Cat Food Market Size, Share, Trends and Forecast by Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2026-2034

Cat Food Market Size and Share:

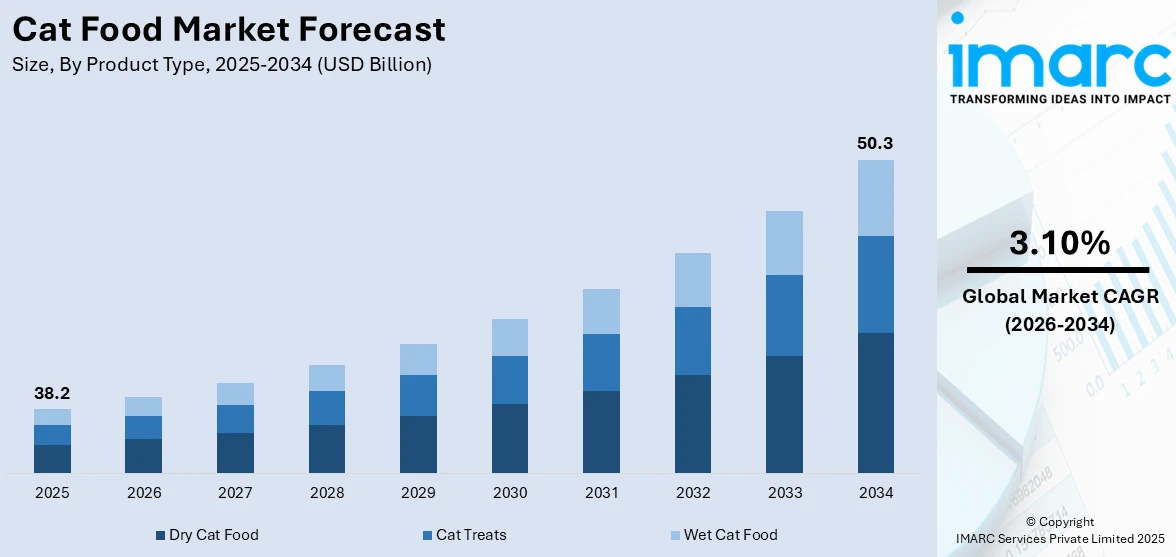

The global cat food market size was valued at USD 38.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 50.3 Billion by 2034, exhibiting a CAGR of 3.10% from 2026-2034. North America currently dominates the market in 2025, with a significant share of around 30.0%. The market is primarily driven by the growing interest in quality pet nutrition, increased adoption of cats as pets, awareness regarding specific dietary needs, innovation in functional formulations, environmentally responsible practices, improvement in product variety, increasing disposable incomes, growing urban pet ownership, and the availability of digital platforms that improve convenience for consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 38.2 Billion |

|

Market Forecast in 2034

|

USD 50.3 Billion |

| Market Growth Rate (2026-2034) | 3.10% |

The market is significantly influenced by the increasing number of pet owners globally, which is raising the demand for premium cat food products. Additional factors such as rapid urbanization and busier lifestyles boost convenient ready-to-serve options for cat food products. Growth in e-commerce websites increases the purchasing of cat foods since customers have a wide variety of products offering affordable pricing. Also, innovations in cat food are enriching market offerings. For instance, the Pet Food Industry, on March 22, 2024, reported an increase in innovative cat food and treat offerings highlighting health benefits and addressing hydration, dental care, and nutrition. Trends such as smaller single-serving wet food options, dry kibble enhancements, and dental health treats were showcased at the Global Pet Expo due to increasing cat ownership and demand among millennials and Gen Z pet owners.

To get more information on this market Request Sample

The United States stands out as a key regional market which is growing with great momentum due to the rising trend of pet humanization that is augmenting the demand for premium and super-premium cat food products. Also, considerable rise in pet health and wellness awareness is stimulating the sales of specialty diets, which include grain-free, organic, and functional formulations made according to cats' specific health requirements. Besides this, innovative marketing strategies, including personalized subscription services and targeted advertising campaigns, are improving brand visibility and consumer engagement. Additionally, sustainability initiatives, including eco-friendly packaging and responsibly sourced ingredients, resonate with environmentally conscious pet owners and contribute to market growth in the United States.

Cat Food Market Trends:

Increasing Cat Ownership

The global cat food market is heavily influenced by the trend of cat humanization, where cats are treated like family members. This move has led to a massive increase in pet ownership throughout the world. In 2022, cats accounted for 32.3% of the global pet food market, which grew by 55.8% from 2017 to 2022 due to a rise in the cat population by 18.8%. Moreover, in many countries, cats are considered a symbol of luck and fortune, particularly in Europe, which is positively impacting the market share. Additionally, cats require less space to live than dogs and need less living space compared to dogs and can remain alone at home for extended periods without human supervision. From 2017 to 2022, over 70% of pet owners, including those in Russia and the United States, viewed their cats as family members, companions, or even children. Such an increasing ownership of cats and growing consciousness of cats’ health and well-being is primarily augmenting the cat food market demand.

Rising Awareness Among Individuals

Growing health-conscious attitudes among cat owners is one of the major factors expanding the cat food market size. Cat's parents invest most of their cat expenditure in cat food as they are concerned about their cats' well-being and are seeking products that cater to specific health concerns like obesity, diabetes, and food allergies in pets. For example, the United States pet food made up 42.4% of the expenditures related to pets in 2022. The United States had 40% of pet parents buying premium pet food in 2022, and Hong Kong's cat food market was also dominated by premium pet food, as it covered 75% of the pet food sales in 2022. Manufacturers are investing more in expanding their operations in a wide variety of specialized products, including functional benefits like improving immune system, digestive health, and coat condition. For example, in October 2023, Nestle announced the commissioning of two new production lines of its Purina pet food facility in Hungary, raising the level of production by 66%. The capacity increase led to an increase in the annual capacities of the plant from about 150,000 metric tons to 250,000 metric tons.

Increasing Product Offerings

Key market players are increasingly investing in research and development (R&D) activities to offer diversified flavors, textures, and improved nutritional compositions of cat food, which is reshaping the cat food market trends. For instance, in March 2024, a UK vegan pet food business, Omni introduced nutritionally complete cat food featuring cultivated chicken meat, further broadening its product range. In addition to this, the integration of modern technology in manufacturing processes is enabling the production of a wider variety of pet food with improved nutritional value and a longer shelf life, which is further augmenting the cat food market share. For instance, BrightPet Nutrition Group unveiled a refreshed brand presence for its Blackwood pet nutrition portfolio at Global Pet Expo 2024, held March 20–22 in Orlando. The rebrand precedes several new product launches planned for the brand later this year, including new meal toppers, freeze-dried single-ingredient treats, and granola treats, as well as a new branding for Blackwood’s Oven Baked Bites.

Cat Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cat food market report, along with forecasts at the global and regional levels from 2026-2034. Our report has categorized the market based on product type, pricing type, ingredient type, and distribution channel.

Analysis by Product Type:

- Dry Cat Food

- Cat Treats

- Wet Cat Food

Dry cat food leads the market in 2025, holding a share of around 44.6%. Its dominance is driven by convenience, cost-effectiveness, and longer shelf life compared to wet food. Dry food is easier to store, requires less frequent feeding, and often helps maintain dental health. It is also typically more affordable, appealing to budget-conscious pet owners. Additionally, dry food offers a wide variety of options, catering to different dietary needs, such as grain-free or high-protein formulations. Despite its lead, the demand for wet and specialized cat foods is growing due to a focus on pet health and nutrition.

Analysis by Pricing Type:

- Mass Products

- Premium Products

Mass products lead the market in 2025, with a significant share of 44.5%. The mass products segment of the global cat food market holds the largest consumer base of budget-friendly and widely available cat food. Mass-produced pet food brands offer a variety of products, such as dry kibble and canned food that cater to the basic dietary needs of cats. Mass products, in mass quantities, are very largely available in supermarkets and even in convenience stores, coupled with online platforms. Such facilities are easily accessible to these pet owners, increasing mass adoption. This segment serves pet owners who look for affordability while ensuring their cats get the necessary nutrition. In addition, economies of scale in manufacturing enable the manufacturers to retain cost-effectiveness while ensuring large-scale production. Urbanization and an increasing number of middle-income households increase the size of the consumer base for value-for-money cat food.

Analysis by Ingredient Type:

- Animal Derivatives

- Plant Derivatives

Animal-derived cat food leads the market in 2025, with a share of 72.9%. It is basically an animal-based product, and consists of meat, poultry, fish, or eggs. This kind of cat food is always rich in protein; since cats are obligate carnivores, these types of foods are essential. Ingredients such as amino acids, vitamins, and minerals play an important role in the development of muscles, energy, and overall well-being of cats. Consequently, the demand for animal-based cat food is rising upward. According to IMARC data, various producers of cat foods are now adding animal-based ingredients to cat foods. For example, in March 2024, a UK-based firm that specializes in developing cultivated meat, Meatly, invented the world's first cans of cat foods that utilize cultivated chicken as the source of protein. The product has been jointly designed with its brand partner, Omni- a new novel protein pet food company established by UK veterinarian Dr Guy Sandelowsky.

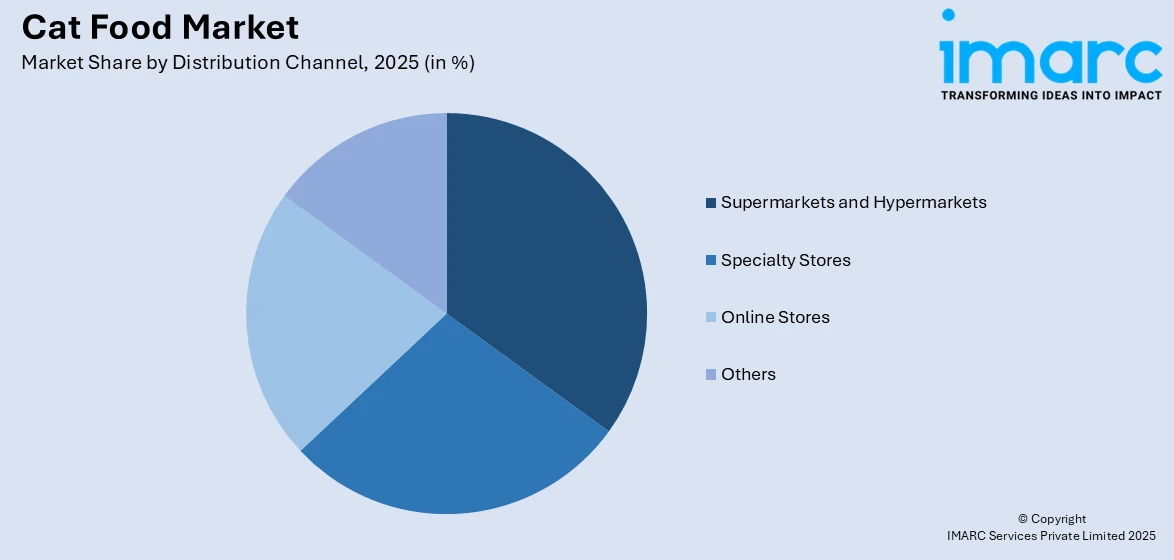

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets are the dominant distribution channels in the cat food market with a share of 23.5%. For instance, in terms of store count, PetSmart was the largest pet specialty retail chain in North America as of March 2022, with a total of 1,669 stores. Retail giants like these offer a wide variety of cat food brands, making them convenient one-stop shops for pet owners. Their large networks and convenient central locations make them accessible to a wide consumer base and, thereby, increase the visibility and convenience of the product. These retail outlets often carry a range of cat food brands and can accommodate different price levels and dietary requirements, making them appealing to a broader cross-section of consumers. Promotions, discounts, and loyalty programs further increase the purchase of bulk quantities, which in turn increases the sales volume. Also, supermarkets and hypermarkets allow the customers to touch and feel the products, thus increasing trust in the quality and suitability. Their ability to stock a large inventory ensures consistent product availability, making these channels indispensable for both consumers and manufacturers.

Regional Analysis

To get more information on the regional analysis of this market Request Sample

- North America

- Western Europe

- Asia Pacific

- Latin America

- Eastern Europe

- Middle East and Africa

In 2025, North America accounted for the largest market share in the market with a share of around 30.0%. North America is a very important region in the cat food market, driven by high pet ownership rates, product innovations, ready availability, and marketing. In 2022, North America emerged to be the largest regional market across the global cat food markets, with a value standing at USD 77.43 Billion. According to pet food market size by country, the United States and Mexico are the major contributors to the North American cat food market due to the high pet ownership rates in these countries. The trend of pet parents giving more importance to their cats' health and nutrition is propelling demand for premium and specialized cat food options. Strong economic stability in the region supports consumer spending on high-quality cat food, including organic, grain-free, and functional variants. Manufacturers in North America maintain continuous innovation with new product formulations and flavors according to consumer choice. Government regulations that emphasize cat food safety and quality enhance market credibility.

Key Regional Takeaways:

United States Cat Food Market Analysis

United States holds a significant position in the North American market with a share of over 86.50%. The pet humanization trend and the number of cat pets are increasingly growing in the United States, which fuels the cat food business. As the American Pet Products Association's 2023–2024 National Pet Owners Survey has indicated, there is a great demand for high-end cat food products as 46.5 million households in the US have had a cat as of 2023. According to industry studies, households with cats increased from 23% to 24% from 2018 to 2022. Currently, the market for cat food and supplies is growing with cat ownership. The premium and super-premium cat food market is increasing due to a rising interest in nutritional benefits, organic formulas, and functional ingredients like probiotics and omega-3 fatty acids. Increasing interest in specialty diets such as grain-free, raw, and freeze-dried varieties also impacts the market. Especially in urban households, convenience-driven formats like single-serve and resealable packaging are driving sales. Online pet food sales are also growing at a rapid pace, which is an example of how e-commerce platforms are transforming the way people shop. The industry is expanding because big players like Nestlé Purina, Mars Petcare, and Hill's Pet Nutrition are continuously focusing on sustainable packaging and new product development.

Europe Cat Food Market Analysis

The large percentage of pet owners in the region and growing demands for high-end cat food products are driving the cat food industry in Europe. Based on a survey conducted by FEDIAF, which stands for the European Pet Food Industry Federation, the amount of pet food in the markets of Europe reached EURO 29.1 Billion (USD 31.1 Billion) in the year 2022. This was ascertained after an average rate of 5.1% annual growth within three years. In 2021, there were 150 pet food companies in Europe. 118,000 people were employed by such companies, which ran an estimated 200 sites. According to FEDIAF, 91 million households in Europe have at least one pet in 2022. This means that around 46% of homes in Europe have at least one pet. 127 million cats lived in 26% of households in Europe in 2022. As the region has been giving emphasis to sustainability and organic products, more and more consumers are going for eco-friendly packaging and organic cat food. There is also a demand for functional foods addressing specific health issues, such as weight management and urinary tract health. Another driver of growth is that more people are shopping through e-commerce channels, which comprise approximately 35% of sales in Europe, as per an industry report. Leading companies are coming up with new ways to satisfy consumer tastes, such using natural and local foods.

Asia Pacific Cat Food Market Analysis

The rapid growth of the Asia-Pacific cat food market is because of urbanization, inflating disposable incomes, and enhanced pet nutrition knowledge. From 2020 to 2023, the market of vat food in this region grew dramatically, but mainly due to China, Japan, and India. Changing lifestyles and smaller families have led to an increase in urban cat ownership, thus upping demand for high-end and personalized cat food items. According to an industrial report about the pet market states that Chinese households spend USD 286 (EUR 257) a year on each pet. This represents 6.73% of total household expenses, as opposed to 1.71% of US household expenses. Furthermore, according to a USDA Foreign Agricutural Services study, the Chinese pet (dog and cat) consumer market grew by 7.5 percent from 2023 to reach USD 41.9 Billion, or 302 Billion yuan, in 2024. The increased demand for functional and freeze-dried meals by South Korean and Japanese consumers shows that these consumers shop based on health consciousness. E-commerce, which accounts for more than 40% of pet food sales in some areas, is attracting investments from international as well as both domestic businesses.

Latin America Cat Food Market Analysis

The cat food industry in Latin America is being driven by growing pet adoption and an expanding middle class. Considering pets like cats a part of the family is another major reason people are happily spending significant amount on them. Surveys within the industry have found that 94% of Argentine pet owners are willing to pay for their animals' happiness and well-being. Data compiled by the Mexican government organization, Condusef, suggests that families here spend over 20% of their monthly income on pets. With more knowledge and awareness regarding the nutritional aspects of their pets and health, more high-quality, grain-free cat food is in demand. Due to their palatability, wet and semi-moist food formats are increasingly popular. The market landscape is also changing with the penetration of e-commerce platforms and the growth of contemporary retail channels. The increasing demand for reasonably priced yet wholesome cat food options is being tapped by both domestic and foreign companies.

Middle East and Africa Cat Food Market Analysis

The cat food market in the Middle East and Africa (MEA) is growing steadily with the rising pet ownership and urbanization in the region. The market is dominated by countries such as South Africa and the United Arab Emirates, where pet care expenditure is rising rapidly. There are more than 1.5 million pet owners (or parents as they prefer to be called) in the United Arab Emirates alone, with data from the recent Pet World Arabia show in Dubai reporting that the pet care sector there is valued at USD 300 Million (and growing). Cat ownership has substantially increased in urban areas due to changes in lifestyle and rise in disposable incomes. Especially in the GCC, with expats complementing the thriving pet care culture there, demand is increasing for premium, internationally sourced cat food. Further, given its higher nutrient content and appeal to pet owners, the moist form of cat food is especially more popular here.

Competitive Landscape:

The competitive landscape of cat food is marked by strong competition among manufacturers focusing on innovation, quality, and pricing strategies to capture consumer loyalty. Companies are in the development of premium, organic, as well as specialized products to meet the cat owners' demand for tailored nutritional wellness solutions. Strategic partnerships help retail and e-commerce outlets enhance market reach. Aggressive marketing targets affordability and premium value platforms. Also, regional players and global brands compete on product differentiation, unique formulations, and packaging. The dynamic nature of the market continues to drive research and development (R&D) investment to address changing consumer preferences.

The report provides a comprehensive analysis of the competitive landscape in the cat food market with detailed profiles of all major companies, including:

- Mars Petcare

- The J.M. Smucker Company (Big Heart Pet Brands)

- Colgate-Palmolive (Hill's Pet Nutrition Inc.)

- Nestle Purina PetCare

- Blue Buffalo Co., Ltd.

- CANIDAE Pet Foods

Recent Developments:

- April 2024: Go! Solutions announced the launch of its latest functional cat food recipe, Go! Solutions Hairball Control + Urinary Care. Formulated in collaboration with Board-Certified Veterinary Nutritionists, this recipe helps control hairballs and discourage urinary struvite crystals in cats.

- March 2024: Meatly, a UK-based cultivated meat company, created the world’s first cans of cat food that utilize cultivated chicken as the source of protein.

- March 2024: Tropikal Pet, a Turkish producer of dog and cat food known for brands like Goody and Champion, agreed to raise USD 9 Million with Eminova Holdings International. With the investment, the company is anticipated to increase its capacity, double its existing export sales, add new products to its product range, reduce the increasing working capital purchase costs, operate at full capacity, and enter the U.S. market.

- March 2024: Vafo's Brit brand introduced its super-premium Brit Care Cat RAW Treats, designed with a focus on quality and nutrition. The new range of cat food offers cats a "distinctive dining experience”, merging irresistible flavors with essential nutrients that bolster their overall well-being.

Cat Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons, Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dry Cat Food, Cat Treats, Wet Cat Food |

| Pricing Types Covered | Mass Products, Premium Products |

| Ingredient Types Covered | Animal Derivatives, Plant Derivatives |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | North America, Western Europe, Asia Pacific, Latin America, Eastern Europe, Middle East and Africa |

| Companies Covered | Mars Petcare, The J.M. Smucker Company (Big Heart Pet Brands), Colgate-Palmolive (Hill's Pet Nutrition Inc.), Nestle Purina PetCare, Blue Buffalo Co., Ltd., CANIDAE Pet Foods, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cat food market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cat food market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cat food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cat food is a specialized diet formulated to meet the nutritional needs of cats. It is designed to provide essential vitamins, proteins, and minerals, ensuring optimal feline health and growth.

The global Cat Food market was valued at USD 38.2 Billion in 2025.

IMARC estimates the global Cat Food market to exhibit a CAGR of 3.10% during 2026-2034.

The global cat food market is driven by increasing pet ownership, rising pet humanization trends, demand for premium products, and growing awareness regarding feline nutritional needs among pet parents.

According to the report, dry cat foods represented the largest segment by product type, driven by their convenience, cost, and variety.

According to the report, mass products represented the largest segment by pricing type, driven by affordability, widespread availability, and appeal to cost-conscious consumers.

According to the report, animal derivatives represented the largest segment by ingredient type, driven by their high protein content and alignment with natural feline dietary preferences.

According to the report, supermarkets and hypermarkets represented the largest segment by distribution channel, driven by convenience, extensive product variety, and attractive promotional offers.

On a regional level, the market has been classified into North America, Western Europe, Asia Pacific, Latin America, Eastern Europe, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Cat Food market include Mars Petcare, The J.M. Smucker Company (Big Heart Pet Brands), Colgate-Palmolive (Hill's Pet Nutrition Inc.), Nestle Purina PetCare, Blue Buffalo Co., Ltd., and CANIDAE Pet Foods, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)