China Hand Sanitizer Market Size, Share, Trends and Forecast by Product, Product Form, End-User, Ingredient, Pack Size, Distribution Channel, and Region, 2025-2033

China Hand Sanitizer Market Size and Share:

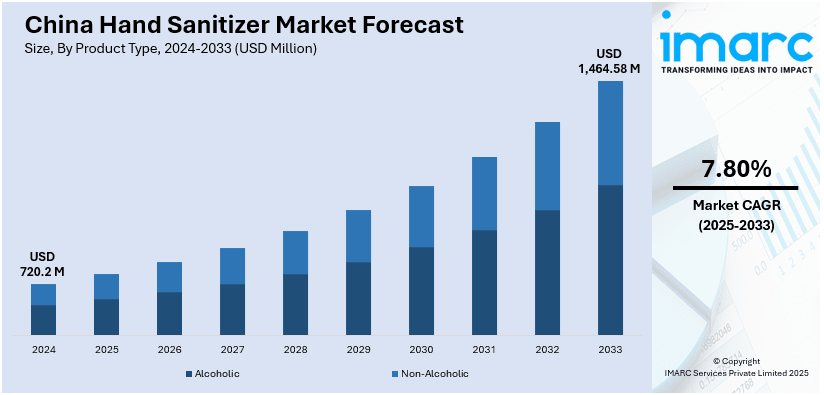

The China hand sanitizer market size was valued at USD 720.2 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,464.58 Million by 2033, exhibiting a CAGR of 7.80% from 2025-2033. The China hand sanitizer market share is increasing due to the heightened awareness about hygiene, government health campaigns, increasing health threats from pandemics, and rising demand among residential and commercial users.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 720.2 Million |

|

Market Forecast in 2033

|

USD 1,464.58 Million |

| Market Growth Rate (2025-2033) | 7.80% |

The China hand sanitizer market growth is attributed to the heightened awareness about personal hygiene, particularly following health crises like the COVID-19 pandemic. With the rapid spread of the virus, the government and public health organizations launched widespread campaigns to educate citizens about the importance of regular hand sanitization in preventing the transmission of infectious diseases. As a result, consumers in urban and rural areas alike have become more diligent in adopting hand hygiene practices. In addition, changing lifestyles, increasing disposable income, and rising health consciousness has led to more frequent use of hygiene products, including hand sanitizers. The Chinese government’s focus on improving healthcare infrastructure and its efforts to curb infectious diseases have reinforced these hygiene practices. The State Council Information Office states that, according to the plan jointly issued by the NHC, the National Administration of Traditional Chinese Medicine, and the National Disease Control and Prevention Administration, China has announced a three-year plan to increase health literacy among its citizens from 2024 to 2027, aiming for an average annual increase of 2 percentage points each year, which highlights the initiative taken by the government.

Additionally, the expanding middle class and urbanization trends have made hand sanitizers a staple in both homes and public spaces. As consumer habits shift, there is a growing expectation for convenient, easily accessible hygiene products, further accelerating market demand. The rapid growth of e-commerce in China has also significantly influenced the hand sanitizer market by improving product accessibility and visibility. Online platforms such as Alibaba and JD.com have become essential sales channels, making it easier for consumers to purchase a wide range of hand-sanitizing products. This convenience has allowed smaller, local brands to gain a foothold alongside established players, broadening consumer choice and fueling competition. Furthermore, the availability of specialized sanitizers, including those with added skincare benefits or alcohol-free formulas, has catered to a variety of consumer preferences, boosting overall demand. Distribution channels have also improved, with sanitizers increasingly available in retail chains, convenience stores, and even in high-traffic locations like transportation hubs, healthcare facilities, and educational institutions. The rise of commercial hygiene protocols across various sectors, such as healthcare, education, and hospitality, has further expanded the market. Businesses are increasingly adopting sanitizing measures to ensure employee and customer safety, pushing the demand for hand sanitizers beyond just residential use. The convergence of these factors has positioned the hand sanitizer market for sustained growth in China.

China Hand Sanitizer Market Trends:

Increasing demand for premium and organic hand Sanitizers

The China hand sanitizer market trends are also influenced by the growing demand for premium and organic products backed by the rise in health-conscious and environmentally conscious consumers. People in major urban cities, like Beijing, Shanghai, and Shenzhen, are highly demanding hand sanitizers with effective germ protection features that provide healthy skin benefits with an environmental cause. Products containing natural ingredients such as aloe vera, tea tree oil, and chamomile are in high demand. Consumers increasingly demand chemical-free formulations. A steady increase in disposable income is observed among China's growing middle class. The State Council Information Office states that the National Bureau of Statistics recorded a 5.3% increase in the country's per capita disposable income in 2024 at USD 5,747. This growth allows middle and high-income classes to afford premium personal care items, including high-quality hand sanitizers that feature nongreasy textures, moisturizing effects, and complex fragrances.

E-commerce revolution

E-commerce is dramatically changing the Chinese hand sanitizer industry, as business sales through internet platforms have increased exponentially since the COVID-19 outbreak. Tmall, JD.com, and Pinduoduo are platforms that have transformed the industry and are leading in providing customers with the ability to browse and discover a variety of products, compare prices, and get them delivered right to their doorstep. Other new product lines of hand sanitizers like travel-sized sprays, refill packs, and luxury formulations are introduced in the market by these platforms, which has been critical. A major driving factor behind this is the live streaming and influencer marketing space. The hand sanitizer brands are often endorsed by popular Key Opinion Leaders (KOLs) and celebrities during livestream sessions, thus boosting immediate sales and increasing brand visibility. Brands are utilizing data analytics to understand consumer behavior and preferences and create personalized marketing campaigns that resonate with targeted demographics. For example, busy urbanites are attracted to compact sanitizers, while families prefer larger packs offering value for money.

Innovation and sustainability

Innovation and sustainability are boosting the China hand sanitizer demand, capturing changing consumer needs and regulatory trends. Brands are, with growing environmental concerns, adopting sustainable practices such as using recyclable or biodegradable packaging or offering refillable sanitizer solutions. These efforts almost align closely with the sustainability goals of China, particularly in its carbon-neutral target for 2060. Chinese Academy of Sciences states that as per the "Big Earth Data in Support of the Sustainable Development Goals Report (2024)", China has met 126 indicators early as part of its success in the UN 2030 Agenda for Sustainable Development, thus demonstrating the nation's zeal in environmental development. At the same time, manufacturers launched new formulations meeting the changing trends of consumers' requirements. As more consumers are requiring products for their sensitive skin types, alcohol-based hand sanitizers have become widely accepted, although there are newly launched quick-drying gels, sprays, and foams, among others.

China Hand Sanitizer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China hand sanitizer market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, product form, end-user, ingredient, pack size, and distribution channel.

Analysis by Product Type:

- Alcoholic

- Non-Alcoholic

Alcohol-based hand sanitizer represent the largest segment, as they effectively kill 99.9% of germs and bacteria, which include viruses like COVID-19. They usually contain 60 to 90 percent alcohol (ethanol or isopropanol) and provide fast-acting properties, reliability, and solid protection for everyone, making them a staple item in hospitals and healthcare facilities, among other high-risk environments. Therefore, their significant use among healthcare professionals speaks to the critical function of these disinfectants. Superior germicidal properties of alcohol-based sanitizers also find considerable promotion in households and public spaces in the face of flu seasons and pandemics, as there is a heightened demand for proper control of pathogenic organisms. According to the World Bank, China has entered aged societies, which consist of over 15% to 20% of the population aged above 65 years. This demographic shift, coupled with the heightened vulnerability of older adults to infections, has further been driving demand for reliable hygiene solutions such as alcohol-based sanitizers. Manufacturers are also addressing consumer concerns about dryness by enriching their formulations with moisturizers like glycerin and aloe vera, enhancing user satisfaction. The government has placed more emphasis on public hygiene and incorporated alcohol-based sanitizers into public health campaigns, which has cemented their position as indispensable infection control products.

Analysis by Product Form:

- Gel

- Liquid

- Foam

- Spray

- Others

Gel-based hand sanitizers are the leading market due to their convenience, versatility, and user-friendly application. Unlike liquid or spray sanitizers, gel sanitizers are thicker, giving better control and minimizing product wastage. They are a preferred hygiene product in personal and professional circles due to their quick-drying properties and cleanliness with minimal residue left on the hands. The popularity of gel sanitizers can be seen in the increasing number of people working in China This has further increased the demand for portable, effective, and easy-to-use hygiene products. Gel-based sanitizers, available in travel-sized formats, are ideal for on-the-go applications, and thus young professionals commuting or working in high-contact environments will love them. With the added benefits of moisturizers, fragrances, and added skincare benefits in their gel formulations, this has become household favorites and a force to reckon with, pushing the boundaries from merely healthcare environments. The refillable pack and travel-sized lines have further penetrated their market for eco-conscious and convenient consumers.

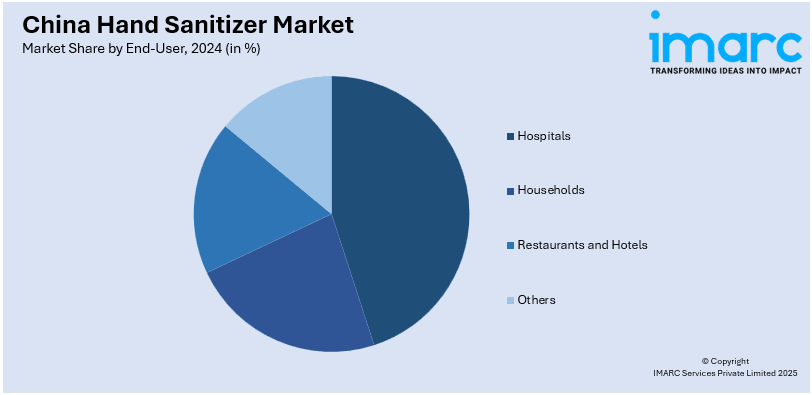

Analysis by End-User:

- Hospitals

- Households

- Restaurants and Hotels

- Others

Hospitals account for the major segment for hand sanitizers in China, driven by stringent hygiene protocols and the critical need to prevent infections. Hand sanitizers are highly essential in a healthcare setting due to the key role they play in preventing the spread of infections, which become hospital-acquired infections (HAIs). The sanitizers have been in the lead in hospitals for their effectiveness in killing germs within a very short time and are therefore indispensable in routine and emergency care. This is as China has seen more healthcare facilities over the years. The population here is also growing old, further increasing the need for hand sanitizer in this field. This need is highlighted by recent public health data. According to Radio Free Asia, sentinel hospitals under China's CDC state that in December 2024, outpatient influenza-like illness cases stood at 1.9%, and hospitalized severe acute respiratory infections at 2.1%, who were positive for COVID-19. Statistics like these indicate the need for further vigilance with hygiene measures in the hospitals lest infectious diseases spread through them. Government regulations and standards of accreditation are also very strict measures that enforce a regular application of hand sanitizer across the health environment. As a result, growth for hand sanitizers will largely remain dependent on hospitals and strengthen their role as the very cradle for safeguarding public health with the implementation of infection control practices in risky locations.

Analysis by Ingredient:

- Natural

- Organic

- Synthetic

Synthetic hand sanitizers lead the Chinese market due to their cost-effectiveness, long shelf life, and high germicidal efficiency. These formulations, often containing chemical agents like triclosan or chlorhexidine combined with alcohol or other active ingredients, provide robust antimicrobial action. Their affordability and accessibility across diverse demographics have cemented their dominance in the market. Synthetic sanitizers have gained popularity in all institutional settings, including hospitals, schools, offices, and various other places, by using large volumes for hygiene preservation. Households and public utility facilities also highly prefer synthetic-based hand sanitizers due to rapid action and variations in forms, from gels and liquids to spray. The current demand for synthetic hand sanitizers is indeed linked with increased public health needs. This further emphasizes the need to implement appropriate hygiene measures to combat the outbreak of respiratory infections, leading to increased demand for synthetic sanitizers.

Analysis by Pack Size:

- Small

- Medium

- Large

Large pack sizes dominate the market, driven by their cost efficiency and suitability for high-consumption environments. The most common sizes of these bulk packaging options are 1 liter and 5 liters, making them especially popular in hospitals, schools, offices, and other public facilities where regular use of hand sanitizers is essential to maintain hygiene. Institutional buyers prefer these bigger packs for the value for money they offer and guarantee a constant supply in high-demand environments. For households, there is also appeal in big pack sizes, particularly during flu season or other times of heightened hygiene awareness. Households prefer bulk refills for smaller dispensers to minimize packaging waste and save money in the long run. Manufacturers are responding to this demand by launching eco-friendly refill solutions and offering discounts on bulk purchases, which align with consumer preferences for affordability and sustainability. This trend is indicative of broader shifts in consumption patterns as China rebalances its growth toward domestic consumption.

Analysis by Distribution Channel:

- Direct Sales

- Retail Sales

- Pharmacies

- Supermarkets and Hypermarkets

- Departmental Stores

- Online

- Others

Direct sales have become the largest distribution channel for hand sanitizers in China, especially for institutional buyers such as hospitals, government agencies, and large enterprises. Institutional buyers typically source directly from manufacturers or distributors to guarantee supply, lower prices, and custom-made solutions tailored to their requirements. For high-consumption environments such as healthcare facilities and schools, direct sales channels enable bulk purchases and long-term contracts for customized solutions such as medical-grade sanitizers and specialized dispensing systems. This streamlined relationship cuts out middlemen, reducing costs increasing efficiency for sellers and buyers alike, and encouraging customer loyalty through dependable delivery. This dominance of direct sales is further supported by the robust e-commerce infrastructure in China. According to Focus–China Britain Business Council, China is the world's largest e-commerce market, with more than 800 Million users, a share of over 40% of the global transactions, and retail e-commerce sales exceeding US$2 Trillion. Huge retail chains and e-commerce platforms are becoming more active at direct selling by ensuring the right and constant inventory levels in response to the surging demand for hand sanitizers in institutional and consumer markets.

Regional Analysis:

- North

- Northeast

- East

- South Central

- Southwest

- Northwest

East China is emerging as a major contributor to the hand sanitizer market, driven by its growing healthcare infrastructure, industrial base, and increasing awareness about hygiene practices. The region, which includes Liaoning, Jilin, and Heilongjiang provinces, has seen a surge in demand for hand sanitizers across both urban and rural areas. Major users of hand sanitizers include hospitals and other public institutions within this region that have stepped up hygiene requirements in the fight against diseases, and bettering health statistics. This cold region further demands hand sanitizers, especially in the most frigid months. Consumers here are now on the lookout for moisturizing sanitizers that will offer both germ-free and dry skin protection. This is particularly critical during flu season, an example of which is December 2024, when flu cases rocketed in Liaoning province with an average weekly growth of over 123%, according to The Straits Times. The high cases of flu call for hygiene measures, thereby further increasing the use of sanitizing products. E-commerce has also grown with huge significance in northeast China, increasing the market demand due to various hand sanitizer products available online on different websites in remote areas of the country. The government's initiatives in public health campaigns and improving healthcare infrastructure add to the rapid growth of hand sanitizer markets.

Competitive Landscape:

Market players in China’s hand sanitizer industry are actively focusing on innovation, sustainability, and strategic collaborations to capture the evolving consumer base. Leading brands are introducing advanced formulations, such as alcohol-free and long-lasting antimicrobial sanitizers, to cater to diverse consumer needs. In addition, adding skincare benefits such as moisturizers, vitamins, and herbal extracts is becoming a common strategy to differentiate products and attract premium buyers, reflecting a growing trend toward multifunctional hygiene solutions. Sustainability is also a key focus, with companies adopting eco-friendly packaging, such as biodegradable bottles and refillable options, aligning with China's broader environmental goals. The above factor is further reinforced by the fact that the country focuses on people-centered urbanization as stated by The State Council of the People's Republic of China. It intends to take a five-year action plan and push the proportion of permanent urban residents to almost 70%. This will again push the demand for products that ensure both consumer convenience and environmental responsibility. Besides product innovation and sustainability, digital marketing is also an important aspect of reaching China's tech-savvy consumers. Brands are using e-commerce platforms, livestreaming, and influencer endorsements to drive sales and build brand awareness. Strategic collaborations between manufacturers, healthcare institutions, and retailers are also becoming more common, ensuring consistent supply and wider distribution. These efforts are creating a positive China hand sanitizer market outlook.

The report provides a comprehensive analysis of the competitive landscape in the China hand sanitizer market with detailed profiles of all major companies, including:

- Walch Malaysia (Whealthfields Lohmann)

- Reckitt Benckiser Household Products (China) Co. Ltd. (Reckitt Benckiser Group PLC)

- Shanghai Likang Disinfection High-Tech Co. Ltd.

- Blue Moon International Co. Ltd.

- S. C. Johnson & Son

- Gojo Industries, Inc

- Procter & Gamble

- Lion Corporation

- Health & Beyond Inc.

- Shenzhen Linkhub Supply Chain Management Co. Ltd.

Latest News and Developments:

- August 2023: The Shanghai Disney Resort launched the "clean" campaign in collaboration with Dettol. Over 300 hand-washing stations were installed, along with 70 hand sanitizer dispensers, in the resort, hotels, and Disneytown. Dettol was listed as the official hygiene supplier, providing hand hygiene tip campaigns and co-branded products to promote cleanliness and health.

- October 2020: Swashes and Up Studios in China launched its "Super BOOMi" hygiene products there, including hand sanitizer, hand wash foam, and wet wipes. The brand was initially launched online on Tmall and its online shop and is now looking to expand product offerings into more offline stores throughout Greater China.

China Hand Sanitizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Alcoholic and Non-Alcoholic |

| Product Forms Covered | Gel, Liquid, Foam, Spray, and Others |

| Ingredients Covered | Hospitals, Households, Restaurants and Hotels, and Others |

| End-Users Covered | Natural, Organic, and Synthetic |

| Pack Sizes Covered | Small, Medium, and Large |

| Distribution Channels Covered | Direct Sales and Retail Sales (Pharmacies, Supermarkets and Hypermarkets, Departmental Stores, Online, and Others) |

| Regions Covered | North, Northeast, East, South Central, Southwest, Northwest |

| Companies Covered | Walch Malaysia (Whealthfields Lohmann), Reckitt Benckiser Household Products (China) Co. Ltd. (Reckitt Benckiser Group PLC), Shanghai Likang Disinfection High-Tech Co. Ltd., Blue Moon International Co. Ltd., S. C. Johnson & Son, Gojo Industries, Inc, Procter & Gamble, Lion Corporation, Health & Beyond Inc., Shenzhen Linkhub Supply Chain Management Co. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China hand sanitizer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China hand sanitizer market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China hand sanitizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The China hand sanitizer market was valued at USD 720.2 Million in 2024.

The China hand sanitizer market is driven by heightened awareness about hygiene, government health campaigns, increasing health threats from pandemics, and rising demand among residential and commercial users.

The China hand sanitizer market is estimated to exhibit a CAGR of 7.80% during 2025-2033.

Some of the major players in the China hand sanitizer market includes Walch Malaysia (Whealthfields Lohmann), Reckitt Benckiser Household Products (China) Co. Ltd. (Reckitt Benckiser Group PLC), Shanghai Likang Disinfection High-Tech Co. Ltd., Blue Moon International Co. Ltd., S. C. Johnson & Son, Gojo Industries, Inc, Procter & Gamble, Lion Corporation, Health & Beyond Inc., Shenzhen Linkhub Supply Chain Management Co. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)