Cloud Backup Market Size, Share, Trends and Forecast by Component, Service Provider, Organization Size, Deployment Mode, Vertical, and Region, 2025-2033

Cloud Backup Market 2024, Size and Trends:

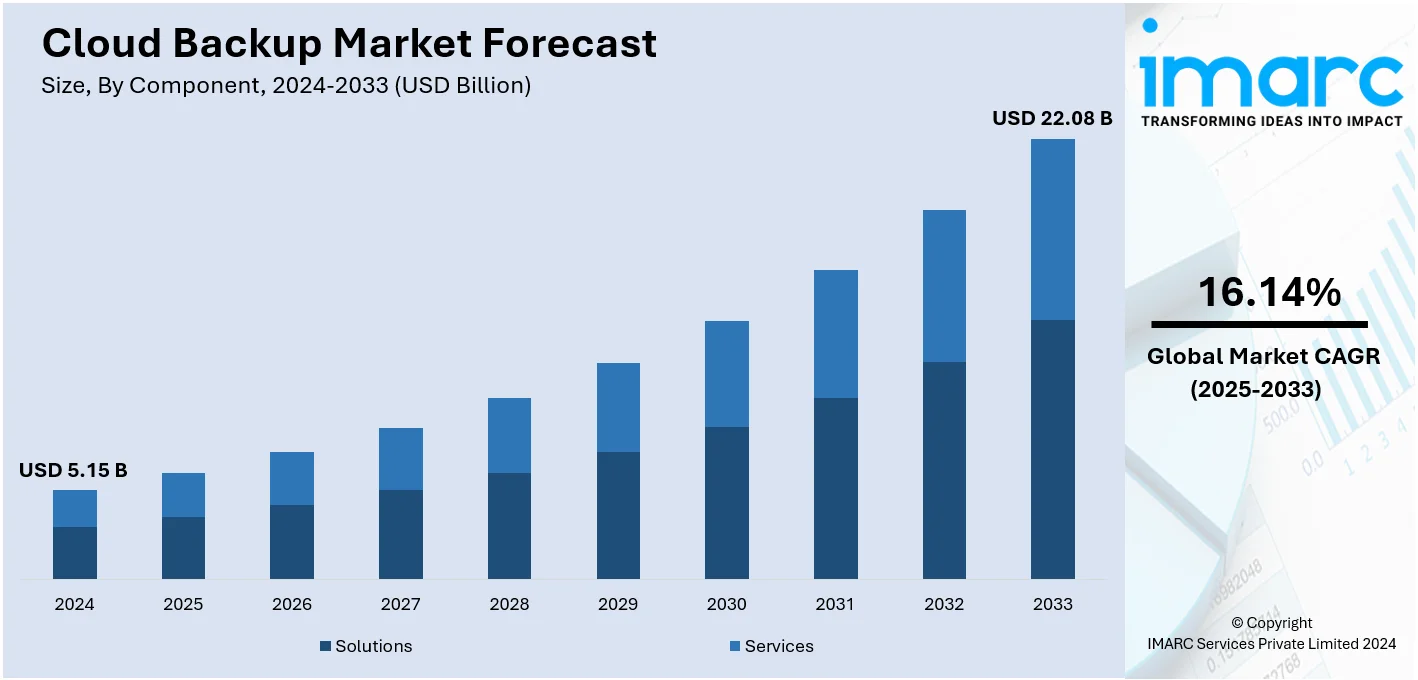

The global cloud backup market size was valued at USD 5.15 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.08 Billion by 2033, exhibiting a CAGR of 16.14% from 2025-2033. North America currently dominates the market, holding a market share of over 37.8% in 2024. The growing occurrence of cyber security breaches, increasing cloud computing activities to delegate routine tasks and enhance operational efficiency, and rising adoption of remote work models to maintain work-life balance are contributing to the expanding cloud backup market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.15 Billion |

|

Market Forecast in 2033

|

USD 22.08 Billion |

| Market Growth Rate 2025-2033 | 16.14% |

The cloud backup market demand is continuously growing due to the rising amount of data volumes, increasing awareness of cybersecurity risks, and the demand for inexpensive and easily scalable data storage and archival. Many companies are migrating from conventional on-premises solutions to new cloud models to plan for continuity and disaster management. The global shift to hybrid and remote work models has also fueled demand, as businesses seek centralized, accessible storage options that can support distributed teams. Innovations in encryption technologies and automated backup processes are further reinforcing the market's growth trajectory.

In the United States, the adoption of cloud backup is accelerating, supported by advancements in infrastructure and the widespread availability of high-speed internet. Major industries such as healthcare, finance, and technology are increasingly relying on cloud services to meet data retention requirements and mitigate risks associated with cyberattacks. For instance, in June 2024, Oracle introduced the Oracle Health Insurance Data Exchange Cloud Service, a cloud-native solution enabling insurers to streamline data exchange, simplify compliance, and support evolving data formats efficiently. Furthermore, the presence of leading cloud providers and a high degree of digitalization across sectors position the U.S. as a key driver in the global cloud backup market.

Cloud Backup Market Trends:

Data Security Concerns

Data security is a primary driver of the cloud backup market trends. In an increasingly digital world, businesses are acutely aware of the importance of safeguarding their data. In 2023, more than 6 Billion malware attacks were reported all over the world. According to IBM, the average overall cost of a data breach is USD 4.88 Million. Cloud backup solutions offer a secure and reliable way to protect critical information from data breaches, cyberattacks, and hardware failures. This factor is pivotal in the adoption of cloud backup services as companies seek to fortify their data security strategies. Cloud backup services offer stringent access controls and multi-factor authentication. These security measures limit access to authorized personnel only, reducing the risk of data breaches due to compromised credentials. Cloud backup providers invest in advanced threat detection and response capabilities. Machine learning (ML) algorithms and artificial intelligence (AI)-driven tools help identify and mitigate potential security threats in real time, further bolstering data security.

Scalability and Flexibility

Scalability and flexibility are key factors propelling the cloud backup market share. Cloud-based backup solutions allow organizations to adapt to changing data storage needs effortlessly. As businesses grow, their data requirements expand, and cloud backup services offer the ability to scale up or down seamlessly. This scalability eliminates the need for large upfront investments in infrastructure, making it an attractive option for businesses of all sizes. Traditional on-premises data storage solutions require businesses to invest in hardware and infrastructure upfront. In contrast, Cloud backup follows a pay-as-you-go model, where organizations only pay for the storage and resources they use. This cost-effective approach eliminates the need for substantial capital expenditures, promoting financial efficiency. Moreover, cloud backup providers typically offer automated resource allocation based on demand. Scalable cloud backup solutions are also integral to disaster recovery strategies. An industry report showed that 84.7% of companies encountered at least one data loss event in the previous year, with some facing multiple incidents monthly. In case of data loss due to unforeseen events like hardware failures or natural disasters, businesses can swiftly recover their data from the cloud.

Cost Efficiency

Traditional backup methods often involve substantial capital expenditures on hardware and maintenance. Cloud backup eliminates these costs, replacing them with a pay-as-you-go model. This cost-effectiveness appeals to businesses looking to optimize their information technology (IT) budgets without compromising data security as cloud backups reduces operational cost by approximately 75%, as per reports. Cloud backup services are managed and maintained by the cloud provider, reducing the burden on in-house IT staff. This operational efficiency allows organizations to redirect IT resources toward strategic initiatives rather than routine maintenance tasks. On-premises data centers consume substantial energy and require physical space. Cloud backup eliminates these expenses, contributing to environmental sustainability and further cost savings. Cloud backup providers handle software updates and maintenance, ensuring that businesses always have access to the latest security features and improvements without additional costs.

Remote Working Model

The rising adoption of remote working models is driving the demand for cloud backup solutions. According to World Economic Forum projections, there will be over 92 million of these remote-work, digital employment worldwide by 2030, an increase of almost 25%. Besides this, with a dispersed workforce, organizations require backup solutions that can protect data from various locations. Cloud backup allows remote employees to securely access and back up their data, ensuring business continuity even in remote work scenarios. Remote work necessitates that employees have access to critical business data from various locations. Cloud backup solutions facilitate this by allowing data to be stored securely in the cloud and accessed with an internet connection. This enables remote workers to collaborate effectively and maintain productivity. The distributed nature of remote work introduces new challenges for data security. Cloud backup providers offer robust security measures, including encryption and access controls, which are crucial for protecting sensitive information in remote work scenarios. This reassures organizations that their data remains secure, regardless of where employees are located.

Stringent Regulatory Compliance

Increasing regulatory requirements for data protection and retention are leading businesses to turn to cloud backup services. These solutions often come with built-in compliance features, helping organizations adhere to data governance standards and avoid legal penalties. Certain regulations mandate that data must remain within specific geographic boundaries. Cloud backup providers offer data center locations worldwide, allowing organizations to choose where their data is stored while complying with regional data residency requirements. This flexibility simplifies compliance with data sovereignty regulations. Regulations often dictate data retention periods and require organizations to maintain audit trails of data access and modifications. Cloud backup solutions include features for automated data retention and audit capabilities, simplifying compliance efforts, and ensuring that organizations can meet legal requirements.

Cloud Backup Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cloud backup market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, service provider, organization size, deployment mode, and vertical.

Analysis by Component:

- Solutions

- Services

Solutions lead the market with around 67.6% of market share in 2024. Solutions encompass the actual software and technology that enable businesses to back up their data to the cloud. They include a wide range of offerings, from cloud-based backup software to data storage and recovery solutions. The primary advantage of cloud backup solutions lies in their ability to provide automated and secure data backup and recovery, ensuring business continuity and data integrity. These solutions often incorporate features like data encryption, data deduplication, and automated backups, making them indispensable for organizations looking to protect their critical data assets and meet regulatory compliance requirements amid a promising cloud backup market outlook.

Analysis by Service Provider:

- Cloud Service Provider

- Telecom and Communication Service Provider

- Managed Service Provider

- Others

Cloud service provider leads the market with around 45.3% of market share in 2024. Cloud service providers are at the forefront of offering cloud backup solutions, leveraging their extensive data center infrastructure and expertise in cloud technology. They offer businesses scalable and cost-effective backup solutions, often bundled with other cloud services, such as storage and computing. Cloud service providers prioritize data security, compliance, and redundancy, making them a preferred choice for enterprises seeking to ensure data integrity and business continuity. Their global reach and ability to offer geo-redundant data storage options contribute to their dominance in the market.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises lead the market with around 75.4% of market share in 2024. Large enterprises often have complex data management needs, vast volumes of critical data, and higher risk exposure in case of data loss. As a result, they invest significantly in comprehensive cloud backup solutions. Large enterprises typically demand scalable, feature-rich solutions that can handle their data backup and recovery requirements efficiently. They often opt for advanced features like multi-site redundancy, data analytics, and integration with other enterprise systems. Data security and compliance are paramount for large enterprises, driving them to choose cloud backup solutions that provide the highest levels of encryption and regulatory compliance capabilities.

Analysis by Deployment Mode:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Private cloud leads the market with around 58.6% of the market share in 2024. Private cloud deployment is favored by organizations with strict security and compliance requirements, such as those in the financial, healthcare, and government sectors. These businesses opt for dedicated cloud infrastructure to have full control over data management, access, and security, further driving the cloud backup market growth as organizations prioritize robust and secure data solutions. Private cloud solutions offer customizable configurations, allowing organizations to tailor their cloud backup environments to meet specific needs. While they may require a higher initial investment, private clouds provide the level of data isolation, privacy, and control that is indispensable for organizations that handle sensitive information.

Analysis by Vertical:

- BFSI

- Consumer Goods and Retail

- Education

- Government and Public Sector

- Healthcare and Life Sciences

- Manufacturing

- Media and Entertainment

- Telecommunication and ITES

- Others

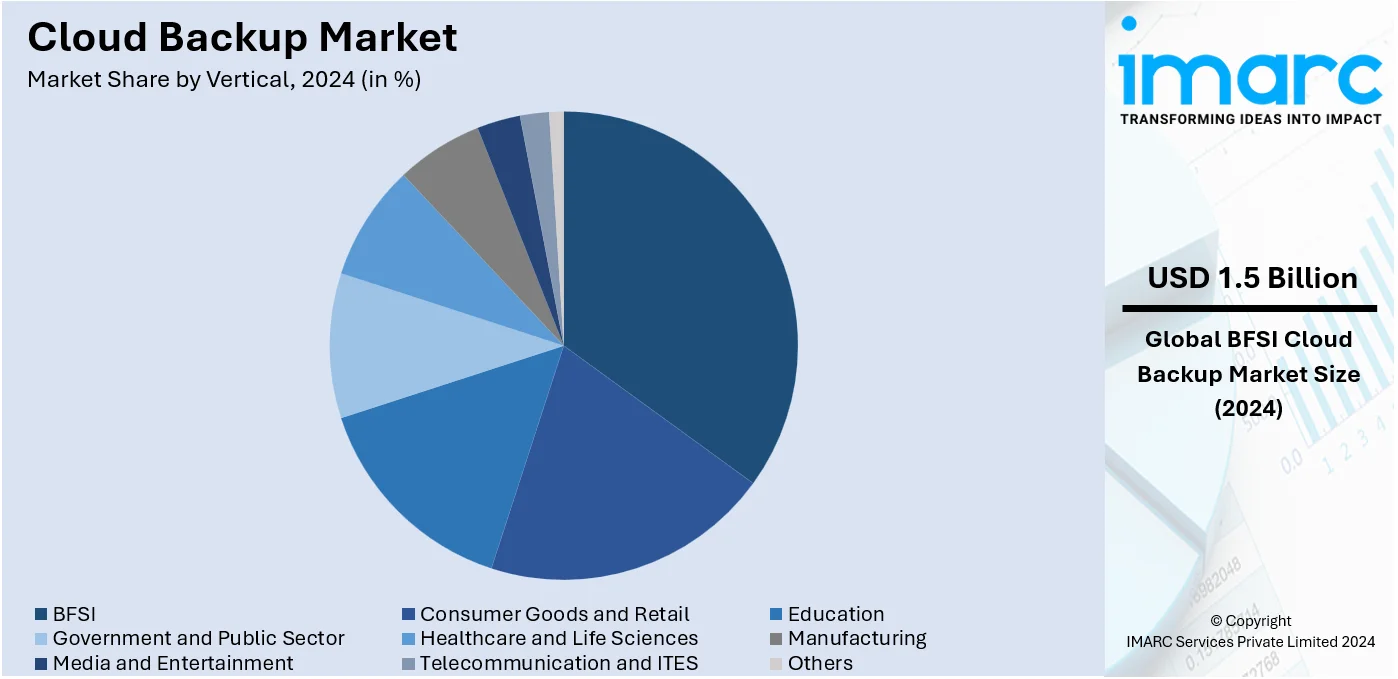

BFSI leads the market with around 28.5% of market share in 2024. Banking, financial institutions, and insurance (BFSI) companies handle vast volumes of sensitive data, including customer financial information, transaction records, and compliance-related data. They also prioritize robust data protection, business continuity, and regulatory compliance. Cloud backup solutions tailored for BFSI verticals often include advanced security features, data encryption, and comprehensive disaster recovery capabilities. These solutions enable financial organizations to safeguard their critical data assets, ensure uninterrupted operations, and meet stringent regulatory requirements.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.8%. The region’s market is largely driven by high-profile data breaches and evolving privacy regulations. Organizations are increasingly turning to cloud backup solutions to ensure the protection of sensitive data. This trend is bolstered by the robust security features offered by cloud backup providers, including encryption, access controls, and compliance certifications. The widespread adoption of remote work is driving the demand for cloud backup solutions. Key players in the region are embracing hybrid cloud strategies, combining private and public cloud resources. This approach allows organizations to optimize their data backup and recovery processes, leveraging the scalability of public clouds while maintaining control and security through private cloud deployments. Moreover, the increasing generation of large volumes of data from innumerable online channels is bolstering the growth of the market.

Key Regional Takeaways:

United States Cloud Backup Market Analysis

In 2024, United States accounted for 88.10% of the market share in North America. Stricter data protection laws, increased adoption of hybrid cloud solutions, and widespread digital transformation across industries are driving the US cloud backup market. With a growing need to protect their digital assets, 88% of U.S. businesses have adopted cloud computing in some form, according to reports. Strong data compliance laws in the US, like CCPA and HIPAA, motivate businesses to spend money on safe cloud backup options. With more than 2,200 attacks every day according to Astra Security data, the increase in cyberattacks emphasizes how important data recovery solutions are, making cloud backup essential. According to Small Business Administration's (SBA) Office of Advocacy data, more than 30 million small businesses rely increasingly on cost-effective cloud services.

SMEs have a significant position in fulfilling these requirements. Moreover, the trend of remote work increases the demand for safe and easily accessible data backup, which is likely to constitute around 25% of the workforce by 2030. Some of the key adopters with a high market share include sectors that handle sensitive data, such as healthcare and finance.

Europe Cloud Backup Market Analysis

Widespread use of clouds, increasing cybersecurity issues, and stringent data privacy regulations such as the General Data Protection Regulation (GDPR) are driving the cloud backup industry in Europe. Dependable cloud backup options will be incentivized by the requirement for strong data protection measures for GDPR compliance, and companies will spend money on it. Interoperable backup systems are required since above 75% of European firms rely on cloud services, as per reports and a large share of them prefer hybrid and multi-cloud models. Ransomware attacks have witnessed a rise of 50% year on year in the region, according to reports, underlining the importance of secure data recovery options. Germany and the UK lead the market due to their strong IT infrastructure and high adoption rates in sectors such as manufacturing and finance. In addition, the investment by the European Union in digital innovation has earmarked about €7.5 billion (USD 7.69 Billion) for the Digital Europe Programme for 2021-2027 to support the adoption of advanced cloud technology, including backup solutions.

Asia Pacific Cloud Backup Market Analysis

Rapid digitalization, rapidly growing cloud usage, and growing data security awareness have made the Asia-Pacific region a premier growth engine for the cloud backup market. Headlined by countries such as China, India, and Japan, in the next years, China's public cloud is expected to more than quadruple its size from USD 32 Billion in 2021 to USD 90 Billion by 2025, according to reports. The demand for scalable and reasonably priced backup solutions is being driven by the region's booming SME sector, which accounts for more than 96% of all enterprises, as per data by Asian Development Bank. The growth of e-commerce and digital payments increases the need for safe cloud backup solutions, with India's digital transactions surpassing USD 3 Trillion in 2022, as per reports. Many organizations are prioritizing data protection as cyberattacks, especially ransomware incidents, have become increasingly prevalent in recent times. Other digital projects, like South Korea's investment in 5G networks and India's Digital India program, will boost cloud-based technologies, such as backup solutions.

Latin America Cloud Backup Market Analysis

Cloud usage by SMEs, rising cyberthreats, and growing focus on data security drive the Latin American cloud backup market. Brazil and Mexico, being the leaders in the region, have shown growth in cloud computing at over 15% yearly basis, according to reports. In the quest to optimize operations while securing data, small and medium enterprises that exceed 99% of all companies in the region are quickly adopting cloud services. Increased ransomware attacks in recent years point to a pressing need for reliable cloud-based backup solutions. The investments of governments in digital infrastructure also include Mexico's Digital Economy Strategy, which urges companies to move to cloud computing. The e-commerce industry expansion is also creating a need for safe data recovery and storage; the industry is expected to reach over USD 100 Billion in sales by 2024, as per reports.

Middle East and Africa Cloud Backup Market Analysis

Initiatives for digital transformation, increasing cyberthreats, and the increasing use of cloud services in significant industries are some factors that support the market for cloud backup in the MEA region. As means of diversification, Middle Eastern governments are heavily investing in cloud infrastructure, as seen in Saudi Arabia's Vision 2030. The necessity for stringent data protection measures has been underlined by the rising growth of ransomware attacks in the region, which have surged sharply year after year. According to an industry report, with over 500 million internet users in 2023, Africa's rapid adoption of mobile and internet technologies is driving demand for cloud backup solutions, especially among SMEs. Cloud backup is being used by important industries like banking and healthcare to improve data security and guarantee adherence to global standards.

Competitive Landscape:

Key players in the cloud backup market are continuously innovating and expanding their offerings to meet the evolving needs of businesses. They are enhancing data security measures, including encryption and access controls, to address growing concerns over data breaches and compliance requirements. These players are also focusing on providing more seamless integration with other cloud services, enabling businesses to build comprehensive cloud ecosystems. Additionally, they are investing in artificial intelligence (AI) and machine learning (ML) technologies to improve data management, automate backup processes, and enhance disaster recovery capabilities. For instance, in July 2024, One Data, a German data management company, announced a €32 million Series B extension, co-led by Vsquared Ventures, Molten Ventures, and HV Capital, to scale its AI-powered data management platform globally. Furthermore, top companies are expanding their global data center presence to offer geo-redundant storage options and low-latency access, ensuring data reliability and accessibility.

The report provides a comprehensive analysis of the competitive landscape in the cloud backup market with detailed profiles of all major companies, including:

- Acronis International GmbH (Acronis AG)

- Amazon Web Services Inc. (Amazon.com Inc.)

- Asigra Inc

- Barracuda Networks Inc. (Thoma Bravo LP)

- Carbonite Inc. (OpenText Corporation)

- Code42 Software Inc.

- Datto Inc.

- Dropbox Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Veeam Software GmbH

- Vmware Inc. (Dell Technologies)

Latest News and Developments:

- October 2024: Having raised USD 127 million to transform cloud infrastructure backup, AEON has come out of stealth mode. For contemporary cloud-based systems, the company seeks to address issues with scalability, cost-effectiveness, and data accessibility. It offers a next-generation infrastructure for smooth data management, with a focus on removing the complexity of conventional backup procedures.

- September 2024: Google Cloud has added a new "Vault" option to its Backup and Disaster Recovery portfolio. Businesses can archive backups for long-term storage and regulatory compliance thanks to this function, which improves data protection. It is intended to facilitate safe, economical storage while guaranteeing that important data can be accessed in the event of an audit or recovery.

- November 2023: Amazon Web Services Inc. (Amazon.com Inc.) announced the introduction of a new application management tool, applications, which focuses on helping customers search for ways to operate their cloud workloads more cost-efficiently.

- June 2023: Asigra Inc. announced that it is building a successful partnership with D2C to provide secure cloud backup to innumerable channel partners.

- January 2023: Datto Inc. announced the availability of its second-generation family of cloud-managed switches, along with the global expansion of the early access for its secure remote access solution, Datto Secure Edge, to complement its existing product lines of Wi-Fi 6 access points and integrated secure routers.

Cloud Backup Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Service Providers Covered | Cloud Service Provider, Telecom and Communication Service Provider, Managed Service Provider, Others |

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Deployment Modes Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Verticals Covered | BFSI, Consumer Goods and Retail, Education, Government and Public Healthcare and Life Sciences, Manufacturing, Media and Entertainment, Telecommunication and ITES, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acronis International GmbH (Acronis AG), Amazon Web Services Inc. (Amazon.com Inc.), Asigra Inc., Barracuda Networks Inc. (Thoma Bravo LP), Carbonite Inc. (OpenText Corporation), Code42 Software Inc., Datto Inc., Dropbox Inc., International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Veeam Software GmbH, Vmware Inc. (Dell Technologies), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cloud backup market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cloud backup market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cloud backup industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cloud backup market was valued at USD 5.15 Billion in 2024.

IMARC estimates the cloud backup market to exhibit a CAGR of 16.14% during 2025-2033, expecting to reach USD 22.08 Billion by 2033.

The market is driven by the increasing need for secure data storage amid rising cyber threats, the growing adoption of remote work models, and the scalability of cloud solutions. Businesses seek cost-efficient, reliable backup systems to enhance operational continuity, comply with regulations, and support seamless disaster recovery strategies.

Large enterprises accounted for the largest segment by organization size, in the cloud backup market, holding a market share of 75.4%. This demand is driven by their need for scalable and reliable data storage solutions to handle massive volumes of business-critical information, ensure compliance with stringent regulatory frameworks, mitigate risks associated with cyberattacks, and support seamless disaster recovery mechanisms.

North America currently dominates the cloud backup market, accounting for a share exceeding 37.8% in 2024. This dominance is fueled by the rising demand for increasing adoption of advanced cloud technologies, a robust IT infrastructure, and rising concerns over data security and regulatory compliance across enterprises.

Some of the major players in the cloud backup market include Acronis International GmbH (Acronis AG), Amazon Web Services Inc. (Amazon.com Inc.), Asigra Inc., Barracuda Networks Inc. (Thoma Bravo LP), Carbonite Inc. (OpenText Corporation), Code42 Software Inc., Datto Inc., Dropbox Inc., International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Veeam Software GmbH, Vmware Inc. (Dell Technologies), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)