CBD Infused Beverages Market Size, Share, Trends and Forecast by Type, Product Type, CBD Type, Grade, Distribution Channel, and Region, 2025-2033

CBD Infuse Beverages Market Size and Share:

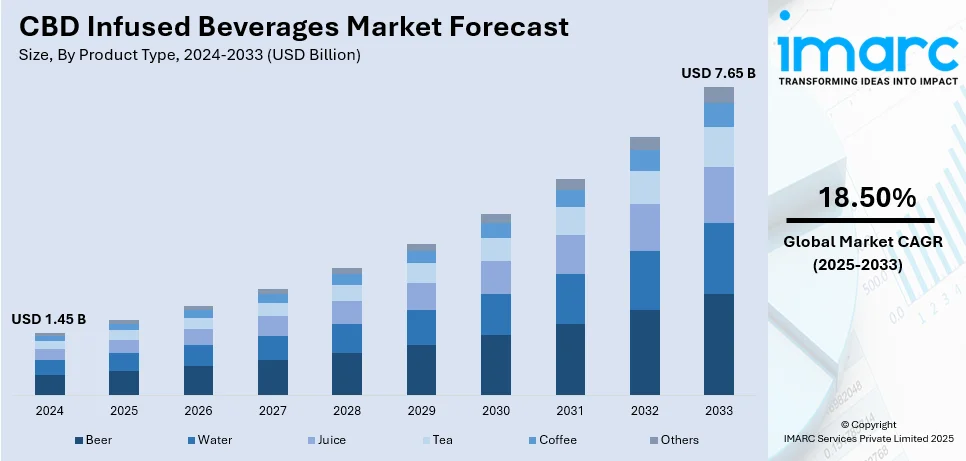

The global CBD infused beverages market size was valued at USD 1.45 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.65 Billion by 2033, exhibiting a CAGR of 18.50% from 2025-2033. North America currently dominates the market, holding a market share of over 57.5% in 2024, due to strong consumer demand, regulatory support, and significant industry investment. The region benefits from an established retail network and growing awareness of CBD's wellness benefits. Continued product innovation and expanding distribution channels contribute to North America's dominant market position.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.45 Billion |

| Market Forecast in 2033 | USD 7.65 Billion |

| Market Growth Rate (2025-2033) | 18.50% |

The CBD-infused beverages market is expanding as consumer preferences shift toward functional and wellness-focused drinks. Growing awareness of cannabidiol’s potential benefits, including stress relief, relaxation, and anti-inflammatory properties, is driving demand across various demographics. Regulatory developments continue to shape the industry, with evolving guidelines influencing product formulations and marketing strategies. Innovation in flavor profiles, bioavailability, and delivery methods, such as water-soluble CBD, is enhancing consumer appeal. The increasing presence of CBD drinks in mainstream retail channels, including supermarkets and convenience stores, further supports market penetration. Additionally, partnerships between beverage companies and CBD producers are accelerating product diversification and brand positioning.

In the United States, the market is seeing steady growth as regulatory clarity improves at the federal and state levels. Consumer demand for plant-based wellness products is contributing to higher adoption rates, particularly in functional beverages like teas, coffees, and sparkling waters. The expansion of e-commerce and direct-to-consumer sales is enabling brands to reach a wider audience, while retail distribution is increasing as major retailers test CBD product offerings. For instance, according to industry reports, U.S. retail e-commerce sales for third quarter of 2024 are estimated at USD 288.8 billion, reflecting a 2.2% increase from second quarter of 2024. As regulatory frameworks stabilize, investment in research and product development is expected to drive long-term market growth.

CBD Infused Beverages Market Trends:

Expansion of Functional Wellness Beverages

Consumers are increasingly seeking beverages that offer functional health benefits, driving demand for CBD-infused drinks. These products are positioned as stress-relieving, anti-inflammatory, and sleep-enhancing solutions, appealing to health-conscious individuals. The trend aligns with the broader shift toward natural and plant-based wellness, influencing both product innovation and marketing strategies. For instance, according to recent industry data, global plant-based beverage consumption is growing at an annual rate of 10.18% from 2020 to 2024. This rise is driven by demand for animal-free diets, ethical and environmental concerns, taste preferences, lactose intolerance (65–75%), and milk allergies (0.5–3.5%). Brands are incorporating complementary ingredients such as adaptogens, vitamins, and herbal extracts to enhance the perceived benefits of CBD. This positioning is helping CBD beverages gain traction in the functional drinks category, attracting a diverse consumer base, including fitness enthusiasts, professionals managing stress, and individuals looking for relaxation solutions.

Retail and E-Commerce Expansion

CBD-infused beverages are becoming more accessible through both brick-and-mortar retail and online sales channels. Supermarkets, convenience stores, and specialty health retailers are increasingly stocking these products, responding to growing consumer interest. At the same time, e-commerce platforms and direct-to-consumer models are enabling brands to reach a broader audience while educating customers about CBD’s benefits. Regulatory shifts are also facilitating entry into mainstream retail, with established beverage companies forming partnerships to strengthen distribution. As a result, the market is seeing increased visibility, greater consumer trust, and enhanced accessibility, which are all contributing to long-term growth. For instance, as per industry reports, global e-commerce sales is anticipated to surpass USD 6.8 trillion in 2025.

Innovation in Product Formulation

Advancements in CBD delivery methods are improving product effectiveness and consumer experience. Brands are investing in water-soluble CBD technology to enhance absorption rates, ensuring consistent potency in beverages. This innovation addresses one of the key challenges in CBD drinks, which is bioavailability, leading to more effective and predictable results for consumers. Additionally, new formulations focus on taste improvement, incorporating natural flavors and sweeteners to create appealing options. The market is also witnessing the introduction of CBD-infused energy drinks, cold brews, and alcohol alternatives, catering to different consumer preferences. For instance, in September 2024, Ybee Iced Coffee debuted in the UK, offering jitter-free energy with premium espresso and cold-pressed CBD to reduce anxiety. Free from artificial sweeteners and flavorings, it caters to wellness-focused consumers seeking alternative energy solutions. Furthermore, these innovations are helping brands differentiate their offerings and strengthen their competitive positioning.

CBD Infused Beverages Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global CBD infused beverages market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, product type, CBD type, grade, and distribution channel.

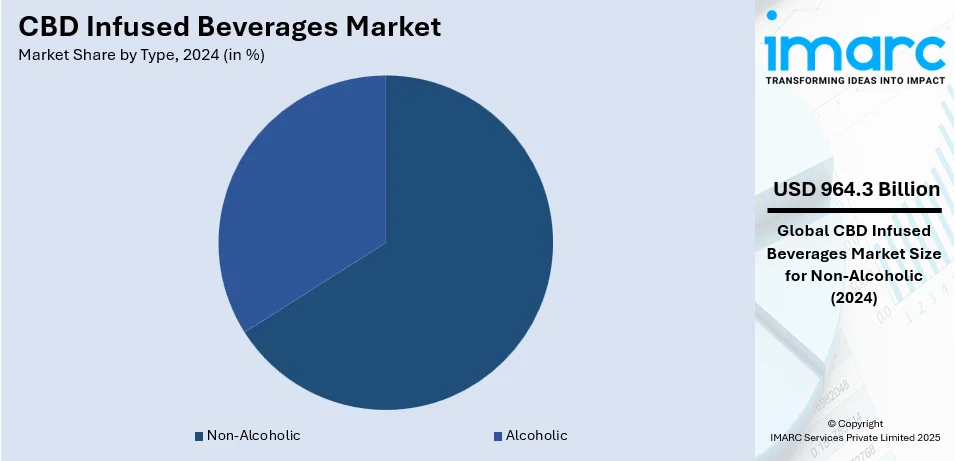

Analysis by Type:

- Alcoholic

- Non-Alcoholic

The non-alcoholic segment accounted for largest type segment with 66.5% of the market share in 2024, propelled by rising consumer preference for health-focused and functional drinks. Consumers seek alternatives to traditional alcoholic beverages, favoring CBD-infused options for relaxation and wellness benefits without intoxication. The segment includes CBD-infused teas, coffees, sodas, and functional waters, which appeal to a broad audience, including health-conscious individuals and non-drinkers. Expanding retail availability, product innovation, and growing mainstream acceptance further drive market growth. Additionally, regulatory flexibility for non-alcoholic CBD beverages compared to alcohol-based counterparts strengthens their market position, making them the preferred choice among consumers and industry players alike.

Analysis by Product Type:

- Beer

- Water

- Juice

- Tea

- Coffee

- Others

CBD-infused beer is gaining popularity as consumers seek alcohol alternatives with relaxation benefits. These beverages combine the familiar taste of beer with the potential calming effects of CBD, appealing to health-conscious drinkers and those looking to reduce alcohol consumption. Breweries are experimenting with flavors and CBD concentrations to create unique craft options. With growing consumer acceptance and increasing availability in dispensaries and specialty stores, CBD beer is carving a niche in the functional beverage market. However, regulatory challenges and alcohol restrictions impact distribution, requiring careful compliance from manufacturers.

CBD-infused water is one of the fastest-growing segments in the market, appealing to consumers looking for convenient, hydrating, and wellness-focused beverages. It offers a tasteless, calorie-free option that seamlessly integrates into daily routines. Enhanced with nano-emulsified CBD for better absorption, it provides a functional alternative to traditional bottled water. The demand for on-the-go health solutions is driving market expansion, with brands innovating by adding vitamins, electrolytes, and adaptogens. Available in retail stores, dispensaries, and online platforms, CBD water continues to gain traction as a mainstream wellness drink.

CBD-infused juice blends the natural goodness of fruits and vegetables with the potential wellness benefits of cannabidiol. Consumers seeking relaxation, stress relief, and immune support favor these beverages for their refreshing taste and functional properties. Available in cold-pressed, flavored, and fortified varieties, CBD juices cater to the growing demand for natural and organic products. Many brands also incorporate superfoods, antioxidants, and probiotics, enhancing their appeal to health-conscious consumers. Furthermore, with increasing availability in health stores, online retailers, and dispensaries, CBD juice is emerging as a preferred choice for those looking to integrate CBD into their daily wellness routine.

CBD-infused tea is a popular choice for relaxation, stress relief, and overall well-being. Combining CBD with herbal, green, or black tea varieties enhances its appeal to consumers looking for calming and functional beverages. Many brands offer caffeine-free and adaptogenic options, making CBD tea a go-to drink for sleep support and anxiety management. With increasing interest in holistic health and natural wellness, CBD tea has gained traction in both specialty stores and e-commerce platforms. In addition, as consumers shift toward healthier lifestyle choices, CBD-infused tea is expected to see sustained demand and further market innovation.

CBD-infused coffee merges caffeine’s energy boost with CBD’s calming effects, offering a balanced beverage for focus, stress relief, and sustained energy. Popular among professionals and wellness enthusiasts, it helps reduce caffeine-related jitters while promoting relaxation. Available in ground, instant, and ready-to-drink formats, CBD coffee is expanding in both brick-and-mortar retail and online stores. Brands are innovating by incorporating organic, single-origin beans and functional additives like MCT oil and adaptogens. As demand for functional beverages grows, CBD coffee continues to attract consumers looking for an enhanced, mindful coffee experience.

Analysis by CBD Type:

- Marijuana-Derived

- Hemp-Derived

- Synthetic

The marijuana-derived segment accounted for largest CBD type segment with 58.6% of the market share in 2024, due to its higher potency and full-spectrum formulations. It offers a broader range of cannabinoids, enhancing therapeutic benefits through the entourage effect. Regulatory changes support growth, with increasing legalization driving demand. Additionally, beverage manufacturers develop THC-compliant formulations to meet legal standards while catering to health-conscious consumers. The segment dominates due to its association with relaxation, pain relief, and wellness. Furthermore, expanding product innovation and premium positioning strengthen its market leadership, as brands focus on enhancing bioavailability and taste profiles to attract a wider consumer base.

Analysis by Grade:

- Pharmaceutical Grade

- Food Grade

Food grade stand as the largest grade in 2024, driven by stringent safety standards and increasing consumer demand for high-quality, consumable CBD products. Food-grade CBD ensures compliance with regulatory requirements, making it the preferred choice for manufacturers and consumers alike. This segment is widely used in CBD-infused teas, coffees, energy drinks, and wellness beverages, offering consistency, purity, and safety. The rising adoption of food-grade CBD in mainstream retail and e-commerce further strengthens its market position. Additionally, growing awareness of product quality and transparency among consumers fuels demand, making food-grade CBD the dominant segment in the CBD-infused beverages industry.

Analysis by Distribution Channel:

- Storefront Dispensaries

- Convenience Stores

- Online

- Others

Storefront dispensaries stand as the largest distribution channel in 2024, offering a controlled and reliable retail environment for consumers. These dispensaries provide high-quality, lab-tested products, ensuring compliance with regulatory standards. Consumers prefer storefront dispensaries for their expert guidance, product variety, and trusted sourcing. The personalized shopping experience and ability to verify product authenticity further enhance their appeal. Additionally, as CBD regulations evolve, dispensaries continue to expand, increasing accessibility and consumer confidence. Their established presence, knowledgeable staff, and dedicated customer base make storefront dispensaries the dominant distribution channel for CBD-infused beverages in both established and emerging markets.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of over 57.5%. The domination is driven by increasing consumer interest in functional drinks and the expanding presence of key industry players. The United States leads the market, supported by strong retail distribution networks, product innovation, and growing consumer acceptance of CBD-based products. Canada also contributes significantly, benefiting from a well-regulated cannabis industry and rising demand for alternative wellness beverages. Furthermore, the region’s advanced research, investment in new product formulations, and expanding e-commerce sector further accelerate market growth. For instance, according to the U.S. Department of Commerce, retail e-commerce sales in the United States reached USD 300.1 Billion during Q3 2024, exhibiting an elevation of 2.6%, thereby enabling wider distribution and consumer adoption of functional and CBD-based drinks.

Key Regional Takeaways:

United States CBD Infused Beverages Market Analysis

The U.S. holds a market share of 91.7% in North America. The CBD-infused beverages market is growing as consumer demand for plant-based wellness products rises in the country. Regulatory developments at federal and state levels continue to shape market dynamics, influencing product availability and marketing strategies. Companies are focusing on functional drinks such as CBD-infused teas, coffees, and flavored waters to attract health-conscious consumers. Additionally, retail distribution is expanding, with supermarkets and specialty stores introducing these products, while e-commerce remains a key sales channel. For instance, as of 2024, California has more than 30,000 established stores, driven by its large population and varied consumer demands. Established beverage brands and startups are investing in formulation improvements, including water-soluble CBD for better absorption. Market growth depends on regulatory clarity, product innovation, and consumer education efforts.

Europe CBD Infused Beverages Analysis

The CBD-infused beverages market is developing as regulatory frameworks evolve, with adoption increasing due to rising consumer interest in wellness drinks. For instance, as per industry reports, the 2024 orange juice supply is shifting as commodity prices hit record highs. Production is forecasted at 232.3 million 40.8 kg boxes, down 24% from last season, marking the smallest crop ever. Moreover, regulatory uncertainty remains a challenge, with varying laws on CBD use in food and beverages across different markets. Companies are focusing on product innovation, including water-soluble CBD and botanical blends, to enhance functionality and appeal. Retail availability is expanding, particularly in health stores and online platforms. As regulations become clearer, investment in branding, distribution, and consumer education will be key to market growth, enabling businesses to strengthen their positioning and reach a wider consumer base.

Asia Pacific CBD Infused Beverages Market Analysis

The Asia Pacific CBD-infused beverages market is in its early stages, influenced by varying regulatory stances across countries. While consumer interest in functional wellness drinks is growing, strict regulations on CBD in food and beverages limit widespread adoption. Additionally, companies are exploring opportunities in regions with more flexible policies, focusing on teas, herbal infusions, and non-alcoholic wellness drinks. Moreover, e-commerce plays a crucial role in market accessibility, as traditional retail channels remain restricted in certain areas. For instance, in 2024, e-commerce market registered worth USD 2 Trillion in China and USD 99 Billion in India. In line with this, 75% of the young adults across Asia actively indulge in online shopping. Future growth depends on regulatory developments, increased consumer awareness, and product innovation tailored to local preferences and cultural acceptance of CBD-based wellness products.

Latin America CBD Infused Beverages Market Analysis

The Latin American CBD-infused beverages market is expanding as regulatory frameworks evolve and consumer awareness increases. Some countries have legalized CBD for medicinal and wellness use, creating opportunities for beverage innovation. Companies are introducing functional drinks, including herbal infusions and flavored waters, to appeal to health-conscious consumers. For instance, as per industry reports, Latin America's functional beverage market is expected to grow at a 7.4% CAGR from 2020 to 2024. E-commerce and specialty health stores are key distribution channels, as mainstream retail adoption remains limited. Regulatory inconsistencies across markets present challenges for widespread commercialization. Growth will depend on clearer legislation, investment in product development, and consumer education, enabling brands to establish credibility and expand their market presence in the region.

Middle East and Africa CBD Infused Beverages Market Analysis

The Middle East and Africa (MEA) CBD-infused beverages market is driven by regulatory advancements, rising wellness trends, and growing consumer interest in functional beverages. Countries like South Africa and the UAE are leading due to progressive cannabis regulations and increasing demand for non-psychoactive wellness products. For instance, the CSIR has supported 23 SMMEs in developing over 40 CBD-infused and cannabis-based products, including nutraceuticals, cosmeceuticals, and herbal remedies, under South Africa’s National Cannabis Master Plan. The region's expanding e-commerce sector, higher disposable incomes, and urbanization further boost market growth. Additionally, the hospitality and tourism industry is integrating CBD-based drinks, catering to health-conscious consumers. Investments in nano-emulsion technology for improved bioavailability and partnerships with international brands enhance product availability, making MEA a promising market for CBD-infused beverages.

Competitive Landscape:

The CBD-infused beverages market is becoming increasingly competitive as new entrants and established beverage companies expand their presence. Startups are driving innovation with unique formulations, while major players leverage existing distribution networks to gain market share. Strategic partnerships between CBD producers and beverage brands are accelerating product development and retail penetration. For instance, in January 2025, Green Monké collaborated with Cookies to launch four hemp-derived THC beverages in select U.S. states. These drinks offer an alcohol alternative amid post-holiday sales declines and wellness trends like “Dry January.” Regulatory uncertainty remains a key factor influencing competition, with companies navigating compliance challenges in different markets. Branding, product differentiation, and consumer education play a crucial role in capturing demand. As the market matures, investments in research, scalability, and supply chain efficiency will determine long-term competitive positioning.

The report provides a comprehensive analysis of the competitive landscape in the CBD infused beverages market with detailed profiles of all major companies, including:

- Alkaline Water Company

- Canopy Growth Corporation

- Tilray Inc

- Heineken

- Cannara Biotech Inc

- Aurora Cannabis

- Aphria Inc.

- Daytrip Beverages

- Curaleaf

- Dixie Brands

Latest News and Developments:

- In January 2024, Aurora Cannabis Inc. launched three new cannabis-infused beverages, initially available to veteran patients. The drinks, available in Neon Rush, Strawberry Pineapple Tropical Fizz, and Pineapple Coconut Fizz flavors, are produced by Vacay and Versus, providing medical cannabis consumers with a flavorful alternative.

- In May 2024, Snoop Dogg, Death Row Records, and Hill Beverage Co. partnered with Total Wine to launch Do It Fluid, a CBD and hemp-derived THC beverage line, in California stores and nationwide via delivery.

CBD Infuse Beverages Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Alcoholic, Non-Alcoholic |

| Product Types Covered | Beer, Water, Juice, Tea, Coffee, Others |

| CBD Types Covered | Marijuana-Derived, Hemp-Derived, Synthetic |

| Grades Covered | Pharmaceutical Grade, Food Grade |

| Distribution Channels Covered | Storefront Dispensaries, Convenience Stores, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alkaline Water Company, Canopy Growth Corporation, Tilray Inc, Heineken, Cannara Biotech Inc, Aurora Cannabis, Aphria Inc., Daytrip Beverages, Curaleaf, Dixie Brands, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the CBD infused beverages market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global CBD infused beverages market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the CBD infused beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The CBD infused beverages market was valued at USD 1.45 Billion in 2024.

IMARC estimates the CBD infused beverages market to reach USD 7.65 Billion in 2033, exhibiting a CAGR of 18.50% during 2025-2033.

The market is driven by rising consumer demand for wellness products, increasing awareness of CBD’s potential health benefits, and evolving regulatory frameworks. Growing interest in functional drinks, alcohol alternatives, and stress relief solutions further accelerates adoption. Product innovation and expanding retail availability strengthen market growth.

North America currently dominates the market, holding a market share of over 57.5% in 2024. This domination of the region is due to strong consumer demand, evolving regulatory support, and established distribution networks. High awareness of CBD’s benefits and a growing preference for functional beverages drive sales. Market expansion is further supported by product innovation, investment in new formulations, and increasing retail availability across various sales channels.

Some of the major players in the keyword market include Alkaline Water Company, Canopy Growth Corporation, Tilray Inc, Heineken, Cannara Biotech Inc, Aurora Cannabis, Aphria Inc., Daytrip Beverages, Curaleaf, Dixie Brands, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)