China Green Building Materials Market Size, Share, Trends and Forecast by Product Type, End User, and Province, 2025-2033

China Green Building Materials Market Size and Share:

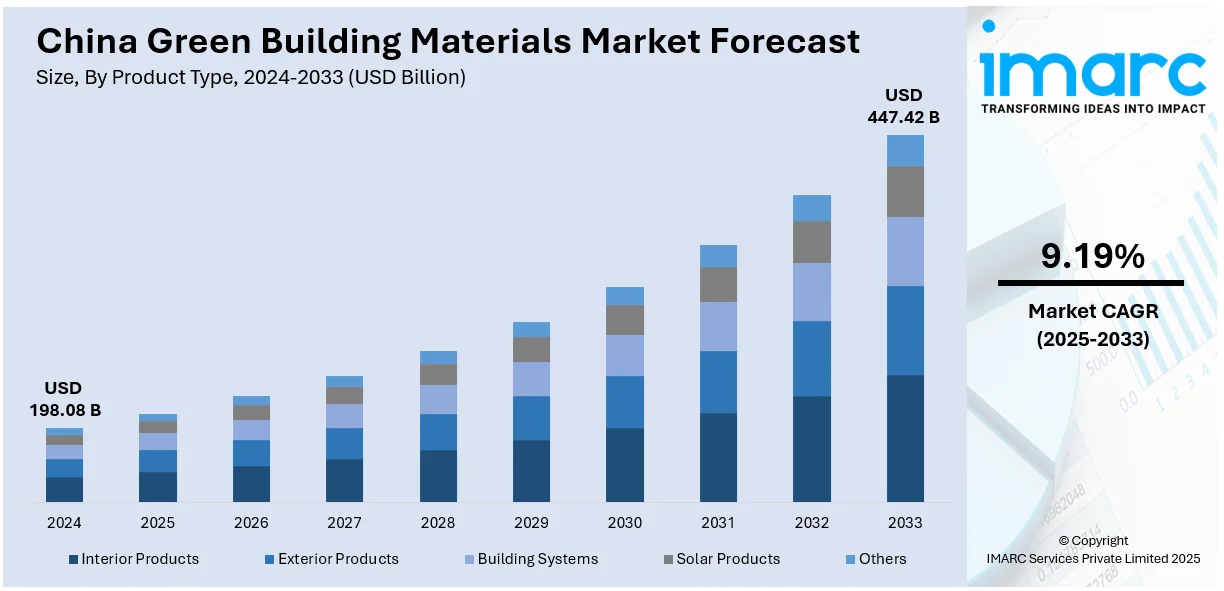

The China green building materials market size was valued at USD 198.08 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 447.42 Billion by 2033, exhibiting a CAGR of 9.19% from 2025-2033. The market is driven by growing technological advancements and increased environmental awareness among masses. Besides this, the urban projects prioritizing eco-friendly materials and innovations reducing emissions are also driving the China green building materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 198.08 Billion |

|

Market Forecast in 2033

|

USD 447.42 Billion |

| Market Growth Rate (2025-2033) | 9.19% |

Growing concerns about pollution and climate change encourage the adoption of sustainable construction practices. People prioritize materials with low carbon footprints and minimal environmental impact, driving green material demand. Public awareness campaigns highlight the benefits of eco-friendly construction, influencing builders and developers alike. Corporate environmental goals further emphasize sustainable materials to align with evolving customer and regulatory expectations. Stricter government policies on emissions drive innovation in low-carbon and energy-efficient building materials. Awareness of indoor air quality increases the demand for non-toxic and environmentally safe materials in buildings. Media coverage on climate issues amplifies the importance of sustainable construction practices across urban and rural areas. Green certifications and labels incentivize developers to use environmentally friendly materials in new projects. Partnerships between environmental organizations and construction firms promote the use of sustainable materials on a larger scale.

Increasing awareness of indoor air quality propels the use of non-toxic and eco-friendly materials. Homeowners prioritize products that reduce allergens and pollutants, improving health and overall living conditions. Builders integrate green materials like low- volatile organic compounds (VOC) paints and sustainable flooring to meet customer expectations. Rising concerns over respiratory health encourage the adoption of energy-efficient ventilation and insulation solutions. Government campaigns promoting healthier environments align with individual preferences, further fueling the market growth. Economic growth enables people to invest in sustainable housing, catalyzing market demand for green materials. The demand for durable, low-maintenance products aligns with the need for healthier, sustainable living spaces. Awareness about environmental health impacts influences individuals to prioritize certified, eco-friendly building products in renovations. Manufacturers innovate to offer high-performance materials that enhance comfort, safety, and indoor environmental quality. Public and private (PPP) investments in sustainable housing amplify the availability of eco-friendly materials in the market, thereby strengthening the market growth.

China Green Building Materials Market Trends:

Rising product innovation

Advanced materials, such as self-healing concrete, improve durability and reduce maintenance costs. Non-toxic, eco-friendly paints and coatings cater to growing health-conscious preferences. Recycled and renewable materials, like bamboo composites, support environmentally sustainable construction practices. Innovative insulation products enhance energy efficiency, reducing overall heating and cooling energy consumption. Lightweight building materials simplify transport and installation, cutting down on carbon emissions and construction timelines. Technological breakthroughs ensure improved material strength while minimizing the use of natural resources. Enhanced manufacturing processes reduce waste and improve energy efficiency during production. Digital design tools enable customization, tailoring materials to specific project requirements and regulatory standards. Research and development (R&D) partnerships foster continuous innovation, expanding the range of green building materials available. By offering cost-effective and high-performing solutions, innovation drives broader adoption in residential and commercial projects. New product features address challenges like temperature control and moisture resistance, enhancing building performance. In January 2025, Mibet launched a waterproof solar carport with a drainage edge to ensure leak-proof performance. It features an internal track structure that collects rainwater and directs it through drainage pipes. The system supports both framed and frameless PV modules and can withstand wind speeds of 45 m/s and snow loads of 1 KN/m². Made with durable aluminum alloys and PVC pipes, it comes with a 10-year warranty.

Rapid economic growth

As per the data published by the National Bureau of Statistics of China, in 2024, the country’s GDP reached 134,908.4 billion yuan, reflecting a 5.0% growth at constant prices. Rapidly growing economy is driving large-scale residential and commercial construction, requiring eco-friendly materials to address environmental concerns. Rising incomes enable greater investment in energy-efficient, health-conscious, and sustainable building solutions. Government-backed initiatives and economic policies allocate substantial resources for green infrastructure projects and technological advancements. Expanding industries create opportunities for innovation in manufacturing eco-friendly materials, enhancing market competitiveness. Higher revenue allows governments to fund sustainable development and implement stricter environmental regulations. Economic growth supports research and development (R&D), enabling the creation of durable, energy-efficient, and cost-effective green materials. This economic dynamism promotes partnerships between public institutions and private companies, fostering widespread adoption of sustainable practices. The combination of industrial expansion and urbanization ensures a consistent demand for innovative green building materials. China's thriving economy facilitates scaling production and reducing costs, making green materials more accessible.

Urban development plans

Urban development plans are driving the China Green Building Materials market demand by promoting sustainable construction solutions. Large-scale urbanization projects prioritize eco-friendly materials to minimize environmental impact and meet regulations. Smart city initiatives integrate green technologies, catalyzing demand for energy-efficient and sustainable building components. According to the United Nations' World Smart Cities Outlook 2024, three Chinese cities including Beijing, Shanghai, and Hong Kong are recognized among the top 10 global innovation hubs. The assessment, which focuses on science, technology, education, and talent, also highlighted China's strong innovation ecosystem. Government policies ensure urban development aligns with low-carbon goals, fostering innovation in green materials. Infrastructure expansion incorporates renewable energy systems and sustainable designs, requiring advanced eco-friendly construction materials. Increased funding for urban housing enhances the adoption of green building materials in residential projects. Economic zones emphasize sustainability, driving demand for innovative and high-performance green solutions. Urban renovation projects focus on retrofitting older buildings with energy-efficient and environmentally friendly materials. By addressing climate goals, urban development plans create a steady demand for sustainable building products. These initiatives contribute significantly to market growth while ensuring sustainable urban environments across the region.

China Green Building Materials Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China green building materials market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and end user.

Analysis by Product Type:

- Interior Products

- Floorings

- Insulation

- Exterior Products

- Windows

- Roofing

- Doors

- Siding

- Building Systems

- Solar Products

- Others

Interior products dominate the green building materials market outlook due to their direct impact on living spaces. These products include sustainable flooring, non-toxic paints, and energy-efficient insulation materials. The demand for eco-friendly interior solutions is driven by health-conscious individuals prioritizing indoor air quality. Manufacturers develop low-emission materials that reduce exposure to harmful chemicals, appealing to environmentally aware buyers. Energy-efficient interior products contribute to reduced energy consumption, lowering utility costs for households and businesses. Renovation projects often prioritize interior upgrades, further driving demand for sustainable materials in this segment. Government incentives promote the use of certified green materials for interiors in public and private buildings. Advanced technologies enable the development of high-performance interior products that meet stringent sustainability standards. Increased awareness about sustainable practices encourages builders and individuals to choose environmentally responsible interior options.

Analysis by End User:

- Residential

- Non-Residential

- Commercial and Office

- Institutional

- Industrial

- Hospitality and Leisure

- Others

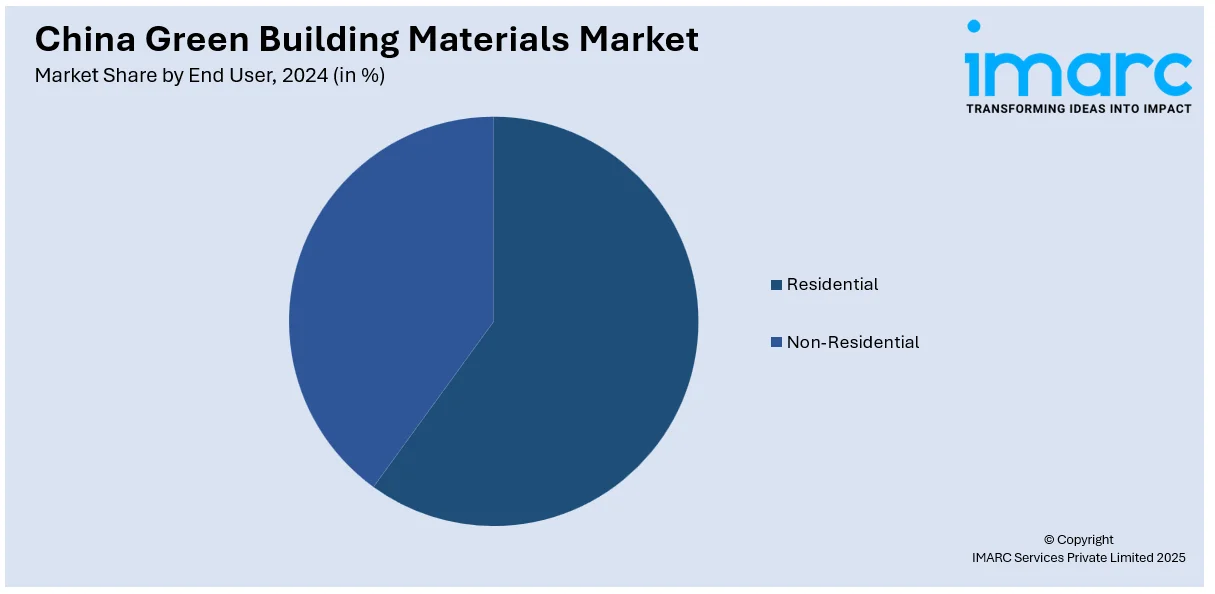

Residential buildings dominate the market as homeowners increasingly prioritize sustainable and energy-efficient construction solutions. The rising urban population in China drives demand for eco-friendly housing to minimize environmental impact. Developers incorporate green materials into residential projects to comply with government regulations and certifications. Energy-efficient insulation, solar panels, and non-toxic paints are popular choices among environmentally conscious homeowners. Affordability of green building materials has improved, making them accessible for a wide range of homeowners. Residential renovations and retrofitting projects often include sustainable upgrades, further influencing demand in this segment. Builders emphasize green materials to create healthier indoor environments, appealing to families and health-conscious individuals. The long-term cost savings of green homes make them an attractive investment for homeowners and developers. Residential projects contribute significantly to national carbon reduction goals, aligning with China’s environmental strategies. Subsidies and incentives for eco-friendly housing encourage widespread adoption of green materials in residential construction.

Provincial Analysis:

- Guangdong

- Jiangsu

- Shandong

- Zhejiang

- Henan

- Others

Guangdong leads the green building materials market due to its robust construction and industrial activities. NEWLIFE Magnetics hosted a meeting, in September 2024, to standardize prefabricated composite rock panels for construction purposes. These panels offer high temperature resistance, corrosion resistance, and eco-friendly properties ideal for modern building needs. The initiative aims to promote sustainability and intelligent development in Guangdong’s construction sector. Prefabricated panels help reduce waste, enhance efficiency, and lower environmental impact in construction projects. NEWLIFE Magnetics leads in establishing advanced materials to support green construction and sustainable practices across the region. Besides this, the province’s high urbanization rate drives demand for sustainable materials in both residential and commercial projects. Guangdong benefits from strong government support for green initiatives, fostering widespread adoption of eco-friendly practices. Proximity to raw material suppliers and advanced manufacturing hubs ensures efficient production of green materials. High population density in Guangdong creates significant demand for sustainable housing and infrastructure developments. Public-private partnerships (PPP) in the province promote large-scale projects incorporating green materials to meet certification standards. Export-oriented manufacturers in Guangdong cater to international markets, bolstering local production capabilities.

Competitive Landscape:

Key players invest in advanced technologies to develop sustainable materials that meet energy efficiency standards. These companies actively collaborate with government bodies to comply with green building certification requirements. Many key players focus on extensive research and development (R&D) to innovate environmentally friendly products. Partnerships with construction firms ensure seamless integration of green materials into large-scale building projects. Leading manufacturers adopt sustainable practices to align with global environmental and corporate responsibility standards. Marketing efforts highlight the benefits of green materials, raising awareness among developers and end-users alike. Some companies leverage economies of scale to reduce costs and make eco-friendly options more competitive. Industry leaders also prioritize training initiatives to educate stakeholders on sustainable building practices. Export-focused firms cater to international demand, further improves the visibility of Chinese green materials worldwide. Key players often invest in supply chain sustainability to reduce the overall carbon footprint, which is strengthening the market growth.

The report provides a comprehensive analysis of the competitive landscape in the China green building materials market with detailed profiles of all major companies, including:

- Guangdong Matsumoto Green New Materials Co., Ltd.

- Shanghai Building Materials (Group) Corporation (Shanghai Land Group Co., Ltd)

- Soben International (Asia Pacific) Limited (Soben International Group Limited)

- Wang Mingde Import & Export Ltd

Latest News and Developments:

- October 2024: GoodWe launched a new eco-friendly global headquarters in Suzhou, China, designed to lead by example in green building design. The building features solar energy solutions, including BIPV, and integrates GoodWe’s own photovoltaic systems. It is equipped with smart energy management and various green technologies, ensuring energy efficiency. Spanning 16,000 square meters across 21 stories, the headquarters provides comfortable workspaces, collaborative areas, and amenities to promote employee well-being.

- August 2024: Youngor introduced HAI550, a sustainable lifestyle commercial space in Shanghai, blending eco-conscious design with retail. The building utilizes recycled materials and features creative, sustainable brands. The space includes pop-up shops, exhibitions, and a "top-up" shop that avoids packaging, offering an innovative approach to sustainable commercial real estate.

- June 2024: Longi launched the Hi-MO X6 Artist solar module, utilizing hybrid passivated back contact (HPBC) technology. It offers a power output of 420-430 W, with an efficiency of up to 22.3%. The product features a uniform, glare-free black appearance and a 30-year power output warranty.

- June 2024: MAD Architects revealed the ZGC International Innovation Center in Beijing, showcasing a unique curving green roof with undulating overhangs. The building showcases cutting-edge, sustainable architecture with energy-efficient designs, contributing to the growing green building trend in China. The project emphasizes innovation, collaboration, and sustainable urban development.

- April 2024: ANTA opened its first zero-carbon mission store in China, aiming to promote sustainability in retail. The store utilizes energy-efficient technologies, eco-friendly materials, and renewable energy sources to reduce its carbon footprint.

China Green Building Materials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End Users Covered |

|

| Provinces Covered | Guangdong, Jiangsu, Shandong, Zhejiang, Henan, Others |

| Companies Covered | Guangdong Matsumoto Green New Materials Co., Ltd., Shanghai Building Materials (Group) Corporation (Shanghai Land Group Co., Ltd), Soben International (Asia Pacific) Limited (Soben International Group Limited), Wang Mingde Import & Export Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, China green building materials market outlook, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China green building materials market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China green building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The green building materials market in the China was valued at USD 198.08 Billion in 2024.

The China green building materials market growth is driven by government regulations promoting sustainable construction, rising environmental awareness, and rapid urbanization in emerging economies. Technological advancements make green materials more affordable and efficient, while energy cost savings attract developers and homeowners. Increasing demand for healthy living environments increases the use of non-toxic and eco-friendly products. Smart city projects and renewable energy integration further accelerate adoption.

The China green building materials market is projected to exhibit a CAGR of 9.19% during 2025-2033, reaching a value of USD 447.42 Billion by 2033.

Interior products dominate the market due to their direct impact on indoor environments. Robust demand for non-toxic paints, sustainable flooring, and energy-efficient insulation drives growth. These materials improve indoor air quality and align with increasing preferences for healthier, eco-friendly living spaces.

The residential sector holds the largest market share, driven by increasing demand for sustainable housing. Builders focus on eco-friendly materials, including non-toxic paints and energy-efficient insulation, to meet regulatory standards and customer expectations for sustainable, healthier living spaces.

Some of the major players in the China green building materials market include Guangdong Matsumoto Green New Materials Co., Ltd., Shanghai Building Materials (Group) Corporation (Shanghai Land Group Co., Ltd), Soben International (Asia Pacific) Limited (Soben International Group Limited), Wang Mingde Import & Export Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)