China Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

China Travel Retail Market Overview:

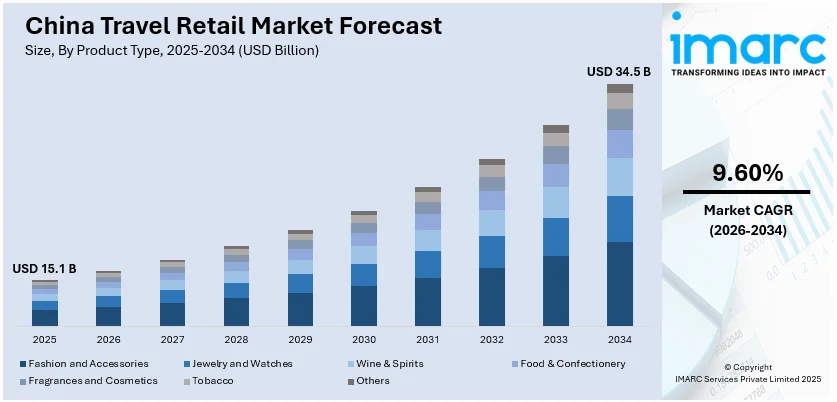

The China travel retail market size reached USD 15.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 34.5 Billion by 2034, exhibiting a growth rate (CAGR) of 9.60% during 2026-2034. Rising disposable income, expanding middle class, duty-free policy relaxations, increasing international and domestic tourism, premium brand demand, airport and downtown duty-free expansions, and e-commerce integration are driving China's travel retail market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15.1 Billion |

| Market Forecast in 2034 | USD 34.5 Billion |

| Market Growth Rate 2026-2034 | 9.60% |

China Travel Retail Market Trends:

Digitalization and Omnichannel Retailing

China’s travel retail market is rapidly embracing digitalization, integrating online and offline experiences to enhance consumer engagement. Retailers are leveraging e-commerce, social commerce, and digital payments to streamline the shopping experience. The rise of WeChat Mini Programs, Alipay Duty-Free Channels, and JD.com’s cross-border platforms enable travelers to pre-order duty-free products before arriving at airports or designated shopping zones. In 2023, China's duty-free e-commerce sales exceeded $10 billion, accounting for nearly 30% of total travel retail sales, creating a positive outlook for market expansion. Moreover, by 2025, mobile payments are projected to cover over 85% of travel retail transactions, reflecting China's cashless economy which is further boosting the growth of the travel retail market. Concurrent with this, the number of cross-border e-commerce users in China reached 189 million in 2023, with a CAGR of 14.2%, further bolstering the market growth. Furthermore, the integration of AI-driven personalized recommendations, live-streaming promotions, and AR/VR-enabled product trials is reshaping consumer behavior. Travel retail giants like China Duty Free Group (CDFG) are collaborating with digital platforms to introduce exclusive online shopping experiences. Brands such as L’Oréal and Estée Lauder now provide virtual beauty advisors, further enhancing customer engagement.

To get more information on this market Request Sample

Growth of Offshore Duty-Free Shopping in Hainan

Hainan is solidifying its position as China’s top offshore duty-free hub, attracting millions of domestic travelers seeking luxury goods at competitive prices. Since the 2020 duty-free policy expansion, spending limits have increased, and new categories like electronics and fine wines have been introduced. Hainan’s duty-free sales reached ¥80 billion ($11 billion) in 2023, a 25% YoY increase, which is providing an impetus to the market growth. In line with this, visitor arrivals to Hainan are expected to surpass 100 million by 2025, supported by infrastructure expansions, further strengthening the market growth. Additionally, the number of licensed duty-free retailers in Hainan rose from 4 to 12 in recent years, intensifying competition. Apart from this, the Hainan Free Trade Port initiative aims to transform the island into a global shopping destination, attracting major luxury brands like Chanel, Cartier, and Louis Vuitton. Enhanced logistics and direct-to-consumer shipping, allowing post-travel delivery of purchases, are boosting consumer confidence. Additionally, Hainan’s “Buy Now, Collect Later” policy helps travelers shop flexibly, contributing to higher conversion rates.

China Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Fashion and Accessories

- Jewelry and Watches

- Wine & Spirits

- Food & Confectionery

- Fragrances and Cosmetics

- Tobacco

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fashion and accessories, jewelry and watches, wine & spirits, food & confectionery, fragrances and cosmetics, tobacco, and others.

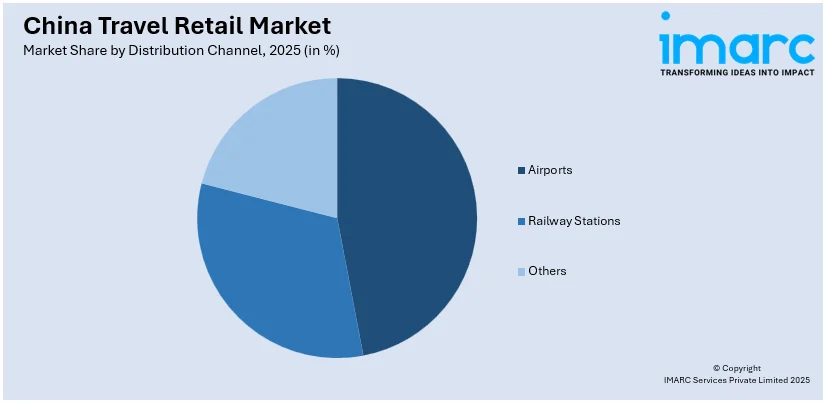

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Airports

- Railway Stations

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, railway stations, and others.

Regional Insights:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

The report has also provided a comprehensive analysis of all the major regional markets, which include North China, East China, South Central China, Southwest China, Northwest China, and Northeast China.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant have been covered in the report. Also, detailed profiles of all major companies have been provided.

China Travel Retail Market News:

- October 2024: SK-II opened its first global travel retail flagship store in Haitang Bay, Hainan. The store offers a multi-sensory skincare experience inspired by the brand's iconic ingredient PITERA™. PITERA™ is a naturally derived ingredient crafted from a proprietary yeast fermentation process, which cannot be created artificially or synthetically.

- October 2024: L'Occitane Travel Retail launched its first-ever L'Occitane en Provence Botanical Lab pop-up at the CDF International Duty Free Complex in Sanya, Hainan. The multi-sensory journey offers travelers a chance to explore the brand's botanical ingredients and create personalized beauty experiences.

China Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fashion and Accessories, Jewelry and Watches, Wine & Spirits, Food & Confectionery, Fragrances and Cosmetics, Tobacco, Others |

| Distribution Channels Covered | Airports, Railway Stations, Others |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the China travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the China travel retail market on the basis of product type?

- What is the breakup of the China travel retail market on the basis of distribution channel?

- What are the various stages in the value chain of the China travel retail market?

- What are the key driving factors and challenges in the China travel retail market?

- What is the structure of the China travel retail market and who are the key players?

- What is the degree of competition in the China travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China travel retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the China travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)