China Swine Feed Market Size, Share, Trends and Forecast by Product Type, Feed Essence, Feed Additive Type, and Region, 2025-2033

China Swine Feed Market Size and Share:

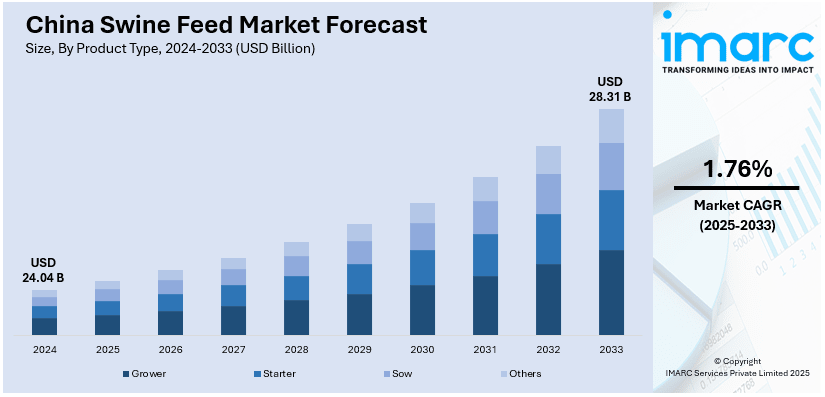

The China swine feed market size was valued at USD 24.04 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.31 Billion by 2033, exhibiting a CAGR of 1.76% from 2025-2033. The market is experiencing steady growth, driven by rising pork consumption and advancements in animal nutrition. Increasing demand for high-quality feed, along with technological innovations in feed additives and protein sources, is shaping the market. Government regulations and sustainability concerns are also influencing market dynamics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.04 Billion |

| Market Forecast in 2033 | USD 28.31 Billion |

| Market Growth Rate (2025-2033) | 1.76% |

The China swine feed market is driven by the rapid growth of industrialized pig farming, which demands high-quality, efficient feed formulations to optimize swine productivity. As the largest pork consumer and producer, China’s increasing focus on food security and sustainable livestock production accelerates the need for advanced feed solutions. For instance, in 2024, the nation yielded 57.06 Million metric tons of pork. Furthermore, the rising adoption of precision nutrition, designed to improve feed conversion ratios and reduce waste, supports the growth of specialized feed segments. Additionally, government policies promoting feed safety and technological advancements in feed additives and genetic engineering continue to drive market expansion.

Increasing consumer awareness about food safety, nutrition, and the rising demand for premium pork are key drivers of the China swine feed market. The growing emphasis on minimizing the environmental impact of farming practices has led to greater investments in sustainable feed solutions. Moreover, challenges related to disease outbreaks, such as African Swine Fever, push the industry toward improved biosecurity measures and higher quality feeds that support animal health and immunity. For instance, as per the Food and Agriculture Organization of the United States, ASF is a virus-caused disease that chiefly impacts wild boars and pigs, depicting a fatality rate of 100%. In response, China took significant actions, such as the Ministry of Agriculture and Rural Affairs (MARA) issued the “Work Plan for Regional Prevention and Control of African Swine Fever and Other Major Animal Diseases (Trial).” This plan divided the country into five regions, with restrictions placed on pig movement, allowing pigs only to move within their respective regions. ASF-free zones were established in each region, and only pigs from these zones, along with breeding pigs and piglets, are permitted to move outside their respective regions. In addition to this, the demand for innovative, antibiotic-free feed formulations further fuels market growth as the industry adapts to regulatory changes.

China Swine Feed Market Trends:

Shift Toward Sustainable Feed Solutions

Sustainability is emerging as a key trend in the China swine feed market, driven by growing environmental concerns and government regulations. There is an increasing demand for feed formulations that reduce the carbon footprint, enhance resource efficiency, and support the circular economy. Feed manufacturers are integrating sustainable ingredients, such as plant-based proteins, and optimizing production processes to minimize waste. Additionally, the development of alternative protein sources like insect meal and algae-based supplements is gaining traction. For instance, as per industry reports, insect meal has 75% of the protein content and 10% of the fat content. Moreover, it has been observed that feeding insect meals to post-weaning piglets is highly safe, even at elevated doses. Furthermore, this trend aligns with both consumer preferences for environmentally conscious production and the industry's shift toward long-term sustainability.

Rise in Functional and Specialized Feed Additives

The China swine feed market is experiencing a shift towards functional and specialized feed additives designed to enhance animal performance, health, as well as feed efficacy. Enzymes, prebiotics, and probiotics are increasingly being incorporated into feed formulations to facilitate gut health, significantly improve absorption of nutrient, and reduce the need for antibiotics. For instance, as per a study conducted and published by researchers at the College of Food Science and Engineering, Central South University of Forestry and Technology, China, in March 2024, probiotics such as Pediococcus pentose and Bacillus subtilis significantly increase port meat color and muscle area around the eyes. Moreover, Bacillus strain can efficiently degrade the anti-nutritional components in the swine feed, resultantly enhancing the nutritional profile of feed. In addition to this, such additives help improve growth rates and overall swine productivity while supporting disease prevention. Moreover, the growing interest in functional ingredients, such as organic minerals and amino acids, is enhancing the nutritional value of feeds. This trend aligns with consumer demand for healthier, antibiotic-free pork production.

Technological Advancements in Feed Manufacturing

Technological innovation is rapidly transforming the China swine feed market, with significant investments in precision nutrition and automated feed manufacturing processes. The use of artificial intelligence, data analytics, and machine learning allows for the customization of feed formulations based on the specific needs of swine at different growth stages. For instance, in February 2024, Dekon Group, a China-based farming firm, Alibaba Group Holding, and Tequ Group announced a strategic alliance to develop AI-based pig-tracking system. This ventures, named ET Brain, will facilitate tracking of pig farming, along with their health. In addition, this leads to improved feed efficiency, reduced waste, and better overall productivity. Additionally, advancements in feed processing technologies, such as extrusion and pelleting, improve feed quality and digestibility. Such innovations enable manufacturers to meet the increasing demand for high-performance, cost-effective feed solutions while addressing sustainability goals.

China Swine Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China swine feed market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, feed essence, and feed additive type.

Analysis by Product Type:

- Grower

- Starter

- Sow

- Others

The grower feed segment holds the leading China swine feed market share, driven by the high demand for nutritionally balanced diets that enhance weight gain and feed efficiency in growing pigs. Targeting the post-weaning to pre-finishing stage, grower feed formulations focus on optimal protein, energy, and micronutrient levels to support rapid muscle development while maintaining gut health. The expansion of commercial pig farming and rising consumer preference for high-quality pork fuel demand for specialized feed solutions. Advancements in feed formulation technologies, including precision nutrition and digestibility enhancers, contribute to market growth. For instance, in March 2024, researchers in China announced the new feed formulation discovery which involves using mulberry leaves as a supplement for swine feed. These leaves can effectively lower skatole risks in pigs, which causes bad odor emissions. Regulatory policies promoting feed safety and quality further shape industry trends. Leading feed manufacturers invest in research and development to improve nutrient absorption, reduce feed conversion ratios, and enhance growth performance. The integration of functional ingredients, such as probiotics and enzymes, ensures improved swine health and productivity, reinforcing the dominance of this segment.

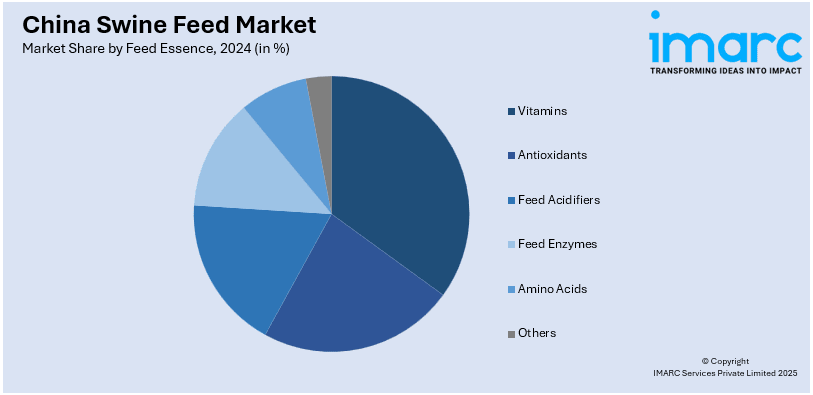

Analysis by Feed Essence:

- Vitamins

- Antioxidants

- Feed Acidifiers

- Feed Enzymes

- Amino Acids

- Others

Amino acids dominate the feed essence segment in China’s swine feed market, playing a critical role in optimizing growth, feed efficiency, and protein synthesis. Essential amino acids, mainly encompassing tryptophan, lysine, threonine, and methionine, are widely incorporated into feed formulations to enhance nutrient utilization and minimize nitrogen waste. The increasing emphasis on sustainable animal nutrition and environmental regulations drives demand for precision-formulated amino acid supplements. As soybean meal prices fluctuate, amino acid supplementation becomes crucial in maintaining cost-effective protein sources for swine. Advances in fermentation-based production and synthetic amino acid technologies enable consistent supply and improved bioavailability. Major feed manufacturers focus on customized amino acid blends tailored to specific growth stages, ensuring optimal performance and economic efficiency. Rising awareness of amino acid balancing in swine diets further accelerates adoption, as farmers seek solutions that maximize feed conversion rates while minimizing resource input, thereby shaping a positive Chine swine feed market outlook.

Analysis by Feed Additive Type:

- Zootechnical Feed Additives

- Sensory Feed Additives

- Nutritional Feed Additives

Nutritional feed additives hold the largest share within the feed additive segment, driven by the need to enhance swine health, immunity, and overall performance. This category includes vitamins, minerals, enzymes, probiotics, and prebiotics, which improve digestion, nutrient absorption, and gut microbiome stability. Rising concerns over antibiotic resistance and stringent regulations on antibiotic-free animal nutrition encourage the adoption of alternative additives that support immune function and disease resistance. Technological advancements in encapsulation and controlled-release formulations improve additive efficacy and stability in feed. Large-scale swine farms prioritize feed additives that enhance growth rates while reducing feed costs, contributing to sustained demand. Continuous research on novel bioactive compounds, including organic trace minerals and functional peptides, drives innovation in nutritional supplementation. The focus on sustainable and precision feeding strategies further reinforces the role of nutritional feed additives in optimizing productivity and ensuring high-quality pork production.

Regional Analysis:

- North and Northeast

- Northwest

- East

- South Central

- Southwest

North and Northeast China represent a significant share of the swine feed market, supported by large-scale pig farming operations and strong government policies promoting feed efficiency. Provinces such as Heilongjiang, Jilin, and Liaoning benefit from vast agricultural resources, ensuring a steady supply of raw materials. The region’s cold climate increases feed demand for energy-dense formulations, enhancing animal health and productivity. Major feed producers have established production facilities to serve the region’s growing livestock sector. Strategic investments in advanced feed technologies further support market expansion.

The Northwest region holds a substantial market share, driven by increasing pig farming activities and government incentives for livestock production. Provinces like Shaanxi, Gansu, and Xinjiang emphasize modernized breeding techniques and optimized feed formulations to improve swine growth rates. Limited arable land has led to the adoption of efficient feed conversion strategies, reducing dependency on external raw material sources. Rising investments in feed mills and distribution networks improve supply chain efficiency. Enhanced disease management and biosecurity measures further contribute to market expansion.

East China dominates the swine feed market due to its well-developed livestock industry, high pork consumption, and advanced feed manufacturing infrastructure. Key provinces, including Jiangsu, Zhejiang, and Shandong, house major feed producers and benefit from strong distribution networks. Technological advancements in precision nutrition and feed additives support the region’s demand for high-performance feed products. Proximity to major ports facilitates efficient raw material imports, reducing supply chain costs. Stringent regulations on feed quality and safety further drive the adoption of premium formulations.

South Central China holds a significant market share, supported by high swine production and increasing demand for specialized feed solutions. Provinces such as Hunan, Hubei, and Guangdong lead in pig farming density, driving consistent feed consumption. Favorable climatic conditions and access to diverse feed ingredients enable cost-effective production. The presence of leading feed manufacturers enhances market competitiveness, while research initiatives focus on optimizing feed conversion rates. Growing concerns over environmental sustainability and disease control encourage investments in advanced nutrition and biosecurity solutions.

Southwest China plays a vital role in the swine feed market, benefiting from expanding commercial pig farms and government-backed agricultural programs. Provinces like Sichuan, Yunnan, and Guizhou are key contributors, leveraging abundant natural resources for feed production. The region’s hilly terrain necessitates efficient supply chain strategies, including localized feed mills and advanced logistics. Rising demand for high-quality protein sources boosts the adoption of nutrient-enriched feed products. Sustainability initiatives and improved farm management practices further strengthen market growth, ensuring long-term industry stability.

Competitive Landscape:

The market is intensely competitive, driven by major domestic and international players. Leading companies, including New Hope Liuhe, CP Group, and Wens Foodstuff, dominate production with advanced formulations and integrated supply chains. For instance, as per industry reports, pig farming accounts for 13.6% of the net sales of New Hope Liuhe Co., Ltd, with its profit expected to increase by up to 121% in the year 2024. Moreover, rising demand for high-quality feed, cost pressures, and stringent regulatory standards intensify competition. In addition to this, key players invest in research and development, optimizing feed efficiency and nutritional value. Furthermore, market consolidation continues, with acquisitions and partnerships shaping industry dynamics. Besides, the presence of multinational firms fosters innovation, while government policies influence pricing, raw material sourcing, and production strategies.

The report provides a comprehensive analysis of the competitive landscape in the China swine feed market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, Louis Dreyfus Company announced the development of its specialty feed production facility in China that will principally focus on fermented soybean meal to improve feed protein digestibility, quality, and palatability. Set to operate by mid-2025, the facility will support local livestock and poultry industries.

- In July 2024, Gold Coin China announced completion of its new feed production plant in China. The facility is constructed with a significant expenditure of USD 23.1 Million, exhibiting 500,000 MT of capacity and said the largest feed plant in Yunnan Province till date that will be focusing on poultry, swine sectors.

- In April 2024, Evonik announced plans to unveil its amino acids portfolio for animal gut health as well as additives at China Feed Industry Expo 2024. Evonik has robust presence in animal nutrition sector of China for 20 years or more.

China Swine Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Grower, Starter, Sow, Others |

| Feed Essences Covered | Vitamins, Antioxidants, Feed Acidifiers, Feed Enzymes, Amino Acids, Others |

| Feed Additive Types Covered | Zootechnical Feed Additives, Sensory Feed Additives, Nutritional Feed Additives |

| Regions Covered | North and Northeast, Northwest, East, South Central, Southwest |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China swine feed market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China swine feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China swine feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The China swine feed market was valued at USD 24.04 Billion in 2024.

Rising pork consumption, industrialization of pig farming, and demand for high-quality feed formulations are driving market growth. Government policies promoting feed efficiency, advancements in feed additives, and increased focus on disease prevention further support expansion. Fluctuating raw material costs and sustainability concerns also shape industry developments.

IMARC estimates the China swine feed market to reach USD 28.31 Billion by 2033, exhibiting a CAGR of 1.76% from 2025-2033.

Grower accounted for the largest product type market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)