Class D Audio Amplifier Market Size, Share, Trends and Forecast by Amplifier Type, Device, End Use, and Region, 2025-2033

Class D Audio Amplifier Market Size and Share:

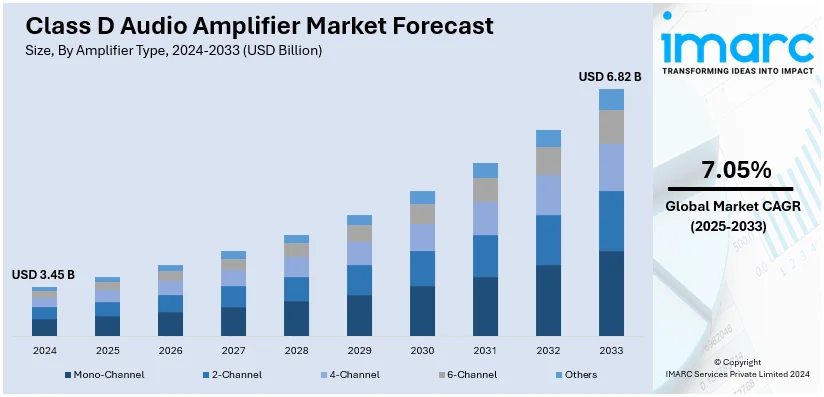

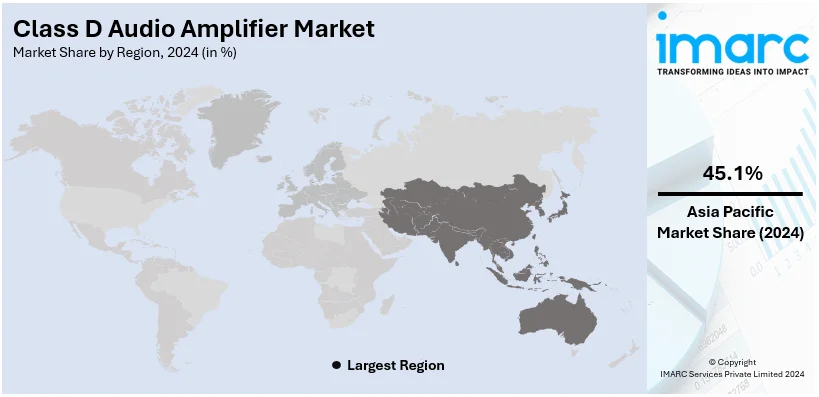

The global class D audio amplifier market size reached USD 3.45 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.82 Billion by 2033, exhibiting a growth rate (CAGR) of 7.05% during 2025-2033. Asia Pacific currently dominates the market in 2024. The escalating demand for compact audio solutions across diverse applications, the rising trend toward wireless and portable devices, advancements in semiconductor technology and digital signal processing, and stringent energy efficiency regulations are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.45 Billion |

|

Market Forecast in 2033

|

USD 6.82 Billion |

| Market Growth Rate (2025-2033) | 7.05% |

The global class D audio amplifier market is driven by growing consumer demand for energy-efficient audio solutions, as these amplifiers offer high power efficiency and minimal heat dissipation. Along with this, the rising popularity of portable and wireless audio devices, such as Bluetooth speakers, soundbars, and headphones, is positively influencing demand for compact and lightweight amplifiers. On 20th August 2024, Marshall introduced two new portable Bluetooth speakers in India: The Emberton III and Willen II. The Emberton III delivers Marshall’s signature sound with Dynamic Loudness for clear audio at any volume, powered by two 38W Class D amplifiers. It features two 2” 10W full-range drivers and two passive radiators, ensuring robust sound performance. Additionally, advancements in audio technology, including improved sound quality and integration with digital platforms, are further fueling market growth. Besides this, the increasing penetration of smart home systems and IoT devices is increasing the need for advanced audio solutions. Moreover, the rise in entertainment and media consumption across the globe continues to support the expansion of the Class D audio amplifier market.

The United States stands out as a key regional market, primarily driven by the escalating adoption of advanced home audio systems and the increasing preference for premium sound experiences across entertainment platforms. Rising consumer awareness of eco-friendly technologies is encouraging the use of energy-efficient amplifiers, aligning with sustainability goals. The integration of audio amplifiers in automotive systems, especially with the growing trend toward electric vehicles, is also accelerating the demand. Rapid advancements in digital signal processing (DSP) technology are enhancing the capabilities of Class D amplifiers, making them a preferred choice for modern audio applications. Furthermore, robust investments in smart consumer electronics and the proliferation of connected devices are creating a positive market outlook.

Class D Audio Amplifier Market Trends:

Growing Consumer Electronics Demand

The increasing popularity of consumer electronics, such as smartphones, tablets, and home audio systems, is enhancing the demand for compact and efficient audio amplifiers. According to IBEF, by 2025, India's consumer electronics and appliances industry is predicted to be the fifth largest in the world. By 2025, the Indian Appliances and Consumer Electronics (ACE) industry is expected to have nearly doubled in size, with a projected value of USD 17.93 billion (INR 1.48 lakh crore). The Indian consumer electronics and appliances market is expected to more than double in value from its 2021 valuation of USD 9.84 billion to INR 1.48 lakh crore (USD 21.18 billion) by 2025. Electronics hardware production in the country stood at USD 87 billion in 2022. India's consumer electronics and home appliances market is set to grow by USD 2.3 billion between 2022 and 2027, exhibiting a CAGR of 1.31%. According to the Class D audio amplifier market forecast, the continuous evolution of consumer electronics and increasing requirement for better audio quality in smaller form factors are projected to facilitate the adoption of Class D amplifiers, thereby contributing to the market growth significantly.

Significant Advancements in Technology

Innovations in semiconductor technology and digital signal processing (DSP) enhance the performance and capabilities of Class D amplifiers. For instance, in January 2023, Infineon Technologies AG introduced its latest generation of MERUS multilevel Class D audio amplifiers. Durable music playback performance in small, affordable, and power-efficient designs is essential, particularly for battery-operated applications. A number of Infineon's ecosystem partners are now prepared to assist prospective clients with their design-in initiatives. Partnering with the experts, the company aims to increase the adoption of new and innovative technology. With a special Class D modulation of up to five distinct output voltage levels, Infineon's Class D audio amplifiers allow for high-fidelity sound playback. These advancements allow for better sound quality, reduced distortion, and the integration of features such as wireless connectivity which are creating a positive Class D audio amplifier market outlook across the globe.

Rising Automotive Audio Integration

The growing integration of high-quality audio systems in vehicles drives the demand for efficient and space-saving Class D amplifiers. For instance, in May 2024, Automobili Lamborghini and Sonus Faber announced a collaboration to offer Sonus Faber’s automotive audio system in the Lamborghini Revuelto. As an optional feature on the Revuelto starting in May 2024, the partnership offers an in-car system with Italian craftsmanship, artistry, and a long history of excellence. The new Revuelto will be the first Lamborghini vehicle available to be customized with Sonus Faber’s inimitable automotive audio system, which was born out of the joint efforts of the R&D and design division of Sonus Faber and the Lamborghini Centro Stile.

Class D Audio Amplifier Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global class D audio amplifier market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on amplifier type, device, and end use.

Analysis by Amplifier Type:

- Mono-Channel

- 2-Channel

- 4-Channel

- 6-Channel

- Others

Mono-channel leads the market in 2024. The demand for mono-channel Class D audio amplifiers is driven by their superior power efficiency, compact size, and high output, making them ideal for applications in subwoofers and portable audio devices. The growth in consumer electronics, such as smart speakers and soundbars, and the increasing adoption of advanced audio systems in automobiles also contribute to this demand. Additionally, mono-channel amplifiers are cost-effective and simplify design, making them attractive for manufacturers focusing on single-channel applications. As vehicles become more equipped with advanced infotainment systems, the need for dedicated amplification for each speaker or audio zone within the car accelerates the demand for mono-channel amplifiers. Furthermore, the compatibility of mono-channel amplifiers with various audio configurations and their ability to deliver consistent power output make them an ideal choice for specific applications, thus driving the Class D audio amplifier demand.

Analysis by Device:

- Television Sets

- Home Audio Systems

- Desktop and Laptops

- Automotive Infotainment Systems

- Others

Home audio systems lead the market in 2024 due to the increasing trend of smart homes and integrated entertainment solutions, which has driven the demand for sophisticated audio systems that seamlessly integrate with other smart devices. Besides this, a growing emphasis on personalized audio experiences, including immersive soundscapes and multi-room audio setups, fuels the need for high-quality and versatile home audio systems. Moreover, advancements in wireless technologies enable convenient connectivity, allowing users to stream audio content effortlessly from various devices. Additionally, the rising awareness of superior audio quality among consumers prompts them to invest in premium audio solutions, propelling the market for high-end home audio systems.

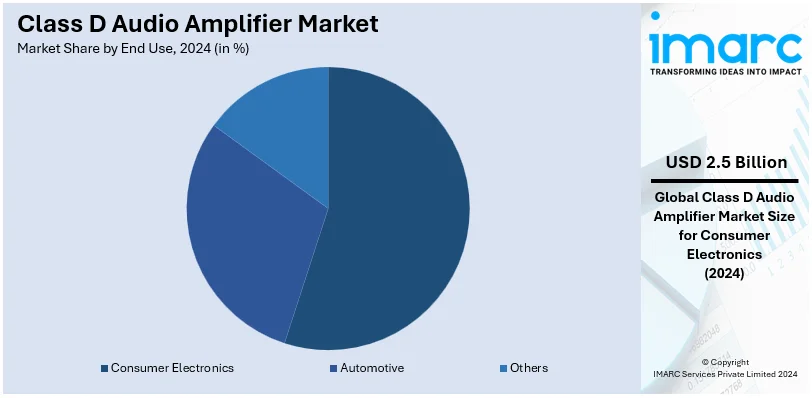

Analysis by End Use:

- Automotive

- Consumer Electronics

- Others

Consumer electronics lead the market in 2024. The consumer electronics segment is experiencing substantial growth, propelled by the escalating consumer demand for sleek, feature-rich gadgets, such as smartphones, tablets, and smart TVs. These devices require compact yet efficient audio solutions, making Class D audio amplifiers an ideal choice due to their energy-efficient and space-saving attributes. Besides this, the rise in wireless audio devices such as wireless headphones and portable speakers necessitates power-efficient amplification, where Class D amplifiers excel. Moreover, the growing trend of integrating voice assistants and AI-driven features into consumer electronics products accentuates the need for clear and high-quality audio output, further enhancing the demand for advanced audio amplification technologies.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share. The Asia Pacific region's growth in the market is underpinned by several significant factors, such as the region's burgeoning population and rising disposable incomes, which have increased the demand for consumer electronics, automotive infotainment, and home entertainment systems. Some of the other major Class D audio amplifier market growth factors in the Asia Pacific region include rapid urbanization and increasing urban lifestyle adoption fostering the demand for portable audio devices, aligning with the efficiency and compactness offered by Class D amplifiers. According to UN-Habitat, 54% of the global urban population, more than 2.2 billion people, live in Asia. By 2050, the urban population in Asia is anticipated to grow by around 50% an additional 1.2 billion people. In line with this, the region's manufacturing prowess and cost-effective production capabilities attract amplifier manufacturers, leading to localized production and supply chain efficiencies. Furthermore, the region's growing technological expertise and emphasis on innovation are further influencing the Class D audio amplifier market dynamics positively.

Key Regional Takeaways:

United States Class D Audio Amplifier Market Analysis

The Class D audio amplifier market in the United States is growing due to the rising product need in the consumer electronics and automotive industries, particularly for small, energy-efficient audio systems. The class D amplifier usage, as expected, is projected to be led by the increased use of soundbars and home theatre systems in the U.S. consumer electronics market growing at 5% per annum between 2024 and 2034 according to industrial reports. They provide the ideal performance for applications in contemporary, thin designs for electrical systems due to its high efficiency (up to 90%) and a reduction in heat dissipation.

The car market is also increasing due to the demand of the auto industry for complex infotainment systems. Reports are stating that in 2023, the sales of cars in the U.S. automobile market are expected to be 15.36 million, an increase of 12.4% as compared to the sales in 2022. Upgraded audio systems were installed in almost 80% of new cars sold in 2023. Class D amplifiers are chosen due to their low power consumption and small size. Class D amplifiers power the public address systems and concert equipment. The pro-audio industry has increased its demands for these amplifiers due to rising concerns about sustainability and the need for energy-efficient solutions in business and residential premises.

Europe Class D Audio Amplifier Market Analysis

The main drivers of the European Class D audio amplifier market are the sophisticated automobile sector and the extensive use of home entertainment systems in the region. The EU auto market achieved a volume of 10.5 million units in 2023 following strong growth of 13.9% from 2022, according to the European Automobile Manufacturers' Association. The majority of the EU markets, except Greece and Poland, were strongly growing; the top four are Italy at 18.9%, Spain at 16.7%, France at 16.1%, and Germany at 7.3%. Energy efficiency and compact design give Class D amplifiers preference for sophisticated infotainment systems appearing in premium automobiles. In addition, the quest for portable and efficient audio equipment, including soundbars and smart speakers, promotes market growth for consumer electronics within the region. Given their widespread use in theatres and sports arenas, among others, pro-audio is an important contributor to Europe's Class D amplifier market—though still predominantly German and British. Environmental regulations that promote energy-saving equipment speed up consumption.

Asia Pacific Class D Audio Amplifier Market Analysis

The increasing electronics and automotive industries in the Asia-Pacific region drive the market for Class D audio amplifiers. Industry reports have stated that China is the world's leading electronics exporter. In 2022, China accounted for more than 33% of the global electronics market with exports of over USD 671.5 Billion. According to industry reports, India's offline sales of audio devices have touched the mark of INR 5,000 crore (USD 588 Million) by June 2024. The class D amplifier's demand will be increased rapidly due to the growth of wearable technology, smart speakers, and smartphones. Another factor propelling the use of entertainment systems in vehicles is the Indian automobile industry, which had grown by 10% in 2023, says the Society of Indian Automobile Manufacturers. The top manufacturers of consumer electronics, South Korea and Japan, rely on the latest Class D amplifiers to develop luxury audio systems. The market is further spurred in emerging nations by growing disposable incomes and higher awareness of energy efficiency.

Latin America Class D Audio Amplifier Market Analysis

The growing demand for consumer electronics and car infotainment systems is driving the Class D audio amplifier market in Latin America. Brazil and Mexico are the largest contributors, with more than 50% of the regional market share. The increasing internet and mobile penetration in the region are further strengthening the market as e-commerce is largely driven due to this. In 2020, the GSMA Association showed that there were 437 Million unique mobile customers in Latin America, which amounts to 69% penetration. By 2025, it is expected to reach 485 million with a penetration rate of 73%. Class D amplifiers are installed by the automobile industry as part of entertainment systems; most notably, Mexico is the world's largest exporter of vehicles to the United States. In addition, the live event and music festival boom in the region increases the demand for Class D amplifiers in professional audio equipment.

Middle East and Africa Class D Audio Amplifier Market Analysis

The market for Class D audio amplifiers in MEA is growing slowly due to increasing investments in consumer electronics and automotive industries. Saudi Arabia and United Arab Emirates lead the market of consumer electronics sector in the GCC due to its massive and richly populated amongst the countries in the Gulf Cooperation Council. According to an industrial report, Saudi boasts a population of 33 million with a mobile penetration rate of 88%, while UAE has a mobile penetration of 91% with a population of 11 million. Growth in the region's luxury car market and growing demand for high-quality audio in smart homes are driving growth. Another important factor driving market growth is the use of Class D amplifiers in professional audio systems for conferences, events, and places of worship. Class D amplifiers are popular in the region as they have a long lifespan and are energy efficient.

Competitive Landscape:

The market for class D audio amplifiers is highly competitive, featuring some of the leading key players. These class D audio amplifier companies dominate through continuous technological innovations, offering high-efficiency, compact, and high-performance amplifiers. Strategic partnerships, extensive research and development (R&D) investments, and a focus on integrating advanced features such as wireless connectivity and digital signal processing (DSP) are crucial for maintaining competitive advantage. For instance, in January 2024, Analog Devices is now sampling its latest audio processor and low-power ANC codec, the ADAU1797. This high-performance device with integrated HiFi 3z and FastDSP cores can efficiently support front-end audio processing with beamforming and noise reduction, as well as neural network-assisted speech recognition (ASR) processing. True wireless stereo (TWS) ANC earbuds and headphones require a CPU that is three times more powerful, low latency, and low power.

The report provides a comprehensive analysis of the competitive landscape in the class D audio amplifier market with detailed profiles of all major companies, including:

- Analog Devices Inc.

- Infineon Technologies AG

- NXP Semiconductors

- ON Semiconductor

- Qualcomm Technologies Inc.

- Renesas Electronics Corporation

- ROHM Co. Ltd.

- Silicon Laboratories

- STMicroelectronics

- Texas Instruments Incorporated

- Toshiba Corporation

Recent Developments:

- October 2024: The MR3 2.0 monitor speaker system from Edifier was introduced with a focus on excellent audio quality and adaptability for both business and home customers. The Class D audio amplifier that is integrated into the MR3 system is a noteworthy feature that guarantees effective power consumption while producing sound of excellent quality. By reducing distortion and improving audio clarity, the amplifier produces a rich sound that is perfect for gaming, music production, and general audio enjoyment.

- April 2024: A new audio amplifier built on Gallium Nitride (GaN) Field-Effect Transistors (FETs) has been released by Efficient Power Conversion (EPC). This amplifier is made to provide high-fidelity, energy-efficient, and improved audio performance. GaN technology is a great option for high-end audio applications since it minimises power loss, speeds up switching, and eliminates distortion.

- February 2024: Monolithic Power Systems (MPS), a global company specializing in high-performance power solutions Monolithic Power Systems (MPS), a global leader in high-performance power solutions, announced the acquisition of Axign B.V., a fabless semiconductor startup from the Netherlands known for its programmable multicore digital signal processors (DSPs) and innovative post-filter feedback loop technology for Class-D amplifiers with balanced feedback from the loudspeaker. An exciting development for the small Dutch company and the audio industry.

- January 2023: GaN power semiconductors pioneer GaN Systems once again teamed up with Dutch company Axign to launch a powerful, 1000W Class-D GaN audio amplifier board at CES 2023. The new reference design combines best-in-Class technologies from GaN Systems and Axign to drive unique audio systems that can be more compact, much more efficient, and improve audio quality. It targets automotive, professional, as well as prosumer applications.

Class D Audio Amplifier Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Amplifier Types Covered | Mono-Channel, 2-Channel, 4-Channel, 6-Channel, Others |

| Devices Covered | Television Sets, Home Audio Systems, Desktop and Laptops, Automotive Infotainment Systems, Others |

| End Uses Covered | Automotive, Consumer Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices Inc., Infineon Technologies AG, NXP Semiconductors, ON Semiconductor, Qualcomm Technologies Inc., Renesas Electronics Corporation, ROHM Co. Ltd., Silicon Laboratories, STMicroelectronics, Texas Instruments Incorporated, Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, class D audio amplifier market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global class D audio amplifier market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the class D audio amplifier industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The class D audio amplifier market was valued at USD 3.45 Billion in 2024.

The class D audio amplifier market is projected to exhibit a CAGR of 7.05% during 2025-2033, reaching a value of USD 6.82 Billion by 2033.

The market is driven by escalating demand for energy-efficient audio solutions, rising adoption of portable and wireless devices, advancements in semiconductor and digital signal processing technologies, and increasing integration with smart home and internet of things (IoT) systems.

Asia Pacific currently dominates the class D audio amplifier market, accounting for a share of 45.1% in 2024. The dominance is fueled by increasing demand for consumer electronics, rising disposable incomes, growing automotive industry, and advancements in audio technology in the region.

Some of the major players in the class D audio amplifier market include Analog Devices Inc., Infineon Technologies AG, NXP Semiconductors, ON Semiconductor, Qualcomm Technologies Inc., Renesas Electronics Corporation, ROHM Co. Ltd., Silicon Laboratories, STMicroelectronics, Texas Instruments Incorporated, and Toshiba Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)