Cell Isolation Market Size, Share, Trends and Forecast by Technique, Cell Type, Product, Application, End Use, and Region, 2025-2033

Cell Isolation Market Size and Share:

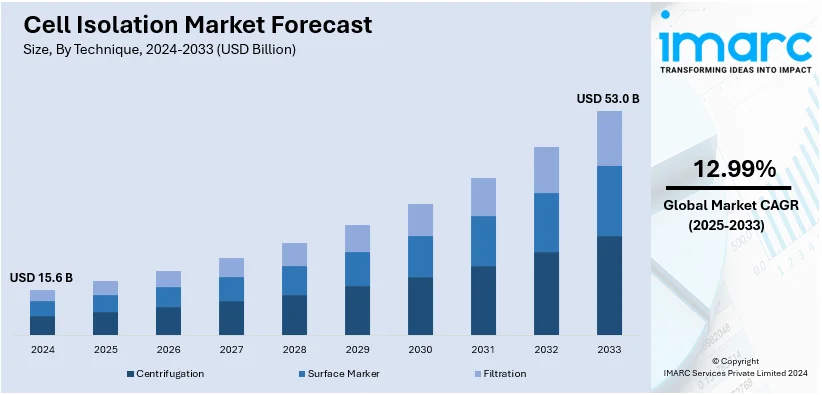

The global cell isolation market size reached USD 15.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 53.0 Billion by 2033, exhibiting a growth rate (CAGR) of 12.99% during 2025-2033. North America, currently dominates the market, holding a market share of over 39.9% in 2024. An increase in chronic illnesses, the necessity for effective isolation methods, the rising demand for regenerative medicine and cell-based therapies, and rising investments in biotechnology and life sciences are factors facilitating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.6 Billion |

| Market Forecast in 2033 | USD 53.0 Billion |

| Market Growth Rate (2025-2033) | 12.99% |

The expanding field of regenerative medicine and the escalating need for efficient cell isolation techniques influence the global cell isolation market growth. The increasing prevalence of chronic diseases in turn creates a demand for advanced cell-based therapies, promoting the market's overall growth. Consequently, more investment and funding in the biotechnology and life sciences segments fuel research and development (R&D) activities, which further increase the market momentum. The increasing demand for personalized medicine, further boosts the requirement for specific cell isolation methods, thus propelling the market growth. The rising emphasis on cancer research and the demand for targeted therapies are contributing to the market growth. The market is further driven by the increasing aging population base and rapid collaborations between academic institutions and industry players.

In the United States, the market is driven by significant advancements in biotechnology and biopharmaceutical research. An increased demand for personalized medicine and regenerative therapies, along with rising incidences of chronic diseases like cancer, boosts the need for precise cell isolation methods. Government funding for healthcare research, coupled with private sector investments, supports innovation in cell isolation technologies. Furthermore, the growing trend toward cell-based therapies and immunotherapies in cancer and autoimmune diseases is fueling market expansion. The presence of leading pharmaceutical and biotechnology companies, along with robust healthcare infrastructure, also accelerates the adoption of cell isolation technologies in clinical and research settings. For instance, in April 2024, Multiply Labs, a robotics company creating industry-leading automated manufacturing systems to produce customized drugs, and GenScript Biotech Corporation (GenScript), one of the world's top suppliers of life-science research tools and services, announced a strategic partnership centered on automating the cell isolation phase of cell therapy manufacturing to simplify this time-consuming procedure.

Cell Isolation Market Trends:

Expanding Field of Regenerative Medicine

The expanding field of regenerative medicine is closely related to the expansion of the worldwide cell isolation market. Regenerative medicine highlights employing the potential of cells to repair broken tissues and organs, thereby modernizing medical treatment paradigms. The need for accurate and effective cell separation methods is becoming more and more clear as researchers investigate regenerative medicines. Isolation of specialised cell types with high purity is vital to guarantee the accomplishment of regenerative procedures. Modern cell separation technologies are developed and adopted in response to this demand, which fuels market growth. Concerning bodies across the globe are making policies and schemes to further advance the field. For instance, 11 policy proposals were created by the US Government Accountability Office to help address the issues or improve the advantages of regenerative medicine.

Rising Prevalence of Chronic Diseases

The escalating prevalence of chronic diseases has ignited a pressing need for advanced cell-based therapies, thereby driving significant growth in the cell isolation market. Chronic diseases like diabetes, cardiovascular disease, and neurodegenerative disorders present significant obstacles for healthcare systems around the world. According to the US Department of Health and Human Services, an estimated 129 Million Americans endure at least one severe chronic illness, such as cancer, diabetes, hypertension, heart disease, and obesity. The number of Americans living with numerous chronic illnesses is rising; 42% have two or more, and 12% have at least five. Chronic illness has a significant influence on the US health care system in addition to its personal toll. Approximately 90% of the USD 4.1 Trillion spent on health care each year goes towards treating and managing mental health issues and chronic illnesses. Cell-based therapies secure massive potential in addressing these tasks by offering regenerative and personalized treatment methods. In order to harness the potential of such therapies, the isolation of viable and functionally intact cells is vital. This imperative has led to intensified research and development efforts to innovate efficient cell isolation methods that cater to the diverse needs of cell-based treatments, shaping the trajectory of the market.

Funding and Investments in Biotechnology and Life Sciences Sectors

Strong funding and developments in the biotechnology and life sciences sectors are driving the market for cell isolation upward. The biotechnology industry across the globe has seen a surge in venture capital (VC) funding during the last three years. For instance, as per the data by Indian Investment Grid, India alone has 15 investment projects totalling USD 3.71 Million in the biotechnology subsector. Private investors, governments, and venture capitalists understand how revolutionary advances in cell separation techniques can be for various uses, such as medication development and illness treatment. Thus, significant financial funds into research initiatives directed towards developing and improving the technologies of cell isolation. Such an inflow of money can further develop new methods, as well as lead to the commercialization of advanced cell isolation products. The market is driven forward by the combination of scientific research and financial investments, placing it at the forefront of technical and medical innovation.

Cell Isolation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cell isolation market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technique, cell type, product, application, and end use.

Analysis by Technique:

- Centrifugation

- Surface Marker

- Filtration

Centrifugation leads the market with around 43.8% of market share in 2024. Important factors supporting the expansion of the centrifugation segment include rising awareness of the diversity of centrifugation procedures, which may isolate a variety of cell types, from subcellular organelles to blood components. Technological improvements in centrifuges, resulting in faster processing and better separation efficiency, also continue to support their wide adoption. The proven reliability and ease of use ensure that the method finds favor with an extensive user base of researchers and clinicians. Centrifugation further meets compatibility standards with the varying sample sizes and volumes, thus being flexible enough to provide for a multitude of experimental needs. Its compatibility with numerous sample sources, such as blood, tissues, and cell cultures, situates centrifugation as a versatile and significant technique in cell isolation workflows, driving its segment growth within the broader market landscape.

Analysis by Cell Type:

- Human Cells

- Animal Cells

Animal cells leads the market with around 53.7% of market share in 2024. The growing use of animal cells in drug development and scientific research is the main factor driving the expansion of animal cell isolation. The increasing demand for effective separation techniques has also been driven by the need for biopharmaceuticals, increasingly using animal cell cultures for production. The increasing regenerative medicine use encourages the investigation of treatments relying on animal cells and requires optimized protocols for isolation. Furthermore, the increase in chronic diseases requires advanced disease modeling utilizing animal cells, further driving the segment's growth. Technological developments in cell isolation techniques support market growth by meeting the complex needs of animal cell isolation. Partnerships between academic institutions and industry players enable knowledge discussion, thereby contributing to innovative resolutions in this segment.

Analysis by Product:

- Consumables

- Reagents, Kits, Media and Sera

- Beads

- Disposables

- Instruments

- Centrifuges

- Flow Cytometers

- Filtration Systems

- Magnetic-activated Cell Separator Systems

Consumables lead the market with around 62.2% of market share in 2024. The consumables segment in the market is driven by the increasing adoption of cell-based therapies and regenerative medicine leading to a boost in demand for consumable products for cell isolation procedures. The demand for effective and reliable consumables including reagents, kits, and disposables is growing as clinicians and researchers endeavor to channel the potential of cell therapies. The increasing incidences of chronic conditions have emphasized personalized medicine and precision treatment, compelling specific consumables for isolating target cell populations. Advances in consumable technologies such as better labeling and tagging agents have improved the efficiency and precision of cell isolation. Furthermore, collaborations between research institutions and consumable manufacturers have driven innovation, leading to the development of specialized products tailored to diverse research needs.

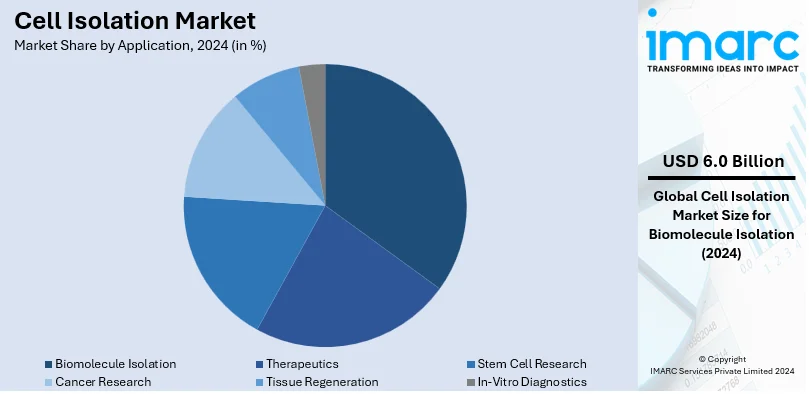

Analysis by Application:

- Biomolecule Isolation

- Therapeutics

- Stem Cell Research

- Cancer Research

- Tissue Regeneration

- In-Vitro Diagnostics

Biomolecule isolation leads the market with around 38.7% of the market share in 2024. The major driver for the increase in this segment is the growing field of proteomic and genomic research. The need to extract biomolecules for diagnosis and treatment is increasing because of the growing interest in personalized medicine. Furthermore, biomolecule isolation has become a prerequisite for drug discovery and development of pharmaceutical and biotechnology companies. Technological advancements, particularly in automation and microfluidics, enhance the efficiency and scalability of isolation methods, further driving market growth. Partnerships and collaborations among market players and academic institutions create a knowledge exchange for innovative isolation solutions. This provides impetus to segmental growth as much from rising demand for biomolecules for research applications as it does from the biopharmaceutical industry.

Analysis by End Use:

- Biotechnology and Biopharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Research Laboratories and Institutes

- Others

Research laboratories and institutes lead the market with around 49.2% of the market share in 2024. The growth of the research laboratories and institutes segment is boosted by the increasing landscape of scientific discovery, which has pushed the demand for cutting-edge tools. Additionally, the growing emphasis on improvements in the biological sciences and healthcare fields calls for effective cell isolation methods, which is propelling market expansion. Partnerships between academia and industry strengthen research capabilities, encouraging the need for high-quality cell isolation tools. In line with this, rising funding and grants focus sources toward research institutions, aiding investment in advanced isolation methodologies. Additionally, the vigorous nature of research demands flexible solutions, boosting the uptake of customizable cell isolation products. Furthermore, the continuous evolution of drug discovery and development deepens the dependence on robust cell isolation for accurate experimentation.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.9%. The region's strong healthcare system and significant research investment are the main drivers of North America's cell isolation market expansion. Furthermore, the need for precise cell-based treatments is fueled by the rise of chronic illnesses like diabetes and cardiovascular conditions, which encourages the use of effective isolation techniques. In line with this, the presence of major biotechnology and pharmaceutical players, coupled with strong research partnerships between academia and industry, promotes technological innovation. Additionally, research and development activities are supported by significant funding from both public and private organizations, which encourages the market's growth. Aside from this, the need of accurate cell separation is increased by North America's growing emphasis on personalized medicine and regenerative medicines. North America's dominant position in the global market is further enhanced by the region's regulatory framework and strict quality standards, which foster the commercialization of cutting-edge cell isolation products.

Key Regional Takeaways:

United States Cell Isolation Market Analysis

Improvements in biomedical research and the rising need for personalised therapy are driving the US cell isolation market. With the help of organisations like the National Institutes of Health (NIH), which gave out nearly USD 47 Billion in research grants in 2023, the United States is at the forefront of life sciences innovation. The use of cell therapy, especially CAR-T therapies, to treat illnesses like cancer has grown in popularity, thereby increasing the need for effective cell isolation technologies. Since isolated cells are essential for creating regenerative therapies, the market is also growing because of an increase in chronic diseases including diabetes and autoimmune disorders. With more than 20,000 current studies involving cell isolation technologies, the increasing prevalence of clinical trials suggests increased market activity. Additionally, the necessity for sophisticated cell processing techniques is highlighted by the growth of biosciences in the country. According to data from the Biotechnology Innovation Organization, the biosciences sector's overall economic impact on the US economy in 2021, as determined by total output, was USD 2.9 trillion. The United States also has a strong network of academic and research institutions, which promotes innovation in cell separation methods like magnetic-activated cell sorting (MACS) and microfluidics. Market expansion is further accelerated by the Food and Drug Administration's support for cell-based therapies and regenerative medicine. This is furthered with the creation of innovative cell separation solutions by businesses like BD Biosciences and Thermo Fisher Scientific, which, in turn, is contributing to the market growth.

Europe Cell Isolation Market Analysis

The growing frequency of infectious and chronic diseases, along with rising investments in healthcare innovation, are driving the cell isolation market in Europe. The use of cell isolation methods is accelerated by the substantial funding of biomedical research provided by the European Union's Horizon Europe initiative, which has a Euro 95.5 Billion (USD 100 Billion) budget (2021–2027). The market is growing because of the region's emphasis on cell-based treatments for neurological illnesses and cancer. France, Italy, and Germany are leading centers with a significant number of stem-cell transplants. According to data from the European Union, Germany had the highest rate of stem cell transplants among EU members in 2018 (9.6 per 100,000 population), closely followed by Italy (9.4). The Netherlands (8.4; 2017 statistics), Belgium (8.4), Sweden (8.2), and France (8.6 per 100,000 population) came next. The market expansion is also supported by regulatory frameworks that support advanced therapeutics, such as the Advanced Therapy Medicinal Products (ATMP) classification system established by the European Medicines Agency. Furthermore, the need for cell-based diagnostics and therapies is fuelled by Europe's ageing population, which is expected to account for 28% of the continent's total population by 2030.

Asia Pacific Cell Isolation Market Analysis

A major market for cell isolation is developing in Asia-Pacific as a result of rising healthcare spending and an increased emphasis on regenerative medicine. China and India are significant contributors; the biotechnology sector in China is expanding at a rate of more than 15% per year, as per an industrial report. Government initiatives such as the "Made in China 2025" plan showcase advancements in biopharmaceuticals and cellular therapies. Japan is also at the forefront, with approved induced pluripotent stem cell (iPSC)-based treatments, which has raised demand for cell isolation. In line with this, the Biotechnology Industry Research Assistance Council (BIRAC), a non-profit Section 8, Schedule B, Public Sector Enterprise established by the Department of Biotechnology (DBT), Government of India, has a flagship program called the "Biotechnology Ignition Grant Scheme (BIG)" that identifies and funds innovative ideas in the biotech industry, further augmenting the research in this field. Market expansion is further accelerated by the region's growing interest in precision medicine and the rising incidence of infectious diseases. Cell isolation methods are also more widely available due to the region's economic production of consumables and reagents.

Latin America Cell Isolation Market Analysis

Growing research into infectious diseases like dengue and Zika is driving the demand for cell isolation in Latin America. With the help of government programs to improve the infrastructure for biomedical research, Brazil and Mexico are the leaders in the region. Cell isolation technologies are becoming more and more popular, partly due to the growth of biobanks and stem cell research initiatives, particularly in Brazil. International partnerships with research institutes in North America and Europe have also made cutting-edge technologies more accessible. Opportunities for cell-based therapeutics that target chronic diseases like diabetes and cardiovascular ailments are created by the region's growing healthcare market. As per the data by International Trade Administration, Brazil is the largest healthcare market in Latin America and spends 9.47% of its GDP on healthcare, which represents USD 161 Billion.

Middle East and Africa Cell Isolation Market Analysis

The rising prevalence of chronic illnesses and infectious disorders is driving growth in the Middle East and Africa (MEA) cell isolation market. In the MENA region, cardiovascular diseases—which include heart disease and stroke—are the main cause of death. According to the Global Burden of Disease Study, over 810,000 people died from ischemic heart disease and over 370,000 from stroke in the region in 2019. In the MENA region, cancer is becoming a bigger concern. It was projected that the region will see approximately 274,000 cancer-related fatalities and almost 461,000 new cancer cases in 2020. Breast, lung, colorectal, and prostate cancers were the most common types. Respiratory diseases, including chronic obstructive pulmonary disease (COPD) and asthma, are prevalent in MENA. COPD itself reported for approximately 3.2 million disability-adjusted life years (DALYs) lost in 2019. To solve healthcare issues, nations like the UAE and South Africa are investing in biotechnology and regenerative medicine. The use of cell isolation techniques is increasing because of partnerships with international research organisations and projects to build cutting-edge labs. The industry is expanding due to developments in immunotherapy and the increased emphasis on stem cell banking. The market's steady growth in the area is further facilitated by investments in healthcare infrastructure and encouraging government initiatives.

Competitive Landscape:

The cell isolation market's competitive environment is characterized by dynamic elements that influence industry dynamics. Intense research and development (R&D) activities ensure continuous innovation that results in the introduction of the latest cell isolation technologies. Market players aim to broaden their product portfolios offering a range of isolation solutions ranging from various cell types and applications. Partnerships among industry and academia promote collaborative advancement towards technological breakthroughs. Regulatory compliance and quality standards remain pivotal in this landscape, influencing market entry and expansion strategies. As the landscape evolves, there is also a growing focus on automation and the incorporation of cutting-edge methods to increase isolation repeatability and efficiency. As the market gains traction due to rising medical needs and scientific developments, competition deepens, facilitating players to distinguish through product efficacy, reliability, and versatility while striving to address the ever-evolving demands of the research and healthcare industries.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alfa Laval AB

- Becton Dickinson and Company

- Beckman Coulter Inc. (Danaher Corporation)

- Bio-Rad Laboratories Inc.

- General Electric Company

- Merck KGaA

- Miltenyi Biotec B.V. & Co. KG

- pluriSelect Life Science UG (haftungsbeschränkt) & Co. KG

- Roche Holding AG

- STEMCELL Technologies Inc.

- Terumo Corporation

- Thermo Fisher Scientific Inc.

Recent Developments:

- June 2024: Researchers at the University of Buffalo received a five-year grant of about USD 2.9 Million from the National Institute of Neurological Disorders and Stroke. With an emphasis on continuing research efforts to optimise cell isolation techniques for therapeutic uses, this grant intends to create novel technologies that potentially improve stem cell therapy for multiple sclerosis and other neurological illnesses.

- March 2024: Bio-Rad Laboratories introduced validated antibodies specifically designed for the enumeration of circulating tumor cells (CTCs). These antibodies improve research on tumour heterogeneity and disease development by making it easier to precisely identify CTC populations. This development marks a substantial breakthrough in instruments accessible for cancer research.

- May 2023: Beckman Coulter launched a new advanced immunoassay analyzer, DxI 9000 Access. The analyzer has the capacity to conduct up to 215 tests per hour per square meter (tests/h/m²).

- May 2023: Becton Dickinson and Company announced that it would invest USD 80 million to build its third plant in Ciudad Juarez.

- February 2023: Alfa Laval AB is expanding production capacity for heat exchangers in Sweden, Italy, China and the US as part of an increased investment program. For this, it has decided to invest SEK 3.8 Billion (USD 360 Million) in a capacity expansion program for heat exchangers.

Cell Isolation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Techniques Covered | Centrifugation, Surface Marker, Filtration |

| Cell Types Covered | Human Cells, Animal Cells |

| Products Covered |

|

| Applications Covered | Biomolecule Isolation, Therapeutics, Stem Cell Research, Cancer Research, Tissue Regeneration, In-Vitro Diagnostics |

| End Uses Covered | Biotechnology and Biopharmaceutical Companies, Hospitals and Diagnostic Laboratories, Research Laboratories and Institutes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alfa Laval AB, Becton Dickinson and Company, Beckman Coulter Inc. (Danaher Corporation), Bio-Rad Laboratories Inc., General Electric Company, Merck KGaA, Miltenyi Biotec B.V. & Co. KG, pluriSelect Life Science UG (haftungsbeschränkt) & Co. KG, Roche Holding AG, STEMCELL Technologies Inc., Terumo Corporation, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cell isolation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cell isolation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cell isolation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cell isolation is the process of separating specific cells from a heterogeneous population, such as tissues or blood, for research or medical purposes. Techniques like centrifugation, magnetic-activated cell sorting (MACS), or fluorescence-activated cell sorting (FACS) enable targeted cell extraction, facilitating studies in cell biology, drug development, and personalized medicine.

The cell isolation market was valued at USD 15.6 Billion in 2024.

IMARC estimates the global cell isolation market to exhibit a CAGR of 12.99% during 2025-2033.

The key factors driving the cell isolation market are advancements in biopharmaceuticals, increasing demand for personalized medicine, rising prevalence of chronic diseases, growing cell-based research, and expanding applications in cancer studies. Additionally, technological innovations in isolation methods and government funding for life sciences research further fuel market growth.

According to the report, centrifugation represented the largest segment by technique, due to its simplicity, cost-effectiveness, scalability, and efficiency in separating diverse cell types.

Animal cells leads the market by cell type due to their critical role in research, drug development, and regenerative medicine applications.

Consumables is the leading segment by product, due to their high usage frequency, low cost, and essential role in processes.

Biomolecule isolation is the leading segment by application, due to its critical role in diagnostics, drug development, and personalized medicine applications.

Research laboratories and institutes is the leading segment by end use, due to their extensive use in scientific studies and drug development.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Cell Isolation market include Alfa Laval AB, Becton Dickinson and Company, Beckman Coulter Inc. (Danaher Corporation), Bio-Rad Laboratories Inc., General Electric Company, Merck KGaA, Miltenyi Biotec B.V. & Co. KG, pluriSelect Life Science UG (haftungsbeschränkt) & Co. KG, Roche Holding AG, STEMCELL Technologies Inc., Terumo Corporation, Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)