China Wind Energy Market Report by Component (Turbine, Support Structure, Electrical Infrastructure, and Others), Rating (≤ 2 MW, >2 ≤ 5 MW, >5 ≤ 8 MW, >8 ≤ 10 MW, >10 ≤ 12 MW, >12 MW), Installation (Offshore, Onshore), Turbine Type (Horizontal Axis, Vertical Axis), Application (Utility, Industrial, Commercial, Residential), and Region 2025-2033

China Wind Energy Market Size:

China wind energy market size reached USD 15,791.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 42,063.4 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The market is rapidly expanding, driven by the implementation of supportive government policies, rising environmental concerns and climate commitments by China, growing focus on enhancing energy security and independence, rapid technological advancements in turbine technology and material science, and the escalating economic diversification efforts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15,791.8 Million |

|

Market Forecast in 2033

|

USD 42,063.4 Million |

| Market Growth Rate 2025-2033 | 11.50% |

China Wind Energy Market Analysis:

- Major Market Drivers: China's wind energy industry has majorly benefited from the policies and incentives of governments like feed-in tariffs, subsidies, and aggressive renewable energy objectives. Furthermore, there have been improvements in wind energy production performance and cost reductions because of technical developments in materials science, grid integration, and turbine efficiency. Also, investments in wind energy as a sustainable substitute for fossil fuels is motivated by concerns related to the environment and pledges to climate targets.

- Key Market Trends: Offshore wind energy is growing in popularity thanks to technological advancements and favorable coastal wind conditions. In addition, the use of digital technologies like artificial intelligence (AI) and the Internet of Things (IoT) in wind turbine operations is maximizing performance and maintenance to better the overall system performance and reliability. The shift from subsidies to competitive bidding processes has also improved the cost-effectiveness and efficiency of wind energy projects.

- Competitive Landscape: The competitive landscape of the market has been examined in the report, along with the detailed profiles of the major players operating in the industry. Some of the key players include China Three Gorges Corporation, China Huadian Corporation Ltd, Datang International Power Generation Co., Ltd., Envision Energy, Goldwind Science & Technology Co., Ltd., Shanghai Electric Group Company Limited, Dongfang Electric Corporation, Ming Yang Smart Energy Group Limited, Sany Electric Co., Ltd., and XEMC Windpower Co., Ltd.

- Challenges and Opportunities: High wind energy capacity locations face many challenges and problems like grid congestion and the need for better grid systems. In certain areas, severe climatic conditions necessitate the use of creative methods to guarantee the longevity and dependability of wind energy installations. However, there is potential for expansion in offshore wind energy and growing national and global markets because of technological advancements and well-thought-out multinational alliances.

China Wind Energy Market Trends:

Implementation of Government Policies and Incentives

In recent years, China has been implementing several encouraging policies to stimulate renewable energy sources, with wind energy being the primary focus. A major objective of China's 13th Five-Year Plan (2016-2020) was to grow wind power capacity to 210 gigawatts (GW) by 2020. This is just one example of the aims the government has set for wind energy capacity in its Five-Year Plans. Feed-in tariffs and subsidies have also played a significant role in encouraging international and local investment in this field. For instance, China said in 2019 that the offshore wind feed-in-tariff program will terminate in 2021 and be replaced by an auction. As a result of this policy change, China added approximately 17 GW of wind energy in the year 2021, which is more than the entire world's addition in a single year. These policies have created a positive regulatory environment for sustained growth and attract investments into China's wind energy market.

Rising Environmental Concerns and Climate Commitments

China's wind energy industry has grown majorly because of the nation's commitment to managing climate change and resolving several issues that are related to the environment. China has been under great strain to curb its carbon footprint and switch to greener energy sources as it is the greatest emitter of greenhouse gases (GHGs) across the globe. In line with this, the 14th Five-Year Plan (FYP) for renewable energy was released by the National Development and Reform Commission (NDRC) in order to control emissions. This plan has set a target for renewable electricity production of 33% and 18% for non-hydro renewable energy for the year 2025. These goals correlate with a draft policy on renewable obligations for 2022-2030 that was released in February 2021. As per the proposal, the percentage of energy generated by wind and solar power would climb by 1.47% a year until 2030, at which point it would account for 26% of the total power consumption.

Growing Focus on Energy Security and Independence

As the world's largest energy consumer, China is dependent on imports of fossil fuels to meet its energy demands. This exposes the nation to geopolitical risks and market volatility, which is why China is developing domestic renewable energy sources like wind power to improve energy security and lessen reliance on imported fuels. China's share of the world's wind energy output in 2019 was around 28.4%, up from 2.1 percent in 2012. The country has been intending to expand its energy mix and provide a reliable and sustainable energy supply by enlarging its wind energy capacity. This move towards greater energy independence is strengthening national security and supporting the long-term sustainability of China's energy system.

China Wind Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, rating, installation, turbine type, and application.

Breakup by Component:

To get more information on this market, Request Sample

- Turbine

- Support Structure

- Electrical Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes turbine, support structure, electrical infrastructure, and others.

As per the China wind energy market trends and report, the turbine is essential for converting wind kinetic energy into electrical energy. It includes blades, rotors, nacelles, and towers, each playing a critical role in the overall efficiency and capacity of the wind turbine. Moreover, rapid technological advancements in turbine design, such as the development of larger and more efficient models that enhance energy capture and reduce costs per megawatt, are promoting the wind energy demand in China.

The support structure segment comprises the foundational elements that are necessary to anchor and stabilize wind turbines to ensure their operational efficiency and longevity. It includes reinforced concrete foundations and steel towers for onshore wind farms, while offshore installations rely on specialized structures such as monopiles, jackets, and floating platforms to withstand marine environments.

The electrical infrastructure segment involves the systems and components required to transmit and integrate the electricity generated by wind turbines into the power grid. It includes transformers, switchgear, substations, and cabling, which are vital for ensuring efficient power transmission and distribution. Moreover, it plays a crucial role in minimizing energy losses, enhancing grid stability, and facilitating the seamless incorporation of renewable energy into the national energy mix.

Breakup by Rating:

- ≤ 2 MW

- >2 ≤ 5 MW

- >5 ≤ 8 MW

- >8 ≤ 10 MW

- >10 ≤ 12 MW

- >12 MW

A detailed breakup and analysis of the market based on the rating have also been provided in the report. This includes ≤ 2 MW, >2 ≤ 5 MW, >5 ≤ 8 MW, >8 ≤ 10 MW, >10 ≤ 12 MW, and >12 MW.

The ≤ 2 MW segment consists of small to medium-sized wind turbines that are used in distributed wind energy applications and community wind projects. These turbines are deployed in rural or isolated areas to provide localized energy solutions, thereby contributing to energy independence and reducing reliance on traditional power grids.

Based on the China wind energy market outlook and forecast, the >2 ≤ 5 MW segment includes medium-capacity wind turbines that are used in onshore and offshore wind farms. They strike a balance between capacity and cost, making them suitable for a wide range of applications. Moreover, they are deployed in areas with moderate wind resources and are integral to many utility-scale projects.

The >5 ≤ 8 MW segment features high-capacity wind turbines that are increasingly becoming the standard for new installations, particularly in offshore wind farms. They offer higher energy output and improved efficiency, making them ideal for large-scale projects to maximize energy production. Moreover, the rapid technological advancements that enhance turbine performance and durability ensuring reliable operation in harsh environments, are positively impacting the China wind energy market size.

The >8 ≤ 10 MW segment represents some of the largest and most advanced wind turbines that are designed for offshore applications where space and wind conditions allow for maximum energy capture. They offer unparalleled efficiency and capacity. Their deployment is associated with large offshore wind farms that contribute significantly to national renewable energy goals.

The >10 ≤ 12 MW segment includes the latest generation of ultra-high-capacity wind turbines. They are designed for large-scale offshore wind farms that are capable of generating vast amounts of electricity and significantly contributing to the grid. The development of these turbines involves cutting-edge engineering and materials science to ensure they can withstand the extreme conditions of offshore environments.

The >12 MW segment represents the pinnacle of current wind turbine technology. They are used in offshore wind farms where they can take advantage of strong and consistent wind resources. The sheer size and capacity of these turbines make them suitable for large-scale energy production, significantly reducing the number of turbines needed and lowering the overall costs of wind farm development.

Breakup by Installation:

- Offshore

- Onshore

The report has provided a detailed breakup and analysis of the market based on the installation. This includes offshore and onshore.

According to the China wind energy market analysis and insights, the offshore wind energy segment involves the installation of wind turbines in bodies of water on continental shelves, where wind speeds are higher and more consistent than on land. Offshore wind farms have the advantage of being able to deploy larger turbines, which are capable of generating significantly more power.

The onshore wind energy segment refers to wind turbines installed on land. Onshore wind farms benefit from lower installation and maintenance costs compared to their offshore counterparts, making them more economically attractive for many regions. Moreover, it is characterized by a wide range of projects, such as small community-based installations and large utility-scale wind farms.

Breakup by Turbine Type:

- Horizontal Axis

- Vertical Axis

A detailed breakup and analysis of the market based on the turbine type have also been provided in the report. This includes horizontal axis and vertical axis.

Horizontal axis wind turbines (HAWT) are the most common type of wind turbine due to their high efficiency and widespread adoption. They have blades that rotate around a horizontal axis, similar to traditional windmills, and are mounted on tall towers to capture stronger wind currents at higher altitudes. HAWTs are favored for large-scale wind farms due to their ability to generate substantial amounts of electricity efficiently.

Vertical axis wind turbines (VAWT) have blades that rotate around a vertical axis, allowing them to capture wind from any direction without the need for orientation mechanisms. It is suitable for urban environments, where wind patterns can be highly variable. VAWTs have a simpler design and can be installed closer to the ground, making them easier to maintain and less visually intrusive.

Breakup by Application:

- Utility

- Industrial

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the application. This includes utility, industrial, commercial, and residential.

The utility segment includes large-scale wind farms that generate electricity for widespread distribution through the power grid. These utility-scale projects are backed by substantial investments and can range from dozens to hundreds of megawatts in capacity. They play a crucial role in national energy strategies, helping to reduce reliance on fossil fuels and lower greenhouse gas emissions.

The industrial segment involves the use of wind energy to power manufacturing facilities, industrial plants, and other large-scale operations. It is utilized in industries that seek to reduce their carbon footprint and manage energy costs more effectively. Industrial entities can secure a stable and cheaper source of electricity while also demonstrating their commitment to sustainability by investing in on-site wind energy generation or local wind projects.

The commercial segment covers the adoption of wind energy by businesses and commercial establishments, including office buildings, retail centers, and other service-oriented enterprises. Commercial applications of wind energy are smaller in scale but offer substantial benefits in terms of energy savings and sustainability. Businesses are increasingly investing in wind energy to achieve corporate social responsibility (CSR) goals, improve their environmental credentials, and reduce operational costs.

The residential segment involves the use of small-scale wind turbines by homeowners and residential communities to generate electricity for personal use. Moreover, the rising demand for sustainable living practices and the increasing affordability of residential wind energy systems, is boosting the China wind energy market share. Homeowners install wind turbines to reduce their dependence on the grid, lower electricity bills, and minimize their environmental impact.

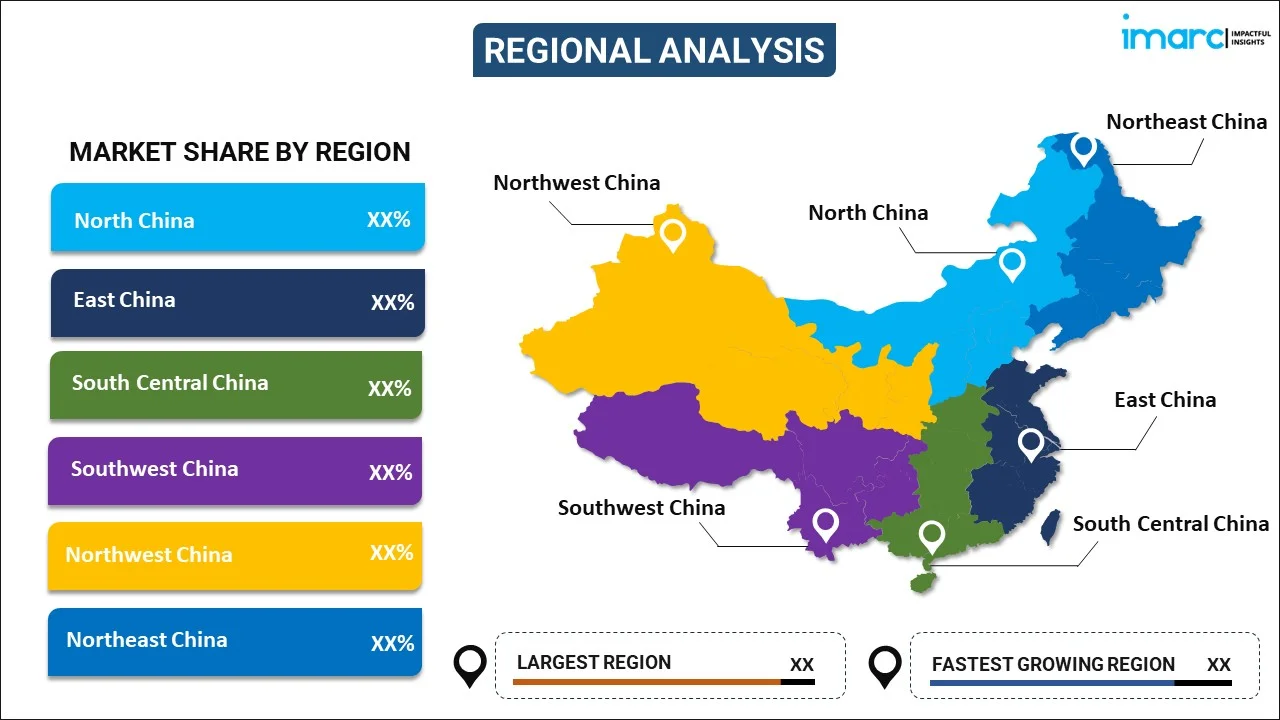

Breakup by Region:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

The report has also provided a comprehensive analysis of all the major markets in the region, which include North China, East China, South Central China, Southwest China, Northwest China, and Northeast China.

North China is a pivotal region for the wind energy market, characterized by its vast and windy plains, which provide ideal conditions for large-scale wind farms. In line with this, the strong government support and substantial investments in wind infrastructure, including advanced grid integration technologies to manage and distribute the generated power efficiently, are supporting the China wind energy market growth.

East China's proximity to the coast allows for substantial offshore wind projects, which are becoming increasingly significant due to the region's high energy demands and limited land availability. Moreover, the region's advanced industrial base supports the manufacturing and technological innovation required for onshore and offshore wind turbines. Additionally, the rising government initiatives and investments in grid infrastructure and renewable energy are fueling the market growth.

South Central China is emerging as a significant market for wind energy due to its diverse geographical features and substantial energy needs. The region's mix of mountainous terrain and coastal areas offers opportunities for onshore and offshore wind projects. Moreover, the robust industrial activity and increasing urbanization, driving the demand for renewable energy, are favoring the market growth.

Southwest China has a complex topography and abundant wind resources, which presents unique opportunities for wind energy development. In line with this, they are leveraging their high-altitude and wind-rich areas to establish significant wind farms. Moreover, the growing focus on balancing environmental conservation with energy development is reflected in careful planning and the deployment of advanced technologies to minimize ecological impact.

Northwest China is known for its vast deserts and high-altitude plateaus, enabling large-scale wind farm installations. The region's development is supported by substantial government investment in renewable energy and infrastructure, including long-distance transmission lines to transport electricity to other parts of China. Moreover, the dual goals of economic development and environmental sustainability in the region are fostering the market growth.

Northeast China is an industrial region transitioning to renewable energy. The region's strong wind resources, combined with its existing industrial infrastructure, provide a solid foundation for wind energy development. In addition to this, the introduction of government policies and incentives to revitalize the region's economy have spurred investments in wind energy projects.

Competitive Landscape:

Key players in the market are focusing on technological innovation and expanding their production capacities to maintain competitive edges. They are investing in research and development (R&D) to produce larger, more efficient turbines and enhance offshore wind capabilities. Moreover, some firms are advancing their offshore wind projects and developing smart wind turbines with integrated digital technologies for better efficiency and maintenance. Besides this, they are leveraging their expertise in digital solutions to optimize wind farm performance and integrating artificial intelligence (AI) and the Internet of Things (IoT) technologies into their operations. These companies are also expanding their global footprint through strategic partnerships and international projects to capture market share in emerging wind energy markets. Moreover, they are actively engaging in sustainability initiatives, aligning their operations with global climate goals, and investing in green technologies to reduce carbon footprints.

The report provides a comprehensive analysis of the competitive landscape in the China wind energy market with detailed profiles of all major companies, including:

- China Three Gorges Corporation

- China Huadian Corporation Ltd

- Datang International Power Generation Co., Ltd.

- Envision Energy

- Goldwind Science & Technology Co., Ltd.

- Shanghai Electric Group Company Limited

- Dongfang Electric Corporation

- Ming Yang Smart Energy Group Limited

- Sany Electric Co., Ltd.

- XEMC Windpower Co., Ltd.

China Wind Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Turbine, Support Structure, Electrical Infrastructure, Others |

| Ratings Covered | ≤ 2 MW, >2 ≤ 5 MW, >5 ≤ 8 MW, >8 ≤ 10 MW, >10 ≤ 12 MW, >12 MW |

| Installations Covered | Offshore, Onshore |

| Turbine Types Covered | Horizontal Axis, Vertical Axis |

| Applications Covered | Utility, Industrial, Commercial, Residential |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Companies Covered | China Three Gorges Corporation, China Huadian Corporation Ltd, Datang International Power Generation Co., Ltd., Envision Energy, Goldwind Science & Technology Co., Ltd., Shanghai Electric Group Company Limited, Dongfang Electric Corporation, Ming Yang Smart Energy Group Limited, Sany Electric Co., Ltd., XEMC Windpower Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the China wind energy market performed so far, and how will it perform in the coming years?

- What is the breakup of the China wind energy market on the basis of component?

- What is the breakup of the China wind energy market on the basis of rating?

- What is the breakup of the China wind energy market on the basis of installation?

- What is the breakup of the China wind energy market on the basis of turbine type?

- What is the breakup of the China wind energy market on the basis of application?

- What are the various stages in the value chain of the China wind energy market?

- What are the key driving factors and challenges in the China wind energy market?

- What is the structure of the China wind energy market, and who are the key players?

- What is the degree of competition in the China wind energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China wind energy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the China wind energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China wind energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)