Centrifugal Pump Market Size, Share, Trends and Forecast by Impeller Type, Stage, Flow Type, Capacity, End-User, and Region, 2025-2033

Centrifugal Pump Market 2024, Size and Trends:

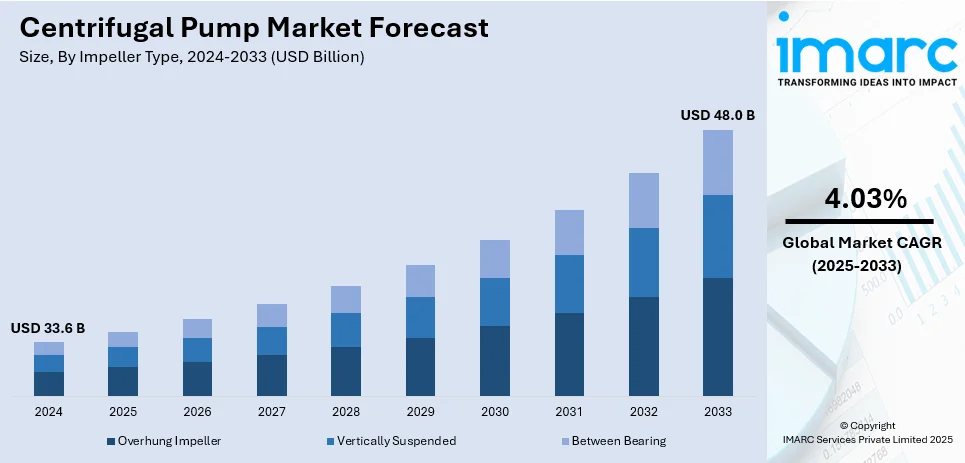

The global centrifugal pump market size reached USD 33.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 48.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 46.9% in 2024. The growing demand for efficient water and wastewater management solutions, the expansion of the oil and gas industry, and increasing investments in infrastructure and industrialization projects globally are some of the key factors, driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 33.6 Billion |

|

Market Forecast in 2033

|

USD 48.0 Billion |

| Market Growth Rate (2025-2033) | 4.03% |

Key drivers of the global centrifugal pump market include the increasing demand for efficient water and wastewater management solutions, spurred by urbanization and population growth. Additionally, the expansion of industrial sectors, such as oil and gas, chemicals, and manufacturing, necessitates reliable fluid handling systems. Technological advancements in pump design and energy efficiency are also significant factors, as industries seek to reduce operational costs and environmental impact. Furthermore, stringent regulations regarding water quality and environmental sustainability are prompting investments in modern pumping technologies, further expanding centrifugal pump market share, along with advancements in this evolving sector.

The United States is a crucial nation in the global centrifugal pump industry, mainly influenced by heavy investments in critical industries, including water management and energy and its cutting-edge industrial infrastructure. The intense requirement for centrifugal pumps is boosted by the nation’s comprehensive oil and gas operations, as well as the crucial demand for effective water treatment and distribution systems. Additionally, stringent environmental regulations encourage the adoption of innovative and energy-efficient pumping solutions. The U.S. market stands out as a major driver in the global centrifugal pump sector, bolstered by the presence of prominent manufacturers and a strong emphasis on innovation and technological progress, which amplify its competitive edge. For instance, in October 2024, Buffalo Pumps, a major centrifugal pumps company, announced plans to expand its manufacturing capacity to facilitate commercial sales for the U.S. military applications. This includes a significant investment of USD 10.6 million

Centrifugal Pump Market Trends:

Growing Product Application in the Oil and Gas Sector

The significant development in oil and gas infrastructure is setting an optimistic outlook for the centrifugal pump industry globally. Such pumps are extensively leveraged in the oil and gas segment to liquefied gases, pump oil, petroleum products, and several other fluids during operations. According to the BP Statistical Review of World Energy 2022, the total global natural gas production reached around 4,036.9 billion cubic meters (bcm) in 2021, recording a 4.5% rise from the 3,861.5 bcm recorded in 2020 and approximately 15% elevation from 2015. Similarly, global natural gas demand stood at around 40,37.5 bcm in 2021, witnessing a 5% rise from 3845.6 bcm in 2019 and around a 16% rise from 2015. The magnifying utilization as well as production of natural gas are significantly elevating the requirement for centrifugal pumps. In addition to this, the proliferation in the oil and gas industry is further amplifying the centrifugal pump market share. For instance, according to IMARC, the global oil and gas market size reached USD 17.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 65.8 Billion by 2032, exhibiting a growth rate (CAGR) of 15.84% during 2024-2032. Besides this, a substantial elevation in exploration efforts, spending in infrastructure, and increasing ventures to attain energy supplies are anticipated to fuel expansion in the oil and gas sector, which, in turn, is expected to provide lucrative growth opportunities to the centrifugal pump market.

Increasing Product Offerings

Various key market players are introducing a wide range of pumps in different types, sizes, and features to cater to diverse industrial needs and create a positive centrifugal pump market outlook. This includes developing specialized pumps for specific applications, enhancing efficiency, and integrating advanced technologies to meet evolving customer requirements and industry standards. For instance, in February 2024, DESMI launched a new mag-drive centrifugal pump, adding a magnetic coupling to its range of centrifugal pumps. The technology provides specific benefits for a methanol fuel system, blending the elevated efficacy and resilient dependability of centrifugal pumps without any requirement for a conventional shaft seal solution in the pump. Similarly, in February 2023, CPC Pumps International extended its product range by launching its new BB5 pump. Use of CPC centrifugal pumps are conventionally in the broader petrochemical and refining sectors. The BB5 is widely used in carbon capture, utilization, and storage (CCUS) processes that are central to lowering CO2 emissions. Besides this, various leading market players are also collaborating with each other to add new and technologically advanced pumps to their portfolios. For instance, in June 2024, TechnipFMC plc partnered with Sulzer Flow Equipment to develop new subsea carbon dioxide (CO2) pump solutions. Such product innovations are anticipated to further propel the centrifugal pump market growth.

Rising Need in the Water and Wastewater Treatment

As per an ITA report, the biggest environmental technology sector for U.S. exports to India is water and wastewater treatment. India possesses the world's 5th largest market for water and wastewater treatment, estimated at around USD 11 billion. It is anticipated to exceed USD 18 billion by 2026. The escalating utilization of centrifugal pumps in the water and wastewater treatment plants is significantly catalyzing the growth of the market. Centrifugal pumps play a crucial role in water and wastewater management by efficiently moving large volumes of water through various stages of treatment and distribution. In wastewater treatment, centrifugal pumps transport sewage and industrial effluents to treatment facilities, where they assist in processes like aeration, sedimentation, and sludge handling. Moreover, the growing concerns regarding water safety are primarily driving the demand for efficient water treatment solutions, such as centrifugal pumps. Additionally, various government authorities across the world are taking initiatives to clean water bodies and control water pollution. For instance, initiatives such as the National Mission for Clean Ganga (Namami Gange) and the Jal Jeevan Mission by the Indian government have spurred investments in water treatment infrastructure, thereby positively impacting the centrifugal pump market outlook. Similarly, the Safe Drinking Water Act (SDWA), passed by the U.S. government, outlines the standards for drinking water quality and monitors states, local authorities, and water suppliers who enforce those standards. Such initiatives are projected to bolster the centrifugal pump market demand over the forecasted period.

Centrifugal Pump Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global centrifugal pump market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on impeller type, stage, flow type, capacity, and end-user.

Analysis by Impeller Type:

- Overhung Impeller

- Vertically Suspended

- Between Bearing

Overhung impeller leads the market with around 47.8% of market share in 2024, due to their design simplicity and efficiency in various applications. These impellers are mounted on a shaft that extends beyond the pump casing, allowing for a compact design that is easy to maintain. Furthermore, their straightforward construction makes them ideal for low to medium flow applications, particularly in water supply and industrial processes. The overhung impeller design also facilitates easy adjustments and repairs, lowering downtime and operational costs. In addition to this, as industries increasingly seek reliable and cost-effective pumping solutions, the demand for overhung impeller pumps continues to grow, solidifying their position as a preferred choice in the centrifugal pump market.

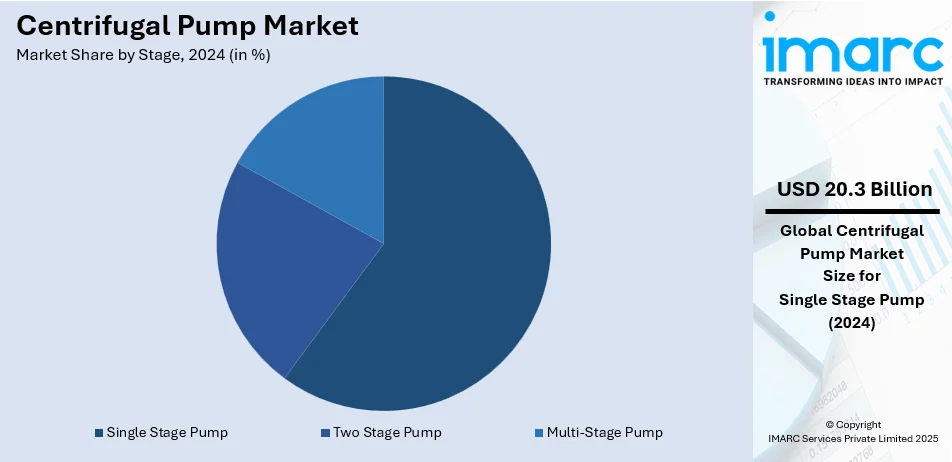

Analysis by Stage:

- Single Stage Pump

- Two Stage Pump

- Multi-Stage Pump

Single stage pump leads the market with around 60.3% of market share in 2024, primarily due to their exceptional efficacy and convenience in various applications. These pumps consist of a single impeller and are designed to handle low to moderate flow rates, making them suitable for a wide range of industries, including water supply, agriculture, and HVAC systems. In addition to this, their simple design allows for easier installation and maintenance, which is a significant advantage for end-users. Besides this, single-stage pumps are often more cost-effective compared to multi-stage alternatives, appealing to budget-conscious consumers. Furthermore, with the growing need for dependable and efficient pumping systems, single-stage pumps are anticipated to sustain their prominent position in the industry.

Analysis by Flow Type:

- Axial Flow Pumps

- Radial Flow Pumps

- Mixed Flow Pumps

Radial flow pumps lead the market with around 62.9% of market share in 2024. These pumps are recognized for their ability to handle high flow rates and provide efficient performance. In radial flow pumps, the fluid enters the impeller axially and is expelled radially, resulting in high pressure and flow efficiency. In addition, this design makes them particularly suitable for applications in water treatment, irrigation, and industrial processes. The versatility of radial flow pumps allows them to be used in various settings, from municipal water supply systems to large-scale industrial operations. Moreover, as industries increasingly prioritize efficiency and reliability, the demand for radial flow pumps continues to grow, reinforcing their importance in the centrifugal pump market.

Analysis by Capacity:

- Small Capacity

- Medium Capacity

- High Capacity

Small capacity centrifugal pumps are designed to handle lower flow rates, typically up to 100 gallons per minute (GPM). They are often used in residential water systems, small-scale irrigation, and light industrial applications. These pumps are compact, energy-efficient, and suitable for applications requiring precise control overflow rates. Medium capacity centrifugal pumps manage moderate flow rates, usually ranging from 100 to 500 GPM. They are commonly utilized in commercial buildings, municipal water systems, and medium-sized industrial processes. These pumps offer a balance between size and power, making them versatile for various applications. High-capacity centrifugal pumps are designed for large flow rates, often exceeding 500 GPM. They are essential in heavy industrial operations, large-scale water treatment plants, and extensive agricultural irrigation systems. These pumps are robust and capable of handling high volumes of water or other fluids, ensuring efficient and reliable performance in demanding applications.

Analysis by End User:

- Chemicals

- Oil and Gas

- Power Generation

- Construction

- Pharmaceuticals

- Food and Beverages

- Metals and Mining

- Water and Wastewater

- Others

Oil and gas leads the market in 2024. Centrifugal pumps are widely utilized in the oil and gas sector to pump oil, petroleum products, liquefied gases, and other fluids during operations. Furthermore, an increase in exploration and production in offshore deep-water oil and gas fields is also augmenting the adoption of centrifugal pumps. Additionally, a significant rise in the utilization of petroleum products is also catalyzing the application of centrifugal pumps in the oil and gas sector. For instance, India's consumption of petroleum products stood at almost 4.44 million barrels per day (BPD) in FY23, up from 4.05 million BPD in FY22. Similarly, in 2022, U.S. total petroleum consumption averaged about 20.28 million barrels per day (b/d), which included about 1.17 million b/d of biofuels (1.002 b/d of fuel ethanol and 0.164 b/d of biodiesel, renewable diesel, and other biofuels combined). Such a significant rise in petroleum usage is anticipated to impact the centrifugal pump industry positively.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 46.9%. The Asia-Pacific region's industrial infrastructure is witnessing growth due to business-friendly policies. Most Asian-Pacific countries are in a growing phase, and the high population growth rate has led to elevated levels of industrialization, a rise in oil and gas exploration activities, and an increase in water supply. All the aforementioned activities require centrifugal pumps. China is expected to account for the major growth in Asia-Pacific crude oil refining between 2023 and 2028. In 2021, China had an oil refining capacity of 16.9 million barrels per day. Moreover, Crude oil consumption in the region grew by 4.8% between 2011 and 2021 and accounted for around 16.41% of global consumption in 2021. Moreover, according to the United Nations University Institute of Water, Environment, and Health, in 2021, high-income nations, including China, UAE, Singapore, and Qatar, treated about 74% of the industrial and municipal wastewater they generated, and this ratio dropped to 43% in upper-middle-income countries and about 26% in lower-middle-income countries. With increasing awareness about the environment and growing water shortage, the demand for water treatment plants and, in turn, centrifugal pumps in water treatment plants are expected to increase over the forecasted period.

Key Regional Takeaways:

United States Centrifugal Pump Market Analysis

In 2024, the United States accounted for 84.80% of the market share in North America. Strong industrial activity, expansion of infrastructure, and water management systems have made the US a big market for centrifugal pumps. The nation's oil and gas sector, producing more than 19 million barrels of oil per day in 2023, relies heavily on centrifugal pumps for upstream, midstream, and downstream operations, as per reports. Another critical factor is efficient water and waste water treatment. According to statistics by U.S. Department of Homeland Security, there are more than 16,000 water treatment facilities alone in the United States. For irrigation and drainage systems in agriculture, centrifugal pumps are being used.

Besides, in the pharmaceutical and chemical industries that combinedly reach a value of more than USD 750 Billion, chemicals and solvents are moved with the aid of centrifugal pumps. Infrastructure Investment and Jobs Act worth USD 1.2 Trillion, as well as other governmental infrastructure modernization funds, facilitate the use of the latest pumping technologies in municipalities and construction applications, according to reports.

North America Centrifugal Pump Market Analysis

North America is a significant region in the global centrifugal pump market, driven by robust industrial activity and a strong focus on infrastructure development. The region's advanced manufacturing sector, particularly in oil and gas, water treatment, and chemical processing, fuels demand for efficient and reliable pumping solutions. For instance, as per industry reports, Canada stands as the sixth biggest natural gas producer and fourth-largest oil producer globally, with gas and oil production anticipated to elevate by 16% by the time period 2030 to 2032 from 2019 levels. Additionally, stringent environmental regulations encourage the adoption of energy-efficient and sustainable pump technologies. The presence of leading manufacturers and innovative companies enhances competition and drives technological advancements. Furthermore, investments in upgrading aging infrastructure and expanding water management systems contribute to market growth. As industries increasingly prioritize automation and smart technologies, North America is poised to maintain its influential position in the centrifugal pump market.

Europe Centrifugal Pump Market Analysis

The region's focus on renewable energy initiatives, tough environmental standards, and energy efficiency concerns has really helped spur a market in the centrifugal pump industry for the European continent. The Fit for 55 Plan by the European Union has led to higher investments in energy-efficient devices like pumps that help reduce the 55% rise in greenhouse gases by 2030. According to the International Energy Agency, industrial uses of over 25% of the total electricity consumed by mechanical systems such as pumping solutions account for usage in Germany alone. Therefore, these countries are on top in the adoption list for Germany, UK, and France. As per the data by European Environment Agency, Europe processes approximately 80% of its wastewater annually, which makes the market for water and wastewater treatment grow rapidly. As per the data by European Parliament, 80% of the world's offshore wind capacity is located in Europe, making centrifugal pumps indispensable for cooling and fluid management in renewable energy projects, particularly in offshore wind farms. The region's demand for high-end centrifugal pumps is also driven by modernization efforts in already operational chemical and pharmaceutical plants.

Latin America Centrifugal Pump Market Analysis

Increased investments in water management, oil and gas, and agriculture fuel the centrifugal pump market in Latin America. Centrifugal pumps are essential for irrigation in Brazil, the biggest economy in this region, whose agriculture industry contributes to nearly 7% of the GDP according to reports. Demand is significantly influenced by the oil and gas industry in the region, primarily in countries like Mexico and Venezuela. The daily average of 1.7 million barrels of oil produced in Mexico, according to media reports' data, call for efficient pumping systems in exploring and refining the oil. The demand for centrifugal pumps has increased as a consequence of increased investments in water treatment and desalination projects caused by lack of water in dry regions of Latin America. Furthermore, usage of pumps is supported by the urbanization of infrastructure development and municipal services across countries such as Argentina and Colombia.

Middle East and Africa Centrifugal Pump Market Analysis

The oil and gas sector, water management requirements, and the expansion of urban infrastructure are the primary growth drivers for the centrifugal pump market in the Middle East and Africa (MEA) region. The Middle East, which has more than 48% of the world's crude oil reserves, according to reports, is critical for petrochemical processing and better oil recovery through the use of centrifugal pumps. Large-scale water desalination plants have been invested in by nations like Saudi Arabia and the United Arab Emirates; in Saudi Arabia alone, desalination accounts for more than 60% of its drinking water production as per a research paper. The need for centrifugal pumps for irrigation and municipal water delivery systems is driven by Africa's growing urbanisation and agricultural activity. National programs such as Saudi Vision 2030 and South Africa's water development projects encourage the adoption of cutting-edge centrifugal pump technologies.

Competitive Landscape:

The competitive landscape is exhibited by the robust establishment of numerous chief players, encompassing emerging firms as well as leading manufacturers. Key companies are currently emphasizing on advancements, heavily investing in research and development projects to improve pump efficacy, energy utilization, and durability. Tactical collaborations and parentships are extensively prevalent, facilitating companies to augment their market foothold as well as product lines. For instance, in June 2024, PG Flow Solutions AS announced a tactical partnership with Ruhrpumpen, a prominent centrifugal pumps manufacturer. This alliance highlights a strategic move in proliferating abilities to cater to the Norway market by providing new, advanced pumps. In addition to this, the magnifying focus on environmental policies as well as sustainability bolsters competition, as companies are actively striving to develop environmentally friendly solutions. The market is also impacted heavily by regional dynamics, with enterprises reinventing their tactics to address the specific requirements of varied sectors, typically encompassing manufacturing, oil and gas, and water treatment.

The report provides a comprehensive analysis of the competitive landscape in the centrifugal pump market with detailed profiles of all major companies, including:

- Baker Hughes (A GE Company)

- Circor International Inc.

- Ebara Corporation

- Flowserve

- Grundfos Holding

- ITT Corporation

- Pentair Inc.

- Someflu

- Tsurumi Manufacturing Co. Ltd.

- Weir

- Wilo SE

- Xylem Inc.

Latest News and Developments:

- June 2024: TechnipFMC plc collaborated with Sulzer Flow Equipment to develop new subsea carbon dioxide (CO2) pump solutions.

- February 2024: DESMI launched a new mag-drive centrifugal pump, adding a magnetic coupling to its range of centrifugal pumps. The technology offers advantages for a methanol fuel system, combining the high efficiency and robust reliability of centrifugal pumps without the need for a traditional shaft seal solution in the pump.

- December 2023: Canada-headquartered CPC Pumps International extended its global manufacturing footprint with the completion of its first pump assembly in Pune, India.

Centrifugal Pump Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Impeller Types Covered | Overhung Impeller, Vertically Suspended, Between Bearing |

| Stages Covered | Single Stage Pump, Two Stage Pump, Multi-Stage Pump |

| Flow Types Covered | Axial Flow Pumps, Radial Flow Pumps, Mixed Flow Pumps |

| Capacities Covered | Small Capacity, Medium Capacity, High Capacity |

| End-Users Covered | Chemicals, Oil and Gas, Power Generation, Construction, Pharmaceuticals, Food and Beverages, Metals and Mining, Water and Wastewater, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Baker Hughes (A GE Company), Circor International Inc., Ebara Corporation, Flowserve, Grundfos Holding, ITT Corporation, Pentair Inc., Someflu, Tsurumi Manufacturing Co. Ltd., Weir, Wilo SE, Xylem Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the centrifugal pump market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global centrifugal pump market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the centrifugal pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The centrifugal pump market was valued at USD 33.6 Billion in 2024.

IMARC expects the centrifugal pump market to reach USD 48.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033.

Key factors driving the market encompass the magnifying need for wastewater and water management, rise in industrial applications, and the augmentation of the oil and gas industry. In addition, innovations in pump technology and the requirement for energy-saving solutions are further bolstering market expansion.

Asia Pacific currently dominates the centrifugal pump market, accounting for a share exceeding 46.9%. This dominance is fueled by heightened industrialization, urbanization, and an elevated requirement for effective water and wastewater management solutions in emerging nations.

Some of the major players in the centrifugal pump market include Baker Hughes (A GE Company), Circor International Inc., Ebara Corporation, Flowserve, Grundfos Holding, ITT Corporation, Pentair Inc., Someflu, Tsurumi Manufacturing Co. Ltd., Weir, Wilo SE, Xylem Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)