China Citric Acid Market Report by Application (Food and Beverages, Household Detergents and Cleaners, Pharmaceuticals, and Others), Form (Anhydrous, Liquid), and Region 2025-2033

Market Overview:

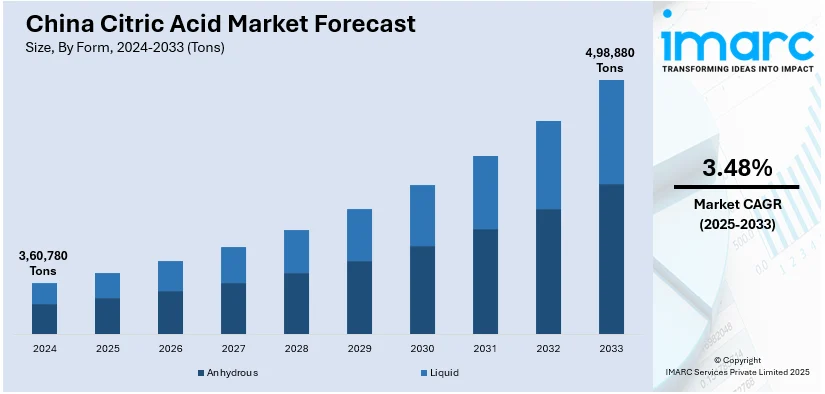

The China citric acid market size reached 3,60,780 Tons in 2024. Looking forward, IMARC Group expects the market to reach 4,98,880 Tons by 2033, exhibiting a growth rate (CAGR) of 3.48% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

3,60,780 Tons |

|

Market Forecast in 2033

|

4,98,880 Tons |

| Market Growth Rate 2025-2033 | 3.48% |

Citric acid is a weak organic tricarboxylic acid that is generally found in citrus fruits, such as lemon, oranges, grapefruits, and pomelos. Soluble in water, dimethyl sulfoxide, alcohol and ethyl acetate, it is commonly utilized in the food industry as a flavoring and preserving agent. It is also utilized for a vast array of industrial purposes, such as providing pH adjustment, controlling the growth of microorganisms, and manufacturing medicines, personal care products, and cosmetics. Additionally, it is also used in the formulation of numerous medicines and health supplements as it aids in improving metabolism and enhancing nutrient absorption in the body.

The market in China is primarily driven by significant growth in the pharmaceutical industry. Along with this, multiple key players across the region are engaging in merger and acquisitions (M&A) activities to create numerous growth opportunities in the market. Apart from this, the widespread adoption of citric acid in the manufacturing of household cleaners, including detergents, dish soaps, and rust remover products, is also creating a positive outlook for the market across the country. Some of the other factors contributing to the market growth include significant growth in the food and beverage industry and extensive research and development (R&D) activities.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the China citric acid market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on application and form.

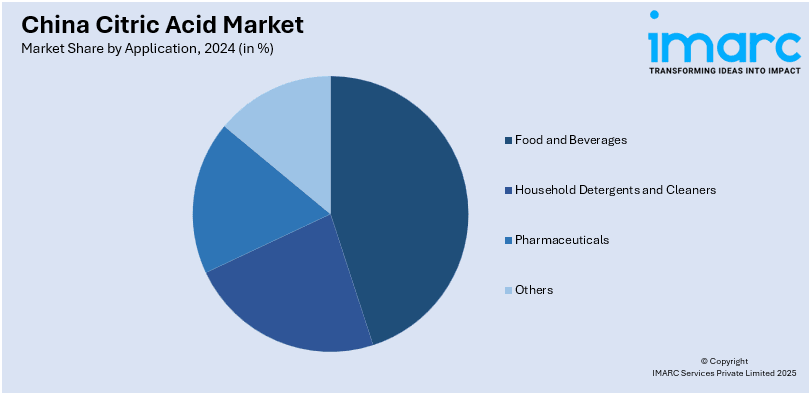

Breakup by Application:

- Food and Beverages

- Household Detergents and Cleaners

- Pharmaceuticals

- Others

Breakup by Form:

- Anhydrous

- Liquid

Breakup by Region:

- North and Northeast

- Northwest

- East

- South Central

- Southwest

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | ‘000 Tons |

| Segment Coverage | Application, Form, Region |

| Region Covered | North and Northeast, Northwest, East, South Central, Southwest |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The China citric acid market reached a volume of 3,60,780 Tons in 2024.

We expect the China citric acid market to exhibit a CAGR of 3.48% during 2025-2033.

The expanding pharmaceutical industry, along with the growing utilization of citric acid in the formulation of numerous medicines and health supplements, is primarily driving the China citric acid market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across China, resulting in the temporary closure of numerous end-use industries for citric acid.

Based on the application, the China citric acid market can be segmented into food and beverages, household detergents and cleaners, pharmaceuticals, and others. Among these, the food and beverage sector currently accounts for the majority of the total market share.

Based on the form, the China citric acid market can be categorized into anhydrous and liquid. Currently, anhydrous form represents the largest market share.

On a regional level, the market has been classified into North and Northeast, Northwest, East, South Central, and Southwest, where Southwest currently dominates the China citric acid market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)