China Skincare Market Size, Share, Trends and Forecast by Distribution Channel, Ingredient Type, and Gender 2025-2033

China Skincare Market Size and Share:

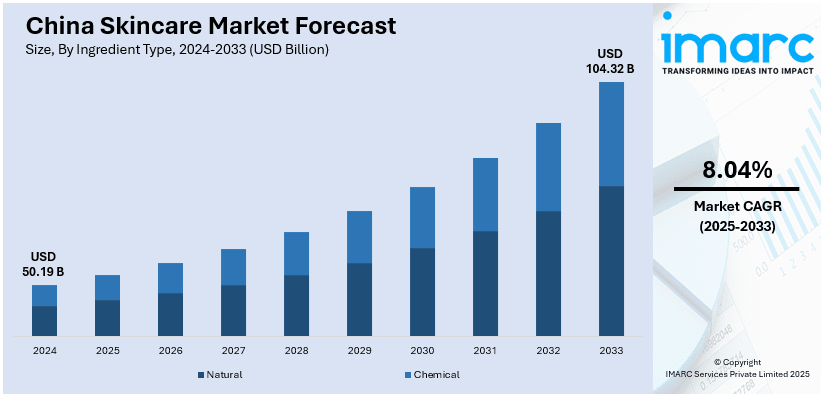

The China skincare market size was valued at USD 50.19 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 104.32 Billion by 2033, exhibiting a CAGR of 8.04% from 2025-2033. The market is driven by the growing awareness among people about skin health due to heightened pollution levels, and the influence of social media promoting skincare routines. Additionally, e-commerce platforms enhance accessibility and personalization, while data-driven marketing helps brands meet customer demands effectively, favoring the China skincare market outlook.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 50.19 Billion |

| Market Forecast in 2033 | USD 104.32 Billion |

| Market Growth Rate (2025-2033) | 8.04% |

Changing social dynamics and the increasing influence of social media have heightened the importance of appearance, particularly among millennials and Gen Z of China. These demographics prioritize self-care and seek products that enhance their skin health and aesthetic appeal. Skincare routines are no longer seen as optional but are considered integral to maintaining a polished image in both personal and professional settings. Social media platforms play a pivotal role in molding beauty standards and promoting skincare products. Influencers and live-streaming hosts regularly share skincare tips and product recommendations, creating a culture that emphasizes well-maintained skin. This trend is further amplified by the popularity of K-beauty and J-beauty routines, which have influenced Chinese people to multi-step skincare regimens.

Data-driven marketing and customer insights are transforming the market by enabling brands to meet evolving customer demands with precision. Advanced analytics tools, powered by big data and artificial intelligence (AI), help companies understand purchasing behaviors, preferences, and emerging trends. By analyzing online searches, social media activity, and transaction data, brands can develop tailored strategies to engage customers effectively. E-commerce platforms play a critical role in collecting and utilizing customer data. These platforms provide skincare companies operating in China with detailed insights into customer demographics, preferences, and product performance. This allows brands to segment their audience and design targeted campaigns, improving marketing efficiency and driving conversions. Personalized product recommendations, enabled by AI algorithms, enhance the shopping experience, ensuring customers are matched with products tailored to their needs. This approach builds trust and loyalty, as buyers feel their unique concerns are being addressed.

China Skincare Market Trends:

Rising number of e-commerce platforms

E-commerce growth is a significant driver transforming access to skincare product and shopping experiences. Online platforms provide a one-stop shop for a wide range of skincare products, offering both domestic and international brands. These platforms cater to diverse needs, from affordable options to luxury offerings, ensuring accessibility across income levels. As per the report published by the State Council of the People's Republic of China in July 2024. China's e-commerce sector has shown significant growth, reaching 7.1 trillion yuan in online sales. This marks a 9.8% increase compared to 2023, driven by digital goods. International expansion is also notable, with 33 Silk Road e-commerce partners joining. Investments in AI and research and development (R&D) are enhancing the online shopping experience. Shopping festivals, including Singles' Day and 618, are become crucial sales events for skincare brands. During these periods, exclusive discounts, flash sales, and bundled deals drive massive traffic and purchases. These events also offer brands opportunities of launching new products and consequently expanding their overall market share.

Increasing pollution concerns

As per the report published by the Lancet in December 2024, China's 2023 pollution levels highlight severe challenges as coal consumption rose by 4%, worsening air quality. Cities exceeding WHO's PM2.5 thresholds increased from 98 to 117, posing significant health risks. Increased pollution levels are leading to skin issues like premature aging, dullness, acne, and increased sensitivity. Due to which many seek skincare solutions specifically designed to combat these effects. Anti-pollution skincare products including cleansers, serums, and protective creams are gaining traction for their ability to shield the skin from particulate matter and harmful environmental stressors. Ingredients like antioxidants, hyaluronic acid, and detoxifying agents are particularly sought after for their protective and reparative properties. Individuals are increasingly drawn to brands that highlight pollution protection in their marketing. Both international and domestic companies, such as Estée Lauder and Herborist are offering products tailored to these concerns. This trend is especially pronounced among urban millennials and Gen Z, who are more aware of environmental challenges and proactive about skincare.

Escalating demand for organic skincare products

The growing demand for organic skincare products is reshaping the market in China as customers are increasingly prioritizing natural and eco-friendly options. Rising awareness among the masses about the harmful effects of synthetic ingredients has driven a shift toward organic formulations, especially among millennials and Gen Z. These groups are more health-conscious and seek products free from parabens, sulfates, and artificial fragrances. Environmental concerns also play a role. Chinese customers are more mindful of sustainability, opting for brands that align with their values. Organic skincare companies emphasize environmentally responsible practices, such as biodegradable packaging and cruelty-free certifications, which appeal to this demographic. To cater this demand, in November 2024, Florasis announced to launch its first skincare line in 2025, inspired by TCM principles. The brand emphasizes natural ingredients like jade powder and botanical extracts to promote beauty and wellness. This move capitalizes on growing interest in traditional Chinese medicine and holistic well-being.

China Skincare Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China skincare market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on distribution channel, ingredient type, and gender.

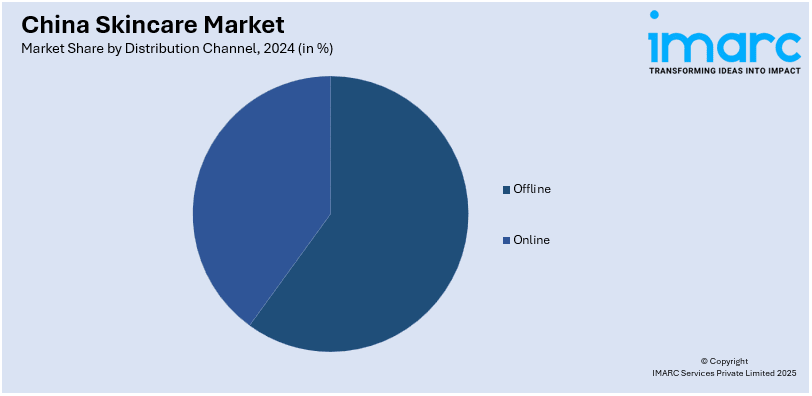

Analysis by Distribution Channel:

- Offline

- Supermarkets and Hypermarkets

- Specialty Stores

- Departmental Stores

- Drugstores and Pharmacies

- Others

- Online

Offline holds the majority of the China skincare market share as they offer a tactile and experiential shopping experience. Customers prefer physical stores to test products, especially for premium organic brands promising quality and authenticity. Department stores and specialty beauty retailers provide expert consultations, building trust among organic skincare buyers. Local pharmacies are also key players, offering easy access to certified organic products in smaller cities. Many customers value offline stores for immediate product availability and personalized service over online options. Brick-and-mortar outlets often create exclusive in-store events and promotions to attract more organic-conscious shoppers. While e-commerce is growing, offline channels maintain dominance due to their strong foothold in customer trust. Physical stores enable brands to establish transparency through certifications and clear labeling for organic products.

Analysis by Ingredient Type:

- Natural

- Chemical

Despite demand for organic skincare, many formulations still include chemical elements for stability and efficacy. Chemical ingredients enhance product shelf life, making them practical for larger-scale distribution and storage. Some chemicals, such as emulsifiers and preservatives, are permissible under organic certification guidelines. Certain skin concerns, like acne or pigmentation, often require chemical compounds alongside natural extracts for better results. Customers value organic products but rely on chemical additions for effectiveness in targeted treatments. Brands combine natural and chemical components to maintain product performance without compromising organic certifications. Chemical ingredients often ensure smoother textures, better absorption, and enhanced sensory experiences in organic skincare.

Analysis by Gender:

- Male

- Female

- Unisex

Female customers drive the market, reflecting a greater focus on beauty and self-care routines. Women are more inclined to explore skincare products, particularly organic ones emphasizing safety and sustainability. Marketing campaigns for organic skincare predominantly target women, reinforcing their dominance in the customer base. Females actively seek products for specific concerns like anti-aging, hydration, and brightening, catalyzing the demand for organic skincare products. Social media platforms are filled with female influencers promoting organic skincare, creating stronger brand connections with women. Women’s preference for clean beauty aligns with their desire for non-toxic, safe, and eco-conscious products. The female demographic often prioritizes ingredient transparency, further fueling interest in organic skincare solutions. Brands design product lines and packaging aesthetics to appeal primarily to women in the organic market.

Competitive Landscape:

Key players play a pivotal role in driving the market for skincare in China. Established international brands alongside domestic giants dominate the industry by offering diverse product ranges tailored to varying customer preferences. These companies leverage advanced R&D capabilities to develop innovative solutions addressing concerns like anti-aging, hydration, and pollution protection, aligning with the needs of China’s urban population. For instance, in February 2024, L'Oréal introduced animal-free collagen skincare in China using recombinant technology for the first time. The Age Perfect Collagen Royal Anti-Aging Face Cream features collagen with a human-like amino acid sequence. This breakthrough innovation helps improve collagen production, promoting skin elasticity. The recombinant collagen market in China is expanding rapidly, with projections to reach 108.3 billion yuan by 2027. Market leaders also drive awareness through extensive marketing campaigns and collaborations with influencers and celebrities on popular social networking platforms. These efforts create strong brand recognition and enhance customer trust. Key players also utilize e-commerce channels to expand their reach and provide personalized shopping experiences using AI-driven tools and virtual consultations.

The report provides a comprehensive analysis of the competitive landscape in the China skincare market with detailed profiles of all major companies.

Latest News and Developments:

- October 2024: SK-II, a luxury skincare brand from Japan, opened its first travel flagship store in China, located at Sanya’s duty-free complex. The store offers a multisensory experience, focusing on the brand’s signature Pitera ingredient. It features interactive art installations to enhance the customer experience. SK-II aims to expand its footprint in China’s travel retail sector through this launch.

- September 2024: Amorepacific is expanding its presence in China with a focus on technological skincare innovations. The company aims to cater to Chinese customers through strategic partnerships, including with Alibaba. Its brands, such as Laneige, Sulwhasoo, and Mamonde, are being rebranded for the local market.

- May 2024: Annemarie Börlind Skincare unveiled its NatuCollagen series at the 2024 China Beauty Expo. The series includes natural ingredients for supporting collagen production as well as enhancing the elasticity of the skin. This launch marks a strategic move into the growing Chinese skincare market. The NatuCollagen collection aims to meet rising demand for effective anti-aging products.

China Skincare Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Distribution Channels Covered |

|

| Ingredient Types Covered | Natural, Chemical |

| Genders Covered | Male, Female, Unisex |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, China skincare market forecasts, and dynamics of the market share from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China skincare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The China skincare market was valued at USD 50.19 Billion in 2024.

IMARC estimates the China skincare market to exhibit a CAGR of 8.04% during 2025-2033.

Key factors driving the market include an expanding middle class, enabling higher spending on premium products. Growing awareness of skin health, fueled by pollution concerns and urbanization is increasing demand for targeted skincare solutions like anti-pollution and anti-aging products. E-commerce and digital innovations, such as AI-powered recommendations and influencer marketing are making skincare more accessible and personalized. Additionally, a shift toward organic and natural products aligns with customer preference for safety and sustainability, further propels market growth and product diversification.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)