Cellulose Fibers Market Size, Share, Trends and Forecast by Fiber Type, Application, and Region, 2025-2033

Cellulose Fibers Market Size and Share:

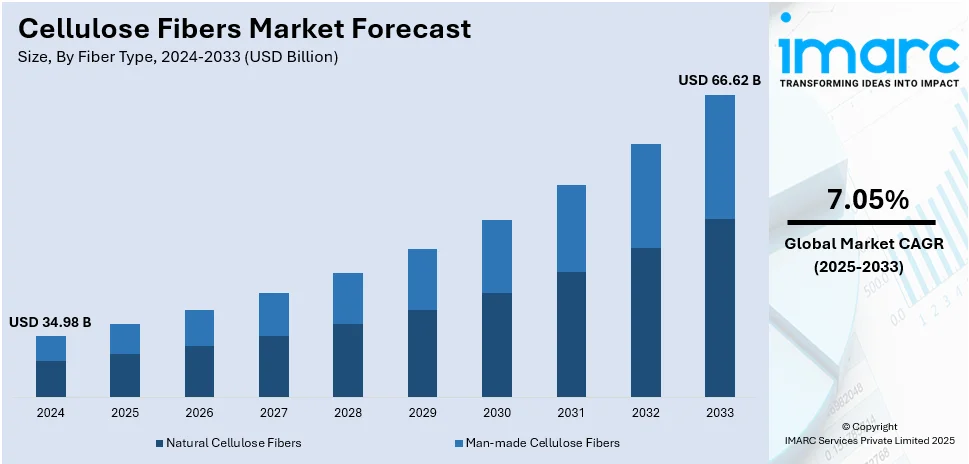

The global cellulose fibers market size was valued at USD 34.98 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 66.62 Billion by 2033, exhibiting a CAGR of 7.05% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 38.5% in 2024, due to its strong textile industry, high production of raw materials like wood pulp, and growing demand for sustainable fabrics. Leading manufacturers and cost-effective production further strengthen the region’s market position.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 34.98 Billion |

|

Market Forecast in 2033

|

USD 66.62 Billion |

| Market Growth Rate (2025-2033) | 7.05% |

The global cellulose fibers market is experiencing growth driven by an increasing demand for sustainable and biodegradable textiles, supported by stringent environmental regulations promoting eco-friendly alternatives to synthetic fibers. The rising preference for natural and renewable materials in apparel, home textiles, and industrial applications is further accelerating market expansion. Additionally, advancements in production technologies, coupled with growing investments in sustainable fiber development, are enhancing product efficiency and affordability. The expanding global population and heightening disposable incomes are also propelling requirement for cellulose fibers in hygiene products, contributing to cellulose fibers market growth. The shift toward circular economies is reinforcing industry momentum.

The United States plays a significant role in the global cellulose fibers market, driven by strong demand from the textile, hygiene, and industrial sectors. Increasing consumer preference for sustainable and biodegradable materials supports market growth, particularly in apparel and home textiles. The expanding nonwoven fabric industry, used in medical and personal care products, further accelerates demand. For instance, as per industry reports, in September 2024, Shalag U.S. Inc., a prominent nonwoven fabric producer announced significant investment of USD 16.6 Million for development of a new production plant in North Carolina. Technological advancements in fiber processing and the presence of key manufacturers enhance market competitiveness. Additionally, stringent environmental regulations promoting eco-friendly alternatives to synthetic fibers facilitate the market expansion, reinforcing the country’s position as a key contributor to global cellulose fiber market demand.

Cellulose Fibers Market Trends:

Growing Demand for Biodegradable and Eco-Friendly Textiles

The increasing emphasis on sustainability and environmental consciousness is driving demand for biodegradable fabrics, significantly benefiting the cellulose fibers market. As cellulose fibers are derived from wood pulp, they are biodegradable, skin-friendly, and environmentally sustainable, making them a preferred choice in the textile industry. As per industry reports, the global eco fiber market increased to USD 52.8 Billion in the year 2024, reflecting the growing shift toward eco-friendly alternatives. Additionally, technological advancements, such as the incorporation of cellulose nanofibrils (CNFs) and cellulose nanocrystals (CNCs), enhance the mechanical properties, biocompatibility, and biodegradability of cellulose fibers, further expanding their applications in textiles and other industrial uses.

Expansion of Industrial and Technical Textile Applications

One of the key cellulose fibers market trends is their increasing use in industrial and technical textiles, such as upholstery, curtains, and nonwoven fabrics, is a key market driver. According to reports, the technical textiles sector constitutes approximately 15% of India's overall textile and apparel industry, playing a significant role in attracting investments and generating employment opportunities. Favorable government policies promoting plant-based sources over petrochemical-derived fibers further support market expansion. Additionally, the cost-effectiveness and easy availability of raw materials enhance cellulose fiber adoption. As industrial applications continue to expand, cellulose fibers are witnessing growing demand across multiple sectors, reinforcing their importance in sustainable textile solutions and industrial manufacturing.

Rising Government Initiatives and Regulatory Support for Sustainable Fibers

Governments across the globe are deploying policies to incentivize the use of plant-based fibers over synthetic alternatives, driving demand for cellulose fibers. Regulatory frameworks supporting sustainability, such as restrictions on plastic-based textiles and incentives for eco-friendly production, are accelerating market growth. Countries in Europe and North America are enforcing stringent environmental regulations, encouraging manufacturers to adopt cellulose fibers in apparel, home textiles, and industrial applications. For instance, as per industry reports, in June 2024, European Union implemented Ecodesign Directive for textile sector, steering 80% of a product's environmental influnce. Fashion brands in the EU are mandated to priorotize transparency, durability, and recyclability. Fortifying sustainability, new textile ecodesign requirements will enhance traceability and finalize by 2025 mid, ensuring resource efficiency and consumer awareness. Additionally, government-backed research into advanced fiber technologies and sustainable raw material sourcing is fostering innovation, further strengthening cellulose fibers’ position as a preferred choice in the global textile and industrial sectors.

Cellulose Fibers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cellulose fibers market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fiber type and application.

Analysis by Fiber Type:

- Natural Cellulose Fibers

- Cotton Fibers

- Jute Fibers

- Wood Fibers

- Others

- Man-made Cellulose Fibers

- Viscose Fibers

- Lyocell Fibers

- Modal Fibers

- Others

Man-made cellulose fibers stand as the largest fiber type in 2024, holding around 53.9% of the market, due to their superior performance, sustainability, and versatility. These fibers, including viscose, lyocell, and modal, are derived from natural cellulose sources such as wood pulp but undergo chemical processing to enhance properties like strength, softness, and moisture absorption. Their growing demand is driven by increasing sustainability initiatives, as they serve as eco-friendly alternatives to synthetic fibers like polyester. Advancements in fiber manufacturing, including closed-loop production processes that minimize environmental impact, further fortify their market position. Key players are making investments in innovative technologies to improve biodegradability and durability, addressing consumer and regulatory demands for sustainable textile solutions. Rising applications across textiles, home furnishings, and industrial uses fuel market expansion, with increasing adoption in fashion and hygiene products. Additionally, government policies promoting biodegradable materials over petroleum-based fibers contribute to the continued growth of man-made cellulose fibers in the global market.

Analysis by Application:

- Apparels

- Home Textiles

- Medical and Hygiene

- Others

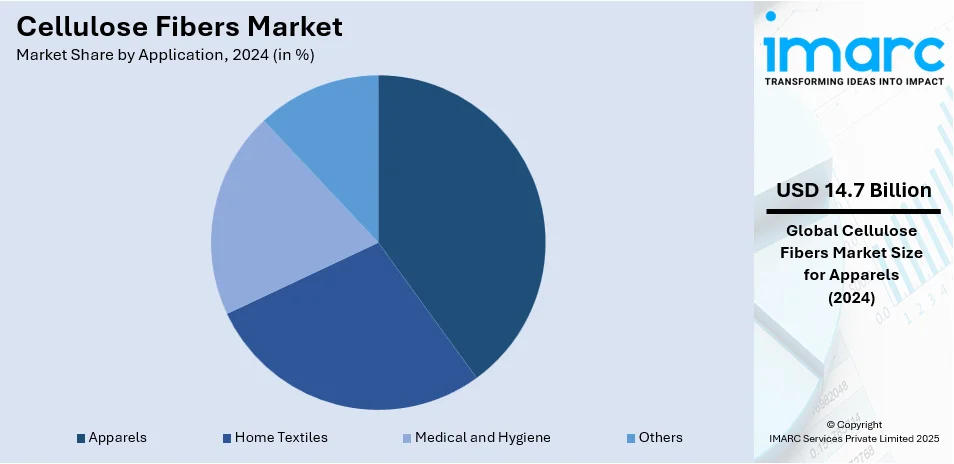

Apparels lead the market with around 42.0% of cellulose fibers market share in 2024, driven by increasing demand for sustainable and comfortable clothing. Cellulose fibers, particularly viscose, lyocell, and modal, are widely used in fashion due to their soft texture, breathability, and biodegradability. Consumers are increasingly prioritizing eco-friendly and ethical fashion, prompting brands to integrate cellulose-based fibers into their product lines. The rise of sustainable fashion movements and stringent environmental regulations restricting synthetic fiber use further support market growth. Leading apparel manufacturers are collaborating with fiber producers to develop innovative fabrics with enhanced durability and reduced environmental impact. Additionally, the expansion of fast fashion, coupled with growing demand for premium and performance-based textiles, is accelerating cellulose fiber adoption in the apparel sector. As brands enhance transparency and traceability in their supply chains, cellulose fibers continue to strengthen their foothold in the global apparel industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 38.5%. Asia-Pacific’s cellulose fibers market is driven by robust textile manufacturing in countries like China, India, and Bangladesh, coupled with rising consumer demand for sustainable products. According to industry reports, 90% of 16,000 surveyed consumers in the region are willing to pay a premium for sustainable products, yet many refrain from purchasing due to a lack of information or distrust in sustainability claims. This highlights the opportunity for cellulose fibers, as consumers increasingly seek eco-friendly alternatives in textiles. Government initiatives promoting sustainability, such as China’s carbon reduction goals, further propel market growth. Additionally, the shift toward biodegradable nonwoven fabrics in personal care and medical applications boosts demand. With increased disposable incomes and e-commerce expansion, demand for sustainable apparel grows, supported by investments in fiber production and technological innovations. Strong collaborations between textile producers and fashion brands foster the development of new, sustainable materials, further shaping a positive cellulose fiber market outlook.

Key Regional Takeaways:

United States Cellulose Fibers Market Analysis

In 2024, United States accounted for 88.20% of the market share in North America. The U.S. cellulose fibers market is driven by growing sustainability concerns, stringent environmental regulations, and increasing demand for biodegradable fibers in textiles. The U.S. textile market reached USD 188.3 Billion during 2024 and is expected to grow to USD 277.4 Billion by the year 2033, showcasing a CAGR of 4.1% from 2025-2033, according to IMARC Group. This growth fuels cellulose fiber adoption as brands integrate eco-friendly materials into apparel and home textiles. Rising consumer preference for breathable, moisture-absorbing fabrics in activewear and sportswear further boosts demand. The nonwoven sector, particularly in hygiene and medical applications, accelerates market expansion. Additionally, advancements in fiber production, such as lyocell and modal technologies, enhance market penetration. Circular economy initiatives and government incentives promoting renewable materials drive industry transformation. Investments in domestic fiber manufacturing improve supply chain resilience and competitiveness. Furthermore, increasing applications in plant-based packaging and filtration solutions strengthen cellulose fiber demand. Collaborations between industry players and research institutions foster innovation, leading to enhanced fiber performance. The shift toward sustainable textiles, coupled with regulatory support, ensures long-term market growth. Expanding corporate commitments to environmental responsibility and evolving consumer preferences reinforce cellulose fibers’ role in the U.S. textile industry's transition to sustainability.

North America Cellulose Fibers Market Analysis

North America holds a critical position in the global cellulose fibers market, driven by strong demand from the textile, hygiene, and industrial sectors. The region's increasing focus on sustainability and eco-friendly alternatives is accelerating the adoption of cellulose fibers in apparel, home textiles, and nonwoven fabrics. Rising consumer preference for biodegradable and renewable materials supports market expansion, particularly in personal care and medical applications. In addition to this, advancements in fiber processing technologies and government initiatives promoting sustainable raw materials further drive market growth. The presence of key industry players, coupled with stringent environmental regulations restricting synthetic fiber usage, reinforces North America's role as a key contributor to the cellulose fibers market, fostering innovation and investment in sustainable textile solutions. For instance, as per industry reports, government of New York and California announced to implement ban on utilization of PFAS in apparel and textile from January 2205. Textile producers are also mandated to leverage the alternative with least toxicity.

Europe Cellulose Fibers Market Analysis

Europe’s cellulose fibers market is supported by stringent environmental regulations, circular economy initiatives, and rising consumer demand for sustainable textiles. The 2023 Fashion Transparency Index reveals that 51% of 250 leading global brands now have a sustainable materials strategy, highlighting the region’s growing commitment to eco-friendly products. This shift drives the adoption of cellulose fibers as brands prioritize sustainable alternatives. The European Union’s Green Deal and related legislation further incentivize the use of biodegradable fibers, fostering market expansion. Additionally, rising demand for eco-friendly nonwoven fabrics in sectors such as personal care, automotive, and medical products enhances market growth. Increasing collaborations between fiber producers and fashion brands stimulate innovation, resulting in the development of higher-quality sustainable textiles. The region’s focus on reducing textile waste and promoting fiber recycling strengthens the market’s prospects. Technological advancements in fiber production and processing improve product performance, supporting cellulose fibers as a key solution for sustainable fashion. As the shift toward bio-based and circular economy-driven materials continues, the demand for cellulose fibers in Europe is expected to sustain long-term growth, driven by both consumer preferences and regulatory frameworks.

Latin America Cellulose Fibers Market Analysis

Latin America’s cellulose fibers market is driven by the region’s growing textile sector and increasing environmental awareness. The Latin American textile recycling market reached USD 280.8 Million in 2024 and is anticipated to grow to USD 520.6 Million by 2033, depicting a CAGR of 6.6% from 2025 to 2033, according to IMARC Group. This growth supports the adoption of sustainable fibers, as demand for eco-friendly materials rises in apparel and packaging industries. The region benefits from government initiatives promoting sustainable manufacturing, as well as increasing investments in innovative textile recycling and fiber production technologies, further strengthening market prospects.

Middle East and Africa Cellulose Fibers Market Analysis

The Middle East and Africa’s cellulose fibers market is supported by growing sustainability initiatives, rising demand for biodegradable textiles, and expanding nonwoven applications. According to report, the fashion ecosystem in Saudi Arabia contributes to 1.8% of the total workforce, employing 230,000 people. This highlights the significant role of textiles in the region’s economy, driving demand for sustainable materials like cellulose fibers. Government regulations promoting eco-friendly materials, along with increasing investments in fiber manufacturing, bolster market growth. Additionally, international brands entering the region accelerate the shift toward sustainable textiles, further supporting cellulose fiber adoption.

Competitive Landscape:

The market is showcasing intense competition, with key players currently gravitating towards sustainability, technological innovations, and product innovation. Major companies are investing in eco-friendly production processes and advanced fiber technologies to enhance product performance and sustainability. Strategic partnerships, mergers, and acquisitions are shaping the competitive landscape, enabling market expansion and portfolio diversification. For instance, as per industry reports, in December 2024, Birla Cellulose, a major man-made cellulosic fiber provider and Circ strategically partnered to boost the expansion of recycling fibers in the textiles segment. This alliance not only caters to the shared target for a sustainable ecosystem but also facilitates the establishment of benchmarks in the textile sector. Furthermore, companies are also emphasizing transparency and traceability in their supply chains to comply with evolving environmental regulations. Additionally, increasing R&D efforts to develop high-performance cellulose fibers with enhanced durability and biodegradability are driving market differentiation, reinforcing competition among global and regional players.

The report provides a comprehensive analysis of the competitive landscape in the cellulose fibers market with detailed profiles of all major companies, including:

- CFF GmbH & Co. KG

- China Bambro Textile (Group) Co. Ltd.

- Daicel Corporation

- Eastman Chemical Company

- Fulida Group Holdings Co. Ltd.

- Grasim Industries Ltd.

- Kelheim Fibres

- Lenzing AG

- Sateri Holdings Ltd.

- Shandong Helon Textiles Sci. & Tech. Co. Ltd.

- Tangshan Sanyou Xingda Chemical Fiber Co. Ltd.

- Zhejiang Fulida Co. Ltd.

Latest News and Developments:

- December 2024: ANDRITZ has opened a technical center in Montbonnot, France, to advance dry molded fiber (DMF) production for sustainable packaging. The center, in partnership with PulPac, features a pilot line for R&D, product trials, and custom designs. This initiative enhances ANDRITZ’s capacity to produce eco-friendly packaging, supporting the green transition.

- October 2024: International Paper is reviewing strategic options for its Global Cellulose Fibers (GCF) business, aligning with its focus on sustainable packaging. The GCF business produces absorbent pulp used in personal care products and specialty pulp for textiles, construction materials, and more. The company has engaged Morgan Stanley as a financial advisor for the review, which may not lead to a transaction.

- October 2024: Lenzing Group has acquired a minority stake in TreeToTextile AB, joining shareholders LSCS Invest, H&M Group, Stora Enso, and Inter IKEA Group. The partnership focuses on advancing sustainable cellulose fiber production in the textile industry.

- September 2024: Birla Cellulose hosted the second edition of its hub-meet at The Residency, Karur, on 30th August 2024, with 110 exporters and company owners from the Karur cluster. The event highlighted the role of sustainable Man-Made Cellulosic Fibers (MMCF) in home textiles, focusing on eco-friendly solutions that align with consumer demand for sustainability.

- August 2024: Lidl Switzerland, in partnership with Swiss cheese producer Hardegger Käse, has introduced cellulose-based packaging for organic Usserrhödler as well as Alpstein mountain cheeses. Composed from leftover wood from FSC-certified forestry, the packaging is free of crude oil-based materials and aims to preserve taste and ensure safety of product. Currently available in over 100 stores, primarily in German-speaking Ticino as well as Switzerland, this initiative is part of Lidl’s sustainability strategy to reduce plastic use by 30% by 2025.

Cellulose Fibers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fiber Types Covered |

|

| Applications Coverage |

Apparels, Home Textiles, Medical and Hygiene, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CFF GmbH & Co. KG, China Bambro Textile (Group) Co. Ltd., Daicel Corporation, Eastman Chemical Company, Fulida Group Holdings Co. Ltd., Grasim Industries Ltd., Kelheim Fibres, Lenzing AG, Sateri Holdings Ltd., Shandong Helon Textiles Sci. & Tech. Co. Ltd., Tangshan Sanyou Xingda Chemical Fiber Co. Ltd., Zhejiang Fulida Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cellulose fibers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cellulose fibers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cellulose fibers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cellulose fibers market was valued at USD 34.98 Billion in 2024.

IMARC estimates the cellulose fibers market to reach USD 66.62 Billion by 2033, exhibiting a CAGR of 7.05% during 2025-2033.

The market is driven by rising demand for sustainable textiles, increasing environmental regulations, and growing consumer preference for biodegradable materials. Advancements in fiber processing, expanding applications in apparel and hygiene products, and government initiatives promoting plant-based fibers over synthetics further support market growth and innovation.

Asia Pacific currently dominates the cellulose fibers market, accounting for a share exceeding 38.5%. This dominance is fueled by its strong textile manufacturing base, abundant raw material availability, and increasing demand for sustainable and cost-effective fibers in apparel, home textiles, and industrial applications.

Some of the major players in the cellulose fibers market include CFF GmbH & Co. KG, China Bambro Textile (Group) Co. Ltd., Daicel Corporation, Eastman Chemical Company, Fulida Group Holdings Co. Ltd., Grasim Industries Ltd., Kelheim Fibres, Lenzing AG, Sateri Holdings Ltd., Shandong Helon Textiles Sci. & Tech. Co. Ltd., Tangshan Sanyou Xingda Chemical Fiber Co. Ltd., Zhejiang Fulida Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)