CBRN Defense Market Size, Share, Trends and Forecast by Threat Type, Equipment, End Use, and Region, 2025-2033

CBRN Defense Market Size and Share:

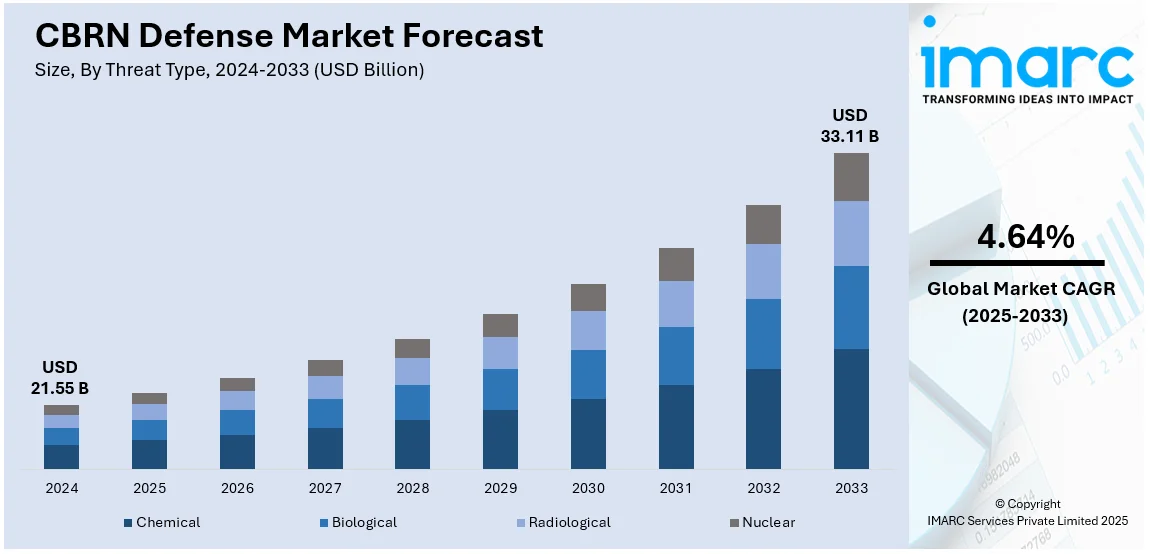

The global CBRN defense market size was valued at USD 21.55 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 33.11 Billion by 2033, exhibiting a CAGR of 4.64% during 2025-2033. North America currently dominates the market, holding a significant market share of over 80.8% in 2024. The deployment of protective solutions by governmental organizations to navigate defense strategies that can be implemented in landscapes where leading-edge development or research activities related to medical countermeasures are necessary, is primarily augmenting the market growth.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.55 Billion |

| Market Forecast in 2033 | USD 33.11 Billion |

| Market Growth Rate (2025-2033) | 4.64% |

The global CBRN defense industry is currently being heavily impacted by escalating concerns regarding the heightening of threats associated with chemical, biological, radiological, and nuclear aspects. Critical prospects for terrorist attacks encompassing CBRN agents, along with notable elevation in geopolitical strains further boost requirement for defense services. Moreover, amplifying fund allocations for defense sectors, especially in Europe and North America, are significantly bolstering investments in leading-edge decontamination, detection, and protection technologies. In addition to this, government ventures and overseas policies related with the security and safety are fueling the industry expansion. Besides this, the demand for improved civil defense tactics and preparedness in response to revolutionizing threats also facilitates the proliferating need for CBRN defense systems.

The United States is a key player in the global CBRN defense market, driven by substantial defense spending and a strong focus on national security. With ongoing investments in advanced CBRN detection, protection, and decontamination technologies, the U.S. military leads in the development and deployment of cutting-edge solutions. The country’s strategic partnerships, government initiatives, and defense programs further strengthen its market position. For instance, in December 2024, U.S. Department of Defense and Japan Ministry of Defense launched a CBRN Defense Policy Dialogue, with an aim to develop comprehensive insights regarding enhancement of CBRN defense abilities. Both the nations announced plans to fortify their alliance in CBRN defense and deploy strategies to tackle CBRN threats. In addition to this, heightened concerns over bioterrorism, chemical warfare, and nuclear threats drive demand for comprehensive defense systems. The U.S. government’s continuous commitment to enhancing homeland security ensures sustained market growth in the region.

CBRN Defense Market Trends:

Development of Effective Countermeasures

The increasing prevalence of political tensions and the rising threats from terrorists are escalating the need for CBRN weapons. Government bodies and defense departments are launching favorable policies to protect military personnel and the public from these weapons. In addition to this, they are introducing the requisite regulations for mitigating the threats stemming from CBRN cases. For example, in December 2021, the South Korea's Defense Acquisition Program Administration (DAPA) revealed that the Republic of Korea Armed Forces employed advanced reconnaissance vehicles with enhanced attributes to mitigate both biological and chemical safety threats. Furthermore, regulatory authorities are also formulating a national tactic for the coordination, establishment, and deployment of CBRN equipment grade, thereby acting as significant growth-inducing factors. For instance, in June 2021, the U.S. Department of Homeland Security (DHS) allocated USD 2 Million to two firms under the Small Business Innovation Research (SBIR) Program for introducing machine learning (ML) techniques to pinpoint CBRN threats. The DHS planned to minimize the time, redundancy, and costs and improve the precision in assessing threats, including narcotics, chemical explosives, and agents, etc., by adopting ML technologies. In addition to this, in April 2022, Kromek was given a contract of USD 2.23 Million from an existing U.K. government-associated client to offer CBRN detection services as well as products. The CBRN products delivery is scheduled for 2026.

Introduction of Defense Equipment

The wide presence of prominent players, including Chemring Group PLC and Smiths Group plc, is catalyzing the CBRN defense market. Furthermore, various companies are collaborating with research institutions and laboratories to design leading-edge CBRN defense equipment or devices. For example, in May 2022, RedWave Technology launched the XplorIR, which is a gas-identification system designed particularly to cater to the emergency response missions’ needs. The XplorIR system refers to a handheld Fourier transform infrared (FTIR) identification equipment that aid in identification of above 5,500 gases at low ppm concentrations. Besides this, key players are integrating advanced sensors and payloads for conducting CBRN missions. In line with this, they are further emphasizing on strengthening trust and loyalty with the stakeholders, reducing costs of product, magnifying awareness, etc.

Numerous Collaborations

Various regulatory authorities and government organizations operating across countries are partnering with prominent key players and entering into agreements for investing in CBRN resistance technologies. This, in turn, is enhancing the CBRN defense market price. For instance, the Medical CBRN Defense Consortium (MCDC) is a well-established community focused on rapid prototyping and maturing medical countermeasures to treat, detect, as well as thwart exposure to CBRN threats. Through the other transaction agreement with the Joint Program Executive Office for Chemical, Biological, Radiological, and Nuclear Defense (JPEO-CBRND), the MCDC is developing medical pharmaceuticals, diagnostics, and therapeutics to protect and enhance the mission of service members. In September 2023, Avon Protection announced a tactical collaboration with OPEC CBRNe, a manufacturer and designer of chemical, biological, and antiviral suit systems. This alliance was aimed to enhance technologies for CBRN protective suit, thereby adhering to the overseas special as well as military forces.

CBRN Defense Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global CBRN defense market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on threat type, equipment, and end use.

Analysis by Threat Type:

- Chemical

- Biological

- Radiological

- Nuclear

Chemical stand as the largest threat type in 2024, holding around 42.7% of the market. The rising incidents of chemical warfare threats are one of the key factors propelling the market growth in this segmentation. For instance, countries, such as Russia, together with China, have calculatedly attacked the authority as well as authenticity of the Organization for the Prohibition of Chemical Weapons (OPCW) and its imputation and analytical mechanisms. Additionally, Russia has elevated the augmentation of disinformation associated with the chemical as well as biological weapons, encompassing during the war situations with Ukraine. Consequently, the inflating need for detecting chemical agents is stimulating the adoption of portable devices and laboratory test instruments, which will continue to propel the global market in this segmentation in the coming years.

Analysis by Equipment:

- Protective Wearables

- Respiratory Systems

- Detection and Monitoring Systems

- Decontamination Systems

- Simulators

- Others

Protective wearables lead the market with around 31.6% of market share in 2024. Protective wearables, including gas masks, gloves, hazmat suits, footwear, etc., form a crucial part of CBRN defense equipment. They are extensively designed to protect against chemical agents, including toxic industrial chemicals (TIC), chemical war agents (CWA), toxic industrial materials (TIM), etc. Besides this, the selection of CBRN protective wearables generally depends on the type and level of contamination. For example, AirBoss Defense Group, a prominent survivability services firm, produces rubber products that are developed to safeguard wearers from the contamination of chem-bio and several other environmental threats, thereby facilitating the functionality of complicated and crucial tasks in extremely hazardous situations effectively.

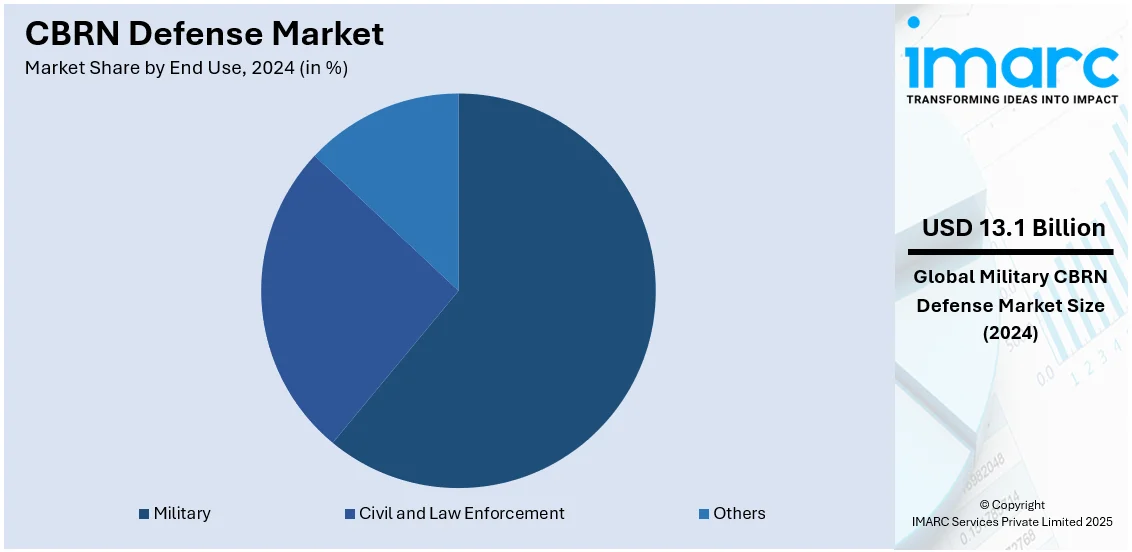

Analysis by End Use:

- Military

- Civil and Law Enforcement

- Others

Military leads the market with around 61.0% of market share in 2024. According to the CBRN defense market statistics, the growth in this segmentation is primarily propelled, owing to the rising investments by government bodies in the CBRN defense systems. For example, the U.S. Army acquired unmanned ground vehicles as per the Man Transportable Robotic System Increment II (MTRS Inc II) to aid special operations forces, CBRN soldiers, engineers, etc. Additionally, the new UGVs are substituting the worn-out non-standard robot fleets for identifying, exploring, and clearing ordnance that are unexploded, landmines, and enhanced explosive devices that improve the flexibility of military personnel.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 80.8%. The increasing investments by government bodies across North America in improving safety measures and CBRN resistance technologies are among the key factors stimulating the regional market. For example, in February 2023, U.S. Department of Defense (DoD) offered Teledyne FLIR a contract worth USD 13.3 Million to augment the R80D SkyRaider unmanned aerial system abilities to autonomously perform CBRN reconnaissance missions. In line with this, regulatory bodies are also acquiring enhanced CBRN defense equipment, which is further acting as another significant growth-inducing factor. For example, the U.S. Department of Defense oversees the implementation of strategies and CWMD policies that include enhancing collaboration with partners and allies to fortify CBRN defense stance and abilities, support WMD interdictions, improve multilateral WMD arms control, etc. These measures and adequate research to identify defense measures are projected to augment the CBRN defense market over the forecasted period.

Key Regional Takeaways:

United States CBRN Defense Market Analysis

In 2024, United States accounted for 99.10% of the market share in North America. The growing adoption of CBRN defense in the United States is significantly influenced by the nation’s expanding defense sector and increasing budgetary allocations toward security initiatives. For instance, since 1980, defense expenditure has risen by 62%, escalating from USD 506 Billion to USD 820 Billion by the year 2023. As the U.S. defense sector witnesses continuous modernization efforts, there is a heightened focus on integrating advanced CBRN defense measures to address evolving threats. The expanding adoption is particularly evident across various military branches, where enhanced preparedness against chemical, biological, radiological, and nuclear hazards has become a strategic priority. Defense organizations are actively equipping personnel with state-of-the-art protective gear, decontamination systems, and advanced detection technologies. The steady rise in defense spending further underscores this trend, with substantial resources allocated to research and procurement of CBRN defense systems. This includes investments in mobile detection units, specialized vehicles, and portable protective solutions designed for rapid deployment in both domestic and international operations. Additionally, U.S. defense contractors and technological innovators are collaborating to develop next-generation solutions tailored to meet the demands of a rapidly evolving threat landscape. These efforts align with national security strategies emphasizing operational readiness and resilience in the face of potential CBRN incidents. This growing focus underscores the critical role CBRN defense plays in safeguarding personnel and infrastructure within the broader defense framework.

Asia Pacific CBRN Defense Market Analysis

The growing adoption of CBRN defense solutions in the Asia-Pacific region is a result of the heightened investment in defense equipment, as nations seek to enhance their military readiness in the face of regional threats. According to India Brand Equity Foundation, during 2022 to 2023, the Ministry of Defence granted 25% of acquisition budget or domestic capital procurement of total USD 2.72 Billion to endorse startups, private industries, and MSMEs involved in defence production landscape. This surge in investment is driven by geopolitical tensions, the need for modernizing defense infrastructures, and the urgency of preparing for potential attacks that involve CBRN weapons. As part of this broader defense strategy, nations are prioritizing the acquisition of advanced detection and protective systems, as well as specialized protective suits and decontamination technologies. The increased focus on CBRN defense is not only critical for the safety of military forces but also for sustaining the protection of civilian populations in vulnerable areas. The accelerating pace of technological advancement in the defense segment, combined with the region's growing security concerns, is accelerating the adoption of these critical systems, particularly in response to emerging threats from non-state actors and regional instabilities.

Europe CBRN Defense Market Analysis

Rising inter-border disputes and escalating tensions in Europe have led to an increased focus on CBRN defense systems as nations recognize the need to be prepared for potential conflicts involving unconventional weapons. For instance, Russia operations in Ukraine have probable spendings up to USD 211 Billion. With the growing frequency of territorial disputes and military confrontations, there is a heightened demand for solutions that can provide comprehensive protection against chemical, biological, radiological, and nuclear threats. The need for CBRN defense is further underscored by the evolving nature of warfare, which increasingly involves hybrid and asymmetric tactics, potentially incorporating CBRN attacks. This has prompted European countries to invest in robust defense infrastructures capable of mitigating the impact of such threats on both military forces and civilians. The ongoing instability in the region, including military buildups and strategic alliances, drives the continuous development and deployment of specialized CBRN systems to safeguard national security and ensure preparedness for any type of conflict.

Latin America CBRN Defense Market Analysis

In Latin America, the growing adoption of CBRN defense solutions is being driven by the expanding military sector. For instance, military spending in Central America and the Caribbean in 2023 was 54 % higher than in 2014. As countries in the region modernize their armed forces and increase defense spending, there is a greater emphasis on strengthening capabilities to protect against CBRN threats. This modernization includes investments in advanced detection systems, protective gear, and decontamination technologies, which are becoming integral to military operations. The rising military focus is aligned with global security concerns, prompting governments to enhance their defense readiness in light of evolving threats, including the use of unconventional weapons. This shift reflects the region's recognition of the need for comprehensive defense measures to ensure the safety of military personnel and critical infrastructure against CBRN risks.

Middle East and Africa CBRN Defense Market Analysis

In the Middle East and Africa, increased investments in public safety are fostering the growth of CBRN defense adoption. For instance, Dubai Police commits to a significant investment of approximately USD 545 Million to enhance security and public safety. Governments in these regions are prioritizing the development of systems that can protect both civilians and military personnel from CBRN threats, recognizing the critical importance of security in areas prone to instability and conflict. With heightened concerns over potential chemical and biological attacks, nations are focusing on advanced technologies such as early detection, contamination control, and protective systems. The ongoing regional conflicts, coupled with rising investments in security infrastructure, are driving demand for comprehensive CBRN solutions. As public safety becomes a key government priority, CBRN defense technologies play a central role in safeguarding both citizens and military forces from the devastating effects of chemical, biological, radiological, and nuclear threats.

Competitive Landscape:

The market is exhibiting intense competition, with leading firms gravitating on tactical collaborations, technological innovations, and military contracts to fortify their market stance. For instance, in September 2024, Riskaware and Smiths Detection collaboratively developed and unveiled an end-to-end platform that can efficiently incorporate, expand, and digitalize the real-time CBRN hazard intelligence services. Moreover, major defense contractors lead the market by offering advanced detection, protection, and decontamination solutions. The increasing investment in defense and homeland security, coupled with rising geopolitical tensions, intensifies competition. Companies are expanding their product portfolios through R&D and acquisitions to enhance threat detection and response capabilities. Additionally, government collaborations and procurement programs further drive market consolidation and industry growth.

The report provides a comprehensive analysis of the competitive landscape in the CBRN defense market with detailed profiles of all major companies, including:

- Argon Electronics (UK) Ltd

- Avon Protection

- Battelle Memorial Institute

- Bruker Corporation

- HDT Global

- Karcher Futuretech GmbH

- QinetiQ

- Rheinmetall AG

- Saab AB

- Smiths Detection Group Ltd

- Teledyne FLIR LLC

- Thales Group

Latest News and Developments:

- May 2024: Norway Awards Bertin Environics CBRN Defense Contract Norway awarded Bertin Environics a seven-year contract for CBRN defense squad kits to be used by Finland. The contract involves supplying ChemProX handheld chemical detectors and SaphyRad MS radiation survey meters. These devices will be used for detecting chemical warfare agents and toxic industrial chemicals, highlighting the growing emphasis on CBRN defense in military operations.

- February 2024: Wheeled CBRN Vehicle by DRDO The Defense Research and Development Organization (DRDO) showcased its newly designed wheeled CBRN (Chemical, Biological, Radiological, and Nuclear) vehicle at the MSME Defense Expo in Pune, India. This vehicle aims to provide enhanced protection to soldiers against hazardous CBRN threats. It was displayed for the first time, highlighting India's advancements in military technology. The vehicle's design focuses on safeguarding personnel in the face of chemical or biological warfare.

- February 2024: Avon Protection EXOSKIN-S1 Suit Avon Protection, a leader in CBRN personal protective gear, introduced its EXOSKIN-S1 CBRN protective suit. This suit is an essential addition to their line of protective wear, providing advanced protection against CBRN threats. Designed with innovation in mind, it ensures that military and first responders are better equipped to handle hazardous environments. The suit features state-of-the-art technology for enhanced durability and comfort in extreme conditions.

- January 2024: UAH and NATO Quantum Technology Partnership Researchers from the University of Alabama in Huntsville (UAH) are spearheading a NATO partnership focused on addressing security challenges posed by emerging quantum technologies. This collaboration is set to tackle the unique threats posed by advancements in quantum computing and communication. By working with NATO, UAH aims to enhance defense strategies to counter the potential risks associated with quantum innovations. The partnership highlights the growing importance of quantum technology in global security frameworks.

- January 2024: US DoD Awards Draper of USD 26 Million Contract to the US Department of Defense (DoD) granted Draper a USD 26 Million contract to enhance CBRN reconnaissance systems. The focus is on developing unmanned missions with advanced flight software, sensor-driven algorithms, and the ability to operate without GPS. This system will improve protection for operators and integrate with the Stryker platform’s command-and-control system.

CBRN Defense Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Threat Types Covered | Chemical, Biological, Radiological, Nuclear |

| Equipments Covered | Protective Wearables, Respiratory Systems, Detection and Monitoring Systems, Decontamination Systems, Simulators, Others |

| End Uses Covered | Military, Civil and Law Enforcement, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Argon Electronics (UK) Ltd, Avon Protection, Battelle Memorial Institute, Bruker Corporation, HDT Global, Karcher Futuretech GmbH, QinetiQ, Rheinmetall AG, Saab AB, Smiths Detection Group Ltd, Teledyne FLIR LLC, Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the CBRN defense market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global CBRN defense market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the CBRN defense industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The CBRN defense market was valued at USD 21.55 Billion in 2024.

IMARC estimates the CBRN defense market to reach USD 33.11 Billion by 2033, exhibiting a CAGR of 4.64% during 2025-2033.

Key factors driving the market encompass elevating geopolitical tensions, increase in defense and homeland security investments, magnifying threats of chemical and biological warfare, and innovations in detection and protection technologies. In addition, government procurement programs and stricter safety policies further bolster market need for CBRN defense solutions.

North America currently dominates the CBRN defense market, accounting for a share exceeding 80.8%. This dominance is fueled by heightened defense expenditure, enhanced military abilities, robust government initiatives, and increase in investments in CBRN threat detection, protection, and decontamination technologies.

Some of the major players in the keyword market include Argon Electronics (UK) Ltd, Avon Protection, Battelle Memorial Institute, Bruker Corporation, HDT Global, Karcher Futuretech GmbH, QinetiQ, Rheinmetall AG, Saab AB, Smiths Detection Group Ltd, Teledyne FLIR LLC, Thales Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)