Cattle Feed Market Size, Share, Trends and Forecast by Ingredient, Type, Distribution Channel, and Region, 2026-2034

Cattle Feed Market Size and Share:

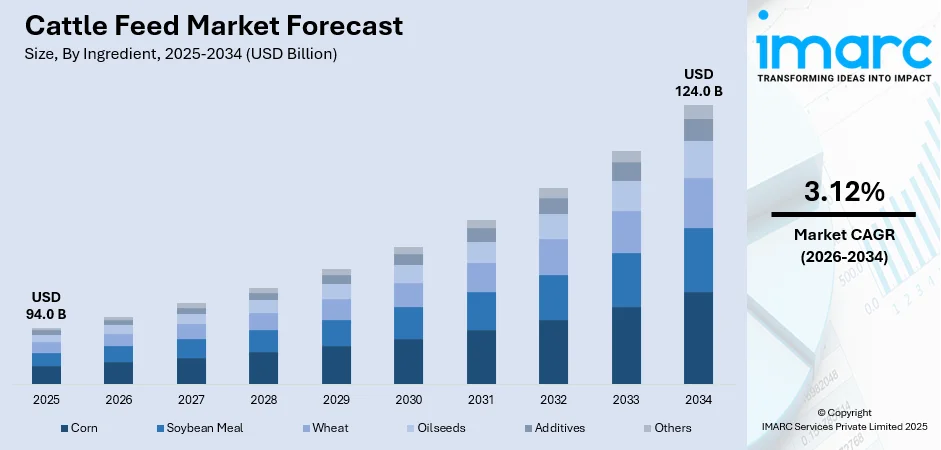

The global cattle feed market size was valued at USD 94.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 124.0 Billion by 2034, exhibiting a CAGR of 3.12% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 38.9% in 2025. The increasing competition among livestock farmers, rising awareness about diseases that can affect livestock, and the growing number of online platforms for the direct purchase of farming supplies are some of the major factors propelling the cattle feed market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 94.0 Billion |

| Market Forecast in 2034 | USD 124.0 Billion |

| Market Growth Rate (2026-2034) | 3.12% |

The growth of the global cattle feed market is driven by rising demand for high-quality dairy and meat products, increasing awareness about animal nutrition, and advancements in feed formulations. The expansion of the livestock industry, particularly in emerging economies, is fueling demand for nutritionally balanced feed to enhance cattle health and productivity. Government initiatives promoting sustainable and efficient feeding practices, along with stringent regulations on animal health and food safety, are further supporting market growth. Additionally, the adoption of precision feeding technologies, probiotics, and organic feed ingredients is gaining traction due to consumer preferences for ethically sourced and antibiotic-free animal products. Rising disposable incomes and urbanization are also boosting meat and dairy consumption, further driving cattle feed demand worldwide.

To get more information on this market Request Sample

The United States is emerging as a key market with 87.80% shares. The increasing demand for high-quality beef, both domestically and internationally, necessitates nutritionally rich feed to enhance cattle health and productivity. In 2022, U.S. beef exports reached a record 3.5 billion pounds, a 3% increase from the previous year, with a notable 16% rise in exports to China. The U.S. animal feed industry supports this demand through nearly 5,650 manufacturing facilities producing over 284 million tons of finished feed annually. Additionally, technological advancements in feed formulations and a growing emphasis on sustainable and efficient feeding practices contribute to cattle feed market growth. However, challenges such as high input costs and economic fluctuations can impact profitability and influence market dynamics.

Cattle Feed Market Trends:

Increasing Health Awareness

There is an increase in the awareness about the health benefits of quality meat and dairy products among individuals. According to the 2023 Food and Health Survey conducted by the International Food Information Council (IFIC), 62% of consumers considered healthfulness the third most significant factor influencing their food choices. This awareness has led to rise in the number of people seeking out products from animals that are well-fed and raised in good conditions. In turn, this consumer demand is propelling cattle farmers to use high-quality, nutritious feed, thereby contributing to the market growth. The health-conscious consumers are becoming a key driver catalyzing the demand for premium cattle feed, designed to enhance both the health of the animal and the end-product.

Rise in Environmental Factors

Changes in environmental conditions are also causing a rise in the demand for cattle feed. According to a report by the U.S. Department of Agriculture (USDA), the 2023 drought in the western United States affected over 60% of grazing land, forcing many farmers to rely more heavily on supplemental feed. Factors like droughts or floods can severely impact the natural availability of grazing fields for cattle. When natural foraging options are limited, farmers are compelled to depend more on formulated cattle feed to sustain their livestock. These environmental challenges have increased the need for reliable and nutritionally balanced cattle feed to ensure that cattle are receiving all the essential nutrients, thus driving up the cattle feed market demand.

Growing Ethical Farming Practices

Ethical and sustainable farming practices are becoming more prevalent, driven by consumer demand for responsibly produced food. An industry survey revealed that consumers are willing to pay an average of 9.7% more for sustainably produced or sourced products, highlighting a growing preference for ethical purchasing choices. These practices often require specialized types of cattle feed that are organic or free from genetically modified organisms (GMOs). As consumers become more educated about the origins of their food, the demand for such specialized cattle feed options is on the rise. The need for environment friendly farming techniques directly correlates with increased demand for specific types of cattle feed.

Cattle Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cattle feed market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on ingredient, type, and distribution channel.

Analysis by Ingredient:

- Corn

- Soybean Meal

- Wheat

- Oilseeds

- Additives

- Others

According to the report, corn represented the largest segment with 26.8% shares. Corn is a primary source of energy in cattle feed due to its high carbohydrate content. It provides the calories needed for daily activities, growth, and milk production. It is generally easy to digest and often included in the form of whole grain, cracked corn, or cornmeal. Soybean meal is a byproduct of soybean oil extraction that serves as a high-protein supplement in cattle feed. Rich in essential amino acids, it helps in the development of muscles, tissues, and enzymes in cattle. It is particularly beneficial for younger animals that are still growing, and lactating cows that need additional protein to produce milk.

Analysis by Type:

- Dairy

- Beef

- Calf

- Others

Dairy accounts for the majority of the market share at 61.8% shares. Dairy cattle require a specialized diet designed to support high milk production, reproductive health, and overall well-being. Their feed typically has higher protein content, often supplied through ingredients like alfalfa, soybean meal, and canola meal. Essential nutrients, such as calcium and phosphorus, are also added to support bone health and milk quality. Carbohydrates are usually derived from corn or barley to provide the energy required for lactation. The focus is on balanced nutrition to maximize milk yield and quality while maintaining the animal's health. Proper feed formulation plays a crucial role in ensuring optimal productivity and longevity of dairy cattle.

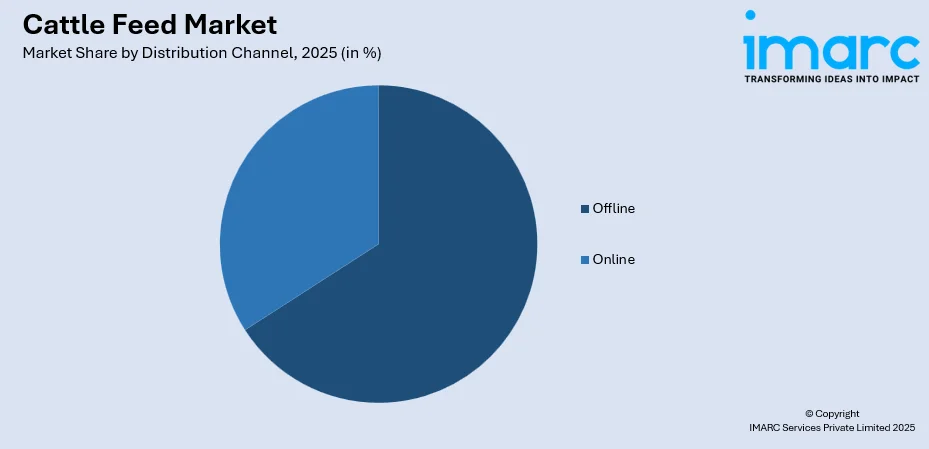

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

According to the report, offline represented the largest segment holding 65.7% shares. Offline channels remain the mainstay for many, particularly in rural areas where digital penetration is less prevalent. These include local feed stores, co-operatives, and agricultural supply shops where farmers can physically inspect products, seek expert advice, and make immediate purchases. Some large-scale operations even opt for direct relationships with manufacturers to secure bulk supplies. This trend highlights the importance of personal interaction and trust in the purchasing process, especially in rural markets where digital infrastructure may still be developing, and farmers value direct access to high-quality, reliable products.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market with 38.9% shares. The increasing adoption of more commercialized farming practices represents one of the primary factors creating a positive cattle feed market outlook in the Asia Pacific region. Moreover, the rising consumption of meat and dairy products is contributing to the market growth in the region. Besides this, the growing health-consciousness is influencing the market positively. Furthermore, government initiatives promoting sustainable agricultural practices, technological advancements in farming, and increasing investments in agricultural infrastructure are further enhancing growth prospects. The region's large population, coupled with its expanding middle class, is driving a surge in demand for high-quality feed products, fueling further market expansion.

Key Regional Takeaways:

North America Cattle Feed Market Analysis

The North American cattle feed market is experiencing growth driven by several key factors. The increasing demand for high-quality beef and dairy products necessitates nutritionally rich feed to enhance cattle health and productivity. In 2022, North America produced approximately 67.3 million tons of beef feed, accounting for 57% of the world's beef feed production. Additionally, favorable government regulations aimed at ensuring animal safety and food quality, along with advancements in feed formulations and sustainable feeding practices, are contributing to market expansion. However, factors like fluctuating cattle herd sizes—which declined by 6% to 89.3 million head as of January 1, 2023—could influence feed demand. Furthermore, the growing emphasis on more sustainable and efficient farming practices is encouraging the use of innovative feed technologies, such as precision feeding. These technologies aim to optimize feed efficiency and reduce waste, helping to lower the overall environmental impact of livestock farming.

United States Cattle Feed Market Analysis

The U.S. cattle feed has gained more attraction in the domestic market because more and more demands are rising within the country from consumers for both beef and milk products. Cattle inventory held by the country, according to the USDA records, was almost 87.2 million heads as of Jan 2024, while increasing protein-based food consumptions with enhanced livestock industries offer a steady feed market for such animals. The trend on sustainable and higher-quality feed input, such as plant-based protein and organic material, is going on. Also, the high market share holder in this is Cargill, Land O'Lakes, and Archer Daniels Midland, which are giving importance to newness and efficiencies. The evolution of animal welfare and nutrition promotes feed additives or supplements. U.S. cattle feed manufacturers are also ramping up their export activities and thereby contributing to the country's global market leadership.

Europe Cattle Feed Market Analysis

Europe's cattle feed market is witnessing a trend with the growth of demand for quality beef and dairy products in tandem with rising emphasis on sustainability. According to an industry report, in 2023, Germany produced 6.5 million tons of cattle feed; France and the UK also remain big contributors to the market. EU regulations through Green Deal and the Farm to Fork Strategy are boosting innovation in feed formulations. Feed innovations include, among others, plant-based feedstocks and alternative proteins, while non-GMO feed continues to grow in demand. Many of the biggest feed manufacturers already become pioneers in research and development work, including ForFarmers and Nutreco. In addition, with the recent boom of precision livestock farming techniques, customized feed solutions are being developed to improve livestock health and productivity.

Asia Pacific Cattle Feed Market Analysis

There has been a high growth rate in the Asia Pacific cattle feed market driven by increased meat consumption and better farming methods. eFeedLink indicates that the total feed consumed in 2023 was 271.62 million tonnes; and for pig feed, this stood at 130.70 million tonnes. The amount of cattle feed is not provided, but China is a giant in the feed business in the region. According to an industrial report, India produces about 7.5 million metric tons of cattle feed every year; however, its domestic demand reaches up to 70 million metric tons. This region is gradually adopting modern feed technologies like precision feeding that enable the optimization of nutrition and productivity. Local producers are collaborating with international players for better quality and reduced costs in feed. The increase in the middle-class income levels and high-protein diet popularity is driving the demand for cattle feed across Asia Pacific.

Latin America Cattle Feed Market Analysis

The cattle feed market in Latin America is expanding with rising consumption of beef and development of agriculture. eFeedLink stated that the animal feed production in Brazil is estimated to have been 88.3 million metric tonnes in 2024, representing a 2.4% growth over the previous year. In 2023, Brazil produced 86.2 million tonnes of animal feed, 1% up from the previous year. The largest economy in the region, Brazil continues to play an important role in the global cattle feed market. The demand for beef and dairy products in Brazil is strong and drives feed consumption. Furthermore, Brazil's efforts to enhance the quality and efficiency of feed production, along with rising exports to other Latin American nations, are strengthening its market influence. Brazil remains at the forefront in the development of the Latin American cattle feed industry because of the constant demand, both conventional and sustainable, for feed ingredients.

Middle East and Africa Cattle Feed Market Analysis

The demand for cattle feed in the Middle East and Africa is changing due to a set of factors such as increased population, rising income levels, and high demand for animal products. As per an industrial report, Emirati animal feed exports are estimated to touch 59.5 million kilograms during 2028 against about 54.7 million kilograms during the year 2023. This growth is due to the strategic focus of the UAE on becoming a hub for agricultural trade and feed export because of the strong infrastructure of the country and regional trade treaties. Domestic feed production is also being developed to sustain both domestic livestock farming and increased export markets. South Africa itself is also becoming a key market player in this region, because domestic production is supplemented by a significant amount of exports, underpinning industry growth overall. Government policies, investments in feed technologies, continue to underpin market development across the Middle East and Africa.

Competitive Landscape:

The leading companies are integrating artificial intelligence (AI), machine learning (ML), sensors, and the internet of things (IoT) that allows real time monitoring of feed intake and cattle health and helps in making timely adjustments to the feed formula. They are also enabling customized diet formulations that can be tailored to individual animal needs and maximize feed utilization, improve animal health, and minimize waste. Moreover, key players are using advanced genetic and breeding techniques to enhance the nutritional value of traditional feed crops like corn and soy, which can result in crops with higher levels of essential nutrients like omega-3 fatty acids that make the feed more beneficial for cattle health.

The report provides a comprehensive analysis of the competitive landscape in the cattle feed market with detailed profiles of all major companies, including:

- ADM Animal Nutrition

- Alltech

- Cargill, Incorporated

- Charoen Pokphand Foods PCL

- De Heus Animal Nutrition

- Godrej Agrovet Limited

- J.R. Simplot Company

- Kent Nutrition Group

- KSE Limited

- Nutreco

- Purina Animal Nutrition LLC. (Land O’Lakes, Inc.)

Latest News and Developments:

- September 2024: Cargill acquired two feed mills from a pet food company to expand its animal nutrition capabilities amid rising U.S. pet care sales. The acquisition aligns with Cargill’s strategy to strengthen its position in the growing pet nutrition market, leveraging increasing consumer demand for premium animal feed.

- September 2024: Scoular invested USD 20 million to expand its feed blending facility in Jerome, Idaho, boosting both production and storage capacity. The project introduced a 120-foot-high concrete feed mill, increasing production capacity by 35% and storage capacity by 40%.

- September 2024: Aboitiz Foods inaugurated its USD 45 million Gold Coin Long An Feed Mill in Long An, Vietnam, marking a significant expansion of its operations in Southeast Asia. This facility spans 3.8 hectares and is designed to produce 300,000 metric tons of livestock and animal nutrition feed annually, utilizing cutting-edge Industry 4.0 technology and a modern laboratory.

- August 2024: Hubbard Feeds, an Alltech company, introduced Recharge®, a nutritional solution for beef cattle to optimize intake, enhance performance, and improve profitability. The product line includes pellets, premixes, drench, and blocks, aiding cattle during stress events. Feedlot trials showed improved feed intake, ADG, and efficiency.

- January 2024: JBS announced a BRL$570 million investment (about USD 116.6 million) to construct three new feed factories in Southern Brazil, specifically in Seberi, Santo Inácio, and Itaiópolis. This expansion will boost the production capacity by over 1 million tons annually, create over 300 jobs, and enhance regional socio-economic growth through advanced automation and technology.

Cattle Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ingredients Covered | Corn, Soybean Meal, Wheat, Oilseeds, Additives, Others |

| Types Covered | Dairy, Beef, Calf, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ADM Animal Nutrition, Alltech, Cargill, Incorporated, Charoen Pokphand Foods PCL, De Heus Animal Nutrition, Godrej Agrovet Limited, J.R. Simplot Company, Kent Nutrition Group, KSE Limited, Nutreco, Purina Animal Nutrition LLC. (Land O’Lakes, Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cattle feed market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cattle feed market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cattle feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cattle feed market was valued at USD 94.0 Billion in 2025.

IMARC Group estimates the market to reach USD 124.0 Billion by 2034, exhibiting a CAGR of 3.12% from 2026-2034.

Key factors driving the cattle feed market include the rising demand for high-quality beef and dairy products, advancements in feed formulations, government regulations ensuring animal safety, increasing awareness of animal nutrition, and the growth of the livestock industry in emerging economies.

Asia Pacific currently dominates the cattle feed market, accounting for the largest share due to the rapid expansion of the livestock sector, particularly in countries like China and India. Increased demand for beef and dairy products, along with government support for livestock farming, contributes to the region's leading position.

Some of the major players in the cattle feed market include ADM Animal Nutrition, Alltech, Cargill, Incorporated, Charoen Pokphand Foods PCL, De Heus Animal Nutrition, Godrej Agrovet Limited, J.R. Simplot Company, Kent Nutrition Group, KSE Limited, Nutreco, Purina Animal Nutrition LLC. (Land O’Lakes, Inc.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)