China Toys Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End-User, and Province, 2025-2033

China Toys Market Size and Share:

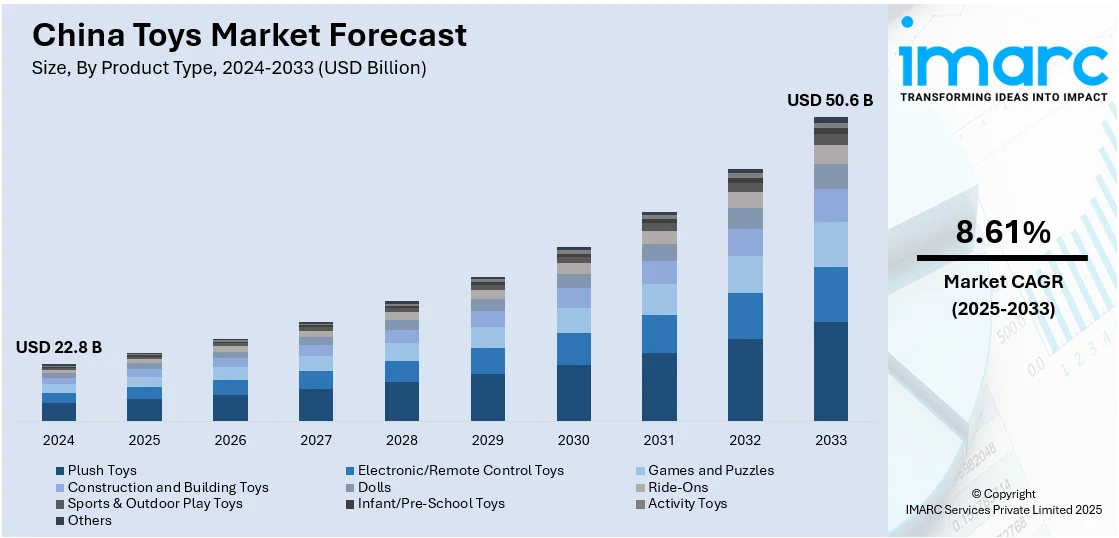

The China toys market size was valued at USD 22.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 50.6 Billion by 2033, exhibiting a CAGR of 8.61% during 2025-2033. Guangdong dominated the market, holding a significant market share of over 31.2% in 2024. The introduction of eco-friendly toy variants, a shift in preference from traditional toys to modern and high-tech electronic toys, and the increasing influence of social media platforms and celebrity endorsements are among the key factors driving the market growth. These factors contribute to China toys market share, positioning the country as a key player in the global industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 22.8 Billion |

|

Market Forecast in 2033

|

USD 50.6 Billion |

| Market Growth Rate 2025-2033 | 8.61% |

Several fundamental elements influence the market. Rising disposable incomes and a burgeoning middle class are driving up expenditure on toys, particularly luxury and instructional items. Rapid urbanization and the growth of contemporary retail outlets, particularly e-commerce platforms, have increased access to a vast range of toy goods. The growing emphasis on early childhood development has increased demand for educational and STEM-based toys, as parents strive to enrich their children's learning via play. Additionally, the growing popularity of collectible toys among teenagers and adults, driven by nostalgia and fandom culture, is one of the major factors propelling the Chinese toy market growth. Technological improvements in toys, such as interactive and smart toys, also help to drive industry growth. Furthermore, worldwide collaborations and license agreements with multinational entertainment franchises promote long-term interest and innovation in the field.

The collectibles and trading card segment in China is expanding, with strategic partnerships driving market innovation. A collaboration between a major toy company and a Shanghai-based manufacturer is set to introduce a new trading card game, aiming for broader global distribution, tapping into the growing consumer demand. For instance, in April 2025, in a strategic move to expand its footprint in the collectibles and trading card segment, Hasbro partnered with Shanghai-based card manufacturer Kayou to co-develop a brand-new My Little Pony Trading Card Game. The game is underway for a broader global rollout.

China Toys Market Trends:

Rise of Educational Toys

China toys market is experiencing a surge in demand for educational toys, driven by parents' rising emphasis on early children's development and cognitive skill-building. STEM kits, logic puzzles, and coding robots are increasingly popular among urban middle-class families. This trend is consistent with China's governmental emphasis on science and innovation, as well as a movement in parental spending priorities towards value-driven purchases that promote a child's academic and personal development. Brands that blend entertainment and skill development are booming. LEGO, for example, is a market leader in this category, offering themed kits that promote problem-solving and creativity. Local businesses are also extending their educational product offerings to meet demand, with a noteworthy increase in Mandarin-focused phonics tools, AI-assisted learning kits, and hands-on activity boxes. Retailers, both online and offline, are allocating more shelf space and marketing efforts to educational toys. The category is currently seen not as a luxury, but as a need for school-aged children. This trend is changing toy design and marketing throughout China.

E-Commerce Driving Toy Sales

The growth of e-commerce is reshaping the toy industry in China, making it easier for brands to reach consumers directly and quickly adapt to market trends. Online platforms such as JD.com, Taobao, and Douyin have become key channels for launching and promoting new toys, particularly during major shopping festivals like 618 and Singles’ Day. Livestream selling and influencer partnerships have also helped toy brands create real-time engagement with consumers. Convenience, selection, and fast delivery have made e-commerce the go-to option for busy parents and gift buyers. This shift is especially important for the China toys wholesale market, where bulk buyers and small retailers use digital platforms to access a wider range of suppliers and manage stock more efficiently. The rise of online-exclusive toy collections, limited-time offers, and digital-first product testing is enabling brands to experiment and gather data quickly. This not only helps refine product lines but also allows for hyper-targeted advertising, often tailored by region or age group. As e-commerce infrastructure continues to mature, it’s expected to remain a dominant force in toy distribution across China.

Increasing Parental Concerns

Parents in China are increasingly concerned about the safety of toys as a result of previous events involving inferior or harmful items. In response to these concerns, producers and merchants are ensuring that their products go through rigorous testing and certification processes to ensure their safety. This creates a good market outlook. Furthermore, as digital toys and smart gadgets gain popularity, parents are becoming increasingly concerned about their children's online safety and privacy. They look for toys that have strong security features, safeguard children's personal information, and offer a safe digital environment. According to Invest China, the designer toys market alone is projected to exceed CNY 110 Billion by 2026, nearly doubling from approximately CNY 60 Billion in 2023, signaling a thriving future for the industry. Furthermore, the continual development of toys that incorporate educational elements, such as building blocks, puzzles, coding toys, and science kits, is providing a boost to the market across China.

Rise of Collectible Toys for Teens and Adults

Based on the China toys market outlook, a dedicated platform for collectible toys catering to teenagers and adult enthusiasts has recently emerged in China. This innovative space highlights a diverse range of collectible products, such as designer figures, blind boxes, garage kits, and dolls, targeting the growing interest of older demographics. As the play culture evolves beyond traditional children's toys, this segment has garnered increasing attention, with a significant focus on high-quality, unique items. The market for these collectible toys is expanding rapidly, driven by demand for personalized, creative, and nostalgic collectibles. For example, in March 2025, Trendy Toy Zone debuted at Toy & Hobby China 2025, unveiling a dedicated platform tailored to the fast-growing market of collectible toys for teenagers and adult enthusiasts. As play culture continues to extend beyond children, the newly launched zone captured significant attention by showcasing a wide array of trendy toys, including designer figures, blind boxes, garage kits, ball-jointed dolls, and cotton dolls.

Rising Implementation of Government Policies

To support domestic toy manufacturing and promote industry development, the Chinese government has implemented a variety of policies, including tax breaks, subsidies, and financial assistance to encourage investment in toy production facilities, R&D, and innovation. Based on China toys market forecast, these initiatives are intended to promote the domestic toy sector, increase competitiveness, and reduce dependency on imported toys. They have also taken steps to increase the enforcement of intellectual property rights (IPR) in the toy business. This has resulted in improved protection for patented designs, trademarks, and copyrights. Furthermore, the government has adopted import and export rules that have an influence on the toy business, since these policies oversee the importation of toys and include safety certificates, customs processes, and labeling standards.

China Toys Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China toys market, along with forecasts at the country and province levels from 2025-2033. The market has been categorized based on product type, distribution channel, end-user, and province.

Analysis by Product Type:

- Plush Toys

- Electronic/Remote Control Toys

- Games and Puzzles

- Construction and Building Toys

- Dolls

- Ride-Ons

- Sports & Outdoor Play Toys

- Infant/Pre-School Toys

- Activity Toys

- Others

Electronic/remote control toys stood as the largest product type in 2024, holding around 55.8% of the market. Electronic/remote control toys incorporate features such as sound effects, lights, motion sensors, touchscreens, voice recognition, and connectivity, making them highly engaging and appealing to children. These toys often provide educational benefits by incorporating interactive learning experiences. They can help develop cognitive skills, problem-solving abilities, creativity, language acquisition, and STEM knowledge. The proliferation of smartphones, tablets, and other smart devices has contributed to the dominance of electronic toys. Many electronic toys can be connected to these devices, allowing for additional features, app integration, and access to online content. These product types also provide entertainment beyond traditional play since they include features as music, videos, games, and digital storytelling.

On the other hand, games and puzzles are highly valued for their educational benefits. They help develop critical thinking, problem-solving skills, spatial awareness, hand-eye coordination, logical reasoning, and strategic planning. They encourage family bonding and social interaction.

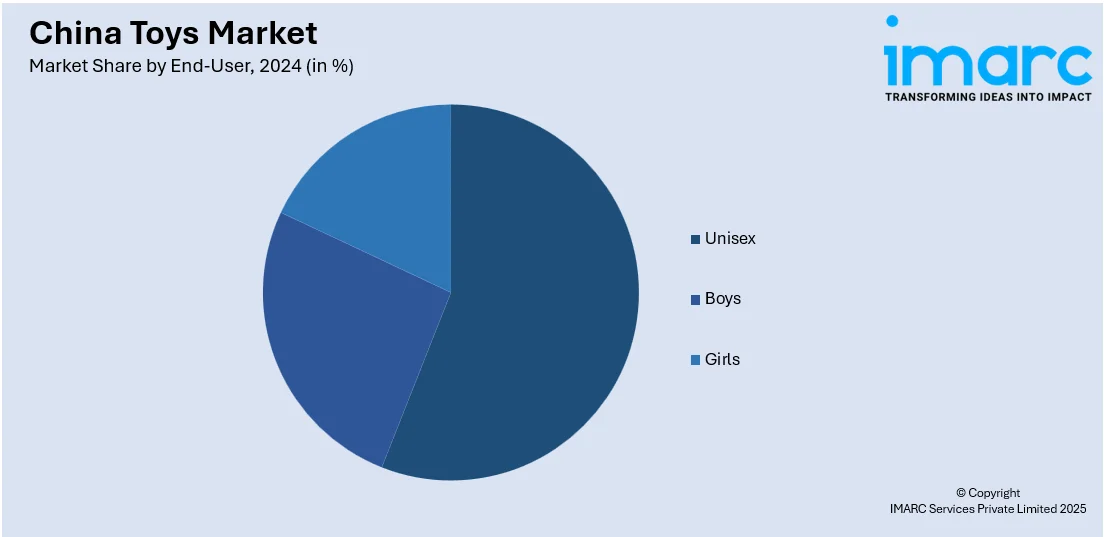

Analysis by End-User:

- Unisex

- Boys

- Girls

Unisex led the market in 2024. Unisex toys appeal to a broader audience as they are designed without specific gender stereotypes. Unisex toys often focus on educational and skill development, appealing to parents who prioritize learning and cognitive growth. These toys offer opportunities for creativity, problem-solving, critical thinking, and fine motor skills development, regardless of gender. Parents across China recognize the value of such toys and their impact on their child's overall development. Unisex toys offer a wide range of play experiences that are not limited to stereotypical gender roles. They encompass various themes, such as building blocks, puzzles, arts and crafts, science kits, and imaginative play sets, allowing children to explore their interests and preferences freely. This diversity in play experiences contributes to the dominance of the unisex sector.

Analysis by Distribution Channel:

- Specialty Stores

- Supermarkets and Hypermarkets

- Departmental Stores

- Online Stores

- Others

Specialty stores led the market in 2024. These stores focus on offering a wide variety of toys that are carefully curated to meet specific customer preferences and interests. They specialize in niche categories, unique products, and high-quality toys that may not be readily available in other retail outlets. These stores prioritize toys that offer educational benefits and promote child development. They cater to parents' desires for toys that enhance cognitive skills, problem-solving abilities, creativity, and STEM learning. By focusing on educational toys, specialty stores differentiate themselves from general retailers and meet the demands of parents seeking enriching play experiences for their children.

On the contrary, online stores offer unparalleled convenience and accessibility to consumers. They provide a wide range of products from various brands, often offering more choices than physical retail stores. Online stores often offer competitive pricing due to reduced overhead costs compared to traditional retail. They can provide discounts, promotions, and flash sales that attract price-conscious consumers.

Analysis by Province:

- Guangdong

- Jiangsu

- Shandong

- Zhejiang

- Henan

- Others

In 2024, Guangdong accounted for the largest market share of over 31.2%. Guangdong held the biggest market share as it is referred to as a major manufacturing hub, particularly for toys. The province is home to numerous factories and production facilities, offering a wide range of manufacturing capabilities and expertise. It has developed industrial clusters focused on the toy industry. It comprises clusters of toy manufacturers, suppliers, and related businesses. These clusters foster collaboration, innovation, and efficiency within the industry, contributing to the dominance of Guangdong in the toys market. It has accumulated years of experience and expertise in toy manufacturing. Guangdong has a vibrant culture of innovation and design in the toy industry. Toy companies in the region invest in research and development, design creativity, and product innovation.

On the other hand, Jiangsu province also holds a significant position in the industry. Jiangsu has a strong manufacturing capacity, particularly in the production of plastic toys, electronic toys, and related components as the province hosts a large number of toy manufacturing companies and factories, leveraging its manufacturing expertise, technology, and infrastructure to produce a wide range of toys.

Competitive Landscape:

The key players in the market have invested in research and development (R&D) activities to introduce new and innovative toy products that capture consumer attention. This may involve incorporating emerging technologies, interactive features, unique designs, or eco-friendly materials to differentiate their offerings. They are also developing educational toys that promote learning, cognitive development, and skill-building. These toys often align with educational curricula and cater to parental preferences for toys that offer educational value. Additionally, they are developing mobile apps, online platforms, or interactive websites to enhance the play experience, engage with customers, and provide additional digital content related to their toys. Also, they are upgrading packaging designs, implementing user-friendly instructions, providing after-sales support, or enhancing customer service through responsive communication channels.

The report provides a comprehensive analysis of the competitive landscape in the China toys market with detailed profiles of all major companies, including:

- Mattel, Inc.

- LEGO System A/S

- Hasbro, Inc.

- VTech Holdings Limited

- Hape International AG

- Silverlit Toys Manufactory Limited

- Sieper GmbH

- Micro Mobility Systems AG

- Ravensburger Ltd

- Shantou City Big Tree Toys Co., Ltd

Latest News and Developments:

- May 2025: Nike and LEGO launched co-branded kids’ products in China, blending sport and play. This includes footwear, apparel, and LEGO sets. In cities like Shanghai and Beijing, Nike would host community events and in-store activations. A new playground in Shanghai, made from recycled shoes, will follow this fall. It's part of Nike’s plan to build 100 courts in Greater China, with 42 already completed, encouraging active play among youth.

- March 2025: LEGO debuted its first F1 Fan Zone at the 2025 Chinese Grand Prix in Shanghai, targeting young consumers and sports fans. The “Build the Thrill” experience included interactive play areas and showcased LEGO F1 sets, including models for all 10 teams. With over 220,000 attendees at the three-day event, LEGO used this platform to boost its toy offerings and brand presence in China’s growing sports-themed toy segment.

- March 2025: Chinese toymaker 52Toys announced that it was planning a Hong Kong IPO to raise up to USD 200 Million in the near term. Employing a dual-track IP strategy, 52Toys is popular for original products like Kimmy & Miki and collaborations with global brands, such as Disney and Harry Potter.

- January 2025: Chinese toymaker Bloks Group raised USD 215 Million in its Hong Kong IPO. The IPO was significantly oversubscribed, with local retail investors bidding 6,000 times the available shares. On debut, Bloks' shares surged 82%, highlighting the booming designer toys market in China.

- October 2024: Blokees launched multiple new products at the 2024 China Toy Expo in Shanghai, showcasing licensed IPs, such as Marvel, Kamen Rider, and Naruto. The company also emphasized global expansion, announcing partnerships across 30+ IPs and collaborations in 15 countries.

China Toys Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Plush Toys, Electronic/Remote Control Toys, Games And Puzzles, Construction And Building Toys, Dolls, Ride-Ons, Sports & Outdoor Play Toys, Infant/Pre-School Toys, Activity Toys, Others |

| End Users Covered | Unisex, Boys, Girls |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Departmental Stores, Online Stores, Others |

| Province Covered | Guangdong, Jiangsu, Shandong, Zhejiang, Henan, Others |

| Companies Covered | Mattel, Inc., LEGO System A/S, Hasbro, Inc., VTech Holdings Limited, Hape International AG., Silverlit Toys Manufactory Limited, Sieper GmbH, Micro Mobility Systems AG, Ravensburger Ltd., and Shantou City Big Tree Toys Co., Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China toys market from 2019-2033.

- The China toys market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within each province.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The toys market in China was valued at USD 22.8 Billion in 2024.

The growth of China toys market is driven by rising disposable incomes, a growing middle class, increased demand for educational and interactive toys, and a strong focus on online retail. Additionally, government support for the children's sector and evolving consumer preferences for innovative, tech-driven products further fuel growth.

The China toys market is projected to exhibit a CAGR of 8.61% during 2025-2033, reaching a value of USD 50.6 Billion by 2033.

Electronic/remote control toys accounted for the largest share, holding around 55.8% of the market in 2024. The growth of electronic toys in China is driven by technological advancements, rising interest in interactive learning, increasing digital engagement among children, and the growing popularity of STEM-based educational toys.

Some of the major players in the China toys market include Mattel, Inc., LEGO System A/S, Hasbro, Inc., VTech Holdings Limited, Hape International AG., Silverlit Toys Manufactory Limited, Sieper GmbH, Micro Mobility Systems AG, Ravensburger Ltd., Shantou City Big Tree Toys Co., Ltd., etc.

Guangdong accounted for the largest share, holding around 31.2% of the market in 2024 due to its dense manufacturing base, export hubs like Shenzhen, skilled labor, and strong supply chain networks, making it central to production and distribution.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)