China Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End Use Industry, and Region, 2025-2033

China Paper Packaging Market Size and Share:

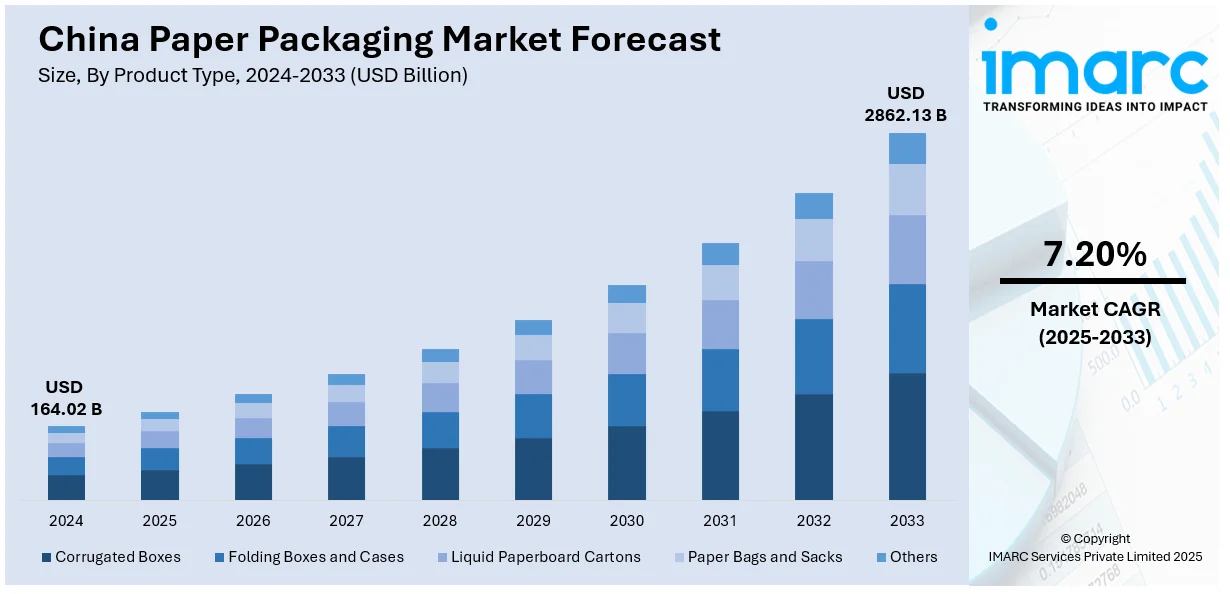

The China paper packaging market size was valued at USD 164.02 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,862.13 Billion by 2033, exhibiting a CAGR of 7.20% from 2025-2033. The market is witnessing significant growth due to government regulations and sustainability initiatives and expanding e-commerce and retail sectors. Moreover, the rise of sustainable and recyclable packaging, technological advancements in smart packaging, and growing demand for lightweight and high-performance materials are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 164.02 Billion |

| Market Forecast in 2033 | USD 2,862.13 Billion |

| Market Growth Rate 2025-2033 | 7.20% |

China's stringent environmental regulations and policies aimed at reducing plastic waste are significantly driving the paper packaging market. For instance, in 2024, China Resources Recycling Group was established in Tianjin with CNY 10 billion capital, aiming to develop a national platform for resource recycling, reuse, processing, distribution, and trade-in services. The country has implemented a series of bans and restrictions on single-use plastics, accelerating the shift toward sustainable packaging solutions. The "Plastic Pollution Control Action Plan" and the "Opinions on Further Strengthening the Treatment of Plastic Pollution" mandate the reduction of non-biodegradable plastic usage, compelling industries to adopt paper-based alternatives. Additionally, the growing emphasis on achieving carbon neutrality by 2060 has further pushed businesses to integrate eco-friendly packaging materials. Consumer preferences are also aligning with these regulations, with an increasing demand for recyclable, biodegradable, and compostable packaging solutions, further strengthening market growth.

China's booming e-commerce industry, fueled by digital transformation and rising consumer spending, is a key driver of the paper packaging market. Leading platforms rely heavily on robust packaging solutions to ensure product safety and enhance consumer experience. The surge in online shopping has led to an increased demand for corrugated boxes, paper mailers, and other sustainable packaging formats. Furthermore, rapid urbanization and a strong retail sector contribute to the growing need for efficient, lightweight, and cost-effective packaging solutions. For instance, in 2024, Wuzhou Special Paper started an Andritz-supplied high-capacity chemo-thermomechanical pulping system, producing 1,500 admt/d of pulp for premium folding boxboard from eucalyptus and acacia chips using a single HC refiner. Innovations in paper-based protective packaging and smart packaging technologies are further enhancing the market's expansion.

China Paper Packaging Market Trends:

Rise of Sustainable and Recyclable Packaging

Sustainability is a dominant trend shaping China's paper packaging market. With the government's strict environmental policies and consumer demand for eco-friendly alternatives, businesses are investing in recyclable, biodegradable, and compostable packaging solutions. The ban on single-use plastics and the push toward a circular economy have accelerated innovation in fiber-based packaging materials, including molded pulp, recycled kraft paper, and water-based coatings. Leading companies are also enhancing paper packaging recyclability by eliminating plastic laminations and adopting mono-material solutions to meet regulatory and consumer expectations. For instance, in 2025, Nine Dragons Paper is set to achieve a production capacity of 25.37 million tpa, reinforcing its market position and enhancing competitiveness in the global paper and packaging industry.

Technological Advancements in Smart Packaging

China’s paper packaging industry is witnessing increased adoption of smart packaging technologies, driven by advancements in digital printing, QR codes, and near-field communication (NFC). Brands are incorporating interactive packaging solutions to improve product traceability, authentication, and consumer engagement. For instance, in 2024, Valmet will supply an OptiWin Drum winder to Wuzhou Special Paper’s PM 19 in China, supporting high-speed production with an 8,210 mm width, 3,000 m/min speed, and 830-tonne daily capacity.

E-commerce platforms and fast-moving consumer goods (FMCG) companies are leveraging intelligent labeling for real-time tracking and anti-counterfeiting measures. Additionally, AI-driven automation in packaging production is improving efficiency, reducing waste, and enhancing the precision of customized packaging solutions.

Growing Demand for Lightweight and High-Performance Materials

The shift toward lightweight yet durable paper-based packaging is gaining traction as companies seek cost-effective and efficient transportation solutions. The rise of online shopping and food delivery services has intensified the need for sturdy, moisture-resistant, and protective packaging materials. Innovations in coated papers, hybrid paper-plastic materials, and multi-layered paperboard packaging are addressing durability concerns while maintaining sustainability goals. For instance, in 2025, Nine Dragons Paper advances capacity expansion projects for bleached folding boxboard, sack kraft, and WPP, adding 2.00 million tonnes of production capacity to strengthen its market presence. Manufacturers are also focusing on reducing packaging weight without compromising structural integrity, optimizing supply chain costs, and minimizing environmental impact.

China Paper Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China paper packaging market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, grade, packaging level, and end use industry.

Analysis by Product Type:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

Corrugated boxes are essential for China’s booming e-commerce, logistics, and retail industries, offering durable and cost-effective packaging solutions. Their lightweight structure ensures efficient transportation, while recyclability aligns with China’s sustainability goals. Advanced manufacturing techniques, including water-based inks and digital printing, enhance branding and customization, making them the preferred choice for online shopping and industrial packaging.

Folding boxes and cases are widely used in food, pharmaceuticals, and consumer goods packaging due to their versatility and aesthetic appeal. They provide high-quality printing surfaces for branding and regulatory information while being lightweight and recyclable. The demand for premium and sustainable packaging is driving innovation in coated, biodegradable, and mono-material folding cartons.

Liquid paperboard cartons are crucial in China’s beverage and dairy sectors, providing lightweight, tamper-proof, and sustainable packaging. Their multi-layer structure ensures product freshness and extended shelf life. With growing consumer preference for eco-friendly alternatives, manufacturers are developing recyclable and plant-based barrier coatings to replace traditional plastic laminations, aligning with China’s plastic reduction policies.

Paper bags and sacks are gaining popularity as China restricts single-use plastics in retail and food packaging. Widely used for shopping, groceries, and industrial applications, they offer durability and recyclability. Advances in moisture-resistant coatings and reinforced paper structures are enhancing their usability, making them a preferred choice in fast-food chains, supermarkets, and construction material packaging.

Analysis by Grade:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

Solid bleached board (SBB) is widely used in China’s premium packaging sector, including cosmetics, pharmaceuticals, and high-end consumer goods. Its smooth, bright white surface enables high-quality printing and embossing, enhancing brand appeal. Despite higher costs, demand is rising due to its superior strength, hygiene compliance, and recyclability, aligning with China’s sustainable packaging initiatives.

Coated recycled board (CRB) is essential for cost-effective, eco-friendly packaging in China’s food, beverage, and FMCG sectors. It combines recycled fiber content with a coated surface for improved printability and moisture resistance. With China emphasizing circular economy practices, CRB is gaining traction as businesses seek affordable, sustainable alternatives without compromising packaging performance and aesthetics.

Uncoated recycled board (URB) is extensively used in corrugated packaging, paper bags, and industrial applications due to its durability and cost efficiency. As China strengthens recycling mandates, demand for URB is increasing, driving investments in improved fiber recovery and processing technologies. Its biodegradability and low environmental impact support China's shift toward sustainable packaging solutions.

Analysis by Packaging Level:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

Primary packaging, which directly encases products, is crucial in China’s food, beverage, pharmaceutical, and personal care industries. Paper-based solutions such as folding cartons and liquid paperboard cartons enhance product protection, branding, and sustainability. With growing regulatory pressure on plastic reduction, companies are adopting recyclable, biodegradable, and fiber-based alternatives to meet consumer and environmental demands.

Secondary packaging, including corrugated boxes and paperboard sleeves, plays a vital role in bundling multiple products for retail and e-commerce distribution. It ensures protection, easy handling, and enhanced shelf appeal. The rapid growth of online shopping in China is driving demand for durable, lightweight, and sustainable secondary packaging that meets logistics efficiency and recyclability standards.

Tertiary packaging, such as bulk corrugated containers, paper pallets, and protective layers, supports large-scale transportation and warehousing. Essential in China’s expanding supply chain, it ensures safe handling and efficient storage of goods. Increased automation and eco-friendly materials are improving cost efficiency, while rising sustainability concerns are promoting the use of recycled fiber and biodegradable alternatives.

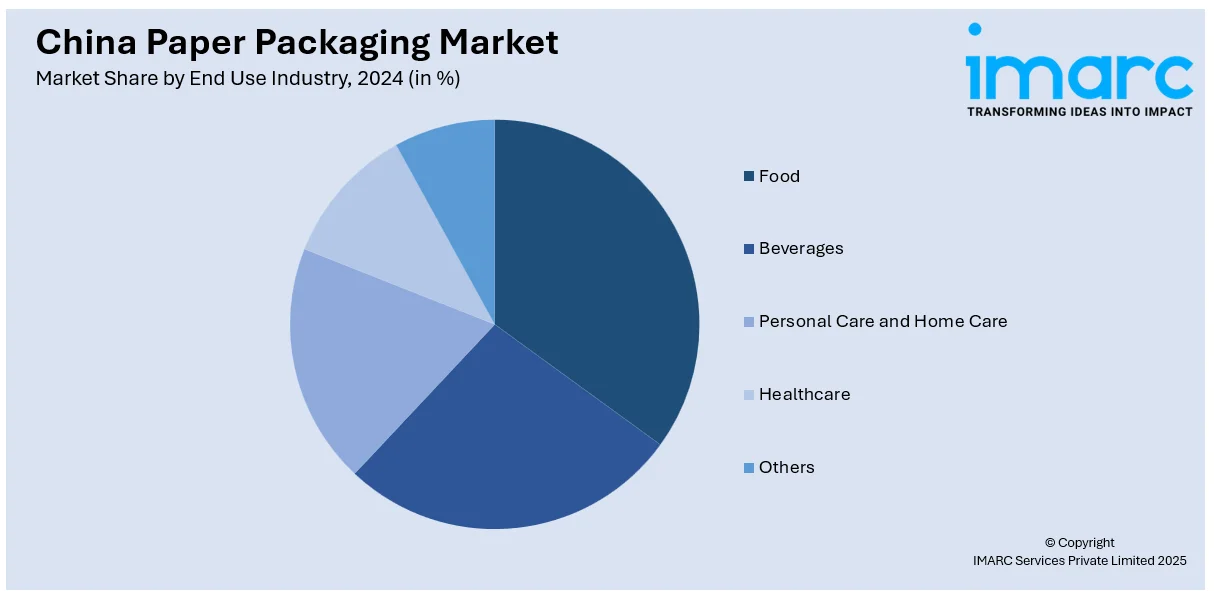

Analysis by End Use Industry:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

The food industry in China increasingly relies on paper-based packaging due to strict regulations on plastic use. Folding cartons, paper bags, and molded fiber trays offer sustainable, biodegradable solutions for snacks, dairy, and ready-to-eat meals. Innovations in moisture-resistant coatings and recyclable barrier layers are enhancing food safety while meeting sustainability and branding demands.

Liquid paperboard cartons are widely used in China’s beverage sector for dairy, juices, and plant-based drinks. These cartons offer extended shelf life, lightweight handling, and recyclability. With growing consumer demand for eco-friendly alternatives, manufacturers are adopting fiber-based solutions with bio-based or recyclable coatings, reducing reliance on plastic packaging while ensuring product protection and convenience.

Paper packaging is gaining traction in China’s personal and home care sectors, replacing plastic in soap boxes, detergent cartons, and cosmetic folding cartons. Brands are investing in premium, recyclable, and biodegradable materials to enhance sustainability and aesthetics. Paper-based refillable packaging and molded fiber solutions are also emerging trends, aligning with eco-conscious consumer preferences.

China’s healthcare industry relies on paper packaging for pharmaceuticals, medical devices, and OTC products. Folding cartons, blister card backing, and paper pouches ensure tamper-proof, lightweight, and sustainable solutions. Compliance with stringent regulations and rising demand for eco-friendly alternatives are driving advancements in recyclable and fiber-based packaging, reducing plastic dependency while maintaining product integrity and safety.

Regional Analysis:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

North China, including Beijing and Tianjin, is a major hub for industrial and e-commerce packaging. The high concentration of logistics centers and online retail demand drives the need for corrugated boxes and secondary packaging. Stringent environmental regulations in the region further accelerate the adoption of recyclable and biodegradable paper-based packaging solutions.

East China, home to Shanghai and Jiangsu, is a leading manufacturing and export center, driving strong demand for high-performance paper packaging. The region’s robust food, beverage, and personal care industries fuel the use of folding cartons and liquid paperboard. Sustainable packaging innovations and smart packaging solutions are also gaining traction in this economically advanced area.

South Central China, including Guangdong, is a key player in consumer goods, e-commerce, and industrial manufacturing. The region’s strong logistics and retail networks drive high demand for corrugated packaging and folding cartons. As a major trade hub, paper-based protective and export packaging solutions are expanding to support international shipping and sustainability goals.

Southwest China, including Sichuan and Chongqing, is experiencing rapid urbanization and industrial growth, increasing the need for food and beverage packaging. Paper-based solutions are widely used in retail and agriculture, supporting local supply chains. Government policies promoting eco-friendly materials are further encouraging businesses to adopt recyclable and compostable packaging alternatives.

Northwest China, with regions like Xinjiang and Shaanxi, relies on paper packaging for agriculture, processed food, and industrial applications. The region’s vast logistics networks require durable corrugated packaging for long-distance transportation. As sustainability concerns grow, investments in fiber-based solutions are increasing to reduce plastic usage and support the circular economy.

Northeast China, including Liaoning and Heilongjiang, has a strong presence in heavy industries and food processing. The demand for sturdy corrugated packaging and paper bags is rising due to expanding logistics and exports. The region’s focus on sustainable forestry and recycling initiatives is fostering growth in eco-friendly paper packaging solutions for various end-use industries.

Competitive Landscape:

The China paper packaging market is characterized by intense competition among domestic and international players. Leading manufacturers dominate the industry with strong production capacities and advanced recycling technologies. For instance, in February 2025, Shandong Jintianhe Paper integrated Valmet’s automation systems to optimize food-grade packaging production, enhancing digitalization, process intelligence, and quality control for high-end coated white cardboard using advanced monitoring and control technologies. Global players are expanding their footprint through strategic partnerships and acquisitions. Companies are focusing on sustainable packaging innovations, smart packaging solutions, and high-performance materials to gain a competitive edge. E-commerce-driven demand and stringent environmental regulations are driving investments in automated production, biodegradable alternatives, and customized packaging solutions to enhance market positioning.

The report provides a comprehensive analysis of the competitive landscape in the China paper packaging market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2024, Fedrigoni completes the acquisition of Arjowiggins China, finalizing the deal in December 2023. The Quzhou mill, a leading producer of translucent papers, enhances Fedrigoni’s presence in Asia, strengthening its distribution network and manufacturing capabilities across China, Hong Kong, the Philippines, Indonesia, and Bangladesh.

- In October 2023, Nine Dragons Paper (Holdings) announced plans to launch 1.55 million tonnes per year of paper and board capacity at its new Beihai, Guangxi mill. The facility will include an 800,000 tpy kraftliner machine, a 550,000 tpy uncoated fine paper machine, and a 200,000 tpy mechanical pulp line.

China Paper Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China paper packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China paper packaging market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paper packaging market in China was valued at USD 164.02 Billion in 2024.

The growth of the China paper packaging market is driven by the rise in e-commerce, increasing demand for sustainable and eco-friendly packaging solutions, and stringent environmental regulations. Advancements in production technologies, automation, and biodegradable materials also contribute, while strategic partnerships and acquisitions by global players further boost market expansion.

The China paper packaging market is projected to exhibit a CAGR of 7.20% during 2025-2033, reaching a value of USD 2,862.13 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)