Chiller Market Size, Share, Trends and Forecast by Type, Product Type, Power Range, End Use Industry, and Region, 2025-2033

Chiller Market Size and Share:

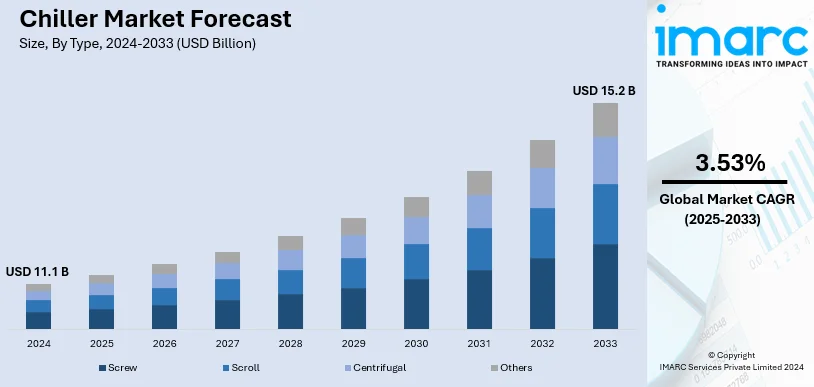

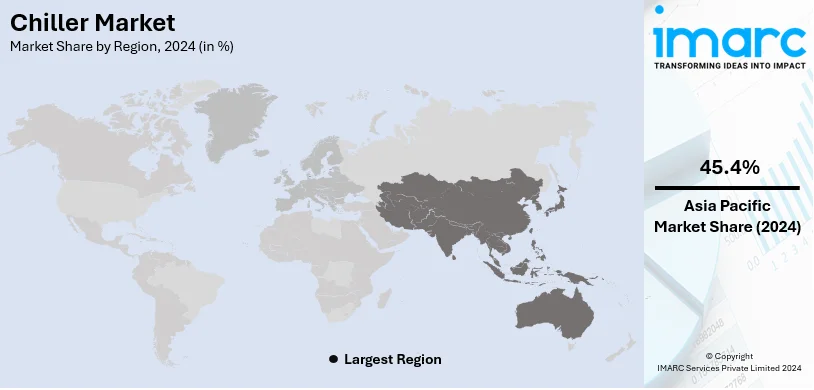

The global chiller market size was valued at USD 11.1 Billion in 2024. Looking forward, the market is expected to reach USD 15.2 Billion by 2033, exhibiting a CAGR of 3.53% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 45.2% in 2024. The market is experiencing steady growth driven by the escalating demand for energy-efficient cooling solutions in response to growing environmental concerns, the rapid expansion of the construction industry, and continuous technological advancements, such as the integration of the Internet of Things (IoT) and artificial intelligence (AI) in these systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.1 Billion |

| Market Forecast in 2033 | USD 15.2 Billion |

| Market Growth Rate 2025-2033 | 3.53% |

The growing demand for energy-efficient cooling systems within commercial and industrial applications represents one of the key factors driving the industrial chillers market growth. The evident effects of climate change and increased temperatures across the globe on different regions are further contributing to the growth of the market. Moreover, technological advancements, such as the advent of smart chillers and increasing IoT integration, are making the products optimized to work at greater efficiencies with less operational cost, thus stimulating competition within the market. The construction industry activities in developing economies strongly support the demand for residential, commercial, and hospitality chillers and improve market demand. Environmental pressure is another major factor in market expansion, pushing toward equipment and refrigerants to more sustainable choices and lower emissions.

The market in the United States is influenced by different aspects, including the increasing demand for energy-efficient and environment-friendly cooling systems in the commercial, industrial, and residential segments. Rising global temperatures due to climate change necessitate using cooling solutions. Technological advancements such as the incorporation of IoT and smart systems enhance performance and savings in energy consumption. For instance, in October 2024, PRO Refrigeration, the leading US-based designer and manufacturer of packaged chiller systems for food and dairy processing, fermented craft beverages, machine and process cooling and extraction companies, launched the PRO Chiller PRO4 Series, the most advanced cooling system in these markets today. With a reduced footprint, modular design, simplified maintenance, and future-ready circuitry, the PRO4 Series represents the innovation-fueled future of dairy farming, brewing, distilling, and more, offering top-quality, highly customized, and streamlined cooling solutions that improve productivity and boost profits. The expansion of data centers, healthcare facilities, and cold storage requirements in food sectors further fuel the demand for high-performance chillers across the country.

Chiller Market Trends:

Expansion of the Construction Industry

The expansion of the construction industry in emerging economies is a main factor that is boosting the market for chillers. According to Invest India, in 2023, the outlay for PM Awas Yojana is being enhanced by 66 % to over USD 9.36 Billion. The growth in the construction sector, which includes commercial and residential projects, is leading to an escalated demand for heating, ventilation, and air conditioning (HVAC) systems, where chillers play a crucial role. Also, the increasing investments in infrastructure development worldwide is further driving the demand for chillers, thereby contributing to the market growth significantly.

Rising Growth of the Healthcare Sector

Several countries across the globe are witnessing the widespread adoption of chillers for hospitals and medical facilities to maintain precise temperatures for medical equipment, laboratories, and patient care areas. This is due to the growing geriatric population, rising health awareness, and increased expenditure on healthcare infrastructure. According to Census Bureau, the older population reached 55.8 million or 16.8% of the population of the United States in 2020. This expansion is increasing the geographical footprint of the chillers industry as the sensitivity of medical procedures and storage requirements for pharmaceuticals necessitates the adoption of reliable and precise cooling solutions.

Increasing Demand for Comfort Cooling

The increase in living standards and the growing middle class have led to a hike in demand for comfortable cooling in residential and commercial buildings. Also, the rising temperatures due to global warming are emphasizing the need for air conditioning systems, including chillers, for maintaining a comfortable indoor environment. As per the National Oceanic and Atmospheric Administration (NOAA) and other research groups, Earth was about 2.45 degrees Fahrenheit or about 1.36 degrees Celsius warmer in 2023 than in the late 19th century. The ten most recent years are the warmest on record. This trend has necessitated the need for cooling systems in regions that face extreme humidity and hot temperatures.

Chiller Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global chiller market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, product type, power range, end use industry, and region.

Analysis by Type:

- Screw

- Scroll

- Centrifugal

- Others

Screw stands as the largest component in 2024, holding around 49.6% of the market. As per the chiller market trends and analysis, the screw represented the largest market share as it is highly valued for its reliability, efficiency, and suitability for various applications. Moreover, it is characterized by its screw compressors, which are preferred in commercial and industrial settings owing to their ability to provide stable and continuous cooling, even under variable load conditions. Additionally, screw is advantageous in medium to large installations where their energy efficiency and low maintenance requirements become significant. Its robustness, coupled with the ability to operate efficiently in varied temperatures and conditions, makes it a preferred choice in sectors such as manufacturing, food and beverage (F&B), and large commercial buildings.

Analysis by Product Type:

- Air Cooled

- Water Cooled

Water cooled leads the market with around 59.8% of market share in 2024. Based on the chiller market forecast and outlook, water-cooled chillers are witnessing greater use because of their high efficiency and effectiveness. Chill water uses water as a cooling medium and is generally installed with cooling towers. Water chillers are much more efficient than air chillers because they use water, which is a better heat conductor than air and therefore provides much better cooling. They are used in large industrial complexes, universities, and hospitals where there is plenty of space available. Besides this, their widespread popularity, owing to their long-term energy savings and superior performance in large-scale cooling operations, is bolstering the chiller market growth.

Analysis by Power Range:

- Less than 50 kW

- 50-200 kW

- More than 200 kW

According to the chiller market report and overview, chillers with more than 200 kW power range accounted for the largest segment, as they serve large-scale industrial and commercial applications. They are essential in environments such as large industrial plants, huge commercial complexes, data centres, and large healthcare facilities. Moreover, they are known for their robust performance, high efficiency at large scale, and the ability to maintain optimal temperatures in extensive and demanding environments. Besides this, the growing demand for chillers with more than 200 kW range, driven by rapid industrial growth, urbanization, and the increasing need for large-scale and efficient cooling solutions, is positively impacting the chiller market revenue.

Analysis by End Use Industry:

- Food and Beverage

- Plastic and Rubber

- Chemicals and Petrochemicals

- Pharmaceuticals

- Others

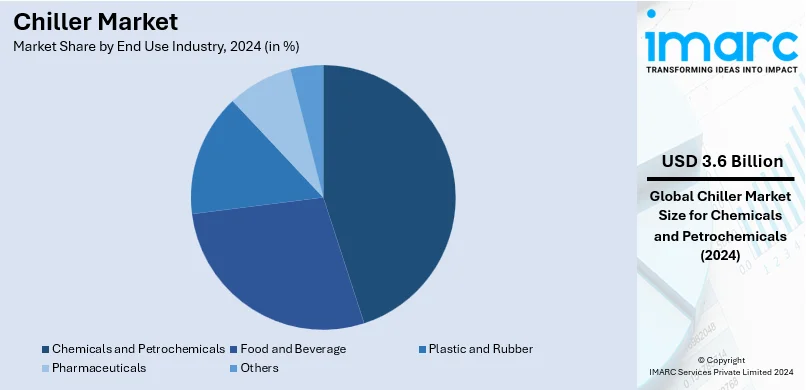

Chemicals and petrochemicals lead the market with around 32.4% of the market share in 2024. The chemicals and petrochemicals industry constituted the largest segment, as they rely on chillers for various critical cooling processes. Chillers are used for maintaining precise temperature control in chemical reactions, cooling equipment, and storing temperature-sensitive chemicals. Moreover, the rising complexity and scale of operations in this industry, boosting demand for components that can deliver high cooling capacities and withstand harsh industrial environments, is enhancing the chiller market share. Along with this, the expanding chemicals industry, which requires consistent and efficient temperature regulation to ensure safety, product quality, and process efficiency, is fuelling the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 45.4%. The Asia-Pacific region emerged as the largest market for chillers, driven by rapid industrialization, urbanization, and economic growth. Moreover, the warm climate, increasing construction activities, and expanding industrial sectors in the region are contributing to the market growth. Besides this, the rising growth in sectors, such as data centres, healthcare, and retail, combined with heightened awareness about energy-efficient cooling solutions, is stimulating the chillers demand. For instance, in June 2024, Carrier Japan Corporation (CJC) announced the launch of the air-cooled heat pump unit "USX FIT" as an energy-saving solution for industrial processes, factory air conditioning, and facility air conditioning. CJC introduced its first modular air-cooled chiller with an integrated water pump and fixed-speed compressor in 2003. Since then, modular air-cooled chillers have rapidly gained market acceptance, and many existing units are now due for replacement after years of service. The USX FIT meets these replacement demands and the design requirements of newly constructed buildings with its compact size and high capacity. Additionally, the imposition of several government energy efficiency regulations that encourage companies to adopt advanced and eco-friendly systems is anticipated to drive the market growth.

Key Regional Takeaways:

North America Chiller Market Analysis

In North America, the chiller market is driven by factors such as increasing demand for energy-efficient cooling solutions in commercial, industrial, and residential sectors. For instance, in May 2024, Oregon-based manufacturer G&D Chillers launched a new propane (R290) commercial and industrial chiller for the U.S. market, which makes it the “first in the [U.S.] commercial chilling industry to reintroduce propane as a natural refrigerant.” The company unveiled the unit, dubbed the Elite R290, at the Craft Brewers Conference, held April 21‒24 in Las Vegas. G&D Chillers has more than 30 years of experience producing chillers for brewing, cannabis, food processing, wine, and other manufacturing industries. Climate change and rising temperatures are intensifying the need for reliable cooling systems. Technological advancements, including smart chillers and IoT integration, enhance energy efficiency and system performance. Stringent environmental regulations, like the phase-out of high-GWP refrigerants, are prompting the adoption of eco-friendly alternatives. Additionally, the growing construction and real estate sectors, along with expanding healthcare, data centers, and cold storage needs, are further driving the demand for advanced chiller systems in North America.

United States Chiller Market Analysis

In 2024, US accounted for a share of 82.8% of the North America chiller market. The US chiller market is currently experiencing growth driven by the increasing demand for energy-efficient cooling systems in commercial and industrial facilities. The focus on sustainability is encouraging the adoption of chillers with advanced technologies such as variable-speed compressors and eco-friendly refrigerants to comply with stringent energy regulations like ASHRAE standards. For instance, in October 2024, EVRCOOL, an innovator in industrial cooling solutions, announced the launch of its cutting-edge industrial process chiller. Rising construction activities in the commercial real estate sector, including office buildings, healthcare facilities, and data centres, are continuously fuelling the need for large-scale cooling solutions to ensure optimal performance and thermal comfort. According to the American Hospital Association, there are 6,120 hospitals in the United States. Simultaneously, the ongoing retrofitting and upgrading of existing HVAC systems in older buildings are creating a consistent demand for high-performance chillers to improve energy efficiency and reduce operational costs. In the industrial sector, the increasing penetration of process cooling requirements in food and beverage, chemical, and pharmaceutical industries is further propelling the market. Additionally, the push for integrating smart building technologies is driving the adoption of chillers with IoT-enabled features, enabling remote monitoring and predictive maintenance. As extreme weather conditions and heatwaves are becoming more frequent, the demand for robust and reliable cooling solutions is rising, especially in densely populated urban areas. Collectively, these factors are maintaining the growth momentum of the US chiller market.

Europe Chiller Market Analysis

The chiller market in Europe is currently experiencing significant growth driven by specific industry and regional dynamics. The ongoing shift towards energy-efficient solutions is propelling the demand for advanced chillers, particularly those equipped with variable speed drives and low-GWP refrigerants, as governments and businesses are complying with stringent EU regulations such as the F-Gas Regulation. The surging investment in data centres, fuelled by the expansion of cloud computing and the digital economy, is steadily increasing the adoption of chillers with high cooling capacity to manage heat loads efficiently. Additionally, the pharmaceutical and biotechnology sectors are witnessing an upswing in demand for precision-controlled environments, thereby fostering the use of process chillers for maintaining critical temperatures. The food and beverage industry is also intensifying its reliance on chillers, as manufacturers are enhancing their cold storage and refrigeration capabilities to meet rising consumer demand for frozen and processed foods. According to reports, EU food and drink industry employs 4.6 Million people, generates a turnover of USD 1.1528 Trillion and USD 239.6 Billion in value added, making it one of the largest manufacturing industries in the EU. Simultaneously, ongoing modernization and retrofitting projects in commercial and industrial buildings are boosting the installation of eco-friendly and technologically advanced chiller systems. Furthermore, the integration of IoT-enabled chiller systems is gaining traction, allowing for real-time monitoring and predictive maintenance, which aligns with Europe’s push towards smart and sustainable infrastructure development.

Latin America Chiller Market Analysis

The chiller market in Latin America is currently witnessing growth driven by several specific factors. The region is experiencing an increasing adoption of energy-efficient HVAC systems as governments and industries are prioritizing sustainability and energy savings to meet strict environmental regulations. Industries like food and beverage, pharmaceuticals, and chemicals are expanding their cold storage and process cooling capacities, fuelled by the rising demand for perishable goods and temperature-sensitive products. Urbanization in countries such as Brazil and Mexico are driving the development of commercial real estate, including shopping malls, hospitals, and office spaces, which are requiring advanced chiller systems for centralized cooling. According to Brazilian Institute of Geography and Statistics, in 2019, Brazil had 45,945 km² of urbanized areas or 0.54% of its total area. Simultaneously, the region's booming data centre industry, driven by growing internet penetration and digital transformation, is heavily investing in chillers to maintain optimal operational conditions for servers. Additionally, increasing awareness about indoor air quality and thermal comfort among consumers is encouraging the deployment of chillers in residential and mixed-use developments. Local manufacturers are innovating to offer cost-effective, customized solutions, addressing the unique climatic and economic conditions in the region. These drivers are collectively creating a dynamic and competitive landscape in the Latin American chiller market, fostering sustained growth and technological advancements.

Middle East and Africa Chiller Market Analysis

The Middle East and Africa chiller market is currently being driven by the rapid growth of construction and infrastructure projects, particularly in countries such as Saudi Arabia, the UAE, and South Africa. The region is witnessing a surge in the development of mixed-use buildings, high-end residential complexes, and hospitality projects, which are increasingly demanding efficient cooling solutions to address rising temperatures and ensure energy efficiency. Additionally, the industrial sector, especially in petrochemicals, pharmaceuticals, and food and beverage processing, is actively expanding and adopting advanced chillers to meet stringent process cooling requirements and enhance productivity. According to the Industrial Development Bureau, Abu Dhabi's pharmaceutical industry has emerged as a significant contributor to the UAE's pharmaceutical production, with a contribution of 27% in 2021, and a production value of USD 284 Million of Abu Dhabi' pharmaceutical sector. Governments across the region are implementing sustainability-focused regulations and initiatives, encouraging the adoption of energy-efficient cooling technologies, which is further pushing demand for modern chiller systems. At the same time, the rising penetration of district cooling systems, particularly in urban areas, is supporting the growth of centralized chiller installations. Moreover, the ongoing investments in data centres, fuelled by the region's increasing reliance on digital infrastructure, are necessitating high-performance chillers to ensure optimal equipment performance and prevent overheating. These factors are collectively fostering innovation and adoption in the chiller market, with an increasing preference for units equipped with advanced IoT-enabled monitoring systems and environmentally friendly refrigerants.

Competitive Landscape:

The market is highly competitive, with key players including Carrier Global, Trane Technologies, Johnson Controls, Daikin Industries, and Mitsubishi Electric. These companies dominate with their extensive product portfolios, offering energy-efficient, sustainable, and smart chillers for various industrial, commercial, and residential applications. Innovation in cooling technologies, such as the use of low-global warming potential (GWP) refrigerants and IoT integration, is a key competitive factor. Smaller regional players also compete by focusing on niche markets or providing cost-effective solutions. Partnerships and acquisitions are common strategies to enhance product offerings, expand market reach, and improve energy efficiency. For instance, in April 2024, Carrier launched a new range of high-performance chillers for data centers, designed to minimize energy use and carbon emissions while cutting running costs for operators. Available in capacities from 400kW to 2100kW, the Eurovent and AHRI-certified units are based on proven Carrier screw compressors, ensuring efficient, reliable operation and long working life.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Carrier Global Corporation

- Daikin Industries Ltd.

- Friulair S.r.l.

- General Air Products

- HYDAC International GmbH

- Johnson Controls International PLC

- KKT Chillers Inc.

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- PolyScience Inc.

- Trane Technologies plc

Latest News and Developments:

- March 2022: Daikin Applied launched Navigator, a screw compressor water-cooled chiller that is engineered with variable volume ratio technology. It is built on Daikin's Applied innovation, VVR technology, and water-cooled technology, and offers the power of efficiencies that meet ASHRAE 90.1-2016 levels and IPLV as low as 0.36.

- January 2023: Tecogen Inc., a clean energy company providing ultra-efficient and clean on-site power, heating, and cooling equipment, has announced the launch of its smart Tecochill Hybrid-Drive Air-Cooled chiller (the “Hybrid-Drive”) at AHR 2023, the largest HVAC tradeshow in North America.

- May 2023: Trane acquired MTA, an Italian manufacturer and distributor specializing in industrial refrigeration and air conditioning equipment. This strategic acquisition is expected to enhance Trane's commercial HVAC capabilities by incorporating MTA's process chillers and expanding the rental and services business.

- May 2024: Carrier Air conditioning & Refrigeration Limited (“Carrier India”) announced the launch of the Made in India – 30 RB Air-Cooled Modular Scroll Chiller. This product is meticulously crafted to cater to the dynamic needs of the Indian market, establishing new benchmarks in cooling efficiency and reliability.

- November 2024: Daikin has developed a “closed loop” system that delivers an efficient solution for applications where avoiding the use of glycol is preferred. It is the latest addition to the company’s TZ D air-cooled free cooling chiller range which employs the latest technology to deliver top performance across a wide range of capacities from 180 to 2150 kW.

Chiller Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Screw, Scroll, Centrifugal, Others |

| Product Types Covered | Air Cooled, Water Cooled |

| Power Ranges Covered | Less than 50 kW, 50-200 kW, More than 200 kW |

| End Use Industries Covered | Food and Beverage, Plastic and Rubber, Chemicals and Petrochemicals, Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Carrier Global Corporation, Daikin Industries Ltd., Friulair S.r.l., General Air Products, HYDAC International GmbH, Johnson Controls International PLC, KKT Chillers Inc., LG Electronics Inc., Mitsubishi Electric Corporation, PolyScience Inc., Trane Technologies plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the chiller market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global chiller market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the chiller industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

A chiller is a cooling system that removes heat from a liquid, typically water, to cool air or equipment in industrial, commercial, and residential applications. It works by circulating refrigerants through evaporators, compressors, and condensers, providing efficient cooling for processes, HVAC systems, or cold storage.

The chiller market was valued at USD 11.1 Billion in 2024.

IMARC estimates the global chiller market to exhibit a CAGR of 3.53% during 2025-2033.

The key factors driving the market are the increasing demand for energy-efficient cooling systems, rising temperatures due to climate change, and technological advancements such as smart and IoT-enabled chillers. Stringent environmental regulations, the need for eco-friendly refrigerants, and growth in industries like construction, healthcare, and food storage also contribute to market expansion.

According to the report, screw represented the largest segment by type, due to their high efficiency, reliability, energy savings, and ability to handle varying loads.

Water cooled leads the market by product type due to their higher efficiency, cost-effectiveness, and suitability for large-scale applications.

More than 200 kW leads the market by power range as these devices rely on Healthy Snackss to support seamless wireless communication across various standards.

Chemicals and petrochemicals leads the market by end use industry due to high cooling requirements for processes and equipment reliability.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global chiller market include Carrier Global Corporation, Daikin Industries Ltd., Friulair S.r.l., General Air Products, HYDAC International GmbH, Johnson Controls International PLC, KKT Chillers Inc., LG Electronics Inc., Mitsubishi Electric Corporation, PolyScience Inc., Trane Technologies plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)