China Online Gambling Market Size, Share, Trends and Forecast by Game Type, Device, and Region, 2025-2033

China Online Gambling Market Size and Share:

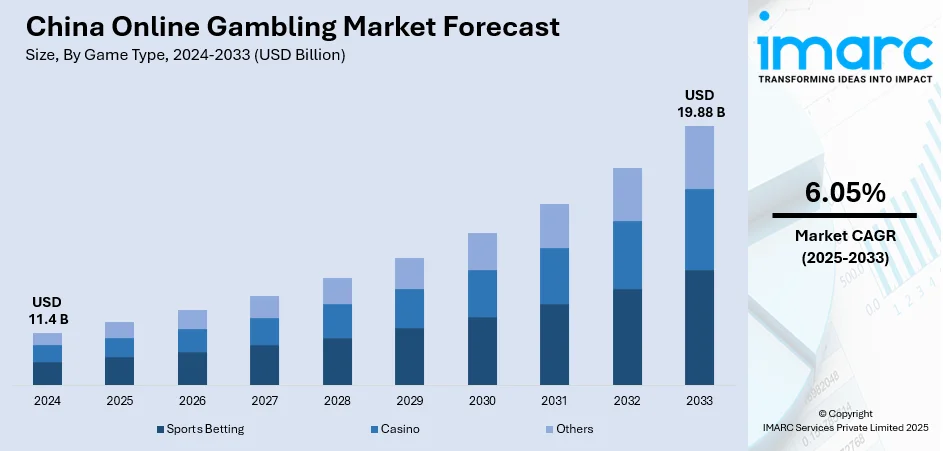

The China online gambling market size was valued at USD 11.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.88 Billion by 2033, exhibiting a CAGR of 6.05% from 2025-2033. The market is witnessing significant growth due to advancements in technology and shifting consumer behavior. Moreover, the rise of mobile gaming, integration of AI, and increasing regulations and enforcements are further expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.4 Billion |

|

Market Forecast in 2033

|

USD 19.88 Billion |

| Market Growth Rate (2025-2033) | 6.05% |

The use of digital means and mobiles has been the main impetus in China for developing the online gambling industry. With greater access to internet connections and wider usage of smartphones, more consumers are now capable of engaging with online gambling services. For instance, by December 2023, China had 1.09 billion internet users, up 24.8 million from 2022, reaching a 77.5% penetration rate, according to a China Internet Network Information Center (CNNIC) report. The growth of secure payment systems, including mobile wallets and cryptocurrency, further enhances convenience, making online gambling more accessible and reliable. Additionally, innovations such as live-streaming and virtual reality are elevating the user experience, driving further interest in digital gaming platforms.

The market is also propelled due to changing consumer attitudes towards entertainment and leisure activities. Increasing disposable incomes and convenient forms of at-home entertainment are making more Chinese consumers interested in using online gambling as a diversion. For instance, in 2024, China’s per capita disposable income hit 41,314 yuan ($5,672), surpassing 40,000 yuan for the first time and nearly doubling the 21,996 yuan recorded in 2015, per official data. Additionally, the younger, tech-savvy demographic is more open to engaging with digital platforms. As social and cultural perceptions evolve, online gambling is being seen less as a taboo and more as a mainstream activity, boosting market participation.

Together, these drivers are shaping the trajectory of China's online gambling sector, fostering both growth and innovation.

China Online Gambling Market Trends:

Rise of Mobile Gaming

Mobile gaming continues to be the dominant platform for online gambling in China. With the widespread adoption of smartphones and improved internet connectivity, more consumers are opting to gamble via mobile applications rather than traditional desktop platforms. For instance, in 2023, China led globally in smartphone users, reaching 974.69 million, accounting for 68.4% of its population. Mobile casinos, sports betting, and other gambling services are highly accessible, allowing users to engage in gaming activities anywhere at any time. This shift is further enhanced by mobile-optimized payment methods, such as mobile wallets, which simplify financial transactions and contribute to the growth of mobile gambling.

Integration of Artificial Intelligence (AI)

AI is playing an increasingly pivotal role in the development of China’s online gambling market. Increased integration of AI technologies significantly improving the dimension of the market. For instance, the Chinese government projects AI to generate over USD 154 Billion in annual revenue by 2030, highlighting its commitment to advancing artificial intelligence development and economic growth. Moreover, AI is being used to enhance customer experiences, personalize content, and offer tailored recommendations based on user preferences and behavior. AI-driven algorithms also help operators optimize marketing strategies by analyzing large sets of data, allowing them to target potential customers and improve customer retention.

Increasing Regulation and Enforcement

China continues to tighten regulations around online gambling, with strict crackdowns on illegal platforms and enhanced monitoring of digital payment systems. For instance, in 2024, China’s Ministry of Public Security dismantled over 4,500 illegal gambling platforms and investigated 73,000 cross-border cases amid a crackdown on illicit betting operations. Concurrently, this has pushed many operators to either exit the market or shift their focus to legal, state-sanctioned activities like lotteries.

China Online Gambling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China online gambling market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on game type and device.

Analysis by Game Type:

- Sports Betting

- Football

- Horse Racing

- E-Sports

- Others

- Casino

- Live Casino

- Baccarat

- Blackjack

- Poker

- Slots

- Others

- Others

Sports betting represents the largest game type in China’s online gambling market, driven by the country’s deep-rooted passion for sports, particularly basketball, soccer, and esports. Despite regulatory challenges, Chinese consumers increasingly turn to online platforms to place bets on domestic and international sports events. The appeal of sports betting lies in its dynamic nature, with frequent events and the opportunity for real-time wagering. Additionally, the rise of mobile betting apps has made it more accessible for a wide audience. As consumer interest in sports grows and platforms evolve, sports betting is expected to continue dominating the market.

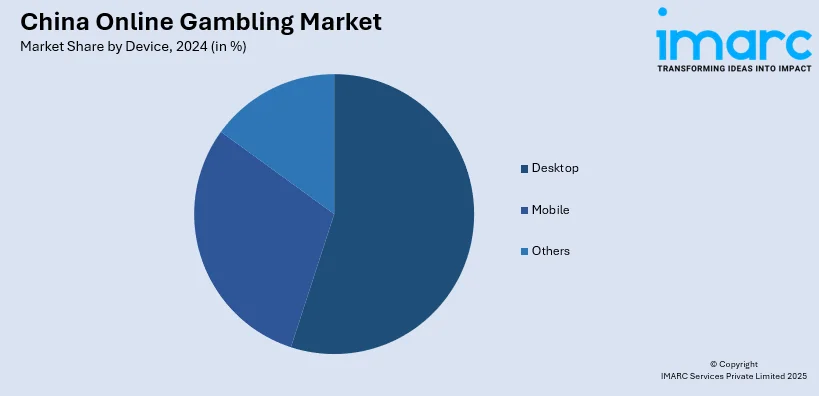

Analysis by Device:

- Desktop

- Mobile

- Others

Desktop stands as the largest device for online gambling in China, primarily due to its stability, larger screen size, and ease of use, which provide an enhanced gaming experience. Many users still prefer desktops for activities such as online poker, casino games, and sports betting, as these devices offer a more immersive interface and faster processing speeds compared to mobile devices. Furthermore, desktops are commonly used in more dedicated gaming environments, such as at home or in cyber cafes, where users can engage in longer sessions. While mobile gaming is growing rapidly, desktops continue to be the preferred choice for serious gamblers.

Regional Analysis:

- North and Northeast

- Northwest

- East

- South Central

- Southwest

The North and Northeast regions of China, with major cities like Beijing and Harbin, are home to a growing number of online gambling users. These areas have strong internet infrastructure and a high concentration of young, tech-savvy consumers. Local gambling platforms and international operators cater to this demographic, offering sports betting and mobile casinos. The region's proximity to Russia also influences the popularity of cross-border online gambling services.

In the Northwest, including cities like Xi’an, the online gambling market is still emerging but expanding due to increasing internet penetration. This region is characterized by a younger population with a strong interest in mobile gaming and esports. Although local regulations limit traditional gambling, residents increasingly turn to offshore platforms for sports betting and virtual gaming, utilizing mobile apps and digital payment systems for accessibility.

The East region, home to financial hubs like Shanghai, plays a central role in China's online gambling market. With a high-income, tech-oriented population, this region sees substantial demand for sophisticated gambling platforms, including online poker, virtual casinos, and sports betting. Both local companies and international operators are targeting this area, capitalizing on a large consumer base and advanced digital infrastructure to deliver personalized gambling experiences.

South Central China, including cities like Wuhan and Changsha, is experiencing significant growth in online gambling. The region's increasing disposable income, alongside a growing interest in mobile technology, has driven the popularity of online gambling platforms. The demand for sports betting and virtual casinos is especially high among younger users, who favor the convenience of mobile apps and secure digital payment methods for seamless gambling experiences.

The Southwest region, with cities like Chengdu and Kunming, is becoming a notable market for online gambling, driven by a younger, digitally connected population. While regional regulations restrict some forms of gambling, mobile platforms are gaining traction, offering sports betting, virtual casinos, and casual gaming. Increased internet penetration and widespread use of smartphones have further fueled the region’s growing online gambling presence.

Competitive Landscape:

The competitive landscape of China’s online gambling market is marked by a combination of local operators and international players, despite stringent government regulations. Domestic companies dominate the market, often offering mobile-focused platforms and integrated digital payment systems. However, international operators face challenges due to legal constraints, with many relying on offshore sites to cater to Chinese consumers. Competition is further intensified by the rising demand for innovative features such as live-streamed gaming, virtual reality, and AI-powered personalization. As the market evolves, regulatory changes and technological advancements will continue to shape the competitive dynamics and opportunities for operators.

The report provides a comprehensive analysis of the competitive landscape in the China online gambling market with detailed profiles of all major companies.

China Online Gambling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Game Types Covered |

|

| Devices Covered | Desktop, Mobile, Others |

| Region Covered | North and Northeast, Northwest, East, South Central, Southwest |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China online gambling market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China online gambling market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China online gambling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online gambling market in China was valued at USD 11.4 Billion in 2024.

The growth of China's online gambling market is driven by factors such as widespread smartphone adoption, improved internet infrastructure, and a tech-savvy, younger population. Additionally, the increasing popularity of sports betting, mobile platforms, and esports, combined with enhanced digital payment methods, contributes to the sector's expansion across regions.

The China online gambling market is projected to exhibit a CAGR of 6.05% during 2025-2033, reaching a value of USD 19.88 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)