India Cheese Market Size, Share, Trends and Forecast by Type, Format, Application, Sales Channel, and State, 2026-2034

India Cheese Market Summary:

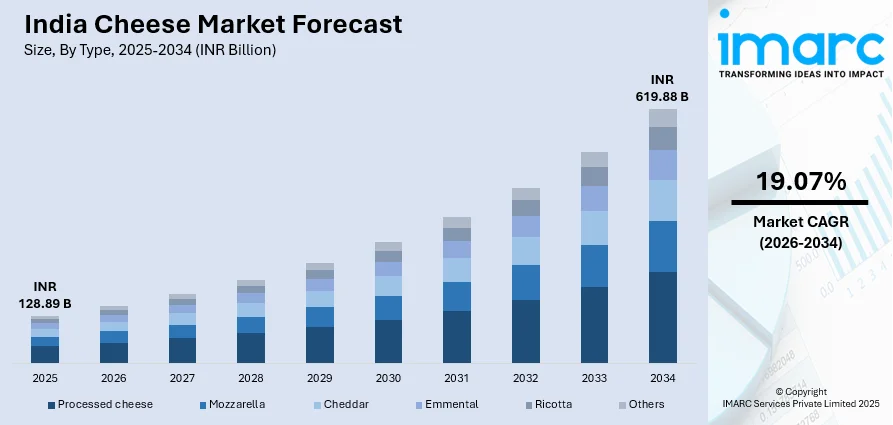

The India cheese market size was valued at INR 128.89 Billion in 2025 and is projected to reach INR 619.88 Billion by 2034, growing at a compound annual growth rate of 19.07% from 2026-2034.

The India cheese market is experiencing transformative growth driven by increasing demand for western and fusion cuisines, health-conscious consumer behavior seeking protein-rich dairy alternatives, and the rapid expansion of quick-service restaurants and foodservice establishments. The growing urbanization coupled with rising disposable incomes among the middle-class population is significantly contributing to the India cheese market share and accelerating cheese adoption across diverse culinary applications.

Key Takeaways and Insights:

-

By Type: Mozzarella dominates the market with a share of 35% in 2025, driven by its widespread application in pizzas, pastas, and Italian cuisine that has gained immense popularity among Indian consumers.

-

By Format: Shredded leads the market with a share of 30% in 2025, attributed to its convenience in food preparation, uniform melting properties, and extensive use in both household cooking and foodservice applications.

-

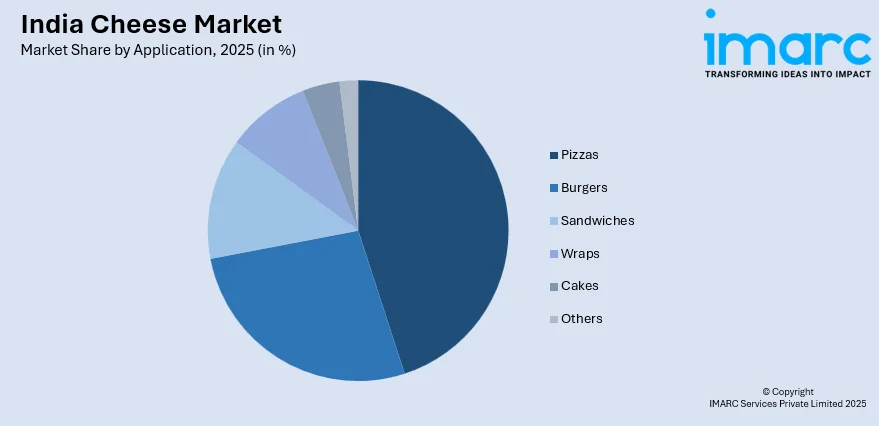

By Application: Pizzas represent the largest segment with a market share of 45% in 2025, owing to the explosive growth of pizza chains, delivery platforms, and consumer preference for cheese-laden Italian cuisine.

-

By Sales Channel: Retail dominates with a share of 78% in 2025, fueled by expanding organized retail presence, increasing household consumption, and growing availability of diverse cheese products across supermarkets and grocery stores.

-

Key Players: The India cheese market features a concentrated competitive landscape dominated by established dairy cooperatives and private dairy companies. Key players differentiate through product quality, brand trust, distribution network strength, and diverse product portfolios spanning processed cheese, mozzarella, cheddar, and specialty cheese variants. Some of the key players include GCMMF, Parag Milk Foods, Britannia, and Mother Dairy.

To get more information on this market Request Sample

The India cheese market has transitioned from a niche western import into a mainstream dairy segment, supported by changing dietary habits and the growing influence of western cuisine. Domestic companies are also making strategic moves. In 2024, Britannia Bel Foods inaugurated a ₹220 crore cheese plant in Ranjangaon, Maharashtra, to locally produce The Laughing Cow and meet rising demand. The market includes a wide range of cheese types such as processed cheese, mozzarella, cheddar, emmental, ricotta, and specialty variants, offered in formats including slices, blocks, spreads, shreds, and cubes. India’s status as the world’s largest milk producer provides a strong base for domestic cheese manufacturing, prompting producers to expand capacities to address rising demand. A gradual shift from traditional paneer toward cheese highlights evolving taste preferences, particularly among younger urban consumers exploring global cuisines. Rapid growth in foodservice outlets, including QSRs, cafes, and pizza chains, has boosted institutional demand. Simultaneously, premiumization is gaining momentum as health-conscious consumers opt for artisanal, organic, and nutritionally enhanced cheese products.

India Cheese Market Trends:

Rising Demand for Western and Fusion Cuisines

The India cheese market is expanding rapidly due to rising adoption of western and fusion cuisines among urban consumers. In 2025, Milky Mist Dairy received SEBI approval for a ₹2,035‑crore IPO to expand and modernize its manufacturing, including cheese production capacity. Pizzas, burgers, pasta, and sandwiches are increasingly embedded in everyday diets, especially among millennials and Gen Z. Growing presence of Italian, Mexican, and American restaurants has normalized cheese consumption, while home cooks increasingly blend cheese with traditional Indian dishes to create fusion recipes.

Emergence of Health-Enhanced and Specialty Cheese Products

Health awareness is influencing cheese consumption patterns in India, boosting demand for low-fat, organic, fortified, and lactose-free variants. In 2025, Odisha‑based Curious Cheese launched India’s first probiotic‑infused cheese line with artisanal Mozzarella, Oaxaca, and Edam made from A2 cow milk and live cultures, promoting gut health. Consumers increasingly perceive cheese as a convenient protein source supporting fitness and healthy snacking. Producers are introducing products aligned with vegetarian and specific dietary needs. Artisanal and specialty cheeses are also gaining traction, driven by premium-seeking consumers valuing authentic flavors and traditional craftsmanship.

Expansion of Quick-Service Restaurants and Pizza Chains

The expansion of quick-service restaurants and pizza chains is significantly increasing institutional cheese demand in India. In June 2025, U.S. pizza chain Little Caesars formally entered the Indian market with plans to open dozens of stores across the country, starting in the Delhi NCR region and targeting 100 outlets by the end of the decade to tap growing pizza consumption beyond major metros. Major brands are extending operations into tier-II and tier-III cities, popularizing cheese-intensive menu offerings. This sustained foodservice demand supports predictable bulk consumption, encouraging investments in manufacturing capacity and supply chain infrastructure.

Market Outlook 2026-2034:

The India cheese market outlook remains exceptionally positive over the forecast period, driven by favorable demographic trends, rising disposable incomes, and continued westernization of dietary habits. The market is expected to benefit from sustained foodservice industry expansion, increasing organized retail penetration, and growing household consumption patterns. Premiumization opportunities will emerge as consumers graduate from basic processed cheese toward specialty varieties including natural cheese, artisanal products, and imported premium brands. Manufacturing investments by domestic and international players will enhance production capabilities and product innovation. The market generated a revenue of INR 128.89 Billion in 2025 and is projected to reach a revenue of INR 619.88 Billion by 2034, growing at a compound annual growth rate of 19.07% from 2026-2034.

India Cheese Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Mozzarella |

35% |

|

Format |

Shredded |

30% |

|

Application |

Pizzas |

45% |

|

Sales Channel |

Retail |

78% |

Type Insights:

- Processed Cheese

- Mozzarella

- Cheddar

- Emmental

- Ricotta

- Others

The mozzarella dominates with a share of 35% of the total India cheese market in 2025.

Mozzarella cheese has established market leadership driven by its essential role in pizza preparation, which represents the largest cheese application in India. India’s mozzarella exports surged sharply in 2025, with shipments reaching $3.29 million in April–September, an over 1,200 % increase from near nil two years ago, led by companies like Amul investing in buffalo‑milk mozzarella production under supportive government schemes. Mozzarella's superior melting characteristics, stretchability, and mild flavor profile make it the preferred cheese variety for pizzas, lasagnas, and various Italian dishes that have gained widespread popularity among Indian consumers.

The mozzarella segment's dominance reflects the profound influence of Italian cuisine on Indian food preferences and the positioning of pizza as a convenient, shareable, and celebratory food option. Domestic manufacturers have invested significantly in mozzarella production capabilities to meet growing demand from both foodservice and retail channels. The segment continues expanding as home cooking trends encourage consumers to prepare pizzas and Italian dishes, creating retail demand for mozzarella in convenient packaging formats suitable for household use.

Format Insights:

- Slices

- Diced/Cubes

- Shredded

- Blocks

- Liquid

- Crème

- Cheese Spreads

The shredded leads with a share of 30% of the total India cheese market in 2025.

Shredded cheese has emerged as the preferred format due to its convenience in food preparation, uniform distribution during cooking, and superior melting properties that enhance dish presentation and taste. The format eliminates the need for grating or slicing, saving preparation time for both household consumers and foodservice establishments. In 2025, Pizza Hut India launched its Ultimate Cheese Crust, featuring molten cheese baked into the crust, supported by a nationwide “Flip To The Cheese” campaign promoting cheesiest-first consumption. Shredded cheese is particularly popular for pizza toppings, pasta gratins, and casseroles where even coverage and consistent melting are essential for optimal results.

The shredded format's market leadership reflects changing consumer lifestyles that prioritize convenience and time-saving food preparation solutions. Manufacturers offer shredded cheese in various pack sizes catering to different consumption occasions, from single-serve pouches for individual use to bulk packaging for foodservice applications. The format benefits from strong demand in the institutional segment where quick service restaurants and pizza chains require ready-to-use cheese for efficient kitchen operations and consistent product quality.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Pizzas

- Burgers

- Sandwiches

- Wraps

- Cakes

- Others

The pizzas dominate with a market share of 45% of the total India cheese market in 2025.

Pizza has emerged as the dominant cheese application in India, driven by the phenomenal growth of pizza chains, delivery platforms, and consumer acceptance of pizza as a preferred food choice for various occasions. The application benefits from pizza's positioning as a convenient, shareable, and family-friendly food option suitable for celebrations, casual dining, and quick meals. The India pizza market size reached USD 5.3 Billion in 2024 and is projected to reach USD 11.8 Billion by 2033, exhibiting a CAGR of 9.24% during 2025–2033. International pizza chains have invested heavily in expanding their Indian footprint, introducing cheese-centric menu innovations that showcase mozzarella and blended cheese combinations.

The pizza application's dominance reflects the successful localization of this Italian dish to Indian taste preferences, with offerings ranging from traditional margherita to fusion variants incorporating Indian flavors and toppings. Home pizza preparation has gained popularity as consumers seek to recreate restaurant-quality pizzas using retail cheese products. The application segment benefits from continuous innovation by pizza chains introducing new cheese-forward products that drive incremental cheese consumption and reinforce pizza's position as the primary cheese application in the Indian market.

Sales Channel Insights:

- Retail

- Institutional

The retail leads with a share of 78% of the total India cheese market in 2025.

Retail channels dominate cheese distribution in India, reflecting the significant role of household consumption in overall cheese demand. Supermarkets, hypermarkets, and modern grocery stores offer extensive cheese assortments enabling consumers to explore diverse varieties, formats, and brands. The organized retail expansion across Indian cities has enhanced cheese accessibility, particularly for processed cheese products that have become household staples for breakfast, snacking, and cooking applications.

The retail channel's leadership is reinforced by the proliferation of neighborhood convenience stores and traditional grocery outlets that stock popular cheese brands, ensuring availability across diverse shopping environments. E-commerce and quick commerce platforms are emerging as significant retail sub-channels, offering convenient home delivery of cheese products with cold chain logistics ensuring freshness. The retail segment benefits from promotional activities, in-store sampling, and advertising campaigns that drive brand awareness and trial among new consumers.

State Insights:

- Karnataka

- Maharashtra

- Tamil Nadu

- Delhi

- Gujarat

- Andhra Pradesh and Telangana

- Uttar Pradesh

- West Bengal

- Kerala

- Haryana

- Punjab

- Rajasthan

- Madhya Pradesh

- Bihar

- Orissa

Karnataka’s cheese market is driven by Bengaluru’s cosmopolitan population, strong QSR presence, and growing café culture. Rising demand for pizzas, burgers, and continental cuisines supports steady consumption across urban and tier-II cities.

Maharashtra leads cheese consumption due to Mumbai and Pune’s urban lifestyles, high disposable incomes, and strong western food adoption. Expanding fast-food chains, bakeries, and foodservice outlets continue to normalize cheese in daily diets.

Tamil Nadu’s cheese market is growing with increasing acceptance of western cuisine in Chennai and Coimbatore. QSR expansion, café culture, and youth-driven experimentation with fusion foods are boosting demand beyond traditional dairy preferences.

Delhi’s cheese demand is fueled by a dense concentration of QSRs, premium restaurants, and home delivery platforms. High awareness of international cuisines and convenience foods drives strong consumption across households and foodservice sectors.

Gujarat’s cheese market benefits from a strong vegetarian population and a long-standing dairy culture. Increasing use of cheese in fusion snacks, street foods, and bakery products is expanding demand beyond traditional paneer.

Cheese consumption in Andhra Pradesh and Telangana is rising due to urbanization in Hyderabad and Visakhapatnam. Growing QSR penetration, café chains, and exposure to western cuisines among young consumers are key growth drivers.

Uttar Pradesh’s cheese market is expanding gradually with urban growth in cities like Noida and Lucknow. Rising QSR outlets, malls, and changing eating habits among younger consumers are increasing cheese-based food adoption.

West Bengal’s cheese demand is driven by Kolkata’s evolving food culture and growing café segment. Increasing preference for baked goods, continental dishes, and fusion snacks is supporting gradual market penetration.

Kerala’s cheese market growth is supported by high literacy, overseas exposure, and evolving dietary preferences. Increased consumption of pizzas, sandwiches, and bakery items is driving cheese usage across urban households.

Haryana benefits from proximity to Delhi NCR, enabling strong cheese demand through QSRs and modern retail. Rising disposable incomes and preference for convenience foods are accelerating consumption in urban centers.

Punjab’s cheese market is influenced by its strong dairy heritage and high milk consumption. Growing acceptance of western fast foods and bakery products is driving increased use of mozzarella and processed cheese.

Rajasthan’s cheese market is emerging steadily with urbanization in Jaipur and Udaipur. Expanding QSR chains, tourism-driven foodservice demand, and rising youth exposure to western cuisines support market growth.

Cheese consumption in Madhya Pradesh is growing with improving retail infrastructure and urban lifestyles. Cities like Indore and Bhopal are witnessing higher demand through fast-food outlets and bakeries.

Bihar’s cheese market remains nascent but shows potential due to rising urbanization and youth population. Gradual expansion of QSRs and changing food preferences are creating new consumption opportunities.

Orissa cheese market is at an early stage, driven by urban growth in Bhubaneswar and Cuttack. Increasing exposure to western foods and organized foodservice is slowly supporting demand growth.

Market Dynamics:

Growth Drivers:

Why is the India Cheese Market Growing?

Increasing Westernization of Dietary Habits and Consumer Preferences

The profound shift in Indian dietary habits toward western and fusion cuisines is driving substantial cheese demand growth. According to reports, Amul recently expanded its cheese production from 40 to 120 tonnes per day, demonstrating how major dairy players are scaling operations to meet growing consumer and institutional demand. Urban consumers, particularly younger demographics, are increasingly incorporating cheese into their regular diets as part of pizzas, burgers, sandwiches, and pasta dishes that have become mainstream food choices. The exposure to global cuisines through travel, media, and social platforms has accelerated acceptance of cheese as a versatile ingredient in both international and Indianized recipes. This dietary westernization represents a fundamental shift from traditional paneer consumption patterns toward cheese adoption across diverse culinary applications.

Rapid Expansion of Quick-Service Restaurant and Foodservice Industry

The explosive growth of quick-service restaurants, pizza chains, and organized foodservice establishments is creating substantial institutional demand for cheese products. In 2025, Burger King India crossed 500+ outlets nationwide, highlighting global burger brands’ expansion and reliance on cheese‑rich menu items like cheeseburgers and loaded wraps to attract urban and tier‑2/3 consumers. International and domestic pizza chains continue aggressive expansion into new markets, introducing cheese-intensive menu items that drive consumption volumes. The food delivery ecosystem expansion through aggregator platforms has extended reach of cheese-centric dishes to consumers across geographic locations and occasions. This foodservice growth creates consistent bulk demand patterns that encourage supply chain investments and domestic manufacturing capacity expansion.

Rising Middle-Class Population with Increasing Disposable Incomes

India's expanding middle class with rising disposable incomes is driving premiumization and volume growth in the cheese market. Domino’s India added over 180 stores nationwide, aiming to double to 4,000 in 5–6 years, boosting institutional cheese demand via increased pizza consumption. Consumers with greater spending capacity are willing to experiment with diverse cheese varieties, premium products, and branded offerings that were previously considered luxury items. The increasing affordability of cheese products relative to income growth is lowering barriers to consumption and encouraging regular usage rather than occasional indulgence. Urbanization trends concentrate this affluent consumer base in metropolitan areas where modern retail infrastructure and foodservice establishments provide convenient cheese access.

Market Restraints:

What Challenges the India Cheese Market is Facing?

Strong Cultural Preference for Traditional Dairy Products

India's deeply rooted cultural preference for traditional dairy products, particularly paneer and ghee, presents a significant challenge to cheese market expansion. Paneer remains the preferred dairy protein in Indian cuisine due to its familiarity, versatility in traditional recipes, and cultural acceptance across regions. Converting traditional dairy consumers toward cheese requires sustained education about cheese applications, flavor profiles, and culinary possibilities beyond western cuisine contexts.

Price Sensitivity and Premium Positioning Challenges

Cheese products command premium prices compared to traditional dairy alternatives, limiting penetration in price-sensitive consumer segments. The cost differential between cheese and paneer discourages substitution, particularly in household cooking applications where paneer offers familiar taste at lower cost points. Manufacturers face challenges balancing product quality with affordability to expand market reach beyond affluent urban consumers.

Cold Chain Infrastructure Limitations

Inadequate cold chain infrastructure in semi-urban and rural areas restricts cheese distribution beyond metropolitan markets. The perishable nature of cheese requires consistent refrigeration throughout the supply chain, which remains challenging in regions with limited cold storage facilities and unreliable power supply. These distribution constraints concentrate market growth in urban areas while limiting expansion potential in smaller towns and rural markets.

Competitive Landscape:

The India cheese market exhibits a relatively concentrated competitive landscape, led by established dairy cooperatives and private players with strong brand equity and wide distribution networks. Market leadership is driven by cooperative-based sourcing models, high consumer trust, and nationwide retail penetration. Competition is intensifying through premium product positioning, continuous product innovation, and strategic manufacturing investments. Players with strong regional dominance effectively cater to both retail and institutional demand. Overall competition is shaped by capacity expansions, portfolio diversification, distribution strengthening, and the entry of international participants through domestic partnerships offering global expertise and specialty cheese products.

Some of the key players include:

- GCMMF

- Parag Milk Foods

- Britannia

- Mother Dairy

Recent Developments:

-

In March 2025, Paras Dairy (VRS Foods) entered India’s premium cheese segment with the launch of its Galacia brand at AAHAR 2025. Manufactured in Maharashtra, the brand debuts with high-quality mozzarella and plans to expand into blocks, slices, and dips across North, West, and South India, backed by an investment exceeding INR 100 crore.

India Cheese Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion INR, ‘000 Kg |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Processed Cheese, Mozzarella, Cheddar, Emmental, Ricotta, Others |

| Formats Covered | Slices, Diced/Cubes, Shredded, Blocks, Liquid, Crème, Cheese Spreads |

| Applications Covered | Pizzas, Burgers, Sandwiches, Wraps, Cakes, Others |

| Sales Channels Covered | Retail, Institutional |

| States Covered | Karnataka, Maharashtra, Tamil Nadu, Delhi, Gujarat, Andhra Pradesh and Telangana, Uttar Pradesh, West Bengal, Kerala, Haryana, Punjab, Rajasthan, Madhya Pradesh, Bihar, Orissa |

| Companies Covered | GCMMF, Parag Milk Foods, Britannia and Mother Dairy |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The cheese market in the India was valued at INR 107.54 Billion in 2024.

The growth of the India cheese market is driven by rising demand for western and fusion cuisines, increasing consumer awareness of cheese’s nutritional benefits, expansion of fast-food chains, and growing online retail platforms making cheese more accessible to urban and rural populations.

The India cheese market is projected to exhibit a CAGR of 19.86% during 2025-2033, reaching a value of INR 593.47 Billion by 2033.

Processed cheese accounted for the largest share in India's cheese market, driven by its affordability, longer shelf life, and widespread use in fast food, ready-to-eat meals, and household consumption.

Some of the major players in the India cheese market include GCMMF, Parag Milk Foods, Britannia and Mother Dairy, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)