Cloud API Market Report by Type (SaaS APIs, PaaS APIs, IaaS APIs, Cross-platform APIs), Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Industry Vertical (Healthcare, BFSI, IT and Telecommunication, Manufacturing, Education, Media and Entertainment, and Others), and Region 2025-2033

Market Overview:

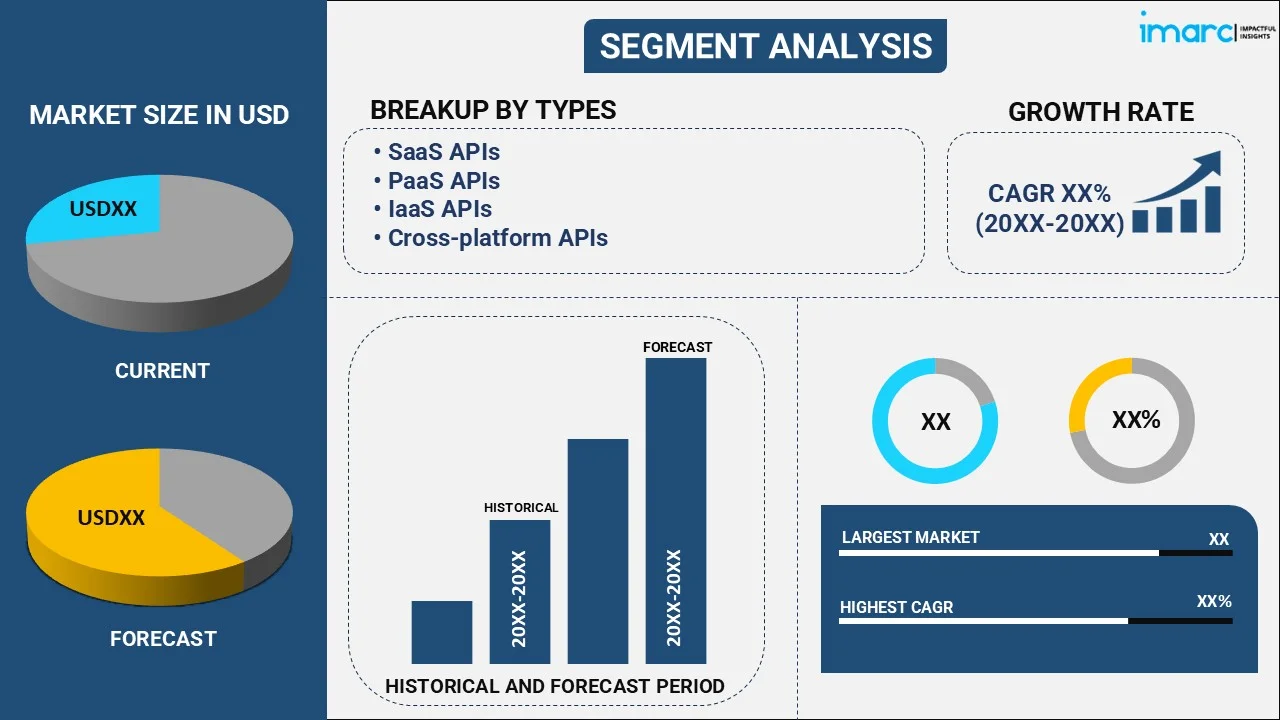

The global cloud API market size reached USD 1,325.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,729.3 Million by 2033, exhibiting a growth rate (CAGR) of 14.42% during 2025-2033. The growing adoption of microservices architecture across the globe, the widespread proliferation of big data and analytics solutions., and the increasing adoption of hybrid and multi-cloud strategies are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,325.8 Million |

| Market Forecast in 2033 | USD 4,729.3 Million |

| Market Growth Rate 2025-2033 | 14.42% |

Global Cloud API Market Analysis:

- Major Market Drivers: The global cloud API market growth is mainly driven by the rising adoption of cloud technologies and digital transformation initiatives across different industries. As businesses nowadays strive to enhance operational efficiency and improve customer experiences, they mainly rely on cloud APIs to provide seamless integration and real time data exchange between different systems and applications. In line with this the growing need for automation and advanced analytics also propels the demand for robust cloud apps that can handle complex interaction and also provide a scalable solution. Furthermore, the growth of IoT and AI technologies propels the demand for cloud APIs that support these innovations enabling smarter and more connected ecosystems. Nowadays are investing more in cloud API solutions to stay competitive and agile in a rapidly evolving digital landscape.

- Key Market Trends: There are several key global cloud API market trends that are shaping its growth and evolution across the world. One significant trend is the increasing emphasis on microservice architecture which allows the organizations to build more flexible and scalable applications. This shift towards micro services drives the demand for cloud native APIs that can seamlessly integrate and manage microservices components. In line with this, there is a growing focus on API security along with enhanced measures being implemented to protect data and prevent breaches in cloud environments. Moreover, the rise of artificial intelligence (AI) and machine learning (ML) integration within APIs enables more intelligent automation and predictive capabilities. In addition to this the adoption of open and hybrid cloud strategies is on the rise as businesses nowadays seek to optimize their cloud investments by ensuring compatibility and interoperability across various cloud environments thereby creating a positive outlook for global cloud API market growth.

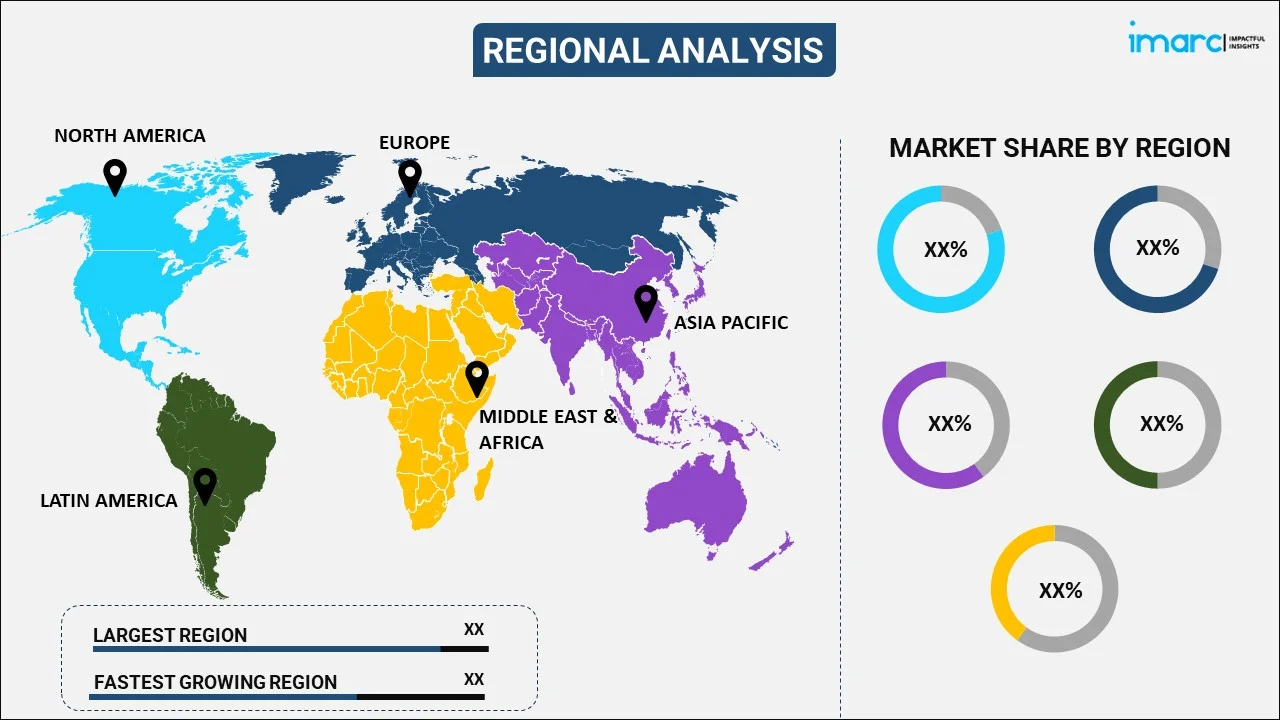

- Geographical Trends: Geographically, the global cloud API industry is experiencing robust growth in North America mainly due to the growing prevalence of project technology companies and a strong focus on enterprise grade cloud solutions. In Europe strict data protection regulations like General Data Protection Regulation (GDPR) are pushing the companies to adopt more secure and compliant cloud APIs. The Asia-Pacific region is witnessing a rapid growth because of the increasing digitalization with countries like China and India leading in mobile technology integration which boosts the demand for mobile friendly cloud APIs. In line with this, Latin America and Middle East are emerging as growing markets driven by digital transformation efforts in public and private sectors looking for cloud API to enhance connectivity and service delivery.

- Competitive Landscape: Some of the major market players in the cloud API industry Amazon Web Services, Inc., Axway, Broadcom Inc., Cloud Software Group, Inc., Google LLC, gravitee.io, International Business Machines Corporation, Kong Inc., Microsoft Corporation, Salesforce, Inc., SAP SE, Tyk Technologies, WSO2 LLC, among many others.

- Challenges and Opportunities:The global cloud API industry presents both significant challenges and opportunities. One of the major challenges is the complexity of managing API integration across various cloud services which can further lead to issues with interoperability and data consistency. Security is another critical concern as API's nowadays can be vulnerable to cyber-attacks necessitating robust security protocols and continuous monitoring. On the opportunity side, the increasing adoption of cloud services across all the sectors provides an extensive market for cloud APIs. In line with this, the growing demand for AI enhanced APIs that can provide advanced analytics and machine learning capabilities which offers businesses various new ways to harness their data for strategic insights.

Cloud API Market Trends/Drivers:

Accelerating Digital Transformation Initiatives

Digital transformation is sweeping across various industries, prompting businesses to adopt cloud-based solutions to remain competitive. As companies increasingly move their operations and data to the cloud, the role of cloud APIs in enabling these transitions becomes crucial. According to an article published by Supply Chain Movement, in spite of a contracting global economy, 60% of companies were intended to increase their investments in digitalization by 2023, with 94% striving for significant and swift results, according to BCG's "Mind the Tech Gap" survey. Additionally, the COVID-19 pandemic has acted as a catalyst for digital transformation, forcing businesses to adapt rapidly to remote work and digital service delivery. Cloud APIs have been instrumental in this accelerated shift, allowing quick adjustments to new business models and facilitating interoperability between various digital platforms. As organizations continue to invest in digital transformation strategies, the need for reliable and scalable cloud APIs will only grow, making them a cornerstone in the broader cloud ecosystem.

Heightening Security Concerns

In an increasingly interconnected digital landscape, the importance of secure data transactions cannot be overstated. Along with this, cloud APIs play a pivotal role in enforcing security protocols when data moves between applications and services. Advanced features, including token-based authentication, data encryption, and role-based access control are often built into cloud APIs to ensure secure communication. As cyber threats become more sophisticated, businesses are recognizing the need for robust security measures, and this is driving investments in secure and reliable cloud APIs. According to an article published by Forbes, cybercrime is on the rise because of increased interconnectivity and reliance on digital technologies. In 2023, over 343 million people fell victim to cyberattacks, and data breaches rose by 72% between 2021 and 2023, surpassing the previous record. As organizations deal with increasingly stringent data protection laws and compliance requirements, the demand for secure cloud APIs is poised to rise, making it a significant market driver.

Need for Operational Scalability and Efficiency

As businesses grow, the complexity of their operations and the need for scalable solutions is increasing. Cloud APIs offer an effective way to scale operations without significant upfront costs. They enable businesses to tap into cloud resources only as needed, thereby optimizing costs. This is especially beneficial for startups and SMEs, who often operate under budget constraints but need the flexibility to scale quickly as they grow. In confluence with this, cloud APIs also contribute to operational efficiency by enabling automation. According to an article published by Microsoft, there are 150 million startups in the world in 2022, with 50 million new ones launched each year. Every day, an average of 137,000 startups emerges. The ability to scale efficiently while maintaining operational robustness is critical for businesses in a competitive landscape. Therefore, the need for operational scalability and efficiency is a key driver for the cloud API industry.

Cloud API Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the cloud API market report, along with forecasts at the global, regional and country levels for 2025-2033. Our report has categorized the market based on type, enterprise size, and industry vertical.

Breakup by Type:

- SaaS APIs

- PaaS APIs

- IaaS APIs

- Cross-platform APIs

SaaS APIs holds the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes SaaS APIs, PaaS APIs, IaaS APIs, and cross-platform APIs. According to the report, SaaS APIs accounted for the largest global cloud API market share.

Software as a Service (SaaS) APIs are a distinct segment within the broader cloud API industry, and they have unique market drivers that fuel their growth. One key driver is the increasing adoption of SaaS applications in business operations. Organizations are integrating multiple SaaS solutions, such as CRM, ERP, and marketing automation tools to streamline their processes. SaaS APIs enable seamless integration between these applications and allow businesses to create a unified, efficient workflow. This eliminates data silos and enables real-time data sharing among departments, leading to improved operational efficiency and decision-making. Another significant driver is the need for customization and flexibility in SaaS applications. Off-the-shelf SaaS solutions may not meet the unique requirements of every business. In addition, APIs allow for easy customization, empowering organizations to tailor the software according to their specific needs. Furthermore, security and compliance are crucial factors, especially for businesses in regulated industries. SaaS APIs often come with built-in security features, ensuring secure data transmission between integrated applications. As companies continue to recognize the benefits of SaaS integration in enhancing productivity, security, and customization, the demand for SaaS APIs in the cloud API industry is expected to rise significantly, thereby creating a positive cloud API market outlook across the globe.

Breakup by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Large enterprises account for the majority of the market share

A detailed breakup and analysis of the market based on the enterprise size has also been provided in the report. This includes large enterprises, and small and medium enterprises (SMEs). According to the report, large enterprises accounted for the largest market share.

For large enterprises, the market drivers behind the adoption of cloud APIs are multifaceted and rooted in both operational and strategic imperatives. One of the primary drivers is the need for digital transformation at scale. Large organizations often have complex, legacy IT infrastructures that require modernization. Cloud APIs facilitate the seamless integration of legacy systems with new cloud-based solutions, enabling a smoother transition and operational continuity. Another significant driver is globalization. As large enterprises expand geographically, they need to standardize their IT operations across multiple locations. Cloud APIs allow for this standardization, enabling businesses to operate cohesively on a global scale. In confluence with this, data analytics and business intelligence are also key considerations. Large enterprises generate and process vast amounts of data. Cloud APIs provide the connectivity needed for powerful analytics tools to access this data in real-time, driving data-driven decision-making. Additionally, compliance and security are paramount for large organizations, especially those in regulated industries. Cloud APIs offer robust security features, helping enterprises meet regulatory requirements.

Breakup by Industry Vertical:

- Healthcare

- BFSI

- IT and Telecommunication

- Manufacturing

- Education

- Media and Entertainment

- Others

Healthcare holds the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes healthcare, BFSI, IT and telecommunication, manufacturing, education, media and entertainment, and others. According to the report, healthcare accounted for the largest market share.

In the healthcare sector, cloud APIs are increasingly becoming vital tools, driven by several market forces. One of the primary drivers is the need for interoperability between various healthcare systems. Cloud APIs allow for seamless integration of these disparate systems, facilitating secure and efficient data exchange. This is particularly important for patient care, where timely access to accurate information can be life saving. Another critical driver is regulatory compliance. In confluence with this, cloud APIs designed for healthcare often come with built-in security features that help organizations meet these compliance standards. Additionally, the growing adoption of telemedicine and remote patient monitoring technologies, accelerated by the COVID-19 pandemic, has amplified the need for robust, secure, and scalable cloud APIs to handle data transmission and integration. These collective market drivers make cloud APIs increasingly indispensable in modern healthcare infrastructures.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest cloud API market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America exhibits the largest segment.

In North America, the cloud API industry is experiencing robust growth, fueled by the region's advanced technological infrastructure and high rate of digital adoption among businesses and consumers. This creates fertile ground for cloud services, which in turn drives demand for cloud APIs to facilitate integration, scalability, and functionality. Another key driver is the strong presence of leading cloud service providers and technology companies in the region, which not only drives competition but also innovation in cloud API offerings. Cybersecurity concerns, particularly in sectors, such as finance and healthcare, are also leading to increased investment in secure and reliable cloud APIs. North American businesses are often at the forefront of compliance requirements, such as GDPR, CCPA, and HIPAA, making robust API security features a necessity. Additionally, the rise of remote work and digital transformation strategies, accelerated by the COVID-19 pandemic, has stimulated the need for cloud APIs that enable seamless, secure, and efficient operational transitions.

Competitive Landscape:

The key players are continuously innovating and expanding their offerings. They invest in research and development to introduce new features, improve performance, and enhance security. Along with this, scalability is a key focus for companies in this market. They are optimizing their APIs to handle increasing workloads and traffic, ensuring that businesses can seamlessly scale their applications. With the growing importance of data security, companies in this sector are dedicated to enhancing the security features of their APIs. This includes encryption, authentication, and authorization mechanisms. In addition, cloud API providers are focusing on cost optimization, offering flexible pricing models and tools to help businesses monitor and control their API usage costs effectively. Therefore, this is significantly supporting the market. In addition, brands are actively engaged in educating the market about the benefits and use cases of their cloud APIs, positioning themselves as experts in their respective domains. Furthermore, collaborations with other technology companies and platforms are contributing to the market.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Amazon Web Services, Inc.

- Axway

- Broadcom Inc.

- Cloud Software Group, Inc.

- Google LLC

- gravitee.io

- International Business Machines Corporation

- Kong Inc.

- Microsoft Corporation

- Salesforce, Inc.

- SAP SE

- Tyk Technologies

- WSO2 LLC

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- In June 2023, Amazon Web Services Inc. (Amazon.com Inc.) announced that Old Mutual had shut down its on-site data centres and moved its complete IT infrastructure, including its banking, insurance, and wealth management systems, to AWS. The move is a significant development in Old Mutual's digital transition.

- In June 2023, Broadcom Inc. announced a new, multibillion-dollar deal to provide wireless processors and radio frequency components for 5G.

- In May 2023, Dell Technologies Inc. and Nvidia announced Project Helix, which will provide a number of full-stack solutions based on their own infrastructure and software, with technical know-how and ready-made tools.

Cloud API Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | SaaS APIs, PaaS APIs, IaaS APIs, Cross-platform APIs |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises (SMEs) |

| Industry Verticals Covered | Healthcare, BFSI, IT and Telecommunication, Manufacturing, Education, Media and Entertainment, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Amazon Web Services, Inc., Axway, Broadcom Inc., Cloud Software Group, Inc., Google LLC, gravitee.io, International Business Machines Corporation, Kong Inc., Microsoft Corporation, Salesforce, Inc., SAP SE, Tyk Technologies, WSO2 LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cloud API market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cloud API market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cloud API industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global cloud API market was valued at USD 1,325.8 Million in 2024.

We expect the global cloud API market to exhibit a CAGR of 14.42% during 2025-2033.

The rising deployment of cloud API software across various industries, such as manufacturing, healthcare, education, etc., to enhance customer experience, increase productivity, improve connectivity, collaboration, and cost-effectiveness, etc., is primarily driving the global cloud API market.

The sudden outbreak of the COVID-19 pandemic has led to the growing adoption of cloud API software for faster communication means and software patched distribution with ease to streamline updates, during the remote working scenario.

Based on the type, the global cloud API market can be segmented into SaaS APIs, PaaS APIs, IaaS APIs, and cross-platform APIs. Currently, SaaS APIs hold the majority of the total market share.

Based on the enterprise size, the global cloud API market has been divided into large enterprises and Small and Medium Enterprises (SMEs), where large enterprises currently exhibit a clear dominance in the market.

Based on the industry vertical, the global cloud API market can be categorized into healthcare, BFSI, IT and telecommunication, manufacturing, education, media and entertainment, and others. Among these, the healthcare sector accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global cloud API market include Amazon Web Services, Inc., Axway, Broadcom Inc., Cloud Software Group, Inc., Google LLC, gravitee.io, International Business Machines Corporation, Kong Inc., Microsoft Corporation, Salesforce, Inc., SAP SE, Tyk Technologies, and WSO2 LLC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)