Cell Separation Technologies Market Size, Share, Trends and Forecast by Product, Cell Type, Technology, Application, End User, and Region, 2025-2033

Cell Separation Technologies Market Size and Share:

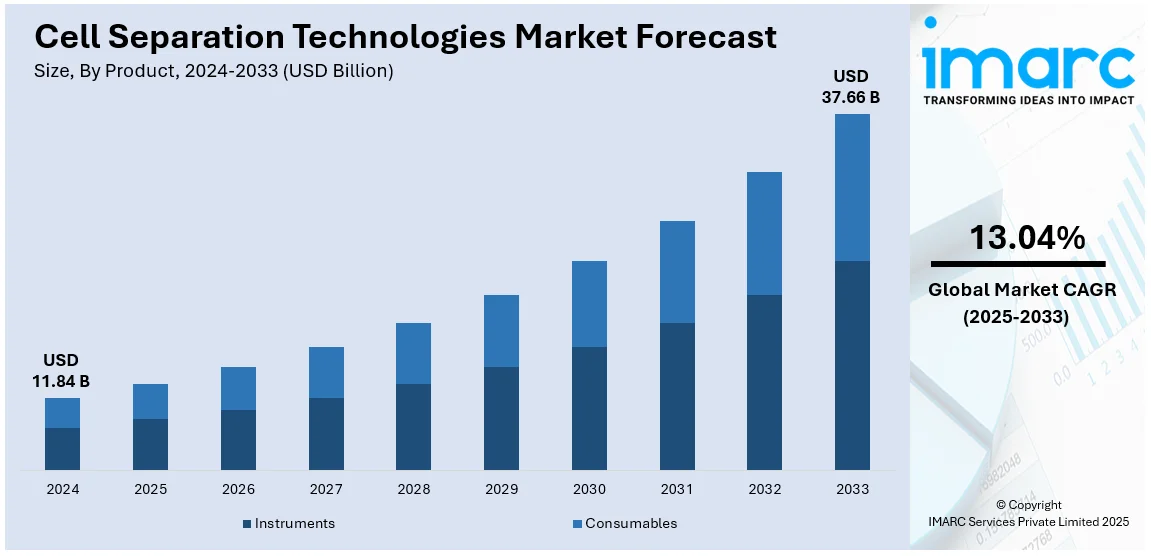

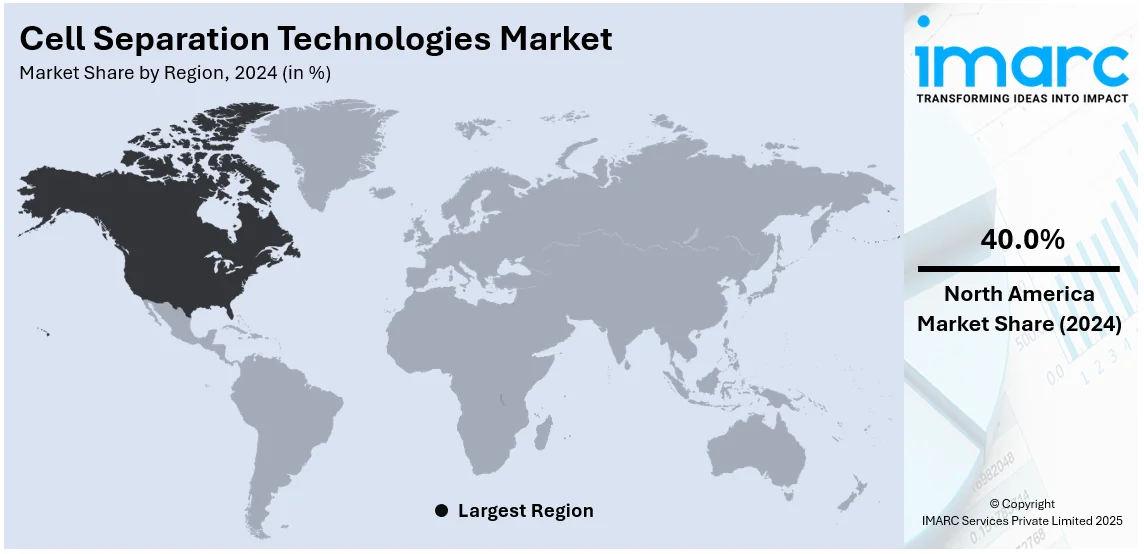

The global cell separation technologies market size was valued at USD 11.84 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 37.66 Billion by 2033, exhibiting a CAGR of 13.04% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.0% in 2024. The rising adoption of cell separation technologies across the pharmaceutical and biotechnology sectors, the growing demand for personalized medicine, and ongoing technological advancements in the industry represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.84 Billion |

|

Market Forecast in 2033

|

USD 37.66 Billion |

| Market Growth Rate (2025-2033) | 13.04% |

The innovations in biotechnology, such as personalized medicine, gene therapies, and immunotherapies, require precise cell separation techniques for isolating specific cell populations. The rising incidence of diseases like cancer, neurological disorders, and autoimmune conditions drives the demand for targeted treatments and research, boosting the need for efficient cell separation methods. The rising emphasis on stem cell research and regenerative therapies fuels the demand for cell separation technologies to isolate stem and progenitor cells for therapeutic use. Increased funding and investments in biopharmaceutical and biotech sectors drive the need for advanced cell separation technologies for drug discovery and biologic production. The factors, collectively, are creating a positive cell separation technologies market outlook across the globe.

The U.S. has world-leading research institutions and hospitals, fostering advancements in biotechnology, drug development, and regenerative medicine that rely on cell separation technologies. With the growing incidence of cancer, neurological disorders, and autoimmune diseases, there is a high demand for precise cell separation methods to support targeted therapies and personalized medicine. The U.S. biopharmaceutical sector is a global leader, requiring efficient cell separation for biologic production, vaccine development, and immunotherapies. U.S. government initiatives and private sector investments in healthcare and biotechnology provide substantial support for advancements in cell separation technologies, which also represent one of the key cell separation technologies market trends. For instance, in January 2025, Akadeum Life Sciences announced the development of The Alerion™ Microbubble Cell Separation method, which is deemed as unmatched in the field of cell therapy in terms of level of support provided. The initiative generated a line-up for a two-to-three-week demo and demands to buy the system, demonstrating Alerion's potential to expedite much-needed advancements in the cell therapy manufacturing industry.

Cell Separation Technologies Market Trends:

Advancements in Biotechnology and Healthcare

The ongoing innovations in biotechnology, particularly in genomics, cell-based therapies, and precision medicine, drive the demand for advanced cell separation technologies. For instance, in April 2024, Multiply Labs, a robotics company creating industry-leading automated manufacturing systems to produce customized drugs, and GenScript Biotech Corporation (GenScript), one of the world's leading providers of life-science research tools and services, announced a strategic partnership centered on automating the cell isolation phase of cell therapy manufacturing to simplify this time-consuming procedure. Techniques such as stem cell therapy, immunotherapies, and gene editing rely on the efficient isolation of specific cell types to ensure optimal therapeutic outcomes. As the healthcare sector continues to adopt personalized medicine, the need for high-precision and scalable cell separation systems grows, supporting advancements in both clinical treatments and pharmaceutical research and facilitating the cell separation technologies market demand.

Increasing Prevalence of Chronic Diseases

The growing incidence of chronic diseases like cancer, neurological disorders, and autoimmune diseases has created a surge in demand for targeted treatments. For instance, in February 2024, The U.S. Food and Drug Administration approved Amtagvi (lifileucel), the first cellular therapy recommended for the treatment of adult patients with melanoma, a type of skin cancer that cannot be surgically removed (unresectable) or that has metastasized to other parts of the body (metastatic) after being treated with other therapies (PD-1 blocking antibody, and a BRAF inhibitor with or without a MEK inhibitor if the patient has a BRAF V600 mutation). Cell separation technologies are critical for isolating specific cell populations needed for cancer research, immunotherapies, and regenerative medicine. As the worldwide burden of chronic diseases increases, the demand for more efficient and scalable cell separation methods is projected to rise. This factor significantly boosts market growth, as research and therapeutic solutions require precise cell isolation for drug development and clinical applications.

Growth in Stem Cell and Regenerative Medicine

The expanding focus on stem cell research and regenerative medicine represents one of the major cell separation technologies market trends. Stem cells are pivotal for creating therapies aimed at tissue regeneration, organ repair, and the treatment of degenerative diseases. Isolating specific stem cell populations is crucial for their effective application in clinical settings. Advances in separation technologies, such as magnetic bead-based and fluorescence-activated sorting methods, enhance stem cell purity and yield, making them essential for growing biotechnological and regenerative treatments, which accelerates market growth. For instance, in July 2024, STEMCELL Technologies commercially introduced the CellPoreTM Transfection System, a ground-breaking new technology. It has the potential to further research into cell engineering and the creation of innovative cell therapies for the treatment of illnesses.

Cell Separation Technologies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cell separation technologies market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, cell type, technology, application, and end user.

Analysis by Product:

- Instruments

- Consumables

Consumables stand as the largest component in 2024, holding around 62.8% of the market. Consumables hold the largest share of the cell separation technologies market due to their recurring demand in research and clinical applications. These include reagents, beads, kits, and filters, essential for every cell separation process. Unlike equipment, which involves a one-time investment, consumables are continually required for each experiment, driving consistent revenue. The growing use of cell separation in cancer research, immunology, and regenerative medicine further boosts their demand. Additionally, advancements in consumable technologies, such as magnetic beads and specialized reagents for higher precision and efficiency, contribute to their dominance in the market, catering to the evolving needs of researchers and clinicians.

Analysis by Cell Type:

- Human Cells

- Animal Cells

Human cells are expected to lead the cell separation technologies market share because they provide essential functions for biomedical research, drug development, and personalized medicine applications. Human cells serve essential functions during disease studies and immunotherapy development and play a vital role in enabling stem cell therapy along with other regenerative medicine applications. The growing focus on cancer research and precision medicine further drives the demand for efficient human cell separation. Additionally, human cells are vital in cell-based assays for drug screening and toxicity studies. The expanding use of human cells in research and clinical activities becomes possible through advancements in separation technologies which employ magnetic as well as flow cytometry methods to isolate specific cell types.

Animal cells hold a significant share in the market due to their extensive use in preclinical studies, biotechnology, and vaccine development. They are indispensable for studying disease mechanisms, testing drug efficacy, and producing biologics, such as monoclonal antibodies. The agriculture and veterinary sectors also utilize animal cells in genetic research and therapeutic advancements. The isolation of animal cells using reliable separation techniques such as centrifugation and filtration commonly allows their use for a broad range of purposes. The growth of this segment is driven by rising demand for biopharmaceuticals and preclinical research due to continued reliance on animal cells as a faucet between basic research and clinical application development.

Analysis by Technology:

- Centrifugation-based Cell Separation

- Surface marker-based Cell Separation

- Filtration-based Cell Separation

The widespread use of centrifugation results from its dependable performance combined with cost-effective operation and quick separation capabilities for sorting cells by size and density. This technique exists as a fundamental laboratory approach for applications that include cell separation, blood component separation, and research trials. Its ease of use, scalability, and compatibility with other methods make it indispensable in both basic and advanced studies, contributing significantly to its large market share in the cell separation technologies sector.

Surface marker-based techniques, including magnetic-activated and fluorescence-activated cell sorting, are highly valued for their specificity and precision. By targeting unique cell surface markers, they allow researchers to isolate desired cell populations for applications in immunology, stem cell research, and cancer therapy. These advanced technologies are critical for high-purity separation, driving their demand in both research and clinical settings. Their efficiency and versatility solidify their position as a major contributor to the market share.

Isolating cells via size and morphology is favored by filtration-based cell separation for simplicity, speed, and cost-effective applications. This method is widely used for large-scale applications such as bioprocessing or cell culture preparation as it’s scalable and easy to integrate into an automated workflow. High throughput processes and minimal dependence on specialist equipment are factors that make filtration a dominant influence on the cell separation technologies market growth.

Analysis by Application:

- Oncology Research

- Neuroscience Research

- Stem Cell Research

- Microbiology

- Immunology Research

- Others

Oncology research drives the demand for cell separation technologies as isolating specific tumor cell types is crucial for studying cancer mechanisms and developing targeted therapies. Techniques like surface marker-based sorting allow researchers to isolate cancer stem cells or circulating tumor cells for analysis. These advancements are essential for personalized cancer treatments, diagnostics, and biomarker discovery, which significantly contribute to the growing market share in oncology research.

In neuroscience research, cell separation technologies are used to isolate specific neuronal and glial cell populations for studying brain diseases, neural development, and regenerative therapies. Accurate separation of cells from the nervous system aids in understanding neurodegenerative disorders like Alzheimer’s and Parkinson’s. The increasing focus on neurobiology and neurotherapeutics, combined with advancements in cell sorting technologies, boosts the demand for these tools in neuroscience research, driving its market share.

Stem cell research drives the cell separation technologies market because scientists need exact methods to separate stem cells and progenitor cells when studying cell differentiation along with medical applications using regenerative medicine. Magnetic-activated cell sorting systems enable the clinical utilization of specific stem cell populations enabling both tissue regeneration and gene therapy applications. The fast pace of stem cell therapy development and their extensive disease-treating capabilities create an enduring market need for cell separation technologies in this sector.

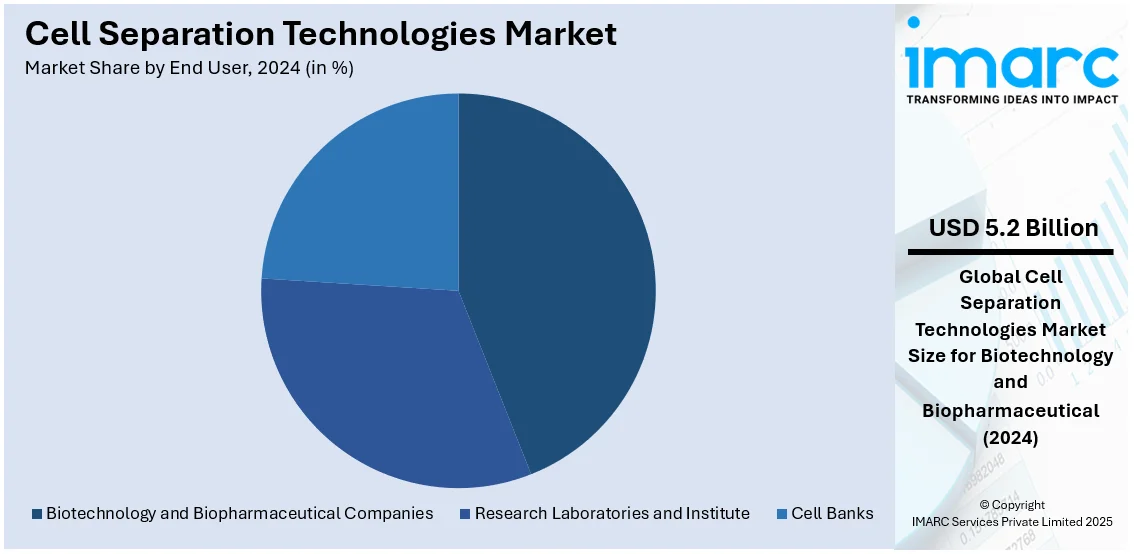

Analysis by End User:

- Research Laboratories and Institute

- Biotechnology and Biopharmaceutical Companies

- Cell Banks

Biotechnology and biopharmaceutical companies leads the market with around 43.7% of the cell separation technologies market share in 2024. Biotechnology and biopharmaceutical companies depend heavily on cell separation technologies throughout their processes of drug development, vaccine generation, and biomanufacturing operations. Cell separation needs precision to obtain high-quality cell isolates for making biologics including monoclonal antibodies and providing safety and effectiveness to therapeutic products. Edge-cutting cell separation systems play a vital role in both delivering cell-based therapies and supporting immuno-oncology treatments and personalized medical practices. The commercial need for novel medicines along with rising biopharmaceutical activities and research pushes ongoing requirements for advanced separation technologies in these markets.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.0%. North America, particularly the U.S. and Canada, has a robust healthcare system and leading research institutions, fostering advancements in cell-based therapies, drug discovery, and personalized medicine. The increasing prevalence of cancer, neurological disorders, and chronic diseases fuels the need for targeted treatments, driving demand for efficient cell separation technologies in both research and clinical applications. Significant investments in biotechnology, life sciences, and healthcare by government agencies and private sectors provide ample resources for innovation in cell separation technologies. North America's dominance in the biopharmaceutical industry creates high demand for cell separation in drug development, biologics production, and vaccine research

Key Regional Takeaways:

United States Cell Separation Technologies Market Analysis

In 2024, the United States accounted for the largest market share of over 90.20% in North America. The United States remains a key player in the global cell separation technologies market, driven by advancements in biotechnology, healthcare research, and precision medicine. One of the major factors propelling growth is the increasing demand for cell-based therapies and immunotherapies, particularly in oncology and regenerative medicine. The U.S. is home to leading biopharmaceutical companies, research institutions, and hospitals that utilize cell separation technologies for drug development, clinical trials, and disease diagnosis. As per reports, there was 2,325 brand name pharmaceutical manufacturing in the US businesses as of 2023. In additions, the growing focus on personalized medicine, which relies heavily on accurate cell isolation techniques for developing tailored treatments, is offering a favorable market outlook. Apart from this, the integration of automation and artificial intelligence in laboratory processes further enhances the precision and efficiency of cell separation technologies, making them indispensable for research and clinical applications. Furthermore, government funding and public-private partnerships also fuel innovation, ensuring the market’s continuous growth. Moreover, the increasing prevalence of chronic diseases like cancer, cardiovascular conditions, and autoimmune disorders is prompting healthcare systems to adopt cell separation technologies for diagnosis, therapy development, and disease management. Additionally, the U.S. regulatory environment, which supports clinical trials and innovations in healthcare, also fosters the market's growth, making it a significant hub for medical device and biotechnology companies.

Asia Pacific Cell Separation Technologies Market Analysis

The Asia Pacific region is experiencing rapid growth in the cell separation technologies market due to increasing healthcare investments, technological advancements, and a rise in chronic diseases. Countries such as Japan, India, and China, are driving market expansion, as they are making significant strides in medical research and biotechnology. Besides this, the rising geriatric population in these nations contributes to the demand for cell separation technologies, which are essential in developing new therapies for age-related conditions such as cancer, diabetes, and neurological disorders. According to the UNFPA, by 2050, the percentage of the elderly population in India is projected to double to over 20% of the total population. In line with this, the expanding healthcare infrastructure in emerging markets is enabling wider adoption of advanced medical technologies, including cell separation. Moreover, there is an increase in the focus on stem cell research and regenerative medicine, which require sophisticated cell isolation methods to enable clinical applications. Furthermore, the ongoing digital transformation of healthcare systems, including AI-driven diagnostic tools and automated laboratory processes, further propels the demand for more efficient and precise cell separation solutions. Government initiatives and funding aimed at enhancing healthcare capabilities also support the growth of the market in this region. The rising awareness of personalized medicine and increasing investments from both private and public sectors create a favorable environment for the continued adoption of cell separation technologies across the region.

Europe Cell Separation Technologies Market Analysis

In Europe, the cell separation technologies market is being influenced by a combination of advancements in medical research, healthcare infrastructure, and government initiatives. The rising prevalence of chronic diseases and conditions like cancer, diabetes, and cardiovascular diseases has created a strong demand for efficient diagnostic and therapeutic solutions, where cell separation plays a crucial role. In line with this, Europe is at the forefront of stem cell research, where cell isolation techniques are critical in advancing regenerative medicine and cell-based therapies. The region's robust healthcare system and highly skilled workforce support the widespread adoption of cutting-edge technologies in hospitals and research laboratories. As per reports, in 2023, over 40% of doctors in Norway, Ireland and Switzerland, and over 50% of nurses in Ireland were foreign-trained. Additionally, Europe benefits from strong regulatory support for clinical trials, facilitating the development and testing of new treatments. The European Union’s commitment to biotechnology innovation and investment in healthcare research provides further impetus to the market's growth. Apart from this, European governments are increasingly funding initiatives aimed at improving the quality of healthcare, which includes the development of advanced technologies like cell separation. Furthermore, the collaboration between private industry and academic research institutions drives innovation, ensuring the market remains competitive and forward-looking.

Latin America Cell Separation Technologies Market Analysis

Rising cases of chronic diseases, the growing focus on healthcare infrastructure, and government initiatives aimed at improving medical research capabilities, are major factors that are propelling the market growth. As per reports, the number of individuals with diabetes are expected to reach 19,224.1 by 2030 in Brazil. Moreover, Brazil, Mexico, and Argentina are leading the market as they are investing in advanced healthcare technologies and biotechnology. The need for better disease diagnostics and treatment options, especially for cancer and autoimmune diseases, is spurring the demand for cell separation technologies. Apart from this, the expanding research and development sector, along with greater access to global healthcare trends, is enabling wider adoption of cell-based therapies in Latin America. The region’s growth is also supported by international collaborations and funding aimed at addressing public health challenges.

Middle East and Africa Cell Separation Technologies Market Analysis

The Middle East and Africa region’s cell separation technologies market is witnessing growth driven by increasing healthcare investments, particularly in the Gulf Cooperation Council (GCC) countries. Governments in the UAE, Saudi Arabia, and Qatar are focusing on enhancing their healthcare infrastructure, which includes the adoption of advanced diagnostic tools such as cell separation technologies. According to reports, healthcare expenditure in the Gulf Cooperation Council (GCC) is predicted to reach USD 135.5 Billion by 2027. Additionally, rising cases of chronic diseases like diabetes, cancer, and cardiovascular disorders are creating a demand for innovative therapeutic approaches, driving the need for precision medicine. Furthermore, growing research collaborations and the expansion of biopharmaceutical industries in the region contribute to market growth, especially in nations like South Africa, where scientific research is gaining momentum.

Competitive Landscape:

The cell separation technologies market is highly competitive, fueled by the rising demand for cell-based therapies, cancer research, and advancements in biotechnology. Key players include Thermo Fisher Scientific, Merck KGaA, Becton, Dickinson and Company, STEMCELL Technologies, and Miltenyi Biotec, which dominate the market with innovative product offerings and strong research capabilities. Emerging companies focus on niche segments like microfluidics and single-cell analysis. Strategic collaborations, acquisitions, and product launches are common strategies to strengthen market presence. Technological advancements, such as automated cell separation systems and magnetic bead-based techniques, further intensify competition as companies aim to meet the evolving demands of healthcare and research sectors.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Akadeum Life Sciences

- Alfa Laval AB

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Corning Incorporated

- Merck KGaA

- Miltenyi Biotec Inc.

- PerkinElmer Inc.

- pluriSelect Life Science UG (haftungsbeschränkt) & Co. KG

- Stemcell Technologies Inc.

- Terumo Corporation

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- September 2024: Sony Corporation ("Sony"), a technology pioneer driving innovation in the field of flow cytometry, and Cellares, the world's first Integrated Development and Manufacturing Organization (IDMO) and a leader in automated cell therapy manufacturing, announced a partnership to jointly develop and integrate advanced flow cytometry-based cell analysis and sorting solutions into the Cellares Cell ShuttleTM, an automated cell therapy manufacturing platform.

- May 2024: China's premier supplier for bioprocesses, Duoning Biotechnology Group ("Duoning"), established a strategic alliance with Bioelectronica, a company that specializes in creating instruments for single-cell/single-bacteria research. The goal of this collaboration is to increase the worldwide marketing of Hypercell®, a high-throughput single-cell sorting device, and other associated goods.

- February 2024: Scientists at MIT and the Singapore-MIT Alliance for Research and Technology created a microfluidic cell sorter that can eliminate almost half of a batch of undifferentiated cells tumor-forming cells without harming the fully-formed progenitor cells.

- October 2023: The global leader in buoyancy-based cell separation technology, Akadeum Life Sciences, unveiled a sneak peek at their AlerionTM cell separation system. The device will use Akadeum's ground-breaking Buoyancy Activated Cell Sorting (BACSTM) microbubble technology to offer a closed system for removing T cells from a leukopak. The device promises to reduce cell depletion, increase cell recovery, automate several manual tasks, improve sample processing resilience, speed up the cell separation process, and lower the frequency of user errors.

Cell Separation Technologies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Instruments, Consumables |

| Cell Types Covered | Human Cells, Animal Cells |

| Technologies Covered | Centrifugation-based Cell Separation, Surface marker-based Cell Separation, Filtration-based Cell Separation |

| Applications Covered | Oncology Research, Neuroscience Research, Stem Cell Research, Microbiology, Immunology Research, Others |

| End Users Covered | Research Laboratories and Institute, Biotechnology and Biopharmaceutical Companies, Cell Banks |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akadeum Life Sciences, Alfa Laval AB, Becton, Dickinson and Company, Bio-Rad Laboratories Inc., Corning Incorporated, Merck KGaA, Miltenyi Biotec Inc., PerkinElmer Inc., pluriSelect Life Science UG (haftungsbeschränkt) & Co. KG, Stemcell Technologies Inc., Terumo Corporation and Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cell separation technologies market from 2019-2033.

- The cell separation technologies market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cell separation technologies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cell separation technologies market was valued at USD 11.84 Billion in 2024.

The cell separation technologies market is projected to exhibit a CAGR of 13.04% during 2025-2033, reaching a value of USD 37.66 Billion by 2033.

The cell separation technologies market is driven by increasing demand for personalized medicine, advancements in cell-based research, growing prevalence of chronic diseases, and rising investments in biopharmaceutical development. Technological innovations, expanding applications in cancer research and regenerative medicine, and the surge in stem cell therapy further propel market growth.

North America currently dominates the cell separation technologies market, accounting for a share of 40.0%. In North America, the cell separation technologies market is driven by advanced healthcare infrastructure, rising chronic disease prevalence, and biopharmaceutical research.

Some of the major players in the cell separation technologies market include Akadeum Life Sciences, Alfa Laval AB, Becton, Dickinson and Company, Bio-Rad Laboratories Inc., Corning Incorporated, Merck KGaA, Miltenyi Biotec Inc., PerkinElmer Inc., pluriSelect Life Science UG (haftungsbeschränkt) & Co. KG, Stemcell Technologies Inc., Terumo Corporation and Thermo Fisher Scientific Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)