China Non-Alcoholic Beverages Market Size, Share, Trends and Forecast by Product Type, Packaging Type, and Distribution Channel, 2025-2033

China Non-Alcoholic Beverages Market Size and Share:

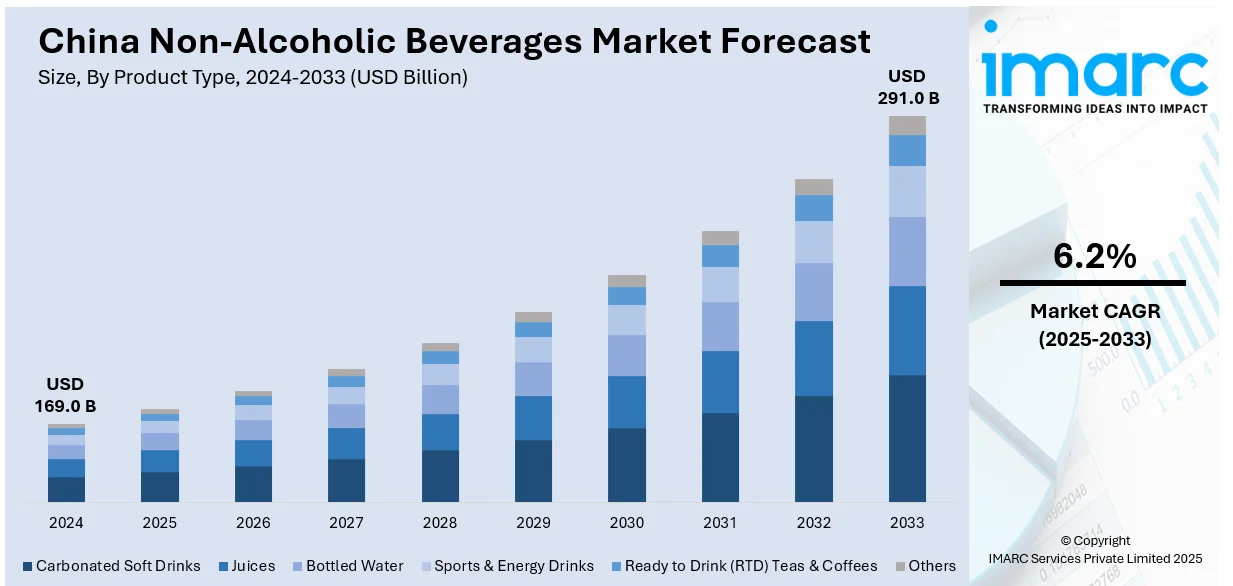

The China non-alcoholic beverages market size was valued at USD 169.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 291.0 Billion by 2033, exhibiting a CAGR of 6.2% from 2025-2033. The China non-alcoholic beverages market share is expanding, driven by the growing demand for alcohol-free beverages that offer better alternatives and attract health conscious consumers, along with the increasing adoption of retail and e-commerce sites, which enable easy availability of a wide selection of drinks and ensure timely delivery.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 169.0 Billion |

|

Market Forecast in 2033

|

USD 291.0 Billion |

| Market Growth Rate (2025-2033) | 6.2% |

The rising demand for convenience beverages is impelling the market growth in China. With busy urban lifestyles, more consumers are turning to ready-to-drink (RTD) beverages for a quick and hassle-free option. Products like bottled teas, juices, and coffee are perfect for on-the-go consumption, whether during the morning commute or at work. As convenience becomes a priority, brands ensure that their drinks are easy to carry, open, and adopt, often with portable packaging like cans and bottles. These drinks are available in an extensive range of flavors and types to suit different tastes and preferences. In addition, brands keep innovating to stay relevant, introducing new formulations and limited-edition drinks to entice consumers.

The increasing adoption of sustainability is offering a favorable China non-alcoholic beverages market outlook. As consumers are becoming more environmentally conscious, there is a higher demand for brands that prioritize sustainable practices. This includes the use of eco-friendly packaging, such as recyclable, biodegradable, or reduced-plastic options. Many beverage companies are shifting to plant-based materials, which not only appeal to the eco-conscious but also align with the rising popularity of plant-based diets. Additionally, brands that focus on ethical sourcing of ingredients like fair trade and organic materials, are gaining consumer trust. Sustainability also extends to production processes, with many companies employing water-saving technologies and reducing their carbon footprint. Consumers, especially younger generations, are interested to pay a premium for products that reflect their values. This trend is helping both local and international beverage brands to tap into a new and eco-aware customer base.

China Non-Alcoholic Beverages Market Trends:

Innovations in flavors

Innovations in flavor are fueling the market growth. Consumers prefer exploring unique and bold tastes, and brands are delivering creative options like exotic fruit blends, floral teas, and drinks inspired by traditional Chinese medicine. In January 2025, Cola, a favored drink among the youth in China, acquired a mild and enduring herbal taste due to continuous innovations by a well-established local brand. Its secret was in a unique formula that incorporated traditional Chinese medicine (TCM) recipes and included various herbs like White Peony Root and Chinese Angelica into cola. Younger generations, especially, are attracted to these novel flavors that merge enjoyment with health advantages. In addition, plant-based drinks are becoming increasingly popular, with choices like oat milk and almond beverages providing creamy consistencies and authentic flavors. Items like these entice health-aware consumers and individuals looking for dairy substitutes. Moreover, seasonal and limited-edition flavors maintain excitement, while customizable beverages, like bubble tea with countless topping options, introduce an engaging aspect.

Rising incidence of lifestyle diseases

The heightened occurrence of lifestyle diseases is supporting the China non-alcoholic beverages market growth. The region is noted for its high population rate. According to the data published on the official website of the World Factbook, as of 2024, the population of China was 1.614 Billion. With its massive population, the country naturally sees a higher number of cases related to diabetes, obesity, and heart issues. This growing health concern encourages more people to choose healthier drinks that fit their wellness goals. Low-sugar teas, zero-calorie sodas, and functional beverages packed with vitamins or probiotics have become popular. Herbal-infused options are also chosen by those seeking natural and guilt-free choices. Consumers prioritize beverages that help to manage health risks, driving the demand for innovative and health-focused options. Brands cater to these needs by offering products that combine good taste with wellness benefits.

Expansion of e-commerce platforms

The rising number of e-commerce platforms is increasing the sales of non-alcoholic beverages. With the rise of online shopping, individuals enjoy effortless access to a wide range of drinks, ranging from teas and juices to functional beverages. As per the information provided on the official website of the State Council, China's e-commerce industry experienced strong expansion in the initial half of 2024. During this timeframe, online retail sales grew by 9.8 percent compared to the previous year, totaling 7.1 trillion yuan (USD 996 Billion), as reported by the Ministry of Commerce (MOC). E-commerce allows brands to reach people in both big cities and smaller towns, breaking geographical barriers. In addition, discounts and personalized recommendations encourage individuals to try new products and purchase more frequently. Social media and influencer marketing also play a big role, as many platforms connect directly to e-commerce sites, making it simple to buy a trending drink. Apart from this, faster delivery services ensure beverages stay fresh and appealing.

China Non-Alcoholic Beverages Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China non-alcoholic beverages market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, packaging type, and distribution channel.

Analysis by Product Type:

- Carbonated Soft Drinks

- Juices

- Bottled Water

- Sports & Energy Drinks

- Ready to Drink (RTD) Teas & Coffees

- Others

Bottled water represents the largest segment. They are seen as a basic and essential drink for many consumers. With high health awareness, people choose water over sugary drinks like sodas. Bottled water is convenient, portable, and easy to access, whether in stores, vending machines, or online. The rising focus on hydration and wellness also creates the need for bottled water. As China’s urban population grows, people are busy and prefer convenient and healthy hydration options throughout the day. Moreover, with concerns about air pollution and water quality in some regions, bottled water offers a reliable alternative. Brands have also diversified their offerings, introducing mineral water, flavored water, and functional water with added vitamins or electrolytes, which attract health-conscious consumers. Apart from this, premium bottled water is gaining traction among affluent consumers who associate it with higher quality and exclusivity.

Analysis by Packaging Type:

- Bottles

- Cans

- Cartons

- Others

Bottles hold the biggest market since they are the most convenient and versatile option for both brands and consumers. Bottled beverages are easy to keep and drink while on the move, making them perfect for hectic city living. Regardless of whether it is bottled water, juices, or tea, buyers prefer packaging that aligns with their busy lifestyles, and bottles are ideal for this. Furthermore, bottled drinks are frequently regarded as cleaner, as they are sealed and safeguard the contents from any contamination. Brands utilize bottles to enhance their image by providing distinctive shapes, sizes, and designs that draw in consumers. Bottles are available in various materials, including plastic, glass, and sustainable choices, accommodating diverse choices. Bottles can also be readily found in supermarkets, convenience stores, and vending machines, making them convenient to obtain. The blend of convenience, cleanliness, and brand attraction keeps bottles leading in the market.

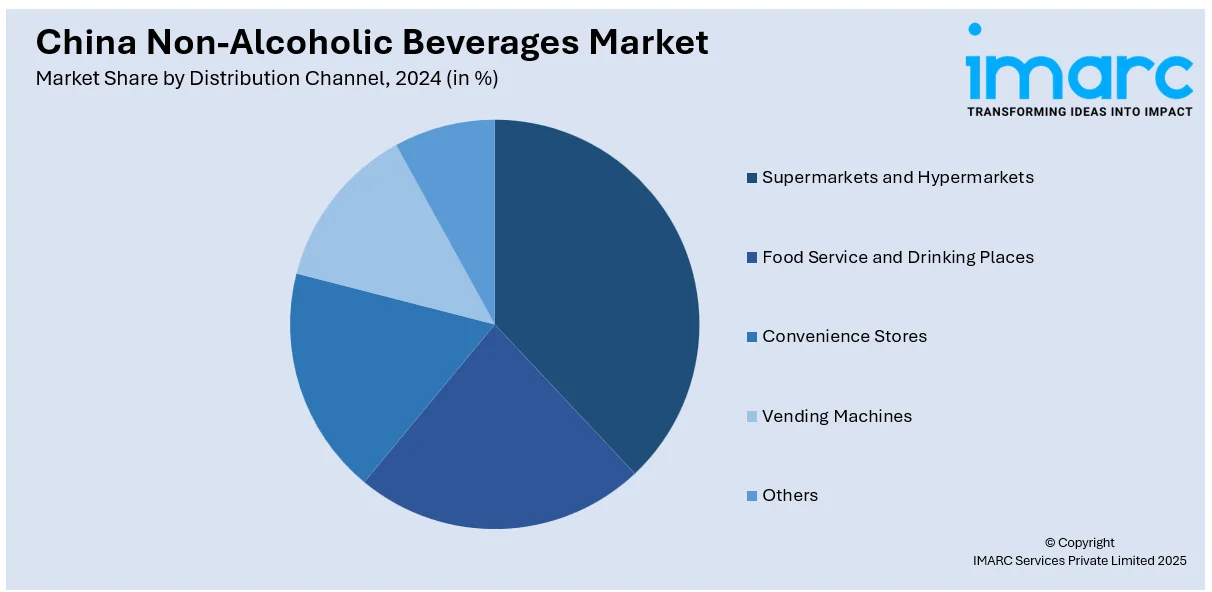

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Food Service and Drinking Places

- Convenience Stores

- Vending Machines

- Others

Supermarkets and hypermarkets exhibit a clear dominance in the market. They provide an extensive range of choices all in a single location. These big retail outlets offer easy access to both popular and specialty non-alcoholic beverages, allowing shoppers to conveniently browse and compare various products. Individuals can easily discover a variety of items, ranging from bottled water and juices to health drinks and plant-based options. Another reason supermarkets and hypermarkets are favored is their extensive coverage. They can be found in both urban and suburban regions, enabling many consumers to access them easily. Furthermore, these shops frequently offer promotions and discounts, motivating more individuals to purchase in greater amounts. As large chains and local businesses expand, supermarkets and hypermarkets have become the preferred spots for bulk buying, giving both high-end and economical choices.

Competitive Landscape:

Key players in the market work on developing innovative products to meet the China non-alcoholic beverages market demand. Big brands and local companies are not only offering popular drinks but also introducing new products that cater to health trends like low-sugar, functional, and plant-based beverages. These companies also wager on marketing strategies and partnerships, using social media channels and influencers to promote their products, which helps to build brand loyalty, especially among younger consumers. They also emphasize broadening distribution channels like e-commerce portals to reach a wider audience across China’s vast regions. By adapting to changing consumer preferences and providing convenience, these key players set trends that influence the entire industry. For instance, in May 2024, Nestlé launched six new coffee lines in China, featuring plant-based drinks and a unique upcycled product. The Coconut Americano consists of more than 20% coconut water and is low in sugar and fat, while the Oatmeal Latte provides 7g of dietary fiber.

The report provides a comprehensive analysis of the competitive landscape in the China non-alcoholic beverages market with detailed profiles of all major companies, including:

- Coca-Cola China Beverages Ltd

- Danone Asia-Pacific Management Co Ltd (Danone S.A.)

- Hangzhou Wahaha Group Co., Ltd.

- Master Kong Holdings Limited (Tingyi (Cayman Islands) Holding Corp.)

- Mondelez (China) Co., Ltd. (Mondelez International, Inc.)

- Nestle (China) Ltd.

- PepsiCo (China) Limited

- Shanghai DyDo DRINCO, Inc. (DyDo Group Holdings, Inc.)

- Suntory Huiyuan (Shanghai) Beverage Co., Ltd (Suntory Holdings Limited)

- Uni-President China Holdings Limited.

Latest News and Developments:

- November 2024: Budweiser, a prominent brand of Belgian company AB InBev, revealed its plans to introduce additional premium beverages in China to satisfy demand. Alongside the debut of its initial sugar free beer, ‘Harbin IGD Zero Sugar’, Budweiser APAC rolled out Budweiser Zero and Corona Cero, both alcohol-free beers, in China.

- August 2024: The Coca Cola Company, a famous multinational corporation, teamed up with Oreo, a well-known snack brand, to introduce a limited-edition beverage named Coca-Cola Oreo Zero Sugar. The new beverage will be launched in major retail stores and McDonald's locations throughout China next month. It showcases a design with Oreo cookies and Coca-Cola bottles, providing a flavor of Coca-Cola blended with a faint Oreo savor.

- August 2024: Danone China, the agri-food company, launched Mizone Electrolyte +, a grapefruit-flavored drink rich in electrolytes, to meet the increasing consumer interest in functional beverages in China. This item is intended for active individuals or anyone looking to boost their electrolyte consumption. Mizone Electrolyte + is built on a coconut water foundation and has 455mg of five key electrolytes- potassium, calcium, sodium, magnesium, and chloride.

- July 2024: The China Beverage Industry Association (CBIA) revealed the endorsement and publication of the new group standard "Electrolyte Beverages”. This important advance intends to govern the manufacturing and standards of electrolyte beverages, guaranteeing safety, uniformity, and creativity in the sector.

- June 2024: Yili Changyi, a Chinese dairy product manufacturer, started large-scale production of MilkBeer, which is set to be released in China by the end of June. The beverage is marketed as the most “invigorating and potent” lactic acid bacteria drink, highlighting “minimal sugar, no fat, and no alcohol” as its main selling features. It includes the firm’s proprietary strain K56, which enhances the intestinal health of consumers.

China Non-Alcoholic Beverages Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Carbonated Soft Drinks, Juices, Bottled Water, Sports & Energy Drinks, Ready to Drink (RTD) Teas & Coffees, Others |

| Packaging Types Covered | Bottles, Cans, Cartons, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Food Service and Drinking Places, Convenience Stores, Vending Machines, Others |

| Companies Covered | Coca-Cola China Beverages Ltd, Danone Asia-Pacific Management Co Ltd (Danone S.A.), Hangzhou Wahaha Group Co., Ltd., Master Kong Holdings Limited (Tingyi (Cayman Islands) Holding Corp.), Mondelez (China) Co., Ltd. (Mondelez International, Inc.), Nestle (China) Ltd., PepsiCo (China) Limited, Shanghai DyDo DRINCO, Inc. (DyDo Group Holdings, Inc.), Suntory Huiyuan (Shanghai) Beverage Co., Ltd (Suntory Holdings Limited) and Uni-President China Holdings Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China non-alcoholic beverages market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China non-alcoholic beverages market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China non-alcoholic beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The China non-alcoholic beverages market in the region was valued at USD 169.0 Billion in 2024.

The rising awareness among the masses about lifestyle diseases like obesity and diabetes is driving the demand for healthier options, such as low-sugar, low-calorie, and functional non-alcoholic beverages in China. Besides this, social media campaigns and celebrity endorsements that target younger demographics are promoting the usage of non-alcoholic beverages, Moreover, the increasing adoption of sustainable production practices and eco-friendly packaging options are impelling the market growth.

IMARC estimates the Asia Pacific payment gateways market to exhibit a CAGR of 6.2% during 2025-2033, reaching a value of USD 291.0 Billion by 2033.

Bottled water accounted for the largest China non-alcoholic beverages product type market share owing to its health benefits, convenience, and affordability. It is a reliable hydration option, with easy accessibility, various sizes, and added features like mineral content, catering to the growing health-conscious consumer base.

Some of the major players in the China non-alcoholic beverages market include Coca-Cola China Beverages Ltd, Danone Asia-Pacific Management Co Ltd (Danone S.A.), Hangzhou Wahaha Group Co., Ltd., Master Kong Holdings Limited (Tingyi (Cayman Islands) Holding Corp.), Mondelez (China) Co., Ltd. (Mondelez International, Inc.), Nestle (China) Ltd., PepsiCo (China) Limited, Shanghai DyDo DRINCO, Inc. (DyDo Group Holdings, Inc.), Suntory Huiyuan (Shanghai) Beverage Co., Ltd (Suntory Holdings Limited), Uni-President China Holdings Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)