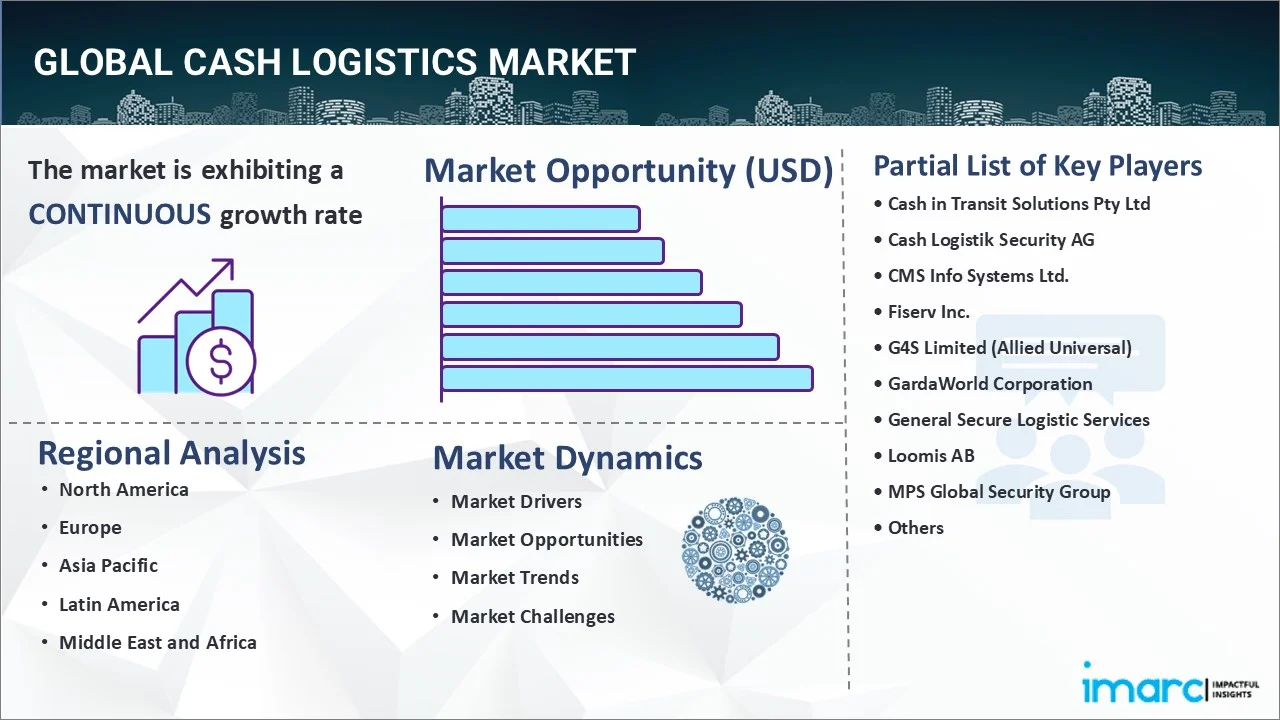

Cash Logistics Market Report by Service (Cash Management, Cash-In-Transit, ATM Services), Mode of Transit (Roadways, Railways, Airways), End User (Financial Institutions, Retailers, Government Agencies, Hospitality, and Others), and Region 2025-2033

Cash Logistics Market Size:

The global cash logistics market size reached USD 24.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 43.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.47% during 2025-2033. The market is driven by the growing demand for secure cash management services, rapid technological advancements, widespread expansion of retail and banking sectors, imposition of stringent regulatory compliance regarding security concerns, and a strategic shift towards outsourcing non-core activities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 24.1 Billion |

|

Market Forecast in 2033

|

USD 43.5 Billion |

| Market Growth Rate 2025-2033 | 6.47% |

Cash Logistics Market Analysis:

- Market Growth and Size: The cash logistics market overview is indicating a stable growth, driven by the increasing demand for secure and efficient cash management and transportation services, expansion of the banking and retail sectors, and the implementation of various government regulations.

- Major Market Drivers: Key drivers influencing the market growth include the rising need for secure cash management solutions, rapid technological advancements in security and logistics, introduction of stringent regulatory compliance requirements, and the ongoing shift towards outsourcing non-core activities.

- Technological Advancements: Recent innovations in smart safes, automated cash deposit machines, and advanced surveillance systems, offering enhanced security and operational efficiency, is fueling the market growth. Furthermore, the integration of the Internet of Things (IoT), artificial intelligence (AI), and blockchain for real-time cash monitoring, is supporting the market growth.

- Industry Applications: The market is experiencing high demand for cash logistics in the banking sector, retail, casinos, and entertainment venues for secure cash collection, transportation, and processing.

- Key Market Trends: The key market trends involve the ongoing shift towards implementing advanced tracking, automation, and biometric security to enhance service efficiency and security. Additionally, the increasing focus in offering comprehensive cash management solutions, such as automated teller machine (ATM) services, cash processing, and forecasting is bolstering the market growth.

- Geographical Trends: According to the cash logistics market overview, the Asia Pacific holds the largest share due to its rapid economic development, high cash usage, and the growing financial sector. Other regions are also showing significant growth, fueled by rising innovation and service diversification to cater to a changing financial landscape.

- Competitive Landscape: The market is characterized by the active involvement of key players who are focusing on expanding their global presence through mergers and acquisitions, and by investing in technology to offer differentiated services.

- Challenges and Opportunities: The market faces various challenges, including the risks associated with cash handling, such as theft and fraud, and adapting to the evolving regulatory landscape. However, the development of more secure and efficient cash logistics processes and the rising focus on leveraging technology to enhance operational efficiency and customer service are creating new opportunities for the market growth.

Cash Logistics Market Trends:

Increasing demand for secure and efficient cash management services

The rising need for secure and efficient cash management services is one of the major factors bolstering the market growth. In line with this, the increasing adoption of cash logistics services as reliable solutions for cash collection, processing, and distribution in businesses across various sectors, including retail, banking, and finance, is catalyzing the market growth. Besides this, the heightened emphasis on security owing to the rising prevalence of theft and fraud, encouraging companies to invest in logistics providers that offer advanced security measures and technologies, is providing a thrust to the market growth. Along with this, the imposition of several regulatory requirements that mandate stringent cash handling and transportation protocols to minimize risks and enhance efficiency in cash transactions, is stimulating the market growth.

Rapid technological advancements in cash management

The rapid innovations such as smart safes, cash recyclers, and automated teller machines (ATMs) that offer advanced functionalities, like real-time cash monitoring and analytics, are providing a thrust to the market growth. Additionally, they provide businesses with greater control and visibility over their cash flows while reducing the chances of discrepancies and enhancing operational efficiency. Furthermore, the widespread adoption of blockchain and other secure digital platforms for tracking and managing logistics operations to reduce the risk of errors and fraud is strengthening the cash logistics market share. Moreover, the introduction of data analytics and artificial intelligence (AI) in cash management processes that allow for predictive cash flow management while optimizing the cash supply chain and reducing downtime for ATMs and other cash points is catalyzing the market growth.

Widespread expansion of retail and banking sectors

The significant growth in the retail and banking sectors as cash remains a prevalent mode of transaction is a major factor creating a positive outlook for the market. Moreover, the rising popularity of retail chains and banking institutions, necessitating the need for robust cash handling and logistics services to manage the increased volume of cash transactions, is providing an impetus to the market growth. Additionally, cash logistics help ensure that cash is available and securely transported between points of sale, ATMs, and banks, thereby facilitating smooth operations and customer transactions. In addition to this, the widespread demand for cash logistics providers, as they offer financial inclusion by facilitating cash, strategic planning, and network optimization, is fueling the market growth.

Implementation of regulatory compliance and security concerns

The imposition of several strict regulations regarding the handling, transportation, and storage of cash to prevent money laundering, theft, and other illicit activities is creating a positive outlook for the market growth. Moreover, the growing need to comply with regulations that require specialized knowledge and capabilities, prompting businesses to rely on cash logistics providers to ensure adherence to legal standards while maintaining high levels of security, is supporting the market growth. Additionally, the increasing concerns over cash-related crimes, encouraging companies to invest in logistics services that offer enhanced security measures, including armored vehicles, secure vaults, and advanced surveillance, is enhancing the cash logistics market share. Along with this, the introduction of new regulations to combat financial crimes and enhance security, propelling cash logistics providers to update their practices and technologies continually, is favoring the market growth.

Growing focus on outsourcing non-core activities

The increasing focus by businesses on their core competencies and outsourcing non-core activities, including cash management, to external service providers is acting as a growth-inducing factor. Moreover, the heightened recognition of the importance of specialized cash logistics providers as they offer efficient, secure, and cost-effective services is favoring the market growth. Furthermore, outsourcing cash handling and logistics allows companies to reduce operational complexities and costs associated with cash management, such as labor, transportation, and security infrastructure. Additionally, the widespread adoption of cash logistics providers, as they enable businesses to benefit from their expertise and advanced technologies and ensure that their cash management processes are optimized and compliant with regulatory standards, is positively influencing the market growth.

Cash Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on service, mode of transit, and end user.

Breakup by Service:

- Cash Management

- Cash-In-Transit

- ATM Services

Cash-in-transit accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the service. This includes cash management, cash-in-transit, and ATM services. According to the report, cash-in-transit represented the largest segment.

Cash-in-transit (CIT) services represented the largest segment as they offer secure transportation of cash and valuables between locations such as banks, ATMs, and retail outlets. Moreover, they are crucial for the safe and efficient movement of physical currency across the financial ecosystem while mitigating risks of theft and loss through the use of armored vehicles, trained personnel, and advanced security protocols. Additionally, the rising popularity of cash-in-transit services, as they ensure liquidity in the market, facilitate retail and banking operations, and support the cash cycle, is contributing to the cash logistics market share.

Cash management services (CMS) offer a broad range of activities to optimize the handling, processing, and storage of cash for businesses. They include services such as cash counting, sorting, and packaging, as well as providing secure storage solutions and cash forecasting. Moreover, the widespread adoption of cash management services to enhance cash visibility, improve operational efficiencies, and reduce the risks associated with handling large volumes of cash is favoring the market growth.

Automated teller machine (ATM) services focus on the replenishment, maintenance, and management of ATMs. They ensure that ATMs are operational, secure, and stocked with the appropriate amount of cash to meet consumer demand. Along with this, their widespread utilization as a convenient access point for banking services, including cash withdrawals and deposits, is fueling the market growth.

Breakup by Mode of Transit:

- Roadways

- Railways

- Airways

Roadways holds the largest share in the industry

A detailed breakup and analysis of the market based on the mode of transit have also been provided in the report. This includes roadways, railways, and airways. According to the report, roadways accounted for the largest market share.

Roadways hold the largest market share due to their flexibility, accessibility, and cost-effectiveness in transporting cash and valuables across varied distances. Moreover, their extensive network enables door-to-door delivery of cash, ensuring timely and secure movement between banks, ATMs, retail outlets, and other cash-handling facilities. In addition to this, the widespread utilization of armored vehicles that are equipped with advanced security features and GPS tracking systems to enhance the safety and efficiency of cash transit operations is strengthening the cash logistics market share. Besides this, the growing utilization of roadway channels to reach remote locations where other modes of transit might not be feasible, is providing a thrust to the market growth.

According to the cash logistics market overview, railways offer a reliable and cost-effective solution for the long-distance movement of large volumes of cash and valuables. In line with this, the increasing utilization of railway transportation as it provides a secure environment for cash logistics, leveraging the inherent security features of railway networks and specialized cargo services, is fueling the market growth.

Airways cater to the fastest and most secure transit of cash and valuables over long distances, including international transfers. It is utilized for high-value shipments that require enhanced speed and security concerns. Moreover, air transport enables cash logistics providers to bypass geographical and infrastructural constraints while offering a swift solution for moving cash across countries or continents.

Breakup by End User:

- Financial Institutions

- Retailers

- Government Agencies

- Hospitality

- Others

Financial institutions represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes financial institutions, retailers, government agencies, hospitality, and others. According to the report, financial institutions represented the largest segment.

Financial institutions represent the largest segment, driven by their foundational role in the economy and the vast amounts of cash they handle. They include banks, credit unions, and other monetary organizations that require extensive cash management, transportation, and processing services to operate efficiently and securely. Furthermore, the increasing reliance of financial institutions on cash logistics for a multitude of services, including cash-in-transit, ATM replenishment, and cash processing, to ensure liquidity and meet the cash demands of their customers is positively impacting the cash logistics market share. Along with this, the rising need for security, reliability, and efficiency in handling cash, making cash logistics companies indispensable is favoring the market growth.

Retailers utilize cash logistics as they need robust cash handling and transportation services to support daily operations. They include supermarkets, department stores, and smaller retail outlets, which handle a substantial volume of cash transactions. Along with this, the rising dependency of retailers on cash logistics services to safely transport daily takings to banks, replenish change funds, and manage back-office cash processing is enhancing the market growth.

Government agencies utilize cash logistics services to manage the collection, processing, and distribution of cash related to public services, fees, fines, and social aid programs. Along with this, they require cash logistics solutions to ensure the secure and efficient handling of public funds while maintaining the integrity and accountability of financial transactions.

The hospitality sector includes hotels, restaurants, and entertainment venues that rely on cash logistics services to manage the high volume of cash transactions. Along with this, the increasing utilization of cash-in-transit services for depositing daily earnings and ATM services to provide guests with easy access to cash is favoring the cash logistics market share.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest cash logistics market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific holds the largest segment, driven by the region’s rapid economic growth, extensive population base, and high reliance on cash transactions. Moreover, the expanding banking and retail industry, fueling the demand for cash logistics services, is propelling the market growth. Additionally, the diverse landscape of urban and rural areas in the region that present unique opportunities for cash management and transportation is bolstering the market growth. Besides this, the proliferation of ATMs, increasing financial inclusion, and the cultural preference for cash transactions amplifying the need for secure and efficient logistics services are creating a positive outlook for the market growth.

Europe represents a significant market for cash logistics, characterized by a well-established banking sector, a strong regulatory framework, and an increasing emphasis on cash recycling. In addition to this, the growing need for high-security cash management solutions due to the rising concerns over theft and fraud and the heightened demand for efficient cross-border cash movement within the European Union (EU) is bolstering the cash logistics market share.

North America is a key player in the market due to its mature financial system and a significant volume of cash in circulation. Moreover, the rising combination of retail sector cash transactions, extensive ATM networks, and the need for secure transport of valuables is creating a positive outlook for the market growth. Along with this, the changing consumer preference for cash in certain transactions and segments, like small businesses and service industries, is catalyzing the market growth.

Latin America’s cash logistics market is driven by the need to improve security and efficiency in cash transactions across the region. Besides this, the rising demand for cash-in-transit and cash management services due to the widespread expansion of retail operations and a growing banking sector is contributing to the market growth.

The Middle East and Africa’s (MEA) cash logistics market is characterized by a growing demand for secure and efficient cash management solutions. Moreover, the widespread expansion of financial services, increased investment in infrastructure development, and rising efforts to enhance financial inclusion among the unbanked population are providing a thrust to the cash logistics market overview.

Leading Key Players in the Cash Logistics Industry:

The cash logistics market overview showcases a competitive landscape with major players engaged in various strategic initiatives to strengthen their market position and respond to evolving industry demands. Additionally, they are investing in technology to enhance the security and efficiency of cash management and transportation services. Along with this, some companies are focusing on developing advanced surveillance systems, biometric authentication, and GPS tracking to ensure the highest levels of security during cash transit operations. Furthermore, they are forming mergers and acquisitions to expand their global footprint and diversify their service offerings. Moreover, leading firms are focusing on expanding their service portfolio to include comprehensive cash management solutions, ATM services, and cash recycling to cater to the diverse needs of financial institutions, retailers, and other sectors.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Cash in Transit Solutions Pty Ltd

- Cash Logistik Security AG

- CMS Info Systems Ltd.

- Fiserv Inc.

- G4S Limited (Allied Universal)

- GardaWorld Corporation

- General Secure Logistic Services

- Loomis AB

- MPS Global Security Group

- Prosegur Compañía de Seguridad S.A (Gubel S.L.)

- SIS Limited

- The Brink's Company

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- In June 2023, CMS Info Systems Limited (CMS) completed the execution of ATM Managed Services of 5,200+ ATMs for Punjab National Bank (PNB) across 526 cities and towns in 26 states in India.

- In April 2021, The Brink's Company announced the acquisition of PAI, Inc., a U.S.-based privately-owned ATM services provider to expand its reach in the U.S.

- In April 2021, G4S Limited was bought by US-based Allied Universal, a provider of security systems and services, making it the third-largest employer in North America and a world leader in integrated security.

Cash Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Cash Management, Cash-In-Transit, ATM Services |

| Mode of Transits Covered | Roadways, Railways, Airways |

| End Users Covered | Financial Institutions, Retailers, Government Agencies, Hospitality, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cash in Transit Solutions Pty Ltd, Cash Logistik Security AG, CMS Info Systems Ltd., Fiserv Inc., G4S Limited (Allied Universal), GardaWorld Corporation, General Secure Logistic Services, Loomis AB, MPS Global Security Group, Prosegur Compañía de Seguridad S.A (Gubel S.L.), SIS Limited, The Brink's Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cash logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cash logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cash logistics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global cash logistics market was valued at USD 24.1 Billion in 2024.

We expect the global cash logistics market to exhibit a CAGR of 6.47% during 2025-2033.

The rising adoption of cash logistics service by banking organizations, as it aids in automating the cash supply chain, reducing operational, transportation, and holding expenses, increasing staff productivity, improving vendor management, etc., is primarily driving the global cash logistics market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary restrictions on intra- and inter-national travel activities, thereby negatively impacting the global market for cash logistics.

Based on the service, the global cash logistics market can be segmented into cash management, cash-in-transit, and ATM services. Currently, cash-in-transit holds the majority of the total market share.

Based on the mode of transit, the global cash logistics market has been divided into roadways, railways, and airways. Among these, roadways currently exhibit a clear dominance in the market.

Based on the end user, the global cash logistics market can be categorized into financial institutions, retailers, government agencies, hospitality, and others. Currently, financial institutions account for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global cash logistics market include Cash in Transit Solutions Pty Ltd, Cash Logistik Security AG, CMS Info Systems Ltd., Fiserv Inc., G4S Limited (Allied Universal), GardaWorld Corporation, General Secure Logistic Services, Loomis AB, MPS Global Security Group, Prosegur Compañía de Seguridad S.A (Gubel S.L.), SIS Limited, and The Brink's Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)