Clinical Laboratory Services Market Size, Share, Trends and Forecast by Test Type, Service Provider, Application, and Region, 2025-2033

Clinical Laboratory Services Market Size and Share:

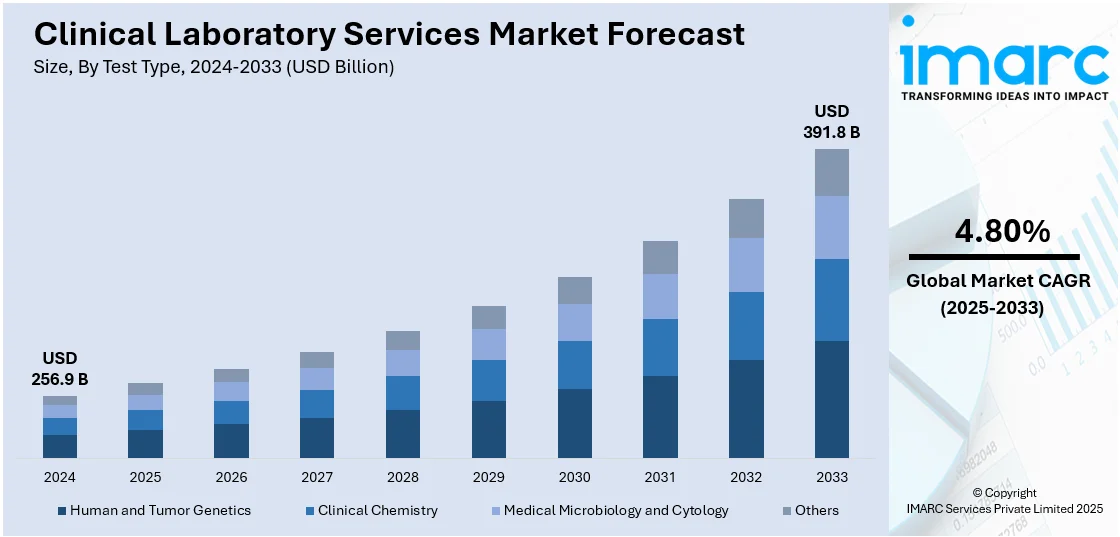

The global clinical laboratory services market size was valued at USD 256.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 391.8 Billion by 2033, exhibiting a CAGR of 4.80% during 2025-2033. North America currently dominates the market, holding a significant market share of over 39.2% in 2024. The growing demand for diagnostic tests, such as blood glucose tests, HbA1c testing, and lipid profiles to manage diabetes, rising reliance on telehealth to access clinical laboratory services as it can reduce barriers to healthcare and increase overall testing volumes, and the increasing trend of precision medicines are positively fueling the clinical laboratory services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 256.9 Billion |

|

Market Forecast in 2033

|

USD 391.8 Billion |

| Market Growth Rate 2025-2033 | 4.80% |

The clinical laboratory services market is driven by several key factors. The rising global burden of chronic and infectious diseases necessitates early and accurate diagnostics, boosting demand for lab testing. Technological advancements, including automation, molecular diagnostics, and AI-based tools, have improved test precision, speed, and efficiency, enhancing overall service delivery. An aging population, more prone to health issues, further drives the need for regular and specialized testing. Increased awareness of preventive healthcare and wellness screenings also contributes to market expansion. Moreover, the growth of personalized medicine and companion diagnostics has increased the demand for advanced laboratory services. Government initiatives, improved healthcare access, and the expansion of health insurance coverage additionally support the growing role of clinical laboratories in modern healthcare.

The clinical laboratory services market growth in the United States is fueled by the rising prevalence of chronic diseases like cancer, diabetes, and cardiovascular disorders, which is fueling the demand for diagnostic testing. Advancements in laboratory technologies, including molecular diagnostics and automation, are enhancing test accuracy and turnaround times. An aging population, growing health awareness, and the emphasis on preventive care are further accelerating the need for routine and specialized lab services. Additionally, expanding insurance coverage and government support for early disease detection contribute to market growth. The rise of personalized medicine also drives demand for advanced clinical laboratory testing in the U.S. For instance, in June 2024, the US laboratory services firm Labcorp introduced Labcorp Global Trial Connect, a collection of central laboratory solutions aimed at speeding up clinical trials, especially at investigator locations. The collection of digital and data solutions seeks to improve trial efficiency, minimize data lags, and simplify workflows at investigator sites. It is accessible to current clients of Labcorp Central Laboratory and aims to accelerate the initiation of clinical trials, sustain study progress, and improve trial efficiency.

Clinical Laboratory Services Market Trends

Rising prevalence of diabetes

There is a rise in the demand for diagnostic tests, including HbA1c testing, blood glucose tests, and lipid profiles, to manage diabetes. These tests are also crucial for diagnosing diabetes, monitoring blood sugar levels, and assessing associated cardiovascular risk factors. To effectively manage diabetes, there is a need to monitor blood glucose levels regularly. Clinical laboratories are very essential as they can help in monitoring glycemic control, kidney function, lipid levels, and other biomarkers. For preventing complications, such as diabetic retinopathy, nephropathy, and neuropathy, clinical laboratories perform screening tests. These screening tests allow for timely intervention that can assist in preventing progression of diabetes. People prefer point-of-care testing (POCT) as it allows rapid testing and immediate results. This testing is more successful for monitoring patients with diabetes. As per the data published on the website of IDF Diabetes Atlas, it is projected that around 783 million people will be suffering from diabetes by 2045.

Growing demand for precision medicine

The IMARC Group’s report shows that the global precision medicine market reached USD 75.2 Billion in 2023. Genetic testing, genomic sequencing, and molecular diagnostics are important for precision medicines to identify biomarkers, genetic variations, and specific molecular targets. According to the clinical laboratory services market forecast, these tests are performed in clinical laboratories, as they help in predicting disease risks, selecting the most effective therapies as an individual’s genetic characteristic, and guiding treatment decisions. To develop and perform companion diagnostics, clinical laboratories are very crucial, which is strengthening the market growth. Companion diagnostics are tests used to identify biomarkers to calculate the success rate of any specific targeted therapy. After knowing this, treatment choices in oncology, infectious diseases, and other therapeutic areas can be optimized. It is very important to analyze genetic variations to monitor the respond of medications in individuals, and pharmacogenomic plays an important role in this analysis. Clinical laboratories provide pharmacogenomic testing to predict drug efficacy, dosage requirements, and potential adverse reactions.

Increasing trend of telehealth

People prefer telehealth nowadays, as it can help connect with doctors even if they are in remote locations. They can also access clinical laboratory services through telehealth platforms, reducing barriers to healthcare and increasing overall testing volumes. It becomes easy to monitor chronic conditions like diabetes remotely through telehealth. Clinical laboratories are very important for the ongoing management of these diseases and improving patient outcomes. Major players operating in the telehealth market are focusing on collaborations and partnerships to expand their customer base. For instance, in 2023, Zoom Video Communications, Inc. and Oracle extended their partnership to provide healthcare services that are quicker, simpler, and more efficient. Home-based kits are distributed by clinical laboratories, and then they process the samples collected at home to provide accurate diagnostic results remotely through telehealth platforms, thereby offering a favorable clinical laboratory services market outlook.

Clinical Laboratory Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global clinical laboratory services market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on test type, service provider, and application.

Analysis by Test Type:

- Human and Tumor Genetics

- Clinical Chemistry

- Medical Microbiology and Cytology

- Others

Clinical chemistry stands as the largest test type in 2024, holding 46.7% of the market share. Clinical chemistry can be defined as a broad range of tests that assess the biochemical components of blood, urine, and other bodily fluids. To diagnose and track a variety of medical disorders, these tests are important as they can provide vital information on hormone levels, organ function, electrolyte balance, and metabolic processes. Regular health screenings and follow-up care for patients with chronic diseases also include many clinical chemistry tests. To evaluate general health status and identify problems, tests such as complete metabolic panels (CMP) and basic metabolic panels (BMP) are frequently ordered.

Analysis by Service Provider:

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

Hospital-based laboratories lead the market with 53.6% of market share in 2024. Hospital-based laboratories are essential components of healthcare facilities as they are closely linked to the whole range of patient services. Within the hospital setting, they provide diagnostic services for surgical units, outpatient clinics, inpatients, and patients in the emergency room. A wide variety of diagnostic tests are usually available at hospital laboratories to support different patient demographics and medical specialties. Clinical chemistry, hematology, immunology, microbiology, molecular diagnostics, and pathology services are all included in this. They offer a one-stop shop for a variety of diagnostic testing requirements.

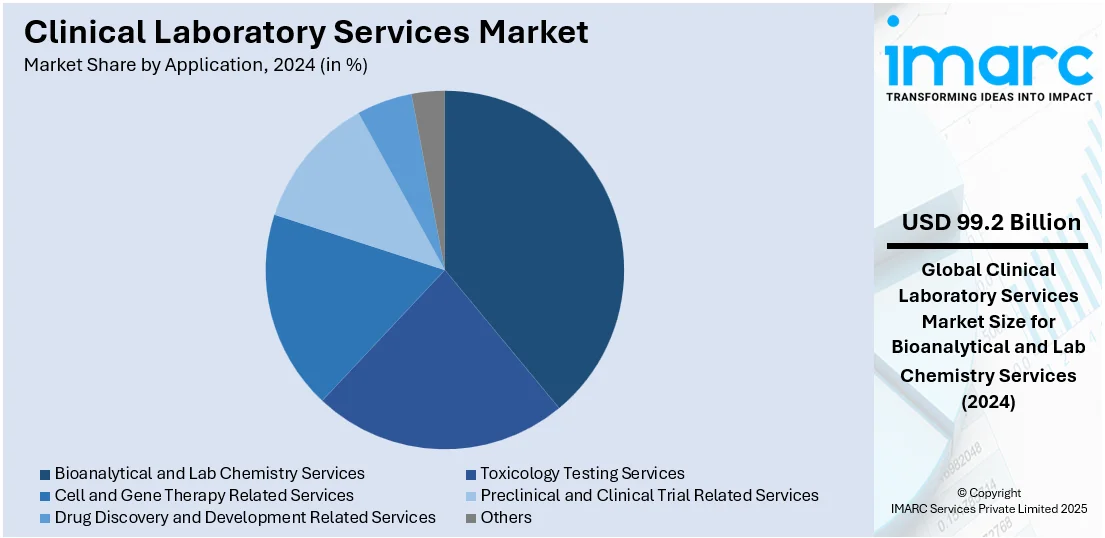

Analysis by Application:

- Bioanalytical and Lab Chemistry Services

- Toxicology Testing Services

- Cell and Gene Therapy Related Services

- Preclinical and Clinical Trial Related Services

- Drug Discovery and Development Related Services

- Others

Bioanalytical and lab chemistry services lead the market with around 38.6% of market share in 2024. Clinical diagnostics and biomedical research depend heavily on a wide range of tests and analyses that are provided by bioanalytical and lab chemistry services. Assays for biomarkers, drug concentrations, metabolites, and other biochemical components in biological samples are among the services provided by these labs. Pharmacokinetic (PK) and pharmacodynamic (PD) investigations are two important steps in the drug development process that bioanalytical services provide for the pharmaceutical and biotechnology industries. Clinical laboratories offer bioanalytical services for measuring drug concentrations in biological matrices, evaluating medication safety and efficacy in clinical trials, and assessing drug metabolism.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.2%. North America has highly developed healthcare systems with cutting-edge infrastructure and widespread access to healthcare services, especially in the United States and Canada. This includes a reputable network of clinics, hospitals, and diagnostic labs that provide a wide range of clinical laboratory services. When it comes to healthcare spending worldwide, the US regularly comes in top. The rapid rise of clinical laboratory services can be attributed to the significant investments made in healthcare infrastructure, technology, and services. The market-driving initiatives of illness monitoring, tailored medication, and diagnostic testing are bolstered by healthcare spending. Key players operating in the US are also focusing on providing tests that support novel technology. For instance, in 2023, Dutch biotech firm Detact Diagnostics’ announced about its plans to begin bacterial detection sampling at its laboratory in the Keene State College situated in the US.

Key Regional Takeaways:

United States Clinical Laboratory Services Market Analysis

In 2024, the United States accounted for 88.50% of the clinical laboratory market in North America. The United States is experiencing a surge in clinical laboratory services adoption driven by the increasing trend of telehealth. For instance, more than seven billion clinical lab tests are performed in the U.S. each year, providing critical data for a relatively small expenditure. As more patients access remote consultations and digital health platforms, the demand for timely and accurate diagnostic support continues to expand. Clinical laboratories are playing a central role in supporting these virtual health services, offering integrated test processing and dissemination results through electronic health records and patient portals. The seamless coordination between telehealth providers and diagnostic labs enables faster treatment decisions, improving overall patient management. Healthcare providers increasingly rely on these services to enhance chronic disease monitoring, acute illness diagnosis, and preventive care assessments. This shift aligns with broader digital health adoption and reimbursement frameworks, fueling continued investment in clinical laboratory services infrastructure to meet growing national demand.

Asia Pacific Clinical Laboratory Services Market Analysis

Asia-Pacific is witnessing rising clinical laboratory services adoption due to the growing prevalence of diabetes across the region. For instance, according to a 2023 study by the Indian Council of Medical Research-India Diabetes (ICMR INDIAB), 10.1 crore people have diabetes. This chronic condition demands frequent monitoring and diagnostic interventions, including blood glucose analysis, HbA1c testing, and related screenings. The increasing burden of diabetes is placing clinical laboratories at the forefront of disease management strategies, with healthcare systems integrating regular lab diagnostics into outpatient and community care settings. Additionally, growing health awareness and expanding access to medical facilities contribute to higher test volumes. Patients seek regular monitoring for disease progression and treatment response, pushing laboratories to scale operations. Public and private health institutions are actively expanding their diagnostic capabilities to accommodate this trend, positioning clinical laboratory services as a crucial component in controlling the diabetes epidemic across diverse population groups.

Europe Clinical Laboratory Services Market Analysis

Europe is experiencing a rapid rise in clinical laboratory services adoption, attributed to significant investments made in healthcare infrastructure, technology, and services. For instance, France (11.9%), Germany (12.6%), and Austria (11.2%) had the highest current healthcare spending as a percentage of GDP in 2022 among EU nations. Governments and private entities are channeling resources into modernizing diagnostic capabilities, automating laboratory workflows, and enhancing data interoperability across systems. These upgrades facilitate quicker test results, higher testing volumes, and better integration with healthcare delivery networks. Technological advancements, including molecular diagnostics and high-throughput platforms, are being widely implemented, transforming traditional laboratory environments into dynamic hubs for precision medicine. Additionally, healthcare policy reforms are supporting broader access to diagnostic services, encouraging regular screenings and early disease detection.

Latin America Clinical Laboratory Services Market Analysis

Latin America is expanding its clinical laboratory services adoption in response to increasing healthcare facilities and privatization. The National Confederation of Health (CNSaúde) and the Brazilian Federation of Hospitals (FBH) report that 62% of Brazil's 7,191 hospitals are private. As private healthcare providers enter the market, investments in diagnostic capabilities grow, leading to a rise in clinical lab testing volumes. Enhanced infrastructure, supported by modern diagnostic tools and expanding hospital networks, is improving access to laboratory services. This growth aligns with rising demand from patients utilizing healthcare facilities more frequently, including those relying on routine and preventive care. The privatization trend is accelerating service quality improvements.

Middle East and Africa Clinical Laboratory Services Market Analysis

The Middle East and Africa are observing greater clinical laboratory services adoption due to rising demand for diagnostic tests such as blood glucose tests, HbA1c testing, and lipid profiles. For instance, the International Diabetes Federation (IDF) reports that the prevalence of diabetes is 9.3% globally and 16.3% in the United Arab Emirates. Growing awareness of chronic diseases and preventive care is prompting individuals to seek early and accurate diagnosis. Health systems across the region are strengthening diagnostic capabilities to meet increasing test volumes. Expanding access to primary care and diagnostic services is positioning clinical laboratories as key players in disease monitoring and treatment support.

Competitive Landscape:

Leading clinical laboratory services companies are aggressively pursuing a range of tactics to fortify their positions in the market and satisfy the expanding need for diagnostic tests. Businesses are reaching more patients worldwide and providing a wider choice of tests by partnering with other companies and increasing their service portfolios through acquisitions. For instance, in 2023, Tufts Medicine, a preeminent integrated academic health system in Massachusetts, and Labcorp, a global leader in innovative and comprehensive laboratory services, announced an agreement to purchase the Tufts Medicine outreach laboratory business and certain operating assets as a precursor to a more extensive strategic partnership. Major firms are also making significant investments in cutting-edge technologies including automation, digital pathology, and next-generation sequencing to increase the precision, effectiveness, and turnaround times of their services. By creating and utilizing specific tests for genetic and molecular diagnostics, they are also concentrating on customized medicine, which supports precision medicine and focused therapeutics.

The report provides a comprehensive analysis of the competitive landscape in the clinical laboratory services market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Becton

- Dickinson and Company

- bioMérieux SA

- Charles River Laboratories

- F. Hoffmann-La Roche Ltd

- Illumina Inc.

- NeoGenomics Laboratories Inc.

- Quest Diagnostics Incorporated

- Siemens Healthcare GmbH (Siemens AG)

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- April 2025: Apollo Diagnostics launched a fully automated Digi-Smart Central Reference Laboratory in Chennai, integrating five clinical laboratory services to reduce turnaround time by 60%. The 45,000-square-foot facility can process over 100,000 samples daily and supports faster diagnostics across India and Southeast Asia.

- April 2025: Scientist.com launched Clinical Labs Navigator™ to enhance clinical laboratory services by streamlining procurement, reducing costs, and accelerating study timelines. The platform supports integrated collaboration between sponsors and CROs, improved budget management, and strengthened compliance in clinical research execution.

- April 2025: Labcorp successfully acquired the ambulatory outreach laboratory division of North Mississippi Health Services, and it now serves as the referral laboratory for seven clinics and hospitals. The action promotes continuity of treatment in communities throughout North Mississippi and increases access to Labcorp's clinical laboratory services. Three new patient service centers are also being planned in Tupelo, West Point, and Amory to strengthen regional clinical laboratory services.

- March 2025: IQVIA Laboratories launched Site Lab Navigator, an e-Requisition solution designed to streamline clinical trial workflows and enhance data accuracy within clinical laboratory services. The platform replaces manual processes with digital requisitioning, reduced site burden, minimized errors, and improved sponsor compliance.

- January 2025: Quest Diagnostics completed the acquisition of the outreach clinical laboratory services business of University Hospitals, expanding access to its diagnostic test menu and health plan network in Ohio. Clinical laboratory services for University Hospitals’ patients and providers were transitioned to Quest’s labs in Twinsburg and Pittsburgh.

Clinical Laboratory Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types | Human and Tumor Genetics, Clinical Chemistry, Medical Microbiology and Cytology, Others |

| Service Providers | Hospital-Based Laboratories, Stand-Alone Laboratories, Clinic-Based Laboratories |

| Applications | Bioanalytical and Lab Chemistry Services, Toxicology Testing Services, Cell and Gene Therapy Related Services, Preclinical and Clinical Trial Related Services, Drug Discovery and Development Related Services, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Becton, Dickinson and Company, bioMérieux SA, Charles River Laboratories, F. Hoffmann-La Roche Ltd, Illumina Inc., NeoGenomics Laboratories Inc., Quest Diagnostics Incorporated, Siemens Healthcare GmbH (Siemens AG), Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the clinical laboratory services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global clinical laboratory services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the clinical laboratory services industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The clinical laboratory services market was valued at USD 256.9 Billion in 2024.

The clinical laboratory services market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 391.8 Billion by 2033.

Key factors driving the clinical laboratory services market include rising demand for early disease diagnosis, increasing prevalence of chronic conditions, advancements in diagnostic technologies, and a growing aging population. Additionally, personalized medicine, preventive healthcare trends, and expanded health insurance coverage are further boosting the need for clinical testing and laboratory services.

North America currently dominates the clinical laboratory services market due to advanced healthcare infrastructure, rising chronic diseases, an aging population, and technological innovations.

Some of the major players in the clinical laboratory services market include Abbott Laboratories, Becton, Dickinson and Company, bioMérieux SA, Charles River Laboratories, F. Hoffmann-La Roche Ltd, Illumina Inc., NeoGenomics Laboratories Inc., Quest Diagnostics Incorporated, Siemens Healthcare GmbH (Siemens AG), Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)