China Diabetes Market Size, Share, Trends and Forecast by Type, Distribution Channel and Region, 2025-2033

China Diabetes Market Size and Share:

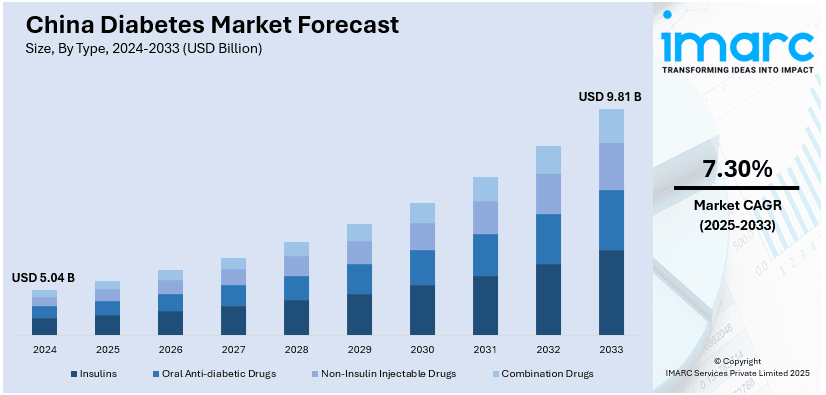

The China diabetes market size was valued at USD 5.04 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.81 Billion by 2033, exhibiting a CAGR of 7.30% from 2025-2033. The China diabetes market is experiencing rapid growth driven by increasing awareness, innovative treatments, and the adoption of digital health solutions, with rising demand for personalized care, advanced therapies, and self-monitoring tools, creating a dynamic and competitive landscape for both domestic and international players.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.04 Billion |

| Market Forecast in 2033 | USD 9.81 Billion |

| Market Growth Rate (2025-2033) | 7.30% |

The key market driver that is fuelling the growth of the China diabetes market are increases in prevalence of the disease, particularly type 2 diabetes, which is largely driven by lifestyle and dietary changes. Improvements in lifestyles characterized by sedentary habits, boosting urbanization, and high calorie, low-nutrient food consumption have amplified obesity levels, which further directly correlates with escalating diabetes cases. The rising geriatric population in China also contributes to this highly, as these people are more prone to chronic conditions, such as diabetes. Additionally, heightened awareness through government initiatives and health campaigns have led to amplified diagnosis rates, which are encouraging a greater demand for treatment and monitoring devices. According to the sources, in April 2023, China’s centralized procurement program reduced insulin prices by 48%, saving an estimated 9 billion yuan annually. Over 10 million diabetes patients benefit, with insulin glargine prices dropping from 180 yuan to 70 yuan per unit. Furthermore, more avenues of access to diabetes-related care have been opened by improvement in healthcare infrastructure in both urban and rural areas, further propelling the market growth.

Advances in medical technology and greater accessibility to new and innovative treatment options also heavily impact the China diabetes market outlook. There has been an upsurge in diabetes management solutions, such as insulin pumps, continuous glucose monitoring devices, and oral medications, which is improving patient outcomes and offering more options for personalized care. For instance, in August 2024, scientists from Zhejiang University developed "smart" insulin that responds to real-time blood sugar changes, potentially reducing injections to once a week for type 1 diabetes patients. Moreover, with the escalating incidence of gestational diabetes, and the increase in recognition for diabetes as a public health problem, prevention aspects have expanded from developing preventive medicine to lifestyle management programs. Furthermore, investments both by domestic pharmaceutical companies and the international ones on diabetes research continue to amplify as new therapies have started to be offered with broadening the competitiveness and diversity landscape of the market. With the improvement in healthcare accessibility by the Chinese government and a surge in affordability of advanced diabetes care, it is likely that the market would continue to boom in the years ahead.

China Diabetes Market Trends:

Increase in Diabetes Awareness and Early Diagnosis

A major trend driving the China diabetes market forecast is heightening awareness of the disease and the significance of early diagnosis. Concurrently, public health campaigns by government initiative and media coverage have all led to a wider awareness of what constitutes the risk factors for this disease and, above all, the significance of regular check-ups. This has resulted in the boost of early-stage diagnoses that enable timely interventions that help to manage the condition better. Therefore, more patients are seeking health care services to be tested and monitored for diabetes and its management, which also fuels the demand for diagnostic equipment, glucose monitoring devices, and medication. This demand is highly driven by health-conscious populations in urban areas, who are becoming highly proactive in the management of their health to avoid long-term complications associated with diabetes.

Growth in Diabetes Treatment and Medication Innovation

Advancements in diabetes care and treatment and medication are also cause to the rapidly growing China diabetes market. The advanced therapies of diabetes-management drugs, such as biologics, GLP-1 receptor agonists, and SGLT-2 inhibitors have virtually transformed the diabetes management globe. Additionally, new treatments have been promising higher efficacy with lesser side effects than the conventional forms of insulin injections and oral medications. The pharmaceutical industry invested a lot into research and its development in designing next-generation medicines for diabetes aimed at fulfilling currently unmet needs, including management of weight as well as protecting the heart, and focused its attention to what is often labeled as personalized medicine. Treatments are individualized according to various genetic, environmental, and lifestyle factors so enhanced outcomes resulted. This expansion in innovative treatment options is most directly contributing to growth within the market, as patients are more likely to seek treatments characterized by improved therapeutic profiles.

Adoption of Digital Health Solutions for Diabetes Management

The other prominent trend in the China diabetes market has been digital health solutions, where diabetic patients are getting intensely engaged in self-monitoring. The rise in chronic disease management platforms, mobile health applications, and telemedicine services has empowered diabetic patients to improve their conditions. Moreover, for monitoring glucose levels and using smart insulin pens, patients are utilizing a very handy app in their lifestyles, making self-control easier to develop for them in managing their diabetes. These solutions provide real-time insights into patient compliance, which is reducing the burden on healthcare systems. The integration of artificial intelligence (AI) and machine learning (ML) in diabetes care enables predictive analytics, helping both patients and healthcare providers make better decisions. This has improved patient outcomes, while new opportunities have been added for diabetes care companies to gain more market reach in China.

China Diabetes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China diabetes market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, and distribution channel.

Analysis by Type:

- Insulins

- Basal or Long Acting Insulins

- Bolus or Fast Acting Insulins

- Traditional Human Insulins

- Biosimilar Insulins

- Oral Anti-diabetic Drugs

- Biguanides

- Alpha-Glucosidase Inhibitors

- Dopamine D2 Receptor Agonist

- SGLT-2 Inhibitors

- DPP-4 Inhibitors

- Sulfonylureas

- Meglitinides

- Non-Insulin Injectable Drugs

- GLP-1 Receptor Agonists

- Amylin Analogue

- Combination Drugs

- Insulin Combinations

- Oral Combinations

Oral anti-diabetic drugs are a leading segment in the diabetes treatment market, primarily because of convenience, cost-effectiveness, and widespread usage. These drugs comprise sulfonylureas, biguanides, DPP-4 inhibitors, and SGLT2 inhibitors, all of which contribute to the control of blood glucose levels by either enhancing insulin sensitivity, increasing the secretion of insulin, or lowering glucose production within the liver. Rising type 2 diabetes especially among geriatric population increases the need for oral anti-diabetics. This category of drugs presents less invasive, relatively easy therapy in place of injection insulin that patients will have fewer inhibitions in adopting it. Moreover, market trends further grow from efforts on development of newer classes of oral anti-diabetic drugs that present lower side effects, thus increasing efficiency. Due to both cost pressures and availability of generics, these drugs have become affordable for many consumers in developed and emerging markets, making them a first choice for patients.

Analysis by Distribution Channel:

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

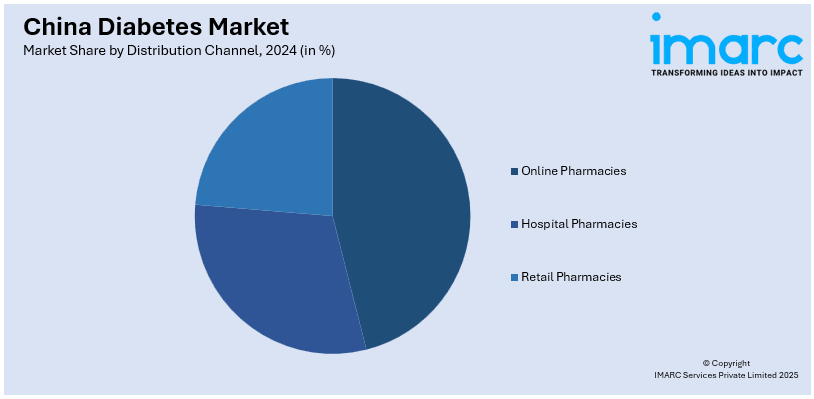

Online pharmacies are highly becoming popular as they save time, enabling customers to buy their diabetes medication from home. Digital health platforms are enhancing accessibility, especially in remote areas with scarce availability of local pharmacies, making it easier for patients to gain wider access to insulin and other diabetes treatments.

Hospital pharmacies are important in providing diabetes medications, especially for inpatients who require immediate or specialized care. These pharmacies ensure proper medical supervision, including correct dosages of insulin and oral anti-diabetic drugs. They also monitor for any adverse reactions, playing a key role in managing blood glucose levels for hospitalized patients.

General sources for the drugs include retail pharmacies that are the most accessible points for prescription and over-the-counter products. Most of these pharmacies become essential points for consultations and medication refills. Their wide coverage in all urban and rural districts makes them an important point for diabetes management, and for larger patients' convenience, in procuring required treatments.

Regional Analysis:

- North Region

- West Region

- East Region

- South Region

- Rest of China

North region China is characterized by a surging demand for diabetes treatments mainly resulting from the rapid urbanization process and increasing old age. A growing case of type 2 diabetes fuels demand for both injectable insulins and oral drugs, for which there are expanding hospitals as well as retail pharmacies to take advantage of such growths that regional health developments are generating.

Growth may not be high, but demand for diabetes care in the West region is certainly growing. Upgradation in health infrastructure, plus support through the government initiatives of enhanced drug accessibility, helps facilitate rising prescriptions and fill this space through better provision and wider accessibility in physical pharmacies, both on land and on virtual planes.

The East region is the most economically developed in China. It has the highest demand for diabetes treatments because of the concentration of advanced healthcare facilities, which include hospitals and pharmacies, meeting the escalating demand for diabetes medicines, both innovative and generic. Awareness campaigns also boost the adoption of effective treatments.

The regions of the South region in China are rapidly becoming diabetic due to boosting urbanization and lifestyle changes. In regions with more diabetes patients, demand has amplified for both insulin as well as oral medications. Awareness of healthcare and access to treatment are improving through both hospital and retail pharmacies.

The rest of China comprises less developed regions, with diabetes care extending through online and physical pharmacies. Government efforts and better health care infrastructure are improving the accessibility of diabetes treatments for rural populations. These efforts have ensured better medication availability for patients in less urbanized parts of China.

Competitive Landscape:

The competitive landscape of China diabetes market exhibits a wide range of diversified key players, from multinational pharmaceuticals companies to local players. These players concentrate their efforts on innovation in developing new treatments for diabetes, including oral medicines, injectable therapy, and continuous glucose monitoring devices. The competition is fierce, as firms have been competing for each market share through differentiation, effectiveness, and affordability of products. Investing in research and development, many players are working to achieve highly advanced, personalized treatments and solutions for their patients. Digital health platforms and mobile applications are also becoming more prominent, while companies intensely include features of technology to offer diabetes management tools. Changes in regulation and initiatives by the governments towards better healthcare access are also influencing competition, encourage market players to innovate and align their offerings with changing consumer demands. The landscape is dynamic, with partnerships, mergers, and acquisitions further intensifying competition.

The report provides a comprehensive analysis of the competitive landscape in the China diabetes market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, Novo Nordisk launched its obesity drug Wegovy in China, following its approval in June. The drug, aimed at treating obesity and weight-related comorbidities, is priced around 1,400 yuan for a month’s supply. China’s rising obesity rates drive demand for such treatments, supporting the drug’s market entry.

- In July 2024, Eli Lilly received approval from Chinese regulators to sell tirzepatide, its weight-loss drug, under the brand Zepbound. Tirzepatide, also the active ingredient in Mounjaro for diabetes, adds to the growing competition in China’s weight-loss market.

- In January 2024, Tonghua Dongbao Pharmaceutical Co., Ltd. launched a GLP-1 Semaglutide Injection, expanding its diabetes treatment portfolio. The company also initiated Phase I clinical trials for an Insulin Degludec/Liraglutide Injection, further advancing its commitment to innovative diabetes management solutions.

- In February 2023, Medtronic's innovative Hybrid Closed Loop Insulin Delivery System (MiniMed 670G BLE) received approval from China’s NMPA. This system, combining insulin pump and glucose sensor technologies, provides continuous blood glucose control for Type 1 diabetes patients aged 14 and older, ensuring enhanced safety through SmartGuard technology.

China Diabetes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Distribution Channels Covered | Online Pharmacies, Hospital Pharmacies, Retail Pharmacies |

| Regions Covered | North Region, West Region, East Region, South Region, Rest of China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China diabetes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China diabetes market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China diabetes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The China diabetes market was valued at USD 5.04 Billion in 2024.

Key drivers of the China diabetes market include rising diabetes prevalence due to urbanization, unhealthy diets, and sedentary lifestyles, increasing awareness about early diagnosis and management, advancements in treatment options, and the growing adoption of digital health tools for personalized care and self-management.

The keyword market is projected to exhibit a CAGR of 7.30% during 2025-2033, reaching a value of USD 9.81 Billion by 2033.

The largest segment in China's diabetes market is oral anti-diabetic drugs, which account for the highest market share. These drugs are widely used in the treatment of type 2 diabetes, contributing significantly to the overall diabetes treatment market in China.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)