Cement Mixer Market Report by Product Type (Diesel Mixer, Drum Rotating Mixer, Twin Shaft Mixer, Tilting Mixer, Non-Tilting Mixer), End User (Industrial, Residential, Commercial), and Region 2025-2033

Cement Mixer Market Size:

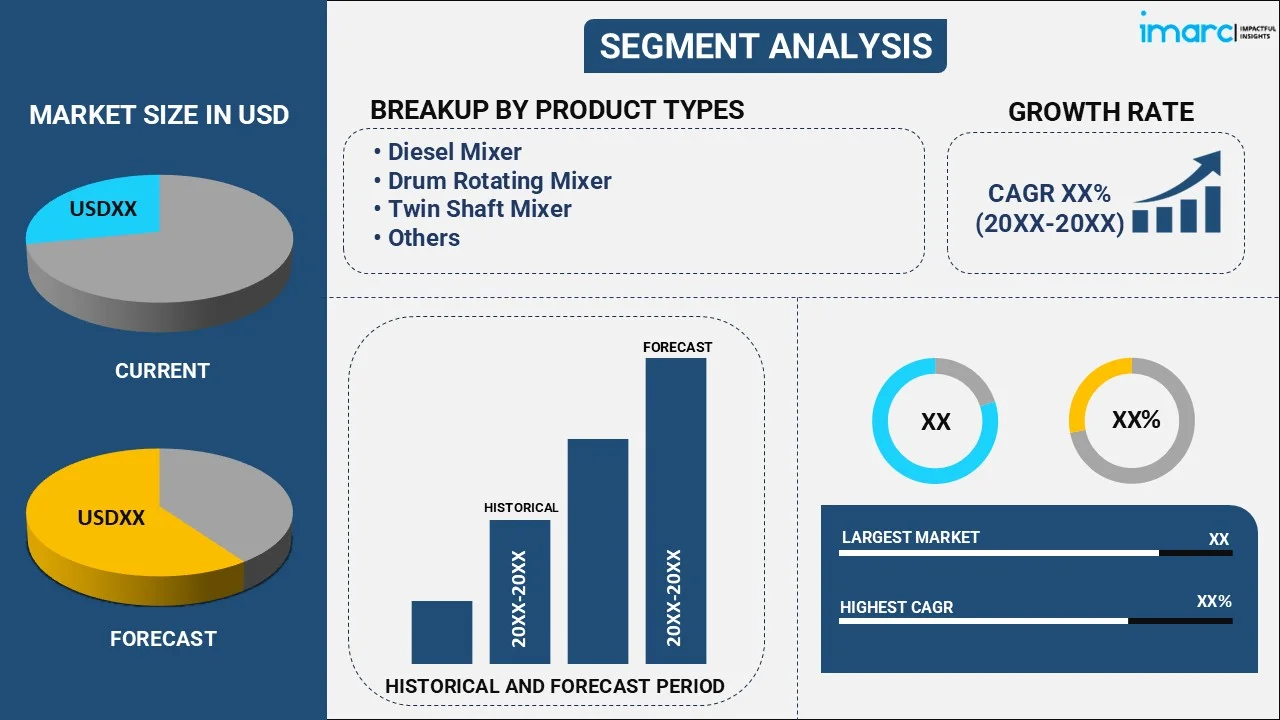

The global cement mixer market size reached USD 15.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.4 Billion by 2033, exhibiting a growth rate (CAGR) of 2.88% during 2025-2033. The market is experiencing significant growth mainly due to increase in construction activities, rapid infrastructure development, and urbanization. The rising demand for portable and durable mixers, along with advancements in automation, also contributes positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.0 Billion |

|

Market Forecast in 2033

|

USD 19.4 Billion |

| Market Growth Rate 2025-2033 | 2.88% |

Cement Mixer Market Analysis:

- Major Market Drivers: Key market drivers include the rise in global construction projects, particularly in developing regions where urbanization is accelerating. Infrastructure expansion such as roads, bridges, and residential buildings, fuels the demand for efficient mixing equipment. Technological advancements including automated and portable mixers, improve productivity and reduce labor costs further propels the market growth. The growing focus on sustainable construction and eco-friendly solutions also contributes significantly, with manufacturers developing energy-efficient models. In line with this, government initiatives and investments in infrastructure development across various regions propel the demand for high capacity and durable cement mixers.

- Key Market Trends: Key market trends include the widespread adoption of automated electric mixers, mainly driven by the need for improved efficiency and reduced emissions. Portable mixers are gaining significant traction due to their flexibility for smaller construction projects. There is also an increasing focus on energy-efficient models aligning with sustainable construction practices. Manufactures nowadays are integrating smart technologies, allowing remote monitoring and operational control, enhancing productivity on construction sites. The demand for higher-capacity mixers is rising, particularly in large-scale infrastructure projects. In addition to this, the development of mixers with lower maintenance requirements is becoming a significant trend in the industry.

- Geographical Trends: Geographical trends in the market shows significant growth in Asia-Pacific mainly driven by rapid urbanization, infrastructure development and construction activities in countries like China and India, and parts of the Southeast Asian region. North America and Europe are also key markets, with a focus on advanced technologies and eco-friendly, energy-efficient mixers to meet strict environmental regulations. In emerging regions such as Africa and Latin America, increasing government investments in infrastructure projects are spurring the product demand. Middle Eastern countries, with their large-scale commercial and residential construction projects, are witnessing a rising need for high-capacity mixers to support their expanding construction industries.

- Competitive Landscape: Some of the major market players in the cement mixer industry include Caterpillar, Liebherr-International AG, SANY GROUP, Sinotruk Hong Kong Ltd., Akona Engineering Pvt. Ltd., Henan Sanq Group Machinery Co., Ltd., Lino Sella World, Shantui Construction Machinery Co., Ltd., Terex Corporation, and Zoomlion Heavy Industry Science & Technology Co., Ltd., among many others.

- Challenges and Opportunities: Market faces various challenges including high equipment costs, which can be a barrier for small-scale contractors, and the maintenance demands of heavy machinery. Environmental regulations are also pushing manufacturers to develop more energy-efficient and eco-friendly models, which can increase production costs. However, these challenges present opportunities for innovation. The rising focus on sustainable construction and the adoption of electric and automated mixers offer manufacturers a chance to create energy-efficient products. Expanding infrastructure projects in emerging economies further open up opportunities for market growth, as the demand for advanced and portable mixers continues to rise in these regions.

Cement Mixer Market Trends:

Technological Advancements

Technological advancements are reshaping the cement mixer market with the introduction of automated and energy efficient models equipped with advanced control systems. These innovations enhance mixer performance by providing precise control over mixing speed, consistency, and output, ensuring high-quality concrete production. Automation reduces the need for manual intervention increasing operational efficiency and reducing labor costs. Energy-efficient mixers also help construction companies meet sustainability goals by minimizing power consumption and reducing emissions. With features like real-time monitoring, remote operation, and programmable settings, these technologically advanced mixers are becoming essential in modern construction projects, catering to both large-scale and small-scale applications. In line with this, in January 2024, Cemen Tech launched the CD2, a new dual bin volumetric concrete mixer. The CD2 features a split bin with compartments for transporting and blending supplementary cementing materials, such as fly ash. It offers precision in measuring, mixing, and dispensing concrete, and replaces traditional bag filters with cartridge filters for simplified maintenance.

Eco‑Friendly Solutions

Eco-friendly solutions are becoming a significant trend in the cement mixer market, driven by the need to reduce carbon emissions in construction. Manufacturers are focusing on developing mixers powered by electric or hybrid systems, replacing traditional fuel-based engines. These mixers contribute to lower air pollution and align with global sustainability goals. Additionally, eco-friendly mixers are designed to be more energy-efficient, reducing overall energy consumption on construction sites. With governments and companies prioritizing green initiatives, the demand for sustainable cement mixers is growing, paving the way for greener construction practices. For instance, in April 2023, the UK's first all-electric ready-mix concrete mixer, known as the 'e-mixer,' completed a successful three-month trial for commercial deliveries in Birmingham. Developed in collaboration with Renault Trucks and TVS Interfleet, the e-mixer produces zero tailpipe emissions and is expected to save 42 tonnes of CO2 annually. Tarmac plans to integrate these electric mixers into its urban operations as part of its sustainability strategy and commitment to achieving net zero status by 2050.

Urbanization and Infrastructure Development

The rapid pace of urbanization and infrastructure development, particularly in emerging economies, is driving significant demand in the cement mixer market. Governments are investing heavily in new infrastructure projects, such as highways, bridges, and public buildings, to support growing urban populations. This surge in construction activities increases the need for efficient and high-capacity cement mixers. Additionally, the residential sector is expanding in these regions, thereby further boosting the product demand. As cities continue to grow and modernize, the cement mixer market is expected to experience sustained growth, particularly in regions undergoing industrialization and urban expansion. According to a report published by Indian Brand Equity Foundation (IBEF), in the Interim Budget 2024-25, India increased capital investment for infrastructure by 11.1% to Rs. 11.11 lakh crore (US$ 133.86 billion), accounting for 3.4% of GDP. The National Infrastructure Pipeline (NIP) now includes 9,142 projects across 34 sub-sectors, with an estimated investment of US$ 1.9 trillion. India aims to reduce logistics cost from 14% to 8% of GDP and raise its ranking in the Logistics Performance Index to 25 within five years. These statistics are reflective of the steadily expanding infrastructural projects and construction activities, which is facilitating the need for cement mixers, thereby contributing to the market growth.

Cement mixer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type and end user.

Breakup by Product Type:

- Diesel Mixer

- Drum Rotating Mixer

- Twin Shaft Mixer

- Tilting Mixer

- Non-Tilting Mixer

Tilting Mixer accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes diesel mixer, drum rotating mixer, twin shaft mixer, tilting mixer and non-tilting mixer. According to the report, tilting mixer represented the largest segment.

Tilting mixers dominate the cement mixer market due to their flexibility and ease of use, particularly in handling large batches of concrete. The design allows for the drum to tilt, making it easier to pour and mix materials efficiently. This feature is especially useful in construction sites where rapid discharge and mobility are key. Tilting mixers are preferred for their ability to produce uniform concrete mixtures with minimal effort, catering to a variety of construction needs. Their capacity to handle different material viscosities also adds to their popularity, making them a top choice for large-scale projects. For instance, in September 2023, D&C Engineers became the exclusive UK distributor of the Erie Strayer 8m3 tilting drum mixer, known for its exceptional craftsmanship and innovative design. This remarkable mixer can produce 160m3 of concrete per hour when combined with a D&C plant. The advancements in product offerings and strategic partnerships are creating a positive cement mixer market outlook, thus driving the growth and product adoption globally further.

Breakup by End User:

- Industrial

- Residential

- Commercial

Commercial holds the largest share of the industry

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, residential, and commercial. According to the report, commercial accounted for the largest market share.

The commercial sector holds the largest share of the cement mixer market, driven by high demand in large-scale construction projects such as office buildings, shopping centers, and infrastructure developments. Commercial applications require high-capacity mixers that can efficiently produce large volumes of concrete, which makes industrial-grade mixers essential. Additionally, the continuous expansion of urban areas and infrastructure projects has fueled the demand for reliable, high-performance cement mixers. These machines are designed to handle the rigorous requirements of commercial construction, making them a preferred choice for contractors seeking durability, efficiency, and the ability to meet tight project timelines.

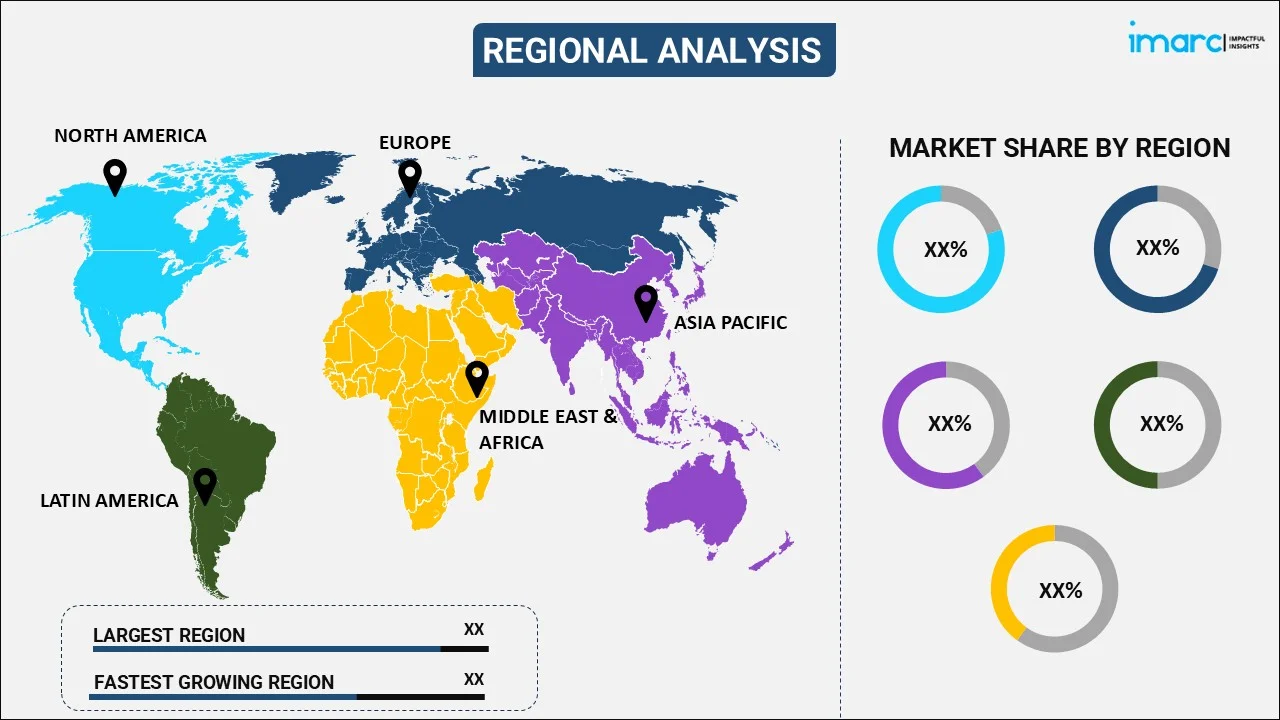

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest cement mixer market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for cement mixer.

Asia Pacific leads the cement mixer market, accounting for the largest share due to rapid urbanization, infrastructure development, and expanding construction activities across countries like China, India, and Japan. Government initiatives focused on building smart cities and enhancing public infrastructure have significantly boosted the demand for cement mixers in the region. For instance, in August 2024, the Cabinet Committee on Economic Affairs (CCEA) approved the establishment of 12 industrial smart cities with a total investment of Rs 28,500 crore under National Industrial Corridor Development Programme (NICDP). The initiative aims to generate 12 lakh direct jobs and 20 lakh indirect jobs. The cities include Agra, Prayagraj, Gaya, Jodhpur, among others, prioritizing clean and sustainable industrial development. The projects aim to drive investments and create a vibrant industrial ecosystem, fostering $2 trillion in exports by 2030. Such significant endeavors and initiatives by the government prove critical in driving the product demand, thereby contributing to the market growth. Additionally, the growing population and rising disposable income are driving residential construction, further propelling cement mixer market growth. The presence of key manufacturers and the availability of low-cost labor also contribute to the region's dominance, positioning Asia Pacific as a key market for cement mixers in both residential and commercial projects.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the cement mixer industry include Caterpillar, Liebherr-International AG, SANY GROUP, Sinotruk Hong Kong Ltd., Akona Engineering Pvt. Ltd., Henan Sanq Group Machinery Co., Ltd., Lino Sella World, Shantui Construction Machinery Co., Ltd., Terex Corporation, and Zoomlion Heavy Industry Science & Technology Co., Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The cement mixer market is highly competitive, with several key players striving to capture market share through product innovation and enhanced distribution networks. Companies are focusing on offering more efficient and technologically advanced mixers to cater to the growing demand in construction, infrastructure development, and residential projects. Additionally, many manufacturers are expanding their product portfolios by introducing portable mixers and eco-friendly models to appeal to diverse consumer needs. Strategic collaborations, mergers, and acquisitions are also common as companies look to strengthen their global presence and stay competitive in this rapidly evolving market.

Cement Mixer Market News:

- In September 2024, JCB Tools unveiled four new high-performance cement mixers designed for trade professionals. The new models, including the JCB-CM150P, JCB-CM150E-110, JCB-CM150E, and JCB-CMH150P, offer innovative features such as seam-welded drums, powerful motors, and high working capacities, catering to the demands of construction environments. These mixers are now available through authorized JCB dealers and the JCB Tools website, aiming to provide superior performance and durability for construction projects.

- In February 2023, CEMEX and Volvo Trucks launched the world's first fully electric heavy concrete mixer truck at an event in Berlin, Germany. The Volvo FMX electric truck will operate at the Berlin Spandau ready-mix plant, aiming to reduce carbon emissions and improve productivity. Both companies are committed to ambitious sustainability targets, with CEMEX aiming to become a net-zero CO2 company by 2050 and Volvo Trucks targeting net-zero greenhouse gas emissions in its value chain by 2040.

Cement Mixer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Diesel Mixer, Drum Rotating Mixer, Twin Shaft Mixer, Tilting Mixer, Non-Tilting Mixer |

| End Users Covered | Industrial, Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Caterpillar, Liebherr-International AG, SANY GROUP, Sinotruk Hong Kong Ltd., Akona Engineering Pvt. Ltd., Henan Sanq Group Machinery Co., Ltd., Lino Sella World, Shantui Construction Machinery Co., Ltd., Terex Corporation, Zoomlion Heavy Industry Science & Technology Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cement mixer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cement mixer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cement mixer industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global cement mixer market was valued at USD 15.0 Billion in 2024.

The rising development of smart cities, along with the growing construction activities in the residential and commercial sectors, represent some of the key factors driving the global cement mixer market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in the temporary halt in numerous construction activities which, in turn, is limiting the overall demand for cement mixer.

Based on the end user, the global cement mixer market can be segmented into industrial, residential, and commercial. Among these, the commercial represents the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global cement mixer market include Caterpillar, Liebherr-International AG, SANY GROUP, Sinotruk Hong Kong Ltd., Akona Engineering Pvt. Ltd., Henan Sanq Group Machinery Co., Ltd., Lino Sella World, Shantui Construction Machinery Co., Ltd., Terex Corporation, and Zoomlion Heavy Industry Science & Technology Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)