Chromatography Resins Market Size, Share, Trends and Forecast by Product, Technique, End Use, and Region, 2025-2033

Chromatography Resins Market 2024, Size and Trends:

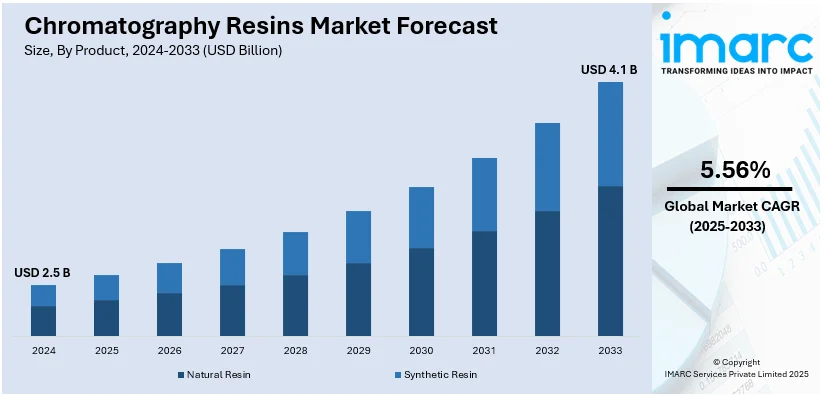

The global chromatography resins market size reached USD 2.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.56% during 2025-2033. North America currently dominates the chromatography resins market share by holding over 33.1% in 2024. The rising demand in biotechnology and pharmaceuticals, the increasing focus on personalized medicines, and growth in environmental and food testing represents some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.5 Billion |

|

Market Forecast in 2033

|

USD 4.1 Billion |

| Market Growth Rate (2025-2033) | 5.56% |

The global chromatography resins market demand is primarily driven by the growing need for biologics and biosimilars, which require advanced separation techniques for purification and analysis. Significant investments in pharmaceutical R&D, particularly in North America, further fuel this demand. Additionally, the rising utilization of chromatography across sectors like food and beverage, environmental analysis, and diagnostic applications is driving the expansion of the market. Technological advancements in resin development, alongside the rising need for high-quality protein separation and purification methods, are also key drivers. Moreover, the expansion of personalized medicine and cell-based therapies creates additional opportunities for chromatography resin applications.

The United States holds a dominant position in the global chromatography resins market growth, driven by its strong biopharmaceutical and biotechnology industries. The country’s substantial investment in pharmaceutical research and development projects propels demand for advanced chromatography technologies. With a focus on biologics, biosimilars, and personalized medicine, the U.S. market continues to expand, fostering innovation in resin development. Furthermore, strategic collaborations between major pharmaceutical companies and resin manufacturers enhance the U.S.’s competitive edge. In addition to this, the growing emphasis on precision medicine and protein purification further strengthens the demand for chromatography resins in the region. For instance, as per industry reports, the chromatography resins industry across the U.S. is anticipated to reach around USD 207.52 Million by the year 2029.

Chromatography Resins Market Trends:

Rising Demand for Biopharmaceuticals

Chromatography serves as a highly adaptable separation method that provides broad accessibility possibilities. The critical starting point of drug discovery requires separation techniques for compounds that appear similar to one another among synthesized substances. Determining purity and performing identification assessments about compounds represents a critical priority. The use of chromatography methods continues to be standard practice for compound separation. The growing usage of biopharmaceuticals is significantly driving the growth of the market. For instance, according to IMARC, the global biopharmaceutical market size reached USD 300.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 643.9 Billion by 2032, exhibiting a growth rate (CAGR) of 8.6% during 2024-2032. Biopharmaceuticals, such as monoclonal antibodies, recombinant proteins, and other biologics, require complex manufacturing processes. Chromatography is a critical technique used in the purification and separation of these products, making chromatography resins essential in their production. The landscape of alternatives to chromatography includes precipitation alongside high-resolution ultrafiltration together with crystallization and high-pressure refolding with charged ultrafiltration membranes and protein crystallization together with capillary electrophoresis and aqueous two-phase extraction and three-phase partitioning and monoliths and membrane chromatography. These new methods bring valuable advantages that may limit future expansion of chromatography resins market growth. These factors are expected to propel the chromatography resins market outlook in the coming years.

Adoption of Personalized Medicines

The rise in personalized medicine is significantly impacting the market. For instance, according to an article published by Taylor & Francis, personalized medicines accounted for around 39% of the therapeutic new molecular entities granted by the agency in 2020. Chromatography instruments serve multiple functions within pharmaceutical industries for materials purification as well as API separation and excipient analysis. The development of tailor-made therapies alongside the safety evaluation of personalized drugs depends on these essential applications. Furthermore, the existence of different process methods drives the industry to continuously refine chromatography resin performance while enhancing efficiency to preserve market share. Advancements in personalized medicine create growing demands for efficient customized techniques which drives the adoption of these alternative methods. Personalized medicine often involves the development of biologics and targeted therapies that require high-purity biomolecules. Chromatographic resins are critical in the purification stages of drug development to ensure the safety and efficacy of these new treatments. These factors further positively influence the chromatography resins market trends.

Technological Advancements

Innovations in resin chemistry have led to the creation of specialized resins designed for specific applications, such as affinity chromatography for targeted protein purification or ion-exchange resins for separating charged molecules. For instance, in November 2023, Cytiva launched the Cytiva Protein Select technology, which streamlines and accelerates recombinant protein purification. The self-cleaving traceless tag and complementary affinity chromatography resin standardize purification for any protein, eliminating the need for protein-specific affinity binding partners. Ongoing advancements in chromatography technologies alongside strict government regulations drive increased demand for chromatography resins across multiple nations because of the rising requirement for high-quality pharmaceutical products. Moreover, these emerging innovations in alternative methods including capillary electrophoresis and high-resolution ultrafiltration with three-phase partitioning have led to increased acceptance of these methods. A shifting market requires chromatography resin producers to maintain ongoing improvements to maintain a competitive position. These specialized resins cater to the growing needs of diverse industries, including pharmaceuticals, biotechnology, and environmental testing, thereby boosting the chromatography resins market demand.

Chromatography Resins Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global chromatography resins market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, technique, and end use.

Analysis by Product:

- Natural Resin

- Synthetic Resin

Natural resin leads with around 52.2% of the chromatography resins market share in 2024. According to the chromatography resins market share, natural resins are often favored in applications involving biopharmaceuticals and biotechnology due to their biocompatibility. They provide a safer option for separating and purifying biomolecules, such as proteins and nucleic acids, which are critical in drug development and production. Moreover, there is increasing pressure on industries to adopt more sustainable practices. Natural resins, derived from renewable resources, offer an eco-friendly alternative to synthetic resins, aligning with global sustainability goals. Furthermore, the elevating requirement for sustainable manufacturing methods and green technologies in biopharmaceuticals is anticipated to bolster the utilization of natural resins. As regulatory organizations are actively focusing on eco-friendly solutions, natural resins are rapidly being acknowledged as a major solution for significantly lowering environmental impact while sustaining high performance in chromatographic applications.

Analysis by Technique:

- Ion Exchange

- Affinity

- Hydrophobic Interaction

- Size Exclusion

- Others

Ion exchange leads the market with around 42.8% of market share in 2024. According to the report, ion exchange represented the largest market segmentation. According to the chromatography resins market overview, ion exchange chromatography is a powerful technique used in chromatography resins to separate and purify ionic compounds. There is a growing need for ion exchange resins in the purification of proteins, monoclonal antibodies, and other biomolecules. In addition to this, the increasing production of biopharmaceuticals drives demand for high-performance ion exchange resins. Moreover, the pharmaceutical industry uses ion exchange chromatography to purify and separate active pharmaceutical ingredients (APIs) and other compounds, driving the demand for these resins. Besides this, the amplifying emphasis on gene therapies and personalized medicine further heightens the requirement for exceptional-quality ion exchange resins in drug development. As biopharmaceutical manufacturers are actively navigating for adaptable and effective purification solutions, the requirement for ion exchange resins is anticipated to boost.

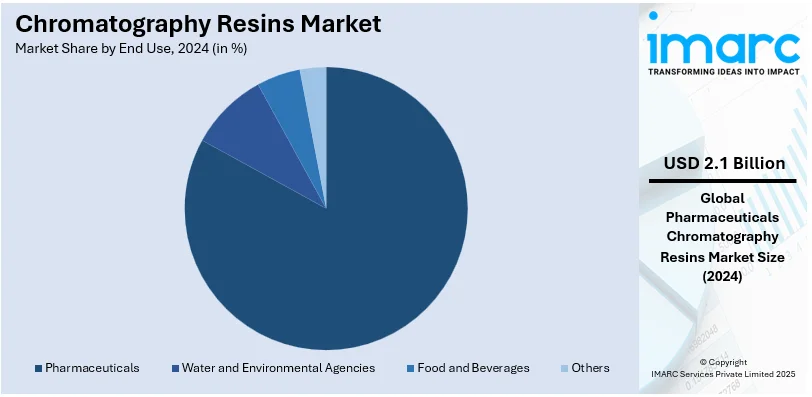

Analysis by End Use:

- Pharmaceuticals

- Water and Environmental Agencies

- Food and Beverages

- Others

Pharmaceuticals lead the market with around 82.5% of market share in 2024. According to the report, pharmaceuticals represented the largest market segmentation. Chromatography resins are critical in drug development and manufacturing processes. They are used for purifying and separating proteins, peptides, and other biomolecules, essential in pharmaceutical production. Moreover, pharmaceutical companies use these resins in processes like affinity chromatography, ion exchange chromatography, and size exclusion chromatography, among others. The high demand for biologics, monoclonal antibodies, and other complex drugs represents one of the chromatography resins market recent opportunities. In addition to this, the elevating emphasis on personalized medicine as well as biologics further fuels the requirement for innovative chromatography resins in the pharmaceutical sector. As drug formulation becomes more complicated, the demand for scalable, effective purification technologies is anticipated to fortify, guaranteeing sustained expansion in the pharmaceutical segment of the chromatography resins market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.1%. According to the report, North America currently dominates the global market. North America accounted for the largest market share, owing to the growth in biologics and biosimilar developments. For instance, according to the Pharmaceutical Research and Manufacturers of America (PhRMA), the U.S. pharmaceutical sector spent around 21% of global revenues on R&D in 2022. Resins are crucial for developing and optimizing these techniques, thereby boosting the chromatography resins market demand. This substantial investment in research projects has led to the rapid adoption of advanced chromatography techniques, further bolstering the requirement for specialized resins. Furthermore, with the escalating emphasis on cell-based therapies and personalized medicine, the need for chromatography resins in North America is anticipated to boost. In addition to this, the magnifying trend of tactical collaborations between resin manufacturers and biopharma companies is elevating chromatography resins market growth in the region.

Key Regional Takeaways:

United States Chromatography Resins Market Analysis

In 2024, the United States accounted for 92% of the market share in North America. Strong healthcare system, increasing R&D spending, and innovation in the field of biopharmaceuticals have positioned the US as the largest market for chromatography resins. In fact, according to data from the International Trade Administration, over 20 percent of total sales made by U.S. biopharmaceutical companies in 2023 came from research and development, which largely relies on chromatography resins for purification processes in manufacturing mAbs, vaccine research, and gene therapy. The need for biologics has increased due to the rising incidence of chronic illnesses including diabetes and cancer; with nearly 129 million people in the US having at least 1 major chronic disease, as per the data by Centre for Disease Control and Protection. As government programs, such as the 21st Century Cures Act, have increased funding for biomedical research and drug development, the demand for resin has grown.

Food and beverages, for example, employ chromatography resins to ensure the quality of products as well as their safety from contamination through additives or impurities. According to reports, the pharmaceutical and biotech industries spend more than USD 90 billion a year on research and development, and the use of sophisticated chromatographic methods like affinity and ion exchange chromatography is only increasing. With most universities in the US actively involved in research on chromatography, the academic sector also contributes to market expansion.

Europe Chromatography Resins Market Analysis

The market for chromatography resins in Europe is driven by strong pharmaceutical production, strict regulatory frameworks, and an increasing focus on personalized treatment. The utilization of advanced purification techniques is triggered by the rigid quality requirements established by the European Medicines Agency for biologics. The countries that have been identified as important markets include major pharmaceutical companies and R&D facilities such as Germany, the United Kingdom, and Switzerland. More than half the European biologics rely on the manufacturing process using chromatography. Resin consumption has also seen an increment due to increased biosimilar demand because of patents expiring in very popular biologics. The region's food and beverage industry, valued at more than €1.3 trillion (USD 1.33 Trillion), according to different reports, uses chromatography resins that guarantee quality as well as EU safety standards. The investment in green technology such as bio-based resin production supports the further growth of the sector and is in line with Europe's sustainability goals. A major reason innovation in applications of chromatographic sciences is being taken forward is a result of association between academic centers and pharmaceutical houses.

Asia Pacific Chromatography Resins Market Analysis

The use of chromatography resins has increased rapidly across the Asia Pacific region, led by government spending towards health care structures and an expanding biopharma manufacturing base. China alone houses 40 mAbs, with this making China one of those countries which can quickly emerge to become a biopharma worldwide production hub. The biotech sector in India is growing annually at 14 percent, according to reports. Consequently, chromatography resins usage in bioprocessing is heavily relied upon for the sector in India. This sector in India has doubled the size from USD 30.2 Billion during 2015 to USD 70.2 Billion in merely five years in the period up to 2020, and this is well documented by statistics from the India Brand Equity Foundation. Resin use has increased as a result of the increased demand for vaccines and diagnostic equipment brought on by the growing incidence of illnesses like hepatitis and tuberculosis. Chromatography is also used in the food safety sector, particularly in South Korea and Japan, for quality control and testing of products including processed foods and seafood. Producers of chromatography resin can significantly benefit from regional government initiatives focused on biopharmaceuticals and diagnostics, like China's Made in China 2025 and India's Made in India.

Latin America Chromatography Resins Market Analysis

Latin America is also spurred by the burgeoning biopharma sector and rising concern over food safety to continue driving demand for chromatography resins. Latin America's biggest pharmaceutical market, Brazil, is a source of significant amounts of the region's pharmaceutical production. Government immunization efforts, such as Brazil's National Immunisation Program, which has achieved a 95% rate of national vaccination coverage, have increased demand for biosimilars and vaccines. Chromatography resins are critical in ensuring the efficacy and purity of these biologics. With countries like Chile and Argentina applying chromatography in wine testing and ensuring export standards, the food and beverage industry also contributes greatly. The demand for resins has also been boosted due to R&D investments and regional biologics production facilities.

Middle East and Africa Chromatography Resins Market Analysis

Growing pharmaceutical production, as well as the investments in health care, in the Middle East and Africa region are responsible for the expanding market of chromatography resins.

Nations such as Saudi Arabia and the United Arab Emirates are enhancing their biopharmaceutical capabilities through national visions like Saudi Vision 2030, which focuses on localizing healthcare manufacturing. High incidence of infectious diseases such as HIV and malaria in the region fuels demand for chromatography-based vaccinations and diagnostic instruments. Reports show that resins are widely used in the pharmaceutical industry in South Africa, which produces more than half of the drugs on the continent. The government's move to raise food safety regulations in urbanising areas further increases the demand for chromatography in food testing applications.

Competitive Landscape:

The global market is exhibiting intense competitive, with major players currently emphasizing on tactical acquisition, collaborations, and mergers, along with product advancements to elevate their chromatography resins market share. For instance, in June 2024, Ecolab Life Scinces and Repligen Corporation collaboratively launched a new affinity resin DurA Cycle. This is a protein A chromatography resin developed for the mega-scale purification applications. Furthermore, major firms dominate the market by actively utilizing their comprehensive research and development abilities and well-structured customer bases. In addition to this, smaller regional players are heightening competition by providing specialized resins customized for particular applications, encompassing analytical testing and biopharmaceutical production. The market is also experiencing elevated investments in both digitalization and automation to enhance the efficacy of chromatography processes, further bolstering competition. Magnified focus on biosimilars as well as biologics is anticipated to accelerate both innovation and expansion in the coming years.

The report provides a comprehensive analysis of the competitive landscape in the chromatography resins market with detailed profiles of all major companies, including:

- Agilent Technologies Inc.

- Bio - Rad Laboratories Inc.

- Merck KGaA

- Mitsubishi Chemical Corporation

- Perkinelmer Inc.

- Purolite Corporation

- Repligen Corporation

- Sepragen Corporation

- Thermo Fisher Scientific Inc.

- Tosoh Corporation

- W. R. Grace & Co.

Latest News and Developments:

- July 2024: Repligen Corporation acquired Tantti Laboratory Inc. Tantti to create a portfolio of macroporous chromatography beads that maximize the purification of novel modalities, such as viral vectors, viruses, nucleic acids, and other large-molecule biologics.

- June 2024: Ecolab's Purolite resin business introduced DurA Cycle, a protein A chromatography resin for large-scale purification procedures, in collaboration with Repligen. The new resin is intended for large-scale commercial production of monoclonal antibodies (mAbs).

- November 2023: Cytiva launched the Cytiva Protein Select technology, which streamlines and accelerates recombinant protein purification.

Chromatography Resins Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Natural Resin, Synthetic Resin |

| Techniques Covered | Ion Exchange, Affinity, Hydrophobic Interaction, Size Exclusion, Others |

| End Uses Covered | Pharmaceuticals, Water and Environmental Agencies, Food and Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Bio - Rad Laboratories Inc., Merck KGaA, Mitsubishi Chemical Corporation, Perkinelmer Inc., Purolite Corporation, Repligen Corporation, Sepragen Corporation, Thermo Fisher Scientific Inc., Tosoh Corporation, W. R. Grace & Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the chromatography resins market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global chromatography resins market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the chromatography resins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chromatography resins market was valued at USD 2.5 Billion in 2024.

IMARC estimates the chromatography resins market to exhibit a CAGR of 5.56% during 2025-2033, expecting to reach USD 4.1 Billion by 2033.

Key factors driving the market encompass the magnifying requirement for biosimilars and biologics, innovations in protein purification methodologies, elevation in biopharmaceutical research and development investments, and the heightening utilization of chromatography in several sectors such as diagnostics, food and beverage, and environmental testing.

North America currently dominates the chromatography resins market, accounting for a share exceeding 33.1%. This dominance is fueled by its resilient biotechnology as well as pharmaceutical industries, which drive elevated demand for leading-edge separation technologies.

Some of the major players in the chromatography resins market include Agilent Technologies Inc., Bio - Rad Laboratories Inc., Merck KGaA, Mitsubishi Chemical Corporation, Perkinelmer Inc., Purolite Corporation, Repligen Corporation, Sepragen Corporation, Thermo Fisher Scientific Inc., Tosoh Corporation, W. R. Grace & Co., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)