Cement Packaging Market Report by Product Type (Sewn Open Mouth, Pinched Bottom Open Mouth, Valve Sacks, Open Mouth Sacks), Material (Paper, Plastic, High-Density Polyethylene (HDPE), Polypropylene (PP)), Capacity (Up To 5 Kg, 5-15 Kg, 15-30 Kg, 30 Kg and Above), and Region 2025-2033

Market Overview:

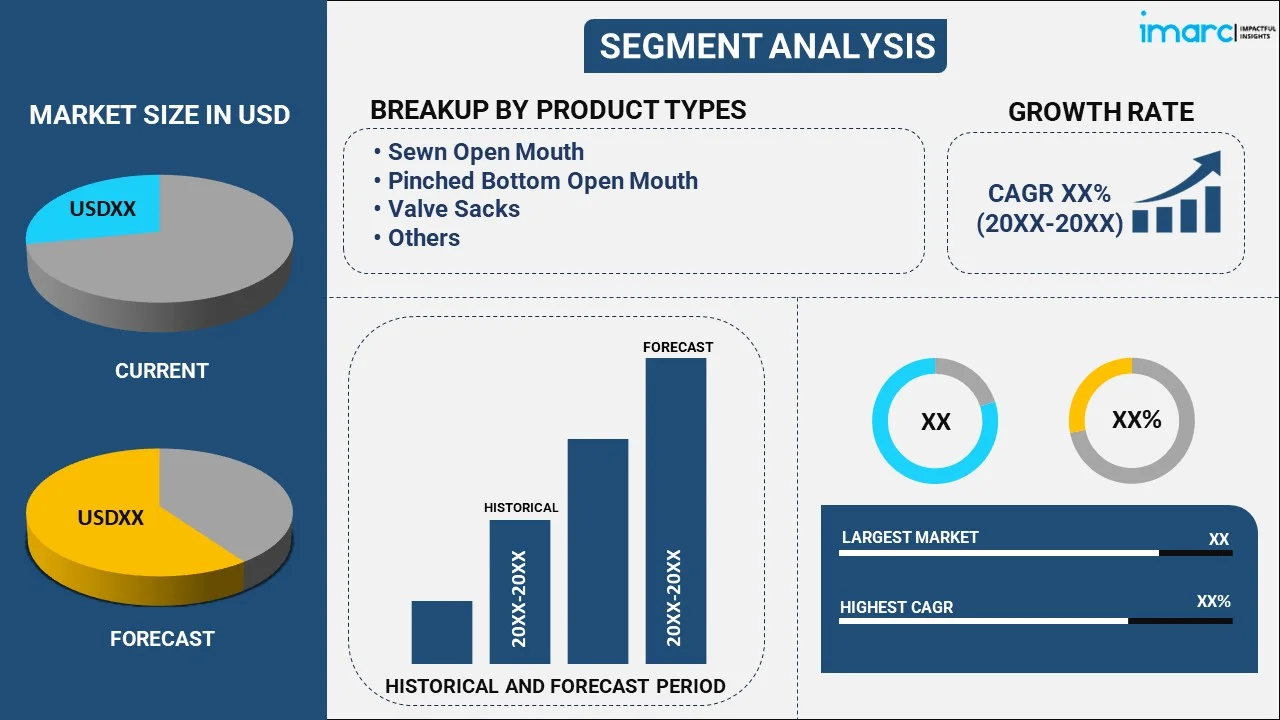

The global cement packaging market size reached USD 373.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 533.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.85% during 2025-2033. The growing construction activities, increasing demand for sustainable packaging solutions, and rising adoption to reduce the risk of landfills represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 373.1 Billion |

| Market Forecast in 2033 | USD 533.3 Billion |

| Market Growth Rate (2025-2033) | 3.85% |

Cement packaging refers to an effective packaging solution for cement that prevent it from moisture. It is packed in bags and sacks and manufactured from various materials, such as paper, plastic, high-density polyethylene (HDPE), and polypropylene (PP). It is widely available in different sizes, colors, textures, designs, and capacities. It is eco-friendly, provides enhanced printing options and low packaging cost, and reduces the wastage of the product. It is lightweight, affordable, customizable, dust and spillage-free, easy to stack, and resistant to water, tear, chemical, and weather. It assists in maintaining the quality of the product, enhancing the shelf life, and ensuring no leakage at the time of transportation. Besides this, it aids in providing durability to the cement while increasing brand or product awareness among the masses. As it is utilized in constructing industrial, residential, and commercial buildings, the demand for cement packaging is rising across the globe.

Cement Packaging Market Trends:

At present, the increasing demand for cement to build hospitals and school facilities worldwide represents one of the key factors impelling the growth of the market. Besides this, the growing utilization of packaged cement due to rising construction activities around the world is positively influencing the market. Additionally, the escalating demand for sustainable packaging solutions for cement to avoid product wastage and contamination is supporting the growth of the market. Apart from this, the increasing preference for paper bags as they provide a longer shelf life as compared to conventional plastic bags is propelling the growth of the market. In addition to this, the rising need for proper cement packaging solutions to increase profitability in a business is offering lucrative growth opportunities to industry investors. Moreover, the growing adoption of enhanced packaging solutions that reduce the risk of landfills worldwide is offering a favorable market outlook. In line with this, the increasing demand for environmentally friendly and recycled cement packaging bags to decrease harmful carbon emissions around the world is bolstering the growth of the market. Furthermore, key players are increasing their brand value by introducing innovative and designed cement packaging solutions to attract a wide consumer base, which is contributing to the growth of the market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cement packaging market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, material, and capacity.

Product Type Insights:

- Sewn Open Mouth

- Pinched Bottom Open Mouth

- Valve Sacks

- Open Mouth Sacks

The report has provided a detailed breakup and analysis of the cement packaging market based on the product type. This includes sewn open mouth, pinched bottom open mouth, valve sacks, and open mouth sacks.

Material Insights:

- Paper

- Plastic

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

A detailed breakup and analysis of the cement packaging market based on the material has also been provided in the report. This includes paper, plastic, high-density polyethylene (HDPE), and polypropylene (PP). According to the report, paper accounted for the largest market share.

Capacity Insights:

- Up To 5 Kg

- 5-15 Kg

- 15-30 Kg

- 30 Kg and Above

A detailed breakup and analysis of the cement packaging market based on the capacity has also been provided in the report. This includes up to 5 kg, 5-15 kg, 15-30 kg, and 30 kg and above.

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others) was the largest market for cement packaging. Some of the factors driving the Asia Pacific cement packaging market included the growing improvement of infrastructure, favorable government initiatives, rapid urbanization, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global cement packaging market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- Bischof+Klein SE & Co. KG

- Cherat Packaging Limited

- LC Packaging International B.V

- Mondi Plc

- Rosenflex UK Ltd.

- Taurus Packaging Private Limited

- ToolAsian Polysacks (P) Ltd.

- Uflex Limited

- Unisun Packaging Limited

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Cement Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Sewn Open Mouth, Pinched Bottom Open Mouth, Valve Sacks, Open Mouth Sacks |

| Materials Covered | Paper, Plastic, High-Density Polyethylene (HDPE), Polypropylene (PP) |

| Capacities Covered | Up To 5 Kg, 5-15 Kg, 15-30 Kg, 30 Kg and Above |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bischof+Klein SE & Co. KG, Cherat Packaging Limited, LC Packaging International B.V, Mondi Plc, Rosenflex UK Ltd., Taurus Packaging Private Limited, ToolAsian Polysacks (P) Ltd., Uflex Limited, Unisun Packaging Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global cement packaging market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global cement packaging market?

- What is the impact of each driver, restraint, and opportunity on the global cement packaging market?

- What are the key regional markets?

- Which countries represent the most attractive cement packaging market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the cement packaging market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the cement packaging market?

- What is the breakup of the market based on the capacity?

- Which is the most attractive capacity in the cement packaging market?

- What is the competitive structure of the global cement packaging market?

- Who are the key players/companies in the global cement packaging market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cement packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cement packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cement packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)