China Airbag Systems Market Size, Share, Trends and Forecast by Airbag Type, Vehicle Type, Sales Channel, and Region, 2026-2034

China Airbag Systems Market Size and Share:

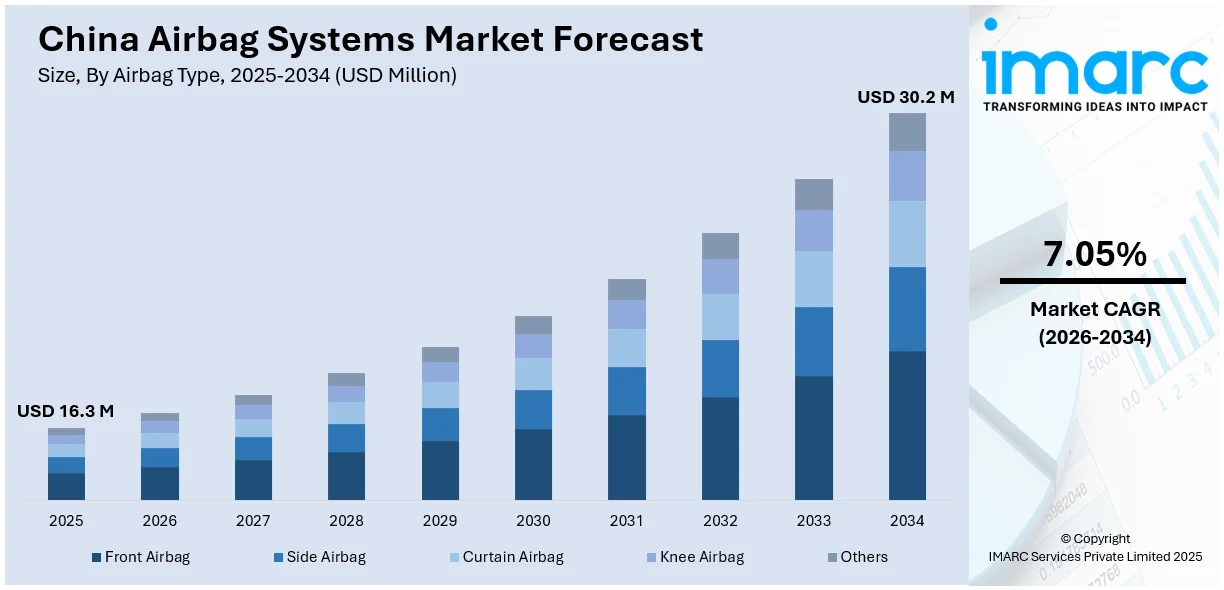

The China airbag systems market size was valued at USD 16.3 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 30.2 Million by 2034, exhibiting a CAGR of 7.05% from 2026-2034. The increasing vehicle production, tightening safety regulations, rising consumer demand for advanced safety features, and technological advancements, are some of the major factors bolstering the China airbag system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 16.3 Million |

|

Market Forecast in 2034

|

USD 30.2 Million |

| Market Growth Rate (2026-2034) | 7.05% |

In China, consumers are increasingly prioritizing safety features. Over the last decade, there has been a noticeable shift in consumer preferences towards vehicles that come equipped with advanced safety technologies. Airbags are at the forefront of these safety systems because they provide essential protection in the event of a collision. With traffic accidents on the rise in China, people are becoming more aware of the need for effective protection. The country saw an alarming annual death toll of around 60,000 individuals because of road accidents in recent years. As road conditions in urban areas continue to worsen and traffic density increases, drivers and passengers are looking for ways to minimize the risks of injury. The government has also been pushing for stricter safety regulations, which in turn has fueled the adoption of airbags in vehicles, especially in smaller and more affordable models. Manufacturers are continuously improving airbag designs to meet safety standards, making them a critical feature in consumer decision-making.

To get more information on this market Request Sample

The country has been tightening its vehicle safety standards, and this is one of the biggest drivers of the China airbag system market growth. The government has implemented several regulations to boost road safety, including mandatory safety equipment in vehicles. For instance, the introduction of the “China 6” vehicle emissions and safety standards in 2023 requires all new vehicles to meet more stringent criteria, including mandatory front airbags for all passenger cars. This implementation of airbags in certain vehicle segments and the increasing scrutiny on vehicle safety performance have made airbags a standard feature in modern cars. This regulatory push ensures that automakers meet higher safety standards, thereby increasing the production and use of airbags in both domestic and international vehicles sold in China.

China Airbag Systems Market Trends:

Rising Automotive Production and Sales

China holds the title of the largest automotive market globally, producing and selling millions of vehicles each year. For instance, the country produced 31.28 million and sold 31.44 million vehicles in 2024, an increase of 3.7 percent and 4.5 percent year-on-year. This increasing production and selling of cars, both domestic and foreign-made, is directly contributing to the China airbag system market demand. As automakers expand their production capacity to meet growing demand, they are incorporating airbag systems into more of their vehicle models. This includes not just high-end models, but also entry-level cars, as consumers look for safety features in vehicles at all price points. The expansion of electric vehicle (EV) production in China also plays a role in driving the airbag market, as these new vehicles, whether fully electric or hybrid, are also being equipped with the latest safety systems. More vehicle manufacturers are prioritizing passenger safety in their design and production processes, leading to an increase in the number of airbags per vehicle. The overall growth of the automotive market ensures that the demand for airbag systems will continue to rise, creating more opportunities for manufacturers of airbags.

Technological Advancements in Airbag Systems

Over time, airbag systems have seen significant technological improvements, and this is another key driver of their increased use in vehicles. Modern airbag systems come with a range of advanced features, including side airbags, knee airbags, and curtain airbags, all designed to protect the passengers from different angles of impact. These technological advancements have made airbags more effective in protecting vehicle occupants, which is why more consumers are demanding them in their vehicles. Innovations like smart airbags, which tailor their deployment speed and force according to the occupant's size and position, are driving growth in China airbag system market share. Additionally, the development of advanced sensors and more sophisticated triggering mechanisms has allowed airbag systems to become faster and more reliable in the event of a crash. These technological advancements make airbag systems more attractive to consumers and increase their demand, pushing automakers to integrate them into their designs.

Growing Awareness of Road Safety Among Consumers

As the middle class in China increases and car ownership grows, more people are concerned about road safety. Consumers are increasingly opting for vehicles that have safety features, such as airbags, considering that they have become more knowledgeable about the risks of car accidents. With access to more information through the internet, social media, and word-of-mouth, people in China are increasingly aware of how airbags can save lives and reduce injury in accidents. This change in mindset has driven the demand for vehicles that feature advanced safety systems. In urban areas, where traffic congestion is high, the risk of collisions is also higher, so people are more likely to prioritize vehicles with comprehensive safety features, including airbags. This growing awareness of the potential benefits of airbags is especially evident among younger drivers, who often view safety as a crucial factor in their vehicle purchasing decisions.

China Airbag Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China airbag systems market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on airbag type, vehicle type, and sales channel.

Analysis by Airbag Type:

- Front Airbag

- Side Airbag

- Curtain Airbag

- Knee Airbag

- Others

As per the China airbag system market forecast, front airbags are the most common and essential type of airbag found in vehicles today. Located in the steering wheel and dashboard, these airbags deploy during a frontal collision to safeguard the driver and front passenger from head and chest injuries. The front airbag market continues to hold a strong share in the Chinese market, particularly as regulatory bodies enforce stricter safety standards. Their widespread use is largely driven by mandatory regulations such as the "China 6" standards and growing consumer demand for basic safety features. Innovations in front airbag design, such as multi-stage and adaptive airbags, are also contributing to their continued dominance in the market.

Side airbags are becoming increasingly important as manufacturers strive to make vehicles safer than just frontal impacts. Side airbags are intended to shield the passenger's upper body and pelvis in the event of a side-impact collision. Side airbags are becoming popular in China, both because of government regulations and consumer demand for more comprehensive safety features. The driving forces for this are the rising awareness of side-impact crashes and the desire to raise safety standards. Other technologies like inflatable curtains and thorax protection systems would also be new developments for this segment.

Curtain airbags are increasingly essential for automotive safety systems, as it is deployed from the roof lining for protecting the head and neck when it is affected by side or rollover crashes. In China, the adoption of curtain airbags has accelerated within the last couple of years, especially among SUVs and crossovers, as rollover accidents are likely to occur often. These airbags are to be fitted to the majority of vehicles in China in the next few years as the manufacturers try to cope with changing safety standards and customer expectations. In mid-to-high-end vehicles, curtain airbags play a significant role in minimizing injury during side and roll-over collisions.

Knee airbags serve to protect lower limbs of auto occupants in case of a head-on collision as they prevent the knee from striking the dashboard and cause less severe injury to the lower limbs. Even though knee airbags are not as commonly used as front or side airbags, their implementation has been more frequent, especially in premium segments of vehicles. Knee airbags in China have recently become popular following the general direction of safety systems towards more comprehensive implementation. These airbags are seen as an essential addition to advanced safety packages, particularly in light of increasing consumer preference for vehicles with multiple airbag types.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Based on the China airbag system market outlook, passenger cars are a major industry segment mainly because of the high volume of production and consumer demand for safety. In China, the growing awareness of safety regulation, such as "China 6" standards, has increased airbag adoption among passenger vehicles. As urbanization continues, car ownership increases, and consumer awareness of safety improves, the demand for airbags in passenger vehicles is expected to maintain strong growth. Automakers are also continuously enhancing airbag technologies, such as adaptive and smart airbags, to offer better protection, especially in smaller and more affordable passenger cars.

Gradual growth in commercial vehicles, such as trucks, buses, and vans, have increased the adoption of airbags, largely due to safety regulations and requirements to protect occupants in heavy-duty vehicles. Commercial vehicles have showed slower adoption rate of airbags in the past as their costs were inhibitive. Presently, the government is enforcing drastic vehicle safety standards that are putting a foothold on its implementation among commercial vehicle types. The demand for airbag systems in commercial vehicles is largely driven by the need for improved safety in collisions, especially in trucks and buses, which are more prone to severe accidents due to their size and weight.

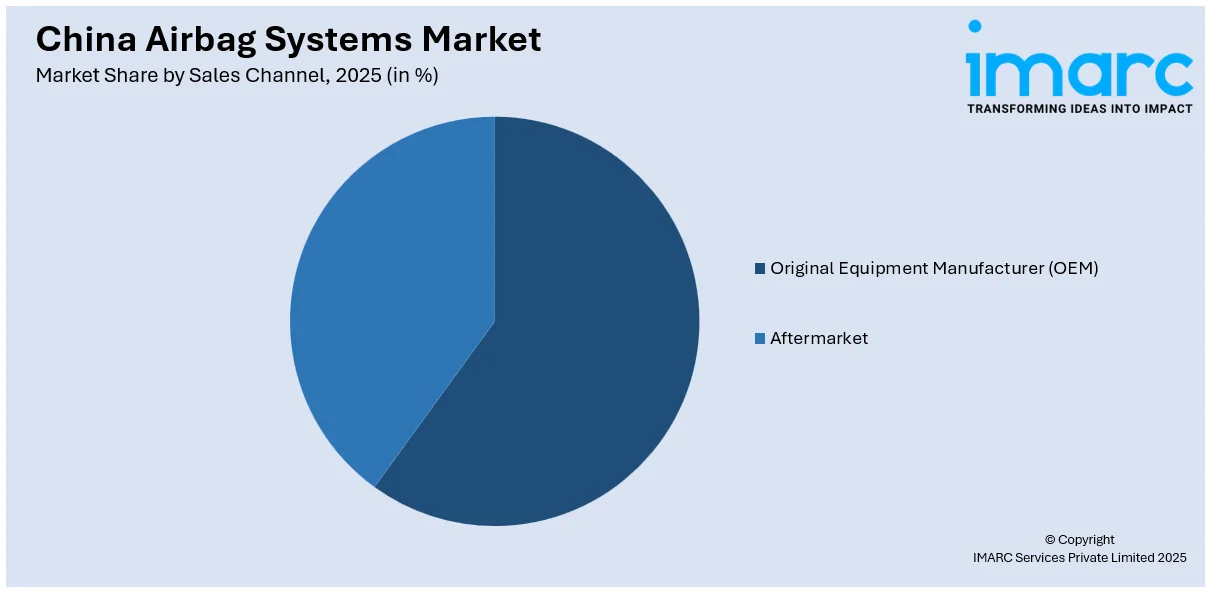

Analysis by Sales Channel:

Access the comprehensive market breakdown Request Sample

- Original Equipment Manufacturer (OEM)

- Aftermarket

According to the China airbag system market trends, the OEM segment is growing due to the rising incorporation of airbags as standard safety features in new vehicles. In China, as vehicle production continues to rise and safety regulations become more stringent, OEMs are installing airbags in the majority of new cars, trucks, and buses. The OEM market benefits from growing consumer demand for safety technologies and compliance with government mandates which require multiple airbags in most vehicles. OEMs are also investing in advanced airbag technologies, including adaptive airbags and smarter deployment systems, to meet evolving safety regulations and improve overall protection.

The aftermarket segment for airbag systems is more modest in size compared with the OEM market but is booming due to increasing longevity in vehicles and the need for replacement of airbags upon accidents, wear and tear, or updates in respect to safety-related issues. In China, as the vehicle fleet is aging and more cars stay on the road for longer periods, demand for aftermarket airbag systems is growing. These categories include installation of replacement airbags, as well as retrofit installations of additional airbags into vehicles that are sold without them. The growing awareness of safety features among consumers of used cars is contributing to the expansion of this sales sector. Installation for fleet- owners commercial vehicles looking for an addition safety upgrade has also increased the demand.

Regional Analysis:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

North China is one of the most important markets for airbag systems due to its large automotive manufacturing base and high vehicle sales. The area is home to many significant domestic automakers as well as joint ventures with foreign producers. Due to strict safety regulations requiring automakers to incorporate airbags into all new models, the region's growing passenger and commercial vehicle population is driving up demand for airbag systems. As the political and the economic center, Beijing also has the highest level of consumer awareness on vehicle safety, which raises demand for vehicles with cutting-edge airbag systems.

East China is an important market for the airbag system, as its robust automotive industry with high production rates of vehicles increases the demand for airbag-equipped vehicles. Being a significant automobile manufacturing hub, this region is home to several foreign and indigenous automobile companies. The increasing number of the middle class in this region also accelerates the demand for safety-equipped vehicles. Additionally, safety standards and regulations have been so strictly enforced that East China vehicle manufacturers have been compelled to include airbags as standard equipment.

South Central China is a very vital region in the adoption of the airbag system, which has been driven by the booming automotive production and expanding consumer market. This region hosts major cities and is considered a hub for automotive manufacturing and sales, both domestic and foreign brands. The region has experienced rapid economic growth, boosting consumer purchasing power and driving demand for vehicles equipped with advanced safety features such as airbags. Because of the betterment in the standardization of vehicle safety regulations and heightened awareness in consumers for the safety measures while on-road, the market is growing.

Southwest China is a rising market for airbag systems, however it lags behind more developed areas such as East and North China. The desire for safer automobiles is being driven by urbanization and increased disposable incomes, which is why this region is witnessing an increase in vehicle sales. But because of a lack of consumer knowledge and laxer enforcement of regulations, the adoption of airbag systems is a little slower here than it is in the northern and coastal regions. The market for airbag systems is nonetheless anticipated to expand gradually as road safety gains importance and automakers produce more reasonably priced cars with airbags.

Northwest China has traditionally had a smaller automotive market, but it is gradually catching up with the rest of the country. The demand for commercial vehicles, like trucks and buses, which have seen an increase in the use of basic safety features like front airbags, is the main factor driving the airbag market in this region. In contrast to more developed nations, airbags are less common in consumer cars overall. As vehicle ownership expands and knowledge of safety features improves, the market for airbags in Northwest China is likely to witness steady expansion, especially in the next few years as government laws demand more extensive safety features in vehicles.

With a significant vehicle manufacturing base, Northeast China has long been one of China's most industrialized areas. Vehicle sales have been impacted by the region's weaker economic growth than other regions of China. Nevertheless, as consumer awareness of safety rises and more cars, especially in cities, are fitted with airbags, the market for airbag systems in Northeast China is growing. Both legal requirements and a trend toward safer passenger automobiles are pushing the region's auto sector to progressively include more sophisticated safety systems.

Competitive Landscape:

The key players in the market are focusing on expansion of production capacities and advancement of airbag technologies to meet the increasing safety demands and regulatory requirements. Manufacturers are investing heavily in developing smarter airbag systems, such as adaptive airbags that can adjust deployment according to factors such as occupant size and seat position. As safety standards in China continue to tighten, companies are working to integrate a wider range of airbags, such as side, curtain, and knee airbags, into their vehicle models. This is particularly important as increased regulations push automakers to offer enhanced protection. The companies are also focusing on the growing market of electric vehicles by developing airbag systems specifically for them, as the vehicle structure and safety requirements of electric vehicles are different from those of traditional combustion engine models. Collaborations with the automotive companies have become more common, as manufacturers wish to advance their safety offerings, enhance product innovation, and sustain their competitiveness in an ever-changing market.

The report provides a comprehensive analysis of the competitive landscape in the China airbag systems market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, ZF Dongfang Automotive Safety Technology (Xi'an) Co., Ltd. held a significant event to mark the expansion of its airbag inflator capacity and the development of a new research and development (R&D) center. This expansion is designed to enhance the current inflator production lines and create a state-of-the-art inflator R&D laboratory.

- In December 2024, Toyoda Gosei Co., Ltd. revealed that they have been working on improving the protection performance of their airbags using computer-aided engineering (CAE) to simulate human body movements and injuries in traffic accidents.

- In December 2024, Autoliv entered into a strategic partnership with China’s Jiangling Motors Co. (JMC) to focus on new innovation and strengthen their global presence. This partnership is led by Autoliv Management Co., Shanghai and marks a significant step in advancing automotive safety technologies, including airbag systems.

- In July 2024, Hyundai Mobis Co. introduced airbags for purpose-built vehicles (PBVs) as its affiliates, Kia Corp. and Hyundai Motor Co., aimed to join the market of tailored automobiles. They introduced a curtain airbag located in the door that deploys from the bottom to the top, as well as a self-supporting passenger airbag that absorbs impact primarily through the lower section of the inflated cushion.

- In May 2024, Shur-Co, LLC announced its acquisition of AB Airbags, Inc., a supplier of premium dunnage airbags, accessory tools, and cargo securement products and solutions.

China Airbag Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Airbag Types Covered | Front Airbag, Side Airbag, Curtain Airbag, Knee Airbag, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Sales Channels Covered | Original Equipment Manufacturer (OEM), Aftermarket |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China airbag systems market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China airbag systems market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China airbag systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The China airbag systems market was valued at USD 16.3 Million in 2025.

The growth of the China airbag systems market is driven by the imposition of stricter safety regulations, increasing consumer demand for advanced safety features, rising vehicle production, rapid technological advancements in airbag systems, and the growing adoption of electric vehicles (EVs).

IMARC Group estimates the market to reach USD 30.2 Million by 2034, exhibiting a CAGR of 7.05% from 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)