Chromium Market Size, Share, Trends and Forecast by Grade, Application, Industry Vertical, and Region, 2025-2033

Chromium Market Size and Share:

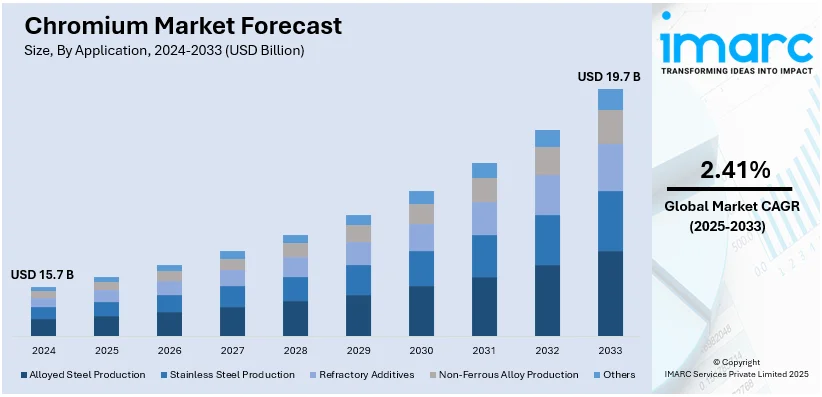

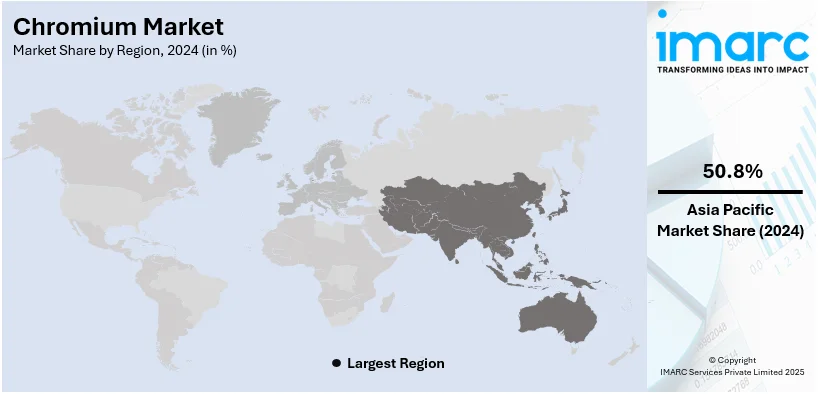

The global chromium market size was valued at USD 15.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.7 Billion by 2033, exhibiting a CAGR of 2.41% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 50.8% in 2024. Rapid industrialization, increasing stainless steel production, infrastructure growth, and the rising demand in the construction and automotive sectors are some of the key factors driving the market toward growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.7 Billion |

|

Market Forecast in 2033

|

USD 19.7 Billion |

| Market Growth Rate (2025-2033) | 2.41% |

The chromium market is driven by several key factors, including the increasing product demand in the steel and alloy industries, as chromium is a crucial component in producing stainless steel. For instance, in May 2024, the key producer of stainless steel in India, Jindal Stainless, announced plans to expand and acquire significant assets to increase its downstream and melting capabilities and rank among the world's largest manufacturers of stainless steel. The corporation revealed a three-pronged investment plan totaling around INR 5,400 crores that aims to make stainless steel the world's leading product. This expansion is expected to influence chromium supply chains, pricing, and the market dynamics globally, further emphasizing its critical role in industrial applications. The growing construction and automotive sectors contribute significantly to this demand, as stainless steel is widely used for structural materials, vehicle components, and machinery. Additionally, the rising use of chromium in the production of various chemicals, including pigments for coatings and dyes, is fueling market growth. Technological advancements in chromium extraction processes, along with increasing demand for specialized alloys in aerospace, defense, and electronics industries, further support the market's expansion. The growing awareness of chromium's applications in renewable energy technologies also contributes to market dynamics.

The chromium market in the United States is driven by several factors, including its essential role in the production of stainless steel, which accounts for a significant portion of demand. The growing automotive and construction industries further contribute to this demand due to the need for durable, corrosion-resistant materials. Technological advancements in chromium production processes, along with the rising investments in infrastructure development also play a key role. In line with this, according to Dodge Construction Network, the U.S. project starts increased by 6% over the first eight months of 2024 as compared to the same period in 2023. In August, the Dodge Momentum Index, a metric used to gauge the planning of nonresidential buildings, likewise reported a 31% increase over the same month the previous year. In line with this, the demand for corrosion-resistant materials is fueled by the expansion of infrastructure, such as buildings and industrial facilities, which raises chromium consumption even more.

Chromium Market Trends:

Increasing Stainless Steel Demand

The primary driver of the chromium market is the growing demand for stainless steel, which contains chromium to enhance corrosion resistance, durability, and aesthetic appeal. For instance, in August 2024, Shyam Metalics and Energy witnessed a 2.88% increase to Rs 719 following a 219% increase in stainless steel sales volume from 1,786 MT sold in July 2023 to 5,699 MT sold in July 2024. From Rs 1,00,399 per ton in July 2023 to Rs 1,37,857 per ton in July 2024, the average realization increased by 37%. In line with this, chromium is a key component in stainless steel production, and this surge in sales suggests heightened consumption of chromium to meet production needs. Industries like construction, automotive, and infrastructure are significant consumers of stainless steel, fueling the demand for chromium. Rapid urbanization and industrialization, particularly in emerging economies, further contribute to this growth. Additionally, advancements in stainless steel applications across various sectors bolster the reliance on chromium as a critical material.

Alloy Production Growth

Chromium is essential for producing high-performance alloys used in aerospace, defense, and industrial machinery. Chromium alloys offer heat resistance, enhanced strength, and anti-corrosion properties, making them vital for demanding applications. For instance, in February 2024, Masteel produced High-Chromium P91 steel grade in continuously cast blooms with a diameter of 1000 mm, setting a new performance highlight. P91 is a hard-to-weld steel grade that is extensively alloyed with molybdenum and chromium to preserve mechanical resistance at high temperatures. For Danieli casting machines, this performance sets a new standard. Increasing investments in aerospace and defense, coupled with technological advancements requiring specialized materials, drive chromium demand. The push for lightweight yet durable materials in transportation and renewable energy sectors also plays a key role in boosting its market.

Rising Chemical Industry Applications

The use of chromium compounds in pigments, dyes, tanning, and catalysts in the chemical industry drives its demand. Chromium oxide-based pigments are preferred for their vivid colors and durability in paints and coatings. For instance, in August 2024, the specialty chemicals company LANXESS announced the cancellation of its initial plans to sell the company and instead continue to produce chromium oxide pigments at the Krefeld-Uerdingen facility. The chromium oxide plant utilizes about 50 people. Chromium oxides are utilized in energy-intensive industries like ceramics, fireproof material manufacture, and color applications. Additionally, chromium is integral to leather processing and water treatment applications, expanding its market presence in diverse industries.

Chromium Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global chromium market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on grade, application and industry vertical.

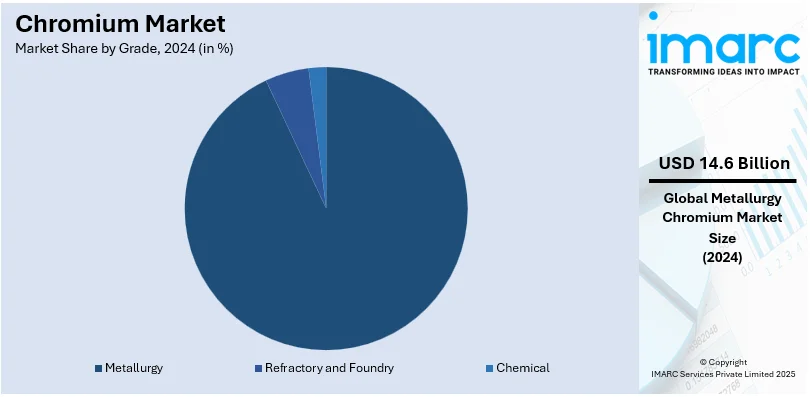

Analysis by Grade:

- Metallurgy

- Refractory and Foundry

- Chemical

Metallurgy stands as the largest component in 2024, holding around 92.5% of the market. Metallurgy holds the largest share of the chromium market due to its critical role in producing stainless steel and specialized alloys. Chromium enhances steel's corrosion resistance, durability, and strength, making it indispensable for construction, automotive, aerospace, and industrial applications. The growing demand for stainless steel, particularly in infrastructure and urbanization projects, drives significant chromium consumption in metallurgy. Additionally, chromium-based alloys are crucial in high-temperature and high-stress environments, such as power plants and aerospace components. The metallurgical sector’s reliance on chromium for both functional and aesthetic properties solidifies its dominance in the chromium market, supported by advancements in alloy technology.

Analysis by Application:

- Alloyed Steel Production

- Stainless Steel Production

- Refractory Additives

- Non-Ferrous Alloy Production

- Others

Stainless steel production holds the largest share of the chromium market because chromium is a key element in enhancing steel's corrosion resistance, durability, and strength. Stainless steel, containing 10-30% chromium, is extensively used in construction, automotive, infrastructure, and industrial machinery due to its longevity and aesthetic appeal. Rapid urbanization and industrialization, especially in emerging economies, are driving the demand for stainless steel. Additionally, its applications in household appliances, medical devices, and renewable energy technologies further contribute to the reliance on chromium. As stainless steel remains integral to modern industries, its production ensures chromium's leading position in the market.

Analysis by Vertical Insights:

- Chemical and Petrochemical

- Energy and Power

- Mining

- Steel

- Automotive

- Others

Chromium is widely used in the chemical and petrochemical industries due to its ability to enhance the properties of various chemicals. It is used in catalysts for refining processes, the production of pigments, and in the creation of chromium compounds, such as chromium trioxide, which is important for electroplating. The demand for chromium in these applications continues to grow with the increasing need for high-quality chemicals, coatings, and advanced manufacturing techniques, solidifying its dominance in this sector.

Chromium is crucial in the energy and power sectors, especially in producing high-performance alloys used in turbines, heat exchangers, and power plants. Its heat resistance, strength, and corrosion resistance properties make it ideal for making components that endure high temperatures and pressures. As global energy demand rises and more renewable energy projects are initiated, the need for chromium in energy generation technologies, including nuclear and fossil fuel-based plants, increases, driving its importance in this market.

The mining industry is a significant consumer of chromium, particularly in the production of specialized alloys used in mining equipment. Chromium enhances the strength, hardness, and resistance to wear and corrosion of machinery like drills, excavators, and crushers. As global mining activities expand to meet the demand for minerals, chromium's role in producing durable, high-performance materials becomes even more essential. Additionally, the need for chrome alloys in the development of advanced materials further supports its position in the mining sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 50.8%. The chromium demand in the Asia-Pacific region is fueled by its swift industrial growth and expanding manufacturing industries. The flourishing shipbuilding sector in South Korea and Japan demands strong, corrosion-resistant chromium alloys for various ship parts. Additionally, the growing electronics industry in nations such as China and Taiwan drive the need for chromium in electroplating methods to obtain resilient and top-notch finishes. Chromium also plays an essential role in the growing renewable energy projects throughout Asia-Pacific, where it is used in elements for geothermal and hydropower systems. According to the Ministry of Power, India reached an all-time high of 223 GW in peak energy demand in June 2023, with renewable energy accounting for 25.44% of the total electricity generation. By May 2023, India’s renewable energy capacity soared to 179 GW, supported by solar (67 GW) and wind (43 GW), which facilitated chromium production by lowering energy expenses and promoting sustainable methods. Aiming for ambitious goals such as 500 GW of non-fossil capacity by 2030 underscores India's transition to sustainable energy options that support industrial processes like chromium processing. The expanding textile and dyeing sectors in India and Southeast Asia rely significantly on chromium compounds for dye manufacturing, driving market expansion. Furthermore, the rise of advanced manufacturing technologies has increased the utilization of chromium in precision machining and tooling uses. The establishment of high-speed rail systems in the area also utilizes chromium-based materials for longevity.

Key Regional Takeaways:

Asia Pacific Chromium Market Analysis

In North America, the chromium market is driven by several key factors, primarily the growing demand for stainless steel and advanced alloys. The automotive, aerospace, and construction industries heavily rely on stainless steel, which contains chromium for enhanced corrosion resistance and strength. The rise in infrastructure projects, including bridges, buildings, and transportation networks, further supports the demand for stainless steel and, consequently, chromium. The region's automotive industry, particularly in the United States, continues to expand, increasing the need for chromium in high-performance vehicle components. Additionally, the energy and power sectors contribute significantly to chromium demand, as it is essential for producing heat-resistant alloys used in turbines, power plants, and industrial equipment. As North America moves toward sustainable energy solutions, chromium's role in renewable energy technologies such as wind turbines and solar panels also supports market growth. Moreover, advancements in mining and petrochemical industries drive further demand for chromium-based products, solidifying its critical role.

United States Chromium Market Analysis

In 2024, the United States accounted for the largest market share of over 75.30%. The chromium industry in the United States is growing because of its requirement in the production of stainless steel, benefiting sectors such as construction, automotive and aerospace. For instance, in December 2024, U.S. auto sales surged by 9.8% in November 2024, driven by improved product lineups and year-end promotions. Light trucks dominated with 1,122,643 units sold. The rise in vehicle production boosts chromium demand for automotive components, critical for durability and corrosion resistance. The need for high-performance alloys is increasing, fuelled by technological progress and industrial production developments. The flourishing construction industry boosts the demand for long-lasting materials, such as chromium-based items. Moreover, the increasing focus on lightweight cars and fuel efficiency in the automotive sector enhances the application of chromium in stainless steel and coatings. The need for corrosion-resistant materials in the electronics industry is also driving the demand. Recycling programs in the U.S. are promoting a circular economy, enhancing the supply of secondary chromium, while government policies that back industrial expansion and sustainable methods further boost the market.

Europe Chromium Market Analysis

The Europe’s chromium demand is driven by its critical applications in the energy and environmental sectors. The region's emphasis on hydrogen production and storage technologies utilizes chromium in specialized alloys for containment vessels and pipelines to ensure integrity under extreme conditions. For instance, in 2023, hydrogen production capacity in the EU, EFTA, and UK totaled 11.2 Mt, with 71% utilization, led by Germany, Netherlands, Poland, France, and Italy (57%). Conventional methods dominated (95.6%), while reforming with carbon capture and power-to-hydrogen contributed 0.5% and 0.41%, respectively. This hydrogen can enhance chromium processing by reducing oxidation and improving sustainability in metallurgical applications. Power generation facilities employ chromium alloys for components operating under high heat, such as boilers and turbines. Chromium's use in precision engineering contributes to producing tools and dies in industrial manufacturing. The demand for chromium in artistic applications, including glassmaking and jewelry, is rising as designers seek durable and visually appealing materials. Additionally, chromium-based catalysts play a vital role in refining processes and chemical synthesis, particularly for clean fuel production. In the environmental sector, chromium compounds are utilized in water treatment to reduce impurities, reflecting the region's focus on sustainability.

Latin America Chromium Market Analysis

In Latin America, chromium finds expanding applications in mining and heavy equipment industries. The region’s vast mineral wealth necessitates durable equipment and machinery that can endure abrasive conditions, where chromium alloys excel. Chromium's presence in protective coatings enhances the lifespan and efficiency of drilling and excavation tools. The region’s focused on agricultural modernization also create demand for chromium-containing materials in irrigation systems and harvesting equipment due to their corrosion resistance. For instance, in February 2024, Brazil's agricultural sector set records with a 16% increase in grain production, reaching 323.8 Million tons, and a 25% rise in exports. Technological advancements and high international demand contribute to this growth, enhancing the role of chromium in agricultural technology and machinery. Additionally, advancements in packaging technology have fostered the use of chromium-based materials for creating durable, food-safe containers.

Middle East and Africa Chromium Market Analysis

The Middle East and Africa leverage chromium’s properties in water management and industrial chemical production. With water scarcity as a pressing challenge, chromium-based alloys are increasingly used in desalination plants and distribution systems for their resistance to harsh saline environments. According to the study, soil salinity in the Western UAE was mapped using a newly developed salinity index, achieving an overall accuracy of 60%, surpassing previous indices (50%). The model showed 67% accuracy in identifying high saline soils and 90% in excessively high saline soils. This precise mapping is beneficial for chromium usage by improving land management and corrosion control in affected areas. Industrial chemical sectors utilize chromium compounds as essential catalysts in petrochemical processing and fertilizer production. Chromium’s role in the jewellery and luxury goods industry also supports demand, as its aesthetic appeal combines with durability to cater to premium markets in the region.

Competitive Landscape:

The chromium market is highly competitive, with key players such as Glencore, Anglo American, and Xstrata dominating production. These companies control significant mining operations and chromium production facilities globally, particularly in South Africa, Kazakhstan, and Turkey. Market players are focused on expanding their capacities, improving efficiency, and securing long-term supply chains. Additionally, demand from industries like stainless steel, energy, and aerospace drives competition. Emerging players in the Asia Pacific region, especially China and India, are increasing production to meet domestic and global demand. Environmental regulations and sustainable mining practices are also shaping the competitive dynamics.

The report has also analysed the competitive landscape of the market with some of the key players being:

- ACI Alloys

- Al Tamman Indsil FerroChrome L.L.C

- Belmont Metals Inc.

- Edgetech Industries LLC

- Eurasian Resources Group

- Ferbasa

- Glencore plc

- Gulf Mining Materials Company

- Odisha Mining Corporation Limited

- ProChem Inc. International

- RD Mathis Company

- Samancor Chrome Ltd.

Latest News and Developments:

- November 2024: Vishnu Chemicals Limited has signed a definitive agreement to acquire a Chrome Mining Complex in South Africa from the Volclay Group of Companies. The acquisition includes a chrome mine spanning approximately 1,800 hectares with an estimated 10 Million tonnes of resources, along with a processing plant and associated infrastructure. This strategic move aims to secure a stable supply of chrome ore for Vishnu's current and future production needs.

- February 2024: Gulf Alloys and Metals (FZC) LLC began trial operations for its new ferrochrome alloy plant in the Sohar Freezone, Oman. The facility is strategically designed to boost ferrochrome production capacity to meet rising global demand. Its location in Oman’s industrial hub provides logistical advantages for exports. This initiative reinforces the company’s commitment to expanding its presence in the ferroalloy market.

- September 2023: Glencore PLC entered a landmark agreement with a major Chinese steelmaker to supply chromite ore over five years. Valued at approximately USD 1 Billion, this deal underscores Glencore’s position in the global chromite market. The agreement aligns with China's growing demand for high-quality raw materials for steel production. It is expected to strengthen Glencore’s revenue streams and market influence in Asia.

- April 2023: Hernic Ferrochrome (Pty) Ltd. announced a bold step towards sustainability by investing in advanced technologies to reduce environmental impact. The initiative targets a 20% reduction in greenhouse gas emissions from its ferrochrome operations by 2025. This move highlights the company's commitment to meeting global environmental standards. It also positions Hernic as a leader in eco-friendly ferrochrome production.

- June 2022: Tenaris unveiled plans for a USD 29 Million investment in its Dalmine steel shop to boost specialty steel production. The upgrade focuses on expanding capabilities for high-chromium-content steels, including chromium 13. The multi-phase project, completed in early 2023, enhances Tenaris’ ability to meet specialized industrial demands. It marks a strategic advancement in its steel manufacturing portfolio.

Chromium Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Coverage | Metallurgy, Refractory and Foundry, Chemical |

| Applications Coverage | Alloyed Steel Production, Stainless Steel Production, Refractory Additives, Non-Ferrous Alloy Production, Others |

| Industry Verticals Coverage | Chemical and Petrochemical, Energy and Power, Mining, Steel, Automotive, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACI Alloys, Al Tamman Indsil FerroChrome L.L.C, Belmont Metals Inc., Edgetech Industries LLC, Eurasian Resources Group, Ferbasa, Glencore plc, Gulf Mining Materials Company, Odisha Mining Corporation Limited, ProChem Inc. International, RD Mathis Company, Samancor Chrome Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the chromium market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global chromium market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the chromium industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Chromium is a chemical element with the symbol Cr and atomic number 24. It is a hard, metallic substance primarily used in the production of stainless steel, alloys, and chrome plating. Chromium is also employed in various industrial applications, including manufacturing pigments, chemicals, and as a catalyst in processes.

The global chromium market was valued at USD 15.7 Billion in 2024.

IMARC estimates the global chromium market to exhibit a CAGR of 2.41% during 2025-2033.

The chromium market is driven by growing demand for stainless steel, alloys, and coatings in industries such as construction, automotive, aerospace, and energy. Chromium's essential role in enhancing corrosion resistance, strength, and heat tolerance supports its use in high-performance materials. Industrial growth, technological advancements, and infrastructure development further boost demand.

According to the report, metallurgy represented the largest segment by grade, due to their critical use in stainless steel production, enhancing strength, corrosion resistance, and durability.

Stainless steel production leads the market by application due to chromium's essential role in enhancing steel's strength and corrosion resistance.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Chromium market include ACI Alloys, Al Tamman Indsil FerroChrome L.L.C, Belmont Metals Inc., Edgetech Industries LLC, Eurasian Resources Group, Ferbasa, Glencore plc, Gulf Mining Materials Company, Odisha Mining Corporation Limited, ProChem Inc. International, RD Mathis Company, Samancor Chrome Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)