China E-Bike Market Size, Share, Trends and Forecast by Mode, Motor Type, Battery Type, Class, Design, Application, and Region, 2025-2033

China E-Bike Market Size and Share:

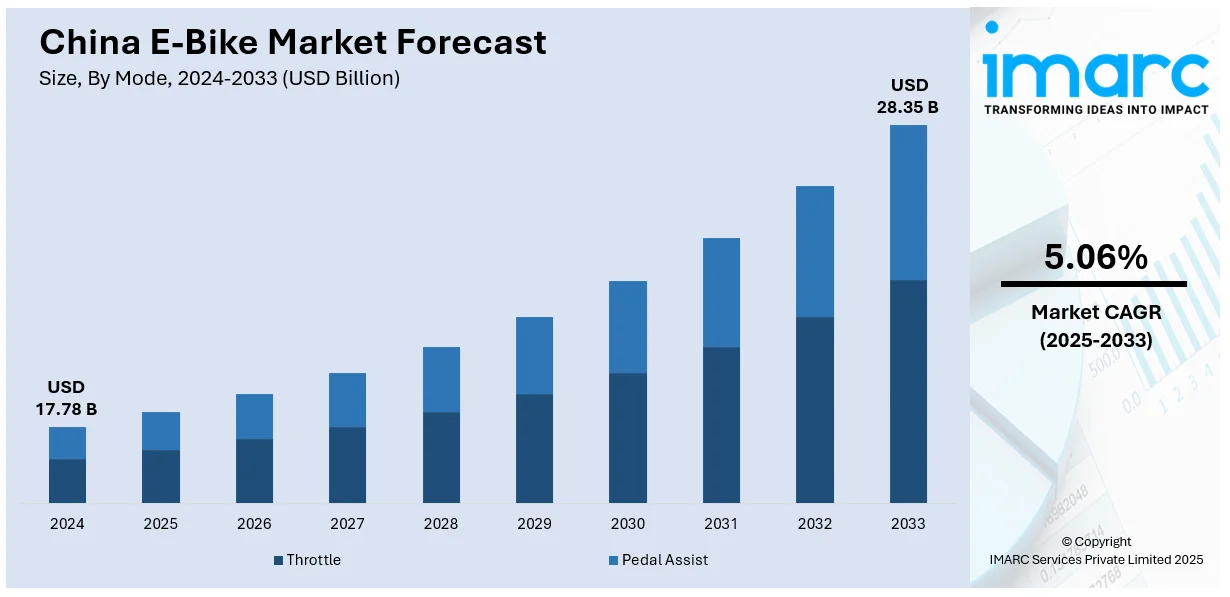

The China e-bike market size was valued at USD 17.78 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.35 Billion by 2033, exhibiting a CAGR of 5.06% from 2025-2033. The market is fueled by urbanization, government incentives, rising fuel costs, and environmental concerns. Advancements in battery technology, increasing disposable income, and demand for cost-effective transportation boost growth. Shared mobility services and stringent emissions regulations further accelerate e-bike adoption, making them a preferred choice for urban commuters.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.78 Billion |

|

Market Forecast in 2033

|

USD 28.35 Billion |

| Market Growth Rate (2025-2033) | 5.06% |

The China e-bike market is experiencing rapid growth, driven by several key factors that contribute to the widespread product adoption and market expansion. The Chinese government actively promotes e-bike adoption through favorable policies, subsidies, and environmental regulations. Restrictions on gasoline-powered two-wheelers in major cities encourage consumers to switch to electric alternatives. Additionally, according to the China e-bike market forecast, incentives such as trade-in programs and tax benefits making e-bikes more accessible and affordable are expected to act as a major contributing to the market growth. For instance, in September 2024, China's Ministry of Industry and Information Technology (MIIT) unveiled a draft standard that aims to improve the technical safety of electric bicycles. It optimizes several aspects, from preventing illegal bike modification to improving the bikes' fire-retardant performance and consumer safety. The goal is to further improve product safety through stricter regulations. With rapid urbanization and increasing traffic congestion in major Chinese cities, e-bikes provide an efficient, cost-effective alternative to traditional vehicles. Their ability to navigate crowded streets, avoid long traffic jams, and access narrow roads makes them ideal for urban commuting.

Innovations in battery technology, including lithium-ion batteries, have improved the range, durability, and efficiency of e-bikes. Lighter and longer-lasting batteries, combined with powerful hub motors and smart features like GPS tracking, enhance user experience and boost China e-bike market demand. For instance, in May 2024, the leading electric vehicle manufacturer and retailer LOBO EV Technologies Ltd. launched three new e-moped models at the Shanghai International Electric Vehicle and Parts Exhibition. About 7,000 manufacturers from around the world participated in the event, which was held at the Shanghai New International Expo Center from May 5–8, 2024, and featured the newest advancements in e-bike technology.

China E-Bike Market Trends:

Government Policies and Regulations

The Chinese government actively promotes e-bikes through favorable policies, subsidies, and stricter emission regulations. E-bike registration and licensing requirements have been simplified to encourage adoption. Additionally, gasoline-powered two-wheeler restrictions in major cities have driven consumers toward electric alternatives. Investments in charging infrastructure and battery recycling programs further support market growth. As China aims to reduce carbon emissions and promote green mobility, government incentives continue to shape the e-bike market, making them an accessible and preferred transportation option across urban and suburban regions. For instance, in January 2025, China's Ministry of Commerce and four other departments unveiled updated guidelines for the 2025 electric bicycle trade-in program. According to the ministry, anyone who trades in their used electric bikes and buys new, qualified ones would be eligible for subsidies.

Urbanization and Traffic Congestion

Rapid urbanization in China has led to increased traffic congestion, making e-bikes a practical solution for daily commuting. With millions of people migrating to cities for work, the demand for efficient and cost-effective transportation has surged. According to industry reports, traffic congestion is a major issue in China's capital, which has a population of over 21 million and an expanding economy. However, Beijing topped the list with a traffic index of 2.08, indicating a 5.6% increase in peak commuter traffic congestion, according to Baidu's China Urban Transportation Report for 2023. With a traffic index of 1.97 in 2019, the capital was rated second out of 100 cities. E-bikes offer an easy way to navigate crowded streets, reducing travel time compared to cars and public transport. Their affordability and low operating costs make them an attractive option for middle- and lower-income groups. As cities continue to expand, the need for flexible, space-efficient transportation further fuels the China e-bike market growth.

Technological Advancements in Battery and Motor Systems

Continuous improvements in battery technology, such as lithium-ion batteries, have significantly enhanced e-bike performance, offering longer ranges and faster charging times. The shift from lead-acid to lithium-ion batteries has made e-bikes lighter, more durable, and energy-efficient. Advancements in hub motors and pedal-assist systems have also improved ride quality, making e-bikes more appealing to consumers. Smart features like GPS tracking, mobile connectivity, and theft protection further increase their attractiveness. As research and development efforts continue, these innovations will drive the adoption of high-performance e-bikes, further expanding their market presence in China. For instance, in December 2024, BYD collaborated with the massive Chinese two-wheeler company TAILG to create batteries for its e-bikes, scooters, and electric motorbikes. The first major two-wheeler manufacturer to collaborate with BYD was TAIL.

China E-Bike Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China e-bike market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on mode, motor type, battery type, class, design, and application.

Analysis by Mode:

- Throttle

- Pedal Assist

Pedal-assist e-bikes hold the largest market share across China because they offer efficiency with prolonged battery operation and regulatory standards. The government supports pedal-assist bike models as their design meets the sustainability targets along with safety requirements. Users can experience a natural riding sensation using these bikes which draws both commuting people and people who want to stay active. Due to their efficient power consumption and extended operational range, they prove to be an economic choice for urban transportation. Technology improvements in motors along with batteries created better performing pedal-assist e-bikes which have made them more popular. Pedal-assist models gain increasing popularity among eco-friendly and practical transportation buyers thus driving their adoption throughout China's urban districts.

Analysis by Motor Type:

- Hub Motor

- Mid Drive

- Others

Hub motors hold the largest China e-bike market share as customers find these systems inexpensive yet dependable and straightforward to use. These motors receive integration within wheels creating lightweight compact designs that lead to less maintenance expenses when compared to mid-drive systems. The basic approach of these systems reduces manufacturing costs, thereby creating affordable prices for e-bikes making them attractive to budget-conscious customers. The power output of hub motors satisfies daily city commutes, and their short-range operation efficiency matches normal Chinese city distances between destinations. Consequently, they are favored by both manufacturers and consumers, boosting their market share.

Analysis by Battery Type:

- Lead Acid

- Lithium Ion

- Nickel-Metal Hydride (NiMH)

- Others

Lead-acid batteries maintain their dominance in the market because they are inexpensive and abundant while having established lead-acid battery manufacturing and recycling systems. Lead-acid batteries have a lower selling price than lithium-ion batteries, thus satisfying the needs of price-conscious buyers. E-bikes featuring lead-acid batteries provide strong operational durability while demanding minimal upfront costs which matches market needs for inexpensive bicycle models, especially among urban residents receiving lower income. Lead-acid batteries maintain dependable power capabilities when operating in cities for brief commuting distances that Chinese consumers use frequently. Despite their heavier weight and shorter lifespan compared to lithium batteries, their cost-effectiveness continues to drive their dominant position in the market.

Analysis by Class:

- Class I

- Class II

- Class III

Class I e-bikes, which are pedal-assist only, hold the largest share in the China e-bike market due to their alignment with local regulations and growing consumer preference for sustainable, eco-friendly transportation. Such e-bikes are excluded from comprehensive licensing and registration standards which allows users from diverse backgrounds to acquire them easily. Pedal-assist technology offers users a natural ride experience and reduces electrical power consumption which ensures operational efficiency along with affordability. Their compliance with Chinese government policies, such as reduced emissions and energy-efficient transportation, further boosts their popularity, particularly in urban areas where regulatory oversight is stricter.

Analysis by Design:

- Foldable

- Non-Foldable

Non-foldable e-bikes hold the largest share in the China e-bike market because they are more durable, stable, and suitable for daily commuting over longer distances. These models typically feature larger frames and batteries, offering better performance and range compared to foldable alternatives. Non-foldable e-bikes are preferred by consumers who prioritize reliability and comfort for longer rides or heavier loads, making them ideal for urban and suburban transportation. Additionally, their simpler design leads to lower manufacturing costs, contributing to affordability. As a result, non-foldable e-bikes meet the needs of a broader customer base, especially in densely populated cities.

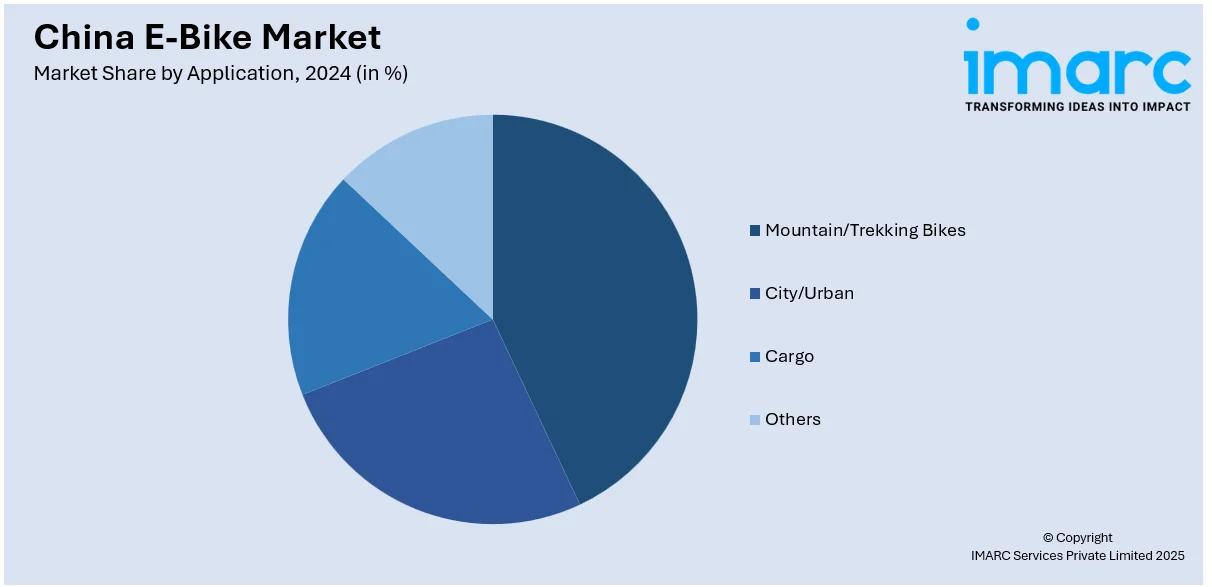

Analysis by Application:

- Mountain/Trekking Bikes

- City/Urban

- Cargo

- Others

City/urban e-bikes hold the largest share in the China e-bike market due to the high demand for efficient, eco-friendly transportation in densely populated areas. Urban commuters prefer e-bikes for their ability to navigate through traffic quickly, reducing travel time and offering cost-effective alternatives to cars or public transportation. Additionally, rising concerns over pollution and traffic congestion drive the adoption of cleaner mobility solutions. With urban areas in China experiencing rapid growth, city/urban e-bikes cater to consumers seeking practical, low-maintenance options for daily commutes, further boosting their popularity and market dominance in the country.

Regional Analysis:

- North and Northeast

- Northwest

- East

- South Central

- Southwest

In Eastern China, the e-bike market is driven by rapid urbanization, increasing traffic congestion, and environmental awareness. Cities like Shanghai and Hangzhou have seen significant growth in e-bike adoption due to their infrastructure, which supports eco-friendly transportation. Government incentives, such as subsidies and reduced taxes for electric vehicles, further boost demand. Rising fuel costs and the need for affordable commuting solutions also play a role. Additionally, advancements in battery technology and increased disposable incomes have made e-bikes more accessible. Consumer preferences for sustainable, convenient transportation options continue to drive the market in this region, making e-bikes a popular choice.

Competitive Landscape:

The China e-bike market is highly competitive, with both domestic and international players vying for market share. Leading domestic brands like BYD, Yadea, and Aima dominate the market due to their extensive distribution networks, strong brand recognition, and affordable offerings. These companies benefit from China's strong manufacturing base and government incentives for electric vehicles. International players, such as Panasonic and Bosch, contribute to the market through advanced battery and motor technologies, enhancing e-bike performance. The market is segmented by product types like pedal-assist, hub motors, and lithium batteries. Additionally, new entrants focus on innovation, such as smart features and shared mobility platforms. Intense competition and continuous technological advancements drive rapid growth and product diversification in the sector.

Latest News and Developments:

- In April 2024, LOBO EV Technologies Ltd. announced the launch of its new 135,754-square-foot manufacturing facility in Wuxi, China. This new facility more than doubles the company's production capacity in the area and is well situated in Dachen sector Park, the epicenter of the Wuxi e-bike sector.

- In May 2024, Shanghai hosted the grand opening of the China International Bicycle Exhibition from May 5 to May 8. Prominent electric two-wheeler manufacturer TAILG displayed its most recent comprehensive line of e-bikes. Visiting clients from South Korea, Europe, and the US were giving the on-site sales a lot of thumbs up.

- In January 2023, Honda launched three electric bicycles (EB*) models—the Honda Cub e:, the Dax e:, and the Zoomer e:—targeting China's youthful Generation Z market at an online launch event on January 10 in Shanghai, China.

China E-Bike Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Modes Covered | Throttle, Pedal Assist |

| Motor Types Covered | Hub Motor, Mid Drive, Others |

| Battery Types Covered | Lead Acid, Lithium Ion, Nickel-Metal Hydride (NiMH), Others |

| Classes Covered | Class I, Class II, Class III |

| Designs Covered | Foldable, Non-Foldable |

| Applications Covered | Mountain/Trekking Bikes, City/Urban, Cargo, Others |

| Regions Covered | North and Northeast, Northwest, East, South Central, Southwest |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China e-bike market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China e-bike market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China e-bike industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-bike market in China was valued at USD 17.78 Billion in 2024.

The growth of the market is driven by urbanization, government incentives, rising fuel costs, and environmental concerns. Technological advancements in battery efficiency, increasing disposable incomes, and the need for cost-effective, eco-friendly transportation further propel demand. Additionally, infrastructure improvements and traffic congestion in cities boost e-bike adoption. The factors, collectively, are creating a China e-bike market outlook.

The China e-bike market is projected to exhibit a CAGR of 5.06% during 2025-2033, reaching a value of USD 28.35 Billion by 2033.

Pedal-assist e-bikes dominate due to efficiency, longer battery life, regulatory support, cost-effectiveness, and growing demand for sustainable urban mobility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)