China Luxury Car Market Size, Share, Trends and Forecast by Vehicle Type, Fuel Type, Price Range, Engine Capacity, and Region, 2025-2033

China Luxury Car Market Size and Share:

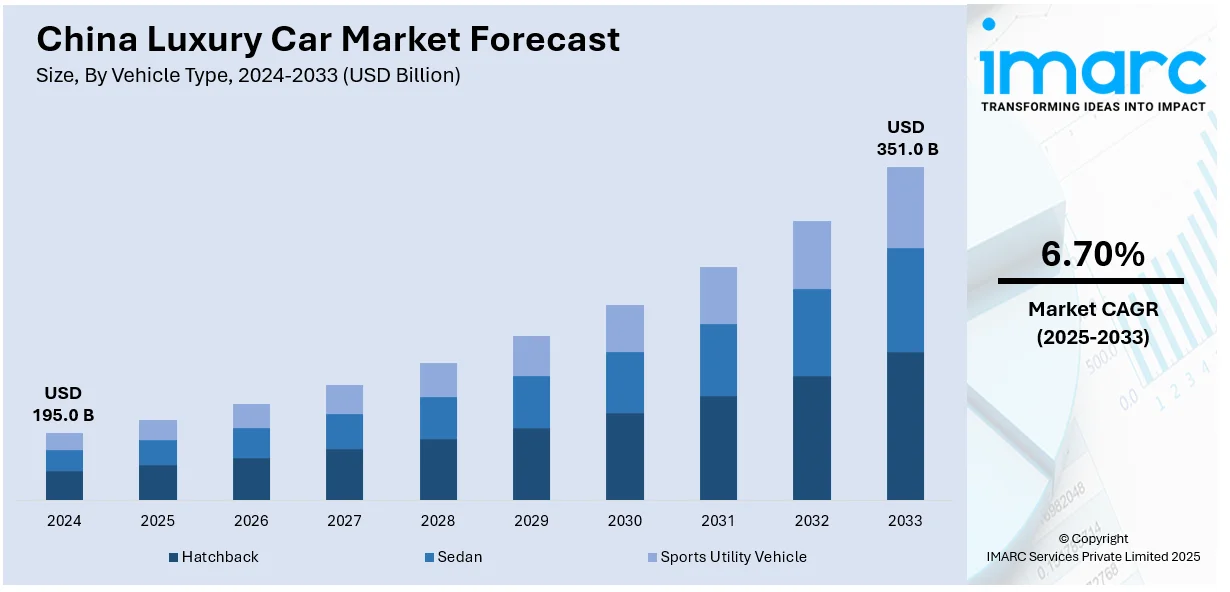

The China luxury car market size was valued at USD 195.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 351.0 Billion by 2033, exhibiting a CAGR of 6.70% from 2025-2033. The market share is driven by rising disposable incomes, growing demand for premium features, and a preference for status symbols. Technological advancements, government incentives for new energy vehicles, and expanding dealership networks further fuel market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 195.0 Billion |

|

Market Forecast in 2033

|

USD 351.0 Billion |

| Market Growth Rate (2025-2033) | 6.70% |

China’s luxury car market is witnessing significant growth, driven by rising disposable income and the adding number of rich consumers. As China’s economy continues to expand, a growing part of the population is achieving advanced buying power, allowing them to invest in ultra expensive vehicles. The country now has one of the world’s largest high- net- worth individual (HNWI) populations, fueling demand for high- end motorcars. Luxury auto brands are capitalizing on this trend by introducing customized and premium offerings tailored to Chinese consumers’ preferences. Also, urbanization and the rise of youthful, status-conscious buyers are accelerating luxury auto purchases. Wealthier consumers are seeking vehicles that reflect their social status, advanced technology, and superior comfort.

The growing emphasis on cutting- edge technology and smart mobility results is a crucial driver of China’s luxury car market. Consumers in China are largely tech- expertise and demand vehicles with state- of- the- art features, including independent driving capabilities, AI- powered infotainment systems, and advanced safety technologies. Luxury auto manufacturers are heavily investing in research and development to introduce electric, hybrid, and intelligent connected vehicles, aligning with China's drive toward sustainable mobility. Leading brands like Tesla, BMW, and Mercedes- Benz are using China’s strong 5G structure and AI invention to enhance their vehicles’ digital ecosystem. Also, the government’s programs supporting electric vehicle embracement have encouraged luxury automakers to launch high- end electric and hybrid models, appealing to environmentally conscious buyers.

China Luxury Car Market Trends:

Rising disposable incomes

China’s luxury car market is expanding rapidly, driven by a growing population of high-net-worth individuals and rising disposable incomes. According to a study released by the National Bureau of Statistics (NBS), the nation's per capita disposable income in 2024 was 41,314 yuan, or around 5,747 US Dollars. This was up 5.3% year over year in nominal terms and 5.1% after accounting for price considerations. As per the people’s republic of China, As China’s economy continues to develop, an increasing number of consumers are seeking premium vehicles as a symbol of status, success, and lifestyle. The younger generation, particularly millennials and Gen Z, is also playing a significant role in luxury car demand, showing strong interest in high-end automotive brands. Additionally, rapid urbanization and an expanding middle class have increased the purchasing power of consumers, further fueling market growth. Foreign luxury brands, including Mercedes-Benz, BMW, and Audi, continue to benefit from this trend by introducing models tailored to Chinese preferences.

Technological advancements

Technological innovation is a key driver of China’s luxury car market, with a strong emphasis on intelligent connectivity, autonomous driving, and electrification. Luxury car manufacturers are integrating cutting-edge technologies such as AI-powered infotainment systems, advanced driver assistance features, and high-performance electric drivetrains to attract tech-savvy Chinese consumers. The Chinese government’s push for electric vehicles (EVs) has also encouraged luxury automakers to launch premium electric models. As per Massachusetts Institute of Technology, by 2030, 40% of vehicles in China will be electric. Brands like Tesla, NIO, and Porsche are capitalizing on this trend by introducing high-end electric vehicles with long-range capabilities and rapid charging technology. Additionally, smart mobility solutions, such as over-the-air software updates and AI-assisted navigation, are becoming key differentiators in the luxury segment. With increasing consumer demand for high-performance, sustainable, and technologically advanced vehicles, luxury carmakers are investing heavily in R&D to enhance their offerings, further driving the growth of China’s luxury car market.

Strong brand presence

The luxury car market in China is highly influenced by the presence of premium brands and the growing demand for customized vehicles. As per International Trade Administration, the market for customization and modification in China was estimated to be worth USD 10 Billion in 2021 and may grow to USD 31.2 Billion by 2025. International automakers such as Rolls-Royce, Bentley, and Ferrari have established strong brand recognition in China, offering exclusive experiences and limited-edition models tailored to Chinese consumers. Luxury car buyers in China place a high value on exclusivity, leading to increased demand for bespoke customization, including personalized interiors, high-end materials, and unique design elements. Many automakers now offer tailor-made services to cater to elite customers looking for one-of-a-kind vehicles. Additionally, luxury brands have been strengthening their presence in China through flagship stores, VIP lounges, and premium customer service programs. The expansion of digital marketing and direct-to-consumer strategies has also enhanced engagement with high-end buyers, thus creating a favorable China luxury car market outlook.

China Luxury Car Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China luxury car market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on vehicle type, fuel type, price range, and engine capacity.

Analysis by Vehicle Type:

- Hatchback

- Sedan

- Sports Utility Vehicle

Sports utility vehicles ( SUVs) dominate China's luxury car market due to their versatility, status appeal, and advanced features. Chinese consumers favor SUVs for their spacious interiors, high ground clearance, and superior road presence, making them ideal for both local and long- distance trip. Luxury automakers, including Mercedes- Benz, BMW, and Audi, have responded to this demand by introducing high- end SUVs with premium comfort, cutting- edge technology, and heavy performance. Another crucial factor is China’s preference for family- acquainted vehicles. With a rising number of rich families, SUVs are perceived as safer and further practical compared to sedans.

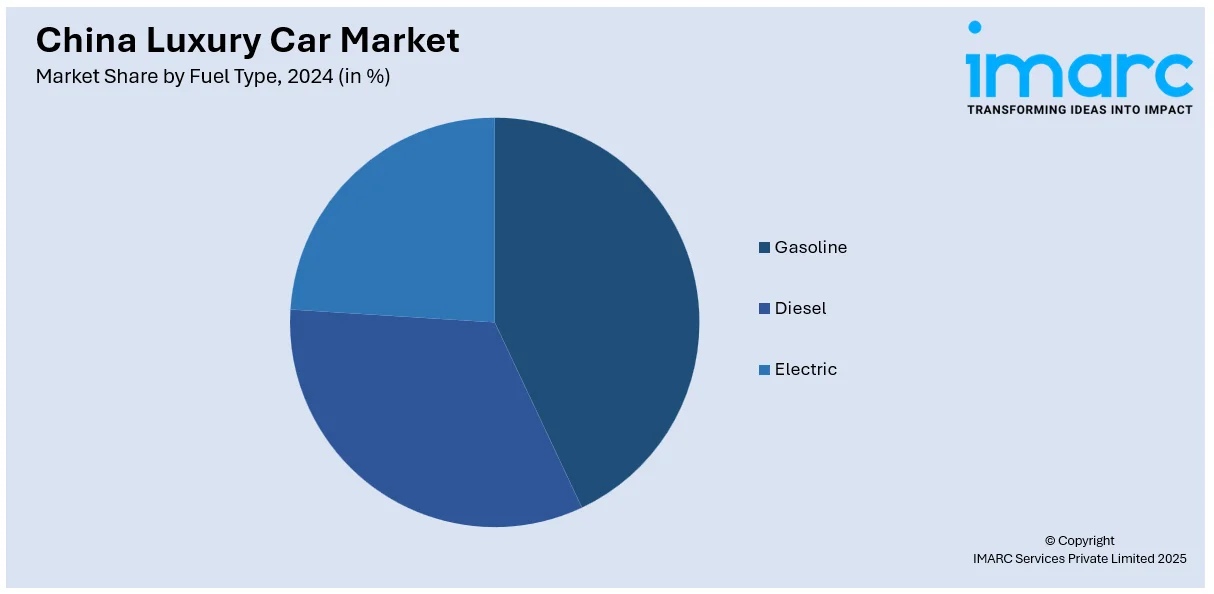

Analysis by Fuel Type:

- Gasoline

- Diesel

- Electric

Gasoline- powered luxury cars continue to dominate the Chinese market due to consumer preferences for high- performance vehicles, a well- established fueling structure, and the legacy of traditional luxury auto brands. Chinese buyers in the luxury segment prioritize engine power, driving dynamics, and brand prestige, which gasoline vehicles have historically delivered. Numerous high- end brands, similar as Mercedes- Benz, BMW, and Audi, have made their reputations on heavy gasoline engines, offering smooth acceleration, meliorated performance, and long driving ranges compared to early electric alternatives.

Analysis by Price Range:

- Entry-Level

- Mid-Level

- High-End

- Ultra

Entry- level luxury cars feed to consumers transitioning from mainstream to extravagant vehicles. These models offer luxury features similar as advanced infotainment systems, premium innards, and enhanced safety technologies at a fairly accessible price. Popular choices in this section include BMW 3 Series, Audi A4, and Mercedes- Benz C- Class, appealing to youthful professionals and first- time luxury auto buyers.

Mid-level luxury cars give a balance between performance, comfort, and cutting- edge technology. They feature more advanced driver- backing systems, superior cabin materials, and enhanced driving dynamics. Vehicles like the BMW 5 Series, Mercedes- BenzE-Class, and Audi A6 dominate this order, attracting business directors and established professionals seeking both prestige and practicality.

High- end luxury cars offer ultra expensive artificer, heavy-duty engines, and superior ride quality. This section includes models such as BMW 7 Series and Porsche Panamera, designed for rich buyers who prioritize comfort, prestige, and cutting- edge automotive inventions.

The ultra-luxury segment represents the zenith of automotive excellence, offering bespoke customization, handcrafted innards, and unmatched performance. Brands like Rolls- Royce, Bentley, and Ferrari dominate this class, feeding to elite consumers seeking exclusivity, prestige, and unequaled luxury gests.

Analysis by Engine Capacity:

- Up to 3,000 CC

- Above 3,000 CC

Luxury cars with engine capacities of over to 3,000 CC dominate the Chinese market due to a combination of regulatory programs, consumer preferences, and technological advancements. The Chinese government imposes high taxes and strict regulations on vehicles with larger engine capacities, making high- performance cars over 3,000 CC significantly more precious. As a result, luxury auto manufacturers concentrate on offering models within this range to attract rich buyers while keeping costs and taxation reasonable. Also, Chinese consumers prioritize a balance between performance, energy effectiveness, and technological features.

Regional Analysis:

- Guangdong

- Jiangsu

- Zhejiang

- Henan

- Sichuan

- Shanghai

- Others

Guangdong is the leading province in China’s luxury car market due to its strong economy, high concentration of affluent consumers, and advanced automotive infrastructure. As per Data Talk, Guangdong citizens' per capita disposable income increased by 4.4% year over year to 51,474 yuan ($7249.86) in 2024. As one of China’s wealthiest regions, Guangdong boasts a high number of high-net-worth individuals who drive demand for premium vehicles. Cities like Guangzhou and Shenzhen are economic powerhouses, home to successful entrepreneurs, corporate executives, and technology professionals who prefer luxury brands such as Mercedes-Benz, BMW, and Porsche.

Competitive Landscape:

Luxury brands like BMW, Mercedes-Benz, and Audi are increasing local production to reduce costs and meet Chinese consumer preferences. Joint ventures with domestic manufacturers, such as BMW’s partnership with Brilliance Auto, allow these brands to optimize production and offer tailor-made models. Customization services, including exclusive interior designs, premium materials, and personalized features, are also becoming a key focus to cater to China’s growing demand for unique luxury experiences. With China’s strong push for electric vehicles (EVs), luxury carmakers are aggressively investing in electrification. Brands like Tesla, NIO, and Porsche are introducing high-performance EVs with extended range and cutting-edge autonomous driving capabilities. According to CarNewsChina, which cited preliminary sales figures from the China Passenger Car Association (CPCA), EV manufacturers sold a record 10.97 million new energy vehicles (NEVs) in China in 2024. Additionally, smart connectivity features, AI-assisted driving, and advanced infotainment systems are becoming essential offerings to attract tech-savvy Chinese buyers. As per China luxury car market forecast, these efforts continue to drive the market growth.

The report provides a comprehensive analysis of the competitive landscape in the China luxury car market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, In China, Chery introduced the luxury off-road brand Jetour Zongheng. In the third quarter of this year, the Jetour Zongheng G700, the brand's debut model, will be released in China. Later, domestic sales of the F700 pickup truck and the 1,572-hp G900 SUV will begin.

- In April 2024, in an effort to attract affluent customers amid a growing pricing war among some of the nation's leading EV manufacturers, Chinese manufacturer Nio unveiled the Nio 2024 ET 7. William Li Bin, claims that the new executive car has more potent smart-driving capabilities, an improved digital cockpit, long driving range, and more comfy passenger seats.

- In January 2025, Great Wall Motor (GWM) is getting ready to introduce "Confidence Auto," a new luxury new energy vehicle brand. The new brand is anticipated to directly compete with BYD's Yangwang brand and will be positioned higher than current brands such as Haval, WEY, Tank, and Ora.

- In September 2024, The Dongfeng Forthing brand unveiled the Xinghai S7, an electric sedan/hatchback. Each of the three models has a 555-kilometer range.

China Luxury Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, Sports Utility Vehicle |

| Fuel Types Covered | Gasoline, Diesel, Electric |

| Price Ranges Covered | Entry-Level, Mid-Level, High-End, Ultra |

| Engine Capacities Covered | Up to 3,000 CC, Above 3,000 CC |

| Regions Covered | Guangdong, Jiangsu, Zhejiang, Henan, Sichuan, Shanghai, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China luxury car market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China luxury car market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China luxury car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The China luxury car market in the region was valued at USD 195.0 Billion in 2024.

The China luxury car market share is driven by rising disposable incomes, growing demand for premium features, and a preference for status symbols. Technological advancements, government incentives for new energy vehicles, and expanding dealership networks further fuel market growth.

The China luxury car market is estimated to exhibit a CAGR of 6.70% during 2025-2033.

Guangdong is the leading province in China’s luxury car market due to its strong economy, high concentration of affluent consumers, and advanced automotive infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)