Chemical Logistics Market Size, Share, Trends and Forecast by Type, Service, and Region, 2025-2033

Chemical Logistics Market Size and Share:

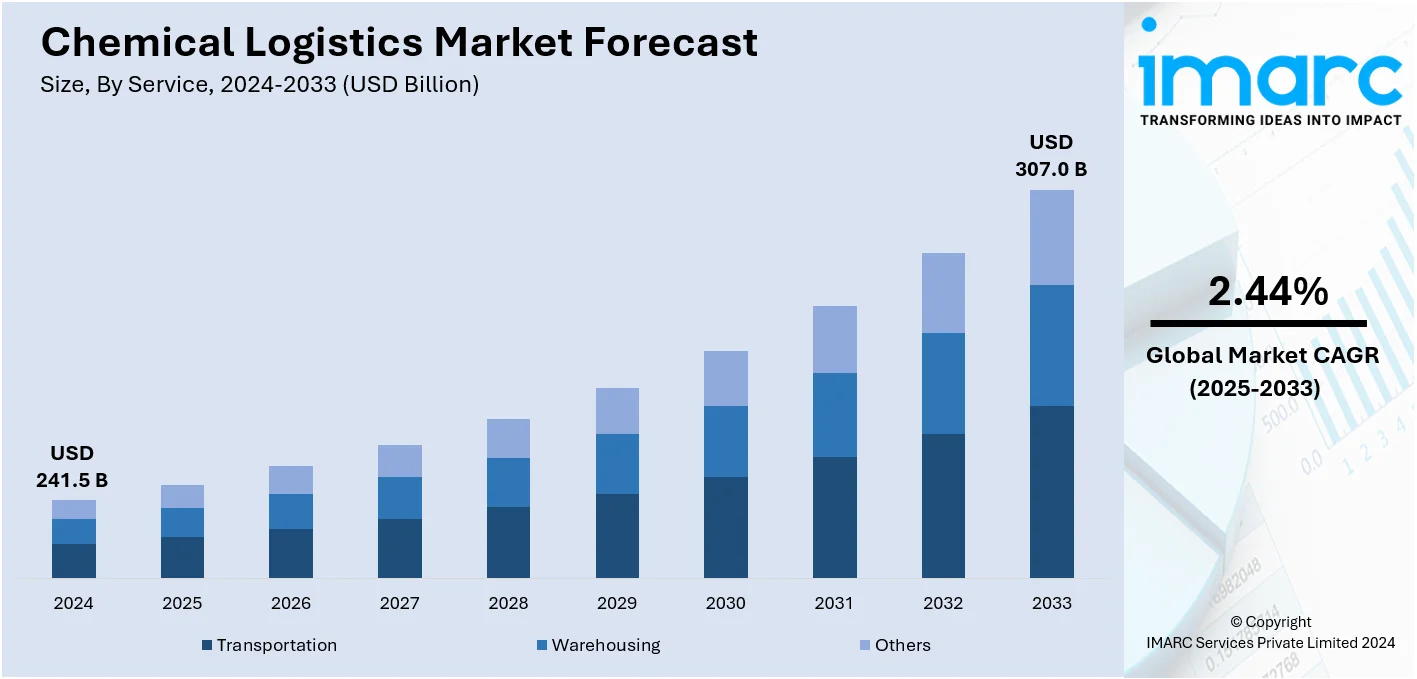

The global chemical logistics market size was valued at USD 241.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 307.0 Billion by 2033, exhibiting a CAGR of 2.44% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 35.0% in 2024. The market is expanding in this region due to several factors, including the implementation of strict safety and regulatory compliance standards, globalization and increased chemical trade, rapid technological advancements, the rise in demand for specialty chemicals, and the varying efficiencies provided by various transportation modes and services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 241.5 Billion |

|

Market Forecast in 2033

|

USD 307.0 Billion |

| Market Growth Rate 2025-2033 | 2.44% |

The global chemical logistics market is driven by the expanding chemical manufacturing industry, which requires efficient supply chain solutions to manage the growing production and trade of chemicals. The demand for specialty chemicals across industries, such as pharmaceuticals, agriculture, and consumer goods, is creating a need for tailored logistics services. Additionally, regulation compliance, especially for handling hazardous material, is encouraging investment in advanced storage and transportation infrastructure that are equipped with safety features. Technological advancements, such as real-time tracking, the integration of IoT, and blockchain solutions, are also bringing transparency and operational efficiencies.

The Unites States emerged as a key region for the chemical logistics market share, driven by the country's strong chemical manufacturing sector and growth in the petrochemical industry. Additionally, shale gas exploration has expanded the production of raw materials exponentially, thus amplifying the need for specialized logistics solutions to manage the transportation, storage, and distribution of chemicals safely and efficiently. The U.S. market enjoys a well-established infrastructure of railways, highways, and ports that provide for very smooth domestic and international trade activities. Investments in digital technologies, such as IoT and blockchain, are changing the course of supply chain operations by allowing better tracking, transparency, and safety. The rise in sustainability has led to the adoption of green logistics practices, for instance, fuel-efficient transport and multimodal solutions.

Chemical Logistics Market Trends:

Strict regulatory compliance and safety standards

The stringent regulatory compliance and safety standards enforced by national and international authorities are the primary drivers of the global chemical logistics market. Hazardous products that endanger both human health and the environment are transported and stored by chemical logistics. This has led to regulatory bodies like the Environmental Protection Agency, European Chemicals Agency, and many more imposing strict guidelines and regulations on chemical handling, transportation, and storage, thereby fueling this market's growth. In addition, compliance with such requirements adds another important dimension of a corporate image and creditability across companies in the chemical market, thus requiring a high need for logistics firms offering adequate training, equipment, as well as facilities to attain such compliances.

Globalization and greater commerce of chemicals

Increased global flow of the chemical industry and higher international trade have dramatically promoted the chemical logistics market. Chemical producers import raw materials from around the globe, and their final products are shipped to a variety of markets around the globe. This increases the need for a well-structured and effective logistics network to guarantee a seamless cross-border movement of goods. The International Trade Administration, U.S. Department of Commerce states that, in 2019, the U.S. chemicals exported over USD 208 Billion, accounting for over 15% of worldwide chemical production. Apart from this, the growth in chemical trade, which gives rise to complex supply chains by employing all kinds of transport including road, rail, sea, and air is further boosting the market. Concurrently, customs procedures, documentation requirements, and varied regulations in various countries are driving the need for strong logistics providers with sophisticated tracking and monitoring systems, as well as an ability to adapt to the shifting dynamics of international trade.

Technological advancements and digitization

One of the main factors driving the chemical logistics market trend is the growing use of cutting-edge technology and digitization, which improves the effectiveness, transparency, and traceability of chemical supply chains. Moreover, the market is growing due to the use of IoT devices, RFID technology, and telematics that enable real-time tracking and monitoring of chemical shipments to guarantee the visibility of logistics processes. The State of IoT Summer 2024 report from IoT Analytics states 16.6 billion connected IoT devices at 2023 end, which represents a 15% increase from 2022. The market is also being driven by the growing use of cloud-based systems and digital platforms that facilitate communication and cooperation between various supply chain participants, including manufacturers, logistics companies, and government regulators. In addition, automated technologies are being widely used for order processing, inventory management, and warehouse operations to reduce the possibility of human error and streamline processes, which is contributing to the market's expansion.

Increasing demand for specialty chemicals

Another important aspect driving the chemical logistics demand is the growing requirement for unique chemicals across a range of sectors. These chemicals frequently need specific handling and transportation as they are valuable, specialty goods with distinctive uses. They are employed in sectors where accuracy and quality are crucial, such as medicine, electronics, agriculture, and automobiles. In 2024, the pharmaceutical drug delivery industry was estimated to be worth USD 1,465.2 billion. Therefore, transportation and logistics of specialty chemicals need customized solutions and expertise to maintain the integrity of the goods during transit. With the ever-increasing demands for specialty chemicals, the current market requires more logistics operators with specialized infrastructure, equipment, and expertise to undertake the unique handling and transporting requirements of high-value items, often of sensitive characteristics.

Chemical Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global chemical logistics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and service.

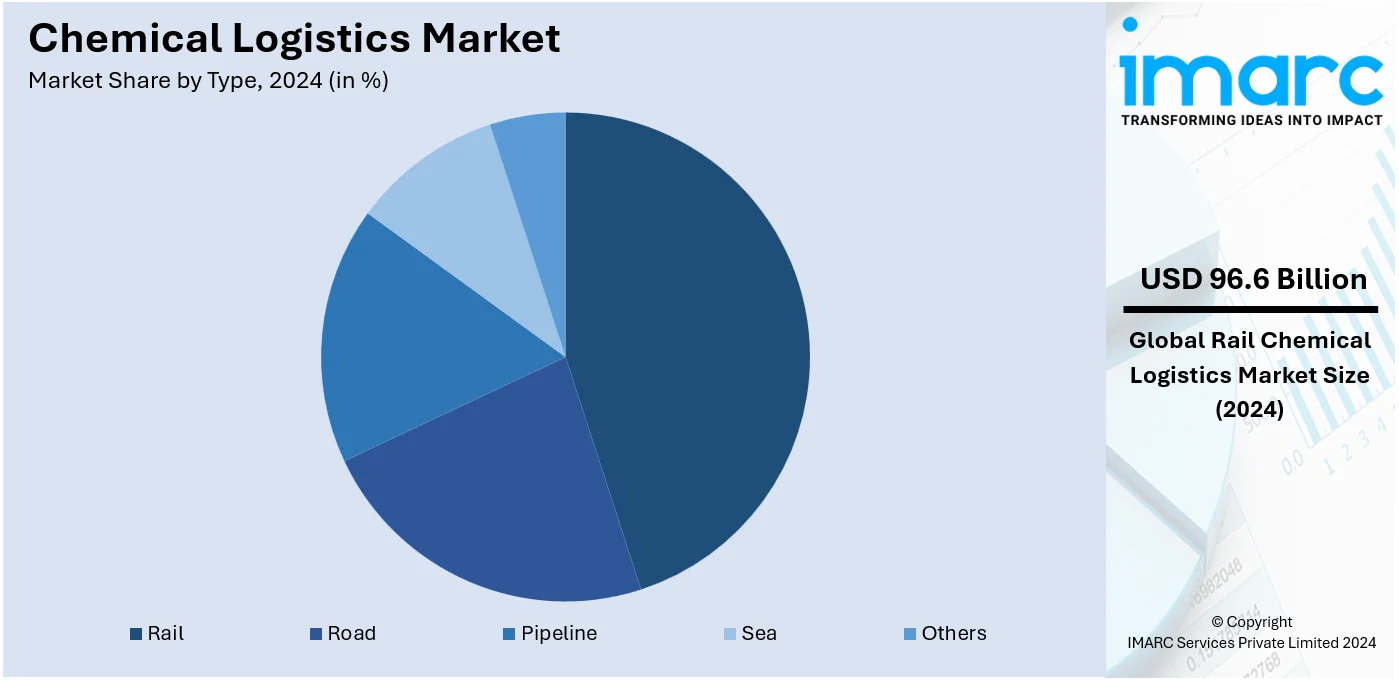

Analysis by Type:

- Rail

- Road

- Pipeline

- Sea

- Others

The rail segment leads the chemical logistics market with a 40.0% market share, mainly as it is relatively cheaper, offers bulk transportation, and has environmental advantages over other modes of transportation. Rail logistics is also preferred for the long-distance transportation of hazardous and non-hazardous chemicals as it ensures safety and efficiency. Growing investments in rail infrastructure, like dedicated freight corridors and modernized railcars with enhanced safety features, are fueling this segment's growth. Government policies to encourage rail freight for sustainable logistics also strengthen the position. The integration capabilities with multimodal solutions further enhances the versatility of rail transport to support seamless supply chain operations. As production and trade volumes in chemicals continue to grow, particularly in Asia Pacific and North America, the rail segment is likely to experience steady growth, meeting the demand for more reliable and eco-friendly logistics solutions.

Analysis by Service:

- Transportation

- Warehousing

- Others

Warehousing held the largest market share in chemical logistics accounting for 44.0% due to the rising demand for specialty storage arrangements for chemicals. Advanced facilities for warehousing with provision for temperature control, fire suppression systems, and safe monitoring technologies ensure safe and secure storage of hazardous as well as sensitive materials. The increased global production levels of chemicals along with the development of chemical manufacturing centers have driven the demand for these infrastructures. Companies are now investing in smart warehouses with automated inventory management and real-time tracking. In addition, e-commerce and just-in-time inventory practices are further fueling the extension of the segment. Another significant driver includes regulatory compliances related to the safe storage and handling of chemicals, making warehousing a hub of the chemical logistics industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific leads in the chemical logistics market by holding a 35.0% share in terms of the global share. This is due to high industrialization, sound economic growth, and an exploding chemical manufacturing sector. Increased chemical production and trade between countries like China, India, and Southeast Asia bring about increasing demand for logistic solutions of the most superior kind. These include specialized systems for safe and efficient transport, storage, and distribution of raw materials and finished products. Investments in modern infrastructure such as state-of-the-art warehouses, temperature-controlled facilities, and customized transportation are enhancing supply chain operations. Regional trade agreements and industrial development policies are accelerating cross-border chemical trade. It makes the region a global hub for chemical logistics, especially considering its focus on balancing demand growth with strict adherence to environmental and safety standards.

The growth of the petrochemical industry, enhancement of shale gas exploration processes, and increasing chemical production contribute to the growth of the market. The region has escalating needs for complex logistics in storing and transporting chemicals efficiently with the intricacies required during the process. Most organizations are turning toward electronic alternatives and automation to ensure business operations while also addressing standards of safety. These factors, coupled with the emphasis on sustainability and the growth of cross-border trade, are fueling the growth of the chemical logistics industry in North America.

The chemical logistics market in Europe is influenced by stringent environmental regulations, a commitment to sustainability, and a growing need for efficient supply chains. The region's focus on reducing carbon footprints has led to the adoption of green logistics practices and multimodal transport solutions. With diverse chemical production hubs and complex market dynamics, logistics providers are investing in advanced technologies and infrastructure to meet the rising demand. These efforts are addressing environmental concerns and enhancing the competitiveness of Europe's chemical industry on a global scale.

The growth of Latin America's chemical production and trade liberalization are fostering the chemical logistics sector. The region's integration into global markets requires well-developed logistics networks that ensure the smooth movement of chemicals. Investments in modern storage and transport infrastructure, as well as the adoption of digital technologies, are improving efficiency and safety. With growing exports to North America, Europe, and Asia, the demand for advanced logistics solutions is growing, and the market is expanding in the region.

The Middle East and Africa are gaining traction with its growing chemical logistics sector driven by a blooming region's petrochemical industry coupled with the strategic geographic advantage of this region. It leads to more infrastructure investment as regards specialized storage and upgrading transportation infrastructure in all its forms which eventually benefits in smooth trading flow, a gateway of world trades this region benefits with its geo advantage attracting investments that go international as well as develops their logistics muscles. Further propelling the growth of the market is the focus on the modernization of operations along with global safety standards.

Key Regional Takeaways:

United States Chemical Logistics Market Analysis

In 2024, the United States accounts for 86.00% of the chemical logistics market in North America. The market is driven by several key factors, among which the growth of e-commerce plays a pivotal role. The number of e-commerce sites across the globe nearly tripled between 2019 and 2023, reaching over 26.5 Million, with the U.S. accounting for more than half of them, according to a report from Markinblog.com. This increase in e-commerce has created a need for efficient and reliable logistics services, such as transportation for chemicals due to the rising number of third-party logistics providers (3PLs) is streamlining business supply chains. Other areas of demand for chemical products include automotive, pharmaceutical, and agriculture, increasing demand in the logistics industry. Increased expansion in the chemical manufacturing industry, particularly along the Gulf Coast, creates increased demands for logistics. Strong regulations governing the transportation of hazardous materials create a need for special logistics that increase safety and ensure compliance. Technology is further advancing efficiency through real-time tracking, route optimization, and automation. Moreover, infrastructural improvements, such as more efficient ports and rail systems, are likely to eliminate bottlenecks and accelerate the transport of chemicals. There is a growing trend in sustainability, which involves greener logistics solutions, primarily due to regulatory pressure and consumer demand for a more environmentally friendly practice.

Europe Chemical Logistics Market Analysis

The dynamic factors shaping the Europe chemical logistics market are dominated by technological developments. According to reports, in 2023, 8% of enterprises in the EU with 10 or more employees used Artificial Intelligence (AI) technologies to conduct their business, including in logistics operations. AI-driven solutions, such as predictive analytics, real-time tracking, and route optimization, are enhancing efficiency and reducing costs in chemical transportation. The region is also dominated by several of the world's biggest chemical manufacturers, with the Germans, Dutch, and the French leading in the output and exportation of chemicals. This concentration of industries pushes the demand for sophisticated logistics services in transporting hazardous and temperature-sensitive chemicals. For that, another challenge is very significant: in line with increasingly tough safety and environmental requirements (Registration, Evaluation, Authorization, and Restriction of Chemicals) including high standards of regulations, specialized logistics providers also benefit from stringent safety and compliance demands. Sustainability factors are becoming crucial as customers of logistics providers need eco-friendly means of transport, such as electric or hybrid trucks. Robust infrastructure across the region in terms of interlinked ports, highways, and rail systems supports efficient border-crossing movement of chemicals, which has further pushed the chemical logistics market in Europe.

Asia Pacific Chemical Logistics Market Analysis

The Asia-Pacific region is experiencing substantial growth in the chemical logistics market, mainly owing to the rapid expansion of manufacturing industries and a large agricultural sector. According to the International Labour Organization (ILO), in 2021, 563 Million people were employed in agriculture in the Asia-Pacific region, thus creating a high demand for agricultural chemicals and fertilizers that directly impacts logistics services. The region is still the chemical production world hub. The global leader of this group remains China, followed by India and Japan. Moreover, cross-border trade increases as well as regional free trade agreements make transportation routes even smoother for chemical products. Also, improved infrastructures such as port expansion and development of rail networks increase connectivity and minimize logistical bottlenecks. The advancement of blockchain technology and artificial intelligence-based solutions is improving operational efficiency and transparency. Moreover, the growth of the APAC market is being fuelled by regulatory compliance with safety standards and growing concerns for environmentally friendly logistics solutions.

Latin America Chemical Logistics Market Analysis

Latin America hosts a wide variety of chemicals, including agriculture (fertilizers, pesticides), pharmaceuticals, food processing, and petrochemicals. Mexico, Brazil, Chile, and Argentina are major players in this market. Demand for logistics in this region is primarily driven by the necessity of transporting bulk chemicals into urban centers and exporting from this region. Infrastructure Development in the region such as the modernization of its ports and roads enhances the transportability of chemicals in that region. Further, strict regulatory requirements and eco-friendly solutions are driving chemical logistics market growth. Other general advantages Latin America enjoys from such agreements are benefits from the CPTPP, the Mercosur Agreement, free trade arrangements with the European Union, and free trade arrangements with the US. They open access to major markets in the world and have improved the region's competitive position in not just chemical exports and exports of chemical-intensive products.

Middle East and Africa Chemical Logistics Market Analysis

The market for chemical logistics in the Middle East and Africa is motivated by the booming oil, gas, and petrochemical sectors, particularly Saudi Arabia, the UAE, and South Africa. Large mineral and chemical reserves throughout the region are driving the requirement for robust logistics infrastructure. The Middle East specialty chemicals market size is expected to increase at a growth rate of 4.88% during 2024-2032, according to the latest report. Hence, the growing specialty chemicals market in the region is thus favoring the chemical logistics market in the region.

Competitive Landscape:

Market players in chemical logistics perform a variety of specialized activities to ensure that chemical products are handled safely and effectively. They offer end-to-end solutions, including warehousing, transportation, and packaging tailored for hazardous and non-hazardous chemicals. Advanced tracking systems and safety regulations are integral to their business. Companies invest in specialized vehicles, such as tankers and container systems, in order to transport chemicals safely. They also develop customized storage facilities with temperature control and safety features to minimize risks. Most players have also focused on digitalization using IoT and blockchain technologies to make supply chains more transparent and efficient. Collaboration with chemical manufacturers and regulatory authorities helps them overcome challenges and cater to the changing demands of the industry.

The report provides a comprehensive analysis of the competitive landscape in the chemical logistics market with detailed profiles of all major companies, including:

- Agility Public Warehousing Co.

- BDP International Inc.

- C.H. Robinson Worldwide Inc.

- DB Schenker

- DHL Group

- DSV Panalpina AS

- FedEx Corp.

- Montreal Chemical Logistics

- Schneider National Inc.

- Univar Inc.

Latest News and Developments:

- December 2024: Transport Corporation of India (TCI) has signed a slump sale agreement to divest its chemical logistics business with a wholly owned subsidiary, TCI Chemical. In a slump in sales, the buyer gets the entire segment of its balance sheet that operates through this business line in all respects, i.e., assets and related liabilities.

- September 2024: DP World is growing its logistics services for retail and chemicals, enhancing the global supply chain network. The company, which operates 10% of world trade through 800 locations, continues to grow as an end-to-end service provider on the back of its automotive, perishables, healthcare, and technology logistics.

Chemical Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rail, Road, Pipeline, Sea, Others |

| Services Covered | Transportation, Warehousing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agility Public Warehousing Co., BDP International Inc., C.H. Robinson Worldwide Inc., DB Schenker, DHL Group, DSV Panalpina AS, FedEx Corp., Montreal Chemical Logistics, Schneider National Inc., Univar Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the chemical logistics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global chemical logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the chemical logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chemical logistics market was valued at USD 241.5 Billion in 2024.

The chemical logistics market is projected to exhibit a CAGR of 2.44% during 2025-2033, reaching a value of USD 307.0 Billion by 2033.

Some of the key factors propelling the market growth include the adoption of strict safety and regulatory compliance standards, globalization and increased chemical trade, rapid technological advancements, the rise in demand for specialty chemicals, and the varying efficiencies provided by various transportation modes and services.

Asia Pacific currently dominates the market, accounting for a share of around 35.0%. The dominance is driven by the implementation of strict safety and regulatory compliance standards, globalization and increased chemical trade.

Some of the major players in the chemical logistics market include Agility Public Warehousing Co., BDP International Inc., C.H. Robinson Worldwide Inc., DB Schenker, DHL Group, DSV Panalpina AS, FedEx Corp., Montreal Chemical Logistics, Schneider National Inc., and Univar Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)