China Automotive Actuators Market Size, Share, Trends and Forecast by Actuator type, Vehicle type, Application type, and Region, 2026-2034

China Automotive Actuators Market Size and Share:

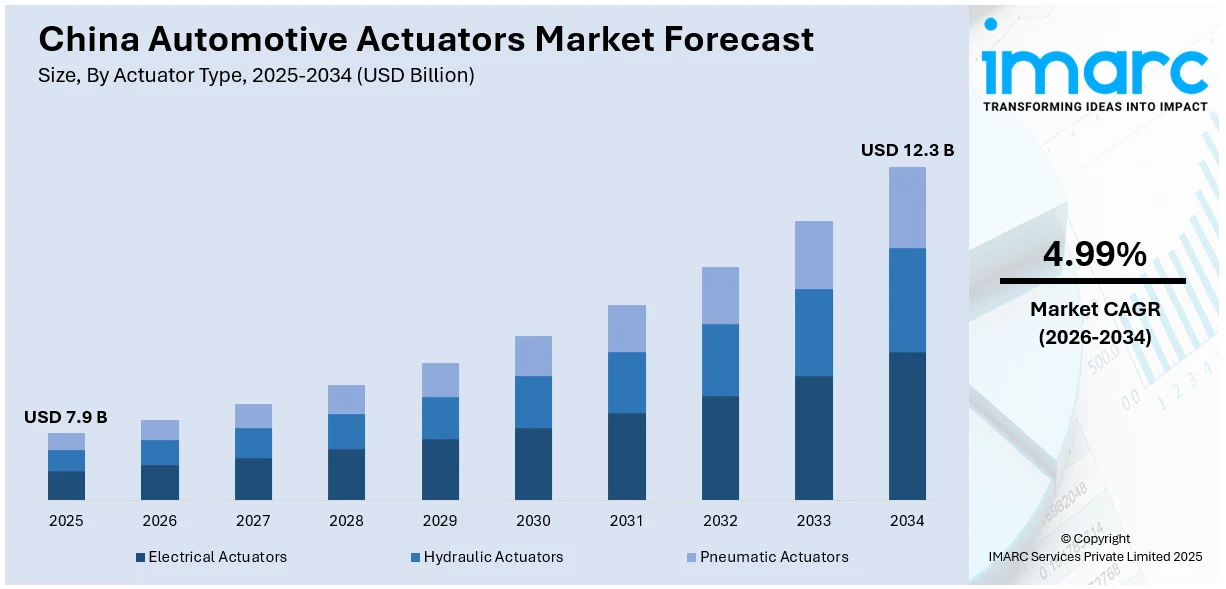

The China automotive actuators market size was valued at USD 7.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 12.3 Billion by 2034, exhibiting a CAGR of 4.99% from 2026-2034. The market is expanding due to the ongoing integration of smart actuators in electric and autonomous vehicles, the rising use of actuators in EV powertrains, and the growing demand for electric actuators in hybrid and internal combustion engine vehicles, enhancing efficiency and safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 7.9 Billion |

|

Market Forecast in 2034

|

USD 12.3 Billion |

| Market Growth Rate (2026-2034) | 4.99% |

The market in China is majorly driven by rapid advancements in vehicle electrification and automation technologies. In accordance with this, the augmenting demand for electric vehicles (EVs) is increasing the need for advanced actuators in key functions such as braking, steering, and climate control. As per industry reports, Chinese EV sales rose 40% last year to 11 million units, reflecting robust market performance and contributing to the growth of the China automotive actuators market share. Furthermore, government support for electric and hybrid vehicles, along with stringent environmental regulations, further accelerates market expansion. Additionally, the growing consumer preference for enhanced vehicle performance, comfort, and safety features is fueling actuator adoption. Innovations in smart actuators, combined with an increasing focus on lightweight materials in vehicle design, are also strengthening market demand and efficiency.

To get more information on this market Request Sample

Apart from this, the improvement in vehicle safety features, where actuators play a key role in precision control, is also driving the market. Moreover, advanced driver-assistance systems and autonomous vehicles are strengthening the demand for actuators, which can support automatic parking, collision avoidance, and adaptive cruise control. For example, on August 27, 2024, BYD announced a partnership with Huawei to incorporate the Qiankun autonomous driving system into its Fangchengbao EVs, starting with the Bao 8 SUV, which represents the increasing market demand for smart features. In addition, the growth in disposable incomes and the emergence of a middle class are also promoting consumer expenditure on premium vehicles, thereby enhancing the China automotive actuators market demand. Moreover, the heightened push towards fuel-efficient and eco-friendly vehicle designs promotes the use of lightweight actuators, which enhance fuel economy and contribute to market growth.

China Automotive Actuators Market Trends:

Rapid Integration of Smart Actuators

A trend in the China market is that smart actuators are being increasingly integrated into electric and autonomous vehicles. As the automotive industry continues to shift toward electric powertrains and advanced automation, actuators are also shifting to provide higher precision and more intelligent functionalities. Notably, on April 8, 2024, Marelli, at the Beijing International Automotive Exhibition, highlighted the company's new innovations in smart actuators and software-defined vehicle solutions, targeting specifically the Chinese market. China automotive actuators market trends reveal that smart actuators will adjust to dynamic driving conditions and will easily fit into the vehicle control systems. This enables critical features such as the automatic steering, braking, and suspension adjustments. These are imperative for the smooth and safe working of electric as well as autonomous vehicles. China needs more sophisticated, efficient cars, and developing such actuators is crucial.

Expansion of Actuators in Electric Vehicle (EV) Powertrains

A key factor driving the market expansion is the increasing use of actuators in electric vehicle (EV) powertrains. With the rapid rise in EV adoption across China, actuators are playing an integral role in optimizing key vehicle components such as electric motors, battery management systems, and thermal management systems. For instance, on July 23, 2024, Vitesco Technologies began serial production of its battery management electronics in Changchun, China, marking a major milestone in expanding its electrification solutions. The battery management controller (BMC) ensures safety and enhances vehicle range by accurately monitoring battery parameters. Actuators are essential for controlling power distribution, battery charging and discharging, and maintaining optimal temperatures, which improves EV efficiency and performance. This growing reliance on actuators within electric powertrains is a significant driver of China automotive actuators market growth, particularly as China continues to lead in electric mobility.

Increased Application of Electric Actuators

Electric actuators are gaining traction in both hybrid and internal combustion engine (ICE) vehicles in China due to their superior energy efficiency, precise control, and faster response times compared to traditional systems. With hybrid vehicles on the rise, electric actuators are crucial in managing functions like throttle control, exhaust gas recirculation, and transmission systems. For example, on March 11, 2024, Kongsberg Automotive (KA) secured a seven-year contract worth over EUR 22 Million to supply electric rotary actuators for plug-in hybrid electric vehicles (PHEVs). Manufactured at KA’s Wuxi, China plant, these actuators will improve vehicle safety by preventing movement in parking mode. The strategic partnerships highlight the expertise and solidifies its position in the growing China automotive actuators market share. As China accelerates its push for sustainable transportation, demand for electric actuators in both hybrid and ICE vehicles is set to grow, creating significant market opportunities.

China Automotive Actuators Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China automotive actuators market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on actuator type, vehicle type, and application type.

Analysis by Actuator Type:

- Electrical Actuators

- Hydraulic Actuators

- Pneumatic Actuators

Electrical actuators have been widely accepted by the China market as a source of precision and energy efficiency as well as a straightforward integration to modern control systems. The majority of the application in throttle control, braking system, and suspension in active electric and hybrid vehicles utilizes this kind of actuators. As a result, electrical actuators can outdo the traditional hydraulic and pneumatic system with much quicker response and lesser maintenance needs. The augmenting demand for electric vehicles (EVs) and ADAS is driving the adoption of electrical actuators. Additionally, their compatibility with software-defined vehicles and ability to operate seamlessly with electronic control units render them indispensable for modern automotive designs in China.

Hydraulic actuators are integral to many high-performance automotive applications where high force and precision are the requirement. Actuators generate motion through the use of a pressurized fluid, ideal for steering, suspension, and braking systems in commercial vehicles and high-performance cars. Although hydraulic actuators are not as energy efficient as electric, their ability to deliver significant amounts of power and torque in demanding environments maintains their relevance. The rise in commercial and industrial vehicles within China increases demand for hydraulic actuators, mainly for advanced safety systems that need the high torque levels to be properly controlled.

Pneumatic actuators, which use compressed air to produce mechanical motion, are also widely used in the China automotive actuators market, particularly in light-duty vehicles and systems that require lower power output. These actuators are valued for their simplicity, cost-effectiveness, and speed, making them ideal for applications such as door mechanisms, seat adjustments, and air suspension systems. They are also commonly used in automatic transmission systems and air conditioning compressors. With the increasing demand for lightweight and energy-efficient vehicles, pneumatic actuators are gaining traction in the market as automakers look for cost-effective solutions that provide quick and reliable performance.

Analysis by Vehicle Type:

- Passenger Car

- Commercial Vehicle

The passenger car market is rapidly increasing in the market, where people are now in search of features and higher performances in the vehicles. The main applications in the market include actuators in power steering, adjustment of seats, and air-conditioning systems that improve driving comfort and safety. With the rising adoption of electric vehicles (EVs), the demand for actuators is expanding further, as these vehicles require more precise and efficient control mechanisms for systems like battery management and thermal regulation. As part of the China automotive actuators market trends, manufacturers are focusing on providing compact, energy-efficient actuators that meet the changing needs of the automotive industry.

The commercial vehicles in China, meanwhile, experience the growing demand for automotive actuators due to increased logistics and transportation industries. Here, actuators become critical as it enables these kinds of support functions like a brake system, suspension control, or an engine control unit where it should be considered most reliable and durable. With the advent of electric commercial vehicles and stricter exhaust emission standards, the demand in the automotive industry for high-performing actuators in energy recuperation and thermal management is very much on an upward trend. This segment of Chinese automotive actuators is expected to continue innovating, with enhanced efficiency and decreasing operational costs at the top of the list with fleet operators targeted by manufacturers for improvement.

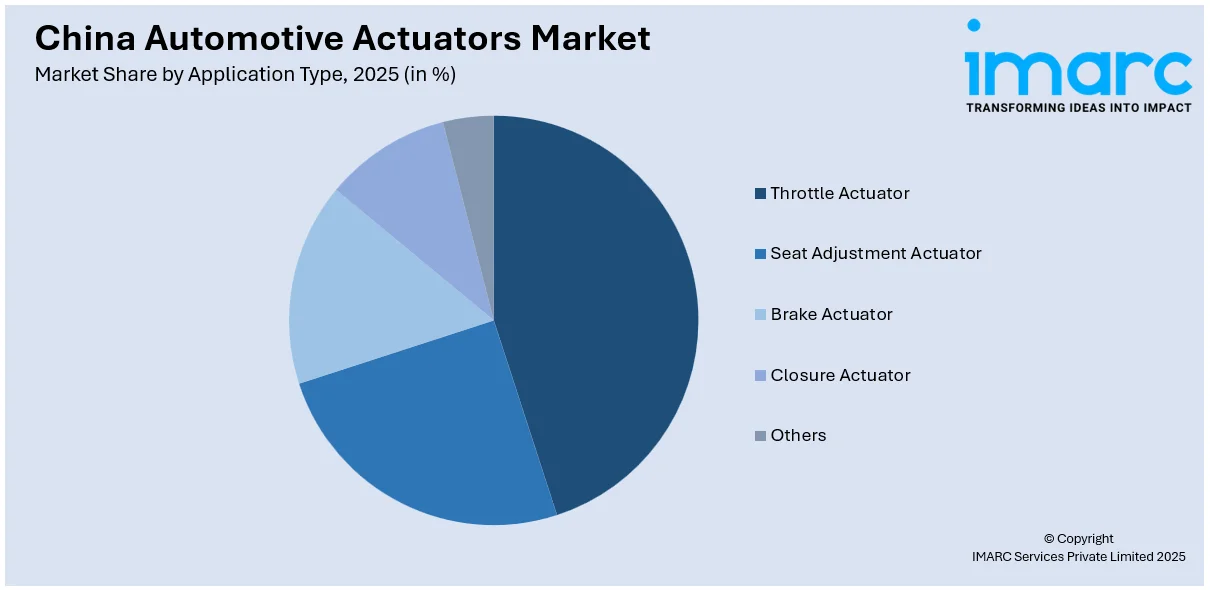

Analysis by Application Type:

Access the comprehensive market breakdown Request Sample

- Throttle Actuator

- Seat Adjustment Actuator

- Brake Actuator

- Closure Actuator

- Others

Throttle actuators play a crucial role in controlling the engine's throttle, regulating the air intake to the engine based on driver input. These actuators have developed to offer greater precision and responsiveness, contributing to enhanced fuel efficiency and vehicle performance. The growing demand for more fuel-efficient vehicles, driven by both consumer preference and government regulations, is propelling the adoption of advanced throttle actuators. Furthermore, the growth of electric vehicles (EVs) in China has increased the need for electronic throttle actuators, which offer faster and more accurate control compared to traditional mechanical systems. As a result, throttle actuators are integral to the China automotive actuators market, aligning with trends toward efficiency and advanced technology.

Seat adjustment actuators are becoming increasingly vital as automotive interiors change to provide more comfort and personalized driving experiences. These actuators enable users to adjust seat positions with precision, contributing to improved comfort, safety, and ergonomics. As consumer demand for high-quality, feature-rich vehicles grows, the integration of advanced seat adjustment actuators is expanding. These actuators are also integrating with smart technologies, such as memory functions that store multiple seating positions for different drivers. The growing trend of vehicle customization is particularly important in the China automotive actuators market outlook, where manufacturers are responding to an increasing preference for personalized and luxury vehicle options, further driving the adoption of advanced actuators.

Brake actuators are critical components in modern braking systems, especially with the rise of electric and autonomous vehicles. These actuators are responsible for initiating braking actions by responding to the driver's input or autonomous system commands. With the shift toward more advanced braking systems like regenerative braking in electric vehicles, brake actuators are becoming more sophisticated. Additionally, their integration with electronic stability control (ESC) and anti-lock braking systems (ABS) is enhancing vehicle safety and performance. In the China market, demand for brake actuators is growing as automakers prioritize vehicle safety and energy efficiency, driven by stricter government regulations and consumer preference for advanced safety technologies.

Regional Analysis:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

North China plays a significant role in the China automotive actuators market, driven by its industrial base and increasing automotive production. The region houses major automotive manufacturers and key suppliers, fostering the growth of actuator technologies. With the rapid adoption of electric vehicles (EVs) and the expansion of domestic and international automakers, demand for advanced automotive actuators is on the rise. North China's strong infrastructure, along with its growing automotive research and development (R&D) capabilities, supports the continued innovation of actuator solutions, especially in the areas of powertrains and safety systems. Additionally, government incentives and green energy policies are fueling the growth of electric mobility, augmenting actuator adoption in this region.

East China, known for its economic dynamism and automotive manufacturing hubs, is another key contributor to the market. With major cities like Shanghai and Hangzhou leading in both traditional and electric vehicle production, East China is witnessing an increase in demand for automotive actuators. The region’s well-established automotive ecosystem and strong presence of multinational automakers create a highly competitive environment, pushing local manufacturers to innovate. As a result, East China is increasingly focusing on advanced actuator technologies for powertrain control, braking systems, and smart vehicle integration. The region is also a hotspot for innovation, especially in the electric vehicle sector, driving actuator growth.

South Central China, which includes economically important provinces like Hunan and Hubei, is emerging as a strategic area for automotive actuator production. With the growing presence of electric vehicle manufacturers and the expansion of domestic brands, the region is seeing significant investments in automotive technology. South Central China is focusing on producing cost-effective, efficient actuators to meet the growing demand for fuel-efficient and electric vehicles. The region's government policies, promoting green technologies and sustainable mobility, further support the demand for automotive actuators. In particular, the push for cleaner energy and the rise in domestic EV production are expected to drive the growth of actuator solutions in South Central China.

Competitive Landscape:

The China automotive actuators market is a complex mix of local and international companies competing with each other in trying to gain leverage from the increasingly dynamic market. Major multinational companies are finding their space by forming strategic collaborations and opening domestic manufacturing units. Meanwhile, native players are becoming innovative and producing actuators, especially for electric and hybrid automobiles. Intense competition drives continuous advancements in actuator technologies, especially electric powertrains, safety systems, and automation. Companies are focusing on reducing costs, increasing efficiency, and meeting regulatory requirements while improving overall vehicle performance.

The report provides a comprehensive analysis of the competitive landscape in the China automotive actuators market with detailed profiles of all major companies.

Latest News and Developments:

- November 25, 2024: At AIRBAG 2024, ZF LIFETEC showcased advanced actuator solutions, including adaptive restraint systems with actuators that adjust seatbelt forces and airbag settings based on occupant size and position. They also presented the "HyDRA®" actuator-driven sled system for validating seat belts with high accuracy. These innovations aim to improve vehicle safety and efficiency, addressing the growing demands of the automotive market, particularly in China.

- July 8, 2024: Vishay Intertechnology will showcase its automotive as well as e-mobility solutions at electronica China 2024, highlighting components like solenoid actuators characterized by excellent force density as well as quick response times. The company will also display innovative power MOSFETs, silicon carbide MOSFETs, and energy-efficient capacitor and resistor solutions for automotive and industrial applications. The event will be held from July 8-10, 2024, in Shanghai.

- April 25, 2024: China Micro Semicon has launched the BAT32A6700, an automotive-grade SoC chip integrating MCU, LDO, LIN transceiver, and CAN controller for simplified automotive actuator design. It offers high performance, meets automotive standards, and includes rich resources like ADC, DAC, timers, and multiple communication interfaces.

- December 23, 2023: ClearMotion secured a USD 1 Billion production order from Chinese EV maker NIO for 3 million units of its active suspension technology. The Billerica-based company’s software-controlled actuators are designed to cancel unwanted motion, improving the in-car experience for both drivers and passengers. This deal marks a significant milestone after about 10 years of development.

- January 12, 2023: At CES 2023, ZF showcased advancements in steer-by-wire (SbW) technology, including a deal with Chinese EV startup Nio for SbW systems starting in 2025. ZF’s system uses dual actuators with separate power supplies for redundancy, ensuring safety and superior steering feel. This technology enables flexible steering wheel placement and offers improved driving control, especially in city driving.

China Automotive Actuators Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Actuator Types Covered | Electrical Actuators, Hydraulic Actuators, Pneumatic Actuators |

| Vehicle Types Covered | Passenger Car, Commercial Vehicle |

| Application Types Covered | Throttle Actuator, Seat Adjustment Actuator, Brake Actuator, Closure Actuator, Others |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China automotive actuators market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China automotive actuators market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China automotive actuators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The China automotive actuators market was valued at USD 7.9 Billion in 2025.

The growth of the China market is driven by advancements in vehicle electrification and automation, the rising demand for electric vehicles (EVs), government support for green technologies, and increasing consumer preference for enhanced vehicle performance, safety, and comfort features, particularly in electric and autonomous vehicles.

The China automotive actuators market is projected to reach a value of USD 12.3 Billion by 2034, growing at a CAGR of 4.99% from 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)