China Sodium Reduction Ingredient Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

China Sodium Reduction Ingredient Market Overview:

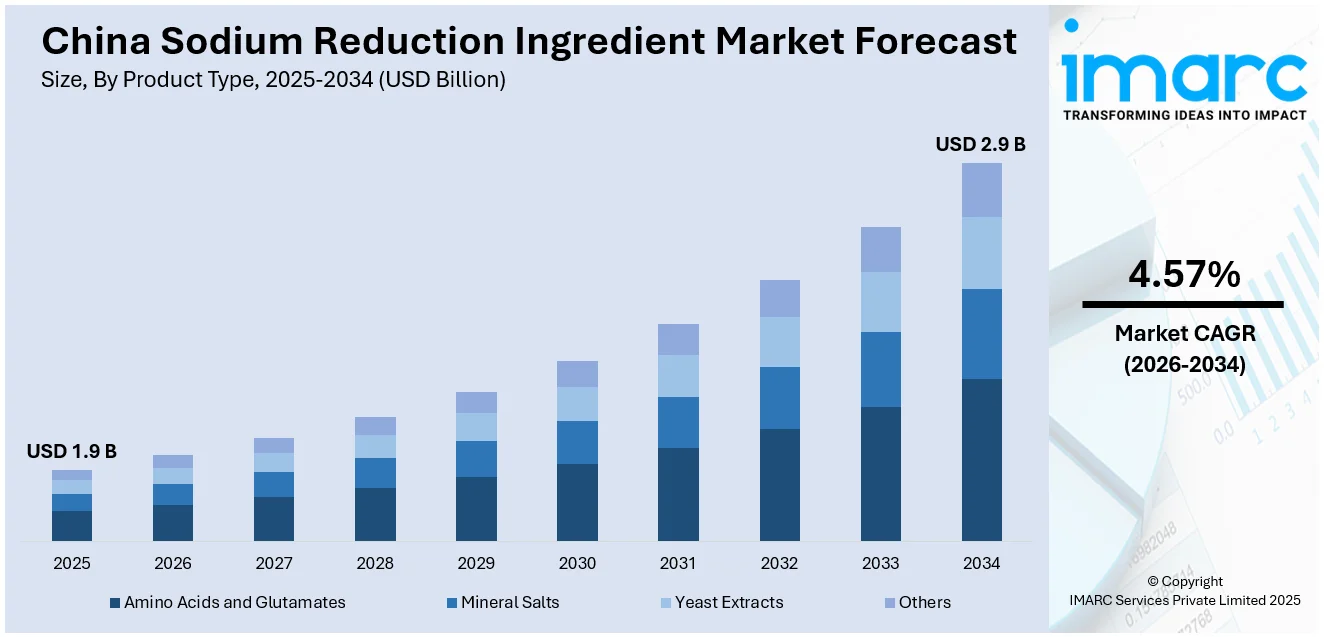

The China sodium reduction ingredient market size reached USD 1.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.57% during 2026-2034. Rising health awareness, government sodium reduction policies, growing demand for low-sodium foods, expansion of processed food industries, technological advancements in salt replacers, increasing consumer preference for clean-label products, and innovations in potassium chloride and umami enhancers, are driving China’s sodium reduction ingredient market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.9 Billion |

| Market Forecast in 2034 | USD 2.9 Billion |

| Market Growth Rate 2026-2034 | 4.57% |

China Sodium Reduction Ingredient Market Trends:

Government-Led Sodium Reduction Initiatives

China is increasing efforts to curb sodium consumption by means of regulation policies and public health promotion. The National Nutrition Plan (2017-2030) is establishing definite targets for sodium reduction, which seeks to reduce the average daily intake of salt to 5g per capita by 2030 from 10.5g. This drive is propelling demand for sodium reduction ingredients across the food and beverage industry. In 2023, the National Health Commission stepped up by enforcing rules that require food makers to follow sodium reduction guidelines. Because of this, there's been a 12% jump in the demand for salt substitutes like potassium chloride and yeast extracts. On top of that, the use of sodium reduction tech in processed food products has grown by 15% this year. Big companies like Mengniu Dairy, Wahaha, and Tingyi are changing their recipes to cut back on salt while still keeping the flavor. The Healthy China 2030 initiative is raising awareness among consumers, pushing brands to make low-sodium options for snacks, instant noodles, and condiments.

To get more information on this market Request Sample

Rising Adoption of Clean-Label Sodium Reduction Ingredients

Chinese consumers are increasingly turning to clean-label sodium reduction options. They’re interested in natural options like yeast extracts, amino acids, and sodium alternatives made from seaweed. These ingredients add a savory umami flavor without a long list of weird additives. In 2023, the market for clean sodium reduction ingredients in China grew by 18% as big brands worked to remove artificial sodium options. By 2025, yeast extract-based sodium substitutes are expected to make up 40% of sales, up from 28% in 2023. Companies like Angel Yeast, Biospringer, and DSM-Firmenich are leading the way with new ideas in natural sodium options that keep the taste good. Awareness about sodium and health jumped to 72% this year, influencing more buyers to look for low-sodium products. As a result, low-sodium soy sauce is becoming more popular, attracting investment from brands like Lee Kum Kee and Haday to meet the changing needs of consumers.

China Sodium Reduction Ingredient Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type and application.

Product Type Insights:

- Amino Acids and Glutamates

- Mineral Salts

- Potassium Chloride

- Magnesium Sulphate

- Potassium Lactate

- Calcium Chloride

- Yeast Extracts

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes amino acids and glutamates, mineral salts (potassium chloride, magnesium sulphate, potassium lactate, and calcium chloride), yeast extracts, and others.

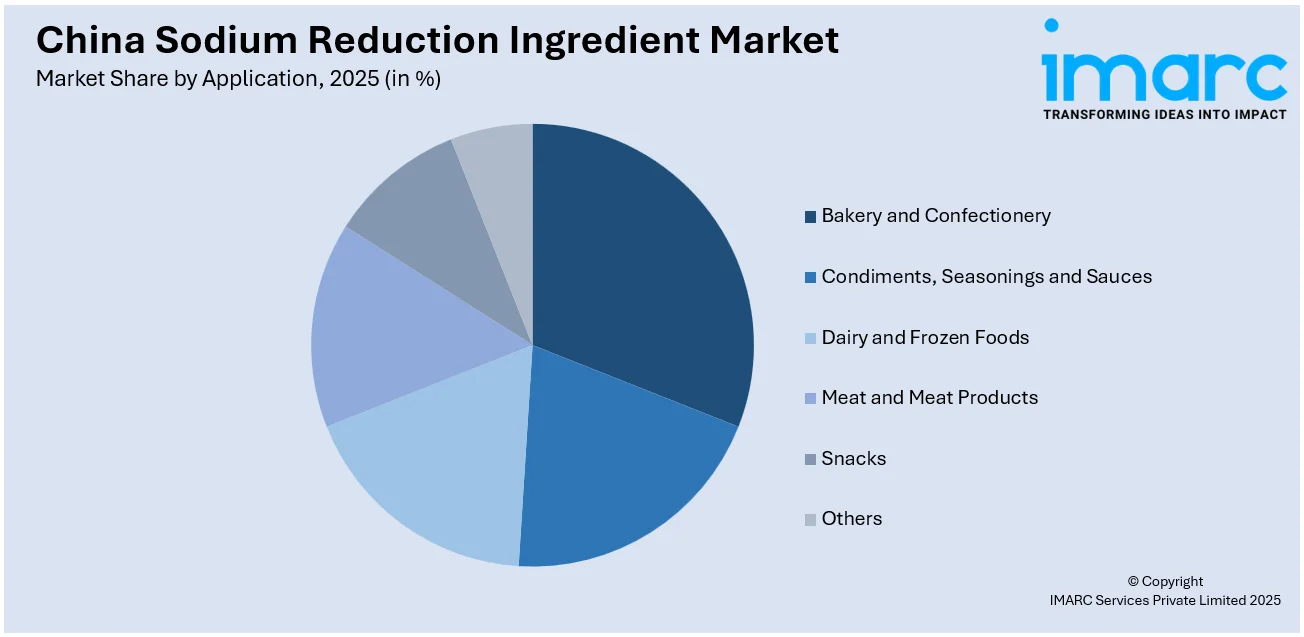

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bakery and Confectionery

- Condiments, Seasonings and Sauces

- Dairy and Frozen Foods

- Meat and Meat Products

- Snacks

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery and confectionery, condiments, seasonings and sauces, dairy and frozen foods, meat and meat products, snacks, and others.

Regional Insights:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

The report has also provided a comprehensive analysis of all the major regional markets, which include North China, East China, South Central China, Southwest China, Northwest China, and Northeast China.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

China Sodium Reduction Ingredient Market News:

- January 2025: Lee Kum Kee launched a reduced-sodium soy sauce in Hong Kong, offering 35% less sodium than its original product, to meet the increasing consumer demand for healthier options. This initiative aligns with the growing preference for low-sodium foods among health-conscious consumers in China, encouraging manufacturers to innovate and incorporate sodium reduction ingredients.

- July 2022: A study in China found that a heart-healthy, lower-sodium version of traditional Chinese cuisine significantly reduced blood pressure among adults with hypertension. This modified diet halved daily sodium intake from nearly 6,000 mg to about 3,000 mg, reduced fat, increased protein and carbohydrates, doubled dietary fiber, and boosted potassium levels. The growing awareness of the health benefits associated with reduced-sodium diets has spurred demand for sodium reduction ingredients in China, influencing the market by encouraging food manufacturers to reformulate products to align with these healthier dietary patterns.

China Sodium Reduction Ingredient Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Bakery and Confectionery, Condiments, Seasonings and Sauces, Dairy and Frozen Foods, Meat and Meat Products, Snacks, Others |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the China sodium reduction ingredient market performed so far and how will it perform in the coming years?

- What is the breakup of the China sodium reduction ingredient market on the basis of product type?

- What is the breakup of the China sodium reduction ingredient market on the basis of application?

- What are the various stages in the value chain of the China sodium reduction ingredient market?

- What are the key driving factors and challenges in the China sodium reduction ingredient market?

- What is the structure of the China sodium reduction ingredient market and who are the key players?

- What is the degree of competition in the China sodium reduction ingredient market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China sodium reduction ingredient market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the China sodium reduction ingredient market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China sodium reduction ingredient industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)