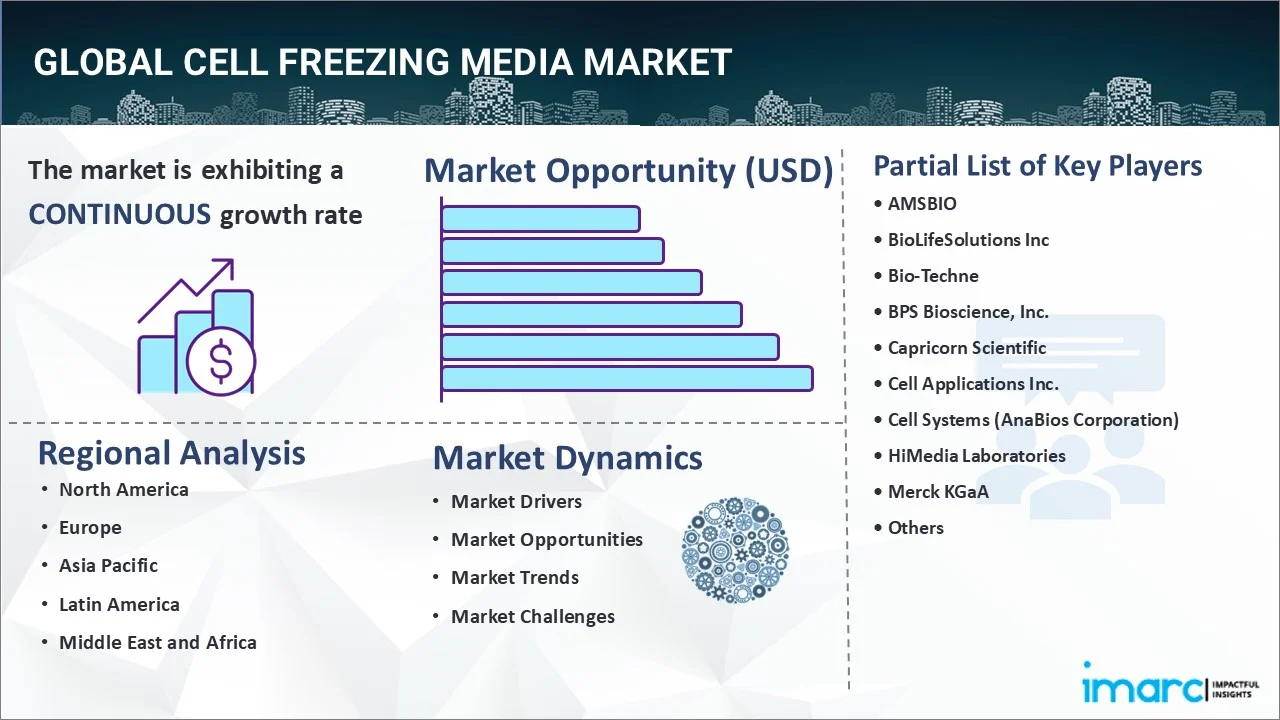

Cell Freezing Media Market Report by Product (DMSO, Glycerol, and Others), Application (Stem Cell Lines, Cancer Cell Lines, and Others), End Use (Pharmaceutical and Biotechnological Companies, Research and Academic Institutes, and Others), and Region 2025-2033

Global Cell Freezing Media Market:

The global cell freezing media market size reached USD 163.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 332.9 Million by 2033, exhibiting a growth rate (CAGR) of 8.21% during 2025-2033. The rising advancements in biotechnology are propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 163.7 Million |

| Market Forecast in 2033 | USD 332.9 Million |

| Market Growth Rate (2025-2033) | 8.21% |

Cell Freezing Media Market Analysis:

- Major Market Drivers: The increasing reliance on cellular research by the pharmaceutical sector for drug development and discovery is stimulating the market.

- Key Market Trends: The growing occurrence of chronic diseases is necessitating the storage of biological samples, which is bolstering the market.

- Competitive Landscape: Some of the major companies in the market include AMSBIO, BioLifeSolutions Inc., Bio-Techne, BPS Bioscience, Inc., Capricorn Scientific, Cell Applications Inc., Cell Systems (AnaBios Corporation), HiMedia Laboratories, Merck KGaA, Sartorius AG, STEMCELL Technologies, and Thermo Fisher Scientific Inc., among many others.

- Geographical Trends: North America exhibits a clear dominance in the market, owing to the wide presence of leading biotechnological and pharmaceutical companies.

- Challenges and Opportunities: The potential complexity is hindering the market. However, the development of more biocompatible cryoprotectants is anticipated to fuel the market in the coming years.

Cell Freezing Media Market Trends:

Rising Focus on Cell Therapy

The increasing requirement for effective preservation techniques to maintain the viability and potency of therapeutic cells is stimulating the market. Companies are introducing specialized media designed to preserve the unique properties of therapeutic cells, which are crucial for successful treatment outcomes. In March 2024, Cellares completed the development of its first clinically ready cell shuttle, a cell therapy manufacturing platform designed to meet global patient demand while reducing process failure rates and costs. Building the Current Good Manufacturing Practice (cGMP)-compliant cell shuttle is essential for ensuring clinical readiness. According to the cell freezing media market overview, this is acting as a significant growth-inducing factor.

Increasing Investments in Biobanking

Biobanks, which store biological samples for clinical use and research, require reliable cryopreservation solutions to maintain the integrity of stored cells. Moreover, the widespread funding and initiatives to expand biobanking facilities are driving the demand for advanced cell freezing media. In May 2024, EIT Health Scandinavia launched a new online hub to ease access to European biobanks and health data registries for researchers and to share expertise on how to exploit these resources. This is one of the cell freezing media market price trends.

Growing Demand for Regenerative Medicine

The inflating number of clinical approvals and trials for cell-based therapies, which necessitate reliable preservation methods to ensure the availability of viable cells, is strengthening the market. In June 2024, Toronto-based biotechnology startup Acorn Biolabs, which helps in cell freezing media for regenerative medicine treatments, announced about US$8 Million in Series A funding across multiple closings.

Global Cell Freezing Media Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the cell freezing media market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the product, application, and end use.

Breakup by Product:

- DMSO

- Glycerol

- Others

DMSO dominates the cell freezing media market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes DMSO, glycerol, and others. According to the report, DMSO represented the largest market segmentation.

DMSO (dimethyl sulfoxide) cell freezing media is designed to enhance cell preservation and viability during cryopreservation. For instance, Thermo Fisher Scientific launched its GIBCO™ recovery cell culture freezing medium, which incorporates a precisely balanced DMSO concentration to ensure high viability. This is expanding the cell freezing media market outlook.

Breakup by Application:

- Stem Cell Lines

- Cancer Cell Lines

- Others

Stem cell lines accounted for the cell freezing media market value

The report has provided a detailed breakup and analysis of the market based on the application. This includes stem cell lines, cancer cell lines, and others. According to the report, stem cell lines represented the largest market segmentation.

Stem cell lines are cultures of stem cells that possess the unique ability to self-renew and differentiate into several specialized cell types, making them invaluable for scientific research and therapeutic applications. Lonza expanded its portfolio with the introduction of ready-to-use cardiac cells that simplify cardiac toxicity testing and cardiovascular research. This is elevating the cell freezing media market statistics.

Breakup by End Use:

- Pharmaceutical and Biotechnological Companies

- Research and Academic Institutes

- Others

Pharmaceutical and biotechnological companies accounted for the cell freezing media market demand

The report has provided a detailed breakup and analysis of the market based on the end use. This includes pharmaceutical and biotechnological companies, research and academic institutes, and others. According to the report, pharmaceutical and biotechnological companies represented the largest market segmentation.

Pharmaceutical and biotechnological companies are making significant strides in the development and launch of advanced cell freezing media, essential for preserving the viability and functionality of cells during cryopreservation. Companies like Merck KGaA are leading this innovation wave with new product offerings that address the critical needs of researchers and clinicians. This is expanding the cell freezing media market segmentation.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest cell freezing media market revenue

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the cell freezing media market research report, North America accounted for the largest market share.

North America accounts for the largest market share, owing to the inflating focus of key players on advancing research in cell therapy, regenerative medicine, and biobanking. In August 2022, a surgical team successfully implanted a patch of tissue made from patient cells with the goal of treating advanced “dry” age-related macular degeneration (AMD). The patient received the therapy as part of a clinical trial that is the first in the United States to use replacement tissues from patient-derived induced pluripotent stem (iPS) cells.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market cell freezing media companies have also been provided. Some of the key players in the market include:

- AMSBIO

- BioLifeSolutions Inc

- Bio-Techne

- BPS Bioscience, Inc.

- Capricorn Scientific

- Cell Applications Inc.

- Cell Systems (AnaBios Corporation)

- HiMedia Laboratories

- Merck KGaA

- Sartorius AG

- STEMCELL Technologies

- Thermo Fisher Scientific Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Cell Freezing Media Market Recent Developments:

- June 2024: Toronto-based biotechnology startup Acorn Biolabs, which helps in cell freezing media for regenerative medicine treatments, announced about US $8 Million in Series A funding across multiple closings.

- May 2024: EIT Health Scandinavia launched a new online hub to ease access to European biobanks and health data registries for researchers and to share expertise on how to exploit these resources.

- March 2024: Cellares completed the development of its first clinically ready cell shuttle, a cell therapy manufacturing platform designed to meet global patient demand while reducing process failure rates and costs.

Cell Freezing Media Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | DMSO, Glycerol, Others |

| Applications Covered | Stem Cell Lines, Cancer Cell Lines, Others |

| End Uses Covered | Pharmaceutical and Biotechnological Companies, Research and Academic Institutes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AMSBIO, BioLifeSolutions Inc, Bio-Techne, BPS Bioscience, Inc., Capricorn Scientific, Cell Applications Inc., Cell Systems (AnaBios Corporation), HiMedia Laboratories, Merck KGaA, Sartorius AG, STEMCELL Technologies, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global cell freezing media market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global cell freezing media market?

- What is the impact of each driver, restraint, and opportunity on the global cell freezing media market growth?

- What are the key regional markets?

- Which countries represent the most attractive cell freezing media market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the cell freezing media market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the cell freezing media market?

- What is the breakup of the market based on the end use?

- Which is the most attractive end use in the cell freezing media market?

- What is the competitive structure of the global cell freezing media market?

- Who are the key players/companies in the global cell freezing media market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cell freezing media market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cell freezing media market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cell freezing media industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)