Chitosan Market Size, Share, Trends and Forecast by Grade, Source, Application, and Region, 2026-2034

Chitosan Market Size and Share:

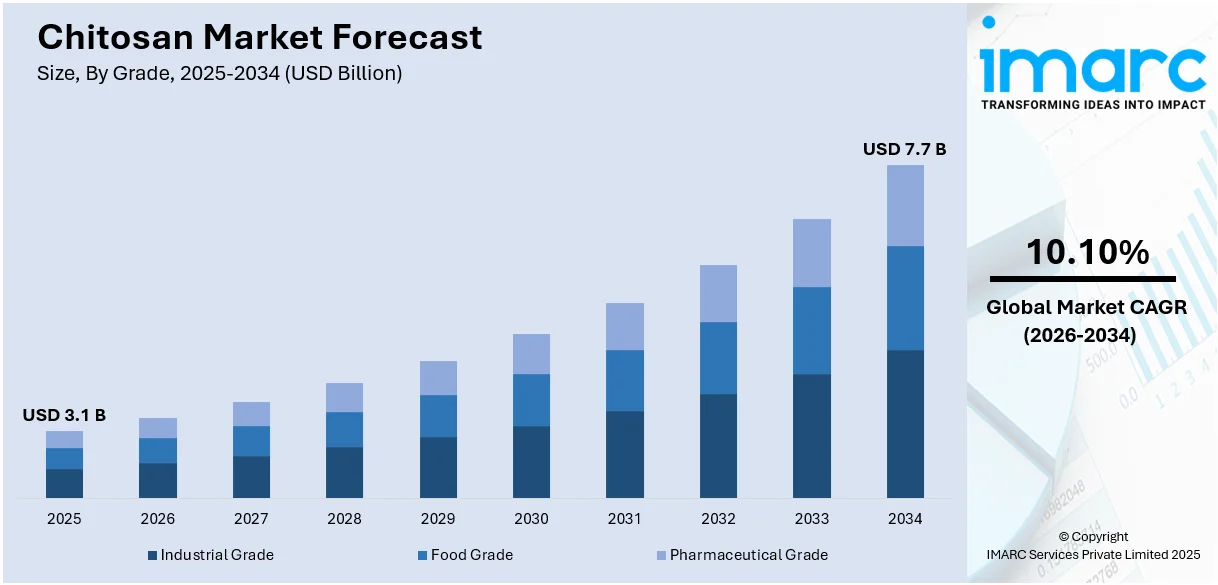

The global chitosan market size was valued at USD 3.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 7.7 Billion by 2034, exhibiting a CAGR of 10.10% during 2026-2034. Asia Pacific currently dominates the market, holding a significant market share of over 44.6% in 2025. This dominance is driven by abundant raw material availability, growing demand in water treatment, agriculture, and healthcare applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.1 Billion |

|

Market Forecast in 2034

|

USD 7.7 Billion |

| Market Growth Rate (2026-2034) | 10.10% |

One major driver of the chitosan market is the increasing demand for environmentally friendly and biodegradable materials. Derived from natural sources like shrimp and crab shells, chitosan offers sustainable alternatives to synthetic products in industries such as agriculture, pharmaceuticals, and water treatment. Its effectiveness as a biopolymer for waste management, seed coating, and drug delivery systems aligns with growing environmental concerns and regulatory pressures for eco-friendly solutions. For instance, in 2024, TomTex introduced a 100% biobased, biodegradable leather alternative made from mushroom chitosan and shrimp shells, addressing the $500 billion leather industry's environmental impact, including greenhouse gas emissions and deforestation. Additionally, its antibacterial and antifungal properties enhance its utility across diverse applications, including food preservation and cosmetics. This multifaceted functionality continues to drive the adoption of chitosan, fueling its growth in global markets.

To get more information on this market Request Sample

The United States serves the chitosan market by leveraging its advanced biotechnology and research capabilities to drive innovation in chitosan applications. U.S. manufacturers focus on producing high-quality chitosan for diverse industries, including healthcare, agriculture, and water treatment. The growing demand for sustainable and biodegradable materials aligns with the nation’s commitment to environmental stewardship, further boosting the market. Additionally, the robust pharmaceutical and cosmetics sectors in the U.S. contribute to increased adoption of chitosan in drug delivery systems and personal care products. For instance, in 2024, Dyson launched the Chitosan™ formulations range ($59.99), including pre-style and post-style hair serum. This product line is integrated with oyster mushroom-derived chitosan to offer shine and natural movement. . Moreover, strong regulatory frameworks and investments in research and development position the U.S. as a key player in the global chitosan market.

Chitosan Market Trends:

Increasing Demand in Medical and Pharmaceutical Industries

Chitosan’s usage and importance in the medical and pharmaceuticals sector have become an iconic enhancer of the entire industry. Being biocompatible, biodegradable, and non-toxic has made chitosan penetrate the usage of drug-delivery systems, tissue engineering and extensively heal wounds. Its properties on biological tissues for cell growth or adhesion have been taken advantage of in using suture and bandage along with other wound healing application. The increase in chronic diseases, surgeries, and the emphasis on innovative healthcare solutions has only increased this demand. For instance, 8 chronic conditions, including diabetes and depression, reached a record high prevalence in the 2023 America's Health Rankings report, reflecting the increasing need for advanced medical solutions. This high incidence of chronic conditions increases the demand for effective treatment, which in turn has fueled the acceleration of chitosan application in drug delivery systems and wound care products. Also, governments and health organizations are investing in research and development, thus encouraging the use of chitosan-based products. The global drive to use more sustainable and environment-friendly materials also increases chitosan's appeal as it finds an affinity with modern healthcare targets and strategies.

Rise in Product Demand in the Cosmetic Industry

The overall market for chitosan is largely motivated by its growing use in cosmetics. Chitosan finds a lot of application because it is known for moisturizing, anti-aging, and rejuvenating effects on skin and hair, making the skincare and hair care industries huge consumers. Increasing sensitivity to the composition of the products results in the preference of natural, organic, or plant-derived materials. Chitosan caters to this need; it is safe and natural. In a research article, chitosan's ability to inhibit bacterial action in treating acne-related bacteria was important in the sense that its minimal inhibitory concentrations (MIC) for Cutibacterium acnes were recorded at 512 µg/mL and Staphylococcus aureus at 16/80 µg/mL, contributing to its widespread use in the treatment of acne. Another driving force is the increase in disposable income and the surging popularity of premium beauty and personal care products. Cosmetics are now increasingly formulating chitosan into their products due to consumer demand for efficacious products that also tend to be environmentally responsible. Thus, this tendency aligns with consumer values and drives further the demand for chitosan in the cosmetic industry and drives the overall market growth.

Increasing Applications in the Food and Beverage Industry

Chitosan is witnessing growth in terms of the market due to expanding application in the food and beverages industry. Given the capability of chitosan for its binding with fats and oils, the additive is used in food production, adding less calorie content, or reducing calories and also as a preservative to extend shelf life. Along with this, increasing health-conscious consumers who require low-calorie and nutrient-rich products have increased the demand for the product in this segment. Moreover, the trend for natural and clean-label products has increased the usage of the product as an alternative for artificial preservatives and additives. For example, a 2023 SupplySide Food Business Journal article reports that almost 70% of consumers are highly sensitive to potentially unhealthy ingredients, illustrating increasing interest in clean-label ingredients. Moreover, the McCormick Flavor Solutions' 2023 Clean Label Special Report shows that 83% of consumers consider clean or natural ingredients important. This trend also includes using natural ingredients with safety elements, like in the usage of chitosan, which fulfills such a theme. Also, multifunctionality from its usage and application as used by consumers and endorsed by various regulating agencies underpins the reason behind chitosan as the essential addition to food products for its high market flow.

Chitosan Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global chitosan market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on grade, source, and application.

Analysis by Grade:

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

Industrial grade leads the market in 2025. This segment is influenced by its inherent properties like biocompatibility, antimicrobial attributes, and biodegradability. The growing demand for eco-friendly and sustainable materials in industries such as agriculture, water treatment, cosmetics, and pharmaceuticals has boosted the growth of the industrial-grade chitosan market. Moreover, the awareness of the harmful environmental effects caused by synthetic chemicals has driven companies to look for alternatives, thereby fostering the adoption for chitosan-based applications. Besides this, regulatory policies encouraging the usage of natural and renewable resources also support the industry's growth path. Improving manufacturing processes and extracting technologies have also helped in building the industrial-grade market segment. Consequently, the convergence of environmental consciousness, regulatory support, and technological advancements stands as the primary driving force behind the ascension of the market.

Analysis by Source:

- Shrimp

- Crab

- Squid

- Krill

- Others

Shrimp leads the market with around 62.8% of the market share in 2025. The chitosan industry's shrimp-derived chitosan segment increases with the rise in product demand since this material is known for its benefits, including being biodegradable, non-toxic, and biocompatible. The trend of shifting to eco-friendly and environmentally sustainable products increases the applicability of shrimp-sourced chitosan in the fields of food preservation, pharmaceuticals, and agriculture. Along with this, the growing trend of using natural resources for various applications is in tandem with consumer demand for greener alternatives, which is helping to boost the demand for shrimp-derived chitosan. Also, the availability of shrimp waste as a byproduct of seafood processing helps source the product and thus further propels its prominence. In essence, the convergence of eco-conscious consumer choices, sustainable sourcing practices, and chitosan's versatile applications delineates the substantial market drivers propelling the growth of the shrimp source segment within the overall industry.

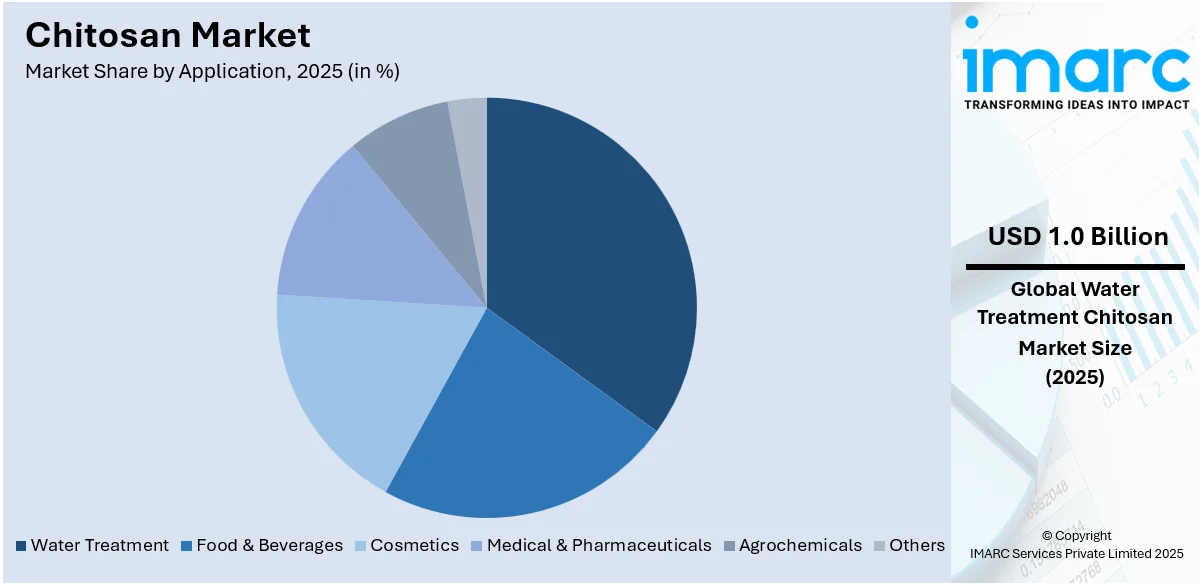

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Water Treatment

- Food & Beverages

- Cosmetics

- Medical & Pharmaceuticals

- Agrochemicals

- Others

Water treatment leads the market with around 34.5% of the market share in 2025. This application within the industry of water treatment is justified by the rising awareness about water pollution and the need for sustainable solutions. Chitosan-based products have come up as a suitable substitute for several processes in water treatment. The pressure to minimize the use of chemicals in the process of water treatment and the chitosan-based capability of removing contaminants like heavy metals and dyes have propelled the usage of chitosan in this industry. In addition, regulatory mandates promoting eco-friendly and non-toxic water treatment methods further amplify the demand for the product. Additionally, the versatility of chitosan in addressing both industrial and municipal water treatment requirements contributes to its sustained growth. Thus, the emergence of environmental consciousness, regulatory impetus, and chitosan's intrinsic properties substantiates its role as a pivotal market driver within the water treatment application.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2025, Asia Pacific accounted for the largest market share of over 44.6%. The chitosan industry in the Asia Pacific region is propelled by the region's substantial population, rapid urbanization, and growing industrial sectors. Along with this, the escalating emphasis on sustainable and eco-friendly products aligns with chitosan's inherent attributes, such as biodegradability and versatility, thereby fostering its adoption in various industries including agriculture, pharmaceuticals, and food processing. In addition, regulatory initiatives aimed at curbing environmental degradation further reinforce the prominence of chitosan-based solutions. Moreover, the rich availability of raw materials, particularly from seafood industries, enhances the feasibility of its production in the region. As technological advancements continue to optimize extraction processes, the cost-effectiveness and quality of chitosan products are being augmented. In essence, the interplay of demographic dynamics, sustainability imperatives, regulatory support, and technological innovations collectively drive the growth of the chitosan industry in the Asia Pacific, positioning the region as a key player in the global market landscape.

Key Regional Takeaways:

United States Chitosan Market Analysis

US accounts for 85% share of the market in North America. The U.S. market for chitosan has been growing significantly, especially with regard to water treatment, fueled by the demand for the use of sustainable filtration techniques. According to the NRDC (National Resources Defense Council), about 77 million people in the U.S., i.e., about a quarter of the population, are served by water systems that report violations of health-based drinking water standards. Advanced purification processes for water are an utmost necessity and driving the market for chitosan-based filters that filter out all contaminants efficiently. The concern of the US government on environmental sustainability and water quality contributes to the growth of the biopolymer technologies including chitosan. Thus, the growth of the market is being accelerated by consumers gaining consciousness and pressure of regulations concerning enhanced water quality wherein chitosan stands a good potential solution. With ongoing innovations in water treatment technologies and chitosan's biodegradability, the market is expected to grow further.

North America Chitosan Market Analysis

The North America chitosan market is witnessing significant growth, driven by the increasing demand for natural and sustainable products in various industries. Derived from chitin, chitosan is gaining significant popularity for its diverse applications across various industries, including agriculture, food and beverage, healthcare, and cosmetics. For instance, in May 2024, Health Canada approved the utilization of chitosan from white button mushrooms as a preservative in foods at levels of 150-1,500 ppm. Approved for use in beverages, cheese, desserts, and sauces. Moreover, rising consumer awareness about the health benefits of chitosan, such as weight management and wound healing properties, is also fueling market growth. Additionally, the growing focus on environmental sustainability is driving the adoption of chitosan as an eco-friendly alternative to synthetic chemicals. The market is characterized by the presence of key players offering a wide range of chitosan products and solutions, further contributing to market expansion. Overall, the North America chitosan market is poised for continued growth in the coming years.

Europe Chitosan Market Analysis

The European chitosan market is growing due to strong sustainability policies and demand from the biomedical sector. Eurostat reports that in 2022, EU countries recycled 40.8% of waste, which has positively influenced the adoption of biodegradable materials such as chitosan. Germany, France, and the UK are leaders in water treatment solutions, using chitosan to remove heavy metals. In the pharmaceutical industry, biotechnology R&D investments in chitosan-based drug delivery are increasing. Germany leads these statistics with a 10% increase in 2023, as reported by German Biotechnology Report 2024. Besides these, the European Food Safety Authority supports chitosan uses in food packaging, which gives additional strength to its marketability. Production is majorly dominated by companies such as Heppe Medical Chitosan and BioLog Heppe, which follows stiff EU safety and sustainability practices.

Asia Pacific Chitosan Market Analysis

This rapidly growing Asia Pacific chitosan market is driven by industries including agriculture, pharmaceuticals, and water treatment. In a report from Japan's Ministry of Agriculture, Forestry and Fisheries (MAFF), the government has pledged Yen 818 Billion, approximately USD 5.5 Billion, for fiscal year 2023 to strengthen food security and support agriculture, including sustainable farming practices. This funding of environmental farming technologies supports the increasing use of biopolymers such as chitosan in agriculture. Furthermore, Japan continues to fund organic farming, with MAFF budgeting Yen 42.6 Billion (about USD 317.8 Million) to support organic agriculture in 2022. China is the largest producer of crustacean waste globally and holds the highest position in chitosan production and export. A strong manufacturing of biopolymers supports the market for chitosan. India's Biotechnology Department says that the Indian biopolymer market is growing at 15% annually, supported by the "Make in India" initiative. The region's expanding pharmaceutical sector is integrating chitosan for drug delivery and wound healing applications. Local firms collaborate with global players, enhancing technological advancements, while rising environmental concerns fuel adoption of chitosan-based water treatment solutions, solidifying Asia Pacific's global leadership.

Latin America Chitosan Market Analysis

The Latin American chitosan market is growing as the agricultural as well as water treatment operations are on the rise. USDA stated that Brazil's Government announced a record R$ 475.5 Billion, approximately USD 88.2 Billion, for 2024/25 Crop Plan that included funds for sustainable farming practices. While this plan covers a wide range of agricultural activities, it shows the government's commitment to supporting sustainable agriculture, which directly benefits the chitosan market, especially for biodegradable fertilizers and eco-friendly pesticides. Moreover, the World Bank has launched a program in November 2024, valued at USD 1.6 Billion, to support family farmers in Brazil. This initiative aims to further market access, agricultural productivity, and climate resilience, bringing more adoption of biopolymers like chitosan in sustainable farming. Brazil's seafood industry already generates a lot of raw materials from which chitosan will be produced, making Brazil the regional leader. Local companies such as Polymar invest in R&D that helps diversify applications in the cosmetic and pharmaceutical industries. Government initiatives in promoting the use of biopolymers and sustainable farming are likely to further strengthen the market.

Middle East and Africa Chitosan Market Analysis

Water scarcity has driven the chitosan market in the Middle East and Africa, along with demands for agriculture and new biomedical uses. ESG News writes that Saudi Arabia has enticed USD 9.8 Billion in private investments targeting agriculture and food sectors, part of Vision 2030. In 2023, the government spent SR4 Billion, around USD 1.08 Billion to expand greenhouse agriculture and boost sustainable crop productivity, as per an industry report. South Africa is currently the world leader in biomedical innovation, using chitosan in wound care and pharmaceutical research. Local companies are scaling up production in order to reduce import dependence, and government-backed programs in water management and agricultural sustainability have positioned the region as an emerging player in the global chitosan market.

Competitive Landscape:

The global chitosan market is experiencing significant growth due to escalating investments in research and development to explore new applications and improve the properties of chitosan. This includes developing innovative extraction methods, enhancing chitosan's functional properties, and discovering novel applications in areas such as medicine, agriculture, and cosmetics. For instance, in 2024, Primex, a prominent marine biotechnology firm, published clinical trial results in BMJ Open Diabetes Research & Care, showing ChitoCare Wound Healing Gel improved full healing rates, with 50% and 75% wound closure significantly higher than placebo in 10 weeks. Along with this, chitosan manufacturers are diversifying their product portfolios to cater to different industries and applications. This involves creating specialized chitosan products with varying molecular weights, degrees of deacetylation, and functional modifications to suit specific needs. Therefore, this positively influences the market. In addition, companies are forming partnerships and collaborations with research institutions, universities, and other businesses to leverage expertise and resources for product development and market expansion. Collaborative efforts help accelerate innovation and widen the scope of chitosan applications. Apart from this, the widespread adoption of eco-friendly practices in chitosan production and processing, including sourcing raw materials responsibly, reducing waste, and minimizing the environmental footprint of their operations is significantly supporting the market. Furthermore, key players are offering customized chitosan solutions to meet the specific needs of clients in various industries, contributing to the market.

The report provides a comprehensive analysis of the competitive landscape in the chitosan market with detailed profiles of all major companies, including:

- Primex EHF

- Heppe Medical Chitosan GmbH

- Meron Group

- KitoZyme SA

- Golden-Shell Pharmaceutical Co. Ltd.

- FMC Corporation

- Agra Tech, Inc.

- Axio Biosolutions Pvt Ltd

- Marshall Marine Products

Latest News and Developments:

- July 2024: DPH Biologicals and KitoZyme have formed a partnership to launch ChitoNox FC as a biocontrol product, which can be used for sustainable growth by growers in the U.S. It is based on fungal chitosan, protecting seedlings against nematodes and soil-borne diseases while helping to promote root development and further plant growth.

- July 2023: Axio Biosolutions Pvt Ltd acquired 510(k) clearance from the US Food and Drug Administration (FDA) for the Axiostat Gauze line of enhanced hemostatic gauze, which prevents severe traumatic bleeding. Axiostat in Z-fold Hemostatic gauze is based on a biomaterial technology that is 100% chitosan-based and has already achieved CE certification. It is utilized by several military forces across the world to minimize trauma bleeding.

- May 2023: FMC Corporation established a partnership with Syngenta Crop Protection to offer a ground-breaking weed control solution for rice. Tetflupyrolimet, the novel active component, was discovered and developed by FMC for use in rice with assistance from Syngenta.

- March 2023: Meron Group released new dessert premixes for HoReCA. The company's launch will concentrate on ready-to-use premixes and specialized blends.

Chitosan Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Industrial Grade, Food Grade, Pharmaceutical Grade |

| Sources Covered | Shrimp, Crab, Squid, Krill, Others |

| Applications Covered | Water Treatment, Food & Beverages, Cosmetics, Medical & Pharmaceuticals, Agrochemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Primex EHF, Heppe Medical Chitosan GmbH, Meron Group, KitoZyme SA, Golden-Shell Pharmaceutical Co. Ltd., FMC Corporation, Agra Tech, Inc., Axio Biosolutions Pvt Ltd., Marshall Marine Products. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the chitosan market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global chitosan market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the chitosan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Chitosan is a natural biopolymer derived from chitin, found in the exoskeletons of crustaceans like shrimp and crabs. It is valued for its biodegradability, biocompatibility, and antimicrobial properties, making it useful in industries such as healthcare, agriculture, food packaging, and water treatment for eco-friendly and sustainable applications.

The chitosan market was valued at USD 3.1 Billion in 2025.

IMARC estimates the global chitosan market to exhibit a CAGR of 10.10% during 2026-2034.

The global chitosan market is driven by its versatile applications in healthcare, water treatment, and agriculture. Increasing demand for biodegradable, eco-friendly materials, rising adoption in wound care and pharmaceuticals, and growing awareness of sustainable solutions are key factors boosting its market growth across diverse industries.

According to the report, industrial grade represented the largest segment by grade, driven by its extensive use in water treatment, agriculture, and bioplastics, offering cost-effective solutions for large-scale applications requiring high performance and efficiency.

Shrimp leads the market by source, owing to its abundant availability, high chitin content, cost-effectiveness in extraction, and its widespread use as a primary raw material for producing high-quality chitosan.

Water treatment is the leading segment by application, driven by chitosan's natural ability to remove heavy metals, impurities, and contaminants, its biodegradability, and its effectiveness as a flocculating and chelating agent in wastewater management.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global chitosan market include Primex EHF, Heppe Medical Chitosan GmbH, Meron Group, KitoZyme SA, Golden-Shell Pharmaceutical Co. Ltd., FMC Corporation, Agra Tech, Inc., Axio Biosolutions Pvt Ltd., Marshall Marine Products, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)