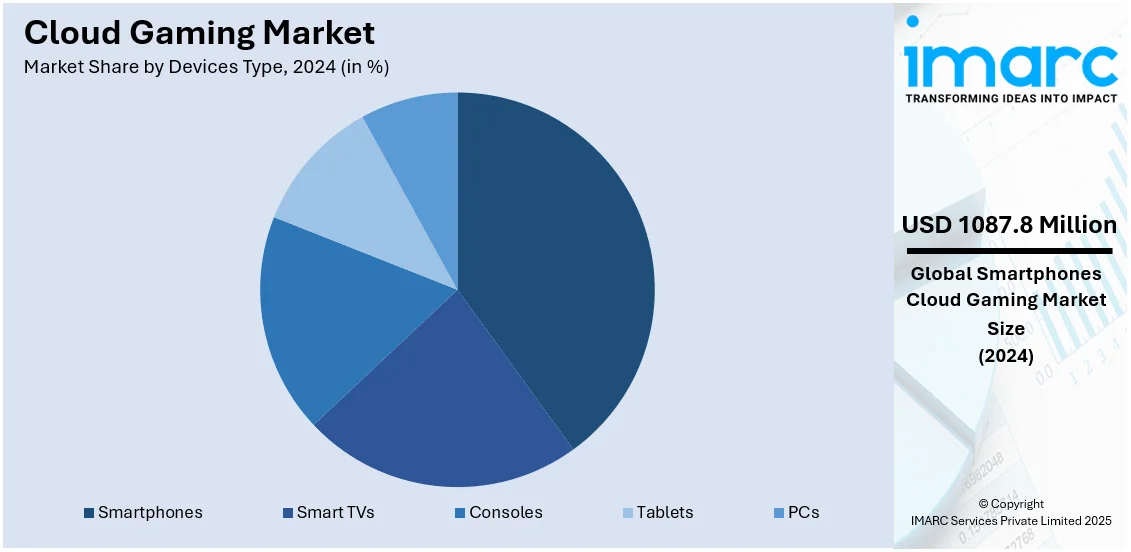

Analysis by Devices Type:

- Smartphones

- Smart TVs

- Consoles

- Tablets

- PCs

Smartphones stand as the largest component in 2024, holding around 40.2% of the market. Dedicated applications can be installed on the mobile phones to use the cloud gaming services. A user can stream games from the cloud servers to his smartphone, and he can play high-quality games on his mobile device without needing powerful hardware. Some smart TVs support the cloud gaming platforms. A user can access the cloud gaming service through the built-in application of a TV or a dedicated streaming device. This means that they can play the games directly on the smart TVs without having to have a gaming console. Cloud services can be integrated into a gaming console. Users access and stream games from the cloud, which expands the game library and eliminates the use of physical game discs or downloading.

Analysis by Genre:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

Adventure/Role-Playing Games (RPGs) are immersive games that involve players taking on the role of a protagonist or a character in a vast and open virtual world. Players go on quests, solve puzzles, and engage in various activities to progress through the storyline of the game. RPGs include character development, which allows players to level up, gain new abilities, and shape the outcome of the game. Puzzle games are focused on challenging players with mental exercises and problems to solve. These games can vary from simple logic puzzles to more complex brain teasers. Cloud gaming platforms can offer a variety of puzzle games that cater to different skill levels and interests. Social games are designed to be played with and against other players. They often involve multiplayer features, which allow players to interact, collaborate, or compete with friends and other gamers online. They can range from casual titles to more intense competitive experiences.

Analysis by Technology:

- Video Streaming

- File Streaming

Video streaming leads the market with around 54.8% of market share in 2024. Video streaming is the most common technology used in cloud gaming. It is hosted on powerful remote servers in data centers. Its input commands are sent to the server, and the game is processed on the remote server when a user wants to play a game. Its technology allows users to play high-quality games on devices with limited processing power due to the heavy processing handled by the cloud servers. File streaming is another technology used in some cloud gaming services. It involves transmitting only the essential files and data needed to run the game on the device of the user. It can be more efficient in terms of bandwidth as compared to video streaming and it requires faster and more reliable internet connections to avoid performance issues during gameplay.

Analysis by Gamers:

- Hardcore Gamers

- Casual Gamers

Casual gamers lead the market with around 52.5% of market share in 2024. Casual gamers engage in gaming more casually and sporadically. They can play games as a form of relaxation or to pass the time, rather than pursuing competitive challenges. Cloud gaming is particularly attractive to casual gamers due to its user-friendly nature and simplicity. It eliminates the need for complex hardware setup and frequent software updates, which makes it accessible to a broader audience. Casual gamers appreciate the convenience of cloud gaming, which enables them to enjoy gaming experiences without making a significant investment in gaming equipment. They value the ability to play on a variety of devices, including smartphones, tablets, and smart TVs. Hardcore gamers are dedicated enthusiasts who are deeply passionate about gaming. They devote significant time and effort to playing video games and often seek challenging and competitive experiences. Cloud gaming appeals to hardcore gamers due to its accessibility and the ability to play high-quality games on various devices, even those with lower-end hardware.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 47.9%. The increasing number of casual and professional gamers represents one of the primary factors driving the demand for cloud gaming in the Asia Pacific region. Moreover, rising reliance on smartphones and high-speed internet connectivity is contributing to the market growth in the region. Besides this, the growing number of gaming zones in commercial areas is influencing the market positively in the region. North America is estimated to witness stable growth, owing to increasing influence of social media, rising popularity of e-sports, integration of advanced technologies, etc.

Key Regional Takeaways:

United States Cloud Gaming Market Analysis

In 2024, the United States accounts for around 84.3% of the cloud gaming market in North America. The cloud gaming is transforming the entertainment industry across the United States, creating significant opportunities for gamers and businesses alike. Major tech hubs like California and Washington are spearheading the development of robust platforms, enabling players to access high-quality games without high-end hardware. States such as Texas and Florida are witnessing rapid growth in gaming communities, supported by cutting-edge infrastructure and investments in data centres. For instance, in 2024, the United States contributes significantly to the global gaming market, with over 3.32 Billion active gamers worldwide. This surge in gaming participation is boosting the growth of cloud gaming platforms. Companies headquartered in the United States, including Microsoft and NVIDIA, are expanding their gaming ecosystems, making premium gaming experiences more accessible. Additionally, underserved rural regions, such as those in the Midwest, are beginning to benefit from improved internet connectivity, democratizing access to interactive entertainment. According to Pew Research, rural residents of America have experienced a 9 percentage point increase in home broadband adoption since 2016. Back then, about 63% of rural residents reported having a high-speed internet connection at home. This evolution is redefining gaming, creating an inclusive environment that reaches players from coast to coast.

Asia Pacific Cloud Gaming Market Analysis

The Asia-Pacific is rapidly emerging as a hub for interactive digital entertainment, driven by advancements in internet infrastructure and consumer demand for accessible gaming solutions. Countries like Japan, South Korea, and China are leveraging cutting-edge technologies to expand immersive gaming experiences, attracting Millions of users. The region’s vibrant youth population has fuelled exponential growth in mobile-based platforms. According to reports, the rapid 5G rollout and gaming demographic growth could make the region the largest cloud-streamed gaming market. In pioneer countries across the Asia Pacific, 5G is well-established, with the technology expected to account for a third or more of total mobile connections by the end of 2024 in nations like Australia, Japan, New Zealand, Singapore, and South Korea, where adoption will surpass 60%, according to the figures from GSMA. With dynamic markets and reduced hardware dependency, Asia-Pacific stands as a beacon of transformative gaming potential, shaping global industry standards while democratizing entertainment across its culturally diverse regions.

Europe Cloud Gaming Market Analysis

The cloud gaming market in Europe is experiencing significant growth, driven by advancements in cloud computing, high-speed internet access, and increasing consumer demand for gaming experiences without the need for expensive hardware. As more gamers seek flexibility and convenience, cloud gaming services allow users to stream games directly to their devices, reducing the reliance on high-performance gaming consoles or PCs. The expansion of 5G networks across the region is also playing a crucial role, enhancing the speed and reliability needed for seamless cloud gaming experiences. Additionally, Europe's strong gaming culture, combined with the rise of subscription-based models from major players like Google Stadia, Microsoft Xbox Cloud Gaming, and Nvidia GeForce Now, is further fueling the market. According to the European Games Developer Federation, the European video games market was valued at an estimated €23 Billion in 2020. This marked a significant growth, with a 22% increase in consumer spending compared to the previous year. The growth of eSports and online multiplayer gaming is another key factor, as cloud gaming provides a scalable and accessible platform for competitive gaming. As the infrastructure continues to improve, the European cloud gaming market is expected to grow rapidly, attracting both consumers and developers to innovate in this space.

Latin America Cloud Gaming Market Analysis

Latin America, encompassing countries such as Brazil, Mexico, Argentina, and Colombia, is leveraging technological advancements to transform its gaming industry. With increased internet penetration and digital connectivity, regions like São Paulo, Mexico City, and Buenos Aires are witnessing a surge in interactive entertainment, reducing reliance on high-cost gaming hardware.

According to the Game Brasil Survey, approximately 82.1% of Brazilians consider playing video games to be one of their primary forms of entertainment. This highlights the significant role that video gaming plays in Brazilian culture, with a large portion of the population embracing it as a key leisure activity. The rising gaming culture coupled with increasing internet penetration is significantly driving the market in the region. For instance, according to Bloomberg Linea, internet penetration in Latin America went from 43% to 78%, surpassing that of China.

Middle East and Africa Cloud Gaming Market Analysis

Cloud gaming is significantly advancing digital entertainment in the Middle East and Africa (MEA), with rapid infrastructure development supporting its growth. In countries like the UAE and Saudi Arabia, robust 5G networks enhance seamless gaming experiences, while in South Africa and Nigeria, increasing smartphone penetration democratizes access. For instance, the UAE gaming industry is rapidly growing, with 73% of the population being gamers and the market valued at USD 0.4 Billion in 2021, according to the government. Ranked 35th globally by revenue in 2019, the UAE's high mobile penetration and investment drive its thriving gaming ecosystem. Strategic partnerships, such as those between global gaming platforms and regional telecom providers, are driving engagement. Localized content tailored to cultural preferences boosts adoption, particularly in GCC states. Additionally, government initiatives in Egypt and Kenya promote digital innovation, creating a fertile ground for this technological evolution across Middle East and Africa.

Leading Cloud Gaming Market key Players:

The report has also analysed the competitive landscape of the market with some of the key players being:

- Utomik B.V.

- Nvidia Corporation

- Numecent Holdings Ltd.

- RemoteMyApp SP ZOO (Vortex)

- Parsec Cloud Inc.

- Paperspace

- LiquidSky Software Inc.

- Simplay Gaming Ltd.

- Ubitus Inc.

- Microsoft Corporation

- Sony

- Amazon web services

- IBM Corporation

- Samsung electronics

- GameFly

- CiiNow Inc.

Latest News and Developments:

- In November 2024, Microsoft significantly enhanced Xbox Cloud Gaming by enabling players to stream games they own, expanding beyond the Game Pass library. This update allows access to a broader range of titles across various devices, including Android platforms where users can now purchase and stream games directly through the Xbox app. Additionally, popular franchises like Call of Duty have been integrated into the cloud service, marking a substantial advancement in gaming accessibility.

- In November 2024, Samsung launched its mobile cloud gaming platform for Galaxy devices in North America, transitioning from its beta phase. This service enables instant play of Android-native games via the Galaxy Store without downloads or account setups, aiming to streamline the gaming experience. By reducing latency and simplifying access, Samsung seeks to align mobile gaming with the convenience of streaming services in other entertainment sectors.

- In November 2024, OnePlay, India's leading cloud gaming platform, partnered with SkyPro IPTV and Velosting to introduce integrated packages combining IPTV and cloud gaming. This collaboration allows users to enjoy AAA gaming and live TV without the need for high-end hardware. The partnership with Velosting aims to enhance OnePlay's infrastructure, delivering high-performance, low-latency gaming experiences across the Asia-Pacific region.

- In April 2023, Microsoft Corporation enhanced its cloud gaming portfolio by entering a strategic ten-year agreement with Nware, a European cloud gaming platform. This partnership integrates Nware's platform into Microsoft's game streaming ecosystem, expanding its reach across Europe. It aims to deliver seamless gaming experiences and broaden access to Xbox titles. This move reinforces Microsoft's leadership in cloud gaming innovation and accessibility.

- In 2021, Amazon Web Services diversified its offerings with a new subscription plan tailored for families. The Luna+ upgrade, priced at USD 2.99 per month, introduces 36 kid-friendly games to its cloud gaming library. This initiative targets younger audiences and emphasizes safe, age-appropriate entertainment. It underscores Amazon's commitment to catering to diverse gaming demographics and enhancing customer engagement.

Cloud Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Types Covered | Smartphones, Smart TVs, Consoles, Tablets, PCs |

| Genres Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulations, Others |

| Technologies Covered | Video Streaming, File Streaming |

| Gamers Covered | Hardcore Gamers, Casual Gamers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Utomik B.V., Nvidia Corporation, Numecent Holdings Ltd., RemoteMyApp SP ZOO (Vortex), Parsec Cloud Inc., Paperspace, LiquidSky Software Inc., Simplay Gaming Ltd., Ubitus Inc., Microsoft Corporation, Sony, Amazon web services, Google, IBM Corporation, Samsung electronics, GameFly, CiiNow Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cloud gaming market from 2019-2033.

- The cloud gaming market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cloud gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cloud gaming market was valued at USD 2,705.9 Million in 2024.

IMARC estimates the cloud gaming market to exhibit a CAGR of 39.9% during 2025-2033, reaching USD 77,711.9 Million by 2033.

Key factors driving the cloud gaming market include increasing demand for online video games, and rising adoption of smart devices such as smartphones, smart TVs, and tablets. Additionally, the growing availability of 5G networks, enabling low-latency gaming experiences, and increasing interest in cross-platform and multiplayer gaming experiences.

Asia-Pacific currently dominates the cloud gaming market, accounting for a share exceeding 47.9% in 2024. This dominance is fueled by the region's growing reliance on smartphones, high-speed internet penetration, and the rising number of casual and professional gamers.

Some of the major players in the cloud gaming market include Utomik B.V., Nvidia Corporation, Numecent Holdings Ltd., RemoteMyApp SP ZOO (Vortex), Parsec Cloud Inc., Paperspace, LiquidSky Software Inc., Simplay Gaming Ltd., Ubitus Inc., Microsoft Corporation, Sony, Amazon web services, Google, IBM Corporation, Samsung electronics, GameFly, and CiiNow Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)