Chlorinated Paraffins Market Size, Share, Trends and Forecast by Product Type, Application, and Region 2026-2034

Chlorinated Paraffins Market Size and Share:

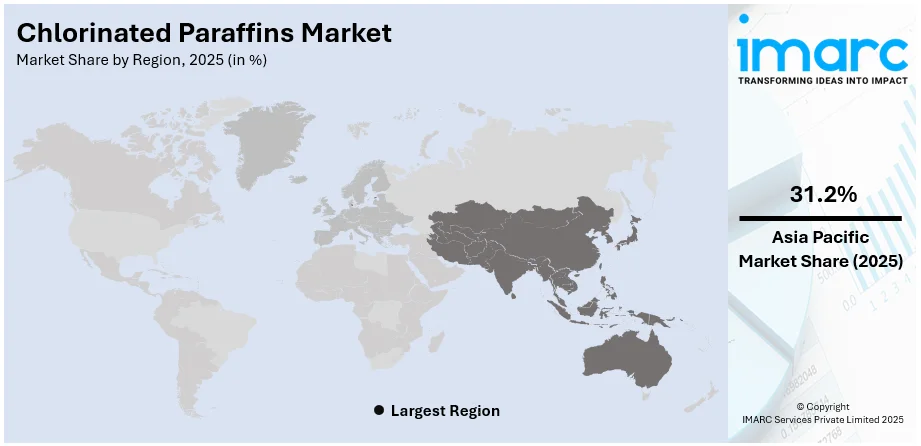

The global chlorinated paraffins market size was valued at USD 2.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3.1 Billion by 2034, exhibiting a CAGR of 3.48% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 31.2% in 2025. The chlorinated paraffins market is expanding due to rising demand in lubricants, plasticizers, and flame retardants. Growth is driven by increasing domestic production, regulatory shifts affecting global supply, and industrial expansion in plastics, rubber, and coatings, influencing market dynamics and competitive strategies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.3 Billion |

| Market Forecast in 2034 | USD 3.1 Billion |

| Market Growth Rate 2026-2034 | 3.48% |

The increasing demand for chlorinated paraffins in industries like plastics, rubber, and metalworking fluids has led to a surge in domestic production. Companies are expanding their manufacturing capacities to meet this growing requirement and reduce reliance on imports. This expansion not only enhances the supply chain but also stabilizes prices and ensures a steady flow of raw materials for downstream industries. In April 2023, KonnArk expanded its Bharuch-Gujarat facility for chlorinated paraffin wax production with a 42,000 TPA capacity. This boosts domestic supply and supports industries like plastics and rubber, enhancing market growth and reducing import dependence. With this increase in production, domestic manufacturers are strengthening their market position and improving supply reliability. The expansion of production facilities also aligns with the shift towards self-sufficiency, enabling industries to source raw materials locally. This development is a key driver in reducing fluctuations caused by global supply disruptions and price volatility.

To get more information on this market Request Sample

The United States continues to be a major force in the market fueled by the increasing demand for chlorinated paraffin in industrial lubricants, plasticizers, and flame retardants. Expanding manufacturing activities and infrastructure developments are accelerating market growth. Rising regulatory scrutiny is also shaping industry trends, prompting a shift towards sustainable formulations. The growing emphasis on material performance and durability in sectors like construction, automotive, and electronics is driving continuous innovation in chlorinated paraffin applications. The market is further influenced by supply chain advancements, technological integration, and strategic investments aimed at enhancing production efficiency and meeting evolving industry standards.

Chlorinated Paraffins Market Trends:

Regulatory Impact on Global Supply

Stringent regulations on chemicals, particularly chlorinated paraffin, are reshaping the global market. Environmental concerns over persistent pollutants are driving governments to impose stricter policies that affect production, import, and trade. These regulatory measures are leading to supply chain disruptions and encouraging the search for alternative solutions. In September 2024, South Korea’s Ministry of Environment classified short-chain chlorinated paraffins (SCCPs) as persistent pollutants under Notification No. 2024-571. This regulation restricts production, import, and use, prompting market shifts toward alternatives and impacting global supply chains for plasticizers, lubricants, and flame retardants. With such restrictions, companies are facing increased compliance costs, and some regions may witness reduced availability of SCCPs. This shift forces manufacturers to innovate and invest in sustainable alternatives. The regulations also impact global trade flows, causing price variations and making sourcing strategies more complex. The long-term impact will likely be a transition towards safer formulations and the adoption of new chemical technologies.

Increasing Industrial Demand for Plasticizers

The rising demand for flexible plastics, coatings, and lubricants is fueling the need for chlorinated paraffins. These compounds act as effective plasticizers, improving material properties in various industrial applications. As industries continue to expand, the requirement for chlorinated paraffin-based additives is steadily increasing. In October 2024, Lords Chloro Alkali expanded its chlorinated paraffin wax (CPW) production capacity from 20 TPD to 50 TPD. This increase strengthens domestic supply, supports industrial demand in lubricants and plasticizers, and enhances profitability, reducing dependency on imports while stabilizing market prices. This expansion reflects the growing reliance on chlorinated paraffins in sectors such as adhesives, sealants, and industrial coatings. The need for cost-effective plasticizers with good stability and performance is further driving this trend. As industries seek efficient solutions to enhance material durability, the demand for chlorinated paraffins is expected to remain strong, reinforcing their position in the market.

Expanding Use of CPs in Construction Materials

CPs find applications in the construction sector in different materials like roofing membranes, flooring, and insulation to make them more resistant to fire and flexible. Along with this, growing construction operations in residential, commercial, and industrial sectors account for one of the key reasons that is positively impacting the expansion of the market globally. There is also a growing use of CPs in paints, coatings, and adhesives. Together with various initiatives taken by the regulatory bodies of various countries to encourage the utilization of green building materials and reduce carbon footprints, is contributing towards the market growth. According to the United States Environmental Protection Agency, in 2022, U.S. greenhouse gas emissions increased 0.2% compared to 2021 levels. Further, CPs are used in the production of automobile parts like auto seats, door panels, hoses, seals, gaskets, bumpers, and dashboards. This, combined with the growing demand for luxury cars, increased emphasis on driver and passenger comfort and safety, and high growth in the automobile market, is having a positive impact on the market. For example, since early 2021, carmakers have made over USD 75 Billion worth of investments in the U.S. Other than this, CPs are used in the textile sector to offer ultraviolet (UV) protection and deepen the color of the fabric. This, along with the surging demand for high-quality and colorful fabrics, is driving the market. In addition, the increasing application of CPs in manufacturing electronic components, including printed circuit boards (PCBs) and semiconductors, to minimize friction and wear during assembly and enhance equipment performance is contributing to market growth.

Chlorinated Paraffins Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global chlorinated paraffins market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type and application.

Analysis by Product Type:

- Medium Chain

- Short Chain

- Long Chain

In 2025, medium chain stands as the largest component holding around 46.7% of the market. The extensive use in metalworking fluids, adhesives, sealants, and coatings is a key market driver for this segment. Medium-chain chlorinated paraffins (MCCPs) offer superior lubrication, flame retardancy, and thermal stability, making them ideal for industrial applications. The automotive, construction, and manufacturing industries are increasingly adopting MCCPs for enhanced performance and durability. Regulatory shifts toward environmentally compliant formulations are pushing manufacturers to develop low-toxicity alternatives, ensuring sustained market growth. Companies are investing in research to enhance MCCP efficiency while meeting evolving safety standards, reinforcing its dominance in the chlorinated paraffin market.

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Metal Working Fluids

- Lubricating Additives

- Plastics

- Rubber

- Paints

- Others

In 2025, metal working fluids led the market by material type with 35.2% of the market share. The rising demand for high-performance metalworking fluids in industries like automotive, aerospace, and manufacturing is a key growth driver. Meta working fluids, known for their excellent lubrication, thermal stability, and extreme pressure resistance, enhance machining efficiency and tool life. Their widespread adoption in cutting, grinding, and forming operations supports market expansion. Leading manufacturers are innovating to develop low-toxicity, environmentally friendly formulations, aligning with stringent regulations. The need for cost-effective, high-performance metalworking solutions is driving the dominance of this segment in the market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, the Asia-Pacific region dominated the chlorinated paraffins market, accounting for the largest share over 31.2% due to rising industrial activities and expanding end-use industries. The increasing demand from the plastic, rubber, metalworking, and paints & coatings sectors is a key market driver. Chlorinated paraffins are widely used as secondary plasticizers in PVC, flame retardants, and extreme pressure additives in metalworking fluids, enhancing material performance and durability. The region’s rapid urbanization and infrastructure growth are further boosting demand, particularly in China and India, where manufacturing sectors are expanding. Government regulations promoting industrial growth and the rising need for cost-effective, high-performance additives are accelerating adoption. Leading manufacturers such as KLJ Group and Aditya Birla Chemicals are investing in capacity expansions and product innovation to meet growing demand. The shift toward environmentally sustainable formulations is also influencing market dynamics, positioning Asia-Pacific as a key region for chlorinated paraffin consumption.

Key Regional Takeaways:

United States Chlorinated Paraffins Market Analysis

United States witnesses increasing demand for chlorinated paraffins as the chemical sector expands, driven by industrial advancements and rising production capacities. According to International Trade Administration, the U.S. chemical manufacturing industry total FDI in the industry was USD 766.7 Billion in 2023. The chemical sector relies on chlorinated paraffins for applications such as lubricants, plasticizers, and flame retardants, supporting manufacturing growth. Expanding industrial operations require durable additives, making chlorinated paraffins essential for enhancing product performance. The chemical sector also benefits from the cost-effectiveness and versatility of these compounds, encouraging broader usage in processing and formulation. Research into advanced chemical compositions further strengthens demand, ensuring sustainable application across industries. Regulatory considerations are prompting manufacturers to refine formulations, aligning with safety and environmental standards. The chemical sector’s dynamic landscape fosters consistent adoption of chlorinated paraffins in key production streams.

Asia Pacific Chlorinated Paraffins Market Analysis

Asia-Pacific is experiencing increased utilization of chlorinated paraffins due to the rapid expansion of the automotive industry, necessitating high-performance additives for various manufacturing processes. According to India Brand Equity Foundation, the automobile sector received a cumulative equity FDI inflow of about USD 35.65 Billion between April 2000 - December 2023. The automotive industry depends on chlorinated paraffins for enhanced lubrication, improved wear resistance, and flame retardancy in crucial components. Advanced material engineering promotes their inclusion in vehicle production, ensuring cost-effective and durable solutions. The automotive industry’s focus on lightweight materials and fuel efficiency reinforces demand for chlorinated paraffins in specialized formulations. The increasing vehicle production rate amplifies usage, positioning chlorinated paraffins as vital elements in industrial applications. Performance optimization in component manufacturing strengthens their adoption, ensuring long-term relevance.

Europe Chlorinated Paraffins Market Analysis

Europe is witnessing steady demand for chlorinated paraffins, fuelled by the adoption of eco-friendly construction materials aimed at minimizing carbon footprints. For instance, the EU has a set target for 2030 of a 55 % net reduction in greenhouse gas emissions. Construction material innovation integrates chlorinated paraffins to improve fire resistance, enhance durability, and optimize formulation stability. The construction sector prioritizes sustainability, increasing reliance on additives that reduce energy consumption and extend material lifespan. Strategies to minimize carbon footprints encourage research into efficient formulations, aligning with evolving environmental objectives. Regulatory emphasis on sustainable building materials reinforces chlorinated paraffin applications, ensuring their continued integration in key infrastructure projects. Construction advancements highlight the role of chlorinated paraffins in performance improvement and compliance-driven initiatives.

Latin America Chlorinated Paraffins Market Analysis

Latin America is seeing rising chlorinated paraffins consumption, propelled by construction activities fuelled by urbanization. For instance, 85.2 % of the Latin America population is urban (565,084,260 people in 2024). Expanding urban centers necessitate infrastructure enhancements, boosting demand for additives that improve material performance. The construction sector integrates chlorinated paraffins in coatings and plastics to ensure long-term stability and fire resistance. Urbanization trends drive real estate and commercial developments, reinforcing the need for effective material additives. The construction sector prioritizes structural integrity, increasing reliance on high-performance compounds for enhanced durability. Regulatory considerations support chlorinated paraffin adoption in formulation strategies, ensuring material efficiency in modern construction projects.

Middle East and Africa Chlorinated Paraffins Market Analysis

Middle East and Africa is witnessing sustained chlorinated paraffins demand, supported by the expansion of the textile industry. According to reports, in 2022, the UAE textile market was valued at more than USD10 Billion and is now expected to expand by more than 5% a year over the medium term. The textile industry incorporates chlorinated paraffins to enhance fiber treatment, improve flame resistance, and ensure long-lasting material properties. Processing advancements in synthetic and natural textiles drive the integration of specialized additives, ensuring quality enhancement. Manufacturing efficiencies in the textile industry emphasize stable chemical applications, reinforcing chlorinated paraffin utilization. The textile industry’s evolving material requirements foster ongoing reliance on durable, high-performance compounds.

Competitive Landscape:

Technological advancements, material innovations, and rising industrial demand are shaping the chlorinated paraffins market. Moreover, expanding applications in PVC, metalworking, and flame retardants, along with infrastructure growth and regulatory developments, are driving market expansion. Increasing investments in sustainable formulations and production efficiency are fostering innovation. Regional expansions, research initiatives, and evolving industry standards are intensifying competition, promoting cost-effective and high-performance solutions across various end-use industries. The report has also analysed the competitive landscape of the market with some of the key players being:

- Aditya Birla Chemicals (Thailand) Limited (Aditya Birla Group)

- Ajinomoto Fine-Techno Co. Inc. (Ajinomoto Co. Inc.)

- Altair Chimica S.p.A. (Esseco Group Srl)

- Caffaro Industrie SPA

- Dover Chemical Corporation (ICC Industries Inc.)

- Flow Tech Group of Industries

- INEOS Inovyn (INEOS Group Limited)

- JSC Kaustik (NikoChem Group)

- KH Chemicals BV (Ravago S.A.)

- KLJ Group

- NCP Chlorchem (Pty) Ltd

- Química Del Cinca Sl

- Vantage Specialty Chemicals Inc.

Latest News and Developments:

- March 2023: A chlorinated paraffin plant in Pakistan, designed by Sichuan Zhongyuan United Chemical Co., Ltd., began operations with a 15,000-ton annual capacity. The facility aims to meet rising industrial demand for chlorinated paraffins in various applications. This expansion strengthens the regional supply chain and enhances production capabilities.

- February 2023: Payal Group expanded its chlorinated paraffins production capacity to 70 KTA by inaugurating a 35 KTA facility at its integrated plant in Dahej, Gujarat. This expansion positions the company among India's top three chlorinated paraffin manufacturers. The project aims to support the growing downstream PVC industry and boost exports of secondary plasticizers.

- October 2022: NOVA Chemicals Corporation launched EX-PCR-NC4, a mechanically recycled polyethylene resin supporting sustainability goals. While not directly linked to chlorinated paraffins, such innovations influence the chemical sector's evolving material landscape. The introduction of EX-PCR-NC4 highlights growing industry efforts to reduce environmental impact and enhance product performance.

- March 2022: Germany-based AWAX S.p.A. acquired Sasol Wax GmbH to expand its wax portfolio and strengthen its European presence. Sasol Wax GmbH specializes in manufacturing various wax products, including paraffin wax. This acquisition may impact the supply chain for related chemicals like chlorinated paraffins. The move aligns with industry trends in specialty chemicals and market consolidation.

- January 2022: Altair Chimica installed a fourth reactor to enhance the production of ‘eco-bio’ chlorinated paraffins, boosting capacity by 25% to 16,000 Tons/year. The reactor is dedicated to ESSEBIOCHLOR, emphasizing biodegradability and sustainability in chlorinated paraffin production. This expansion strengthens the company’s photo-chlorination plant, a key component of its organic chemistry operations. The project aligns with Industry 4.0 and sustainable chemistry advancements, reinforcing Altair Chimica’s commitment to innovation.

Chlorinated Paraffins Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Medium Chain, Short Chain, Long Chain |

| Applications Covered | Metal Working Fluids, Lubricating Additives, Plastics, Rubber, Paints, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aditya Birla Chemicals (Thailand) Limited (Aditya Birla Group), Ajinomoto Fine-Techno Co. Inc. (Ajinomoto Co. Inc.), Altair Chimica S.p.A. (Esseco Group Srl), Caffaro Industrie SPA, Dover Chemical Corporation (ICC Industries Inc.), Flow Tech Group of Industries, INEOS Inovyn (INEOS Group Limited), JSC Kaustik (NikoChem Group), KH Chemicals BV (Ravago S.A.), KLJ Group, NCP Chlorchem (Pty) Ltd, Química Del Cinca Sl, Vantage Specialty Chemicals Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the chlorinated paraffins market from 2020-2034.

- The chlorinated paraffins market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the chlorinated paraffins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chlorinated paraffins market was valued at USD 2.3 Billion in 2025.

The chlorinated paraffins market is projected to exhibit a CAGR of 3.48% during 2026-2034, reaching a value of USD 3.1 Billion by 2034.

Key factors driving the chlorinated paraffin market include growing demand in industries like PVC production, flame retardants, metalworking, increased automotive applications, and regulatory support for safer, more efficient chemical formulations.

Asia-Pacific currently dominates the chlorinated paraffins market, accounting for a share of 31.2%. The market growth is driven by rising demand in PVC, metalworking fluids, and flame retardants, fueled by industrial expansion, urbanization, and infrastructure development.

Some of the major players in the chlorinated paraffins market include Aditya Birla Chemicals (Thailand) Limited (Aditya Birla Group), Ajinomoto Fine-Techno Co. Inc. (Ajinomoto Co. Inc.), Altair Chimica S.p.A. (Esseco Group Srl), Caffaro Industrie SPA, Dover Chemical Corporation (ICC Industries Inc.), Flow Tech Group of Industries, INEOS Inovyn (INEOS Group Limited), JSC Kaustik (NikoChem Group), KH Chemicals BV (Ravago S.A.), KLJ Group, NCP Chlorchem (Pty) Ltd, Química Del Cinca Sl, Vantage Specialty Chemicals Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)